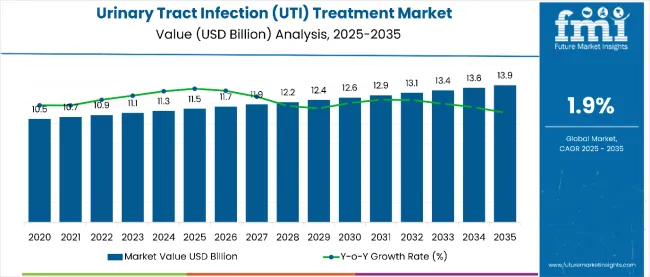

The urinary tract infection (UTI) treatment market has grown steadily in recent years. In 2025, it reached a value of USD 11.5 billion. By 2035, it is projected to rise to USD 13.9 billion. This shows a moderate growth rate of 1.9% per year. Demand is increasing due to more infections in older adults, women, and children.

Repeated UTIs are also adding to treatment volumes. In 2025, antibiotic resistance and new treatment rules pushed focus toward safer, targeted options. Drug companies are updating their antibiotic products. They aim to lower side effects and improve results, especially for tough-to-treat infections. Mixed drug therapies are being adjusted to increase safety and effectiveness.

In 2024, Bayer launched an AI-based digital tool. It helps women track UTI symptoms and follow treatment plans. It also gives reminders and tips to reduce repeat infections. At the same time, a Japanese startup released a home urine test kit. It uses color sensors and phone AI to spot UTIs early and prompt action. More companies are working on non-antibiotic options.

These include natural aids like cranberry extract and D-mannose, along with products that boost immunity. This shift helps cut antibiotic use and matches WHO guidelines for responsible treatment. Novartis’ Head of Infectious Diseases shared this outlook: “The future of infection control lies in tailored therapies based on microbial profiling. Precision medicine isn’t just for cancer-it’s becoming vital in everyday infections like UTI.”

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11.5 billion |

| Industry Value (2035F) | USD 13.9 billion |

| CAGR (2025 to 2035) | 1.90% |

Immune system modulation plays a crucial role in UTI treatment, particularly for individuals with recurrent infections, as it helps regulate the body’s immune response. Researchers are exploring several potential therapies to enhance immune function and reduce infection frequency

Antibiotic resistance is significantly reshaping the UTI treatment market, as bacteria evolve to resist commonly used antibiotics. Resistance mechanisms such as enzyme production, efflux pumps, mutations, and horizontal gene transfer are rendering traditional antibiotics less effective, leading to increased treatment failure. This trend is pushing healthcare providers toward stronger, more expensive antibiotics, further complicating treatment protocols and escalating healthcare costs.

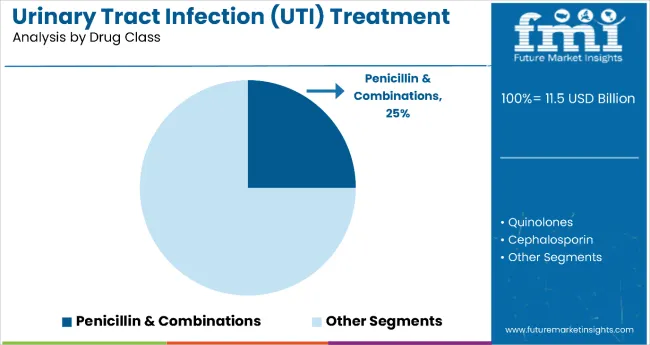

The penicillin & combinations segment accounts for 25% share. Penicillin and its combinations are preferred for urinary tract infection (UTI) treatment because of their proven effectiveness against common bacterial pathogens, particularly Escherichia coli, which is a primary cause of UTIs.

These antibiotics work by inhibiting bacterial cell wall synthesis, leading to effective bacterial elimination. Combinations such as amoxicillin with clavulanic acid enhance the antibiotic’s spectrum by overcoming resistance mechanisms like beta-lactamase production.

They are generally well-tolerated, have a favorable safety profile, and are available in oral and injectable forms, offering flexibility in treatment.

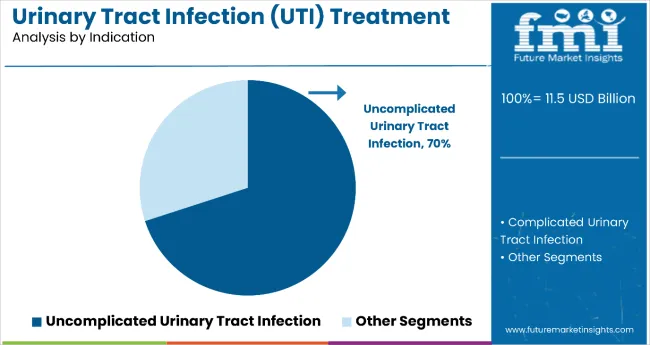

Uncomplicated urinary tract infections (UTIs) accounted for approximately 70% of all UTI cases in 2025. These infections primarily affect healthy, non-pregnant women, with contributing factors including hormonal influences and the anatomical structure of the female urinary tract. The mainstay treatments for uncomplicated UTIs include nitrofurantoin, fosfomycin, and trimethoprim-sulfamethoxazole.

These medications are effective in resolving infections and often help prevent recurrence. However, increasing resistance to traditional antibiotics has shifted clinical practice towards one-dose and short-course therapies, which improve patient adherence and reduce the risk of developing further resistance.

Telehealth platforms are increasingly integrating smart diagnostic tools to predict UTIs, facilitating remote patient care. In countries like the USA and the UK, online prescriptions are commonly provided, especially for women under 50 years of age. Pharmaceutical companies such as GSK and Pfizer are investing in innovative drug delivery methods that target the bladder directly, thereby minimizing systemic side effects.

Preventive care is also gaining traction in the market. The use of probiotics and pH-balanced hygiene products is becoming widespread, supported by studies demonstrating that maintaining a healthy balance of natural microbiota can lower the risk of UTIs. Consequently, there is a growing emphasis on treatments designed to prevent UTIs in a holistic and natural manner.

The urinary tract infection (UTI) treatment demonstrated sluggish yet positive expansion, achieving a CAGR of 2.1% from 2020 to 2024. In response to the growing challenge of multi-drug resistant bacteria, most pharmaceutical companies are actively engaged in the development of antibiotics containing more than one Active Pharmaceutical Ingredient (API).

This strategy not only addresses resistance concerns but also widens the spectrum of drug activity. There is a notable emphasis on the creation of new drugs to combat uncontrolled UTI infections, reflecting a commitment to advancing therapeutic options.

The acceptance of combination products among physicians on a global scale is a significant trend contributing to the anticipated growth of the UTI treatment market in the forecast period. This approach is gaining widespread acknowledgment and is poised to be a key driver for market expansion.

The approval of new dosage forms of existing drugs by the USA Food and Drug Administration (FDA) is identified as a pivotal factor expected to propel the development of the urinary tract infection therapeutics market in the foreseeable future. The introduction of novel formulations enhances treatment options and addresses evolving patient needs.

An intriguing trend in the UTI treatment landscape is the increasing popularity of herbal medicines across different regions. The adoption of herbal remedies for UTI treatment is gaining traction, contributing to the diversification of therapeutic approaches and potentially impacting market dynamics.

The scope for urinary tract infection (UTI) treatment is predicted to increase at a CAGR of 1.9% from 2025 to 2035, with the global market expected to reach a valuation of USD 13.84 billion by 2035.

| Historical CAGR from 2020 to 2024 | 2.1% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 1.9% |

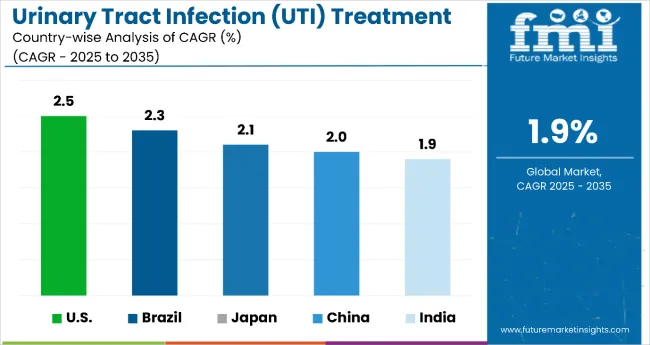

The following table shows the top five countries by revenue, led by the United States and Brazil. The extent of investment in healthcare infrastructure and the overall expenditure on healthcare play pivotal roles in determining the accessibility and uptake of treatments for urinary tract infections (UTIs) in the United States.

Elevating awareness levels among healthcare professionals and the general public regarding symptoms, prevention strategies, and appropriate treatment for urinary tract infections (UTIs) has the potential to contribute positively to the growth of the market in Brazil.

| India | 1.9% |

|---|---|

| The United States | 2.5% |

| China | 2.0% |

| Japan | 2.1% |

| Brazil | 2.3% |

The urinary tract infection treatment market in the United States is expected to witness a CAGR of 2.5% by 2035. The overall prevalence of urinary tract infections in the United States can influence the demand for UTI treatments in the country.

Advances in medical technology, including diagnostic tools and treatment options, can drive the growth of the UTI treatment market by offering more effective and efficient solutions.

The rising concerns about antibiotic resistance may drive the development of new and innovative treatments for UTIs in the United States. The level of investment in healthcare infrastructure and overall healthcare spending can influence the accessibility and adoption of UTI treatments

The urinary tract infection (UTI) treatment market in China is expected to account for a CAGR of 2.0% through 2035. China's large population contributes to a high number of UTI cases.

As the population ages, there may be an increased prevalence of UTIs, driving the demand for treatment. The rising investments in healthcare infrastructure and facilities can improve access to healthcare services, including the diagnosis and treatment of UTIs.

Increased awareness among both healthcare providers and the general population about the importance of early diagnosis and proper treatment of UTIs can drive market growth. Government initiatives and policies related to healthcare and pharmaceuticals can play a significant role in shaping the market landscape for UTI treatments.

Urinary Tract Infection (UTI) Treatment market in Japan is expected to grow with a CAGR of 2.1% during 2025 to 2035. The presence of a robust healthcare system and high healthcare standards contribute to a well-established and sophisticated UTI treatment market in the country. Japan’s well-developed healthcare infrastructure facilitates access to medical services, including the diagnosis and treatment of UTIs.

The presence of a strong pharmaceutical industry in Japan may contribute to research and development activities, leading to the introduction of new and improved UTI treatment options.

A well-informed population and healthcare professionals may contribute to early detection and treatment of UTIs, potentially influencing market growth.

The urinary tract infection (UTI) treatment market in Brazil is expected to account for a CAGR of 2.3% through 2035. The overall prevalence of UTIs in Brazil is a key factor influencing the demand for UTI treatments.

Factors such as lifestyle, hygiene practices, and environmental conditions can contribute to UTI incidence. Increasing awareness among both healthcare providers and the general population about UTI symptoms, prevention, and proper treatment can positively influence market growth.

India's large and growing population contributes to a substantial number of healthcare cases, including urinary tract infections. The sheer volume of cases can drive demand for UTI treatments. Rising healthcare awareness among the Indian population, coupled with improved education on hygiene practices, may lead to early detection and treatment of UTIs, contributing to market growth.

The growing government initiatives focused on healthcare improvement, access to medical services, and infectious disease management can significantly impact the UTI treatment market. The urinary tract infection (UTI) treatment market in India is expected to account for a CAGR of 1.9% through 2035.

Companies within the urinary tract infection treatment market are strategically engaging in partnerships, collaborations, and occasional divestitures of business divisions. These actions are undertaken to sustain and strengthen their competitive positions within the market.

Product Portfolio

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.5 billion |

| Projected Market Size (2035) | USD 13.9 billion |

| CAGR (2025 to 2035) | 1.90% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million prescriptions for volume |

| Drug Classes Analyzed (Segment 1) | Penicillin & Combinations, Quinolones, Cephalosporin, Aminoglycoside Antibiotics, Sulphonamides, Azoles and Amphotericin B, Tetracycline, Nitrofurans, Others |

| Indications Analyzed (Segment 2) | Complicated, Uncomplicated |

| Distribution Channels Analyzed (Segment 3) | Hospital Pharmacies, Gynecology and Urology Clinics, Drug Stores, Retail Pharmacies, Online Drug Stores |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the UTI Treatment Market | Allergan, Bayer AG, Pfizer, GlaxoSmithKline, Bristol-Myers Squibb Company, Janssen Global Services, Lupin Ltd, Merck & Co., Almirall, S.A, Dr. Reddy’s Laboratories Ltd. |

| Additional Attributes | Sales growth by drug class and indication, Distribution trends across pharmacies and clinics, Market penetration of online drug stores, Regional prevalence and treatment protocols, Emerging therapies and resistance management strategies |

| Customization and Pricing | Customization and Pricing Available on Request |

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 20: Latin America Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 28: Western Europe Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 30: Western Europe Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 52: East Asia Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 54: East Asia Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by Drug Class, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Indication, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by Indication, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Indication, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 10: Global Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 14: Global Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Drug Class, 2024 to 2034

Figure 22: Global Market Attractiveness by Indication, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Indication, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 34: North America Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 38: North America Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Drug Class, 2024 to 2034

Figure 46: North America Market Attractiveness by Indication, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Indication, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 58: Latin America Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 62: Latin America Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Drug Class, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Indication, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Indication, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Drug Class, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Indication, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Indication, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Drug Class, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Indication, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Indication, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Drug Class, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Indication, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Indication, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 154: East Asia Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 158: East Asia Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Drug Class, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Indication, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Drug Class, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Indication, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by Drug Class, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Indication, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by Indication, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Indication, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Indication, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Drug Class, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Indication, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

As of 2025, the market for urinary tract infection (UTI) treatment is expected to be valued at USD 11.46 billion.

By 2035, the market value of urinary tract infection (UTI) treatment is expected to reach USD 13.84 billion.

From 2025 to 2035, urinary tract infection (UTI) treatments are expected to flourish at a CAGR of 1.9%

The Uncomplicated (UTI) segment is expected to account for a market share of 76.2% in 2025.

The United States is likely the top-performing market, with a CAGR of 2.5%.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA