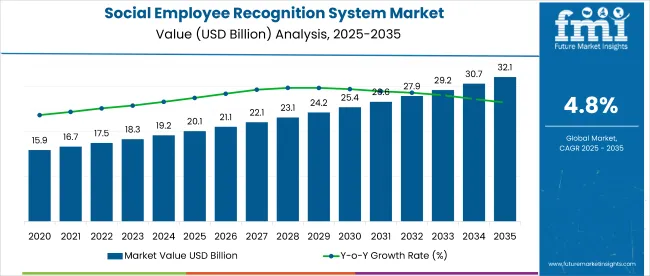

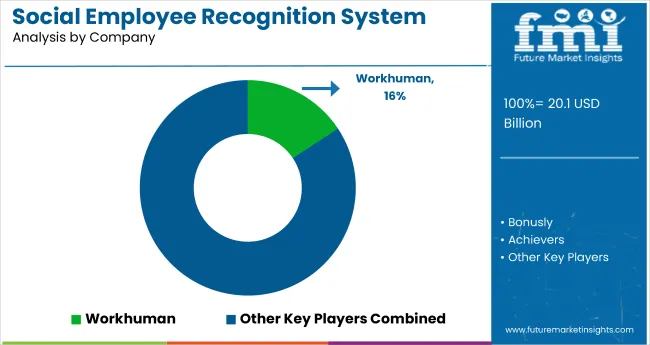

The global social employee recognition system market is poised for significant growth, expanding from USD 20.1 billion in 2025 to USD 32.1 billion by 2035, reflecting a robust CAGR of 4.8%. Driven by digital transformation, heightened focus on employee well-being, and an evolving hybrid workforce, organizations across sectors are deploying recognition platforms to improve engagement and retention.

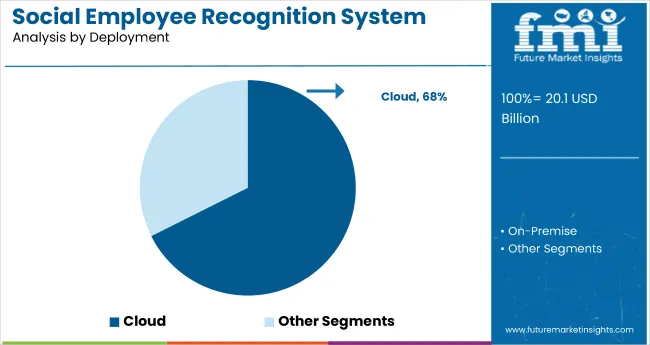

Cloud-based deployment models are at the forefront of this shift, with a CAGR of 14.9%, owing to their scalability, cost-efficiency, and remote accessibility. This is especially attractive for SMEs and enterprises operating with distributed teams. In contrast, on-premises systems continue to find relevance among highly regulated sectors like BFSI and healthcare, where compliance and data security remain paramount.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 20.1 billion |

| 2035 Market Size | USD 32.1 billion |

| CAGR (2025 to 2035) | 4.8% |

Among industries, retail & consumer goods are expected to command the highest market share at 31.9% in 2025. High employee turnover and frontline workforce dynamics in this sector are compelling organizations to invest in real-time, mobile-first recognition solutions that reinforce positive behavior and align employees with brand values.

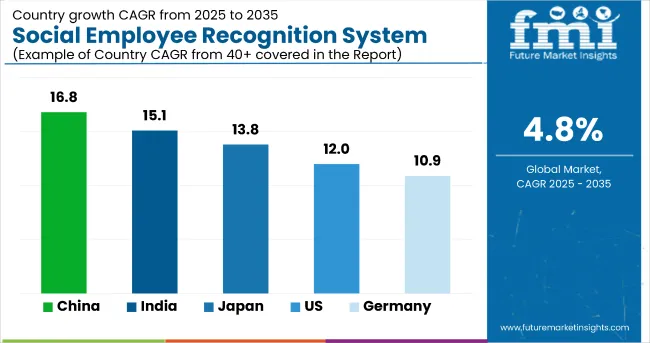

Regionally, China (16.8% CAGR), India (15.1%), and Japan (13.8%) lead global growth, underpinned by rapid digitization, AI integration in HR platforms, and supportive government initiatives. In the USA, the adoption of AI-powered sentiment analysis and cultural analytics in recognition software continues to redefine employee engagement models.

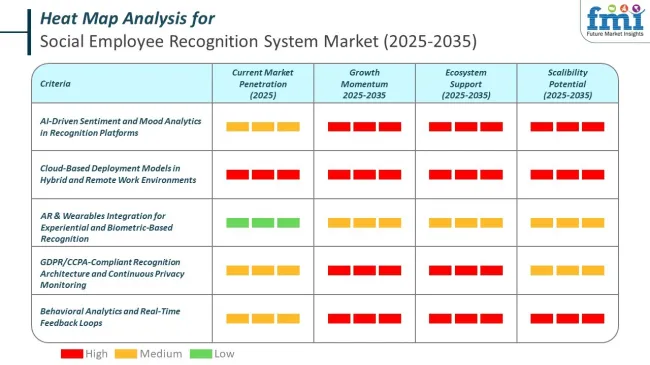

Key vendors such as Workhuman, Bonusly, Kudos, Achievers, and Awardco are investing in advanced analytics, blockchain-based rewards, and mobile-first capabilities to differentiate in a competitive landscape. The market is also witnessing growing interest in privacy-compliant systems as GDPR, CCPA, and other regional laws shape the product development roadmap.

Overall, the next decade is likely to be characterized by hyper-personalized recognition ecosystems, driven by AI, automation, and a relentless emphasis on employee experience.

AI is transforming the core of recognition platforms in the social employee recognition system market. From being systems of record, they are now systems of insight. Machine learning algorithms are trained to spot under-recognition patterns. Natural language processing also plays a key role.

Workhuman’s use of AI stands out in the social employee recognition system market. Its Moodtracker tool maps emotional trends at the team level. Instead of waiting for quarterly feedback cycles, recognition happens as moods shift. If a team shows signs of burnout, the platform triggers timely interventions. Recognition is aligned with emotional reality rather than HR calendars.

Awardco integrates predictive logistics. Through Amazon Business, it uses AI to manage delivery and inventory. When employees choose rewards, the system calculates the fastest fulfillment route. AI also tracks which items are trending to ensure supply meets demand. The outcome is a seamless experience from selection to delivery.

Emerging technologies are adding more intelligence in the social employee recognition system market. Blueboard is using AR to simulate reward experiences before redemption.

The market is reshaped by behavioral analytics, emotional intelligence, and predictive modeling.

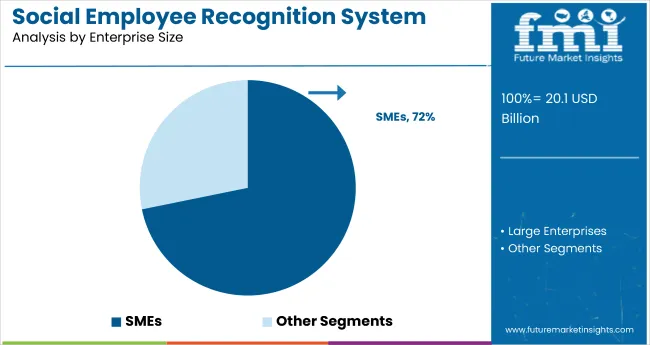

Small and Medium Enterprises (SMEs) dominate with 71.8% of the market share in the social employee recognition system market, reflecting their growing need for cost-effective, scalable solutions to improve employee engagement and retention. SMEs are increasingly adopting these systems as they offer affordable alternatives to traditional HR practices while providing powerful tools for boosting workplace morale and productivity. The segment's growth is driven by the recognition that employee satisfaction directly impacts business performance, particularly in competitive talent markets where SMEs must differentiate themselves from larger corporations.

These organizations benefit from flexible, user-friendly platforms that require minimal IT infrastructure and can be quickly implemented across small teams. Social recognition systems enable SMEs to create culture-driven workplaces that foster peer-to-peer appreciation, goal achievement tracking, and transparent performance feedback. As remote and hybrid work models become more prevalent, SMEs are leveraging these digital solutions to maintain team cohesion and employee connection, ensuring the segment's continued market leadership.

Cloud deployment holds the dominant position with 67.6% of the market share in social employee recognition systems, driven by its superior scalability, cost-effectiveness, and ease of implementation. Cloud-based solutions eliminate the need for extensive on-premise infrastructure, making them particularly attractive to organizations seeking rapid deployment and reduced IT maintenance overhead. The segment benefits from enhanced accessibility, allowing employees to engage with recognition platforms from any location and device, which is essential in today's distributed work environment.

Cloud deployment offers automatic updates, robust security features, and integration capabilities with existing HR and collaboration tools, streamlining the user experience across organizations. The model's subscription-based pricing structure aligns with modern business preferences for operational expenditure over capital investment, while providing predictable costs and scalability options. As businesses continue to embrace digital transformation and remote work flexibility, cloud-based employee recognition systems are positioned to maintain their market dominance through enhanced functionality and seamless user experienced.

| Company | Workhuman |

|---|---|

| Contract/DevelopmentDetails | Partnered with a multinational technology company to deploy a social employee recognition platform, aiming to boost employee engagement and retention through peer-to-peer recognition and rewards. |

| Date | March 2024 |

| Contract Value (USD million) | Approximately USD 12 |

| Renewal Period | 3 years |

| Company | Achievers Solutions Inc. |

|---|---|

| Contract/DevelopmentDetails | Secured a contract with a financial services firm to implement an employee recognition system, enhancing company culture and employee satisfaction through real-time feedback and reward mechanisms. |

| Date | July 2024 |

| Contract Value (USD million) | Approximately USD 10 |

| Renewal Period | 2 years |

Rising focus on employee engagement and retention in competitive job markets

In the present-day competitive job markets, organizations are making conscious efforts to focus on employee engagement and retention as a way to retain talented & motivated employees. The extremely high rates of disengagement have been a major area of concern; for example, it was found that 71% of government employees are “not engaged” in their jobs, which severely impacts productivity and increases turnover. Agencies are employing strategies like mentoring programs to address it, which have proven to foster higher engagement and lower attrition.

Fostering environments where employees feel valued and recognized, supported by leadership commitment and accountability, is part of more recent research focusing on this area. Organizations with such practices seek to be a great place to work, raising job satisfaction and loyalty, and reducing the costs that go with high employee turnover.

Growing influence of AI and automation in real-time employee feedback and rewards

The use of AI and automation into human resource practices is transforming the real-time employee feedback and rewards systems. AI facilitates automating repetitive tasks, which frees up HR professionals to devote their time to creating strategic initiatives that improve employee engagement.

AI can enhance operational efficiency and provide personalized feedback; the result is a more engaged workforce, according to studies. In fact, the integration of AI in performance management has generated concerns around fairness and transparency. Diversity-related issues have also arisen; for instance, AI-powered performance systems have led to conflicts over the need for agreed-upon procedures and human intervention to prevent misuse and maintain fairness. However, leveraging AI strategically in feedback and reward systems can lead to more adaptive and motivating work environments, despite the potential for misalignment.

Adoption of mobile-first recognition apps for a remote and desk less workforce

The increased focus on remote and deskless work has surged the deployment of mobile-first recognition applications that enable organizations to reach their employees no matter where they are. With such platforms, real-time recognition and feedback can be provided, helping to create a culture of inclusion and appreciation among remote teams.

Mobile apps are flexible and that means they can fit into the daily work flows easily, making it easier for managers and peers to recognise accomplishments in a timely fashion. This not only boosts morale but is also highly responsive to the increasing demand for digital solutions that accommodate different working arrangements. Using mobile-first recognition tools, businesses can keep their workforce aligned and engaged with each other.

Employee recognition platforms face resistance due to data security and privacy issues

Employee recognition tools gather and retain large volumes of private and professional information, such as employee performance data, feedback, and history of rewards. This data is typically shared across various departments and accessed via cloud-based systems, which can leave it open to being breached or misused.

Especially where compliance is a must, organizations are becoming more concerned with the management of employee information. Also, employees may be uncomfortable about the fact that their data is stored, processed, and analyzed by automated systems, prompting trust issues, and reluctance to participate in the recognition programs.

And since recognition platforms are often integrated with HR and payroll systems, they further expand the attack surface in terms of sensitive data being at risk. Failure to properly manage or keep such information safe can mean reputational damage for the companies and possible legal consequences. Organizations operating across multiple countries also have to deal with the challenge of compliance with various regional data protection laws. Location-Based: Different regions may have their privacy regulations like GDPR in Europe or CCPA in California do not have any competence.

Tier 1 Vendors- These are the market giants who hold a major share of the global social employee recognition system market. These companies are known for their end-to-end and cutting-edge solutions, wide global coverage, and a large amount of capital. Their huge market share can be explained by their unique combination of scalable, customizable, and integrated platforms that meets the complicated needs of enterprises across industries.

They regularly invest in R&D to improve their products, harnessing state-of-the-art technologies like AI and ML to give users personalized, real-time recognition experiences. In addition, their vast brand recognition and established customer base play a significant role in helping them maintain market leadership positions.

The mid-tier of the market consists of so-called Tier 2 vendors. Although not as far-reaching or comprehensive as Tier 1 vendors, these companies usually have a strong market presence and provide robust employee recognition solutions. Tier 2 vendors tend to focus on building out their own end-to-end solution capabilities to fill the feature and functionality gaps to market leaders.

They can frequently find niches in between mid-sized enterprises and verticals within various industries and provide specialized solutions to meet the needs of these organizations. Although they could struggle to compete with Tier 1 vendors, a closer focus enables them to react more quickly to market trends and customer feedback, leading to improved innovation and customer satisfaction.

Vendors in Tier 3 are emerging players or niche providers in the market for social employee recognition systems. These types of companies tend to grow based on reaching market scale and providing a customized solution to any customer, often aimed at small and medium business and niche sectors.

These emerging companies focus on filling niche market gaps and providing services such as localization, account customization, and dedicated support, which larger Tier 2/3 vendors have difficulty delivering. Typically, their focus has on aggressive pricing of their products, personalized service, and ability to customize based on unique customer needs. Though they have less resources and brand recognition than larger rivals, their specialised products and customer-focused strategies allow them to compete in the marketplace.

The section highlights the CAGRs of countries experiencing growth in the Social Employee Recognition System market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.1% |

| China | 16.8% |

| Germany | 10.9% |

| Japan | 13.8% |

| United States | 12.0% |

The Evolution of Chinese Corporations into an AI-Driven Work Environment Market competition and technological advancement of enterprises are force to promote this trend. AI has already found its way into workplace applications in finance, retail, high-tech sectors, and other industries that account for a sizable chunk of China's estimated 2019 AI market. As an example, large tech companies adopt AI-based platforms to tailor employee recognition, resulting in a more enthusiastic and lucrative workforce.

Recently, Futian District in Shenzhen, employing the cutting-edge DeepSeek model, hired 70 AI-powered digital employees to enhance government efficiency. Trained on data up to October 2023, these AI agents are engineered to perform 240 distinct governmental functions including processing documents and managing public services, illustrating China's ambition to embed AI in both the public and private spheres. China is anticipated to see substantial growth at a CAGR 16.8% from 2025 to 2035 in the Social Employee Recognition System market.

Along with the fastest growth of the working population in the world, India is also witnessing a major shift in workforce dynamics with increasing dependency on remote and hybrid work models. As this change in work dynamics established itself, mobile-first recognition applications became ubiquitous to reach employees no matter where they may be.

About 20 per cent of all job postings in India in recent data offer remote or hybrid work options, a dramatic increase from 0.9 per cent in 2020. In fact, 38% of job postings in the Information Technology sector are also hybrid and remote roles, which shows the adaptability of the entire sector to flexible work arrangements. Mobile-first recognition tools -where employees can be the first to acknowledge who they see doing things the right way - are in place to maintain a high morale in teams that are far away from each other, risking lack of cohesion normally cultivated by being together.

The government of India too has sighted the potential of flexible work setups; as per data, 90% of employees work in hybrid models, a healthy mix of in-office and remote work. India's Social Employee Recognition System market is growing at a CAGR of 15.1% during the forecast period.

From Employee Recognition Platforms to Corporate Culture by Hype & AI True North Reporters in the USA, there is an ever increasing demand to integrate AI-powered sentiment analysis and machine learning for culture and productivity within employee recognition platforms.

These tools learn from communication patterns and feedback to assess employee mood, intervention, and determine the best way to recognize staff. Yet these technologies have ignited discussions of privacy and ethics. Recent articles, such as this one, point out that workplace surveillance has taken on new dimensions, with AI tools keeping an eye on everything from when employees arrive to how long they stare at their computer screens - raising questions about trust and morale. However, the USA government recognizes the transformative potential of AI across many sectors despite these challenges.

The Department of State adds that AI technologies are at the heart of a new global technology revolution, one that is central to the well-being. USA is anticipated to see substantial growth in the Social Employee Recognition System market significantly holds dominant share of 74.3% in 2025.

The Social Employee Recognition System Industry is competitive as companies providing a solution at the same time are increasing due to the engaged solutions demand in every industry. Vendors compete on AI-enabled analytics, real-time recognition and mobile-first platforms. Adoption is heavily influenced by pricing models, integration capabilities and customization options. And increasing competition is leading providers to improve user experience and provide value-added services.

Industry Update

| Report Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 20.1 billion |

| Projected Market Size (2035) | USD 32.1 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| Deployment Types | Cloud-Based, On-Premise |

| Industries Covered | BFSI, Healthcare, Retail & Consumer Goods, IT & Telecom, Manufacturing |

| Top Segments Covered | By Deployment, By Industry, By Region |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Workhuman, Bonusly, Achievers, Kudos, Awardco, Nectar, Blueboard, Guusto, Terryberry, Fond |

| Additional Attributes | AI-enabled analytics, mobile-first platforms, compliance with GDPR/CCPA, market share analysis, contract wins |

| Customization & Pricing | Available upon request |

In terms of deployment, the segment is divided into Cloud based and on premise.

In terms of Enterprise Size, the segment is segregated into SMEs and Large Enterprises.

In terms of industry, the segment is segregated into Retail & CGs, IT & Telecom, Healthcare, Media, Travel, Manufacturing and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Social Employee Recognition System Market is expected to grow at a CAGR of 4.8% from 2025 to 2035, reaching USD 32.1 billion by 2035 due to rising demand for AI-driven employee engagement tools.

Cloud-Based deployment is projected to lead the market, growing at a CAGR of 14.9% between 2025 and 2035, driven by scalability, real-time access, and cost-effectiveness.

Key players include Workhuman, Bonusly, Achievers, Kudos, Awardco, Nectar, Blueboard, Guusto, Terryberry, and Fond.

East Asia is forecasted to grow at the fastest rate, with a CAGR of 15.9%, led by advancements in AI-driven platforms in China and Japan.

Retail & CGs lead due to high employee turnover and the necessity for structured recognition programs that boost satisfaction, retention, and customer experience.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Enterprise Type, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Industry Type , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 17: Global Market Attractiveness by Deployment Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Industry Type , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 37: North America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Industry Type , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Industry Type , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Industry Type , 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Industry Type , 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Deployment Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Industry Type , 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 137: East Asia Market Attractiveness by Deployment Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Industry Type , 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Enterprise Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Industry Type , 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Enterprise Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Enterprise Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Enterprise Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Industry Type , 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry Type , 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry Type , 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Deployment Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Enterprise Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Industry Type , 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

SocialFi NFTs Market Size and Share Forecast Outlook 2025 to 2035

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Social Tourism Market Forecast and Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social TV Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Social Advertising Tools Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Media Content Creator Market

Social Media Analytics Market

Social Software As A Collaborative ERP Tool Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA