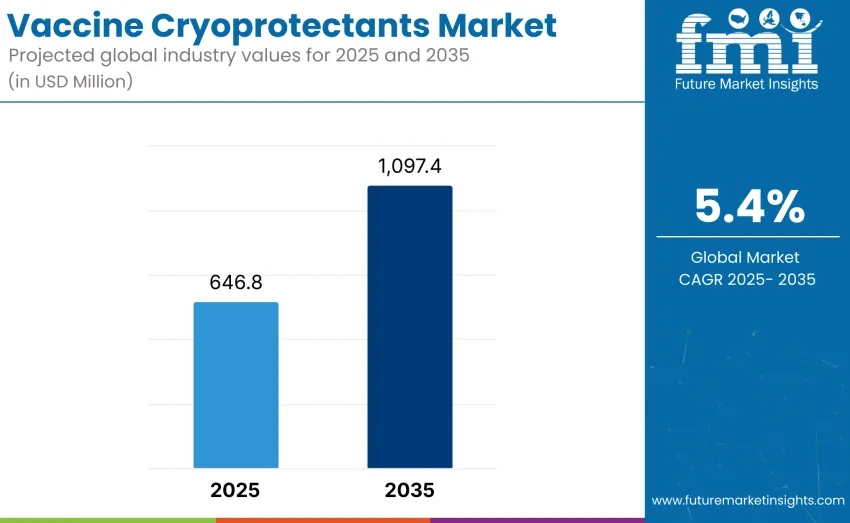

The global vaccine cryoprotectants market is expected to reach USD 1,097.4 million by 2035, recording an absolute increase of USD 450.6 million over the forecast period. This market is valued at USD 646.8 million in 2025 and is likely to grow at a CAGR of 5.4% over the assessment period. Growth is projected to record a compound annual growth rate of 5.4 percent, driven by increasing demand for advanced vaccine preservation solutions and rising investments in cold-chain infrastructure worldwide.

Expansion is expected to be supported by an increased focus on vaccine stability and extended shelf life, particularly for temperature-sensitive biologics. Adoption of cryoprotectants is being recognized as a critical strategy to maintain efficacy and potency of vaccines during storage and transportation. Innovations in cryoprotectant formulations, including development of polysaccharide-based and amino acid-based stabilizers, are projected to enhance growth by providing enhanced preservation of vaccine integrity under ultra-low temperature conditions.

Technological advancements in cryopreservation techniques are projected to influence dynamics. Modern cryoprotectants are designed to minimize ice crystal formation, maintain protein structure, and reduce degradation of sensitive vaccine components, supporting production and distribution of high-quality immunization products. Integration of cryoprotectants into scalable vaccine manufacturing processes is expected to enhance operational efficiency and reduce product loss, strengthening demand.

Between 2025 and 2030, the vaccine cryoprotectants market is projected to expand from USD 646.8 million to USD 842.5 million, resulting in a value increase of USD 195.7 million, which represents 43.4% of total forecast growth for the decade. This phase of development will be shaped by rising demand for stable, long-term vaccine storage solutions and expanding global immunization programs, innovation in cryoprotectant formulations and stability enhancement technologies, as well as increasing integration with advanced cold-chain logistics and automated storage systems.

From 2030 to 2035, growth is forecast from USD 842.5 million to USD 1,097.4 million, adding USD 254.9 million, constituting 56.6% of overall ten-year expansion. This period is expected to be characterized by development of specialized cryoprotectant solutions for mRNA, viral vector, and protein-based vaccines, strategic collaborations between cryoprotectant manufacturers and vaccine developers, and enhanced focus on sustainable production practices and energy-efficient cold-chain integration. Growing focus on global vaccination programs, pandemic preparedness, and advanced vaccine preservation will drive demand.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 646.8 million |

| Market Forecast Value (2035) | USD 1,097.4 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The global vaccine cryoprotectants market is driven by increasing demand for advanced vaccine preservation solutions that enhance stability and extend shelf life during storage and transportation. Growth has been supported by rising scale of vaccine production and distribution, where cryoprotectants are applied to maintain potency under ultra-low temperature conditions. Adoption has been accelerated by improvements in cryoprotectant formulations, which allow vaccines to remain stable across diverse platforms, including mRNA, viral vector, and protein-based vaccines.

Technological innovation and formulation enhancements have allowed manufacturers to differentiate their offerings and meet growing demand from commercial vaccine producers, contract research organizations, and biobanking facilities. Increased investment in manufacturing capacity and cold-chain capabilities in emerging markets has facilitated deployment of cryoprotectants at global scale. These factors have driven worldwide expansion and are expected to sustain growth throughout the forecast period.

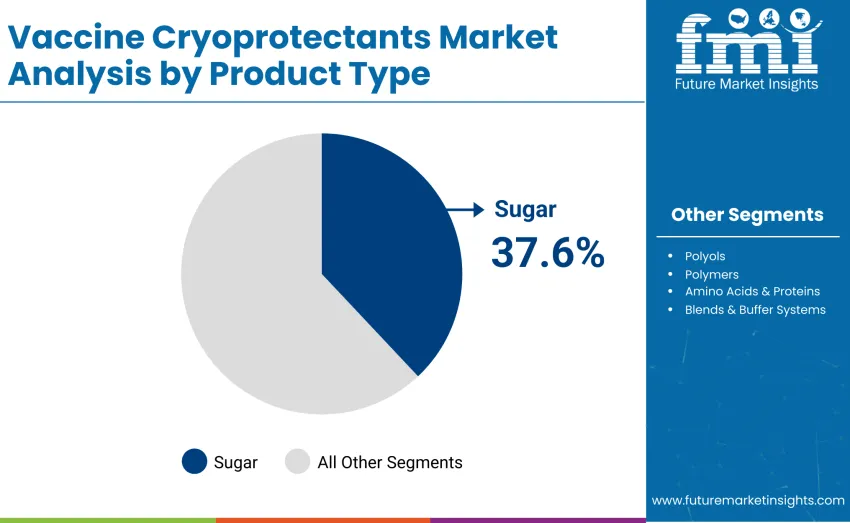

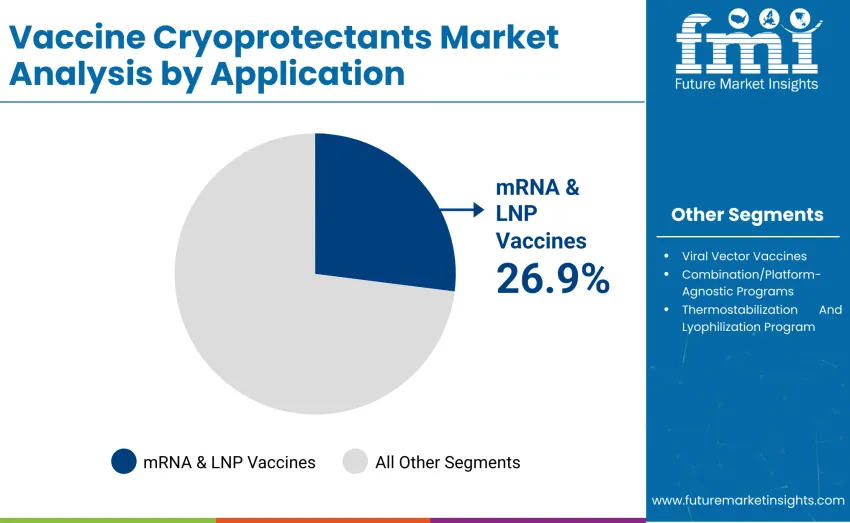

The vaccine cryoprotectants market is segmented by product type, application, and region. By product type, division includes sugars, polyols, amino acids & proteins, polymers, and blends & buffer systems. Based on application, categorization covers mRNA & LNP vaccines, viral vector vaccines, protein subunit & inactivated vaccines, live-attenuated & oral vaccines, and thermostabilization & lyophilization programs. Regionally, segmentation spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The sugars segment represents the dominant force, capturing a 37.6% share of total revenue in 2025. This category encompasses widely used cryoprotective agents such as sucrose and trehalose, which are applied to stabilize vaccine formulations during ultra-low temperature storage and freeze-drying processes. Leadership stems from critical role in maintaining vaccine potency, protecting protein structures, and preventing aggregation during cryopreservation, ensuring efficacy across diverse vaccine platforms.

The polyols segment maintains substantial share, serving applications where enhanced stabilization, glass formation, and moisture retention are required for mRNA, viral vector, and protein-based vaccines. Amino acids & proteins constitute another key segment, providing targeted stabilization of labile vaccine components, reducing structural degradation, and enhancing thermal tolerance. Polymers are employed in specialized formulations to improve viscosity, structural integrity, and long-term stability, while blends & buffer systems offer multifunctional protection by combining complementary cryoprotectants.

Key advantages driving the sugars segment include:

The mRNA & LNP vaccines segment dominates with a 26.9% share in 2025, reflecting rapid expansion of mRNA vaccine development and distribution worldwide. Leadership is reinforced by widespread adoption among commercial vaccine manufacturers, contract research organizations, and biopharmaceutical companies, where cryoprotectants are applied to preserve lipid nanoparticle integrity, enhance thermal stability, and maintain vaccine potency during ultra-low temperature storage and transport.

The viral vector vaccines segment holds substantial share through applications in adenovirus-based and other viral vector vaccines, where cryoprotectants support structural stability, reduce aggregation, and ensure consistent efficacy across production batches. Protein subunit & inactivated vaccines represent another key segment, utilizing cryoprotectants to protect labile proteins, prevent denaturation, and enable reliable freeze-drying processes. Live-attenuated & oral vaccines segment relies on cryoprotectants to maintain virus viability during long-term storage, distribution, and thermostabilization programs.

Key market dynamics supporting application preferences include:

The global vaccine cryoprotectants market experiences sustained growth, underpinned by increasing scale of vaccine production, expanding global immunization programs, and rising demand for long-term preservation solutions. Technological progress in cryoprotectant formulation and improved cold-chain logistics has enabled maintenance of vaccine potency under ultra-low temperature conditions, facilitating broader adoption across commercial manufacturers, contract research organizations, and public health initiatives. Government policies promoting vaccine accessibility and regulatory support for advanced preservation technologies have reinforced expansion.

Expansion faces constraints from high production and formulation costs, particularly for advanced cryoprotectants tailored to sensitive vaccine platforms. Stringent regulatory requirements for efficacy validation across diverse vaccine types and complex freeze-drying compatibility issues pose challenges. Cold-chain dependency and limited ultra-low temperature storage capacity in emerging regions can restrict adoption, while technical complexities related to large-scale vaccine stabilization continue to hinder operational efficiency.

Emerging trends include development of platform-specific and multifunctional cryoprotectant formulations, with blends and buffer systems being optimized for structural integrity, pH maintenance, and thermal stress resistance. Thermostabilization programs are gaining prominence, reducing reliance on energy-intensive cold-chain infrastructure and enabling wider distribution in resource-constrained regions. Strategic collaborations between cryoprotectant manufacturers, vaccine developers, and logistics providers are increasingly pursued to co-develop integrated solutions.

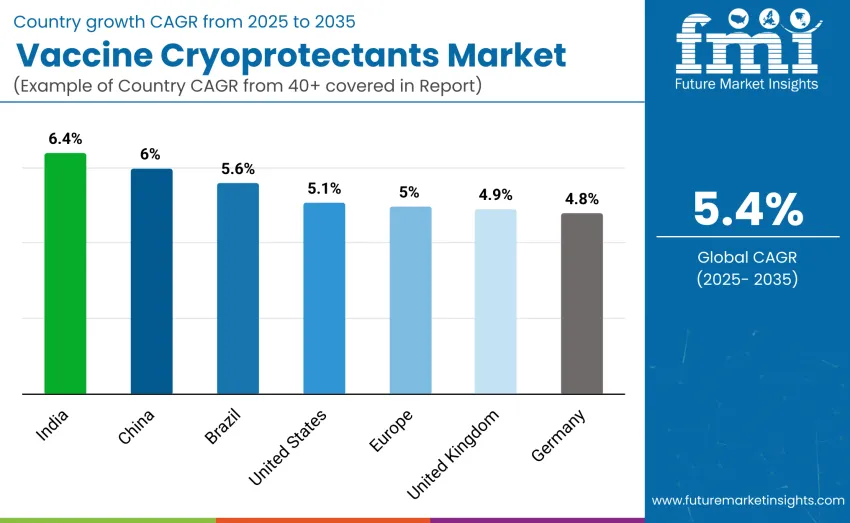

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

| Brazil | 5.6% |

| China | 6.0% |

| India | 6.4% |

| Europe | 5.0% |

| Germany | 4.8% |

| United Kingdom | 4.9% |

The vaccine cryoprotectants market is expanding globally, with India leading at a 6.4% CAGR due to strong immunization programs, biotechnology growth, and adoption of advanced cryoprotectants. China follows at 6.0%, driven by rapid vaccine manufacturing expansion and investment in cold-chain systems. Brazil records 5.6% growth supported by increased vaccine production and public health initiatives. The USA shows a 5.1% CAGR, reflecting its mature vaccine ecosystem and advanced cryoprotection technologies. Europe grows at 5.0%, with Germany at 4.8% and the UK at 4.9%, driven by research strength and regulatory-supported adoption.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential with a CAGR of 6.0% through 2035. Leadership is supported by government-led healthcare modernization programs, rapid expansion of biotechnology clusters, and industrial adoption of advanced cold-chain logistics for vaccine storage and transport. Growth concentrates in major metropolitan and industrial regions, including Beijing, Shanghai, Shenzhen, and Hangzhou, where research institutes, hospitals, and vaccine manufacturers are implementing state-of-the-art cryoprotectants to improve vaccine stability and shelf-life.

Strategic policy initiatives, including the Made in China 2025 program and targeted subsidies for cold-chain infrastructure, have accelerated adoption among domestic producers. Partnerships between public research institutions and private enterprises have enabled technology transfer, workforce development, and regulatory compliance. Extensive government programs have been implemented to modernize healthcare facilities and integrate advanced vaccine storage systems, ensuring that hospitals, research institutes, and distribution hubs are equipped with state-of-the-art cryoprotectant solutions.

In India, the vaccine cryoprotectants market is projected to grow at a CAGR of 6.4% through 2035. Expansion is supported by large-scale development of cold-chain infrastructure across hospitals, clinics, and rural health centers to improve vaccine accessibility. Government programs, such as the National Vaccine Development Program, provide financial incentives, grants, and low-interest loans to facilitate acquisition of advanced cryoprotectants. Local manufacturing capacity has been enhanced through public-private partnerships and technology transfer agreements.

Regional production hubs in Bangalore, Hyderabad, Mumbai, and Pune have strengthened logistics efficiency, ensuring temperature-stable vaccine delivery. Nationwide immunization campaigns and increased public awareness regarding vaccine importance have stimulated demand for cryoprotectants in both urban and semi-urban healthcare facilities. Significant investments have been made to establish temperature-controlled storage and transport networks in major cities and peripheral healthcare centers, improving vaccine accessibility and reliability across diverse populations.

Germany's vaccine cryoprotectants market is expected to grow at a CAGR of 4.8% through 2035. Expansion is driven by advanced engineering practices in pharmaceutical manufacturing, compliance with strict EU regulatory standards, and sustainability initiatives in cold-chain management. Key biotechnology and research clusters in Berlin, Munich, Hamburg, and Frankfurt have facilitated integration of advanced cryoprotectants in vaccine storage and transport.

Collaborative research programs between universities, research institutes, and private companies have accelerated innovation, optimized logistics, and enhanced workforce expertise. Focus on energy-efficient cold-chain facilities and precision monitoring technologies has ensured product stability and operational efficiency, supporting adoption across professional healthcare and research settings. German pharmaceutical and biotechnology companies leverage advanced engineering practices to integrate cryoprotectants into vaccine production, storage, and logistics systems, enhancing operational efficiency and reliability.

Brazil's vaccine cryoprotectants market is projected to grow at a CAGR of 5.6% through 2035, supported by expansion of healthcare infrastructure and modernization of cold-chain systems. Urban centers such as São Paulo, Rio de Janeiro, Brasília, and Porto Alegre are focal points for implementing advanced storage solutions in hospitals and vaccination centers. Government subsidies and financial assistance programs have incentivized both public and private adoption of cryoprotectants.

Partnerships with international technology providers have improved temperature stability, storage efficiency, and compliance with quality standards. Nationwide vaccination campaigns and public awareness initiatives have increased demand for reliable cold-chain logistics and cryoprotectant solutions. Major metropolitan regions have seen significant infrastructure development to support temperature-controlled vaccine storage and distribution networks while public financial support and procurement schemes encourage both private and public healthcare providers to adopt advanced cryoprotectants.

The United States vaccine cryoprotectants market is expected to grow at a CAGR of 5.1% through 2035. Growth is driven by advanced research capabilities in pharmaceutical and biotechnology sectors, coupled with automation and digitalization of cold-chain logistics. Key biotech clusters in California, Massachusetts, New Jersey, and Texas have enabled large-scale adoption of cryoprotectants in vaccine production, storage, and transport.

Collaboration between private manufacturers and academic research institutions has facilitated process optimization, regulatory compliance, and workforce skill development. Mature distribution networks and national immunization programs ensure reliable availability of cryoprotectants across urban and rural healthcare facilities, supporting sustained expansion. Leading pharmaceutical and biotech clusters have incorporated cryoprotectants into sophisticated vaccine development and production processes to enhance stability and efficacy while extensive adoption of automated monitoring and temperature-controlled storage systems ensures high operational efficiency.

The United Kingdom's vaccine cryoprotectants market is projected to grow at a CAGR of 4.9% through 2035. Expansion is driven by presence of leading biomedical research hubs in London, Cambridge, and Oxford, where cryoprotectants are integrated into vaccine research and cold-chain systems. Public health programs and government-funded initiatives have promoted adoption in hospitals, laboratories, and vaccination centers.

Partnerships between private biotech companies and research institutions have facilitated technology transfer, professional training, and workflow optimization. Established distribution infrastructure ensures consistent supply and delivery across regional healthcare networks, while national immunization campaigns sustain demand for temperature-stable vaccine storage solutions. Universities and research centers have implemented cryoprotectants in research pipelines and hospital storage systems, facilitating advanced vaccine handling and quality assurance across the expanding healthcare network.

The vaccine cryoprotectants market in Europe is projected to grow from USD 169.5 million in 2025 to USD 273.3 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain leadership with a 28.5% share in 2025, declining slightly to 27.8% by 2035, driven by advanced pharmaceutical infrastructure, robust biotechnology clusters, and well-established cold-chain logistics in Berlin, Munich, and Hamburg.

France follows with a 22.3% share in 2025, increasing to 22.6% by 2035, supported by extensive vaccine production capabilities in Paris and Lyon, government immunization programs, and research investments in cryoprotectant integration. The United Kingdom holds a 19.5% share in 2025, rising to 19.8% by 2035, underpinned by national vaccination initiatives, modern biomedical research hubs, and strong collaboration between public health authorities and private biotech companies.

Italy maintains a 13.2% share across the period, enabled by regional healthcare networks, biotechnology partnerships, and focus on cold-chain efficiency. Spain accounts for 9.5% in 2025, reaching 9.7% by 2035, reflecting expansion of hospital storage systems and training programs for vaccine handling. The Netherlands maintains a 6.8% share, while the Rest of Europe grows from 7.0% to 7.2%, supported by enhanced cold-chain adoption in Nordic and Central & Eastern European countries.

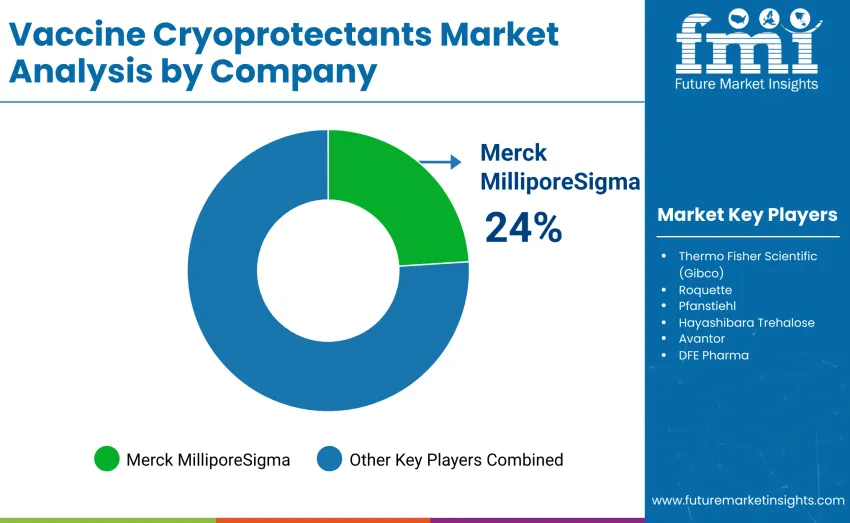

The global vaccine cryoprotectants market is moderately concentrated, with 12-15 players shaping competitive dynamics through formulation quality, cryogenic stability, regulatory compliance, and distribution strength rather than cost competitiveness alone. The top three companies hold over half the global share, led by Merck MilliporeSigma, which now accounts for 24% of the market. Its leadership is driven by advanced stabilizer technologies, including trehalose, polyol-based formulations, and deep technical expertise supporting vaccine preservation workflows. Thermo Fisher Scientific (Gibco), Roquette, and Pfanstiehl also maintain strong positions through high-purity cryoprotectant formulations, process integration capabilities, and robust regional distribution networks designed to support precise cold-chain management.

Mid-tier challengers such as Hayashibara and Avantor gain traction through specialized formulations and environmentally sustainable production practices tailored to niche applications. Meanwhile, emerging manufacturers across Asia increasingly intensify competition with rapid product development cycles, cost-effective cryoprotectants, and partnerships with local distributors, especially in price-sensitive regions such as India, Southeast Asia, and Latin America. Market dynamics increasingly favor companies that combine proven cryoprotectant performance with strong technical support, cold-chain integration services, and professional training programs, ensuring consistent adoption within hospitals, research laboratories, and large-scale vaccine manufacturing facilities.

| Items | Values |

|---|---|

| Quantitative Units | USD 646.8 million |

| Product Type | Sugars, Polyols, Amino Acids & Proteins, Polymers, Blends & Buffer Systems |

| Application | mRNA & LNP Vaccines, Viral Vector Vaccines, Protein Subunit & Inactivated Vaccines, Live-Attenuated & Oral Vaccines, Thermostabilization & Lyophilization Programs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | Merck MilliporeSigma, Thermo Fisher Scientific ( Gibco ), Roquette, Pfanstiehl, Hayashibara (Nagase), Avantor, DFE Pharma, SPI Pharma, Cytiva, Others |

| Additional Attributes | Dollar sales by product type and application, regional trends across North America, Europe, Asia Pacific, and Latin America, competitive landscape of vaccine cryoprotectant manufacturers, technical specifications, cold-chain integration, automated handling compatibility, and innovations in formulation stability, thermal protection, and specialized solutions for enhanced vaccine preservation and transport reliability |

The global vaccine cryoprotectants market is valued at USD 646.8 million in 2025.

The market is projected to reach USD 1,097.4 million by 2035.

The market will grow at a CAGR of 5.4% from 2025 to 2035.

Sugars lead the market with a 37.6% share in 2025.

Key players include Merck MilliporeSigma, Thermo Fisher Scientific (Gibco), Roquette, Pfanstiehl, Hayashibara, Avantor, DFE Pharma, SPI Pharma, and Cytiva.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vaccine Residual Process Reagents Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Preservatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Vial Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Transport Carrier Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Shippers Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Vaccine Packaging Market Growth - Demand & Forecast 2024 to 2034

Vaccine Ampoules Market

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Live Vaccines Market

Swine Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Covid Vaccine Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Covid Vaccine Packaging Manufacturers

Nasal vaccines Market

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Dengue Vaccines Analysis by Product Type by Product, By Age Group and by Distribution Channel through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA