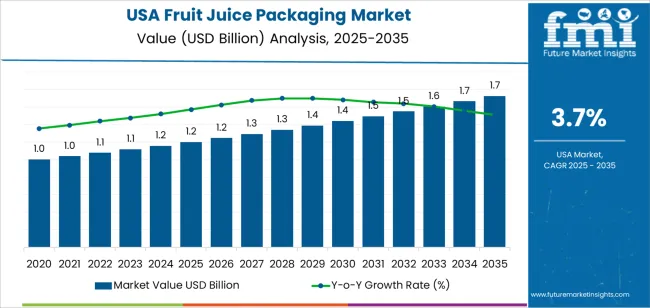

The demand for fruit juice packaging in the USA is expected to grow from USD 1.2 billion in 2025 to USD 1.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.70%. As the fruit juice industry continues to evolve, packaging solutions play a crucial role in enhancing product appeal, extending shelf life, and ensuring consumer safety and convenience. Increasing consumer demand for premium and healthier fruit juices, along with a shift toward eco-friendlier and eco-friendly packaging, is expected to fuel this growth. Innovations in packaging design, such as the development of lightweight, recyclable, and tamper-evident containers, will continue to drive demand for fruit juice packaging.

The rising preference for ready-to-drink (RTD) beverages, particularly fruit juices, is also contributing to the growth of the fruit juice packaging industry. As more consumers prioritize health-conscious and on-the-go drink options, manufacturers are focusing on offering convenient and attractive packaging to meet this demand. Packaging solutions that maintain the freshness and nutritional integrity of fruit juices, such as innovations in aseptic and glass packaging, will play a significant role in driving industry growth.

Between 2025 and 2030, the demand for fruit juice packaging is expected to increase from USD 1.2 billion to USD 1.3 billion, with steady growth observed in this period. This moderate increase reflects stable demand across various fruit juice categories, driven by consistent consumer preference for convenience and resource efficiency. During this phase, industry share is likely to see some erosion from traditional packaging materials such as plastic bottles, as consumers shift towards more environmentally friendly alternatives like glass and biodegradable containers. The demand for eco-friendly packaging is expected to gain momentum as eco-conscious consumer behavior continues to grow.

From 2030 to 2035, the industry for fruit juice packaging is expected to experience stronger growth, reaching USD 1.8 billion. This growth will be largely driven by innovations in eco-friendly and functional packaging designs. The industry is expected to see significant gains from packaging solutions that cater to both environmental concerns and product preservation. As the demand for environmentally friendly packaging rises, manufacturers that adopt new materials and technologies, such as biodegradable plastics or recyclable paper-based containers, will see their industry share increase. This trend toward eco-friendlier packaging is likely to offset the potential erosion in industry share for traditional packaging solutions, resulting in net growth for the industry.

| Metric | Value |

|---|---|

| Demand for Fruit Juice Packaging in USA Value (2025) | USD 1.2 billion |

| Demand for Fruit Juice Packaging in USA Forecast Value (2035) | USD 1.8 billion |

| Demand for Fruit Juice Packaging in USA Forecast CAGR (2025 to 2035) | 3.70% |

The demand for fruit juice packaging in the USA is growing as beverage producers respond to consumer preferences for convenience, freshness, and portability. Single‑serve bottles, pouches, and on‑the‑go formats enable consumers to enjoy juice in varied environments, including workplaces, schools, and outdoor settings. As brand owners seek to differentiate their products and extend shelf appeal, packaging formats become key components of value creation.

Changes in processing and distribution are also influencing requirements for juice packaging. Retailers and online channels demand reliability and ease of handling; packaging must protect product quality, support logistics efficiency, and deliver user convenience. Materials and closures are being chosen to maintain flavour integrity, prevent leakage, and support rapid shelf turnaround.

Innovation in materials, formats and printing is further enhancing packaging performance. Lightweight bottles, resealable caps, clear windows and high‑definition graphics are becoming more common in juice applications. Packaging suppliers are designing formats that support smaller home consumption sizes, multi‑packs and premium offerings. As beverage portfolios expand to include blends, functional ingredients and exotic flavours, the packaging must keep pace. With these factors at play, the demand for fruit juice packaging in the USA is anticipated to rise steadily through 2035.

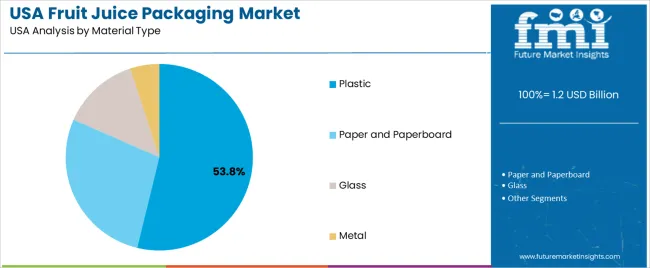

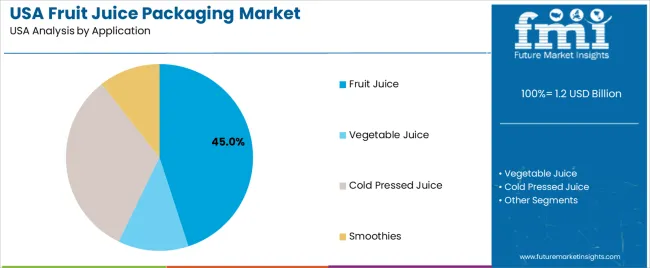

Demand for fruit juice packaging in the USA is segmented by material type, application, capacity, and opening type. By material type, demand is divided into plastic, paper and paperboard, glass, and metal, with plastic holding the largest share at 53.8%. The demand is also segmented by application, including fruit juice, vegetable juice, cold pressed juice, and smoothies, with fruit juice leading the demand at 45.0%. In terms of capacity, demand is divided into up to 250ml, 251 to 750ml, 751 to 1000ml, and above 1000ml. Regarding opening type, demand is divided into cap opening, clip opening, straw hole opening, and lid opening. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Plastic accounts for 53.8% of the demand for fruit juice packaging in the USA. Plastic packaging is favored for its lightweight nature, durability, and versatility. It is easier to transport and store compared to heavier alternatives like glass or metal, which makes it the preferred choice for manufacturers. Plastic packaging offers a wide range of customization options, including different shapes, sizes, and designs, making it suitable for various fruit juice products.

The affordability of plastic, combined with its ability to preserve the freshness and quality of fruit juice, has contributed to its dominant share in the packaging industry. Plastic packaging is also highly convenient for consumers, as it is easy to handle, open, and consume. While resource efficiency concerns about plastic waste continue to grow, innovations in recyclable and biodegradable plastics are helping address these issues, ensuring that plastic packaging remains a leading choice in the fruit juice industry.

Fruit juice accounts for 45.0% of the demand for fruit juice packaging in the USA. Fruit juice is one of the most widely consumed beverages, with a strong demand across various consumer segments, including health-conscious individuals and those seeking natural, refreshing drinks. The growing focus on healthy, vitamin-rich beverages has driven the demand for fruit juices, further contributing to the need for effective and efficient packaging solutions.

Packaging plays a key role in preserving the freshness, taste, and nutritional value of fruit juices, and the demand for attractive, convenient, and functional packaging solutions continues to rise. The rise in on-the-go consumption and the increasing availability of fruit juices in various retail formats, from supermarkets to convenience stores, has made packaging more important than ever in maintaining product integrity. As the demand for fruit juices continues to grow, the packaging sector will continue to meet these needs with innovative and consumer-friendly solutions.

Key drivers include growing consumer demand for ready‑to‑drink and single‑serve beverages, increasing preference for natural, organic and functional juices which require eye‑catching and safe packaging, and rising focus on resource efficiency leading to innovation in recyclable, lightweight and eco‑friendly packaging materials. Restraints include high cost of premium packaging formats, pressure on packaging material supply chains (e.g., PET, aluminium, paperboard) which can raise lead times and costs, regulatory and food‑contact safety requirements that limit material choices, and competition from alternative beverage formats (such as bottled water or plant‑based drinks) that may divert packaging investment.

Why is Demand for Fruit Juice Packaging Growing in USA?

In USA, demand for fruit juice packaging is growing because beverage producers are responding to consumer demand for convenient, on‑the‑go formats like small bottles, pouches or cartons that suit busy lifestyles. The surge in premium, organic and functional juice offerings means brands now rely on distinctive packaging to communicate quality, natural ingredients and resource efficiency credentials. Online‑retail growth has increased need for robust packaging that withstands shipping while remaining attractive on shelf. Changing consumption patterns, including juice as a health accessory rather than simply a refreshment, are driving higher demand for advanced packaging formats aligned with brand image and logistics.

How are Technological Innovations Driving Growth of Fruit Juice Packaging in USA?

Technological innovations are fueling growth of fruit juice packaging in USA by introducing materials and formats that improve performance, aesthetics and resource efficiency. Examples include lightweight PET and plant‑based plastics that reduce environmental footprint, pouches with spouts or resealable caps for convenience, barrier coatings that extend shelf‑life without preservatives, and smart labels or QR codes to tell brand stories or trace origin. Automation in packaging lines and digital printing allow smaller‑batch customisation and faster time‑to‑industry. These advances allow juice brands to differentiate, meet consumer expectations for resource efficiency and functionality, and optimise supply‑chain efficiency all reinforcing packaging demand.

What are the Key Challenges Limiting Adoption of Fruit Juice Packaging in USA?

One major challenge is cost premium, innovative materials, barrier technologies or custom shapes raise packaging cost, which may reduce margins for juice manufacturers. Another challenge is supply‑chain complexity, sourcing new materials, ensuring food‑contact safety and achieving recycling compatibility add time and risk. Regulatory compliance (e.g., food‑contact approvals, labelling, recycling laws) can restrict material choices and slow innovation. Also, changing legacy production lines to handle new formats involves capital investment and operational disruption. Competition from other beverage categories may limit packaging upgrades when juice producers focus instead on pricing or ingredient innovation.

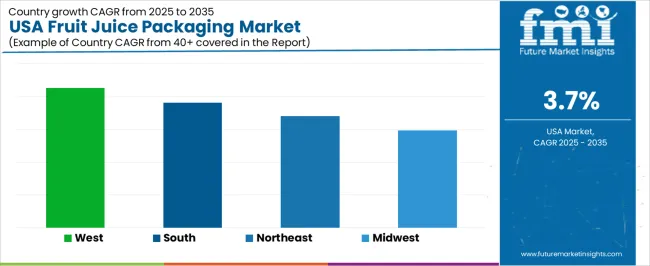

| Region | CAGR (%) |

|---|---|

| West | 4.3 |

| South | 3.8 |

| Northeast | 3.4 |

| Midwest | 3.0 |

Demand for fruit juice packaging in USA is increasing across all regions, with the West leading at a 4.3% CAGR. This growth is driven by the region’s strong consumer demand for health-conscious beverages and the adoption of eco-friendly packaging solutions. The South follows with a 3.8% CAGR, supported by the region's growing beverage industry and rising preference for natural, healthy drink options. The Northeast shows a 3.4% CAGR, driven by high urban demand for convenient, ready-to-drink products. The Midwest experiences moderate growth at 3.0%, with increasing interest in fresh and healthy beverage options.

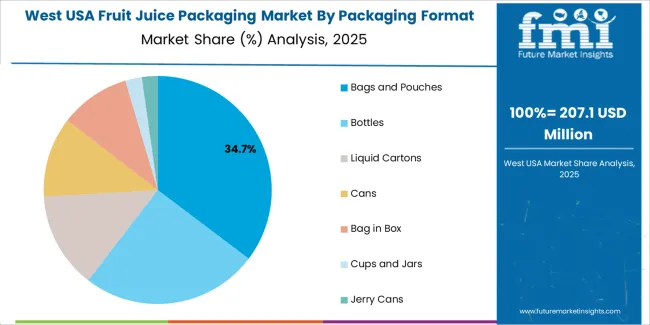

The West is experiencing the highest demand for fruit juice packaging in USA, with a 4.3% CAGR. This growth is driven by the region's strong consumer preference for health-conscious beverages, with an increasing shift toward fresh, natural juices. Cities like Los Angeles, San Francisco, and Seattle are hubs for the wellness movement, where consumers are increasingly choosing fruit juices as part of their healthier lifestyle. The West’s demand for eco-friendly packaging solutions is another key factor, as many consumers are opting for eco-friendly, recyclable packaging in response to growing environmental concerns. As the demand for ready-to-drink juices rises, packaging companies are adopting innovative solutions to meet consumer expectations for convenience and quality.

In addition to consumer trends, the West’s robust retail and e-commerce sectors have played a significant role in driving growth. Retailers are expanding their product offerings, including cold-pressed juices, organic juices, and other healthy beverage options, all of which require specialized packaging. With continued interest in health and resource efficiency, the West is expected to lead the way in the expansion of fruit juice packaging in USA.

The South is seeing strong demand for fruit juice packaging in USA, with a 3.8% CAGR. The region’s growth is fueled by an expanding beverage sector, with increasing consumer demand for healthier drink options. States like Texas, Florida, and Georgia are witnessing an uptick in fruit juice consumption, as more people choose natural beverages over sugary alternatives. The South’s large and diverse population, coupled with rising health awareness, has created a strong industry for packaged fruit juices, which are seen as convenient and nutritious options.

As consumer preferences continue to shift toward natural and organic products, the demand for fruit juice packaging has risen accordingly. This includes a growing interest in eco-friendly packaging solutions, which are becoming a key selling point for brands. The South’s warm climate also drives demand for refreshing beverages like fruit juices, especially during the summer months. Retailers and manufacturers are responding to this demand by offering a wider variety of fruit juice products, which is further driving the need for specialized, eco-friendly packaging. As the industry continues to grow, the South is expected to see a steady increase in fruit juice packaging demand.

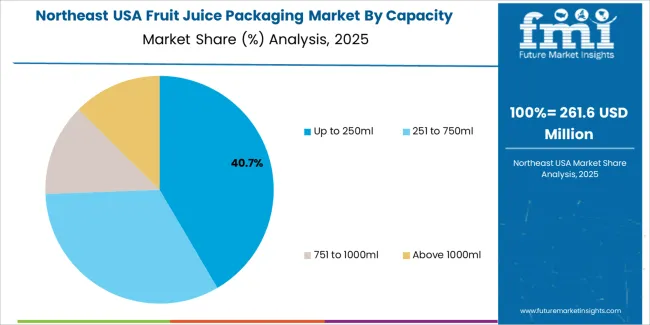

The Northeast is experiencing steady demand for fruit juice packaging in USA, with a 3.4% CAGR. This growth is driven by the region’s dense urban population, with cities like New York, Boston, and Philadelphia serving as major centers for ready-to-drink beverages. The Northeast has a well-established industry for convenience foods and drinks, and fruit juices are becoming an increasingly popular option for busy consumers looking for a quick, healthy beverage. As more people opt for fresh, natural juices over sugary sodas, packaging solutions that preserve the freshness and quality of these drinks are in high demand.

The Northeast’s focus on health and wellness is also driving demand for fruit juice packaging, as consumers become more conscious of their nutritional choices. The region has seen a rise in organic and cold-pressed juices, which require specialized packaging to maintain quality and shelf life. Retailers in the Northeast are responding by expanding their beverage offerings, making fruit juices more accessible to consumers. As demand for healthy, convenient options grows, the need for innovative and eco-friendly fruit juice packaging will continue to rise in the Northeast.

The Midwest is experiencing moderate demand for fruit juice packaging in USA, with a 3.0% CAGR. This growth is driven by the increasing consumer preference for fresh, healthy beverages, with fruit juices being seen as a convenient and nutritious option. States like Illinois, Michigan, and Ohio have witnessed a rise in health-conscious consumers seeking alternatives to sugary drinks. As more people adopt healthier lifestyles, the demand for fruit juices packaged in convenient, portable formats has increased.

The Midwest’s growing focus on health and wellness, coupled with a strong retail presence, has created a favorable environment for fruit juice packaging growth. As the industry for fresh and organic juices expands, packaging companies are responding with solutions that ensure product freshness and longer shelf life. The rise of online shopping has made it easier for consumers to access a wide range of juice products, further fueling the demand for fruit juice packaging. While the growth rate is slower than in other regions, the Midwest is seeing a steady rise in the demand for fruit juice packaging, driven by changing consumer habits and increased health awareness.

In the USA, demand for fruit juice packaging is driven by broader growth in ready‑to‑drink beverages, evolving consumer preferences for healthier, convenient options, and the need for packaging that both preserves freshness and supports brand appeal. Materials such as paperboard cartons, plastic bottles, pouches, and metal cans are commonly used, and packaging formats that enable on‑the‑go consumption or extended shelf life see higher uptake. Industry growth is supported by rising consumer awareness of functional beverages and by changing retail and e‑commerce channels that favor single‑serve and portable formats.

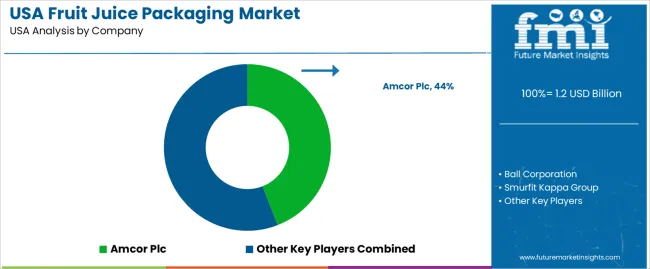

Key suppliers active in the USA fruit juice packaging space include Amcor Plc with a 44.1% share, Ball Corporation, Smurfit Kappa Group, Tetra Laval International S.A., and DS Smith Plc. These companies differentiate through breadth of material offerings (plastic, metal, paperboard, carton), global scale of production and logistics networks, ability to deliver innovative packaging formats (for example high‑barrier cartons, aseptic pouches, lightweight bottles), and collaboration with beverage brands on design and branding. Their strong positioning gives them advantages in servicing large beverage producers and optimized supply chains.

The competitive landscape is influenced by several forces. One driver is the need for packaging that supports consumer convenience, portability, shelf‑stability, and brand differentiation. Another driver is innovation in design, materials, and formats that reduce weight, improve functionality, and enhance presentation. At the same time, challenges include pressure on costs of raw materials and logistics, regulatory and compliance requirements for food‑grade packaging, and shifting consumer attitudes that drive frequent refresh of packaging. Firms that can offer flexible manufacturing, fast new‑format introduction, strong design support, and integrated service are likely to maintain strong positions in the USA fruit juice packaging segment.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Capacity | Up to 250ml, 251 to 750ml, 751 to 1000ml, Above 1000ml |

| Material Type | Plastic, Paper and Paperboard, Glass, Metal |

| Opening Type | Cap Opening, Clip Opening, Straw Hole Opening, Lid Opening |

| Application | Fruit Juice, Vegetable Juice, Cold Pressed Juice, Smoothies |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | Amcor Plc, Ball Corporation, Smurfit Kappa Group, Tetra Laval International S.A., DS Smith Plc. |

| Additional Attributes | Dollar sales are driven by material types such as plastic, paper, glass, and metal, with packaging capacities ranging from 250ml to over 1000ml. The industry is segmented by applications, including fruit juice, vegetable juice, cold-pressed juice, and smoothies. Regional trends focus on the West, South, Northeast, and Midwest USA, highlighting the growing demand in the beverage industry. |

The demand for fruit juice packaging in usa is estimated to be valued at USD 1.2 billion in 2025.

The market size for the fruit juice packaging in usa is projected to reach USD 1.7 billion by 2035.

The demand for fruit juice packaging in usa is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in fruit juice packaging in usa are bags and pouches, bottles, liquid cartons, cans, bag in box, cups and jars and jerry cans.

In terms of capacity, up to 250ml segment is expected to command 42.7% share in the fruit juice packaging in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Fruit Juice Packaging Providers

Fruit Juice Packaging Market Growth – Trends & Forecast through 2035

Demand for Fruit Juice Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA Freeze Dried Fruits Market Growth – Innovations, Trends & Forecast 2025–2035

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Reusable Consumer Packaging Market

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Market Share Breakdown of USA and Canada Molded Fiber Pulp Packaging Manufacturers

Demand for Fruit Pectin in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Snacks in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Packaging Tubes in USA Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA