The global Urinary Bag Market is estimated to be valued at USD 2,070.115 Million in 2025 and is projected to reach USD 3,064.276 Million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,070.115 million |

| Market Value (2035F) | USD 3,064.276 million |

| CAGR (2025 to 2035) | 4.0% |

The urinary bag market is witnessing consistent expansion driven by the rising incidence of chronic urinary disorders, an aging population, and the increasing prevalence of long-term catheterization across hospital and home care settings.

Improvements in infection prevention materials and user-centric product designs are influencing purchasing decisions among clinicians and patients alike. Manufacturers are focusing on advanced anti-reflux valves, secure drainage mechanisms, and antimicrobial components that enhance safety and usability.

Healthcare providers have demonstrated a preference for urinary bags that integrate leak-proof construction and simplified emptying systems, aligning with infection control guidelines emphasized in recent clinical publications. Regulatory authorities have supported innovation through streamlined pathways for product upgrades, which has accelerated the introduction of improved designs.

The market outlook is expected to be further strengthened by rising awareness campaigns about continence care, increased reimbursement coverage for home-use drainage solutions, and technological integration such as urine output monitoring features.

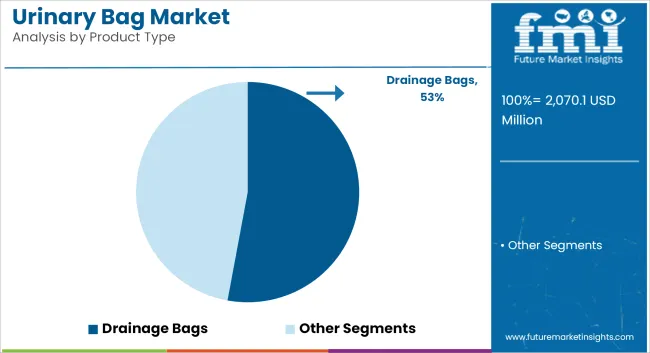

In 2025, drainage bags are anticipated to hold a 52.9% revenue share in the urinary bag market. This segment’s leadership has been driven by their critical role in managing urinary incontinence and supporting long-term catheterized patients.

Clinical preferences have favored drainage bags due to their capacity for continuous urine collection and reduced risk of overflow incidents, which has contributed to their widespread adoption across acute care, long-term care, and home care settings. Enhanced features such as anti-reflux valves, clear volume markings, and closed drainage systems have been integrated to improve infection control and simplify usage.

Reimbursement support and clinician training initiatives have further reinforced demand, while manufacturers have prioritized investments in high-quality materials to enhance patient comfort and compliance. These factors collectively have established drainage bags as the cornerstone of the product segment in urological management.

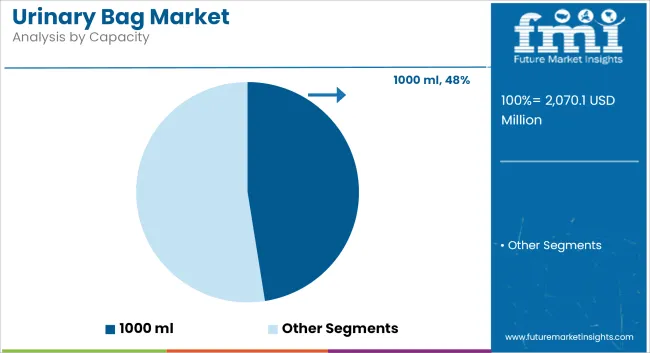

The 1000 ml capacity segment is projected to account for 47.5% of the market share in 2025. Its prominence has been attributed to the optimal balance it offers between capacity and portability, meeting clinical requirements for safe urine collection without frequent emptying. Healthcare providers have demonstrated strong preference for 1000 ml bags in both hospital and home care settings due to reduced handling frequency and minimized spillage risks.

Design improvements have included reinforced hanger systems and advanced drainage ports that enhance convenience and patient independence. Regulatory approvals have consistently supported this capacity configuration, further validating its safety and efficacy in long-term use. The segment has also benefited from the standardization of care protocols recommending mid-range capacities for patients requiring moderate drainage volumes, securing its role as the preferred choice in the

Risk of Infections and Hygiene Maintenance

One major challenge in the urinary bag market is how to make certain sure its hygienic use prevents urinary tract infections (UTIs) and other complications. Inadequate maintenance of catheters and over-long use of bags can mean bacterial growth, imperilling the patient.

Product Comfort and Discreetness

Due to uncomfortable and ungainly volumes, patients often new find themselves self-conscious about urinary bags. Manufacturers keep iterating design options that combine effectiveness, comfort, and a discreet manner.

Aging Population and Increase in Chronic Conditions

As the world’s population grows older and conditions related to urology such as incontinence, bladder cancer and so on become more frequent, the demand for urinary bags is increasing dramatically. In-home care is a big contributor to this growth in market expansion.

Product Innovation and Sustainability

Improved performance has come from developments in anti-reflux valves, odour control and user-friendly taps. Also, with an eye fashionable 'green ' materials and reusable products to meet new global protection trends.

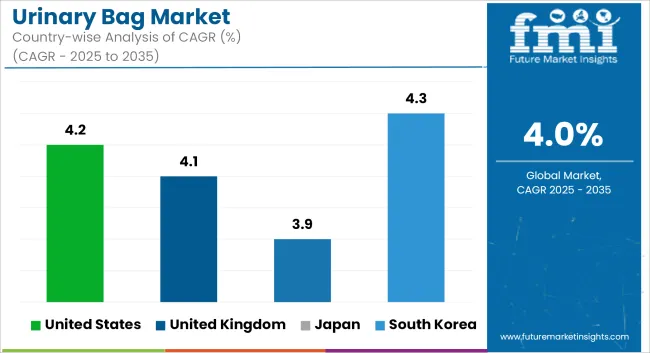

The United States' urinary bag market has been increase strong growth for years, with continence-related diseases and chronic urological conditions becoming more common. The high average age of population after decades in America, and a rising number of surgical procedures are some key drivers that brought about growing demand for urinary collection devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

The urinary bag market in the United Kingdom has been growing steadily, with increased awareness and improvements in home healthcare services. Government support for care over the long-term and a growing geriatric demographic contribute to this growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The urinary bag market in the European Union is steadily increasing, powered by an aging population and the presence of threat diseases like prostate cancer or neurogenic bladder. Both better medical facilities and favourable reimbursement policies help the market grow, while companies get free loans to assist during this time.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

Japan’s urinary bag market is seeing moderate growth, supported by one of the world’s most rapidly aging populations and a high incidence of urological and post-surgical care requirements. Demand is increasing for compact, discreet, and ergonomically designed urinary bags that cater to both hospital and homecare segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea's urinary bag market is growing, with the demand for urological devices being driven by patients themselves and an increased emphasis on cleanliness and comfort in long-term care settings. Technological advances and greater awareness are fuelling adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The urinary bag market is moderately consolidated, with competition driven by innovation in anti-reflux mechanisms, user comfort features, and infection prevention solutions. Leading manufacturers are investing in high-quality materials, ergonomic designs, and advanced drainage valves to improve patient experience in acute care, long-term care, and home settings. Strategic acquisitions, regional distribution agreements, and product line extensions are central to sustaining market share and expanding global reach.

Additionally, rising incidence of chronic urinary retention, incontinence, and increasing surgical volumes are fueling demand across hospital and outpatient environments. Emphasis on closed-system drainage, antimicrobial coatings, and convenient emptying mechanisms is shaping competitive differentiation.

Key Segments

In December 2024, Teleflex introduced a line of closed-system urinary collection bags with advanced anti-reflux valves designed to reduce catheter-associated urinary tract infections (CAUTI).

In February 2024, Mexple has launched its revolutionary UroMen and UroWomen urine collection kits, designed for male and female incontinence. These innovative products combine advanced design, comfort, and functionality to meet the growing demand for superior home medical care, significantly enhancing the user experience.

The overall market size for Urinary Bag market was USD 2,070.115 Million in 2025.

The Urinary Bag market is expected to reach USD 3,064.276 Million in 2035.

Increasing prevalence of urinary incontinence, rising aging population, post-surgical care needs, and growing demand for convenient, high-capacity urinary solutions will drive the urinary bag market during the forecast period.

The top 5 countries which drives the development of Urinary Bag market are USA, European Union, Japan, South Korea and UK.

Drainage Bags demand supplier to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA