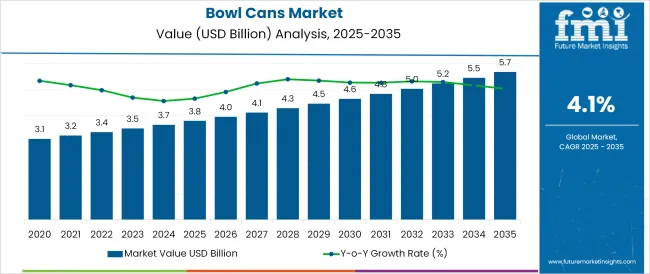

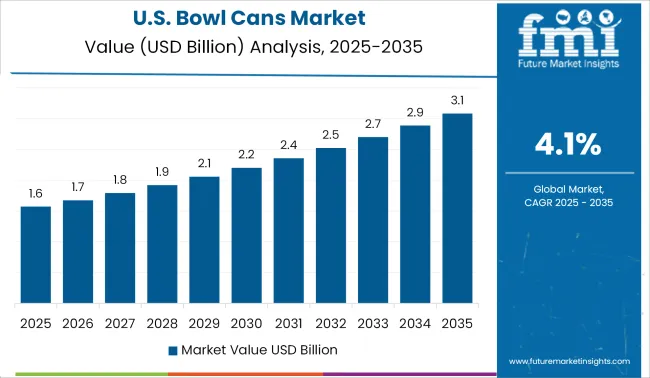

The Bowl Cans Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The bowl cans market is gaining momentum as sustainability imperatives, evolving consumer preferences, and advances in packaging technology converge to redefine food and beverage packaging. The demand for durable, lightweight, and aesthetically appealing solutions has driven adoption of bowl cans across ready to eat meals, snacks, and specialty food categories.

Manufacturers are aligning with regulatory and environmental trends by investing in recyclable materials and low-impact coatings to meet consumer and legislative expectations. Innovations in design, improved shelf appeal, and compatibility with automated filling and sealing lines are further strengthening their market presence.

Future growth is expected to be fueled by premiumization of packaged food, heightened focus on circular economy practices, and collaborative development between material suppliers and food brands to optimize performance and sustainability. These factors are collectively paving the path for broader market penetration and long-term relevance in competitive retail environments.

The market is segmented by Type, Material, Structure, Bowl Can Shape, Volume, Fabrication, and Application and region. By Type, the market is divided into Epoxy, Acrylic, Polyester, and Others. In terms of Material, the market is classified into Aluminum and Steel. Based on Structure, the market is segmented into Two piece bowl can and Three piece bowl can.

By Bowl Can Shape, the market is divided into Standard, Slim, Sleek, and Others. By Volume, the market is segmented into 200 mL - 500 mL, Below 100 mL, 100 mL - 200 mL, and Above 500 mL. By Fabrication, the market is segmented into Printed, Plain, Embossed, and Others.

By Application, the market is segmented into Beverage Can, Food Can, General Line Can, Aerosol Can, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

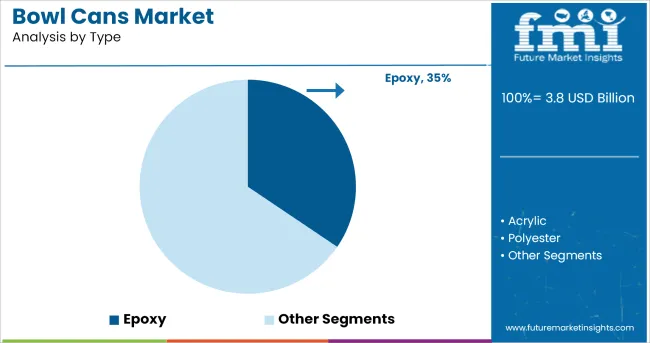

When segmented by type, the epoxy segment is projected to hold 34.5% of the total market revenue in 2025, establishing itself as the leading type. This leadership is attributed to its superior protective barrier properties, which safeguard product integrity against moisture, oxygen, and chemical contamination.

Epoxy coatings have enabled manufacturers to extend shelf life, enhance visual quality, and ensure food safety, particularly in acidic or high-moisture contents. Its widespread acceptance has also been supported by its ability to comply with evolving food contact safety standards while maintaining cost-effectiveness.

Continuous improvements in formulation to reduce bisphenol content and align with regulatory changes have further reinforced its preference among producers. These performance and compliance advantages have solidified epoxy’s position as the dominant type in the bowl cans market.

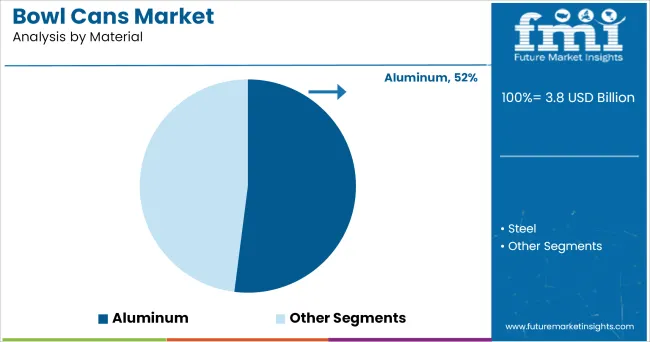

Segmented by material, aluminum is expected to account for 52.0% of the bowl cans market revenue in 2025, retaining its leadership position. This dominance has been underpinned by aluminum’s exceptional combination of strength, lightweight nature, and infinite recyclability, which addresses both performance and sustainability demands.

Its inherent resistance to corrosion, along with excellent formability, has facilitated efficient manufacturing of bowl cans with minimal material wastage. The material’s premium appearance and compatibility with high-speed production lines have enhanced its appeal to both manufacturers and consumers.

Furthermore, its alignment with circular economy principles and high scrap value have incentivized its use, enabling brands to meet environmental targets without compromising product quality. These attributes have positioned aluminum as the material of choice for high-volume and premium packaging applications in the market.

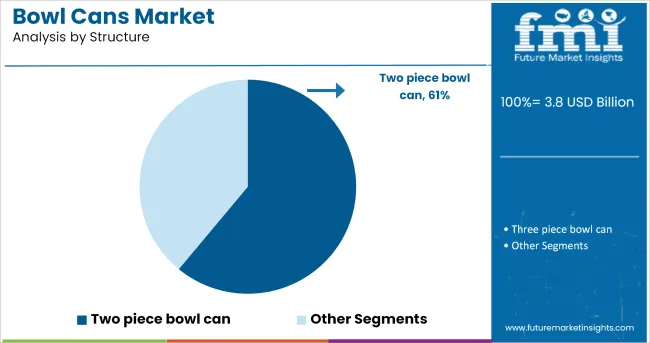

When segmented by structure, the two piece bowl can is forecast to capture 61.0% of the market revenue in 2025, maintaining its position as the leading structural segment. This leadership has been driven by the structural integrity, efficient material usage, and superior sealing performance of two-piece designs.

The elimination of side seams and reduced potential leak points have made two piece cans especially attractive for food applications demanding airtight and hygienic packaging. Their streamlined production process, which combines body and bottom in a single piece, has improved manufacturing efficiency and reduced production costs.

Additionally, the two-piece structure enhances design flexibility, allowing for distinctive shapes and finishes that improve shelf appeal and brand differentiation. These combined functional and economic benefits have reinforced the two-piece bowl can’s prominence in the market.

The growth in the adoption of beverage products globally is lashing the demand for bowl cans. Improved promotional activities by different companies of food & beverages to rise the demand for the usage of the target product owing to increased sales of cold drinks and soft drinks.

The rising demand for changing lifestyles and healthy food among consumers has headed to large consumption of canned products. The growing technologies have allowed the products to enable the manufacturers to adopt smart innovation in product designing. Such products are being lightweight, recyclable and eco-friendly are driving the growth during the forecast period of 2024 to 2035.

Epoxy type of target product are widely used in extensive applications among beverage can manufacturers. However, from the historic period, the companies have started relieving epoxy bowl cans with other substitutes owing to regulatory policies and toxicological presence to put forth by several governing agencies. Polyester and acrylic type are currently being used as an alternative option to epoxy type of bowl cans.

Acrylic type offers clean advent coupled with sulphide and corrosion pigment resistance. Though, these products are brittle in nature, with the possibility of change in taste and odour of foods.

The epoxy type cools down faster as compare to others, aerosol can and others, as plastics are preferred by consumers. Beverage types of can companies have to obey with the strict principles set down by food authorities affecting the quality of the cans. This is expected to drive the demand for the product.

Additionally, these products are ease to maintain the taste and flavour of the product. Beverage type of bowl cans are consumed for alcoholic purposes and non-alcoholic beverages type of cans are used for filling soft drinks, herbal teas, fruit juices, energy drinks, etc.

Whereas, beverage types of cans lengthen the barrier against light and oxygen, subsequently holding the freshness and flavour of beverages. Such growing demand for beverage types of a can is likely to augment the sales.

North America holds the highest market shares for bowl cans market. The growth in the region is attributed to the established availability of chemical industries, personal care, pharmaceutical industries and food and beverages sectors. This, in turn, is expected to use the target product in the above-mentioned industries for various purposes, thus increasing the product demand in the region.

The manufacturing of the product in the region is mainly measured by the USA Food and Drug Administration. Companies at the regional level must comply with regulations concerning bowl cans. This, in turn, is likely to urge the manufacturers to develop the product under government regulations.

As the population is on the rise, the North American people drinks & eats more than ever before, as of 2024, more money was spent on food at dining and restaurants establishments compared to food or grocery stores.

Another dynamic influence behind the swell in growth in the restaurant sector has been the continual implementation of foodie culture by North Americans, hence, with the increase in demand for cold drinks and other bowls can products, the demand for the target product is projected to increase rapidly over the forecast period.

The Asia-Pacific region is projected to be the fastest-growing bowl can market across the world. The region is a manufacturing sector for chemical, pharmaceutical and food & beverages industries, owing to the low cost of raw materials and availability of cheap labour. This is likely to increase the depletion of the product, thus fueling the regional demand.

Countries such as China, Japan, India, Indonesia, Thailand, New Zealand and Australia are considered for the contribution to the regional market. Thus, the growth is projected to be high. Many types of bowl cans are used in the region, such as acrylic, epoxy, polyester and others. The demand from the food & beverage sector is on surge due to the rise in the regional population.

Manufacturers such as Crown Holdings and Ball Corporation are entering into the Asia Pacific region by mounting new production plants in the region. This led to the increase in consumption of the product. Apart from this, high disposable income, urbanization, high industrial growth, and lower production of fresh drinks are driving regional growth.

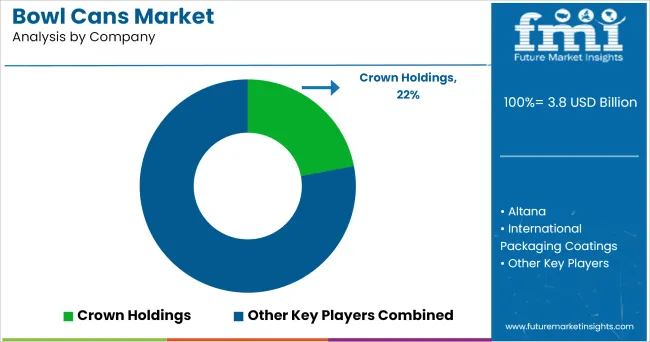

The bowl cans market is moderately consolidated in nature with a few major manufacturers leading a significant position globally. Some of the major players are

These manufacturers have executed various growth strategies like collaboration and new product launch to expand their global presence and escalate their respective sales. For instance, in 2024, Ball Corporation has collaborated with Tubex Industria for its acquisition of USD 80 million. This partnership will enlarge their regional reach and as the demand for bowl cans increases, the acquisitions will help to take the orders from the global market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments by type, by material, by structure, by bowl can shape, by volume, by fabrication, by application and by geographies.

The global bowl cans market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the bowl cans market is projected to reach USD 5.7 billion by 2035.

The bowl cans market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in bowl cans market are epoxy, acrylic, polyester and others.

In terms of material, aluminum segment to command 52.0% share in the bowl cans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Bowl Cans Manufacturers

Cans Market Analysis – Innovations & Industry Forecast 2025 to 2035

Eco Bowls Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tin Cans Market

Sink Bowls Market Size and Share Forecast Outlook 2025 to 2035

Food Cans Market

Beer Cans Market

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Jerry Cans Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Industry Share & Competitive Positioning in Jerry Cans

Market Share Insights of Paint Can Manufacturers

Areca Bowl Market

2 Piece Cans Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Beta-Glucans Market Trends – Growth, Demand & Forecast 2025 to 2035

Industry Share Analysis for 2-Piece Cans Companies

Market Share Insights for Bagasse Bowls Providers

Plastic Cans Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA