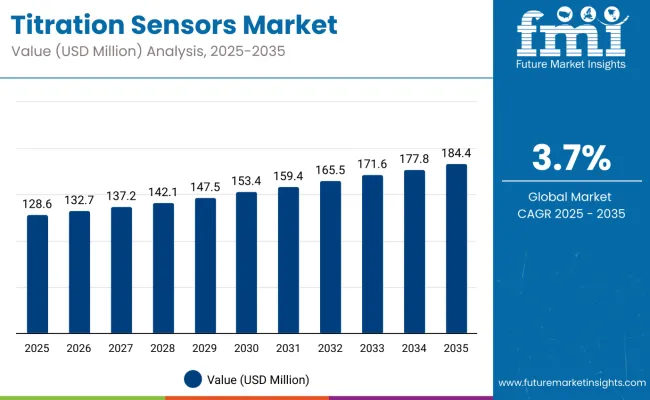

The global titration sensors market is expected to be valued at USD 128.6 million in 2025 and is projected to reach approximately USD 184.4 million by 2035. This reflects an absolute increase of USD 59.9 million, equivalent to a growth of 46.6% over the forecast period. The expansion is forecast to occur at a CAGR of 3.7%, with the market size estimated to grow by nearly 1.5X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 128.6 million |

| Industry Value (2035F) | USD 184.4 million |

| CAGR (2025 to 2035) | 3.7% |

Between 2025 and 2030, the market is projected to expand from USD 128.6 million to USD 156.4 million, adding USD 27.8 million in value. This initial growth will be driven by rising demand for pH and conductivity sensors in water treatment plants across Asia and Europe, as governments tighten water quality standards and industrial discharge regulations. Expansion in pharmaceutical research labs will further push adoption of high-precision titration sensors in this phase.

From 2030 to 2035, the market is expected to grow from USD 156.4 million to USD 184.4 million, representing a cumulative increase of USD 31 million. Growth in this period will be shaped by the integration of digital titration systems with IoT and cloud-based monitoring platforms, along with increased investments in academic research facilities across the USA, Japan, and Germany.

From 2020 to 2024, the titration sensors market expanded steadily, driven by increasing demand in water treatment facilities, pharmaceutical laboratories, and chemical manufacturing plants, where high accuracy and reliability are essential for compliance and process optimization.

During this period, the market value increased from nearly USD 111.2 million in 2020 to USD 124.9 million in 2024, reflecting consistent adoption across both developed and emerging economies. Growth was further supported by stricter environmental monitoring regulations in Europe and East Asia, as well as by rising use of titration sensors in pharmaceutical quality assurance and R&D operations.

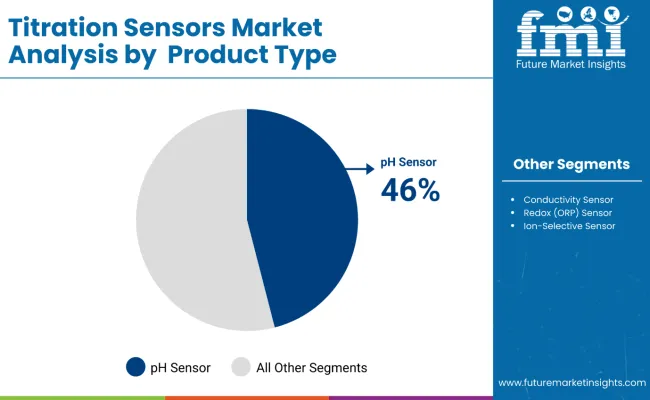

The industry landscape during this time was dominated by pH sensors, which accounted for the largest share of installations in 2024, supported by their widespread use in municipal water treatment, academic institutions, and pharmaceutical formulations.

These sensors gained favor due to their accuracy, long service life, and compatibility with digital titration systems, enabling wider penetration in both industrial and research laboratory segments. Market participation was led by established sensor manufacturers leveraging partnerships with instrument providers, after-sales calibration services, and compliance certifications (ISO/FDA/EU standards) to strengthen trust among end users.

By 2025, the market is estimated to reach a valuation of USD 128.6 million. This transition is being influenced by the rising preference for IoT-enabled titration systems in industrial laboratories, improvements in sensor durability and response time, and the integration of automated calibration technology to reduce human error.

As industries continue to prioritize data integrity, efficiency, and real-time monitoring, demand is gradually shifting toward sensors that combine high precision, digital connectivity, and low maintenance cycles. The 2025 baseline is set to serve as a springboard for accelerated growth, particularly as the sector aligns with FDA/EU compliance requirements and expanding water quality initiatives in Asia-Pacific and North America.

The titration sensors market is expanding as compliance-heavy industries tighten control over water quality and process chemistry. Municipal and industrial water treatment programs are the single largest pull, requiring continuous pH and conductivity measurement to meet discharge and potability standards. Utilities and private operators are refreshing fleets with higher-stability, low-drift sensors to reduce recalibration frequency and maintain audit trails.

Growth is reinforced by pharmaceutical, chemical, and food & beverage workflows that depend on titrimetric endpoints for QA/QC and batch release. As assay volumes rise, plants are standardizing on long-life pH and ORP probes that withstand repeated sterilization and CIP/SIP cycles, while laboratories specify ion-selective electrodes for targeted assays (e.g., sodium, chloride, fluoride) in formulations and raw-material verification.

A third driver is digitization of the lab and plant floor. Sensors increasingly ship with digital IDs, onboard diagnostics, and seamless links to titrators, LIMS/MES, and cloud dashboards, improving data integrity and supporting requirements such as 21 CFR Part 11/Annex 11. This connectivity enables predictive maintenance, alerting teams before drift or fouling compromises results, cutting downtime and consumables spend.

Besides, capacity build-outs in China and India and facility upgrades in the USA, Germany, and Japan are broadening the installed base. Universities and public research institutes, important end users alongside industrial labs, continue to add teaching and research titration stations, sustaining demand for pH (46% share) and conductivity sensors (24%), while specialty applications lift ORP and ion-selective sensors. Together, these forces create steady replacement cycles and incremental unit growth through 2035.

pH sensors are estimated to capture 46% of the sensor type segment in 2025, maintaining their dominance through 2035. Their dominance is attributed to their versatility and reliability in critical industries such as water treatment, pharmaceuticals, and chemical processing. In China, pH sensors are widely deployed in municipal wastewater facilities to meet strict environmental discharge standards, while in the United States, pharmaceutical and biotech labs rely on them for drug formulation and quality assurance.

Compared to ORP and ion-selective sensors, pH sensors provide a universal baseline measurement that underpins both industrial and academic research applications. Their long service life, low drift characteristics, and compatibility with automated titration systems make them indispensable in high-throughput labs, particularly in Germany and Japan, where data accuracy and reproducibility are non-negotiable.

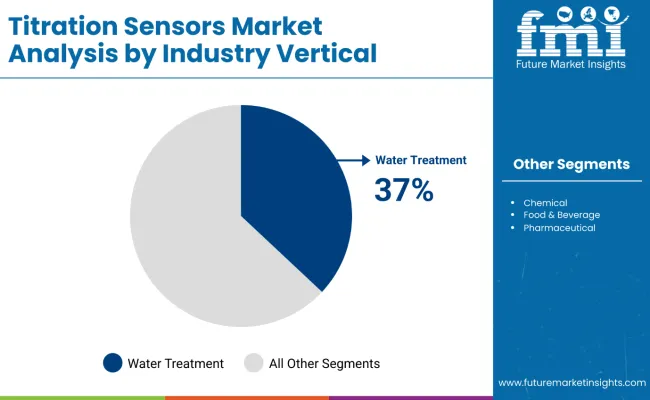

The water treatment industry is projected to account for 37% of the industry vertical share in 2025, sustaining its dominance through the forecast period. This leadership is driven by the expansion of municipal water treatment plants in China and India, along with stricter EU Water Framework Directive compliance programs in Germany. In these facilities, pH and conductivity sensors are integrated into online monitoring systems to ensure real-time control of water quality parameters.

In emerging economies, particularly India, government-backed initiatives such as the Jal Jeevan Mission are fueling large-scale procurement of titration sensors for community water monitoring. Meanwhile, Japan’s urban water systems are upgrading to advanced digital titration platforms to align with smart city initiatives, further reinforcing demand.

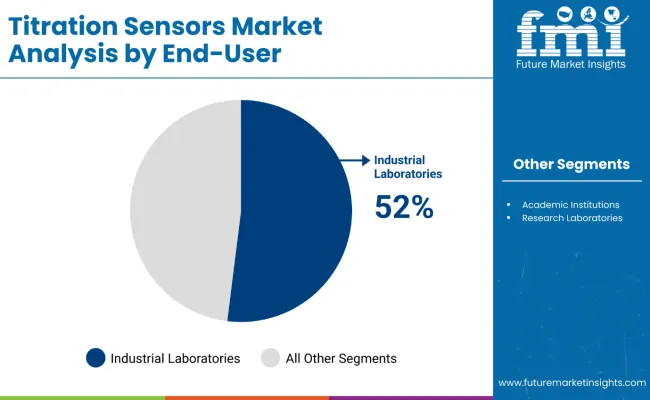

Industrial laboratories are expected to represent 52% of the end-use segment in 2025, making them the largest consumer group for titration sensors worldwide. Their prominence is shaped by the chemical, pharmaceutical, and water treatment industries, all of which require high-precision sensors for continuous monitoring, QA/QC protocols, and regulatory compliance.

In Germany, specialty chemical firms rely heavily on robust conductivity and ORP sensors for product validation, while in the United States, CROs and biotech research labs drive steady demand for pH and ion-selective sensors. Academic institutions, though smaller in share, are also expanding their adoption in India and China, where government funding is strengthening research output. Compared to smaller research labs, industrial laboratories invest in digitally connected titration sensors with predictive maintenance capabilities to minimize downtime and ensure operational efficiency.

Demand for titration sensors is being supported by factors such as compliance-led upgrades in water and wastewater, digitally native sensors and data integrity by design, longer life, lower maintenance in harsh matrices, multi-parameter and modular architectures, lab automation and micro-volume titration, sustainability and total-cost reductioncalibration-as-a-service and remote support.

Compliance-led upgrades in water and wastewater

Utilities and industrial effluent plants are refreshing fleets to meet tighter discharge and potability limits. This is lifting demand for stable, low-drift pH and conductivity sensors with longer calibration intervals and audit-ready data. The pull is strongest in USA municipal operations, Germany’s compliance-heavy utilities, and large China/India greenfield plants where online titration points are being added rather than replaced.

Digitally native sensors and data integrity by design

Labs and plants are standardizing on sensors with digital IDs, on-sensor calibration records, and secure handshakes to titrators, LIMS/MES, and cloud dashboards. This reduces transcription errors and simplifies 21 CFR Part 11/Annex 11 compliance, especially in USA pharma/CRO hubs and Japan’s research institutions. Built-in diagnostics (slope, offset, impedance) enable predictive maintenance before drift jeopardizes batch release.

Longer life, lower maintenance in harsh matrices

Materials advances solid-state or polymer reference systems, anti-fouling junctions, ISFET/non-glass pH tips, and CIP/SIP-capable housings are extending sensor uptime in chemical, food, and wastewater duties. Germany’s specialty chemicals and India’s bulk pharma plants are prioritizing probes that tolerate sterilization and frequent cleaning, cutting consumables spend and downtime.

Multiparameter and modular architectures

End users are consolidating measurement points via combo probes (pH/temperature/conductivity) and modular cables/housings that swap quickly between titrators and inline loops. This is popular in China’s large water treatment campuses and USA food & beverage lines where footprint and changeover speed matter. Modular spares strategies also simplify inventory for multi-site operators.

Lab automation and micro-volume titration

High-throughput QA/QC is pushing autosamplers, robotic titration stations, and micro-volume cells that minimize reagents while maintaining accuracy. Japan’s electronics and pharma labs and German method-development groups are pairing these systems with fast-response pH/ORP and ion-selective sensors to shorten cycle times without sacrificing traceability.

Sustainability and total-cost reduction

Procurement teams are weighting reagent reduction, sensor recyclability, and energy-efficient analyzers alongside accuracy specs. In India and the USA, “green lab” initiatives and corporate ESG targets are accelerating the shift to longer-life electrodes and heat-recovery/autosleep features on titration platforms, lowering both cost per test and environmental impact.

Service models: calibration-as-a-service and remote support

Vendors are bundling factory pre-calibration, swap programs, and remote health monitoring to guarantee uptime across multi-site networks. This resonates with USA water districts and China’s municipal operators, where lean teams prefer predictable service windows and automated alerts over reactive maintenance.

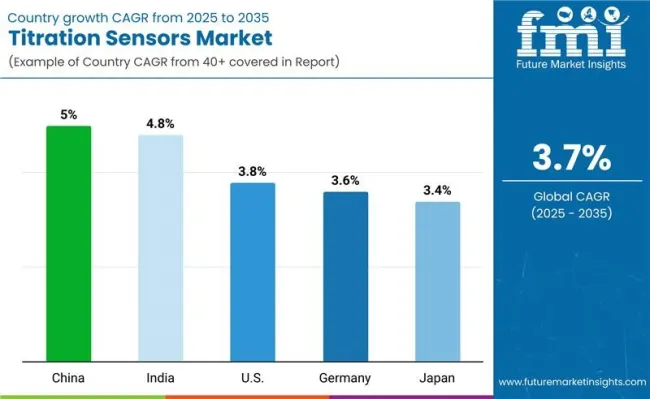

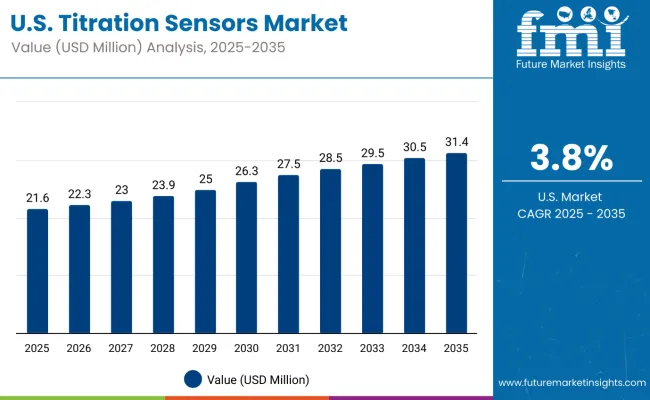

The USA titration sensors market is expected to grow at a CAGR of 3.8% from 2025 to 2035, supported by strict EPA water quality mandates, high investment in pharmaceutical and biotech R&D, and demand for precision pH and conductivity sensors in academic and industrial laboratories. Universities and contract research organizations (CROs) are expanding adoption of advanced titration systems to meet FDA data integrity requirements.

China is the fastest-growing market with a projected CAGR of 5.0% through 2035, driven by industrial growth in chemicals, food processing, and water treatment. Expanding municipal water treatment projects and the country’s commitment to environmental sustainability goals are creating strong demand for conductivity and pH sensors. Domestic sensor manufacturers are also scaling production to meet demand in mid-range segments.

Germany’s market is forecast to grow at a CAGR of 3.6% over the forecast period. Precision in pharmaceutical R&D, specialty chemicals, and high-quality food & beverage testing supports consistent demand for titration sensors. Regulatory compliance under EU water directives further reinforces adoption in municipal and industrial treatment facilities.

India’s titration sensors market is projected to expand at a CAGR of 4.8%, driven by its pharmaceutical manufacturing hub, rising academic research output, and expanding industrial laboratories. The government’s investment in water quality monitoring under the Jal Jeevan Mission further accelerates demand for pH and conductivity sensors in treatment facilities.

Japan’s titration sensors market is expected to grow at a CAGR of 3.4% from 2025 to 2035, supported by electronics manufacturing, pharmaceutical R&D, and leading research universities. Demand is shifting toward compact, high-precision pH and ion-selective sensors, reflecting Japan’s focus on innovation and accuracy in laboratory environments.

| Countries | 2025 |

|---|---|

| Germany | 24% |

| Italy | 13% |

| France | 16% |

| UK | 14% |

| Spain | 7% |

| BENELUX | 8% |

| Russia | 6% |

| Rest of Europe | 12% |

| Countries | 2035 |

|---|---|

| Germany | 23% |

| Italy | 12% |

| France | 15% |

| UK | 15% |

| Spain | 8% |

| BENELUX | 8% |

| Russia | 5% |

| Rest of Europe | 14% |

The European Titration Sensors market is projected to grow at a CAGR of 3.7% from 2025 to 2035, reaching USD 32.8 million by 2035, up from USD 22.8 million in 2025. Growth will be paced by compliance-driven replacements, energy-efficiency retrofits, and deployment in noise-sensitive facilities (healthcare, food & beverage, precision engineering).

Western Europe remains replacement-led and specification-heavy, while Southern Europe advances on plant upgrades and tourism-related refurbishments. Oil-free rotary screw platforms and portable, acoustically enclosed units remain the winning configurations due to hygiene, reliability, and low dB(A) performance in mixed-use urban settings.

Germany continues to be the lead market in Europe, though its growth is increasingly maturity-driven and specification-heavy. Demand is strongest in precision machining, automotive Tier-1/Tier-2 suppliers, and medical technology packaging lines, all of which rely on oil-free rotary screw compressors equipped with acoustic shrouds to comply with DIN and EU noise regulations. Predictive maintenance and IoT-enabled monitoring are widely adopted to reduce downtime in multi-shift plants, and hospitals and pharmaceutical packaging facilities increasingly specify compressors with certified purity and low-vibration performance.

Italy shows consistent growth, anchored by the food processing and pharmaceutical packaging sectors, where HACCP and GMP compliance drive demand for oil-free, dry air solutions. Ports in Liguria and Campania, along with heavy machinery clusters, are expanding their use of portable units for quay-side applications and industrial maintenance bays. Small and medium enterprises across northern Italy are also transitioning from legacy piston models to quieter, energy-efficient compressors that reduce workplace exposure to noise.

France demonstrates strong hygiene-critical adoption, particularly in the aerospace and healthcare sectors. Toulouse remains a hub for aerospace operations, where low-vibration, oil-free compressors are essential in precision assembly and maintenance facilities. In addition, France’s extensive hospital networks in Île-de-France are upgrading to acoustically enclosed, oil-free compressors to support sterile environments and cleanroom-adjacent workflows. The food and beverage industry also adds momentum, with urban plants adopting quiet compressors to comply with strict neighborhood noise ordinances.

The UK is witnessing steady market growth, supported by large-scale infrastructure renewal projects and the country’s strong professional trades ecosystem. Rail, utilities, and public estate refurbishment projects are creating demand for portable, oil-free units capable of operating indoors in noise-restricted zones.

The growth of tool leasing and compliance bundles, which often include sound testing and maintenance services, is helping small and medium-sized enterprises access advanced quiet compressor technology. In addition, tradespeople and premium DIY users in urban areas are increasingly adopting compact, portable compressors for renovation projects.

Spain is emerging as a share gainer in the European market. Catalonia’s strong automotive supplier base, coupled with refurbishment activity in the tourism sector, is driving demand for quiet, portable compressors suited to space-constrained urban environments.

Airports, resorts, and hotels are expanding their use of low-dB(A) compressors to conduct night-shift maintenance without disrupting guests and visitors. Regional government grants promoting energy-efficient equipment upgrades are further accelerating adoption, particularly in high-density urban centers.

The BENELUX region remains a critical hub for pharmaceuticals, chemicals, and logistics, all of which rely heavily on quiet compressor technology. Clean manufacturing facilities and large logistics campuses are adopting oil-free models with advanced filtration systems and remote monitoring capabilities.

Distribution centers and cold-chain facilities across Belgium and the Netherlands are specifying acoustically enclosed units to comply with strict neighborhood sound limits. Public procurement programs in this region also emphasize energy efficiency, with strong adoption of IE3/IE4 motors and heat-recovery-enabled compressors.

Russia, despite facing geopolitical and economic pressures, continues to represent a significant market for quiet compressors, particularly in utilities and process industries. Municipal services in Moscow and St. Petersburg are procuring quiet, robust portable units to conduct maintenance in noise-sensitive urban areas. Industrial plants in oil & gas, chemicals, and metals are favoring durable rotary screw compressors that can withstand intensive use while delivering consistent performance.

The country’s healthcare sector is also upgrading hospital and laboratory infrastructure with oil-free models that provide hygienic, low-noise compressed air. With sanctions reshaping supply chains, Russia is increasingly turning toward domestic and partner-brand manufacturers to secure reliable equipment supply.

The titration sensors market in Japan is projected to remain technology-driven, with pH sensors leading at 40% share in 2025. Demand is closely tied to the country’s precision electronics manufacturing, pharmaceutical R&D, and water treatment standards, all of which require high stability and long service life in sensor design. Japan’s market reflects an emphasis on accuracy, compact integration, and cleanroom compatibility, supported by regulatory alignment with ISO and regional water safety guidelines.

The South Korean titration sensors market is characterized by strong industrial laboratory usage, which accounts for 45% of the market share in 2025, supported by the country’s robust semiconductor, petrochemical, and heavy industries. End-use growth is further shaped by the expanding academic research ecosystem and sustained government investment in biotechnology and materials science. Compact sensors with IoT integration and low-drift electrodes are becoming preferred choices for both institutional and commercial laboratories.

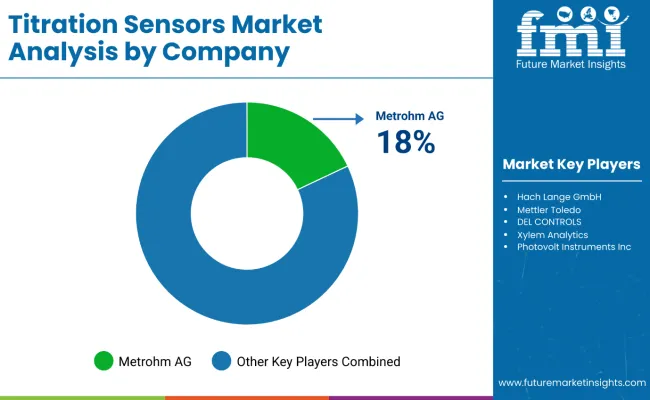

The titration sensors market is moderately consolidated, with a handful of global instrumentation majors and specialized sensor developers dominating share. Competition is shaped by long-term supply contracts, portfolio breadth, and the ability to serve both industrial end-users and academic/research institutions.

Multinationals such as Metrohm, Mettler-Toledo, Hach, and Hamilton retain leadership by leveraging end-to-end titration solutions, where sensors are bundled with titrators, software, and calibration kits. These firms differentiate through compliance-ready systems (21 CFR Part 11, GMP/GLP adherence) and data integration features for laboratories operating under FDA and EMA oversight. For example, Metrohm has built dominance in Europe through a mix of distributor networks and in-house training academies that reinforce brand loyalty among universities and public research labs.

Asian competitors, particularly from Japan and South Korea, are strengthening their positions through miniaturized, high-precision pH and conductivity sensors tailored to electronics and semiconductor fabs. Companies such as HORIBA (Japan) and DKK-TOA leverage regional expertise in water quality and process control, securing contracts in ultra-pure water and environmental monitoring. Meanwhile, Chinese entrants are competing on cost efficiency and rapid delivery, supplying to municipal water utilities and lower-budget research institutes, though they still lag behind Western players in long-term stability and calibration standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 128.6 Million (2025) |

| Type | pH Sensor, Conductivity Sensors, ORP Sensors, Ion-Selective Sensors, Other Types |

| Industry Vertical | Chemical, Food & Beverage, Pharmaceuticals, Water Treatment |

| End User | Academic Institutions, Industrial Laboratories, Research Laboratories |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, France, Italy, South Korea, Spain, BENELUX |

| Key Companies Profiled | Metrohm AG, Hach Lange GmbH, Mettler Toledo, DEL CONTROLS, Xylem Analytics, Photovolt Instruments Inc , Foundation Instruments, Inc., Hirschmann Laborgeräte GmbH & Co. KG, Myron L Company |

The global titration sensors market is estimated to be valued at USD 128.6 million in 2025, supported by strong demand from water treatment plants, chemical production facilities, and pharmaceutical quality control laboratories that rely on precise electrochemical measurements.

The market is projected to reach approximately USD 184.4 million by 2035, reflecting the wider adoption of IoT-enabled sensors, automation in high-throughput laboratories, and the replacement of conventional electrodes with high-precision, long-life variants.

The market is forecast to expand at a CAGR of 3.7% during this period, driven by stricter water quality regulations, pharmaceutical R&D expansion in the USA and India, and the modernization of industrial laboratories in East Asia and Europe.

pH sensors are expected to maintain the largest share in 2025, accounting for 46% of global demand. Their dominance comes from widespread use in pharmaceutical titrations, water treatment monitoring, and chemical analysis. In Japan, pH sensors alone account for 40% of the market, reflecting the country’s emphasis on accuracy in electronics and life sciences.

Water treatment is projected to be the leading industry vertical in 2025, contributing 37% of total revenue, as governments and private utilities invest in advanced monitoring systems for municipal water quality, wastewater management, and desalination plants.

Key companies include Metrohm AG, Mettler-Toledo International Inc., Hach (Danaher Corporation), Hamilton Company, HORIBA Ltd., DKK-TOA Corporation, Thermo Fisher Scientific, and Hanna Instruments. These players compete on compliance readiness, sensor longevity, and service support across industrial and research laboratory applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Image Sensors Market Growth – Trends & Forecast through 2034

Chest Sensors Market

PPG Biosensors Market – Size, Share & Growth Forecast 2025 to 2035

Motion Sensors Market

EMG Biosensors Market

Airbag Sensors Market

Shutter Sensors Market Size and Share Forecast Outlook 2025 to 2035

Printed Sensors Market Size and Share Forecast Outlook 2025 to 2035

Quantum Sensors Market Size and Share Forecast Outlook 2025 to 2035

Seismic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA