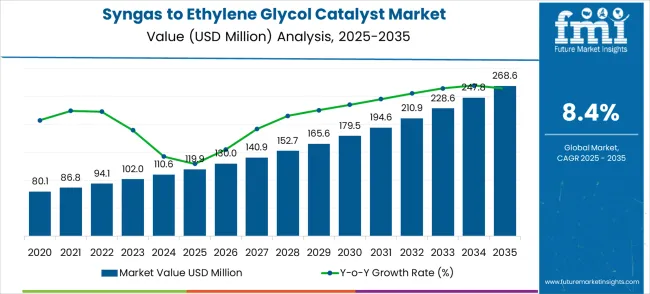

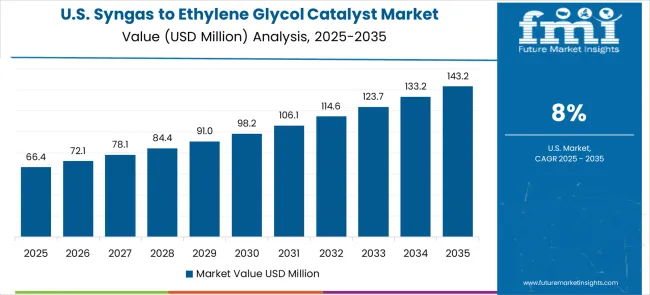

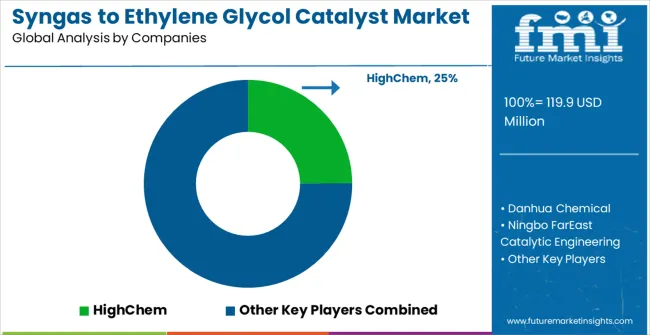

The global syngas to ethylene glycol catalyst market is valued at USD 119.9 million in 2025 and is slated to reach USD 268.6 million by 2035, recording an absolute increase of USD 148.7 million over the forecast period. This translates into a total growth of 124.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.4% between 2025 and 2035.

The overall market size is expected to grow by nearly 2.24X during the same period, supported by increasing demand for sustainable ethylene glycol production, growing adoption of syngas conversion technologies in chemical manufacturing, and rising consumer preference for alternative feedstock-based catalysts across diverse polyester manufacturing and chemical synthesis applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 119.9 million |

| Forecast Value in (2035F) | USD 268.6 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

From 2030 to 2035, the market is forecast to grow from USD 185.3 million to USD 268.6 million, adding another USD 83.3 million, which constitutes 56.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of palladium catalyst formulations and advanced catalyst support systems, the integration of carbon capture and utilization technologies, and the development of premium high-efficiency conversion solutions. The growing adoption of circular economy principles and renewable energy integration will drive demand for syngas to ethylene glycol catalysts with enhanced sustainability features and improved process economics characteristics.

Between 2020 and 2025, the syngas to ethylene glycol catalyst market experienced robust growth, driven by increasing demand for sustainable chemical production and growing recognition of syngas conversion catalysts as essential components for alternative feedstock utilization with superior environmental benefits and process efficiency. The market developed as chemical manufacturers recognized the potential for syngas to ethylene glycol catalysts to reduce carbon footprint while maintaining production efficiency and product quality. Technological advancement in catalyst formulation and process optimization began emphasizing the critical importance of maintaining high conversion rates and operational stability in advanced sustainable chemical manufacturing applications.

Market expansion is being supported by the increasing global demand for sustainable chemical production and the corresponding need for alternative feedstock conversion technologies that can provide environmental benefits and superior process efficiency while maintaining product quality across various ethylene glycol manufacturing and chemical synthesis applications. Modern chemical manufacturers are increasingly focused on implementing catalytic solutions that can utilize renewable feedstocks, reduce carbon emissions, and provide consistent performance in demanding industrial environments. Syngas to ethylene glycol catalysts' proven ability to deliver superior conversion efficiency, enhanced sustainability benefits, and reliable catalytic performance make them essential components for contemporary sustainable chemical manufacturing and green chemistry solutions.

The growing emphasis on carbon neutrality and sustainable manufacturing is driving demand for syngas to ethylene glycol catalysts that can support renewable feedstock utilization, enable efficient carbon conversion, and provide reliable performance in chemical production applications with reduced environmental impact. Chemical processing companies' preference for catalysts that combine environmental benefits with operational reliability and economic viability is creating opportunities for innovative syngas conversion catalyst implementations. The rising influence of circular economy principles and climate change mitigation is also contributing to increased adoption of catalysts that can provide sustainable chemical synthesis solutions without compromising process efficiency or product quality.

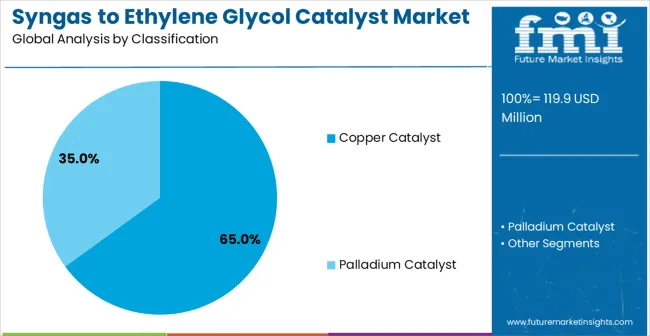

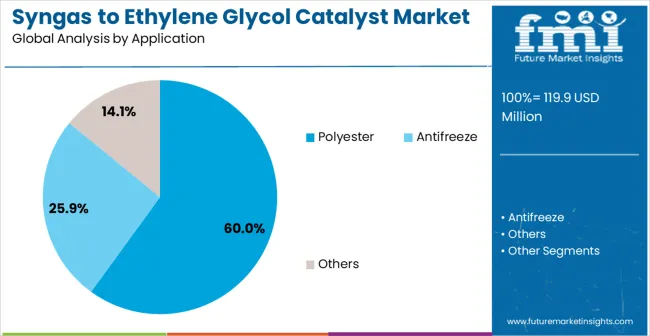

The market is segmented by classification, application, and region. By classification, the market is divided into copper catalyst, palladium catalyst, and others. Based on application, the market is categorized into polyester and antifreeze. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

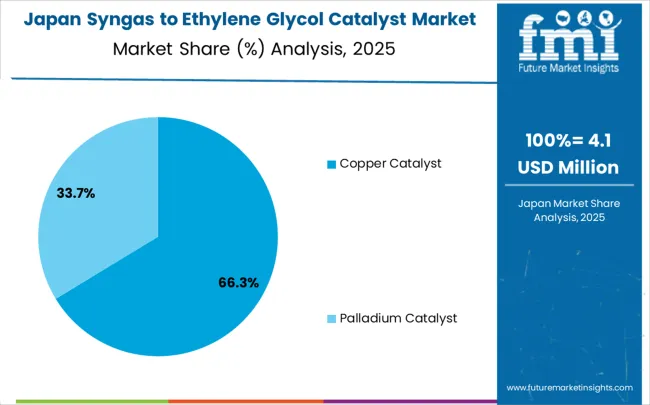

The copper catalyst segment is projected to account for 65% of the syngas to ethylene glycol catalyst market in 2025, reaffirming its position as the leading classification category. This dominance is driven by copper catalysts’ proven catalytic activity, cost-effectiveness, and adaptability across ethylene glycol production, polyester manufacturing, and diverse chemical processing applications. Copper catalysts provide reliable conversion efficiency, enabling consistent product output while optimizing operational performance. Chemical producers increasingly rely on copper catalyst technologies to meet production demands while maintaining cost efficiency and process reliability. Investments in enhanced copper catalyst systems and process optimization reinforce adoption across industrial-scale operations. Advanced formulations ensure long-term performance, high selectivity, and compatibility with different syngas feedstocks. As manufacturers prioritize operational efficiency, economic viability, and regulatory compliance, copper catalysts remain the preferred choice for large-scale syngas conversion, securing their status as the cornerstone of contemporary ethylene glycol production strategies.

Polyester applications are projected to represent 60% of syngas to ethylene glycol catalyst demand in 2025, highlighting their role as the primary end-use market for chemical catalysts in polyester production. Polyester manufacturers increasingly prefer these catalysts for their feedstock flexibility, high conversion efficiency, and ability to produce quality ethylene glycol while ensuring process stability. These catalysts support both environmental compliance and operational cost-effectiveness, aligning with growing industry emphasis on sustainable chemical processing. Rising polyester consumption in textile and packaging sectors, coupled with stricter regulatory standards and sustainability mandates, drives continuous demand for advanced catalyst systems. Investments in specialized syngas-to-ethylene glycol catalysts enable manufacturers to optimize production efficiency, minimize waste, and achieve enhanced selectivity. As industrial requirements expand, polyester applications are expected to maintain dominance, reinforcing the importance of catalyst innovation and operational excellence in modern chemical manufacturing strategies.

The syngas to ethylene glycol catalyst market is advancing rapidly due to increasing demand for sustainable chemical production and growing adoption of alternative feedstock technologies that provide enhanced environmental benefits and superior process efficiency across diverse chemical manufacturing and polyester production applications. However, the market faces challenges, including feedstock availability constraints, technical complexity requirements, and the need for specialized process infrastructure investments. Innovation in catalyst regeneration and carbon utilization technologies continues to influence product development and market expansion patterns.

The growing adoption of palladium catalyst formulations and enhanced support systems is enabling chemical catalyst manufacturers to produce premium syngas to ethylene glycol catalysts with superior conversion efficiency, enhanced selectivity characteristics, and advanced operational stability. Advanced catalyst systems provide improved chemical performance while allowing more efficient syngas utilization and consistent output across various feedstock compositions and reaction conditions. Manufacturers are increasingly recognizing the competitive advantages of advanced catalyst capabilities for product differentiation and premium market positioning in demanding sustainable chemical processing segments.

Modern syngas to ethylene glycol catalyst producers are incorporating carbon capture and utilization technologies and process integration systems to enhance sustainability benefits, improve carbon efficiency, and ensure consistent performance delivery to chemical manufacturers and processing facilities. These technologies improve environmental performance while enabling new applications, including waste-to-chemical processes and circular carbon utilization. Advanced sustainability integration also allows manufacturers to support premium positioning and environmental responsibility beyond traditional catalyst production capabilities.

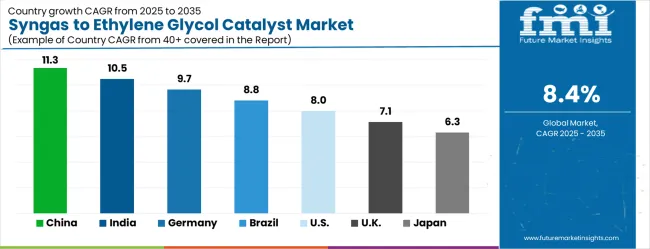

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| Brazil | 8.8% |

| USA | 8.0% |

| UK | 7.1% |

| Japan | 6.3% |

The syngas to ethylene glycol catalyst market is experiencing strong growth globally, with China leading at an 11.3% CAGR through 2035, driven by the expanding chemical manufacturing industry, growing sustainable production initiatives, and significant investment in alternative feedstock catalyst infrastructure development. India follows at 10.5%, supported by large-scale chemical industry expansion, emerging sustainable technology facilities, and growing domestic demand for environmental-friendly catalysts and green chemistry solutions. Germany shows growth at 9.7%, emphasizing technological innovation and sustainable catalyst development. Brazil records 8.8%, focusing on renewable feedstock utilization and sustainable chemical manufacturing modernization. The USA demonstrates 8.0% growth, prioritizing clean technology advancement and high-performance sustainable catalyst solutions. The UK exhibits 7.1% growth, emphasizing sustainable manufacturing capabilities and green catalyst adoption. Japan shows 6.3% growth, supported by precision chemical manufacturing excellence and advanced sustainable technology innovation.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The syngas to ethylene glycol catalyst market in China is projected to grow at a CAGR of 11.3% through 2035, driven by expansion of chemical manufacturing infrastructure and rising alternative feedstock utilization supported by government carbon neutrality initiatives. The country's dominant chemical production capacity and increased investment in green chemistry technologies are creating significant demand for advanced catalyst solutions. Domestic and international chemical companies are scaling manufacturing and distribution capabilities to meet rising demand across industrial regions. Strong chemical sector expansion, coupled with the deployment of advanced process technologies, is supporting the adoption of syngas conversion catalysts among manufacturers seeking improved process efficiency and carbon reduction outcomes.

The syngas to ethylene glycol catalyst market in India is expected to expand at a CAGR of 10.5% through 2035, driven by growing chemical manufacturing capacity, emerging green technology facilities, and increasing domestic demand for environmentally-conscious catalyst solutions. The developing chemical supply chain and industrial sector growth are fueling adoption of advanced catalyst systems. International technology providers and domestic manufacturers are strengthening production and distribution networks to meet market needs. Expanding chemical process modernization, along with rising government focus on environmental protection, is supporting wider adoption of syngas conversion catalysts for chemical enterprises seeking enhanced process efficiency and regulatory compliance.

The syngas to ethylene glycol catalyst market in Germany is projected to grow at a CAGR of 9.7% through 2035, supported by advanced chemical manufacturing capabilities, strong technological expertise, and high demand for environmentally-conscious process solutions. German chemical producers are investing in precision catalyst technologies and advanced green chemistry methods to maintain production excellence. Collaboration between research institutions and chemical companies is accelerating innovation in syngas conversion catalysts. Expanding adoption of advanced catalysts in high-value chemical applications is supporting efficient production, reduced environmental impact, and process optimization across the manufacturing network.

The syngas to ethylene glycol catalyst market in Brazil is expected to grow at a CAGR of 8.8% through 2035, driven by increasing utilization of renewable feedstocks, modernization of chemical manufacturing facilities, and rising investment in green chemistry technologies. Local chemical producers and international collaborators are establishing production capabilities to serve domestic and emerging regional markets. Government programs promoting renewable feedstock use and industrial development are accelerating adoption of advanced catalyst systems. Expanding urban industrial zones, coupled with robust process modernization, is enabling broader deployment of syngas conversion catalysts across chemical production facilities.

The syngas to ethylene glycol catalyst market in the United States of America is projected to grow at a CAGR of 8.0% through 2035, driven by advanced chemical manufacturing expertise, emphasis on clean technologies, and rising demand for high-performance catalyst solutions. Chemical companies are investing in improved process efficiency, carbon utilization methods, and environmentally-conscious catalyst systems. Expansion of advanced chemical process networks and technology innovation programs is enabling wider adoption of syngas conversion catalysts across domestic industrial centers. Increasing focus on regulatory compliance and performance optimization is supporting the deployment of high-quality catalyst solutions among leading chemical manufacturers.

The syngas to ethylene glycol catalyst market in the United Kingdom is expected to expand at a CAGR of 7.1% through 2035, supported by established chemical manufacturing expertise, high-quality process standards, and adoption of green process technologies. Chemical companies are developing advanced catalyst systems for domestic and export markets, focusing on improving environmental performance and production efficiency. Investment in research-driven catalyst development and industrial modernization is supporting widespread adoption of syngas conversion solutions. Expanding chemical production capabilities and regulatory alignment are driving broader deployment of high-performance catalyst technologies across the manufacturing network.

The syngas to ethylene glycol catalyst market in Japan is projected to grow at a CAGR of 6.3% through 2035, driven by precision chemical manufacturing, adoption of environmentally-conscious technologies, and rising demand for high-quality catalyst solutions. Japanese chemical manufacturers are investing in premium syngas conversion catalysts and process optimization methods. Regional specialization in precision manufacturing and green technology development is facilitating innovation in catalyst applications. Expansion of advanced chemical processing facilities and adoption of high-performance catalysts are supporting efficiency, reliability, and environmental compliance across domestic industrial regions.

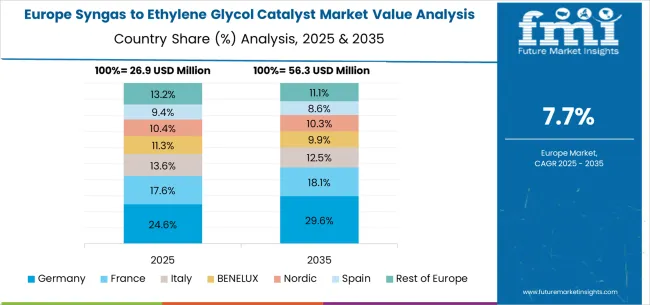

The syngas to ethylene glycol catalyst market in Europe is projected to grow from USD 26.4 million in 2025 to USD 59.1 million by 2035, registering a CAGR of 8.4% over the forecast period. Germany is expected to maintain its leadership position with a 25.0% market share in 2025, declining slightly to 24.5% by 2035, supported by its strong chemical manufacturing industry, advanced sustainable technology facilities, and comprehensive green chemistry supply network serving major European markets.

France follows with an 18.0% share in 2025, projected to reach 18.3% by 2035, driven by robust demand for syngas to ethylene glycol catalysts in sustainable manufacturing, chemical processing, and environmental technology applications, combined with established chemical traditions incorporating green technology solutions. The United Kingdom holds a 16.5% share in 2025, expected to decrease to 16.2% by 2035, supported by strong chemical sector demand but facing challenges from competitive pressures and industrial restructuring. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 12.0% in 2025, expected to reach 12.2% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 10.5% to 10.6% by 2035, attributed to increasing adoption of sustainable chemical technologies in Nordic countries and growing green manufacturing activities across Eastern European markets implementing environmental modernization programs.

The syngas to ethylene glycol catalyst market is characterized by competition among established chemical catalyst manufacturers, specialized sustainable technology suppliers, and integrated green chemistry solution providers. Companies are investing in advanced catalyst technology research, conversion efficiency optimization, sustainability enhancement, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective syngas to ethylene glycol catalyst solutions. Innovation in catalyst formulations, process integration, and environmental compliance is central to strengthening market position and competitive advantage.

HighChem leads the market with a strong market share, offering comprehensive sustainable catalyst solutions with a focus on polyester applications and green chemistry systems. Danhua Chemical provides specialized catalyst capabilities with an emphasis on chemical processing and manufacturing efficiency. Ningbo FarEast Catalytic Engineering delivers innovative catalyst solutions with a focus on Asian markets and sustainable technology. Shanghai Pujing Chemical specializes in catalyst manufacturing and advanced conversion solutions for chemical markets. Haiso Technology focuses on catalyst technology and integrated sustainable operations. Shangqiu Guolong New Materials offers specialized catalyst products with emphasis on green chemistry applications and environmental optimization.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 119.9 million |

| Classification | Copper Catalyst, Palladium Catalyst, Others |

| Application | Polyester, Antifreeze |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | HighChem, Danhua Chemical, Ningbo FarEast Catalytic Engineering, Shanghai Pujing Chemical, Haiso Technology, and Shangqiu Guolong New Materials |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in catalyst systems, conversion innovation, sustainability development, and process optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global syngas to ethylene glycol catalyst market is estimated to be valued at USD 119.9 million in 2025.

The market size for the syngas to ethylene glycol catalyst market is projected to reach USD 268.6 million by 2035.

The syngas to ethylene glycol catalyst market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in syngas to ethylene glycol catalyst market are copper catalyst and palladium catalyst.

In terms of application, polyester segment to command 60.0% share in the syngas to ethylene glycol catalyst market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Toilet Roll Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Total Reflection X-Ray Fluorescence Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Tow Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

Torrified Wheat Market Size and Share Forecast Outlook 2025 to 2035

Total Dust Detector Market Size and Share Forecast Outlook 2025 to 2035

Total Aflatoxin Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Tocotrienol Market Size and Share Forecast Outlook 2025 to 2035

Toilet Seat Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Tortilla Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tomato Sauce Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Tonsil And Adenoid Removal Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA