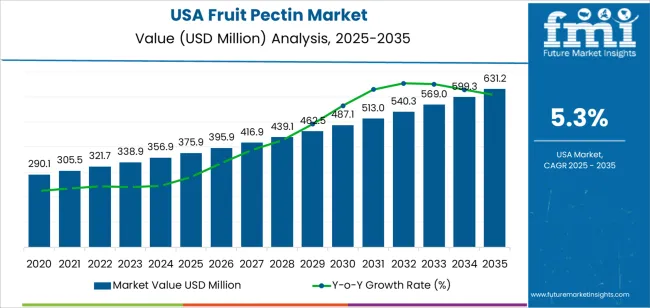

The USA fruit pectin demand is valued at USD 375.9 million in 2025 and is forecasted to reach USD 631.2 million by 2035, recording a CAGR of 5.3%. Demand is supported by sustained use of pectin as a gelling, stabilising, and thickening agent across food processing, nutrition products, and specialised dietary formulations. Growth is influenced by increased consumption of clean-label ingredients, wider use of plant-derived hydrocolloids, and steady innovation in functional food categories. Fruit pectin supports texture, viscosity control, and product stability in beverages, confectionery, and nutritional applications that require consistent formulation performance.

Food supplements represent the leading application as manufacturers incorporate pectin into fibre-enriched products, chewable supplements, and structured gummies designed for vitamin, mineral, and botanical delivery. Pectin’s compatibility with active ingredients and its ability to form uniform matrices support its rise in supplement formats aimed at digestive health, controlled release, or plant-based product differentiation. Its natural origin continues to align with consumer preferences for minimally processed functional ingredients.

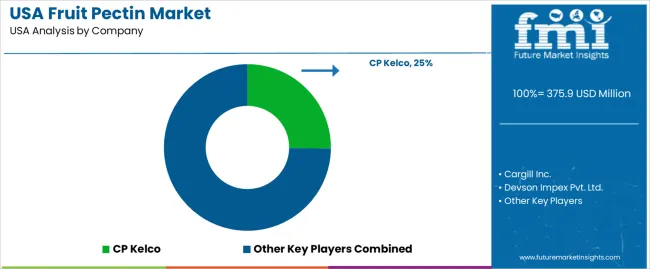

Demand is strongest in the West, South, and Northeast, where supplement manufacturers, beverage formulators, and large food processors drive procurement. Key suppliers include CP Kelco, Cargill Inc., Devson Impex Pvt. Ltd., Nestlé S.A., and Danone S.A., providing fruit-pectin ingredients suitable for high-volume commercial production.

Growth momentum analysis shows a steady early-phase trajectory driven by consistent use of pectin in jams, jellies, fruit preparations, and reduced-sugar formulations. Between 2025 and 2029, momentum will remain firm as manufacturers expand clean-label product lines and rely on pectin as a natural gelling, stabilising, and thickening agent. Demand across bakery fillings, dairy applications, and functional beverages will reinforce stable early growth.

From 2030 to 2035, momentum will shift toward a more predictable pattern as major application categories mature and procurement cycles align with stable processing demand. Incremental gains will come from improved extraction efficiencies, expanded use in plant-based foods, and formulation updates targeting reduced-sugar claims. Growth remains durable but less accelerated as supply chains and product portfolios stabilise. The momentum profile reflects a natural-ingredient segment shaped by consistent industrial utilisation, ongoing reformulation trends, and steady integration of pectin across USA food and beverage manufacturing environments.

| Metric | Value |

|---|---|

| USA Fruit Pectin Sales Value (2025) | USD 375.9 million |

| USA Fruit Pectin Forecast Value (2035) | USD 631.2 million |

| USA Fruit Pectin Forecast CAGR (2025-2035) | 5.3% |

The demand for fruit pectin in the USA is increasing because food and beverage manufacturers are turning to natural gelling and stabilising ingredients that align with clean-label and plant-based trends. Fruit pectin, commonly derived from citrus peels or apple pomace, is favoured in products like jams, jellies, fruit spreads, yogurt, and reduced-sugar beverages. Rising consumer preference for minimally processed foods with simple ingredient lists drives substitution of synthetic additives with fruit pectin.

Manufacturers in bakery, confectionery and functional food segments use pectin to improve texture, mouthfeel and shelf performance while meeting dietary fibre or clean-label aspirations. Expansion of health-oriented products and plant-based formulations further strengthens demand for pectin as a versatile functional ingredient. Constraints include seasonal and geographic variability of raw-material supply, dependence on fruit-processing by-products such as citrus or apple peel, and higher cost relative to conventional additives. Some formulators may face reformulation challenges when switching to pectin in existing recipes.

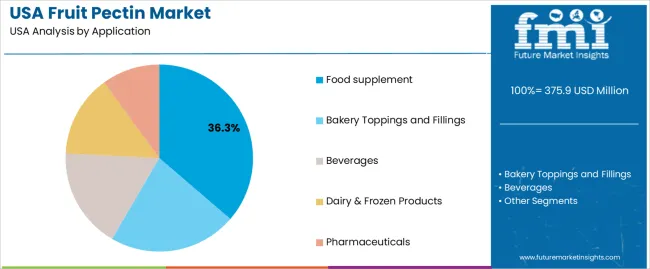

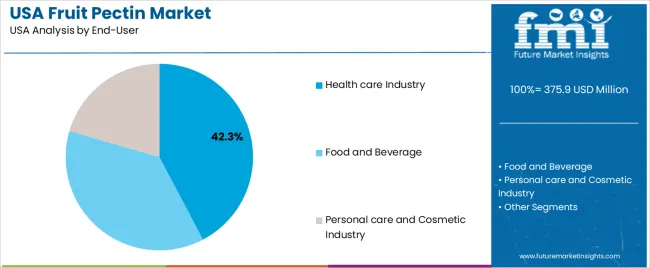

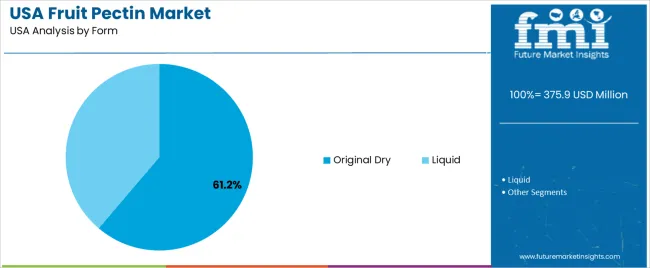

Demand for fruit pectin in the United States reflects its use as a natural gelling, stabilising, and thickening agent across food, beverage, health-supplement, and pharmaceutical formulations. Application patterns are influenced by product-development requirements, consumer preferences for plant-derived ingredients, and the increasing adoption of functional additives supporting texture and nutritional consistency. End-user distribution highlights reliance from healthcare and food sectors, while form selection is shaped by processing needs and product functionality.

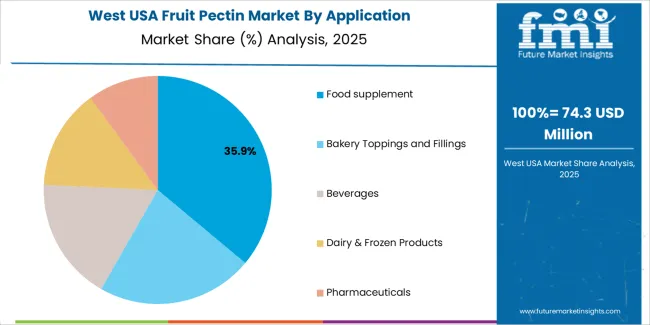

Food-supplement applications hold 36.3% of USA demand and form the leading application category. Pectin is widely used in gummies, chewables, and fibre-enriched supplements requiring consistent texture and plant-based structuring. Bakery toppings and fillings represent 22.1%, relying on pectin for heat-stable gels and uniform viscosity. Beverages account for 17.4%, especially in juice drinks and functional blends requiring suspension and mouthfeel control. Dairy and frozen products represent 14.2%, benefiting from stabilising properties in yogurts and frozen desserts. Pharmaceuticals hold 10.0%, using pectin in controlled-release formulations. Application distribution reflects diverse formulation requirements across nutritional, culinary, and therapeutic categories.

Key drivers and attributes:

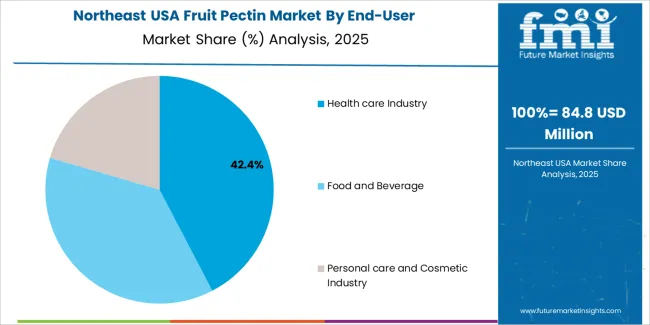

The healthcare industry holds 42.3% of national demand, making it the leading end-user group. Pectin is used in dietary supplements, fibre-enriched formulations, and controlled-release pharmaceutical products requiring stable gel formation and predictable dissolution behaviour. Food and beverage producers account for 37.2%, using pectin in jams, juices, dairy products, confectionery, and functional foods that rely on plant-based structuring. The personal-care and cosmetic industry represents 20.5%, applying pectin as a natural thickening and stabilising agent in gels, creams, and emulsions. End-user distribution reflects functional versatility, regulatory acceptance, and compatibility with clean-label development practices across multiple product categories.

Key drivers and attributes:

Original dry pectin holds 61.2% of USA demand and represents the principal form used across manufacturing settings. Dry pectin offers longer shelf life, consistent hydration behaviour, and ease of handling during formulation of supplements, bakery products, dairy items, and confectionery. Its compatibility with automated processing supports large-scale production. Liquid pectin represents 38.8%, serving applications requiring rapid dispersion, pre-hydrated systems, or specific texture profiles in beverages and sauces. Form distribution reflects processing efficiency, product-stability requirements, and the degree of formulation flexibility needed in food, beverage, and health-supplement development.

Key drivers and attributes:

Rise in demand for clean-label food ingredients, growth of processed fruit and beverage products, and expanded functional food applications support industry growth.

In the United States, demand for fruit-derived pectin is increasing as manufacturers reformulate products to meet consumer preferences for “natural” and plant-based ingredients. The food and beverage industry uses pectin as a gelling, thickening or stabilizing agent in jams, jellies, fruit spreads, ready-to-drink beverages, and dairy or non-dairy desserts. Consumers seek cleaner ingredient labels, less synthetic additives, and more plant-based options, which boosts usage of pectin. Functional and reduced-sugar food and beverage launches are expanding the need for pectin to maintain texture and mouth-feel when sugar content falls. The United States benefits from a sizeable fruit-processing industry (citrus, apples) which supports local availability of raw material and reinforces demand.

Raw-material supply variability, competition from alternative hydrocolloids, and pricing pressure limit faster expansion.

Production of fruit pectin depends on fruit peel and pomace availability, especially from citrus and apples, which can vary due to seasonality, crop yields and weather conditions. These fluctuations can lead to raw-material cost spikes, which may restrain margin and adoption of higher-spec pectin grades. Some food manufacturers use alternative hydrocolloids such as carrageenan, xanthan gum, or modified starches which may offer lower cost or different functional properties, thereby reducing incremental pectin demand in certain formulations. Because pectin has been available for decades, growth is more incremental than rapid, and reformulation challenges or cost constraints can delay uptake.

Development of low-sugar and plant-based formulations, growth in non-traditional applications beyond jams, and strengthened domestic supply chain for clean-label variants.

Manufacturers are developing pectin grades designed for reduced-sugar spreads, low-calorie yogurts, plant-based desserts and beverages, helping pectin maintain relevance in reformulated products. Use of pectin is expanding beyond traditional jam and jelly applications into beverages, bakery fillings, confectionery, and functional foods, which broadens demand. Suppliers are investing in domestic processing and sustainable sourcing of fruit peels to improve supply reliability and to serve the clean-label movement. These trends support steady demand growth for fruit pectin in the USA as food manufacturers continue to emphasise natural ingredients and reformulated clean-label solutions.

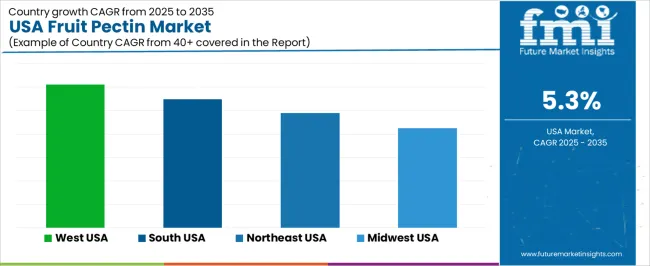

Demand for fruit pectin in the USA is increasing through 2035 as food and beverage manufacturers expand its use in jams, jellies, fruit preparations, gummies, dairy applications, and clean-label formulations requiring natural gelling agents. Growth reflects strong interest in reduced-sugar products, plant-derived stabilizers, and texture-enhancing ingredients suitable for both large-scale processors and specialty brands. Regional variation reflects differences in fruit-processing activity, confectionery production, and innovation in functional foods. The West leads with a 6.1% CAGR, followed by the South (5.5%), the Northeast (4.9%), and the Midwest (4.3%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.1% |

| South | 5.5% |

| Northeast | 4.9% |

| Midwest | 4.3% |

The West grows at 6.1% CAGR, supported by active production of fruit-based foods, confectionery items, and functional beverages across California, Washington, and Oregon. Manufacturers rely on fruit pectin to formulate reduced-sugar jams, shelf-stable fruit spreads, and plant-based gummies with consistent gel strength. Beverage companies integrate pectin to stabilize pulp-containing drinks and natural juice blends. Clean-label preferences drive interest in plant-derived stabilizers over synthetic alternatives. Retail shelf expansion for natural preserves and premium fruit preparations reinforces consistent usage by regional processors. Co-manufacturers in the West support small and mid-sized brands producing organic and specialty fruit-based products.

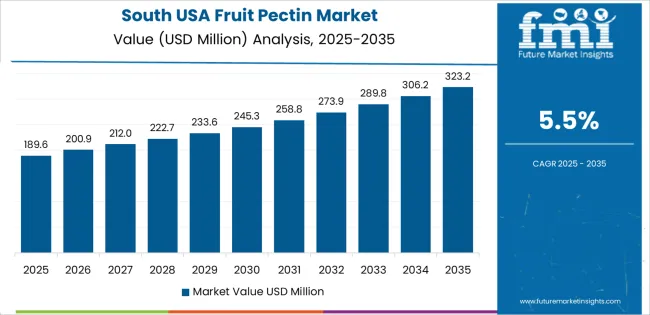

The South grows at 5.5% CAGR, supported by robust confectionery and fruit-processing activity across Texas, Florida, Georgia, and surrounding states. Manufacturers use fruit pectin to produce gummies, fruit chews, and confectionery items requiring stable texture under warm regional climates. Beverage and dairy processors incorporate pectin to stabilize fruit-yogurt blends and flavored drinkable yogurts. Retailers expand assortments of fruit preserves and low-sugar spreads that depend on pectin for consistent gel formation. Home-cooking and small-batch canning traditions in parts of the South reinforce steady demand for retail pectin sachets and bulk supply.

The Northeast grows at 4.9% CAGR, supported by established production of jams, jellies, artisanal preserves, and bakery fillings across New York, New Jersey, and Pennsylvania. Specialty food producers rely on pectin for clean-label texture control in premium fruit spreads and small-batch preserves. Large processors integrate pectin into bakery fillings, fruit syrups, and confectionery components. Beverage companies use pectin to stabilize natural fruit inclusions and reduce phase separation in cold-filled drinks. Retailers in metropolitan industries maintain steady demand for organic and reduced-sugar preserves made with natural gelling agents. Regional interest in craft and artisanal food products reinforces stable usage patterns.

The Midwest grows at 4.3% CAGR, supported by large-scale food-processing operations and gradual expansion of fruit-based product lines across Illinois, Minnesota, Wisconsin, and Ohio. Manufacturers use fruit pectin for bakery, dairy, and confectionery formulations requiring consistent gelling, thickening, or stabilizing properties. Retail demand for fruit spreads and low-sugar preserves provides steady turnover for pectin-based products. Regional dairy processors use pectin to stabilize fruit-on-the-bottom yogurt and blended yogurt drinks. Although adoption is slower compared with coastal regions, strong production capacity and reliable ingredient supply chains support continuous growth in pectin usage.

Demand for fruit pectin in the USA is shaped by a concentrated group of ingredient suppliers supporting dairy, bakery, confectionery, beverage, and nutrition applications. CP Kelco holds the leading position with an estimated 25.2% share, supported by controlled citrus- and apple-pectin production, consistent gel strength, and long-standing supply relationships with major food manufacturers. Its position is reinforced by reliable quality management and predictable functional performance across low-sugar and standard formulations.

Cargill Inc. follows as a significant participant, offering standardized pectin grades used in jams, fruit preparations, spoonable yogurts, and plant-based beverages. Its strengths include steady raw-material sourcing, documented application support, and dependable performance under varied pH and temperature conditions. Devson Impex Pvt. Ltd. maintains a developing presence through cost-efficient sourcing and distribution of pectin suited to confectionery and bakery fillings. Nestlé S.A. and Danone S.A. contribute additional capability through internal formulation expertise, using pectin extensively in their product portfolios while influencing broader demand patterns through standardized functional requirements and long-term procurement strategies.

Competition across this segment centers on gelation consistency, viscosity control, thermal stability, clean-label suitability, and reliability of year-round supply. Demand remains steady due to continued use of pectin in reduced-sugar foods, increased formulation activity in fruit-based products, and strong uptake in dairy and beverage applications requiring predictable texture, stability, and natural ingredient profiles.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Application | Food Supplement, Bakery Toppings and Fillings, Beverages, Dairy & Frozen Products, Pharmaceuticals |

| End-User | Health Care Industry, Food and Beverage, Personal Care and Cosmetic Industry |

| Form | Original Dry, Liquid |

| Function | Thickeners, Gelling Agents, Stabilizer, Fat Replacer, Detoxification Agents |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | CP Kelco, Cargill Inc., Devson Impex Pvt. Ltd., Nestlé S.A., Danone S.A. |

| Additional Attributes | Dollar sales by application, end-user, form, and function categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of pectin suppliers and food ingredient manufacturers; advancements in high-methoxyl and low-methoxyl pectin formulations; integration with dairy stabilization, clean-label bakery fillings, functional beverages, and nutraceutical products in the USA. |

The global demand for fruit pectin in USA is estimated to be valued at USD 375.9 million in 2025.

The market size for the demand for fruit pectin in USA is projected to reach USD 631.2 million by 2035.

The demand for fruit pectin in USA is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for fruit pectin in USA are food supplement, bakery toppings and fillings, beverages, dairy & frozen products and pharmaceuticals.

In terms of end-user, health care industry segment to command 42.3% share in the demand for fruit pectin in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Pectin Market Report – Growth, Demand & Innovations 2025-2035

Analysis and Growth Projections for Fruit Pectin Business

USA Freeze Dried Fruits Market Growth – Innovations, Trends & Forecast 2025–2035

Demand for Fruit Pectin in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Fruit Snacks in USA Size and Share Forecast Outlook 2025 to 2035

Fruit Punnet Market Forecast and Outlook 2025 to 2035

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA