The sulfamic acid market is witnessing stable growth, driven by its widespread use in cleaning, descaling, and pH adjustment applications across industries. The compound’s effectiveness as a non-volatile, non-hygroscopic acid with strong descaling properties makes it suitable for both household and industrial purposes.

Increasing demand from metal finishing, pulp and paper, and chemical processing industries has further supported market expansion. The market benefits from regulatory acceptance as a safer alternative to more corrosive cleaning acids, promoting sustainable maintenance practices.

Additionally, its utility in dye and pigment manufacturing enhances industrial relevance. Future market growth is expected to be reinforced by rising consumption in water treatment, detergents, and electronics sectors, coupled with expanding manufacturing capabilities in Asia-Pacific.

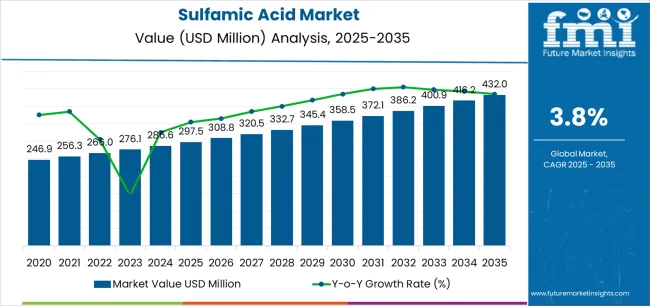

| Metric | Value |

|---|---|

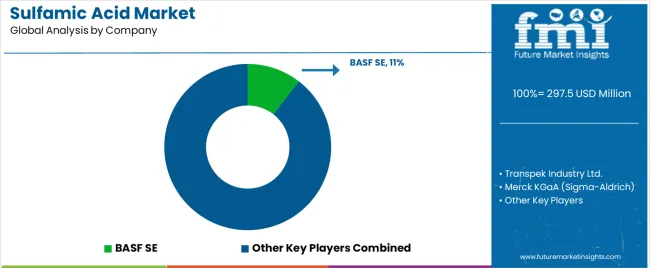

| Sulfamic Acid Market Estimated Value in (2025 E) | USD 297.5 million |

| Sulfamic Acid Market Forecast Value in (2035 F) | USD 432.0 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

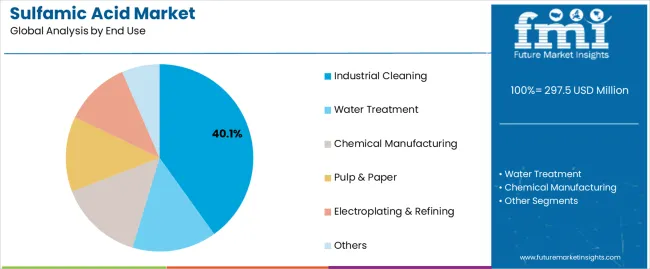

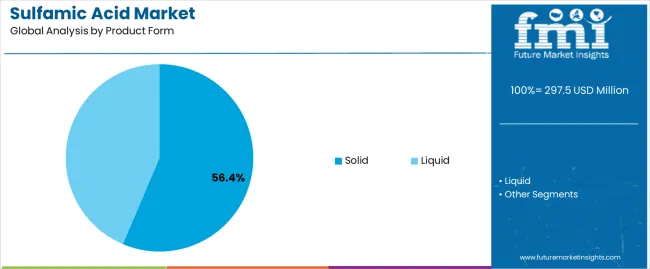

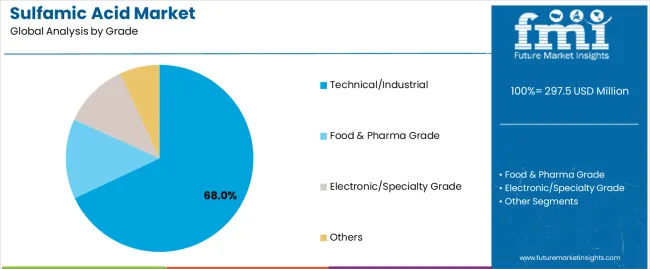

The market is segmented by End Use, Product Form, and Grade and region. By End Use, the market is divided into Industrial Cleaning, Water Treatment, Chemical Manufacturing, Pulp & Paper, Electroplating & Refining, and Others. In terms of Product Form, the market is classified into Solid and Liquid. Based on Grade, the market is segmented into Technical/Industrial, Food & Pharma Grade, Electronic/Specialty Grade, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial cleaning segment dominates the end-use category with approximately 40.1% share of the sulfamic acid market. This leadership is attributed to sulfamic acid’s efficiency in removing mineral scales, rust, and deposits from industrial equipment and surfaces.

Its non-fuming and non-corrosive properties make it ideal for use in chemical plants, power generation, and food processing facilities. The segment benefits from increasing awareness of plant maintenance efficiency and compliance with safety standards.

As industries aim to minimize downtime and enhance equipment longevity, demand for sulfamic acid-based cleaning agents continues to grow. With ongoing industrial expansion and maintenance optimization initiatives, the industrial cleaning segment is expected to maintain its leading market position.

The solid segment holds approximately 56.4% share in the product form category, reflecting its dominance due to ease of handling, stability, and storage convenience. Solid sulfamic acid is widely used in cleaning formulations, descaling agents, and metal treatment processes.

Its crystalline nature ensures accurate dosing and minimizes spillage, making it suitable for industrial-scale applications. The segment benefits from lower transportation and packaging costs compared to liquid variants.

Additionally, advancements in packaging technology have improved product safety and shelf life. With rising demand for durable and easy-to-transport cleaning chemicals, the solid form segment is expected to sustain its dominant share.

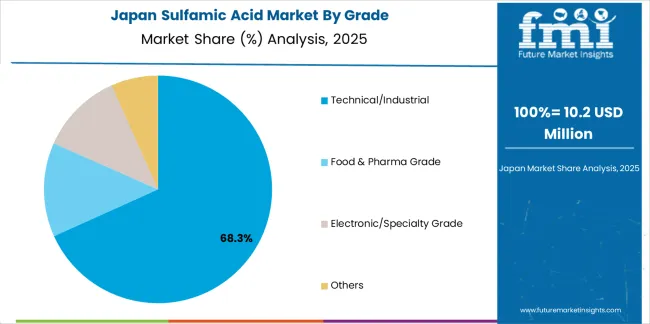

The technical/industrial segment accounts for approximately 68.0% share in the grade category, driven by its extensive use in manufacturing, cleaning, and chemical processing applications. This grade offers high purity levels suitable for large-scale industrial processes, ensuring efficiency and consistency in end-use performance.

Demand is supported by increasing production of dyes, paper, and detergents, where sulfamic acid serves as a key intermediate. The segment’s growth is reinforced by its cost-effectiveness and suitability for a wide range of industrial applications.

With expanding manufacturing output and ongoing industrial modernization, the technical/industrial grade segment is projected to retain its leading market share over the forecast period.

This section offers a thorough examination of the industry during the previous five years, with an emphasis on anticipated changes in the sulfamic acid market. The market grew at a CAGR of 3.2% during the historical period. The industry is expected to grow consistently at a 3.8% CAGR until 2035.

| Historical CAGR | 3.2% |

|---|---|

| Forecasted CAGR | 3.8% |

Strict environmental restrictions and the development of eco-friendly alternatives to cleaning and descaling products are expected to limit the sulfamic acid market in the upcoming decade. Furthermore, technological improvements are likely to result in more effective procedures that can affect the industry's need for sulfamic acid.

Fundamental factors that are anticipated to boost the demand for sulfamic acid through 2035 are as follows:

Industry players are going to desire to be wise and flexible over the anticipated period since these difficult attributes position the industry for success in subsequent decades.

Rise in the Practice of Flooding Technique and Micro-Computed Tomography

The efficacy of the flooding technique and the micro-computed tomography approach in examining the structure and composition of diverse chemical compounds, such as sulfamic acid, has garnered considerable interest in the industrial chemistry sector.

The market for sulfamic acid is anticipated to expand significantly over the ensuing decade due to the rising demand for high-end skincare and cosmetics products. Because of sulfamic acid's superior exfoliating and anti-aging qualities, it is an essential component in many personal care products.

Sulfamic acid is in high demand since it is a safe and environmentally friendly substitute for harsher chemicals, contributing to the rising popularity of natural and organic skincare products.

Throughout the forecasted decade, the sulfamic acid market is anticipated to witness significant expansion due to the growing need for sophisticated chemical analysis methods and the expanding personal care sector.

Extensive Use of Sulfamic Acid in Agriculture, Pharmaceuticals, and Food Processing Sectors

Sulfamic acid is gaining popularity due to its diverse applications and cost-effectiveness in agriculture, pharmaceuticals, and food processing industries. Sulfamic acid is a nitrogen source and soil conditioner, improving plant growth management.

Sulfamic acid is also a key intermediate in pharmaceutical compound synthesis, producing drugs like antibiotics and antiviral medications due to its high purity and compatibility with pharmaceutical processes.

In food processing, sulfamic acid is used as a cleaning and descaling agent to remove mineral deposits, scale, and stains from equipment surfaces. Sulfamic acid is a cost-effective alternative chemical suitable for industries seeking performance without compromising performance, offering economies of scale and streamlined procurement processes.

Ecological Sustainability Goals Driving the Demand for Sulfamic Acid

Manufacturers are focusing on developing eco-friendly sulfamic acid formulations to reduce environmental impact throughout their lifecycle. This includes reducing carbon footprint, waste generation, and ensuring biodegradability or recyclability.

They are exploring alternative feedstock and production methods that use renewable resources or sustainable chemical processes, such as bio-based precursors or greener synthetic routes. Non-toxic formulations are being developed, eliminating hazardous additives and ensuring safe handling and disposal practices.

Manufacturers also pursue certifications and eco-labels to verify their formulations' biodegradability, eco-friendliness, and sustainability credentials. Compliance with recognized standards enhances product credibility and market acceptance among environmentally-conscious consumers and businesses.

This commitment to sustainability, regulatory compliance, and meeting the evolving needs of consumers and industries is reflected in their continuous efforts to create eco-friendly sulfamic acid products.

| Attributes | Details |

|---|---|

| Top Product Form | Solid |

| Market share in 2025 | 74.8% |

Despite being minor, the solid category is projected to hold a 74.8% market share in 2025. The demand for the solid form of sulfamic acid is expected to rise due to the following reasons:

| Attributes | Details |

|---|---|

| Top End Use | Industrial Cleaning |

| Market share in 2025 | 40.1% |

The industrial cleaning segment is expected to hold a 40.1% share of the market in 2025. Chlorine water treatment, chemical production, paper and pulp, electroplating and electrorefining, and other areas are anticipated to come after it. Several aspects contribute to the development of the industrial cleaning segment:

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 25.2% |

| Germany | 15.8% |

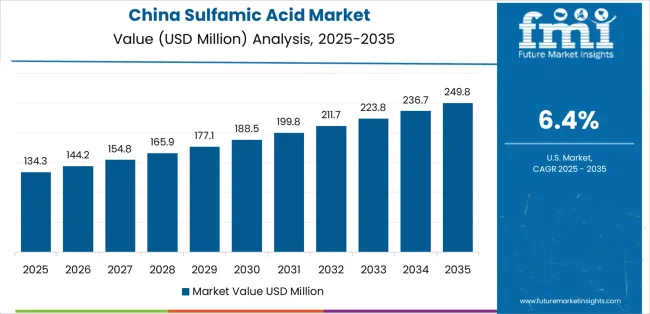

| China | 28.5% |

| Japan | 12.5% |

| India | 20.2% |

The use of sulfamic acid is expected to grow substantially in the industrial cleaning market. This is because there is a growing need for effective, environmentally friendly cleaning products to improve corporate processes. The United States sulfamic acid market is projected to grow at an astounding CAGR of 25.2% from 2025 to 2035. These factors are propelling the industry's expansion:

The Chinese market for sulfamic acid is expected to grow at a CAGR of 28.5% through 2035. Since sulfamic acid has little effect on the environment, it also serves as a sustainable and eco-friendly chemical option. The following are some of the main trends in the market:

The market in Japan is anticipated to rise at a significant CAGR of 12.5% through 2035. Some of the primary trends are:

The demand for amidosulfuric acid in animal feed products is expected to rise significantly in India. The market is anticipated to witness a CAGR of 20.2% over the forecast period. Among the primary drivers are:

The market in Germany is anticipated to record a CAGR of 15.8% from 2025 to 2035. The country is slated to develop a significant demand for amino sulfonic acid for pulp and paper manufacturing. The following are some of the main trends:

Leading sulfamic acid manufacturers are diversifying their product lines to include new products or alterations, including sulfamic acid, to meet the needs of a range of markets, including water treatment, cleaning products, and medicines.

These businesses employ strict quality control procedures to fulfill industry and client requirements, placing a high priority on constant product quality to preserve customer confidence.

To access untapped customer bases, industry players are also branching out into new geographic areas and investigating specialized markets. Market players spend on research and development to create novel product compositions with improved features or cost-effectiveness.

Leading businesses are investing in environmentally friendly production techniques and encouraging their usage in ecologically sensitive applications as sustainability gains relevance.

The producers of sulfamic acid strive to satisfy changing customer and regulatory requirements by using environmentally friendly procedures and innovative products. In addition to improving market competitiveness, this strategic strategy helps achieve long-term sustainability objectives. Sulfamic acid makers present themselves as dependable providers in a market that is changing quickly, employing constant innovation and adaptation.

Recent Developments in the Sulfamic Acid Industry

The global sulfamic acid market is estimated to be valued at USD 297.5 million in 2025.

The market size for the sulfamic acid market is projected to reach USD 432.0 million by 2035.

The sulfamic acid market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in sulfamic acid market are industrial cleaning, boilers & heat exchangers, metals descaling & pickling, cip & sanitation (f&b, pharma), machinery & plant turnaround cleaning, water treatment, chemical manufacturing, pulp & paper, electroplating & refining and others.

In terms of product form, solid segment to command 56.4% share in the sulfamic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA