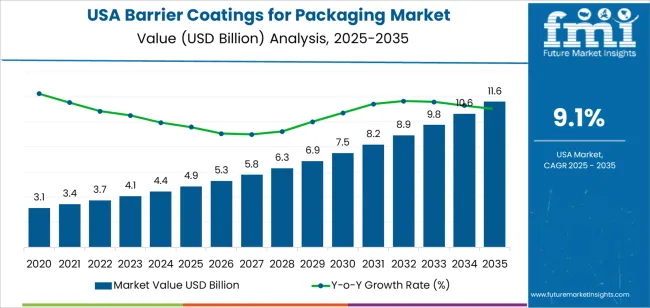

Packaging barrier coating demand in the USA reaches USD 4.9 billion in 2025 and is expected to advance to USD 11.6 billion by 2035 at a CAGR of 9.1%. Early growth is anchored in rapid conversion away from aluminum foil and multilayer plastic laminates toward coated paper and mono-material flexible structures. Food packaging remains the primary driver as processors seek improved oxygen, moisture, and grease resistance without sacrificing machinability on existing filling lines. Snack foods, frozen meals, dairy, and pet food account for a large share of coated surface demand. Water-based and bio-derived coating chemistries gain faster acceptance due to compatibility with high-speed roll coating and extrusion coating processes used across USA packaging plants.

After 2030, growth becomes more substrate-driven than volume-driven. Demand rises from about USD 7.5 billion in 2030 toward USD 11.6 billion by 2035 as coated paperboard and molded fiber packaging expand across foodservice, quick-service restaurants, and e-commerce protective packaging. Beverage carriers, bakery trays, and microwave-ready packaging increase barrier loading per unit area. Brand owners push higher performance requirements tied to shelf-life extension and oil migration control rather than basic moisture protection. Key buyers concentrate among national food processors and global packaging converters operating in the Midwest and Southeast. Supplier strategies focus on coat weight reduction, hybrid polymer blends, and improved heat-seal compatibility to protect margin as coated area per package continues to rise.

Barrier coatings sit at the intersection of material science, food safety, and packaging performance, making their demand curve highly sensitive to regulatory shifts and brand reformulation strategies. Demand in USA increases from USD 4.9 billion in 2025 to USD 7.5 billion by 2030, adding USD 2.6 billion in absolute value. This phase reflects accelerated replacement of traditional plastic laminates with coated paper, molded fiber, and mono-material flexible packaging. Growth is driven by oxygen, moisture, grease, and aroma protection requirements in ready meals, beverages, dairy, and pharmaceutical packaging. Adoption is also reinforced by recycling compatibility and compliance with evolving food contact regulations, keeping growth structurally strong rather than optional.

From 2030 to 2035, the market expands from USD 7.5 billion to USD 11.6 billion, adding a larger USD 4.1 billion within five years. This back weighted acceleration reflects the scaling of high-performance water-based, bio-derived, and PFAS-free barrier technologies across mass packaging formats. As brand owners eliminate aluminum foil and multi-layer plastics, coating functionality shifts from secondary enhancement to primary protection layer. Higher coating weights, multi-barrier stacks, and expanded use in frozen foods, medical packaging, and e-commerce shipments raise value per square meter. Demand growth in this phase is driven by structural material substitution rather than incremental packaging volume alone.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 4.9 billion |

| Forecast Value (2035) | USD 11.6 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

Barrier coatings for packaging in the USA have grown out of rising demand for product protection, shelf life extension, and food safety across processed foods, beverages, pharmaceuticals, and consumer goods. As packaged food and ready-to-eat products became mainstream, manufacturers adopted coatings that block moisture, oxygen, grease, and contaminants to preserve quality. Paper, paperboard, flexible films, and molded fiber packaging increasingly used water-based or polymer barrier coatings to replace traditional plastics or plastics-lined packaging. Manufacturers of snacks, frozen foods, bakery items, and take-away meals leaned on these coatings to meet packaging performance demands under transportation, retail storage, and end-use conditions. As a result, barrier coatings became core components in packaging lines rather than optional add-ons.

Looking ahead, the USA barrier coatings market will be shaped by sustainability, regulatory pressure, and technical innovation more than past volume-driven growth. Companies will increasingly prefer bio-based, water-based, recyclable, or compostable coatings to respond to environmental regulations, consumer demand for greener packaging, and corporate commitments to circular economy. Advances in nanotechnology and hybrid barrier systems will enable thinner, more efficient coatings that deliver high barrier performance while remaining compatible with recycling. Growth is also expected from expansion of e-commerce, meal kits, and frozen/convenience foods, which require robust, moisture-tight and grease-resistant packaging. At the same time, barriers remain: raw material cost volatility, technical challenges in combining barrier performance with recyclability, and trade-offs between barrier strength and environmental compliance will slow some adoption.

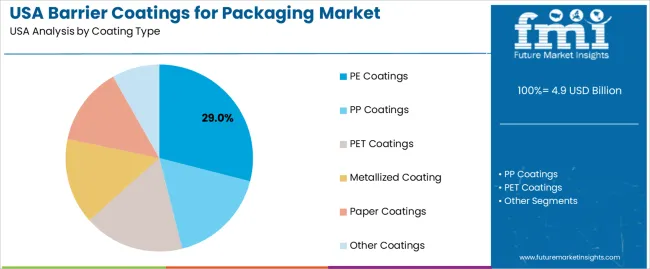

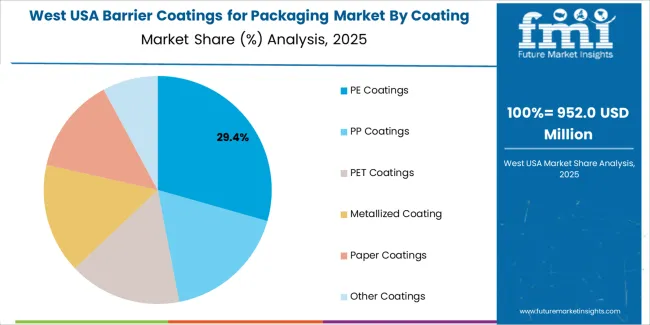

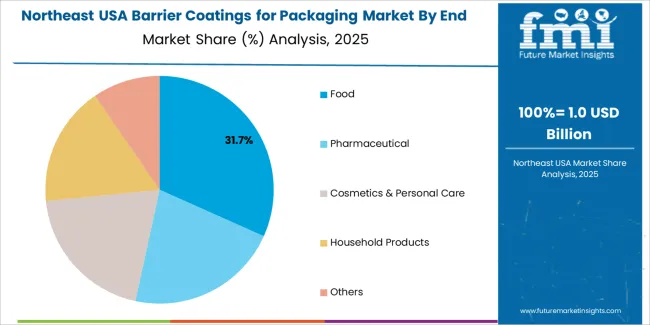

The demand for barrier coatings for packaging in the USA is structured by coating type and end use industry. PE coatings account for 29% of total demand, followed by PP coatings, PET coatings, metallized coatings, paper coatings, and other specialized systems. By end use industry, food leads with a 31.0% share, followed by pharmaceutical, cosmetics and personal care, household products, and other industrial users. Demand behavior is shaped by moisture resistance requirements, oxygen barrier performance, recyclability targets, and shelf life expectations. These segments reflect how material compatibility and product protection needs define coating selection across the USA packaging sector.

PE coatings account for 29% of total barrier coating demand in the USA due to their strong moisture resistance, heat sealability, and broad substrate compatibility. PE performs reliably on paperboard, flexible films, and molded fiber packaging where protection against water vapor and grease is required. Food service packaging, frozen food cartons, and dry goods pouches rely on PE coatings to maintain structural integrity during cold storage and distribution. The material also supports consistent adhesion across high speed coating and extrusion lines.

PE coatings benefit from wide availability of raw material supply and established domestic processing capacity. Cost stability supports use in high volume consumer packaging programs. PE also allows downgauging without rapid loss in barrier performance, which supports material efficiency goals. These processing reliability, cost control, and performance consistency factors sustain PE as the leading coating type in the USA barrier coatings for packaging segment.

The food industry accounts for 31.0% of total barrier coating demand in the USA due to the need for extended shelf life, contamination control, and moisture and oxygen management. Packaged bakery items, snacks, frozen meals, confectionery, and ready to eat foods depend on coated packaging to preserve product quality during transport and storage. Barrier coatings also support grease resistance in quick service food packaging and takeaway containers.

Food packaging operations run at high production volumes, which drives continuous coating consumption across paperboard and flexible substrates. Regulatory requirements for food contact safety add another layer of coating specification rigor. Innovation in recyclable and fiber based food packaging further increases coating demand to replace plastic layers. These high volume output, regulatory pressure, and product protection needs position food as the leading end use industry for barrier coatings for packaging in the USA.

Demand for barrier coatings in USA packaging is driven by extended shelf-life requirements, national distribution distances, and the dominance of moisture- and oxygen-sensitive packaged foods. Snacks, dairy substitutes, ready meals, pharmaceuticals, and pet food all require controlled protection against gas, grease, and moisture transfer. Growth in single-serve packaging and e-commerce fulfillment increases the need for lightweight flexible barriers that protect products during long transit cycles. Regulatory expectations around food safety and pharmaceutical stability also reinforce barrier performance as a technical necessity rather than a design upgrade.

In the USA, food and beverage packaging accounts for the largest share of barrier coating USAge due to high throughput and strict spoilage control needs. Paperboard cartons, flexible films, and foldable pouches depend on coatings to replace traditional aluminum layers in many formats. Pharmaceutical blister packs, medical device wraps, and sterile sachets use barrier coatings for vapor and light protection. Growth in home-delivery meal kits and portion-controlled nutrition packs further expands demand. These end-use structures rely on coatings to balance protection with machinability and lightweight transport performance.

Barrier coating expansion in the USA is restrained by cost sensitivity in mass-market packaging and compatibility challenges with high-speed converting equipment. Multi-layer coating systems add material and curing cost compared with basic laminations. Some water-based coatings still struggle with high-humidity resistance, limiting substitution in frozen and refrigerated foods. Recycling system fragmentation also complicates acceptance of coated paper formats in certain states. Brand owners weigh barrier performance against recyclability claims and price targets. These processing, cost, and waste-stream constraints moderate the pace of full-scale conversion.

Barrier coating demand in the USA is shifting toward solutions that support mono-material packaging and fiber-based recyclable formats. Water-based and bio-derived coatings gain preference where they enable paper and pouch recyclability without aluminum. Tunable coatings with selective oxygen, grease, or aroma barriers allow application-specific optimization rather than blanket protection. High-speed digital printing compatibility also influences coating selection. Performance testing now focuses on real-world distribution stress rather than lab-only metrics. These trends indicate barrier coatings are evolving into engineered interface layers that balance protection, processing, and recovery requirements.

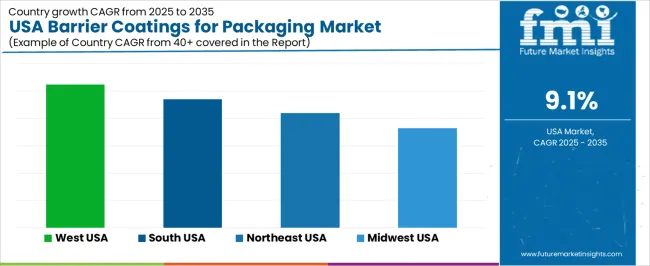

| Region | CAGR (%) |

|---|---|

| West | 10.5% |

| South | 9.4% |

| Northeast | 8.4% |

| Midwest | 7.3% |

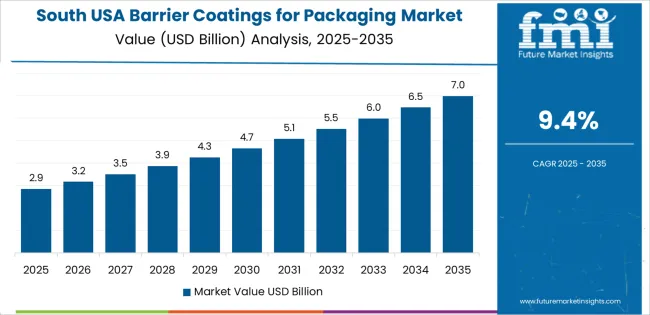

The demand for barrier coatings for packaging in the USA is expanding across all regions, with the West leading at a 10.5% CAGR. Growth in the West is supported by strong food and beverage processing activity, high adoption of advanced packaging formats, and rising focus on shelf life extension. The South follows at 9.4%, driven by expanding flexible packaging production, agricultural product packaging, and growth in regional consumer goods manufacturing.

The Northeast records 8.4% growth, supported by dense food processing clusters, pharmaceutical packaging demand, and demand for high performance coating solutions. The Midwest shows comparatively moderate growth at 7.3%, reflecting steady packaging demand from processed foods, chemicals, and industrial goods with gradual adoption of advanced barrier coating technologies.

Growth in the West reflects a CAGR of 10.5% through 2035 for barrier coatings for packaging demand, supported by strong activity in food processing, plant based product packaging, and premium beverage production. Flexible packaging formats require moisture and oxygen protection to extend shelf life and preserve product integrity. Technology oriented packaging converters emphasize high performance coating solutions for specialty applications. Sustainability driven brand positioning also encourages adoption of water based and recyclable compatible coatings. Demand remains innovation led, shaped by continuous product launches across ready meals, beverages, and nutraceutical packaging segments.

The South advances at a CAGR of 9.4% through 2035 for barrier coatings for packaging demand, driven by large scale food processing, poultry packaging, and expanding beverage bottling operations. High humidity conditions increase the need for effective moisture barriers in flexible films and paper based cartons. Regional packaging converters supply multilayer coated solutions to support high volume output. Private label packaged food growth adds steady demand. Demand remains volume driven, guided by continuous production schedules and year round packaging operations across food and beverage manufacturing corridors.

The Northeast records a CAGR of 8.4% through 2035 for barrier coatings for packaging demand, shaped by dense urban food distribution, pharmaceutical packaging, and premium personal care product manufacturing. High regulatory oversight reinforces strict barrier performance standards for sensitive products. Ready meals, cold chain foods, and healthcare packaging rely on oxygen and moisture protection systems. Limited storage space increases reliance on extended shelf life solutions. Demand remains compliance and quality driven rather than cost driven, with stable consumption across regulated food and healthcare packaging supply chains.

The Midwest expands at a CAGR of 7.3% through 2035 for barrier coatings for packaging demand, supported by meat processing, agricultural product packaging, and institutional food supply operations. Bulk protein packaging requires moisture and grease resistance to maintain product safety during storage and transport. Grain based food products also use coated paper and flexible films for shelf life protection. Manufacturing led demand outweighs branding driven packaging needs. Growth remains stable and production aligned, guided by predictable output from food processing plants and agricultural packaging operations.

Demand for barrier coatings in the USA is increasing as manufacturers seek to extend shelf life, preserve product quality, and maintain hygiene across food, beverage, personal care, and pharmaceutical packaging. Products such as paperboard cartons, flexible films, and multilayer packaging require coatings that block moisture, oxygen, grease, and other contaminants.

Growth in e-commerce, home delivery, and cold-chain logistics also drives the need for durable, high-performance coatings. At the same time, environmental and regulatory pressures encourage adoption of water-based and recyclable coating solutions. Advances in polymer chemistry and application technologies allow packaging producers to meet performance standards while supporting recyclability and sustainability requirements.

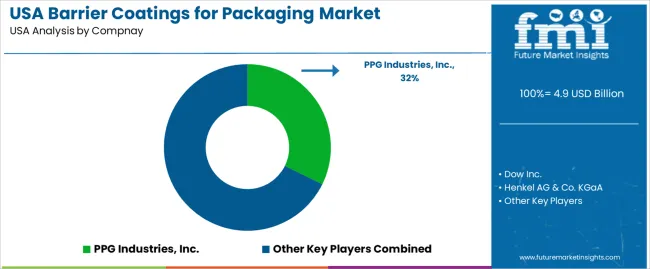

Key companies shaping the barrier coatings landscape in the USA include PPG Industries, Dow Inc., Henkel AG & Co. KGaA, AkzoNobel N.V., and Mondi Group. PPG and Dow focus on high-performance coatings for food and beverage packaging. Henkel provides tailored formulations for industrial and consumer packaging applications. AkzoNobel and Mondi develop coatings optimized for paper-based and recyclable substrates. These firms drive the market through a combination of technological innovation, regulatory compliance, and broad supply networks. Their solutions enable packaging producers to meet functional and environmental requirements, supporting growth across multiple industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Coating Type | PE Coatings, PP Coatings, PET Coatings, Metallized Coating, Paper Coatings, Other Coatings |

| End Use Industry | Food, Pharmaceutical, Cosmetics & Personal Care, Household Products, Others |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | PPG Industries, Dow Inc., Henkel AG & Co. KGaA, Mondi Group, AkzoNobel N.V. |

| Additional Attributes | Dollar by sales by coating type, Dollar by sales by end use industry, Dollar by sales by region, Regional CAGR, Adoption of water-based coatings, Mono-material packaging penetration, Regulatory compliance impact, E-commerce packaging demand, Functional performance requirements |

The demand for barrier coatings for packaging in USA is estimated to be valued at USD 4.9 billion in 2025.

The market size for the barrier coatings for packaging in USA is projected to reach USD 11.6 billion by 2035.

The demand for barrier coatings for packaging in USA is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in barrier coatings for packaging in USA are pe coatings, pp coatings, pet coatings, metallized coating, paper coatings and other coatings.

In terms of end use industry, food segment is expected to command 31.0% share in the barrier coatings for packaging in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Barrier Packaging Providers

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

USA Sachet Packaging Market Report – Trends, Demand & Industry Outlook 2025-2035

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of High Barrier Packaging Films for Pharmaceuticals

Market Share Breakdown of High Barrier Packaging Films Suppliers

USA Pharmaceutical Packaging Market Insights – Demand, Size & Industry Trends 2025-2035

Reusable Consumer Packaging Market

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

Reusable Cold Chain Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Reusable Cold Chain Packaging Market Share & Provider Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA