The demand for weight loss supplements in USA is valued at USD 1.8 billion in 2025 and is projected to reach USD 6.3 billion by 2035, reflecting a compound annual growth rate of 13.5%. Absolute dollar opportunity measures the additional revenue generated across the forecast window, calculated by comparing each year’s value with the base period. From 2025 to 2030, the market expands from USD 1.8 billion to USD 3.4 billion, creating an absolute gain of USD 1.6 billion. By 2035, the cumulative increase reaches USD 4.5 billion, indicating strong, sustained expansion. Growth is shaped by broader adoption of supplements positioned for weight management across capsules, powders and functional beverages as consumers seek products that align with varied lifestyle patterns.

The annual progression shows a rising opportunity curve starting from USD 2.0 billion in 2026 and continuing upward through USD 2.6 billion in 2028 and USD 3.8 billion in 2031. The largest incremental gains occur between 2032 and 2035, where the market expands from USD 4.3 billion to USD 6.3 billion, adding USD 2.0 billion over the final years of the period. This consistent pattern demonstrates a market that grows through broadening product ranges, refined formulations and stronger reach across retail and online channels. As new consumers enter the category and repeat purchases increase, the absolute dollar opportunity continues to widen, supported by steady year-to-year increases that reinforce long-term demand.

Peak demand in USA for weight loss supplements is projected at USD 6.3 billion by 2035, up from a trough of USD 0.9 billion in 2020. The total value uplift between the trough and peak is therefore USD 5.4 billion. Growth accelerates gradually from USD 1.4 billion in 2024 to USD 1.8 billion in 2025, and then rises more sharply to USD 3.0 billion by 2030, reaching the peak of USD 6.3 billion in 2035. This reveals a nearly seven-fold increase over the 15-year horizon.

The pacing of demand uplift illustrates two distinct phases: the early phase (2020 to 2025) where value rises from USD 0.9 billion to USD 1.8 billion a gain of USD 0.9 billion and the subsequent acceleration phase (2025 to 2035) where the bulk of the increase occurs (USD 4.5 billion). This pattern suggests the initial period serves as foundation building, while the later period captures mass adoption, higher per-unit pricing and expanded product formats. Stakeholders should focus resources on the acceleration window to maximise benefit from the peak value phase.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.8 billion |

| Forecast Value (2035) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The demand for weight loss supplements in USA is influenced by rising rates of overweight and obesity, together with growing consumer interest in quick and convenient options for managing body weight. Many individuals seek supplements as adjuncts to diet and exercise, motivated by wellness trends and appearance-related goals. Over-the-counter products that claim to suppress appetite, boost metabolism or support fat burning are widely available in retail outlets and online, reflecting both consumer interest and commercial availability.

Consumer behaviour and retail distribution also play significant roles in shaping demand. Busy lifestyles increase appeal of ready-to-take supplements, while marketing emphasises natural ingredients and clean labels to align with wellness mindsets. The availability of direct-to-consumer brands and subscription models further lowers entry barriers for users. On the supply side, price competition and proliferation of new brands create choice but also confusion, and the effectiveness of many products remains contested. Despite these limitations, demand for weight-loss supplements in USA continues at a strong pace as consumers seek accessible weight-management tools.

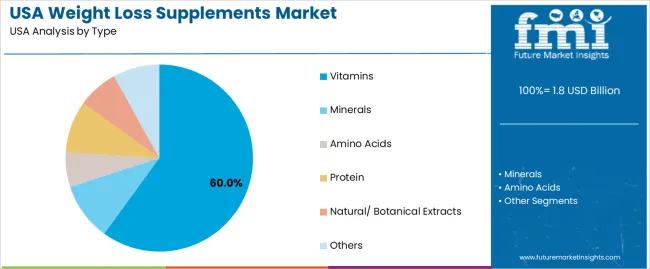

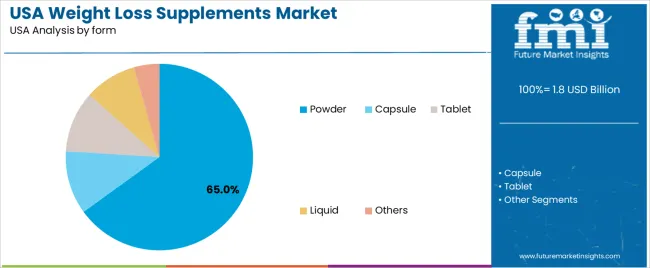

The demand for weight loss supplements in the USA is shaped by the range of supplement types and the forms in which they are consumed. Types include vitamins, minerals, amino acids, protein, natural or botanical extracts and other specialized blends that support metabolic activity or appetite management. Forms such as powders, capsules, tablets, liquids and other delivery formats influence how easily consumers incorporate these products into daily routines. As individuals pursue structured weight management strategies, the combination of diverse supplement types and convenient consumption forms guides overall demand across health-focused households and fitness-oriented buyers in the USA.

Vitamins account for 60% of total demand for weight loss supplements in the USA. Their leading position reflects widespread use of vitamin-based formulations that support energy metabolism and help maintain nutrient balance during calorie-restricted diets. Consumers often select vitamin blends to complement exercise routines and manage fatigue while pursuing weight goals. Many products combine B-complex vitamins and other essential nutrients to support daily functioning, which encourages consistent adoption. Vitamin-based supplements appeal to a broad audience because they are familiar, easy to understand and compatible with other wellness habits practiced by USA consumers.

Demand for vitamin-focused supplements is also strengthened by the prevalence of multivitamin formats designed specifically for weight management. These formulations provide structured support for users who want clear dosing and predictable intake. Vitamins are frequently included in combination products that target metabolism, hydration or appetite control, increasing their presence across retail shelves. As weight management routines remain common among adults, the reliability, accessibility and versatility of vitamins maintain their position as the most frequently chosen supplement type in this category.

Powder forms account for 65.0% of total demand for weight loss supplements in the USA. Their popularity stems from ease of mixing into beverages, shakes and meal replacements, which supports structured dieting practices. Powders allow users to adjust serving sizes and integrate supplements into morning routines or workout recovery periods. Many consumers prefer powders because they blend well with protein shakes and other functional drinks commonly used in weight management. Longer shelf life and flexible storage further contribute to frequent household use.

Demand for powder formats is reinforced by the growth of personalized nutrition and the popularity of daily smoothie preparation. Powders support concentrated nutrient delivery and can incorporate protein, amino acids or botanical extracts that appeal to fitness-oriented users. The format also enables clear labeling and straightforward customization, helping consumers align supplement intake with specific weight loss goals. As the preference for convenient, adaptable products continues to grow, powder-based supplements maintain their leading role in USA weight management routines.

Demand for weight loss supplements in the USA continues to expand as consumers pursue convenient options that support weight management alongside dietary and lifestyle changes. Increased awareness of metabolic health, wider availability through retail and online channels and interest in natural or plant-based ingredients contribute to growth. At the same time, questions around product efficacy, regulatory pressure and strong competition from prescription treatments create obstacles. These combined factors lead to steady but selective adoption across different consumer segments in the US wellness market.

American consumers are adjusting to busier routines and reduced physical activity, which encourages reliance on supplemental support for weight control. Many individuals prefer products that promise appetite regulation, energy support or metabolic balance without complex regimens. This aligns with rising health awareness driven by preventive-care messaging and digital wellness culture. The presence of these supplements in convenience stores, pharmacies and online platforms increases visibility and accessibility. As a result, interest grows among adults seeking manageable solutions that fit daily schedules.

Opportunities are expanding in plant-based formulations, clean-label products and personalised nutrition offerings. Brands that incorporate familiar natural ingredients or mild flavour profiles tend to appeal to consumers who favour simplicity and transparency. Subscription platforms and direct-to-consumer models offer additional growth potential by providing tailored product bundles and consistent delivery. These formats attract buyers who prefer structured routines. As wellness platforms and digital retail channels continue to grow, suppliers can engage niche groups with focused claims and specialised formulations.

Several constraints reduce broader adoption. Higher-priced supplements may deter cost-sensitive buyers, especially when compared with traditional dietary approaches. Some consumers remain sceptical about the effectiveness or long-term value of supplements, creating hesitation in repeat purchases. Regulatory scrutiny surrounding health claims further complicates marketing and product positioning. Competition from fitness programmes, lifestyle applications and prescription treatments also draws attention away from over-the-counter solutions. These challenges influence the pace of expansion and prevent uniform adoption across all demographic groups.

| Region | CAGR (%) |

|---|---|

| West | 15.5% |

| South | 13.9% |

| Northeast | 12.4% |

| Midwest | 10.8% |

Demand for weight loss supplements in the USA is rising across regions, with the West leading at 15.5%. Growth in this region reflects strong interest in fitness products, wide retail availability, and steady engagement in weight management routines. The South follows at 13.9%, supported by expanding consumer focus on lifestyle improvement and higher participation in nutrition programs. The Northeast records 12.4%, shaped by dense urban markets and consistent supplement purchases across pharmacies and online channels. The Midwest shows a 10.8% CAGR, influenced by gradual adoption among consumers seeking accessible options for managing body weight. Together, these regions show a broad shift toward supplement-based routines as part of general wellness habits.

West USA is projected to grow at a CAGR of 15.5% through 2035 in demand for weight loss supplements. California and neighboring states are increasingly consuming capsules, powders, and functional beverages designed to support metabolism, appetite control, and fat reduction. Retailers and e-commerce platforms offer a wide variety of products to meet health-conscious consumer demand. Manufacturers are producing plant-based, protein-enriched, and natural ingredient formulations. Rising awareness of fitness, wellness, and lifestyle health trends drives adoption. Urban centers with high disposable income and active lifestyles contribute to strong growth in weight loss supplement consumption across West USA.

South USA is projected to grow at a CAGR of 13.9% through 2035 in demand for weight loss supplements. Urban centers such as Houston, Miami, and Atlanta increasingly adopt supplements including protein powders, herbal capsules, and functional drinks. Rising health awareness, dietary control, and lifestyle-focused consumption drive adoption. Manufacturers produce natural, plant-based, and nutrient-fortified formulations to meet diverse consumer needs. Retail and e-commerce channels expand product accessibility. The combination of fitness trends, obesity management initiatives, and rising disposable income supports steady growth in weight loss supplement consumption across South USA.

Northeast USA is projected to grow at a CAGR of 12.4% through 2035 in demand for weight loss supplements. Cities including New York, Boston, and Philadelphia increasingly consume capsules, powders, and drinks aimed at fat reduction, metabolism enhancement, and appetite management. Rising awareness of wellness, active lifestyles, and preventive health measures drive adoption. Manufacturers are producing natural, plant-based, and functional ingredient formulations. Retailers and e-commerce platforms expand availability in urban and suburban areas. Health-conscious populations, urban fitness trends, and lifestyle-focused consumption ensure steady adoption of weight loss supplements throughout Northeast USA.

Midwest USA is projected to grow at a CAGR of 10.8% through 2035 in demand for weight loss supplements. Urban and suburban centers, including Chicago, Detroit, and Minneapolis, are increasingly adopting capsules, powders, and functional beverages for weight management, metabolism enhancement, and appetite control. Rising health awareness and lifestyle-focused consumption drive adoption. Manufacturers are supplying natural, plant-based, and nutrient-enriched formulations. Retail and online channels expand product accessibility in smaller cities. Fitness trends, preventive health initiatives, and urban wellness programs contribute to steady adoption of weight loss supplements across Midwest USA.

The demand for weight loss supplements in the USA is driven by rising obesity levels, increased health awareness, and a growing focus on preventive wellness. As more people seek solutions outside of pharmaceuticals, supplements that claim to support metabolism, suppress appetite, or manage fat absorption gain traction. A growing segment of consumers also looks for clean label, natural-ingredient options and convenience formats such as powders and capsules. Digital advancement and e-commerce growth make these products more accessible, while lifestyle shifts-such as sedentary work habits and increased consumption of processed foods-increase the demand for supplemental aids in weight management. These dynamics create a robust environment for the weight loss supplement segment.

Major companies shaping the USA weight loss supplement segment include Amway Corporation, Herbalife Nutrition, GNC, Glanbia Performance Nutrition Inc., and Ajinomoto Health & Nutrition. Each of these firms brings a broad portfolio of products targeting weight loss or weight-management applications, ranging from meal replacements and fat-burner formulations to ingredient supplies and functional blends. Their competitive strategies emphasise product innovation, distribution reach (including direct-selling and retail), and brand trust in the health-and-wellness ecosystem. Through partnerships, marketing and formulation expertise, these companies influence how weight-loss supplements are positioned, chosen and adopted by USA consumers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Supplement Types | Vitamins, Minerals, Amino Acids, Protein, Natural/Botanical Extracts, Others |

| Form Types | Powder, Capsule, Tablet, Liquid, Others |

| End-Use Segments | 19-40 Years, Under 18 Years, 41-50 Years, Above 50 Years |

| Distribution Channels | Supermarket/Hypermarket, Pharmacies/Drug Stores, Specialty Stores, Online Retail, Others |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Amway Corporation, Herbalife Nutrition, GNC, Glanbia Performance Nutrition Inc., Ajinomoto Health & Nutrition |

| Additional Attributes | Dollar by sales by type, form, end-use, distribution channel, and region; regional CAGR and adoption trends; functional benefits such as metabolism support, fat reduction, appetite management; clean-label and natural ingredient positioning; retail and e-commerce distribution; plant-based and nutrient-enriched formulations; subscription and direct-to-consumer models; product innovation and customization; fitness and wellness-driven consumption trends; consumer demographic targeting; pricing and promotional strategies; market expansion through multi-channel retailing. |

The global demand for weight loss supplements in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the demand for weight loss supplements in USA is projected to reach USD 6.3 billion by 2035.

The demand for weight loss supplements in USA is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in demand for weight loss supplements in USA are vitamins, minerals, amino acids, protein, natural/ botanical extracts and others.

In terms of form, powder segment to command 65.0% share in the demand for weight loss supplements in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Weight Loss Supplements Market – Growth, Demand & Health Trends

Demand for Weight Loss Supplements in Japan Size and Share Forecast Outlook 2025 to 2035

Weight Loss and Obesity Management Market Analysis - Size Share and Forecast Outlook 2025 to 2035

Canine Weight Loss Drugs Market

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Demand for Low Loss Phase Stable Cable in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA