The demand for aquaculture vaccines in USA is valued at USD 166.0 million in 2025 and is projected to reach USD 364.1 million by 2035, reflecting a compound annual growth rate of 8.2%. Growth is shaped by expanding aquaculture production, where disease prevention is essential to maintaining stock health and predictable yield. As fish farming operations scale, vaccination programs become more structured, supporting the use of injectable, immersion and oral vaccine formats. Hatcheries and grow-out facilities continue to adopt routine vaccination schedules to improve survival rates and reduce treatment costs. Broader interest in health management practices reinforces procurement of vaccines suited to varied species and farming conditions across USA’s aquaculture sector.

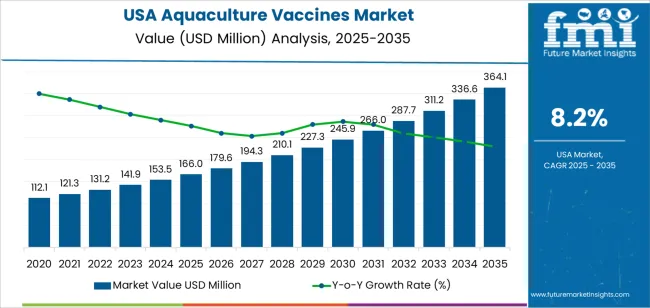

The growth curve shows a strong and consistent upward pattern, beginning at USD 112.1 million in earlier years and reaching USD 166.0 million in 2025 before advancing toward USD 364.1 million by 2035. Yearly values rise steadily, moving from USD 179.6 million in 2026 to USD 194.3 million in 2027 and continuing upward through USD 266.0 million in 2031 and USD 311.2 million in 2033. The smooth progression reflects stable expansion in farmed fish volumes and increased emphasis on preventive health programs. As producers integrate more targeted vaccination strategies and improve handling systems, demand for aquaculture vaccines maintains firm momentum, shaped by consistent operational needs and evolving disease management practices across USA.

Demand in USA for aquaculture vaccines is projected to rise from USD 166.0 million in 2025 to USD 364.1 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 8.2%. Starting at USD 112.1 million in 2020, the value develops through USD 153.5 million by 2024 and reaches USD 166.0 million in 2025. Over the next decade, demand increases steadily through USD 245.9 million in 2030 and ultimately achieves USD 364.1 million in 2035. Growth is driven by expansion of aquaculture operations, higher disease prevention focus, and the shift toward vaccination over antibiotics in fish and shellfish farming.

The growth contribution of this uplift is driven by both increased volume of vaccine deployments and rising value per unit of vaccine. Early in the period (2025–2030) most of the increase comes from volume as more aquaculture farms adopt vaccination programmes and expand production scale. In the latter part of the period (2030–2035), value growth becomes more pronounced as vaccines become more advanced covering broader species, employing recombinant technologies, and commanding higher prices. Suppliers who invest in innovative formulations and delivery methods are best positioned to capture this opportunity toward USD 364.1 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 166.0 million |

| Forecast Value (2035) | USD 364.1 million |

| Forecast CAGR (2025–2035) | 8.2% |

The demand for aquaculture vaccines in USA is growing as fish-farming operations increasingly recognise disease prevention as critical to production efficiency and profitability. With intensification of aquaculture to meet rising seafood consumption and a shift toward high-value species, producers require reliable vaccines to reduce losses from bacterial, viral and parasitic infections. Outbreaks in confined facilities can severely affect yield, which makes vaccination programmes essential. Producers also face pressure to reduce antibiotic use and comply with regulatory or export standards that favour prophylactic health management. These factors lead to higher adoption of vaccines across major fish species cultivated in USA aquaculture systems.

Another driver is the advancement of fish-health protocols and expansions in hatchery and grow-out infrastructure in USA. Equipment and biological supply chains are stronger, enabling integration of vaccination services and delivery systems within farm operations. Manufacturers responding to market needs are offering species-specific formulations, improved administration routes such as immersion or oral vaccines, and broader coverage for emerging pathogens. While challenges such as high development cost, species-specific R&D and regulatory approval timelines remain, the upward trend in production scale, disease awareness and sustainability standards ensures that demand for aquaculture vaccines in USA remains on a steady growth path.

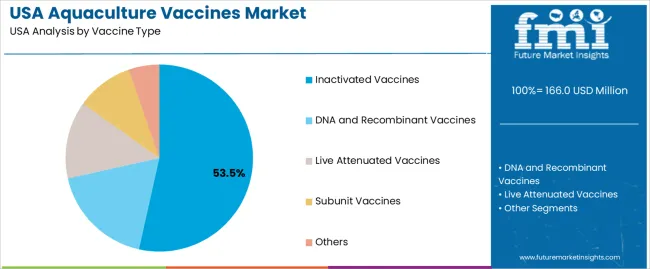

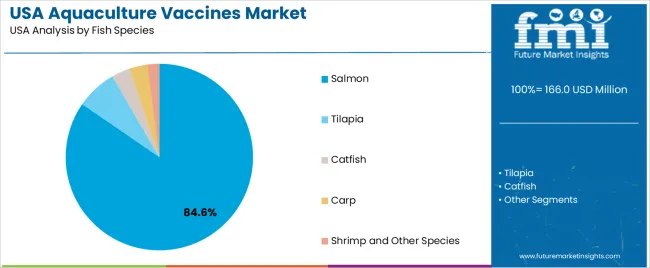

The demand for aquaculture vaccines in USA is shaped by the vaccine types used across farming operations and the fish species that depend on routine immunization. Vaccine types include inactivated, DNA and recombinant, live attenuated, subunit and other formulations, each supporting different protection profiles and handling requirements. Fish species covered in vaccination programs include salmon, tilapia, catfish, carp, shrimp and other species raised in varied production settings. As producers focus on maintaining stock health, reducing losses and supporting predictable growth cycles, the combination of vaccine formulation and species-specific needs guides overall demand across USA’s aquaculture sector.

Inactivated vaccines account for 54% of total demand within vaccine type categories. Their leading share reflects dependable safety profiles, straightforward administration and compatibility with large-scale aquaculture routines. These vaccines do not replicate within the host, which supports stable handling practices and consistent immune response across varied water conditions. Producers value their predictable performance and suitability for mass vaccination programs. Inactivated vaccines align with operations that prioritize low-risk immunization methods and reliable integration into existing health management schedules. These factors reinforce consistent use across USA’s commercial fish farms.

Demand for inactivated vaccines also expands as farms maintain structured disease prevention programs designed to limit outbreaks. Their compatibility with different species and production systems supports broad adoption across hatcheries and grow-out facilities. These vaccines help maintain stock uniformity and steady survival rates, which are essential for meeting harvesting timelines. As aquaculture operations continue emphasizing dependable and manageable vaccination strategies, inactivated vaccines maintain a central role in USA’s aquaculture health practices.

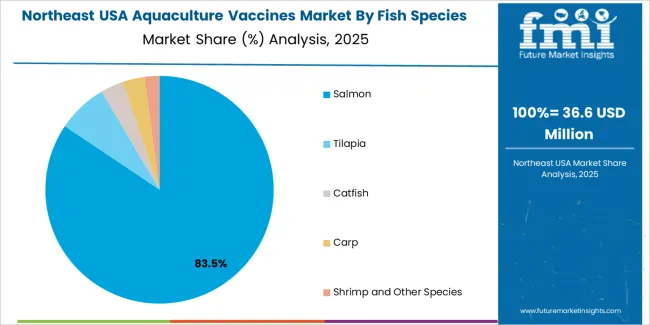

Salmon accounts for 84.6% of total demand across fish species categories. This strong position reflects the prominence of salmon farming within USA’s aquaculture industry and the species’ requirement for comprehensive health management. Salmon are vaccinated routinely to protect against bacterial and viral challenges that affect stock performance. Producers rely on vaccination to maintain steady growth rates and reduce disruptions in production cycles. The species’ high economic value reinforces continuous adoption of vaccine programs that support predictable yields and quality standards. These conditions establish salmon as the primary species shaping vaccine demand across USA.

Demand for salmon vaccination continues to grow as farms expand production capacity and refine stocking density practices. Salmon operations depend on health protocols that minimize disease transmission across different life stages, making vaccination an essential component of routine management. The species’ sensitivity to environmental changes further strengthens reliance on well-structured immunization schedules. As producers focus on stability and uniformity in harvest outcomes, salmon remains the dominant species driving the use of aquaculture vaccines in USA.

The demand for aquaculture vaccines in the USA is growing as fish and shellfish farming operations expand and focus more on disease prevention rather than antibiotic treatment. Drivers include rising demand for seafood, consumer preference for antibiotic-free aquaculture products, and regulatory pressure on animal health. At the same time, barriers such as high cost of vaccine development, regulatory approval complexity and limited use among smaller farms constrain uptake. These dynamics together influence how quickly aquaculture vaccine adoption scales in the USA.

How Are Expanding Aquaculture Production and Sustainability Focus Shaping Vaccine Demand in USA?

In the United States, aquaculture production is increasing to meet seafood demand while reducing pressure on wild fisheries. As production intensifies and farm densities increase, disease risk rises, prompting vaccine use. Additionally, sustainability goals and consumer awareness push producers toward immunisation solutions to reduce chemical treatments and mortality losses. These factors lead to stronger interest in aquaculture vaccines by USA fish-farm operators and integrators seeking to improve biosecurity and productivity.

Where Are Growth Opportunities Emerging for Aquaculture Vaccines in USA’s Sector?

Growth opportunities in the USA lie in vaccine deployment for high-value species such as salmon, trout and shellfish, and in developing markets for new vaccine types (e.g., DNA, immersion, oral vaccines) that suit large-scale farms. Atlantic coast, Pacific northwest and aquaculture in inland states represent opportunities for uptake. Suppliers offering vaccines tailored to USA species, regulatory support and service models for vaccination programmes may capture additional demand. This opens pathways for vaccine expansion in USA aquaculture.

What Challenges Are Limiting Broader Adoption of Aquaculture Vaccines in USA?

Despite favourable demand, several challenges slow broader adoption in the USA aquaculture vaccine market. High development and regulatory compliance costs increase vaccine prices, reducing accessibility for smaller farms. Some producers may rely on conventional treatments or non-vaccination strategies due to cost or logistical constraints. Limited species-specific vaccines, administration difficulties in large fish populations and insufficient field data also constrain adoption. These factors moderate how rapidly vaccines become standard across USA aquaculture operations.

| Region | CAGR (%) |

|---|---|

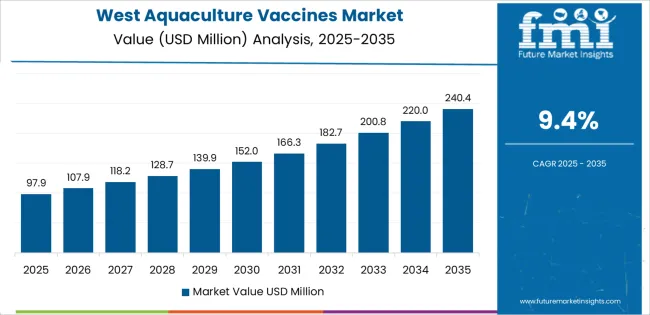

| West | 9.4% |

| South | 8.4% |

| Northeast | 7.5% |

| Midwest | 6.5% |

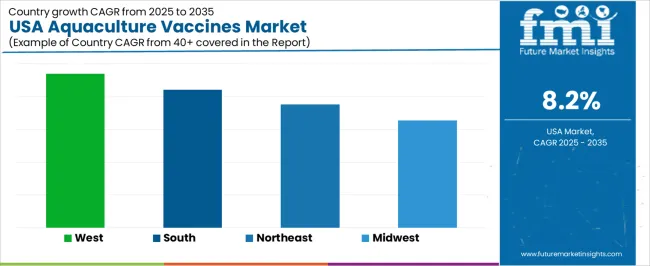

Demand for aquaculture vaccines in the USA is rising across regions, and the West leads at 9.4%. Growth in this region reflects active seafood production along coastal areas and steady adoption of health management practices among commercial fish farms. The South follows at 8.4%, supported by expanding aquaculture operations and increasing focus on maintaining stock health in warm-water species. The Northeast records 7.5%, shaped by steady reliance on vaccines to reduce losses in regional fisheries and shellfish farms. The Midwest grows at 6.5%, where land-based aquaculture systems and recirculating facilities adopt preventive health tools. These regional patterns show broad national movement toward disease control practices that support reliable aquaculture output.

West USA is projected to grow at a CAGR of 9.4% through 2035 in demand for aquaculture vaccines. California and neighboring states are increasingly adopting vaccines for fish, shrimp, and shellfish farming to prevent bacterial and viral diseases. Rising focus on disease management, production efficiency, and aquaculture sustainability drives adoption. Manufacturers provide inactivated, live, and recombinant vaccines suitable for various aquatic species. Distributors ensure accessibility across commercial aquaculture farms. Growth in aquaculture production, expansion of fish farms, and rising demand for high-quality seafood support steady adoption of aquaculture vaccines in West USA.

South USA is projected to grow at a CAGR of 8.4% through 2035 in demand for aquaculture vaccines. Texas, Florida, and Louisiana are increasingly adopting vaccines for freshwater and marine aquaculture operations to prevent infections and improve survival rates. Rising need for disease control, farm productivity, and fish quality drives adoption. Manufacturers supply vaccines compatible with regional aquatic species and farm sizes. Distributors ensure accessibility across aquaculture facilities. Expansion of commercial aquaculture, increased fish production, and disease prevention initiatives support steady adoption of aquaculture vaccines in South USA.

Northeast USA is projected to grow at a CAGR of 7.5% through 2035 in demand for aquaculture vaccines. New York, Massachusetts, and Maine are adopting vaccines for freshwater and marine fish farming to reduce mortality and improve productivity. Rising demand for disease prevention, aquaculture quality, and operational efficiency drives adoption. Manufacturers provide inactivated, live, and recombinant vaccines suitable for commercial farms. Distributors ensure availability across aquaculture operations and research centers. Expansion of aquaculture production, regional fish farms, and increased focus on sustainable seafood support steady adoption of aquaculture vaccines across Northeast USA.

Midwest USA is projected to grow at a CAGR of 6.5% through 2035 in demand for aquaculture vaccines. Illinois, Minnesota, and Michigan are gradually adopting vaccines for freshwater aquaculture operations to reduce disease and increase production efficiency. Rising focus on fish health, mortality reduction, and operational efficiency drives adoption. Manufacturers provide vaccines suitable for multiple freshwater species and farm scales. Distributors expand access across urban and semi-urban aquaculture farms. Growth in fish production, aquaculture facility expansion, and disease prevention programs ensure steady adoption of aquaculture vaccines across Midwest USA.

The demand for aquaculture vaccines in the USA is driven by rising incidences of infectious diseases among farmed fish and shellfish populations. Intensive aquaculture operations face heightened risks of bacterial, viral and parasitic outbreaks, prompting producers to adopt vaccination as a preventive measure. At the same time, growing consumer demand for sustainable seafood and pressure to reduce antibiotic use are pushing farm operators toward immunisation strategies. The expansion of recirculating aquaculture systems (RAS) and land-based production in the US also supports vaccine uptake, as biosecurity measures become more critical. Taken together, these factors create increasing demand for vaccines tailored to aquatic species in the US aquaculture industry.

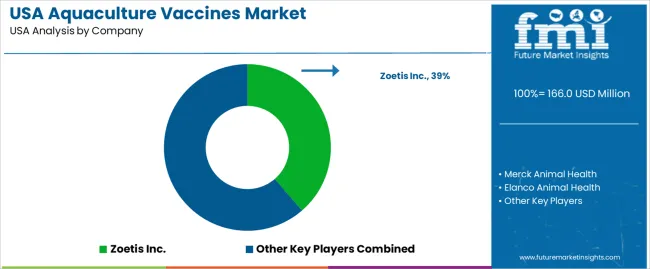

Key companies active in the US aquaculture vaccine segment include Zoetis Inc., Merck Animal Health (part of Merck & Co.), Elanco Animal Health, HIPRA and Benchmark Holdings. These firms supply vaccines and immunisation solutions designed for fish and shellfish species raised in the US. Zoetis, Merck and Elanco carry broad animal-health portfolios with aquaculture expansions. HIPRA and Benchmark specialise in aquatic-animal health innovations and species-specific immunisation. Their capabilities in vaccine development, regulatory compliance and service support help shape how aquaculture vaccine products are selected, administered and managed across US domestic aquaculture operations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Vaccine Type | Inactivated Vaccines, DNA and Recombinant Vaccines, Live Attenuated Vaccines, Subunit Vaccines, Others |

| Fish Species | Salmon, Tilapia, Catfish, Carp, Shrimp and Other Species |

| Pathogen Type | Bacteria, Virus, Others |

| End User | Commercial Aquaculture Farms, Small-Scale Farmers in Emerging Markets, Government and Cooperative Programs, Research Institutions and Diagnostic Labs |

| Region | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Zoetis Inc., Merck Animal Health, Elanco Animal Health, HIPRA, Benchmark Holdings |

| Additional Attributes | Dollar by sales by vaccine type, fish species, and pathogen type; regional CAGR and adoption patterns; adoption of injectable, immersion, and oral vaccines; integration of health management programs in hatcheries and grow-out operations; impact of disease prevention on survival and yield; trends toward antibiotic reduction and biosecurity practices; innovations in DNA, recombinant, and multi-species vaccines; value per unit and premium product adoption; projected growth toward USD 364.1 million by 2035. |

The demand for aquaculture vaccines in usa is estimated to be valued at USD 166.0 million in 2025.

The market size for the aquaculture vaccines in usa is projected to reach USD 364.1 million by 2035.

The demand for aquaculture vaccines in usa is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in aquaculture vaccines in usa are inactivated vaccines, dna and recombinant vaccines, live attenuated vaccines, subunit vaccines and others.

In terms of fish species, salmon segment is expected to command 84.6% share in the aquaculture vaccines in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquaculture Vaccines Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Chile Aquaculture Vaccines Market Insights – Size, Demand & Forecast 2025-2035

China Aquaculture Vaccines Market Outlook – Growth & Forecast 2025-2035

Norway Aquaculture Vaccines Market Insights – Size, Demand & Growth 2025-2035

Vietnam Aquaculture Vaccines Market Trends – Growth & Demand 2025-2035

Demand for Aquaculture Vaccines in Japan Size and Share Forecast Outlook 2025 to 2035

Australia and New Zealand Aquaculture Vaccines Market Report – Key Trends & Forecast 2025-2035

Aquaculture Prebiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA