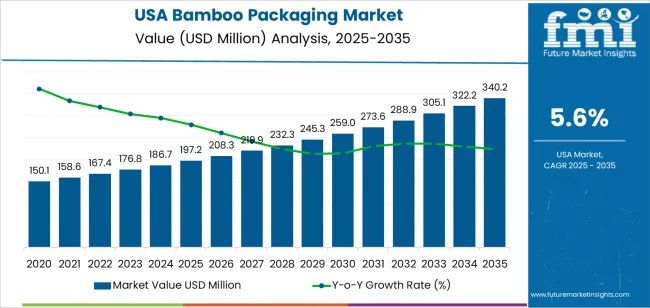

The demand for bamboo packaging in the USA is expected to grow from USD 197.2 million in 2025 to USD 340.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.6%. Bamboo packaging is gaining popularity as a sustainable, eco-friendly alternative to traditional plastic and other packaging materials. Driven by increasing consumer demand for environmentally conscious products, coupled with regulatory pressures for sustainable packaging solutions, the market for bamboo packaging is expected to expand steadily over the forecast period.

The market will experience consistent growth, with demand rising from USD 197.2 million in 2025 to USD 208.3 million in 2026, and USD 219.9 million in 2027. The demand for bamboo packaging will continue to grow steadily, reaching USD 232.3 million by 2028, USD 245.3 million by 2029, and USD 259.0 million by 2030. By 2035, the demand for bamboo packaging is expected to reach USD 340.2 million, reflecting sustained demand driven by growing awareness of environmental issues and the widespread adoption of sustainable packaging solutions in various industries.

The absolute dollar opportunity for bamboo packaging in the USA from 2025 to 2035 is USD 143.0 million. This represents the total increase in market value over the forecast period, driven by steady demand growth across a range of industries that are increasingly adopting sustainable packaging solutions. The growth is primarily attributed to rising consumer and regulatory pressures for environmentally friendly alternatives to traditional packaging materials. As businesses continue to embrace sustainability in their operations, the demand for bamboo packaging is expected to capture a larger share of the packaging market.

This opportunity reflects a continuous trend toward sustainable consumption, where industries like food and beverage, cosmetics, and retail are gradually shifting towards more eco-conscious materials. The substantial value accumulation over the next decade highlights the increasing preference for bamboo as a renewable, biodegradable, and versatile material. As businesses seek to meet sustainability goals and consumer expectations, bamboo packaging is positioned for significant growth, making up an increasingly larger portion of the overall packaging sector. This absolute dollar opportunity underscores the growing potential for bamboo-based packaging solutions to drive both innovation and market expansion in the USA.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 197.2 million |

| Industry Forecast Value (2035) | USD 340.2 million |

| Industry Forecast CAGR (2025 to 2035) | 5.6% |

Demand for bamboo packaging in the USA is rising as consumers and companies increasingly prioritise sustainability, environmental responsibility, and reduction of plastic waste. Bamboo offers a renewable, rapidly growing resource that requires less water and fewer chemicals than conventional timber. It is biodegradable or compostable under appropriate conditions. These qualities appeal to households, retailers, and manufacturers seeking packaging materials with lower ecological footprint. In food and beverage, cosmetics, personal care, and consumer goods industries, bamboo packaging is gaining ground because it combines environmental credentials with functional performance and aesthetic appeal. As more businesses integrate corporate social responsibility and eco friendly practices into their brand identity, bamboo packaging becomes a viable alternative to plastic, paper, or conventional materials.

At the same time regulatory pressure and changes in consumer behaviour support this shift. Many states and municipalities in the United States have introduced restrictions or bans on single use plastics, encouraging producers to adopt sustainable packaging alternatives. As plastic packaging becomes less socially acceptable and often costlier under regulatory frameworks, bamboo stands out as a credible solution. Advancements in manufacturing and material processing technologies have improved bamboo packaging’s strength, durability, and moisture resistance, making it more competitive with traditional packaging materials. These improvements enable bamboo packaging for a wider variety of uses — from containers, trays, cups, and cutlery to premium retail boxes, cosmetic jars, and sustainable mailers. Given rising environmental awareness, regulatory pressure, and demand for sustainable consumer goods, demand for bamboo packaging in the USA is likely to grow steadily in the coming years.

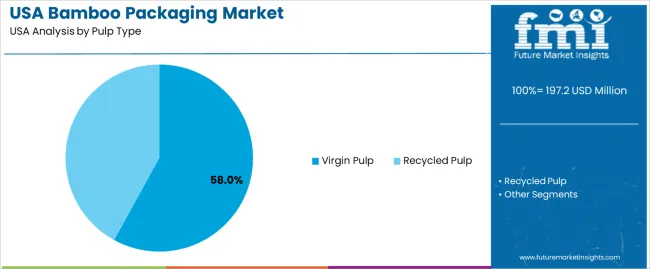

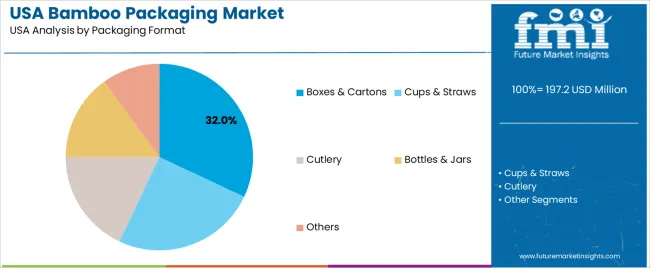

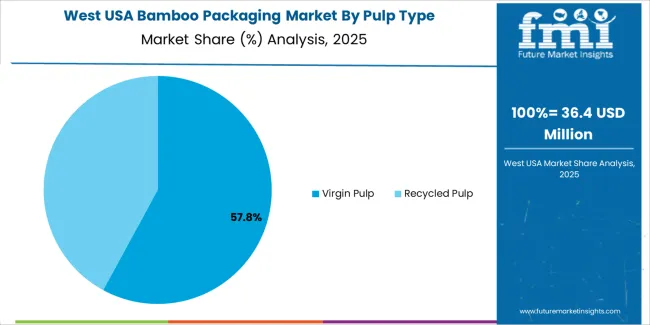

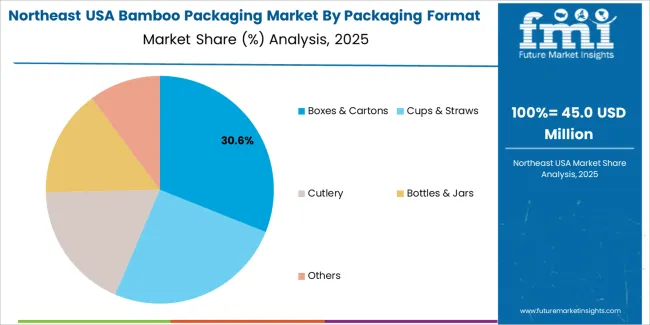

The demand for bamboo packaging in the USA is primarily driven by pulp type and packaging format. The leading pulp type is virgin pulp, accounting for 58% of the market share, while boxes & cartons are the dominant packaging format, capturing 32% of the demand. Bamboo packaging, known for its eco-friendly and sustainable properties, is increasingly used across various industries as companies look for alternatives to plastic and other non-sustainable materials. As the trend toward sustainability grows, the demand for bamboo packaging continues to rise in the USA.

Virgin pulp leads the demand for bamboo packaging in the USA, holding 58% of the market share. Virgin pulp is made from fresh bamboo fibers and is favored for its strength, durability, and high-quality finish, making it ideal for packaging applications. Bamboo pulp is a highly renewable resource, and products made from virgin pulp have a premium appeal in markets that prioritize sustainability. The ability of virgin pulp to be processed into a variety of packaging products such as boxes, cartons, and wraps is a key driver of its dominance in the market.

The demand for virgin pulp is further fueled by growing consumer interest in eco-friendly products and packaging solutions that reduce environmental impact. As industries shift toward sustainable alternatives, particularly in the food and beverage, retail, and e-commerce sectors, bamboo packaging made from virgin pulp is becoming a preferred choice. Virgin pulp's strength and quality also make it suitable for premium packaging, which is increasingly sought after by brands aiming to appeal to environmentally conscious consumers. As sustainability continues to be a major focus, the demand for virgin bamboo pulp in packaging is expected to remain strong in the USA.

Boxes & cartons are the leading packaging format for bamboo packaging in the USA, capturing 32% of the market share. Bamboo boxes and cartons are used widely in the packaging of food products, electronics, and consumer goods. These packaging formats offer a sturdy, eco-friendly alternative to traditional materials like plastic and corrugated cardboard, making them especially appealing in the retail and e-commerce industries. Bamboo packaging offers durability and an attractive, natural appearance, enhancing the appeal of products while minimizing environmental impact.

The demand for bamboo boxes and cartons is driven by their ability to provide secure and sustainable packaging solutions for a wide range of products. As businesses continue to adopt more eco-conscious practices and consumers become more environmentally aware, bamboo boxes and cartons are increasingly seen as a premium packaging option. The combination of sustainability, strength, and aesthetics positions bamboo boxes and cartons as the leading choice in the bamboo packaging market in the USA. With the rising trend of sustainable packaging, this format is expected to maintain its strong demand in the market.

Demand for bamboo packaging in the USA is growing due to increasing consumer preference for sustainable and eco friendly packaging materials. Bamboo offers a renewable, biodegradable alternative to plastic and conventional packaging. The rise in environmental awareness, along with regulations pushing for reduced plastic use, is driving adoption. Bamboo packaging is gaining traction in industries like food and beverage, personal care, and e commerce, where it is used for its durability, light weight, and positive environmental profile.

What are the Drivers of Demand for Bamboo Packaging in the USA?

The main drivers of demand for bamboo packaging in the USA include the growing shift towards sustainability and eco friendly alternatives to plastic. Regulations on plastic waste, increasing consumer preference for green products, and corporate sustainability goals are pushing brands to use bamboo packaging. The demand for biodegradable and recyclable materials is increasing in sectors like food and beverage, personal care, and e commerce. Additionally, advancements in bamboo processing and improved product quality have made bamboo packaging more affordable and accessible.

What are the Restraints on Demand for Bamboo Packaging in the USA?

Despite growing interest, some restraints exist for bamboo packaging in the USA. The higher cost of production compared to plastic and traditional materials may limit adoption, especially in cost-sensitive industries. Supply chain challenges and sourcing consistency of bamboo can create reliability issues for manufacturers. Additionally, bamboo packaging may not always meet performance standards for durability or moisture resistance, especially in products requiring long shelf life. Regulatory compliance and certification for food safety and biodegradability can also slow adoption.

What are the Key Trends Influencing Demand for Bamboo Packaging in the USA?

Key trends include increasing regulations targeting plastic waste, which encourage companies to adopt more sustainable materials like bamboo. There is also a growing consumer demand for transparency and sustainability in packaging. As eco-conscious consumers seek out greener products, brands are turning to bamboo to differentiate themselves. Additionally, improvements in bamboo processing and manufacturing technology have made bamboo packaging more cost effective and scalable, allowing it to compete with traditional materials in mainstream markets.

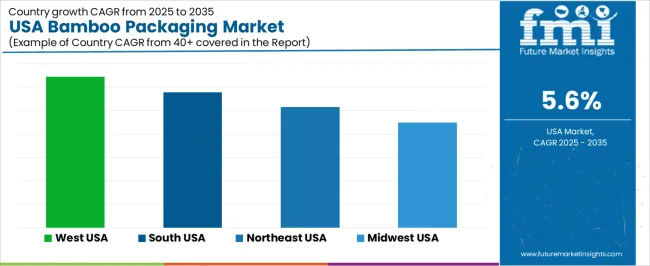

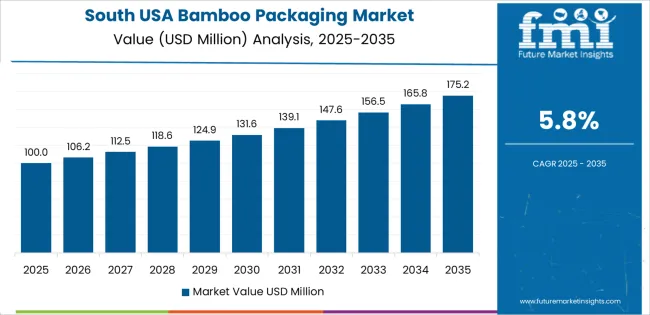

The demand for bamboo packaging in the USA is projected to grow across all regions, with the West USA leading at a CAGR of 6.4%. The South USA follows with a CAGR of 5.8%, driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. The Northeast USA is expected to grow at 5.2%, while the Midwest USA shows slightly slower growth at 4.5%. These regional variations reflect factors such as the availability of sustainable packaging alternatives, regional awareness of environmental issues, and industry adoption of bamboo-based solutions.

| Region | CAGR (%) |

|---|---|

| West USA | 6.4 |

| South USA | 5.8 |

| Northeast USA | 5.2 |

| Midwest USA | 4.5 |

In the West USA, the demand for bamboo packaging is expected to grow at a CAGR of 6.4%. The region has long been a leader in environmental consciousness and sustainable practices, making it a key market for bamboo-based products. States like California are known for their focus on reducing plastic waste and encouraging eco-friendly packaging solutions. Bamboo, being a renewable and biodegradable resource, aligns with the West's commitment to sustainability. Additionally, the large number of e-commerce businesses and foodservice industries in this region, many of which are seeking eco-friendly alternatives to traditional plastic and paper packaging, further supports the growth of bamboo packaging. The combination of consumer demand, regulatory initiatives, and business adoption makes the West USA a strong driver of growth in the bamboo packaging market.

In the South USA, the demand for bamboo packaging is projected to grow at a CAGR of 5.8%, fueled by both environmental concerns and the increasing need for cost-effective, sustainable packaging solutions. The South has seen a rise in the adoption of eco-friendly alternatives across various industries, including food, retail, and consumer goods. As consumers become more aware of the environmental impact of packaging waste, businesses in the South are seeking alternatives like bamboo packaging, which offers durability, biodegradability, and a reduced environmental footprint. With the growing importance of sustainability in consumer choices and corporate practices, the demand for bamboo packaging is expected to continue expanding in the South USA, particularly in states with high population growth and industrial activity.

In the Northeast USA, the demand for bamboo packaging is expected to grow at a CAGR of 5.2%. The region's focus on sustainability and environmental policies makes it a natural fit for the adoption of bamboo packaging. Northeast states, particularly New York and Massachusetts, have strong regulations aimed at reducing plastic waste and promoting greener packaging solutions. As consumers increasingly demand sustainable products, companies in the food and beverage, retail, and packaging industries are turning to bamboo as an eco-friendly alternative to traditional materials. Additionally, the growing popularity of bamboo products among environmentally conscious consumers and businesses in urban centers ensures steady demand for bamboo packaging in the Northeast USA. The combination of consumer awareness, regulatory support, and industry adoption drives continued growth in this region.

In the Midwest USA, the demand for bamboo packaging is expected to grow at a CAGR of 4.5%. The region has historically had a slower adoption rate of eco-friendly alternatives compared to the West and Northeast, but there is growing interest in sustainable packaging solutions. As the Midwest’s manufacturing and agricultural sectors evolve, there is a rising demand for packaging materials that align with environmental goals. Bamboo packaging, with its renewable properties and low environmental impact, is becoming an attractive choice for industries looking to reduce waste and meet sustainability goals. While the demand in the Midwest is growing at a more moderate pace, the increasing availability of bamboo-based products and growing consumer interest in sustainability will likely contribute to steady growth in the region.

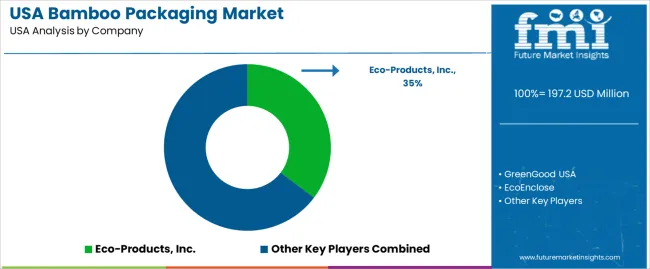

The market for bamboo packaging in the USA is expanding. Growth reflects increasing consumer concern about plastic pollution, corporate sustainability goals, and regulatory pressure on single use plastics. Demand arises from food and beverage, cosmetics, personal care, and e commerce sectors. Firms that emphasise biodegradable and renewable materials stand to gain. Among suppliers, one firm reportedly holds about 35.3% of the market: Eco Products, Inc.. Other notable actors include GreenGood USA, EcoEnclose, PacknWood, and Huhtamaki Group. These companies compete to supply bamboo based boxes, containers, trays, and other sustainable packaging solutions.

Competition in this market centres on material quality, production techniques, breadth of product range and sustainability credentials. Some firms leverage advanced processing and molding to offer bamboo containers resistant to moisture and suitable for food or cosmetic use. Others highlight clean label credentials, compostability or recyclability to appeal to eco conscious buyers. Packaging providers attempt to match traditional plastic or paper alternatives in strength and durability while offering environmental benefit. Market materials and brochures emphasise bamboo’s renewability, biodegradability and natural aesthetics. Competition remains active as suppliers refine products to suit varied industries, regulatory demands, and consumer expectations for sustainability and performance.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Pulp Type | Virgin Pulp, Recycled Pulp |

| Packaging Format | Boxes & Cartons, Cups & Straws, Cutlery, Bottles & Jars, Others |

| End Use Industry | Foods & Beverages, Cosmetics & Personal Care, Healthcare, Fashion and Accessories, Electrical & Electronics |

| Key Companies Profiled | Eco-Products, Inc., GreenGood USA, EcoEnclose, PacknWood, Huhtamaki Group |

| Additional Attributes | The demand for bamboo packaging in the USA is driven by the increasing consumer and industry preference for sustainable, eco-friendly packaging solutions. Bamboo, as a renewable resource, is gaining popularity across various industries, including foods and beverages, cosmetics, healthcare, fashion, and electronics. The market is segmented based on pulp type, with both virgin pulp and recycled pulp used in different applications. Bamboo packaging formats, such as boxes, cartons, cups, straws, cutlery, and bottles, cater to the growing need for environmentally responsible packaging. Major companies like Eco-Products, GreenGood USA, and Huhtamaki Group lead the market, focusing on innovation and product offerings that meet the demand for both functional and sustainable packaging solutions. The market is expected to expand as more industries adopt bamboo-based packaging alternatives. |

The demand for bamboo packaging in USA is estimated to be valued at USD 197.2 million in 2025.

The market size for the bamboo packaging in USA is projected to reach USD 340.2 million by 2035.

The demand for bamboo packaging in USA is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in bamboo packaging in USA are virgin pulp and recycled pulp.

In terms of packaging format, boxes & cartons segment is expected to command 32.0% share in the bamboo packaging in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bamboo Packaging Market Share, Growth & Trends 2025 to 2035

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Reusable Consumer Packaging Market

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

Demand for Bamboo Products in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Packaging Tubes in USA Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Demand for Boxboard Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bag-In-Box Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Juice Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Molded Fiber Pulp Packaging industry Analysis in USA and Canada - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Moisture-resistant Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA