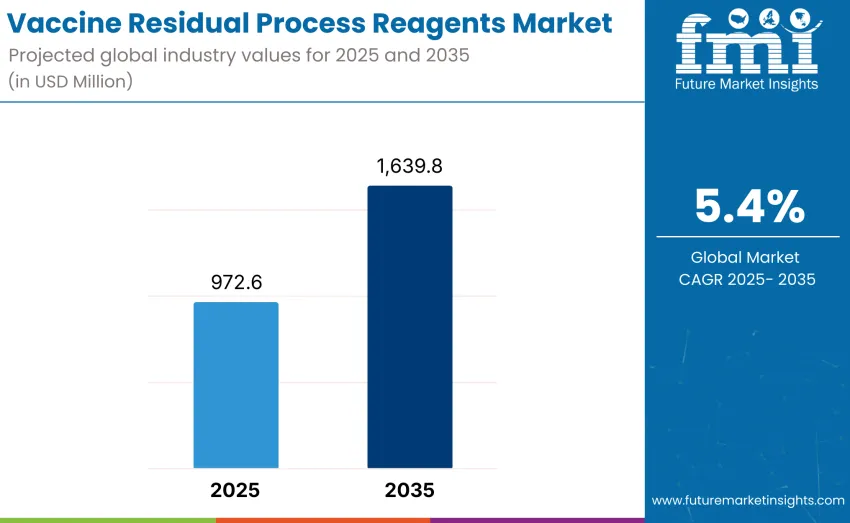

The global vaccine residual process reagents market is projected to reach USD 1,639.8 million by 2035, recording an absolute increase of USD 667.2 million over the forecast period. This market is valued at USD 972.6 million in 2025 and is set to rise at a CAGR of 5.4% during the assessment period. Overall size is expected to grow by nearly 1.5 times over the same period, supported by increasing demand for high-quality vaccines worldwide, driving adoption of advanced quality control solutions and growing investments in biopharmaceutical manufacturing infrastructure and process optimization initiatives globally.

Increasing complexity of vaccine platforms and rising global immunization targets create demand for high-precision reagents capable of detecting host cell proteins, nucleic acids, and endotoxins at trace levels. Technological advancements in assay design, reagent formulation, and automated detection platforms are reshaping the vaccine residual process reagents landscape. Modern systems integrate with ELISA, HPLC, PCR, and chromatography tools, enabling precise detection of residual contaminants and supporting streamlined quality control workflows. Innovations in reagent sensitivity, stability, and reproducibility allow manufacturers to maintain regulatory compliance while reducing batch release times.

Government vaccination programs, global immunization campaigns, and public health initiatives accelerate growth. Biopharmaceutical companies and research institutions worldwide are investing in laboratory infrastructure and process optimization to ensure vaccine safety and efficacy. Industry adoption of large-scale automated production platforms drives sustained demand for high-performance reagents that support rapid vaccine development, efficient batch testing, and global distribution. Training programs for laboratory personnel and quality control teams enhance adoption of sophisticated reagents, enabling manufacturers to maintain consistent product quality across diverse vaccine pipelines.

Between 2025 and 2030, the vaccine residual process reagents market is projected to expand from USD 972.6 million to USD 1,262.9 million, resulting in a value increase of USD 290.3 million, which represents 43.5% of total forecast growth for the decade. This growth phase will be driven by rising global demand for vaccines, increased production capacities, innovation in residual process reagents, and adoption of advanced purification and formulation technologies. Companies are strengthening positions through investment in high-quality reagents, enzyme technologies, process optimization, and strategic expansion in emerging and established markets.

From 2030 to 2035, growth is forecast from USD 1,262.9 million to USD 1,639.8 million, adding USD 376.9 million, constituting 56.5% of overall ten-year expansion. This period is expected to see increased adoption of specialized reagents for next-generation vaccines, collaborations between reagent suppliers and vaccine manufacturers, and focus on scalable, efficient, and sustainable manufacturing processes. Rising global vaccination programs, demand for higher purity reagents, and regulatory compliance will continue to drive growth, along with innovation in enzyme and solvent formulations tailored for advanced vaccine production processes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 972.6 million |

| Market Forecast Value (2035) | USD 1,639.8 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The vaccine residual process reagents market grows by enabling biopharmaceutical manufacturers to achieve superior vaccine purity and safety while maintaining efficient production workflows for regulatory compliance. Vaccine producers face mounting pressure to deliver high-quality products within stringent regulatory timelines, with advanced residual process reagents providing significant improvement in contaminant detection and removal efficiency over conventional methods, making these technologies essential for modern vaccine manufacturing operations. Growing global vaccination programs create demand for professional-grade reagents that can deliver consistent quality across mRNA, viral vector, and protein subunit vaccine production requiring precise impurity control.

Government initiatives promoting vaccine development and manufacturing infrastructure drive adoption in biopharmaceutical facilities, contract manufacturing organizations, and research institutions, where high-quality reagents have direct impact on product safety and regulatory approval success. The global shift toward automated production platforms and quality control systems accelerates demand for reagents that enable rapid batch testing and release processes while maintaining compliance with international standards. Premium pricing of specialized reagents and complex integration requirements with sophisticated purification systems may limit adoption among smaller manufacturers.

The vaccine residual process reagents market is segmented by reagent class, application, and region. By reagent class, division includes nucleases for residual DNA removal, detergents & solubilizers, inactivation agents, precipitation polymers & flocculants, extraction solvents & phase-transfer aids, buffer additives & scavengers, and LNP/wash & auxiliary process reagents. Based on application, categorization covers mRNA & LNP vaccines, viral vector vaccines, protein subunit & inactivated vaccines, live-attenuated & oral vaccines, and combination/platform-agnostic programs. Regionally, segmentation spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

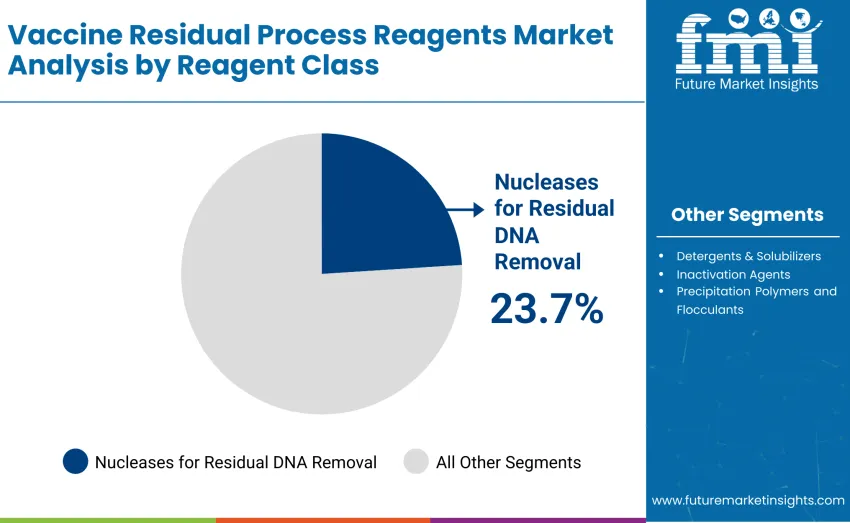

The nucleases for residual DNA removal segment represents the leading force, capturing approximately 23.7% of total revenue in 2025. This segment includes high-purity enzymatic reagents used to degrade residual host-cell DNA during vaccine production, ensuring regulatory compliance and product safety. Leadership stems from essential role in maintaining vaccine quality, reducing contaminants, and supporting high-volume manufacturing workflows where process consistency and regulatory adherence are critical for successful commercialization.

The detergents and solubilizers segment holds 19.6% of share, supporting protein extraction, solubilization, and formulation processes. Inactivation agents account for 16.4%, aiding viral inactivation and stabilization, while precipitation polymers and flocculants contribute 14.8%, helping remove impurities and clarify production streams. Extraction solvents and phase-transfer aids represent 9.7%, buffer additives and scavengers 8.9%, and LNP/wash & auxiliary process reagents 6.9%, providing support for lipid nanoparticle formulation and auxiliary purification steps across diverse vaccine manufacturing platforms.

Key advantages driving the nucleases segment include:

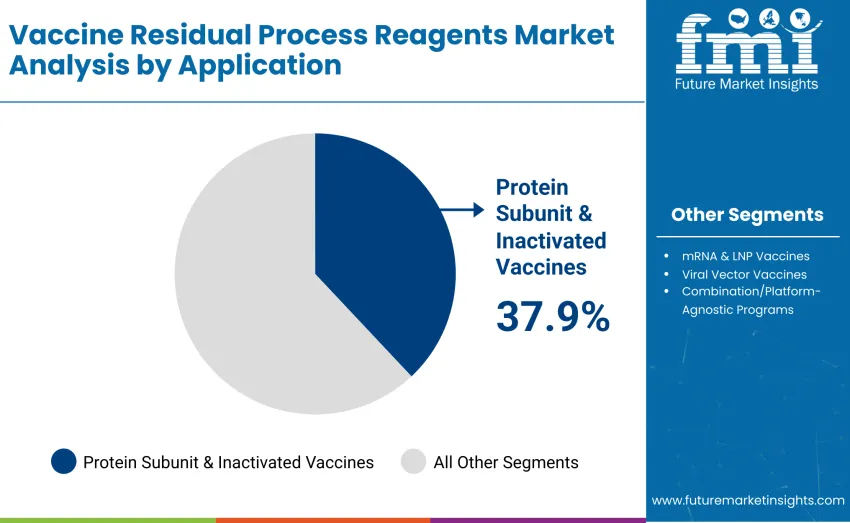

Protein subunit and inactivated vaccines dominate with 37.9% revenue share in 2025, reflecting their widespread adoption and stringent purification requirements these platforms demand. Viral vector vaccines account for 24.6%, and mRNA & LNP vaccines represent 22.8%. Live-attenuated and oral vaccines contribute 9.8%, while combination/platform-agnostic programs account for 4.9%, serving diverse therapeutic applications and research initiatives requiring specialized reagent solutions.

Key market dynamics supporting application preferences include:

The vaccine residual process reagents market is driven by several key factors tied to growth of global vaccine production and increasing focus on product safety and regulatory compliance. Expansion of vaccination programs worldwide, including COVID-19, influenza, and other emerging infectious diseases, creates higher demand for high-quality reagents that ensure vaccine purity and efficacy. Scaling up of vaccine manufacturing capacities, including mRNA, viral vector, and protein subunit platforms, requires reliable residual process reagents to support automated workflows, high-throughput purification, and formulation processes across diverse production environments.

Stringent regulatory requirements from agencies such as the FDA, EMA, and WHO necessitate precise control over residual DNA, proteins, and other impurities, reinforcing the need for advanced enzymatic and chemical reagents in vaccine production. Restraints include high costs associated with premium reagents, which can pose adoption barriers for small-scale manufacturers or emerging regions. Technical complexity in integrating reagents into sophisticated purification and formulation workflows requires skilled personnel and strict adherence to protocols, which may limit efficiency if not properly managed.

Key emerging trends in the reagent market include the increasing adoption of next-generation reagents designed for mRNA and lipid nanoparticle (LNP) vaccine platforms, which are crucial for the development of novel vaccines. There is also a focus on the creation of multi-functional reagent solutions that streamline the DNA removal, inactivation, and purification processes, enhancing overall efficiency. Additionally, there is growing investment in sustainable and scalable reagent manufacturing processes to meet the rising global demand, driven by the expansion of vaccine production and biotechnology research in response to global health challenges.

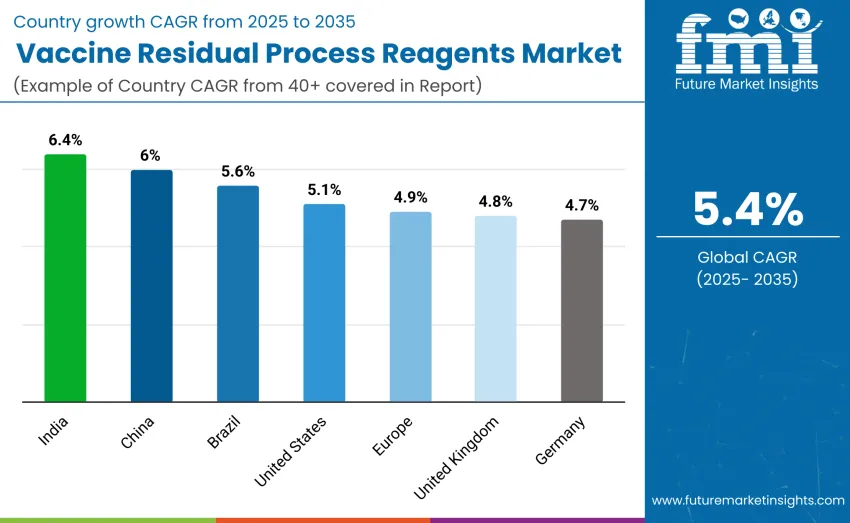

| Country/Region | CAGR 2025 to 2035 (%) |

|---|---|

| United States | 5.1 |

| Brazil | 5.6 |

| China | 6.0 |

| India | 6.4 |

| Europe | 4.9 |

| Germany | 4.7 |

| United Kingdom | 4.8 |

The vaccine residual process reagents market is growing globally, with India leading at a 6.4% CAGR due to government programs promoting local vaccine production and adoption of advanced reagents. China follows with a 6.0% CAGR, driven by expanded vaccine manufacturing and government support for mRNA production. Germany grows at 4.7%, supported by strong manufacturing infrastructure and regulatory standards. Brazil shows a 5.6% CAGR, fueled by expanding vaccine production. The USA maintains a 5.1% growth rate, while the UK shows steady progress at 4.8%, driven by research and manufacturing advancements in vaccine production.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The vaccine residual process reagents market in China is projected to grow at a CAGR of 6.0% from 2025 to 2035. Growth is primarily driven by national initiatives to modernize vaccine manufacturing facilities, including large-scale adoption of nucleases, inactivation agents, and detergents to optimize DNA removal and virus inactivation processes. Industrial adoption has been facilitated by government-funded programs aimed at strengthening domestic biopharmaceutical infrastructure, with significant investment in mRNA and viral vector vaccine production hubs located in Beijing, Shanghai, Shenzhen, and Hangzhou.

Key market factors:

The vaccine residual process reagents market in India is forecasted to grow at a CAGR of 6.4% through 2035. Expansion is supported by enhanced local manufacturing capacity for mRNA, viral vector, and protein subunit vaccines, underpinned by government programs promoting pharmaceutical infrastructure development and public-private partnerships. Adoption of nucleases, precipitation polymers, and buffer additives has been accelerated by establishment of regional biopharma clusters in Bangalore, Hyderabad, Mumbai, and Pune.

Germany's vaccine residual process reagents market is expected to grow at a CAGR of 4.7% through 2035. Growth is driven by engineering excellence in vaccine manufacturing facilities and rigorous regulatory standards under the European Medicines Agency. Adoption of detergents, solubilizers, and LNP/wash auxiliary reagents has been prioritized in production sites located in Berlin, Munich, Hamburg, and Frankfurt, enabling consistent viral vector and protein subunit vaccine quality. Sustainability initiatives, including solvent recycling and energy-efficient purification systems, have been integrated into manufacturing workflows.

Key development areas:

The vaccine residual process reagents market in Brazil is forecasted to expand at a CAGR of 5.6% from 2025 to 2035. Growth is fueled by modernization of local vaccine production facilities and increasing demand for domestic immunization programs. Adoption of precipitation polymers, inactivation agents, and buffer additives has been supported by public health initiatives and partnerships with international reagent suppliers to ensure high-quality materials are available for mRNA, viral vector, and protein subunit vaccines.

Leading market segments:

The USA vaccine residual process reagents market is projected to register a CAGR of 5.1% through 2035. Growth is supported by advanced adoption of automated purification systems and high-performance reagents in both commercial and contract development organizations. Extensive research investment has facilitated innovation in nucleases, inactivation agents, and extraction solvents, optimizing yield, safety, and regulatory compliance. Adoption is concentrated in key vaccine manufacturing hubs in California, Washington, Texas, and New York.

Key market characteristics:

The vaccine residual process reagents market in the UK is projected to grow at a CAGR of 4.8% through 2035. Expansion is supported by advanced vaccine production infrastructure concentrated in London, Manchester, Bristol, and Edinburgh. High-quality nucleases, detergents, and extraction solvents have been integrated into purification and inactivation workflows to enhance yield and consistency in mRNA and viral vector vaccine production. Public sector support and government-funded research initiatives have accelerated adoption of process reagents.

Market development factors:

The vaccine residual process reagents market in Europe is projected to grow from USD 254.8 million in 2025 to USD 408.3 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain leadership with a 28.5% share in 2025, slightly declining to 27.8% by 2035, supported by advanced vaccine manufacturing infrastructure, robust regulatory compliance under the EMA, and major production hubs in Berlin, Munich, and Hamburg.

France follows with a 22.3% share in 2025, increasing to 22.6% by 2035, driven by strong biotechnology clusters and high-quality reagent adoption in Paris and Lyon. The United Kingdom holds a 19.5% share in 2025, reaching 19.8% by 2035 through expansion of modern vaccine production facilities and public-private collaborations. Italy, Spain, the Netherlands, and the Rest of Europe contribute steadily through localized infrastructure upgrades, workforce training programs, and adoption of advanced process reagents in regional biopharma clusters.

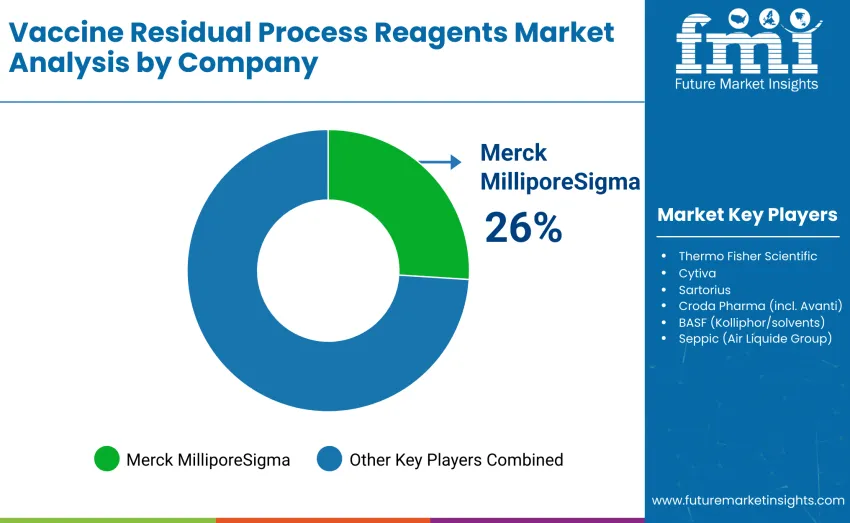

The global vaccine residual process reagents market is moderately concentrated, with 12–15 key players driving most commercial activity. The top three companies, Merck MilliporeSigma (including Benzonase), Thermo Fisher Scientific, and Cytiva, collectively hold roughly 55–60% of the global market share, with Merck MilliporeSigma holding a 26% share. These leaders benefit from established brand reputations, comprehensive product portfolios, and strong regulatory compliance records. Competition is primarily shaped by reagent purity, process compatibility, and scalability for mRNA, viral vector, and protein subunit vaccine production, rather than pricing alone.

Leaders maintain competitive advantages through extensive research investments, high-purity nucleases, inactivation agents, and solvents, as well as integration with automated purification and inactivation workflows. Mid-tier competitors like Sartorius, Croda Pharma (including Avanti), and BASF focus on specialized reagents such as surfactants, lipids, and formulation solvents, with regional penetration strategies. Emerging players such as ArcticZymes, Eastman, NOF Corporation, and Promega drive competition with niche offerings like SAN nucleases, PEG/lipids, and high-quality enzymes.

Competition is particularly fierce in cost-sensitive regions across Asia-Pacific, Latin America, and emerging economies, where pricing pressure drives adoption of alternative suppliers. Innovation in specialized reagents, sustainable manufacturing processes, and workflow integration continues to define competitive positioning.

| Items | Values |

|---|---|

| Quantitative Units | USD 972.6 million |

| Reagent Class | Nucleases for Residual DNA Removal, Detergents & Solubilizers, Inactivation Agents, Precipitation Polymers & Flocculants, Extraction Solvents & Phase-Transfer Aids, Buffer Additives & Scavengers, LNP/Wash & Auxiliary Process Reagents |

| Application | mRNA & LNP Vaccines, Viral Vector Vaccines, Protein Subunit & Inactivated Vaccines, Live-Attenuated & Oral Vaccines, Combination/Platform-Agnostic Programs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | Merck MilliporeSigma (incl. Benzonase ), Thermo Fisher Scientific, Cytiva , Sartorius, Croda Pharma (incl. Avanti), BASF ( Kolliphor /solvents), Seppic (Air Liquide Group), NOF Corporation (PEG & lipids), ArcticZymes (SAN nucleases), Eastman (BPL/formulation solvents), Promega (nucleases & enzymes), Others |

| Additional Attributes | Dollar sales by reagent type and application, regional trends across Asia Pacific, Europe, and North America, competitive landscape of key manufacturers, technical specifications, workflow integration, innovations in reagent chemistry and detection methods, and development of specialized configurations with enhanced sensitivity, specificity, and regulatory compliance |

The global vaccine residual process reagents market is valued at USD 972.6 million in 2025.

The market is projected to reach USD 1,639.8 million by 2035.

The market will grow at a CAGR of 5.4% from 2025 to 2035.

Nucleases for residual DNA removal lead the market with a 23.7% share in 2025.

Key players include Merck MilliporeSigma, Thermo Fisher Scientific, Cytiva, Sartorius, Croda Pharma, BASF, Seppic, NOF Corporation, ArcticZymes, Eastman, and Promega.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Process Pipe Coating Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Preservatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Process Spectroscopy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Vial Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Transport Carrier Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Shippers Market Size and Share Forecast Outlook 2025 to 2035

Processed Fruit and Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Process Plants Gas Turbine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Market Share Insights for Processed Cashew Providers

Analysis and Growth Projections for Processed Superfruit Market

Processed Meat Market Analysis by Type, Packaging, Meat Type, and Region through 2035

Process Liquid Analyzer Market Growth - Trends & Forecast 2025 to 2035

Process Instrumentation Market Growth - Trends & Forecast 2025 to 2035

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Analysis and Growth Projections for Processed Cheese Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA