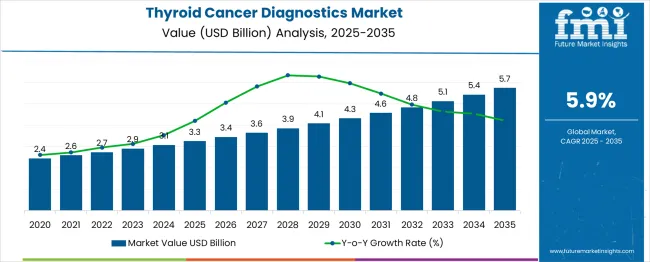

The global thyroid cancer diagnostics market is set to increase from USD 3.2 billion in 2025 to USD 5.7 billion by 2035, reflecting a 6% CAGR and creating an absolute dollar opportunity of USD 2.5 billion. Market expansion is supported by the rising prevalence of thyroid cancer cases, advancements in imaging technologies, and the integration of molecular diagnostics that enable early detection and improved treatment planning. Growing awareness programs further reinforce demand, expanded screening initiatives, and adoption of precision medicine approaches in oncology.

Quick Stats for Thyroid Cancer Diagnostics Market

Over the forecast horizon, regional growth dynamics shape the trajectory of the market. North America and Europe continue to contribute strongly due to established healthcare infrastructure, advanced diagnostic facilities, and supportive reimbursement frameworks, Asia Pacific demonstrates faster adoption, driven by increasing cancer awareness, improved healthcare spending, and modernization of diagnostic laboratories. Between 2025 and 2030, growth remains steady, supported by incremental adoption of advanced imaging techniques such as ultrasound, CT, and MRI. From 2031 to 2035, acceleration is observed as next-generation sequencing, biomarker testing, and AI-enabled diagnostic platforms become more widely implemented. Collectively, these drivers ensure that the thyroid cancer diagnostics market experiences consistent expansion, achieving a multiplication factor of 1.78x over the decade.

| Metric | Value |

| Estimated Value in (2025E) | USD 3.2 billion |

| Forecast Value in (2035F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 6% |

Recent developments in the thyroid cancer diagnostics market focus on precision testing, advanced imaging, and minimally invasive techniques. Molecular profiling and next-generation sequencing are increasingly used to identify genetic mutations for personalized treatment. AI-assisted imaging and automated cytology are improving accuracy and reducing diagnostic errors. Liquid biopsy innovations are gaining momentum, offering non-invasive options for monitoring tumor progression. Strategic collaborations between diagnostic firms and healthcare providers are accelerating access to cutting-edge tools. Growing adoption of digital pathology, faster turnaround times, and integration with electronic health records are enhancing patient care. These trends are advancing innovation and expanding diagnostic capabilities globally.

The thyroid cancer diagnostics market is driven by five primary parent markets with specific shares. In-vitro diagnostics lead with 36%, as blood tests and molecular assays are widely used for detecting tumor markers. Imaging technologies contribute 28%, employing ultrasound, CT, MRI, and nuclear medicine scans for diagnosis and staging. Biopsy and cytology account for 14%, with fine-needle aspiration biopsies providing tissue-level confirmation. Genomic and molecular diagnostics represent 12%, offering insights into genetic mutations and targeted therapy decisions. Hospital laboratories and diagnostic centers hold 10%, providing integrated testing services. These segments collectively shape demand for thyroid cancer diagnostic solutions worldwide.

Market expansion is being supported by the increasing incidence of thyroid cancer globally and the corresponding demand for effective diagnostic solutions. Modern healthcare systems are increasingly focused on early detection strategies that can identify malignant thyroid nodules before they progress to advanced stages. The proven efficacy of various diagnostic techniques in accurately identifying different types of thyroid cancer makes them essential components of comprehensive cancer care programs.

The growing focus on personalized medicine and precision diagnostics is driving demand for advanced molecular testing methods that can provide detailed genetic profiling of thyroid tumors. Healthcare provider preference for multi-modal diagnostic approaches that combine imaging, laboratory tests, and tissue analysis is creating opportunities for integrated diagnostic solutions. The rising influence of medical guidelines and professional recommendations is also contributing to increased adoption of standardized diagnostic protocols across different healthcare settings and geographic regions.

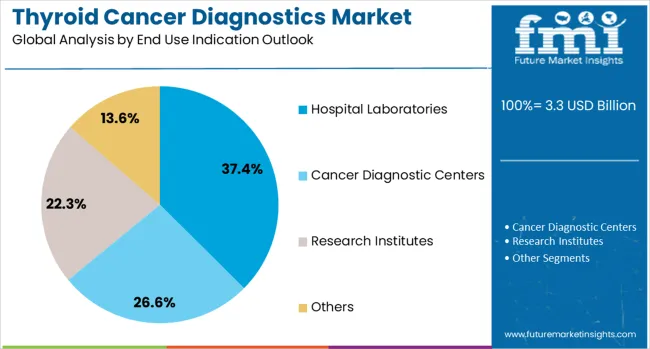

The market is segmented by cancer type, technique, end use, and region. By cancer type, the market is divided into papillary carcinoma, follicular carcinoma, and others. Based on technique, the market is categorized into imaging, blood test, biopsy, and others. In terms of end use, the market is segmented into hospital laboratories, cancer diagnostic centres, research institutes, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The papillary carcinoma segment is projected to account for 80% of the thyroid cancer diagnostics market in 2025, reaffirming its position as the most prevalent form of thyroid cancer worldwide. Healthcare providers increasingly recognize that papillary thyroid carcinoma represents the majority of all thyroid cancer cases, making specialized diagnostic approaches essential for accurate identification and staging.

This cancer type forms the foundation of most diagnostic protocols, as it represents the most commonly encountered thyroid malignancy in clinical practice. Medical professional guidelines and clinical evidence continue to support the development of targeted diagnostic strategies specifically designed for papillary carcinoma detection. With healthcare systems focusing on standardized screening approaches, papillary carcinoma diagnostics align with both early detection and comprehensive cancer care goals. Its high prevalence across different patient populations ensures sustained market dominance, making it the central growth driver of thyroid cancer diagnostic demand.

Imaging techniques are projected to represent 37% of thyroid cancer diagnostic demand in 2025, underscoring their role as the preferred initial diagnostic approach for thyroid nodule evaluation. Healthcare providers gravitate toward imaging methods for their non-invasive nature, comprehensive visualization capabilities, and ability to provide detailed anatomical information about thyroid structures and surrounding tissues.

The segment is supported by the increasing sophistication of imaging technologies, including high-resolution ultrasound, computed tomography, and magnetic resonance imaging systems. The healthcare facilities are increasingly integrating advanced imaging protocols with artificial intelligence enhancement and computer-aided detection systems, improving diagnostic accuracy and workflow efficiency. As medical professionals prioritize patient comfort and diagnostic precision, imaging-based thyroid cancer diagnostics will continue to maintain their prominent position within the comprehensive diagnostic market landscape.

The hospital laboratories segment is forecasted to contribute 37% of the thyroid cancer diagnostics market in 2025, reflecting the central role of hospital-based diagnostic services in cancer care delivery. Healthcare institutions increasingly rely on in-house laboratory capabilities to provide rapid, comprehensive diagnostic testing that supports clinical decision-making and patient management throughout the cancer care continuum.

Hospital laboratories benefit from their integration within comprehensive healthcare systems, enabling seamless coordination between diagnostic testing, clinical evaluation, and treatment planning. The segment also advantages from healthcare institutions' investments in advanced diagnostic equipment, specialized personnel, and quality assurance programs that ensure reliable test results. With growing prioritize on multidisciplinary cancer care approaches and the need for rapid diagnostic turnaround times, hospital laboratories serve as critical diagnostic hubs, making them essential drivers of market growth and innovation in the thyroid cancer diagnostics category.

The thyroid cancer diagnostics market is advancing steadily due to increasing cancer incidence rates and growing demand for accurate diagnostic solutions. The market faces challenges including high costs of advanced diagnostic equipment, regulatory complexities, and variability in healthcare infrastructure across different regions. Innovation in molecular diagnostics and artificial intelligence integration continue to influence product development and market expansion patterns.

The growing adoption of molecular diagnostic techniques is enabling healthcare providers to identify specific genetic mutations and biomarkers associated with thyroid cancer. Advanced molecular testing offers precise tumour characterization, treatment selection guidance, and prognostic information that influence patient management decisions. Genetic testing technologies are driving market growth through their ability to provide personalized diagnostic insights that support targeted therapy approaches and improved patient outcomes.

Modern diagnostic manufacturers are incorporating artificial intelligence and machine learning algorithms into imaging systems and laboratory analyzers to enhance diagnostic accuracy and workflow efficiency. These technologies improve the detection of subtle abnormalities, reduce interpretation variability, and provide decision support tools for healthcare professionals. Advanced AI integration also enables automated analysis capabilities that streamline diagnostic processes while maintaining high standards of accuracy and reliability.

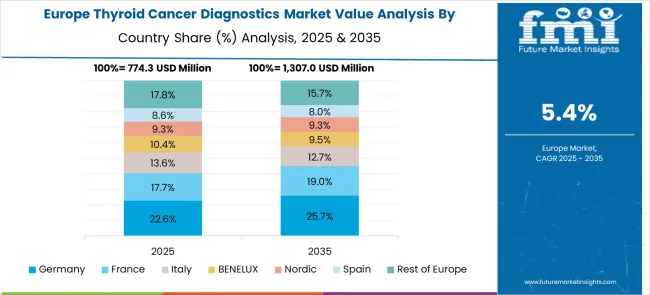

The thyroid cancer diagnostics market in Europe demonstrates mature development across major healthcare systems with Germany showing strong presence through its advanced healthcare infrastructure and prioritize on comprehensive cancer screening programs, supported by medical institutions leveraging cutting-edge diagnostic technologies to develop effective thyroid cancer detection protocols that address the growing need for early identification and accurate tumor characterization.

France represents a significant market driven by its well-established healthcare system and sophisticated approach to cancer diagnostics, with healthcare providers and diagnostic companies pioneering advanced thyroid cancer testing methodologies that combine traditional imaging techniques with molecular diagnostic approaches for enhanced detection accuracy and patient care optimization.

The UK exhibits considerable growth through its National Health Service focus on standardized cancer screening protocols and evidence-based diagnostic approaches, with healthcare institutions leading the implementation of cost-effective thyroid cancer diagnostic programs and comprehensive patient education initiatives. Italy and Spain show expanding adoption of advanced diagnostic technologies, particularly in specialized cancer centers and university hospitals. BENELUX countries contribute through their focus on healthcare innovation and research-driven diagnostic development, while Eastern Europe and Nordic regions display growing potential driven by healthcare infrastructure improvements and increasing access to advanced diagnostic services across diverse healthcare settings.

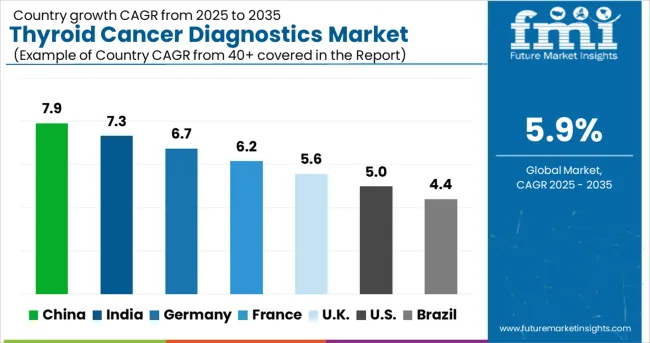

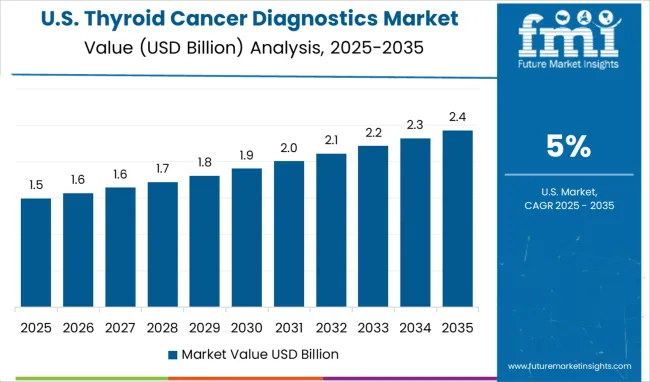

In 2025, the global thyroid cancer diagnostics market is expected to grow from USD 3.2 billion to USD 5.7 billion by 2035 at a CAGR of 6%. China, at 7.9%, outpaces the global rate as part of BRICS expansion, supported by large-scale cancer screening and public hospital upgrades. India posts 7.3%, also BRICS-driven, with government-led oncology programs and expanding private diagnostics. Germany, at 6.7%, reflects OECD alignment, where advanced imaging technology and hospital-based pathology accelerate adoption. France records 6.2%, benefiting from OECD healthcare reforms and research-driven testing improvements. The United Kingdom, at 5.6%, shows steady growth shaped by NHS-backed initiatives and early diagnostic policies. The United States, at 5.0%, grows below the global average as a mature OECD market, with innovation in molecular diagnostics but slower incremental expansion. ASEAN markets provide emerging opportunities as regional healthcare access improves.

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

| China | 7.9% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.2% |

| UK | 5.6% |

| U.S. | 5.0% |

China is expanding at a CAGR of 7.9%, supported by growing diagnostic imaging infrastructure and an increasing number of specialized oncology centers. The country’s healthcare reforms focus on early detection, with large investments made in hospital-based molecular testing capabilities. The adoption of advanced diagnostic modalities such as fine-needle aspiration cytology, immunohistochemistry, and genetic testing is expanding in tier 1 and tier 2 cities. Pharmaceutical companies are collaborating with local diagnostic firms to establish affordable test kits tailored for large-scale screening. Efforts to improve rural healthcare accessibility also contribute to the market’s upward trajectory.

India is advancing at a CAGR of 7.3%, with growth led by affordable diagnostic services and expansion of private pathology labs across urban and semi-urban regions. The nation’s rising awareness about thyroid disorders has increased patient inflow into diagnostic centers. Cost-effective ultrasound imaging, nuclear medicine techniques, and molecular assays are being widely adopted to improve detection accuracy. Domestic diagnostic chains are investing in next-generation sequencing panels, enabling comprehensive cancer profiling. India’s large patient base creates demand for early detection kits that are both affordable and scalable. The market is also supported by growing insurance penetration that helps patients access advanced testing services. It is strongly believed that localized innovation in diagnostics will further expand India’s role in the global thyroid cancer testing landscape.

Germany is growing at a CAGR of 6.7%, with highlighting on advanced diagnostic technologies integrated into clinical oncology practices. Hospitals and cancer care centers are utilizing PET-CT, high-resolution ultrasound, and molecular profiling to improve diagnostic precision. German laboratories are pioneers in adopting liquid biopsy techniques, which are increasingly applied for early thyroid cancer detection and recurrence monitoring. The market is shaped by collaborations between biotech companies and academic research institutions that develop innovative biomarkers and imaging technologies. Regulatory compliance and high-quality standards continue to drive demand for sophisticated diagnostic solutions. The general view is that Germany will maintain its role as a strong innovation hub within the European diagnostic space, supporting both local patients and international research.

France is advancing at a CAGR of 6.2%, supported by government-backed initiatives to enhance cancer screening services and expand diagnostic infrastructure. French healthcare providers prioritize molecular testing, immunoassays, and advanced imaging to improve thyroid cancer detection. National cancer programs focus on early diagnosis and personalized treatment planning, which are driving greater adoption of biomarker-based tests.Partnerships between diagnostic companies and public hospitals are accelerating the adoption of precision medicine tools. France’s strong focus on research-driven diagnostic solutions enhances its role as a regional hub for innovation in thyroid cancer testing.

The United Kingdom is witnessing a CAGR of 5.6%, with strong focus on integrating AI-driven imaging and digital pathology platforms into oncology care. NHS initiatives to improve cancer detection rates are fueling demand for cost-effective yet advanced diagnostic solutions. Private diagnostic chains are investing in high-resolution ultrasound equipment and molecular panels for targeted cancer profiling. Clinical adoption of AI-based algorithms for early thyroid lesion identification is being scaled across multiple healthcare regions. Partnerships with research institutes further strengthen the local diagnostic ecosystem.

The United States is advancing at a CAGR of 5.0%, shaped by widespread adoption of molecular diagnostics, imaging, and AI-assisted technologies. Clinical laboratories are rapidly integrating genetic testing panels for precision oncology applications. Strong collaborations between diagnostic companies, hospitals, and research institutes are fueling technology innovation. Adoption of liquid biopsy and next-generation sequencing is becoming increasingly common for early detection and recurrence monitoring. Insurance coverage expansion has improved patient access to advanced thyroid cancer diagnostics, driving higher utilization rates.

GE HealthCare provides advanced imaging technologies, including ultrasound and nuclear medicine systems, that enhance thyroid cancer screening and monitoring. Hologic, Inc. offers diagnostic solutions focused on women’s health but also extends molecular testing capabilities applicable to thyroid cancer diagnostics. Koninklijke Philips N.V. strengthens this field with diagnostic imaging systems integrated with digital healthcare solutions. Toshiba Corporation, now under Canon Medical Systems, contributes with imaging technologies for oncology and diagnostic applications. Agilent Technologies, Inc. delivers molecular diagnostic tools, genomic solutions, and laboratory equipment that support cancer research and patient diagnostics.

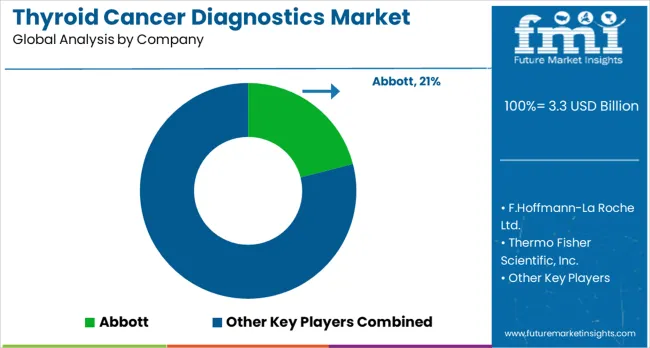

The market is supported by healthcare and biotechnology organizations offering advanced imaging, molecular testing, and laboratory solutions. Abbott provides a portfolio of diagnostic kits and immunoassays that support the detection of thyroid disorders and cancer biomarkers. F. Hoffmann-La Roche Ltd. delivers molecular diagnostic technologies and laboratory testing systems that strengthen cancer detection and monitoring. Thermo Fisher Scientific, Inc. offers genetic analysis tools, sequencing platforms, and laboratory consumables tailored for oncology applications. Siemens Healthcare GmbH supports this space with diagnostic imaging systems and clinical laboratory automation technologies. Bio-Rad Laboratories, Inc. contributes through laboratory instruments and reagents for molecular biology and cancer testing applications.

Illumina, Inc. plays a vital role with its next-generation sequencing platforms, enabling precision medicine approaches in thyroid cancer diagnostics. The combined expertise of these organizations enhances the availability of diagnostic tools ranging from imaging and molecular testing to sequencing and laboratory automation. These offerings allow healthcare providers to deliver earlier detection, accurate diagnosis, and personalized treatment strategies for thyroid cancer, aligning with global efforts to strengthen oncology care and improve patient outcomes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.2 billion |

| Cancer Type | Papillary carcinoma, Follicular carcinoma, Others |

| Technique | Imaging, Blood Test, Biopsy, Others |

| End Use | Hospital Laboratories, Cancer Diagnostic Centers, Research Institutes, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Abbott, F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc, Siemens Healthcare GmbH, Bio-Rad Laboratories Inc, GE HealthCare, Hologic Inc, Koninklijke Philips NV, Toshiba Corporation, Agilent Technologies Inc, Illumina Inc |

| Additional Attributes | Dollar sales by diagnostic technique and cancer type, regional demand trends, competitive landscape, healthcare provider preferences for molecular versus conventional diagnostics, integration with personalized medicine approaches, innovations in AI-enhanced imaging, liquid biopsy technologies, and point-of-care testing solutions |

Cancer Type

The global thyroid cancer diagnostics market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the thyroid cancer diagnostics market is projected to reach USD 5.7 billion by 2035.

The thyroid cancer diagnostics market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in thyroid cancer diagnostics market are papillary carcinoma, follicular carcinoma and others.

In terms of technique outlook, imaging segment to command 36.9% share in the thyroid cancer diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thyroid Function Test Market Analysis - Growth & Trends 2025 to 2035

Market Share Breakdown of Thyroid Ablation Devices Manufacturers

Thyroid Care Supplements Market – Growth, Demand & Hormonal Health

Thyroid Deficiency Treatment Market

India Thyroid Function Test Market Insights - Trends, Demand & Growth 2025-2035

Pet Hypothyroidism Therapy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hypoparathyroidism Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Insights for Hypoparathyroidism Treatment Providers

Papillary Thyroid Cancer Market Size and Share Forecast Outlook 2025 to 2035

Injectable Thyroid Drug Market Size and Share Forecast Outlook 2025 to 2035

Hashimoto's Thyroiditis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Differentiated Thyroid Cancer Therapeutics Market

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA