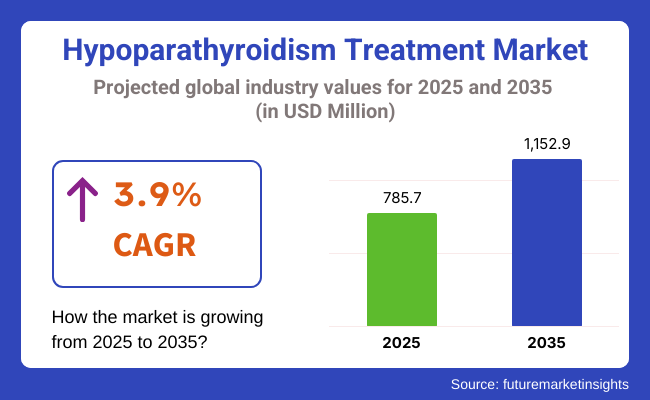

The global hypoparathyroidism treatment market is expected to experience significant growth from USD 785.7 million in 2025 to USD 1,152.9 million by 2035, reflecting a CAGR of 3.9% during the forecast period. This market expansion is largely driven by advancements in therapeutic options and an increasing understanding of hypoparathyroidism among healthcare professionals and patients alike.

Hypoparathyroidism, characterized by the underproduction of parathyroid hormone (PTH), leads to calcium imbalances, which can result in symptoms such as muscle spasms, bone pain, and even life-threatening complications like seizures and kidney failure. The growing prevalence of this rare endocrine disorder, combined with improved diagnostic techniques, is expected to further fuel market demand for effective treatments.

A key driver of market growth is the ongoing development of innovative treatments, particularly recombinant parathyroid hormone (rPTH) therapies. These therapies offer a more targeted approach compared to traditional calcium and vitamin D supplementation, addressing the root cause of the disorder by directly supplementing the deficient hormone.

As the clinical understanding of hypoparathyroidism advances, treatment options are becoming increasingly specialized, which is likely to improve the quality of life for patients and lead to better clinical outcomes. Additionally, the availability of newer, long-acting PTH analogues and oral peptide therapies promises to enhance the convenience of treatment for chronic hypoparathyroidism, thus contributing to an increased adoption of these therapies.

The market is also supported by the increasing focus on rare disease treatments and the expansion of healthcare infrastructure in emerging markets, where access to specialized therapies may have previously been limited.

As more healthcare providers become familiar with the nuances of managing hypoparathyroidism, patient awareness is expected to rise, leading to earlier diagnoses and, consequently, greater demand for therapeutic interventions. Furthermore, collaborations between major pharmaceutical players like Takeda, Amgen, Ascend is Pharma, and Roche to develop innovative, more effective therapies will play a pivotal role in shaping the market landscape over the next few years.

The table below compares the compound annual growth rate of the global hypoparathyroidism treatment market for the first halves of 2024 and 2025. It offers essential perspectives on how this sector functions by highlighting major changes and trends in revenue generation. Half H1: January through June H2: July through December. In the first half (H1) of the decade from the year 2024 to 2034, the company is expected to grow at a CAGR of 3.7%. While, in the later years of that decade, it is anticipated to rise by about 4.3%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.7% |

| H2 (2024 to 2034) | 4.3% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 4.3% |

From H1 2025 to H2 2035, the growth rate will start to reduce mildly to 3.9 percent in the half and stay nearly lower at 4.3 percent in the second half of the period. In the H1 period of the period the industry went 20 BPS down, in the H2 period the industry went 4 BPS down.

The section contains information about the leading segments in the industry. Based on product type, the Calcium Supplements segment is expected to account for 37.9% of the global share in 2025.

| By Product type | Value Share (2025) |

|---|---|

| Calcium Supplements | 37.9% |

One major reason why calcium supplements rank as the first treatment is that they are accessible. Calcium supplements are found everywhere; the drugs are quite cheap and easy to administer, hence they form the first-line treatment for most patients afflicted with hypoparathyroidism. They come in various forms such as tablets, chewable forms, and powders; thus they can be made to fit the needs and preferences of each patient.

They are available over the counter in most countries and therefore improve access for patients who may have financial constraints or who do not have immediate access to more complex therapies. This leads to a combination of symptoms such as muscle spasms and cramps and can also cause pains in the bone. Normalizing calcium levels, is the course of treatment to most patients afflicted with hypoparathyroidism, which could be the most direct yet effective way with the administration of calcium supplements.

| By Distribution Channel | Value Share (2025) |

|---|---|

| Retail Pharmacies | 37.1% |

It remains one of the primary factors driving retail pharmacies for the delivery of hypoparathyroidism treatments as accessibility is on one of its ends. The place of the majority of communities comes with at least a local and accessible point pharmacy.

As well, this drug has proven mostly to continue keeping patients within this group through on-going therapy mainly to handle any fluctuations within its calcium level for hypoparathyroid patients. In urban and rural settings, retail pharmacies serve an important function of providing ready access to a patient's prescribed medications without needing to travel for miles or traverse complicated healthcare systems.

Further widening access to medicines is the opening of online retail pharmacies, hence increasing access among those patients staying in remote locations or who find it hard to travel. It is possible to order from within the comfort of their homes as some online pharmacies deliver medications even faster and at cheaper prices compared to those from the traditional pharmacies. This facilitates compliance by eliminating some barriers to accessing treatments.

Rising Post-Surgical Hypoparathyroidism Cases Drive Demand for Advanced Treatment Solutions

An increasing incidence rate of post-surgical hypoparathyroidism boosts growth in the treatment markets of hypoparathyroidism. The biggest stimulus in treating hypoparathyroidism has actually come to be through post-operative conditions that primarily have risen during neck and thyroid surgeries. Such procedure, such as the case for the resection of cancerous conditions from the thyroid area and cases where one experiences a hyperthyroid or goiter state, frequently damages the parathyroid gland along with resecting thyroid tissues.

Surgeons and endocrinologists are becoming more aware of post-surgical hypoparathyroidism, which presents earlier and gives adequate time to intervene. This has led to better management by increased monitoring and post-operative care protocols, making fewer emergency visits to the hospitals due to the severity of hypocalcemia.

This increase in the patient population is an added demand for better treatments in the form of novel hormone replacement therapies that present better outcomes as compared to calcium and vitamin D supplementation. Surgical treatments are increasingly popular, and a strong demand is expected for proper, long-term treatment solutions for the market to expand significantly.

Breakthroughs in rPTH Therapy Enhance Patient Outcomes and Market Growth

Management was previously achieved either through supplementation of calcium and vitamin D or was symptomatic, without being physiological in replacement for PTH. The targeted use of rPTH, such as that found in Natpara, which is under the umbrella of Takeda Pharmaceuticals, can more effectively replace the missing hormone.

This innovation has led to improvement in patient outcomes, reduced complications, and enhanced quality of life. Accelerating regulatory approvals and ongoing research for developing more stable and effective formulations will lead to the massive demand for rPTH-based therapies, driving growth in the market.

Pharmaceutical companies are also attempting to enhance the delivery mechanisms of rPTH by introducing long-acting formulation and combination therapy, thereby enhancing patient compliance and efficacy. These technological advancements position rPTH as the future of hypoparathyroidism treatment.

Expanding Diagnostic Capabilities and Education Initiatives Fuel Growth in Hypoparathyroidism Treatment

Rising awareness regarding hypoparathyroidism and its complications will substantially increase the chances to improve the rates of early diagnosis through focused campaigns and screening programs. There are many such instances of hypoparathyroidism that either go undiagnosed or get diagnosed based on the false premise of having another disease whose symptoms overlap. Governments, health care organizations, and pharmaceutical firms are investing in educating patients as well as doctors regarding the proper early detection and treatment of the disease.

Increased patient advocacy and improvement in diagnosis through increases in the capacity of diagnostics are going to open up new avenues for growth in the market, which will ensure timely initiation of treatment and offer better control over the diseases. Digital health tools, AI-powered diagnostics, and telemedicine initiatives improve access to expert consultations and screenings. By utilizing these improvements, technology can fill the gap in early diagnosis and effective treatment and then fuel growth in the market.

Stringent Regulatory Norms and Limited Accessibility of Advanced Therapies may Restrict Market Growth

Although promising progress has been shown, the expensive nature of recombinant parathyroid hormone therapies remains one of the primary challenges to its expansion in the market. At a premium price, rPTH therapies are cost-prohibitive for many patients, especially low- and middle-income countries. Moreover, not much reimbursement under healthcare policies exists, nor does the strict requirement for regulatory adherence make it feasible for use that is more extensive.

Many healthcare systems are still dependent on traditional treatment options because they are cost-effective, which slows the uptake of innovative therapies in the market. Besides, unequal healthcare access across regions creates challenges in equitable treatment distribution.

Patients in developing nations face difficulties in getting specialized care, which further limits the adoption of advanced therapies. Addressing these cost and accessibility challenges through policy changes, subsidies, and alternative pricing models could significantly enhance market penetration.

Tier 1 companies are the industry leaders with 85.2% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Takeda Pharmaceuticals Ltd, Ascendis Pharma A/S, Entera Bio Ltd and F. Hoffmann-La Roche Ltd

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 15.0% worldwide. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Amgen Inc., ProLynx, Inc., Extend Biosciences, Inc. among others.

Compared to Tiers 1 and 2, Tier 3 companies offer outsourced testing services, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for hypoparathyroidism treatment in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 85.7%.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

| UK | 4.0% |

| Germany | 3.6% |

| China | 4.0% |

| India | 4.4% |

Germany is one of the biggest economies in Europe, with a health care system very well developed; hence, demand for hypoparathyroidism treatments shoots up. A number of significant parathyroid diseases are prevailing in the country, and a cause is a growing aging population along with increasing cases of thyroid-related disorders. This directly relates to the growing demand for novel treatments like drugs and medical devices related to calcium and vitamin D deficiencies.

Besides that, the country's health care is considered one of the most developed in the world, and vast sums of money are spent to give the people quality health care service that they require. This also includes large re-imbursement for rare diseases and advanced treatments. Therefore, considering reimbursement policy about innovative drugs within Germany can support the easier introduction of therapies within the market in a more fluid manner, in which most of the patients who have rare conditions like hypoparathyroidism get timely treatment.

USA is dominated with the multiple underlying growth factors about hypoparathyroidism treatment. The main driver of this market is the growing prevalence and diagnosis of rare endocrine diseases like hypoparathyroidism. Recent advances in medical technology, including genetic testing and better diagnostic tools, have made it easier to detect hypoparathyroidism early, which also increases the treatment demand. Although the country's healthcare system is complex, the system has multiple programs that help patients receive the latest therapies, which also increases the market growth for rare diseases like hypoparathyroidism.

The FDA's approval of innovative and new treatments for hypoparathyroidism has significantly expanded the pool of treatment alternatives in the United States. As an example, the FDA approved Ascendis Pharma's Yorvipath, or TransCon PTH, as a once-daily treatment for hypoparathyroidism and provided patients with an effective alternative to traditional calcium and vitamin D supplementation. The product has also got an approval in 2024, henceforth it stands for a large leap toward a more targeted and advanced therapy more advanced than that of hormonal balancing therapy for enhanced quality of life.

The Indian hypoparathyroidism treatment market is expected to grow due to a number of factors. High prevalence of thyroid-related disorders has led to increased incidences of hypoparathyroidism, especially after surgeries. The incidence of such patients is rising due to which an effective treatment strategy is being searched for addressing the imbalances of calcium and phosphate in the patient's body.

Some initiatives the Indian government is taking in this direction include National Health Mission and Ayushman Bharat, whereby a health insurance facility is being provided to the low-income group. With these, health care is being made accessible and affordable to many patients with such rare diseases like hypoparathyroidism. Thus, the number of patients is on the increase with diagnosis and subsequent treatment. With this increased patient population requiring these specialized therapies, the Indian market is driven even further.

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 785.7 million |

| Projected Industry Size (2035) | USD 1,152.9 million |

| CAGR (2025 to 2035) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million/Prescriptions in thousand treatment courses |

| Segments by Product Type | Parathyroid Hormone (Natpara, others); Vitamin D Analogue (Vitamin D₂, Vitamin D₃); Calcium Supplements (≈ 37.9 % share 2025) |

| Segments by Route of Administration | Oral, Parenteral |

| Segments by Distribution Channel | Hospital Pharmacies, Retail Pharmacies (≈ 37.1 % share 2025), Online Sales |

| Key Regions | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | Takeda Pharmaceuticals Ltd; Ascendis Pharma A/S; Entera Bio Ltd; F. Hoffmann-La Roche Ltd; Amgen Inc.; ProLynx Inc.; Extend Biosciences Inc.; BionPharma Inc.; Others |

| Additional Attributes | Growth driven by rising surgical hypoparathyroidism incidence, improved screening for inherited forms, and patient preference for once-daily or weekly PTH analogues; calcium-plus-calcitriol regimens remain first-line therapy |

| Customization and Pricing | Region-specific forecasts, product-mix modelling, and price-sensitivity analysis available on request |

In terms of product type, the industry is divided into Parathyroid Hormone (Natpara and Others), Vitamin D Analogue (Vitamin D2 and Vitamin D3) and Calcium Supplements

In segments of route of administration, the industry is segregated into oral and parenteral.

In segments of distribution channel, the industry is divided into hospital pharmacies, retail pharmacies and online sales.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global hypoparathyroidism treatment industry is projected to witness CAGR of 3.9% between 2025 and 2035.

The global hypoparathyroidism treatment industry stood at USD 756.1 million in 2024.

The global hypoparathyroidism treatment industry is anticipated to reach USD 1,152.9 million by 2035 end.

China is expected to show a CAGR of 4.0% in the assessment period.

The key players operating in the global hypoparathyroidism treatment industry are Takeda Pharmaceuticals Ltd, Ascendis Pharma A/S, Entera Bio Ltd, F. Hoffmann-La Roche Ltd, Amgen Inc., ProLynx, Inc., Extend Biosciences, Inc., BionPharma Inc. and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Hypoparathyroidism Treatment Providers

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA