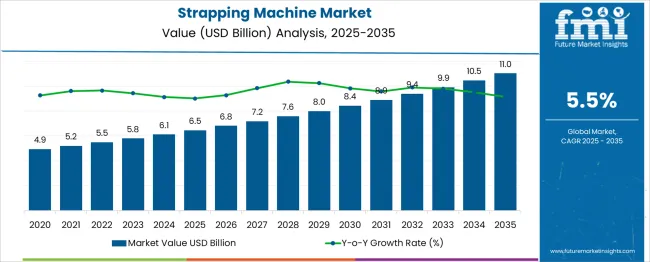

The Strapping Machine Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Between 2020 and 2030, the market value increases from USD 4.9 billion to around USD 8.0 billion, reflecting an average annual growth rate of 5.3%. This phase of growth is driven by rising demand for automated and semi-automated strapping solutions across various industries, including packaging, logistics, and manufacturing. Increasing emphasis on improving operational efficiency, reducing manual labor, and enhancing package security fuels adoption. Technological advancements in strapping machines such as enhanced tension control, integration with conveyor systems, and user-friendly interfaces contribute to market expansion. Regulatory requirements focusing on packaging safety and transportation standards further support growth during this period. From 2030 to 2035, the market accelerates from USD 8.4 billion to USD 11.0 billion, propelled by increased deployment of advanced strapping technologies incorporating IoT capabilities, remote monitoring, and predictive maintenance features.

Emerging economies display significant uptake due to expanding manufacturing sectors and infrastructural development. The market evolves in response to changing industrial automation trends, supply chain complexities, and sustainability initiatives. Overall, sustained growth is expected through 2035, driven by continuous innovation, increasing automation adoption, and growing demand for efficient and reliable packaging solutions worldwide.

| Metric | Value |

|---|---|

| Strapping Machine Market Estimated Value in (2025 E) | USD 6.5 billion |

| Strapping Machine Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The strapping machine market is undergoing steady expansion, driven by the need for high-speed, secure bundling and packaging solutions across logistics, manufacturing, and warehousing operations. Automation of end-of-line packaging processes is accelerating, with companies investing in strapping equipment to reduce labor costs, improve throughput, and ensure product safety during transportation.

Increasing e-commerce activity and globalized supply chains are further supporting demand for standardized, tamper-resistant packaging. Technological enhancements such as touchscreen interfaces, self-diagnostics, and compatibility with diverse strap materials are reshaping customer expectations.

Environmental concerns are also influencing machine design, with manufacturers focusing on recyclability, energy efficiency, and support for biodegradable or recycled strapping materials. As more industries transition toward smart packaging lines, strapping machines are poised to play a key role in improving operational agility and packaging reliability.

The strapping machine market is segmented by type, material, application, distribution channel, and geographic regions. The strapping machine market is divided into Automatic, Semi-automatic, and Manual. In terms of material, the strapping machine market is classified into Polypropylene, Steel, Polyester, and Others. Based on the application, the strapping machine market is segmented into Packaging, Logistics & transportation, E-commerce, Manufacturing, Construction materials, Textiles, Food and beverage, and Others. The distribution channel of the strapping machine market is segmented into Direct and Indirect. Regionally, the strapping machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

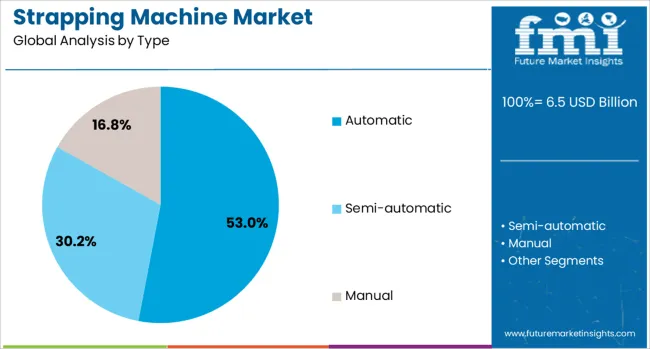

By type, automatic strapping machines are projected to dominate the market with a 53.00% share in 2025. This segment’s leadership is driven by its integration into high-speed production lines where minimal manual intervention is required.

Automatic models offer rapid throughput, consistent tensioning, and reduced downtime, making them ideal for heavy-volume sectors like food and beverage, e-commerce fulfillment, and industrial goods packaging. These systems enhance efficiency and safety by automating strap feeding, sealing, and cutting in one continuous process.

As manufacturers prioritize labor optimization and throughput consistency, automatic machines are increasingly being selected for both primary and secondary packaging workflows.

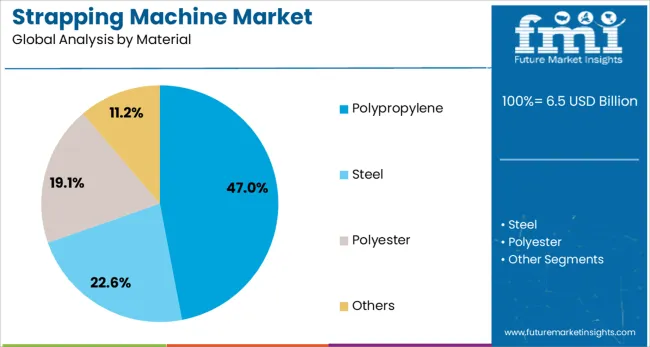

Polypropylene (PP) is expected to be the leading strapping material in the market with a 47.00% share in 2025. PP strapping is favored due to its lightweight nature, cost-effectiveness, and compatibility with a wide range of goods.

Its tensile strength and elongation properties make it ideal for bundling light to medium-duty items such as cartons, paper stacks, and plastic containers. Polypropylene straps work well with both semi-automatic and automatic machines, offering high-speed sealing and minimal jamming.

Additionally, recyclability and low environmental impact have increased the appeal of PP among companies striving for sustainable packaging solutions.

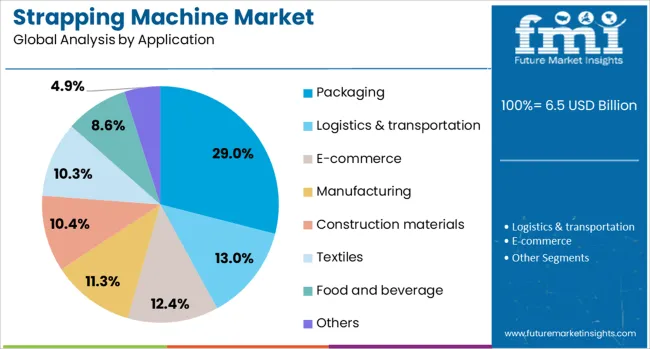

The packaging sector is anticipated to lead the strapping machine market by application, contributing a 29.00% share in 2025. The packaging industry’s reliance on strapping solutions for carton reinforcement, pallet stabilization, and product bundling has driven this dominance.

With growing demand for safe and efficient shipping of consumer goods, electronics, food products, and industrial equipment, strapping machines provide a critical layer of protection. Innovations in strap customization, barcoding integration, and smart diagnostics have improved packaging speed and precision.

As global trade continues to rise and warehouse automation becomes mainstream, packaging will remain the primary application area for strapping machine deployment.

The strapping machine market is driven by growth in logistics, manufacturing, and e-commerce, along with increasing automation and operational efficiency needs. Versatility in material compatibility and integration with packaging lines further strengthens its market position.

The strapping machine market is experiencing strong growth due to the expansion of logistics and e-commerce sectors, where secure packaging is essential to prevent product damage during transit. High-volume parcel shipments require efficient load securing, making automated and semi-automated strapping machines indispensable. Companies are increasingly opting for systems capable of handling varying product sizes and packaging formats without manual adjustments. The rapid turnover in distribution centers also demands faster cycle times, which modern strapping machines can deliver. Growth in cross-border trade and third-party logistics operations further reinforces the market, as businesses prioritize reliable and cost-effective strapping solutions to maintain product integrity during storage and long-distance transportation.

Manufacturing industries, including metals, construction materials, and chemicals, are increasingly adopting strapping machines to secure heavy and bulky loads. These machines provide consistent tension, ensuring stability during handling and storage. Automated units integrated with production lines reduce bottlenecks and improve operational efficiency. Industries dealing with high-value or fragile goods benefit from precise tension control, preventing both under-strapping and over-strapping. Strapping machines are also being used in palletized cargo applications to reduce reliance on shrink wrap, lowering packaging costs. With industrial production expanding in many regions, the role of strapping machines in ensuring product safety and streamlining dispatch processes is becoming more prominent.

Strapping machines are increasingly designed to work with a range of strap materials, such as polypropylene, polyester, and biodegradable options, enabling businesses to choose solutions that match product weight, size, and shipping requirements. Enhanced automation features, including sensor-based tension control and programmable settings, are improving packaging consistency while reducing operator dependency. The ability to integrate with conveyors, sortation systems, and palletizers ensures smooth end-of-line operations. Machines offering quick-change strap reels and low-maintenance components are gaining attention, especially in high-throughput environments. These improvements in automation and material handling are enabling businesses to achieve higher output while ensuring packaging integrity across diverse industry sectors.

Businesses are adopting strapping machines as part of broader cost-optimization strategies, aiming to minimize packaging waste, reduce labor requirements, and improve throughput. Machines with energy-efficient drive systems and automated fault diagnostics help reduce downtime and operational costs. Modular designs allow companies to upgrade or reconfigure equipment as packaging needs evolve, improving long-term return on investment. Demand for high-speed, reliable units that can function continuously in demanding industrial environments is increasing. This focus on efficiency also extends to faster maintenance processes, as user-friendly interfaces and self-monitoring capabilities make troubleshooting and adjustments quicker, ensuring uninterrupted packaging operations and consistent load security.

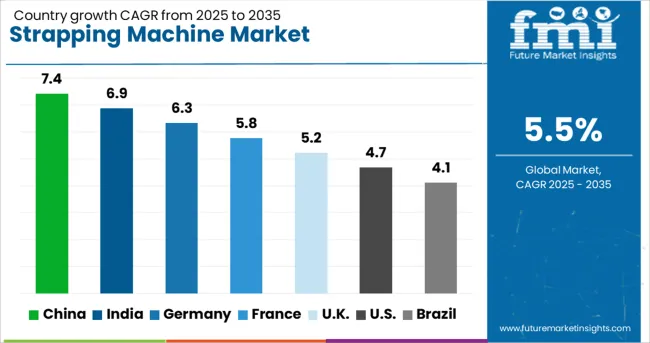

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The strapping machine market is projected to expand at a global CAGR of 5.5% from 2025 to 2035, supported by increasing demand for efficient load securing in logistics, manufacturing, and e-commerce sectors. China leads with a CAGR of 7.4%, driven by large-scale investments in automated packaging lines, rapid growth in export-oriented manufacturing, and high-volume e-commerce shipments. India follows at 6.9%, fueled by rising adoption of industrial automation in packaging, growth in organized retail, and government-supported manufacturing expansion. France grows at 5.8%, benefitting from modernization of packaging facilities in food, beverage, and pharmaceuticals. The United Kingdom achieves 5.2% growth, underpinned by demand from logistics hubs and the expansion of third-party warehousing services. The United States posts a CAGR of 4.7%, reflecting steady replacement demand, increased packaging automation in distribution centers, and growing use in heavy-duty industrial applications. The analysis spans over 40 countries, with these markets representing key benchmarks for capacity planning, technology integration, and competitive positioning in the global strapping machine industry.

China is projected to post a CAGR of 7.4% during 2025–2035, outpacing the global average of 5.5% as packaging automation expands across export manufacturing, e-commerce hubs, and integrated logistics parks. During 2020–2024, CAGR was near 4.8% as investments focused on basic end-of-line upgrades and capacity recovery. The rise is being driven by high-throughput parcel networks, palletized shipping in electronics and appliances, and integrated lines that pair strappers with palletizers and conveyors. Domestic suppliers are scaling servo-driven heads and sensor-based tension control, improving uptime and unit economics. Import substitution in premium segments is being pursued by tiered offerings for corrugated, metals, and FMCG plants.

India is forecast at 6.9% CAGR for 2025–2035, above the global 5.5% as packaging lines are added in food, pharma, and consumer durables. Between 2020–2024, CAGR stood near 4.6% as capital budgets remained selective and semi-automatic units dominated. The step-up is supported by organized retail expansion, dedicated freight corridors, and 3PL warehousing clusters that require reliable load securing. Cast-polypropylene and PET strap usage is widening, which supports higher tension settings and longer coil change intervals. Vendors are offering rental and pay-per-strap models that improve adoption among mid-sized plants. Training programs for operators are improving cycle consistency and reducing rework.

France is expected to grow at 5.8% CAGR in 2025–2035, slightly above the global figure. In 2020–2024, CAGR was about 3.9% as projects prioritized selective retrofits. The improvement is supported by modernization in food and beverage, pharmaceuticals, and cosmetics where traceability and damage reduction are prioritized. End-of-line cells are being reconfigured with quick-change arches, low-noise drives, and PLC connectivity to MES layers. Corrugated converters are standardizing on programmable tension profiles for mixed SKU pallets, which has raised machine utilization. Service contracts with predictive checks are being adopted to maintain OEE thresholds and reduce strap waste.

The United Kingdom is projected at 5.2% CAGR for 2025–2035 against a global 5.5%. During 2020–2024, CAGR is estimated at about 3.7%, shaped by cautious capex and reliance on semi-automatic benches. The rise to 5.2% is explained by warehouse automation in parcel networks, growth in 3PL hubs, and food-pharma pack lines that prefer clean, low-maintenance strappers. Mixed-SKU pallet shipping after retail consolidation has increased the need for programmable tension and corner-guard compatibility. Local distributors are stocking PET strap and offering uptime-linked service, which improves lifecycle economics. Data capture from controllers is being used to cut strap use per pallet and improve audit trails.

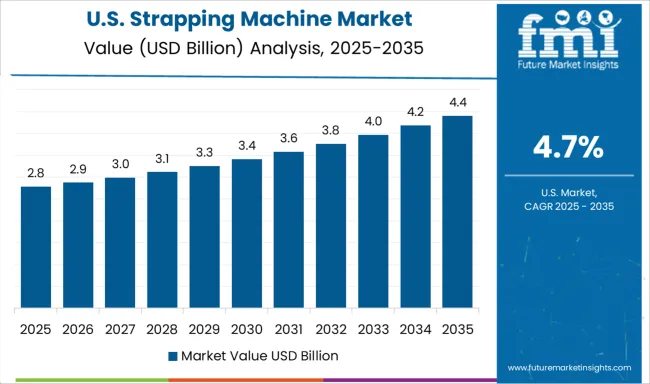

The United States is expected at 4.7% CAGR during 2025–2035, slightly below the global rate, with 2020–2024 around 3.5% as investments targeted replacements in legacy DCs. Growth is supported by automation in regional fulfillment centers, heavier SKUs in home improvement, and broader PET strap adoption for higher retained tension. Integrated cells pairing strappers with robots and wrappers are being specified to raise OEE and reduce operator touches. Vendors are emphasizing modular heads, quick-thread paths, and IoT diagnostics to limit stoppages. Aftermarket programs for wear parts and strap quality audits are helping lower total applied cost per pallet.

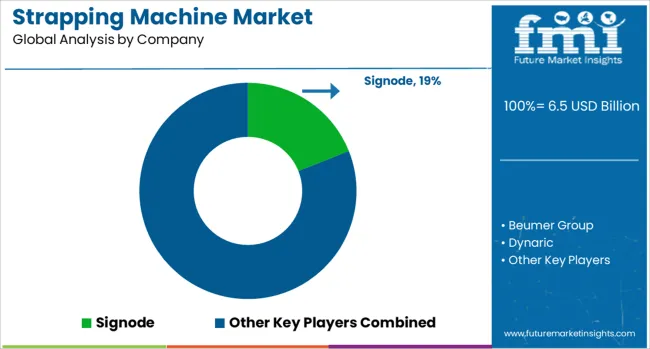

The strapping machine market is characterized by strong competition among global packaging machinery manufacturers, each focusing on innovation, speed, and integration capabilities to meet diverse industry needs. Signode leads with an extensive range of high-performance automatic and semi-automatic strapping solutions, emphasizing durability, minimal maintenance, and compatibility with various strap materials. Beumer Group integrates strapping systems into complete intralogistics and packaging lines, offering turnkey solutions for industries such as logistics, beverages, and construction materials. Dynaric specializes in high-speed polypropylene and polyester strapping equipment, providing tailored solutions for e-commerce, food, and industrial packaging applications.

Fromm Packaging Systems is recognized for robust strapping tools and fully automated systems designed for high-demand sectors including metals, timber, and distribution. Ishida incorporates strapping into integrated weighing and packaging solutions, particularly for the food industry. M.J. Maillis Group offers a comprehensive portfolio combining strapping, wrapping, and related consumables, targeting manufacturing and warehousing sectors. Mosca is known for precision-engineered strapping machines with advanced tension control, catering to corrugated, print, and logistics industries. Packway provides versatile, cost-effective systems popular in small to mid-sized production environments, while Polychem focuses on user-friendly machines and PET strap solutions. Samuel Strapping Systems delivers heavy-duty industrial models suited for steel, lumber, and construction sectors. Solinear, StraPack, Transpak, and Wexxar Bel contribute with specialized equipment, regional service support, and niche market focus, ensuring broad application coverage. Competitive strategies center on enhancing automation, reducing energy consumption, offering modular designs for flexible layouts, and integrating IoT-based diagnostics for predictive maintenance. With rising demand from e-commerce, manufacturing, and logistics, leading players are investing in localized production, aftermarket services, and tailored solutions to secure long-term customer partnerships.

In July 2024, Signode announced the M410NE Notch electric motor-head strapping machine, designed to service a North American mill with enhanced performance and precision.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Type | Automatic, Semi-automatic, and Manual |

| Material | Polypropylene, Steel, Polyester, and Others |

| Application | Packaging, Logistics & transportation, E-commerce, Manufacturing, Construction materials, Textiles, Food and beverage, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Signode, Beumer Group, Dynaric, Fromm Packaging Systems, Ishida, M.J. Maillis Group, Mosca, Packway, Polychem, Samuel Strapping Systems, Solinear, StraPack, Transpak, and Wexxar Bel |

| Additional Attributes | Dollar sales by machine type and automation level, share by end-use industry and region, pricing trends, competitive landscape, raw material cost outlook, emerging demand from e-commerce and logistics, regulatory compliance impact, technology integration opportunities. |

The global strapping machine market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the strapping machine market is projected to reach USD 11.0 billion by 2035.

The strapping machine market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in strapping machine market are automatic, semi-automatic and manual.

In terms of material, polypropylene segment to command 47.0% share in the strapping machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pallet Strapping Machines Market

Vertical Strapping Machines Market

Horizontal Strapping Machine Market Trends and Forecast 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Strapping Tapes Market Analysis by Material Type, Adhesive Type, End-User, and Region through 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA