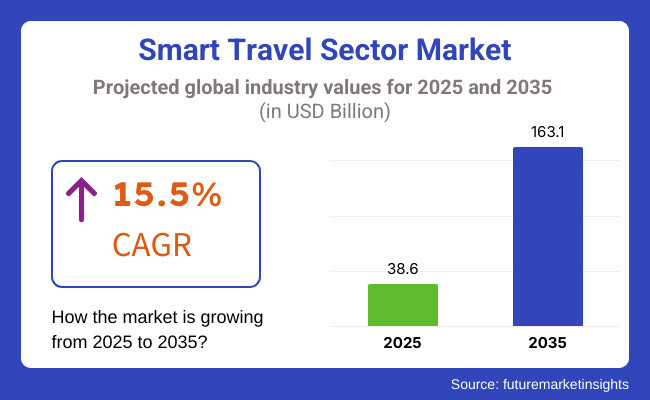

The smart travel market is expected to witness a commendable growth from 2025 to 2035 on account of the increasing adoption of advanced travel technologies along with the growing customer inclination toward digital platforms and the rising integration of IoT, AI and cloud-based solutions in the travel industry. This market is focusing on real-time data analytics, personalized traveller experiences, and connected infrastructure are expected to have USD 38.6 billion in market size by 2025 and USD 163.1 billion in market size by 2035.

This transition to smart travel ecosystems, where different players from airports to hotels, transport services, and tour operators cooperate, will inspire innovation and efficiency in the entire industry. Rising expectations for contactless services, seamless travel solutions, and better data security are changing the market environment as well. Besides this, the use of block chain technologies for secure ticketing, AI driven personalization and increasing collaborations between conventional travel companies and technology firms are foreseen to support significant growth opportunities throughout the forecast period.

The North America smart travel market is experiencing significant traction on the back of ubiquity of digital travel solutions and the presence of a mature travel ecosystem. Regionic infrastructure is well established and significant investments have been made into smart airport projects; so they are taking the lead in real-time tracking systems, automated check-ins and predictive maintenance technologies to improve transport networks. Biometric systems, AI-driven customer service platforms, and connected travel platforms are the way of the future, and particularly, the USA and Canada are leading the charge.

Governments and industry leaders throughout North America are also focused on fostering resilient travel and transport networks, enhancing cybersecurity protocols, and creating multimodal transport solutions for seamless travel. Federal investment in innovation in aviation, broader adoption of ground-breaking technologies like the block chain, which provides secure digital identities; and urban air mobility solutions to capitalize on emerging markets all make the region even more competitive on the global stage.

Europe’s smart travel industry is well supported by national ambitions for sustainable tourism, low-emission transport solutions and cross-border digital travel systems. Countries Brazil, Portugal, China are investing massively in smart transport hubs, automated rail networks, and AI-driven traffic management systems. The European Union’s drive to create sustainable travel platforms and promote multi-modal travel options that think pairing high-speed trains with green municipal transport is guiding the market terrain.

Furthermore, the emphasis on improving passenger safety and convenience and integration of biometric-based access control, block chain tickets and customized travel itineraries in the region has led to innovation while significantly expanding the market coverage. Interest in hydrogen-powered vehicles, digital transformation of public transport and expanded connectivity in remote areas spans Europe, where smart travel is driving a renaissance.

Countries in the Asia-Pacific are quickly adapting to the digital revolution in transportation and tourism, thereby fast-tracking the smart travel sector across the region. In the smart city initiatives adopted by China, Japan, India, and South Korea, travel technologies are integrated into the urban planning process, targeting passenger movement and connectivity. App-based transport platforms, AI travel assistants and smart traffic systems are streamlining the entire travel process.

A key developing aspect of the sector is a push towards cashless transactions, contactless payments, and integrated travel cards. Modernisation of infrastructure, deployment of smart airport solutions and intelligent transport systems are being embraced by governments across Asia-Pacific to accommodate increasing traveller volumes. In addition, the region is investing in high-speed rail networks, electrified public transit, and the use of AI to reduce congestion, ensuring strong growth in the coming years.

Challenges

Data privacy concerns and integration into existing infrastructure

The Smart travel sector market also faces challenges such as compliance with data privacy regulations, cybersecurity risks, and the integration of advanced technologies into existing travel infrastructure. Uncertainty surrounding data breaches, unwanted tracking, redundancies, and compliance with GDPR, CCPA, and other regulations is increasing in tandem with the growing prevalence of AI, IoT, and blockchain solutions in compelling the travel infrastructure.

Moreover, there is a huge financial and operational challenge in integrating the smart travel solutions with legacy systems in the airports, hotels, and transportation systems. Companies need to overcome these challenges through investment in encrypted data management, AI-enabled security protocols, and easy IoT connectivity.

Opportunity

AI-Driven Personalization and Rise of Contactless Travel

As a result, the smart travel sector market is finding enormous opportunity with the increasing demand for seamless, effective, and personalized travel experiences. Travelers are now interacting with airlines, hotels and mobility service providers in entirely new ways thanks to AI-powered recommendation engines, contactless check-ins and predictive analytics. IoT-Enabled Smart Luggage Tracking, Blockchain based Ticketing, Digital Concierge Services are boosting up the Efficiency & Security.

Similarly, sustainability-oriented smart travel solutions, such as AI-based energy use optimization in the hospitality sector and live carbon footprint monitoring for flights, have started to gain traction. The evolution of the smart travel sector will be driven by companies investing in hyper personalized AI services, biometric security solutions, and digital travel ecosystems.

The smart travel sector market grew rapidly between 2020 and 2024 due to the growing use of AI, automation, and real-time analytics in travel services. Biometric verification, self-service kiosks, and AI chatbots were some of the tools used by hotels and airlines for customer engagement and operational convenience. Yet full-scale implementation faced obstacles including cybersecurity risks, slow regulatory adaptation, and uneven implementation. This meant companies were created that catered to such requests, including AI-driven fraud detection, cloud-based travel data management, and IoT-connected smart city travel ecosystems.

Over the next 5-10 years, the industry will embrace technological evolution with the emergence of AI-driven virtual travel assistants, blockchain-based digital passports, and completely automated transport centres. The growth of AI-powered itinerary curation, met averse-based travel sneak-peeks, and voice-activated digital concierge services will transform the way we travel.

Moreover, the global travel environment will witness on-platform improvements driven by decentralization, AI-inspired carbon and waste footprint tracking, and more efficient navigation experiences brought by AR. The future of the Smart Travel Sector Market belongs to those companies that leverage real-time data analytics, autonomous mobility integration, and AI-assisted travel security.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | GM Platform is fully compliant with GDPR, CCPA, and AI ethics guidelines |

| Technological Advancements | Growth in biometric authentication, AI-driven customer service |

| Industry Adoption | Increased implementation of IoT-based travel tracking and digital wallets |

| Supply Chain and Sourcing | Dependence on centralized data management and legacy systems |

| Market Competition | Presence of traditional travel tech firms and digital start-ups |

| Market Growth Drivers | Demand for convenience, automation, and data-driven personalization |

| Sustainability and Energy Efficiency | Early adoption of energy-efficient hotels and eco-conscious travel platforms |

| Integration of Smart Monitoring | Limited use of IoT-based location tracking and digital concierge systems |

| Advancements in Smart Tourism | Use of AI chatbots, self-service kiosks, and digital booking platforms |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of blockchain-secured digital travel identity, AI-driven compliance monitoring, and decentralized booking security. |

| Technological Advancements | Broadened use of blockchain-based digital travel identity, AI-powered compliance tracking, and open-source reservation security. |

| Industry Adoption | Expansion into decentralized AI-powered travel planning, smart border control, and seamless contactless travel. |

| Supply Chain and Sourcing | Shift toward decentralized blockchain travel ecosystems, AI-enhanced logistics, and self-learning mobility networks. |

| Market Competition | Rise of AI-native travel platforms, autonomous travel service providers, and immersive digital tourism hubs. |

| Market Growth Drivers | Increased investment in AI-assisted itinerary customization, smart airport innovations, and AR-powered navigation. |

| Sustainability and Energy Efficiency | Large-scale deployment of AI-optimized energy tracking, net-zero travel ecosystems, and sustainable aviation analytics. |

| Integration of Smart Monitoring | AI-enhanced predictive analytics, real-time traveller sentiment analysis, and hyper-personalized travel assistance. |

| Advancements in Smart Tourism | Development of AI-driven immersive travel experiences, met averse tourism, and self-navigating smart mobility services. |

The United States smart travel industry has witnessed significant growth over the previous years, and smart travel is expected to rise at a high rate of growth over the forecast period. Top airlines, hospitality chains, and travel tech companies are going for smart mobility platforms, IoT-enabled travel and biometric authentication and systems.

USA Transportation Security Administration and Department of Homeland Security are accelerating the deployment of AI-enhanced security screening devices, digital passports, and face recognition technology to facilitate and secure travellers. Also helping to propel the demand for smart travel solutions are the rise of smart airports, high-speed rail projects and connected transportation networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.2% |

The growth of the UK smart travel sector is strong and is supported by digital transformation in the travel industry, increasing utilization of AI-powered chatbots for travel assistance, and growing smart transport infrastructure. Market growth is being fuelled by the UK government’s investment in smart cities and transport technologies, from London’s smart traffic management tools to digitalised travel systems.

As the sustainable and hassle-free travel boom accelerates, UK travellers are increasingly turning to mobile ticketing, real-time transit apps and AI-based itinerary planners. Smart border control systems at airports and train stations also make international travel safer and more convenient.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.0% |

The Europe smart travel market is observing a tremendous growth, owing to the rising investment in digital tourism solutions, intelligent transportation infrastructure, and AI-based travel analytics. Countries like Germany, France and the Netherlands lead the march to the contactless payments, biometric check-ins and AI-powered travel recommendations.

This momentum around smart travel solutions will be driven by investments in EU smart travel solutions (EU Digital Travel Strategy) and applications of technologies like real-time traffic management, smart airport app services and autonomous public transport systems. In addition, 5G networks and IoT-based tourism services are enhancing tourist experience across the Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 15.4% |

Japan's smart travel sector is hot - and set to hot up further as tech advances, cashless payments and AI-integrated tourism services supercharge the offering. AI-powered concierge services, smart hotels and facial recognition-based transportation systems are among the many ways in which the country’s leadership in robotics and automation is improving the travel experience.

Japan’s Smart Mobility 2030 program is expediting digital tourism innovations, smart train networks and driverless car integration. For instance, the increase in inbound tourism from China, South Korea, and the USA is driving up demand for systems that can provide real-time AI translation, AR-assisted navigation, and smart airport service.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.7% |

The smart travel space in South Korea is booming, backed by a rapidly evolving digital infrastructure, AI-powered travel solutions, and the country’s forefront position in this landscape focused on 5G connectivity. In cities such as Seoul, Busan and Incheon, smart tourism platforms integrating AI, IoT and blockchain are pushing the customer experience envelope.

The Digital New Deal initiative in South Korea is fueling smart city tourism, automated public transport systems, and cashless mobility platforms. The country’s leadership in autonomous vehicle tech and digital payments are also encouraging with the rise of contactless travel experiences.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.0% |

The smart ticketing and smart security services market occupies the leading share in the market of the smart travel sector by pursuing convenience, automation, and additional security during travel. The digital intelligent solutions achieve their core purpose in optimizing travel experience, eliminating operating inefficiencies, and providing seamless mobility, which has rendered them indispensable in public transit systems, aviation firms, hotel chains, and city mobility networks.

Smart ticketing is currently among the smartest solutions that have been accepted in the smart travel industry, giving travelers convenient access to transport systems, tourist facilities, and hospitality infrastructure through electronic, contactless, and mobile payments. Smart ticketing deviates from paper tickets because it supports electronic payment, which cuts down waiting time, does away with paper consumption, and improves the convenience of traveling.

Touchless journeys and mobile ticketing-based digital mobility solutions with NFC-based tickets, QR-code-based boarding passes, and biometric check-ins are driving the emergence of smart ticketing as airports, transport authorities, rail, and event organizers increasingly seek to enhance passenger comfort and travel convenience. There are indicators of high demand in this market with more than 70% of city passengers naming the use of smart ticketing over the use of usual fares as their first preference, which indicates high demand in this market.

Development of AI and blockchain-based journey payment systems, fraud-proof digital tickets, multiple-mode transit cards, and optimal fare real-time optimization has added market demand, which ensured enhanced use of smart ticketing across worldwide transit networks.

Integration of AI-driven predictive analytics, with dynamic fare management algorithms, congestion-based fare optimization, and real-time crowd management, has also grown adoption, ensuring improved efficiency and optimized traveler convenience.

Introduction of multi-platform ticketing environments, one-app-for-all travel products, cross-border ticketing unification, and intermodal fare management has optimized market growth, offering greater flexibility and interoperability in travel reservation and payment systems.

Use of biometric-based smart ticketing, i.e., face recognition, fingerprint authentication, and AI-driven fraud detection, has enabled market growth, providing higher security and touchless travel experience for passengers.

In spite of cost savings, affordability, and convenience in mobility that come along with its implementation, the market for smart ticketing is tainted by security issues, upgradation expenses, and cross-system integrations. Innovative decentralized digital wallet technologies, fraud management using artificial intelligence, and contactless authentication technologies, nevertheless, are enhancing security, scalability, and take-up rates that will propel the smart ticketing solution market even more rapidly.

Smart security services have registered strong marketplace demand in hotel access control, airport security, and mass transit surveillance as shipping and airlines, governments, and hotels are making more investments in automated, artificial intelligence-driven, and biometric security solutions. Unlike conventional security systems, smart security services utilize data-driven new technologies to improve traveler security, facilitate easier verification of identity, and accelerate security clearance procedures.

Growing need for AI-driven risk evaluation and real-time security monitoring, such as biometric scanning, facial recognition, and AI-based baggage scanning has spurred the implementation of smart security services, in which travel providers want enhanced security and anti-counterfeiting options. More than 60% of global airports and key transit points have started using biometric security solutions, which would place the industry highly sought after.

Roll-out of AI-based border control solutions like intelligent e-gates, self-service passport scanning, and blockchain-enabled encrypted traveler authentication has driven market demand, facilitating more advanced security solutions take-up by customs and immigration control.

Release of predictive security analytics like analysis of behavioral patterns, AI-based risk profiling, and anomaly detection to counter fraud has further driven take-up, facilitating enhanced security screening and real-time prevention of threat.

Real-time surveillance and monitoring technologies like AI-driven CCTV tracking, crowd insights, and emergency response systems with real-time incidence have been market drivers, accompanied by augmented passenger security and additional incident response functionality.

Integration of touchless authentication for security measures, like touchless biometric verification, AI-powered voice-based authentication, and sensor identification, has made markets stronger with richer security and hygienic journey experiences.

With the benefit of improved security, rapid security clearance, and fraudulent detection by means of AI, smart security services industry is beset by dangers to privacy, investment in infrastructure, and intensifying cyber assaults. With advancements on the line in privacy-centric AI, quantum-secure verifiers, and decentralized ID confirmation technology, the productivity of smart security services, traveler confidence, and data preservation are becoming progressively more effective and secure, justifying further growth in the sector of smart travels.

Phone booking and online booking segments are two significant market drivers since tourists increasingly incorporate digital-first convenience, personal reservation help, and uncomplicated fraud security when organizing vacations. Phone Booking Segment Dominates Market Demand as Human-Assisted Travel Reservations Continue to Resonate

Telephonic booking has become one of the popular reservation media, providing travelers with immediate support, last-minute itinerary flexibility, and fraud-proof reservation validation for intricate holiday plans. Telephonic bookings are superior to fully automated web sites since telephone booking services involve human-assisted travel planning that provides customized recommendations, instant technical support, and fraud protection for high-ticket bookings.

Increasing demand for high-security and concierge-supported travel reservations, including multi-level identity verification, financially encrypted transactions, and AI-driven phone reservation fraud protection has driven up adoption of phone booking services as travelers want comfort in luxury and business travel booking.

Despite its personal service, fraud protection, and flexible itinerary control strengths, the telephone booking segment also has the drawback of cost of operation, the dependency on the call center's efficiency, and low scalability when it comes to high volume bookings. New voice assistant AI, NLP reservation bots, and live fraud risk scoring in telephone bookings are making it more efficient, secure, and traveler-friendly, ensuring continued market growth for telephone booking services.

Online booking has gained broad market adoption, particularly in airline bookings, hotel bookings, and multimodal travel planning, as digital consumers more and more make use of AI-powered suggestions, real-time prices, and easy online payments. Comparing to phone booking, online booking websites provide self-service convenience, 24/7 accessibility, and automated fraud protection that are among the reasons why technology-inclined travelers like them.

The increasing need for AI-based travel planning, with dynamic pricing models, predictive itinerary suggestions, and blockchain-protected booking transactions, has fueled online booking service adoption, as travelers value speed, efficiency, and cost savings.

While its goodness is digital convenience, immediate reservation, and frugality, the web booking industry has fault lines like cybersecurity attacks, hidden charges, and impersonal treatment for complex travel itineraries. Nevertheless, technology innovation in decentralized booking sites, artificial intelligence (AI) fraud prevention, and virtual reality (VR) sampling of travel destinations is enhancing security, consumer satisfaction, and booking authenticity, allowing online booking sites to expand more widely in the intelligent travel industry.

The market for smart travel sector is growing on the back of rising demand for AI-infused travel experiences, IoT-driven transportation systems, as well as digital payment solutions. Real-time travel analytics, ticketing practices based on blockchain, and contactless travel management are amongst the most important tech trends defining innovative companies in the travel sector today, allowing such organizations to improve efficiency, security, and attractiveness for customers.

Industry players encompass global travel technology providers, digital payment companies, and AI-driven tourism platforms, all of which foster technological improvements in personalized travel planning, smart transportation solutions, and integrated AI customer support systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google Travel & Google Maps | 18-22% |

| Expedia Group | 12-16% |

| Booking Holdings (Booking.com, Priceline, Agoda, Kayak) | 10-14% |

| Amadeus IT Group | 8-12% |

| Sabre Corporation | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google Travel & Google Maps | Develops AI-powered travel planning tools, smart navigation, and predictive traffic analytics. |

| Expedia Group | Specializes in personalized trip recommendations, digital ticketing, and AI-driven travel assistance. |

| Booking Holdings | Provides multi-platform smart travel solutions, contactless hotel check-ins, and blockchain-based travel transactions. |

| Amadeus IT Group | Offers AI-powered airline and hotel booking systems, digital ID verification, and smart mobility solutions. |

| Sabre Corporation | Focuses on travel AI optimization, real-time pricing algorithms, and cloud-based trip management platforms. |

Key Company Insights

Google Travel & Google Maps (18-22%)

Google dominates the smart travel market with real-time traffic predictions, artificial intelligence travel planning, and seamless multi-modal transport navigation.

Expedia Group (12-16%)

Personalized booking services for smart travelers, AI-driven dynamic pricing, and real-time customer assistance

Booking Holdings (10-14%)

Focused on the seamless travel booking experience, Booking Holdings has developed solutions to optimize contactless check-in and mobile trip planning, as well as to apply AI to vacation customization.

Amadeus IT Group (8-12%)

Amadeus operates platforms for airline tickets and hotel bookings powered by AI technology, along with secure blockchain-based transactions to facilitate mention of global travel.

Sabre Corporation (5-9%)

Sabre provides future-ready intelligent travel technology, offering predictive analytics in travel management along with AI-enabled itinerary improvements

Other Key Players (35-45% Combined)

Next-gen smart travel innovations, AI-based personalized experiences, contactless travel solutions, are catered by many travel tech providers, Fintech software development companies, and smart transportation platforms. These include:

The overall market size for smart travel sector market was USD 38.6 Billion in 2025.

The smart travel sector market expected to reach USD 163.1 Billion in 2035.

The demand for the smart travel sector market will be driven by advancements in technology, increasing adoption of mobile applications, demand for personalized travel experiences, IoT integration, smart transportation solutions, and a growing focus on sustainability and convenience in travel management.

The top 5 countries which drives the development of smart travel sector market are USA, UK, Europe Union, Japan and South Korea.

Smart ticketing and smart security services to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Solution Type, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Tourism Type , 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Global Market Attractiveness by Solution Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Tourism Type , 2023 to 2033

Figure 32: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 64: North America Market Attractiveness by Solution Type, 2023 to 2033

Figure 65: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 66: North America Market Attractiveness by Tourism Type , 2023 to 2033

Figure 67: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Solution Type, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Tourism Type , 2023 to 2033

Figure 102: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Solution Type, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Tourism Type , 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Solution Type, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Tourism Type , 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Solution Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Tourism Type , 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Solution Type, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Tourism Type , 2023 to 2033

Figure 242: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Solution Type, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Tourism Type , 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Solution Type, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution Type, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution Type, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Tourism Type , 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourism Type , 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourism Type , 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Solution Type, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Tourism Type , 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA