The thermoform packaging market is witnessing consistent growth driven by expanding demand across food, pharmaceutical, and consumer goods industries. Current market conditions are being influenced by the shift toward lightweight, durable, and cost-effective packaging solutions. The use of thermoforming technology allows for enhanced product protection, reduced material waste, and efficient customization, aligning with sustainability and operational efficiency goals.

Growing consumption of packaged food and healthcare products, coupled with increased e-commerce penetration, is driving high-volume adoption globally. Technological advancements in forming equipment and material innovations are improving product aesthetics, functionality, and recyclability. Regulatory initiatives promoting sustainable packaging practices are encouraging the use of recyclable and bio-based materials.

The future outlook remains strong as manufacturers continue to invest in automation, digital process control, and advanced thermoforming systems to increase throughput and maintain quality consistency These trends collectively reinforce the market’s upward trajectory, ensuring stable demand and long-term profitability for thermoform packaging solutions.

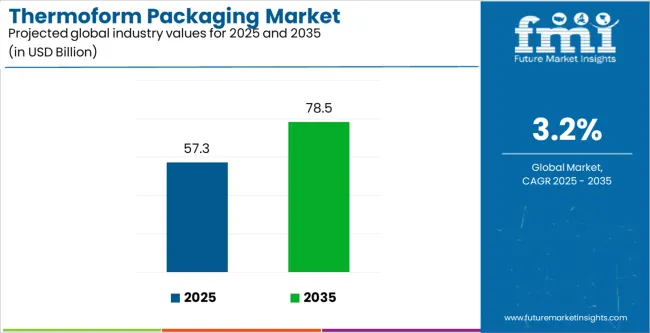

| Metric | Value |

|---|---|

| Thermoform Packaging Market Estimated Value in (2025 E) | USD 57.3 billion |

| Thermoform Packaging Market Forecast Value in (2035 F) | USD 78.5 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

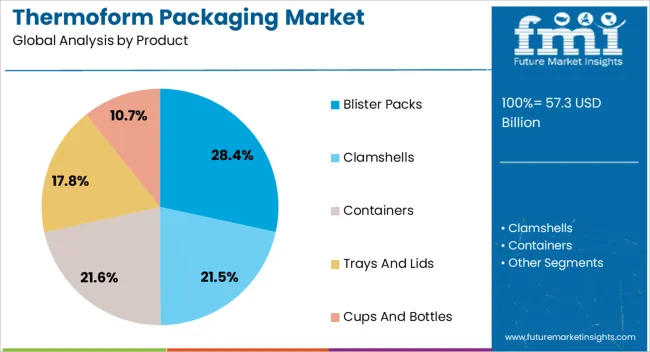

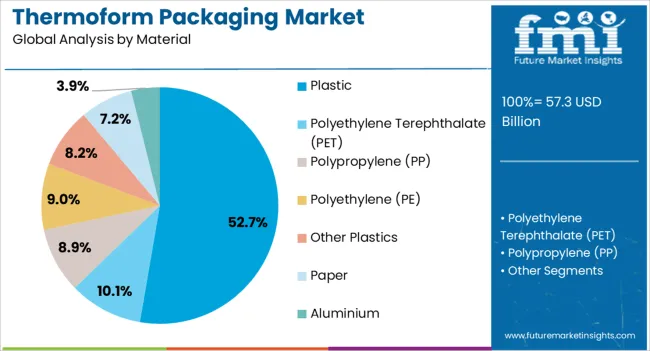

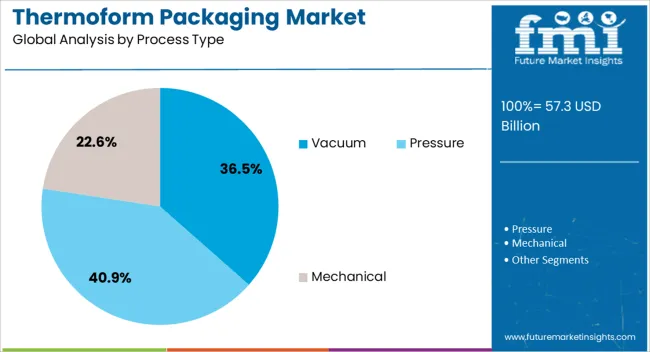

The market is segmented by Product, Material, Process Type, and End Use and region. By Product, the market is divided into Blister Packs, Clamshells, Containers, Trays And Lids, and Cups And Bottles. In terms of Material, the market is classified into Plastic, Polyethylene Terephthalate (PET), Polypropylene (PP), Polyethylene (PE), Other Plastics, Paper, and Aluminium. Based on Process Type, the market is segmented into Vacuum, Pressure, and Mechanical. By End Use, the market is divided into Food, Beverages, Pharmaceuticals, Cosmetics And Personal Care, Homecare And Toiletries, Industrial Goods, and Electrical And Electronics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The blister packs segment, accounting for 28.40% of the product category, has emerged as the leading product type due to its extensive utilization in pharmaceutical and consumer goods packaging. Its dominance is attributed to excellent barrier properties, product visibility, and secure sealing, which enhance shelf life and tamper resistance. The segment benefits from strong adoption in healthcare applications where unit-dose packaging ensures hygiene and accurate dosage control.

Increasing use of blister packs in nutraceuticals, medical devices, and small electronics has expanded their end-use range. Continuous improvements in forming precision, material strength, and sealing efficiency are enhancing cost competitiveness.

Additionally, the integration of recyclable materials and compliance with stringent packaging standards are expected to sustain segment growth The combination of durability, versatility, and sustainability positions blister packs as a core driver of the thermoform packaging market.

The plastic segment, representing 52.70% of the material category, continues to lead due to its adaptability, lightweight nature, and cost efficiency. Thermoplastics such as PET, PVC, and PP are being widely utilized for their formability, clarity, and barrier performance. The segment’s dominance is supported by large-scale industrial use and well-established supply chains that ensure consistent availability.

Material innovation, particularly in bio-based and recyclable polymers, is addressing growing environmental concerns and supporting compliance with global sustainability mandates. Improved thermoforming compatibility and mechanical strength are driving adoption in food packaging, electronics, and medical sectors.

Manufacturers are focusing on incorporating post-consumer recycled content and optimizing resin formulations to balance performance with eco-friendliness These advancements are expected to maintain the leading position of plastic materials within the thermoform packaging industry over the coming years.

The vacuum process type, holding 36.50% of the process category, has established leadership owing to its efficiency in forming precise, durable, and uniform packaging structures. The method’s capability to achieve high production rates with minimal material waste makes it particularly suitable for mass production environments.

It offers superior product protection and shape conformity, meeting the needs of food, electronics, and pharmaceutical packaging applications. Operational benefits such as reduced cycle times, lower tooling costs, and adaptability to various material types have enhanced its market preference.

The integration of automation and advanced temperature control systems has improved forming accuracy and surface finish As end-users increasingly demand cost-effective and high-quality packaging, the vacuum process type is expected to retain its market share and remain integral to modern thermoform packaging manufacturing operations.

Growing Need from the Food and Beverage Industry

The food and beverage industry uses a lot of thermoformed plastic products to package foods, including meat, dairy products, drinks, ready-to-eat cuisine, and baked goods. In addition to providing strength, adaptability, and ease of transportation, such edibles also prolong shelf life and reduce contamination.

Global evolution in the food and beverage sector necessitates packaging solutions that guard against tampering, severe temperatures, moisture, oxygen, and physical stress. Manufacturers are choosing to safeguard their products with creative and useful packaging solutions.

The sector is developing due to consumer demand for processed, ready-to-eat foods that can be consumed on the move. Thermoformed plastic packaging is becoming popular in the food service market because it has good sealing, durability, and tamper-resistant qualities.

Bespoke Beverage Packages Pushes Sales of Sustainable Packaging

The beverage industry is focusing on thermoformed plastic packaging for safety during transport, attracting consumers who prefer convenience and on-the-go drink packaging. Market players are performing several strategies to develop novel customized and sustainable packaging for drinks.

For instance, the PET Recycling Coalition, led by The Recycling Partnership, awarded grants in April 2025 to enhance PET recycling efficiency at material recovery facilities and PET reclaimers, focusing on PET thermoforms, rPET supplies, and improved PET bottle and container capture.

Biodegradable and compostable materials are becoming prevalent as the beverage sector makes a big push towards sustainable materials. With a desire for convenience and drink containers that can be carried with them wherever they go, consumers are expecting packaging solutions that respect the environment.

Stringent Usage of Raw Material to Hamper Demand

Manufacturers from emerging economies such as India and China are working to address single-use plastic pollution, focusing on waste management and awareness. However, challenges include the availability of raw materials and certain properties.

Non-sustainability packaging alternatives for thermoform products hinder the market size and the rise in plastic product development and disposal rules.

Manufacturers are shifting towards biodegradable, sustainable, and bio-derived polymers, leading to a decline in sales. The use of strong adhesives in PET complicates recycling processes and raises recycling costs, further limiting industry expansion.

The global market recorded a CAGR of 2.5% during the historical period between 2020 and 2025. Market growth of thermoform packaging was positive and reached a value of USD 57.3 billion in 2025 from USD 48.9 billion in 2020.

Sales for thermoform packaging augmented between 2020 and 2025 as a consequence of demand from the electrical, pharmaceutical, and food and beverage industries.

A number of advantages provided by thermoform packaging have helped to fuel the industry's expansion globally between 2025 and 2035. These advantages include increased use and convenience, longer shelf life and freshness retention of food, lower packaging costs for food products, no material waste, and easier customization of packages.

The food sector has found thermoform packaging to be a useful solution, offering a number of benefits that support its widespread use and ongoing expansion.

The demand for pharmaceutical drugs is propelling expansion in the pharmaceutical industry in many emerging regions, such as the Asia Pacific and Latin America. The popularity of affordable, environmentally friendly packaging options, such as thermoformed packaging goods, is being aided by the growth of the pharmaceutical industry.

The sales of thermoform packaging is estimated to reach up to USD 78.5 billion by 2035. As sustainability and cost-efficiency remain key considerations for businesses and consumers alike, thermoform packaging is well-positioned to continue its successful trajectory.

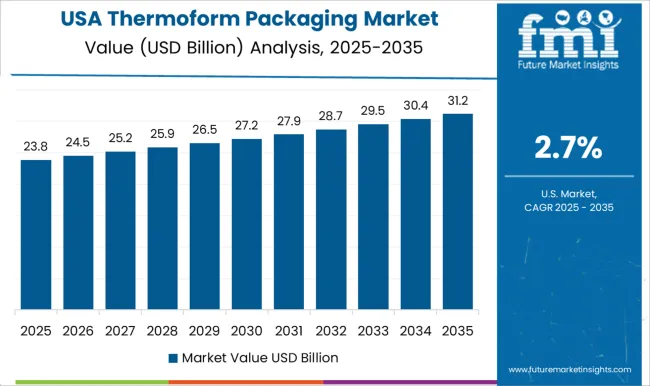

The section below discusses the country-level forecast for the thermoform packaging industry. It includes information on significant nations in North America, Asia Pacific, Europe, and other regions. The United States is estimated to remain the leader in North America, with a 2% CAGR until 2035. In South Asia and the Pacific, India is anticipated to register a CAGR of 5.5% by 2035, trailing China at 4.7%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2% |

| Canada | 1.6% |

| Germany | 1.4% |

| United Kingdom | 1.7% |

| China | 4.7% |

| India | 5.5% |

Large packaged food firms and organized retail's extensive reach were the main factors of the food service market's notable expansion in the United States in 2025. Furthermore, the growth of the industry was assisted by the existence of significant thermoform packaging producers that aimed to acquire a competitive advantage by launching novel products.

The increased consumption of frozen meat and packaged baked goods also played a significant role in shaping the regional market landscape. Looking ahead, the United States thermoform packaging industry is projected to achieve a CAGR of 2% during the forecast period spanning from 2025 to 2035.

Thermoform packaging in China is anticipated to register a CAGR of 4.7% between 2025 and 2035. Consumers are spending more and more money on online merchants.

The expansion of the thermoform packaging industry in China is being compelled by many factors, including manufacturers' changing priorities for sustainable packaging and the increasing disposable income of citizens in China.

Customers' hygiene and safety protocols are high. Additionally, customers' concerns about costs are increasing. Therefore, packaging companies would take significant steps to achieve scale in order to thrive in a competitive ecosystem in China.

India is projected to showcase a CAGR of 5.5% in the forecast period. The growing industrialization trend in the country is projected to play a significant role in pushing demand for sustainable packaging solutions such as containers and trays. Food and beverage manufacturers in the country are moving toward thermoform packaging solutions to attract consumers and retain the flavor of edibles.

In India, food packaging needs good oxygen/moisture barriers, physical stress, temperature, contamination protection, and tamper resistance. Thermoform packaging offers durability, resilience, and enhanced sealing capabilities, extending shelf life and allowing easy access, leading to increased adoption by industry players.

The section contains information about the leading segments in the industry. In terms of product type, the blister packs segment is estimated to account for a share of 36.1% through 2035. By end-use, the food packaging category is projected to dominate by holding a share of 46.4% in 2035.

| Segment | Blister Packs (Product Type) |

|---|---|

| Value Share (2025) | 36.1% |

Manufacturers utilize thermoform packaging because it is simple and economical to ship in blister packs. The two main forms of thermoforming used in food, medicine, electronics, and home care items are thin-gauge and thick-gauge. The demand for blister packs is projected to acquire a revenue share of 36.1% in 2025.

Blister packs are becoming increasingly popular due to their convenience, dosage control, and tamper-proof properties. The growing demand for pharmaceuticals due to chronic disease cases and health awareness is driving sales.

The blister packaging is transforming with the use of innovative technologies like RDFI tags and sensors, aiming to address medication adherence challenges. Since blister packaging offers better price, mobility, and resistance to moisture and oxygen, the pharmaceutical industry is moving toward it for oral solid doses. Food manufacturers also use thermoform packaging because of its aesthetic appeal, affordability, and low weight.

| Segment | Food (End Use) |

|---|---|

| Value Share (2025) | 46.4% |

The food end-user industry segment dominated the market with a sales share of 46.4% in 2025, helmed by the extensive utilization of containers, trays, and clamshells by packaged food manufacturers and food service establishments.

Because of their improved quality, longer shelf lives, and tight seals, thermoformed plastics are becoming more popular in the food packaging industry. These polyethylene and polypropylene polymers are used in food packaging, which helps fast-food chains, convenience stores, bakeries, and caterers.

The increasing consumer demand for convenient food products, influenced by changing lifestyles, is envisioned to boost the adoption of thermoform products in this sector. However, the trend towards sustainable packaging, particularly molded pulp products, may impede the segment's growth.

Leading producers in the thermoform packaging industry are creating and introducing new goods to the market. Augmenting geographical presence and merging with other companies are the primary goals. Partnerships and collaborations for new product development with regional brands and start-up businesses are becoming more prevalent.

Due to the growing need for industrial facilities in areas with immense promise, manufacturers have made large financial investments in these facilities. These are anticipated to provide many possibilities since they provide eco-friendly ways to safeguard goods.

The start-ups have been creating packaging solutions that are zero-waste and sustainable. They have been using the pay-per-use concept, which lowers the packing expenses.

Industry Updates

The industry is segregated into blister packs, clamshells, containers, trays and lids, as well as cups and bottles.

In terms of material, the industry is divided into plastic, paper, and aluminium. The plastic material is further segmented into Polyethylene Terephthalate (PET), Polypropylene (PP), Polyethylene (PE), and other plastics.

The industry is trifurcated into vacuum, pressure, and mechanical, based on the process type.

Few of the leading end-used include food, beverages, pharmaceuticals, cosmetics and personal care, homecare and toiletries, industrial goods, electrical and electronics.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa are covered.

The global thermoform packaging market is estimated to be valued at USD 57.3 billion in 2025.

The market size for the thermoform packaging market is projected to reach USD 78.5 billion by 2035.

The thermoform packaging market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in thermoform packaging market are blister packs, clamshells, containers, trays and lids and cups and bottles.

In terms of material, plastic segment to command 52.7% share in the thermoform packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermoformed Skin Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Thermoformed Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Vacuum Thermoformed Packaging Sector

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Containers Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Tray Market Size and Share Forecast Outlook 2025 to 2035

Thermoforming Films Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Plastics Market Size and Share Forecast Outlook 2025 to 2035

Thermoform Fill Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thermoformed Tubs Market Trend Analysis Based on Material, Shape, End-Users and Regions through 2025 to 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Industry Share Analysis for Thermoform Fill Sealing Machine Providers

Market Share Distribution Among Thermoformed Tubs Manufacturers

Examining Market Share Trends in the Thermoforming Films Industry

Market Share Breakdown of Thermoformed Tray Market

Thermoform Cups Market

Thermoformed Lids Market

Automatic Thermoforming Vacuum Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA