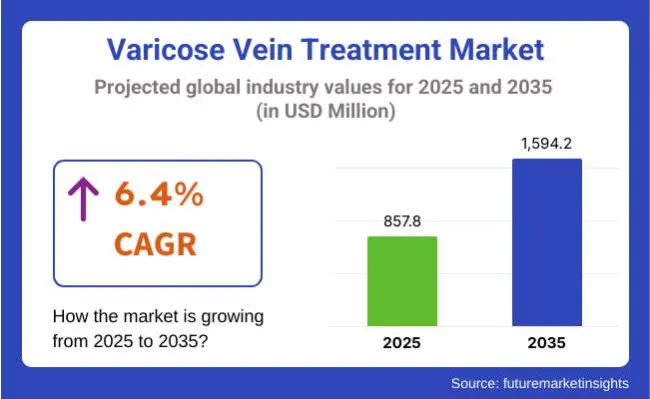

The global varicose vein treatment market is estimated to be valued at USD 857.8 million in 2025 and is projected to reach USD 1,594.2 million by 2035, registering a compound annual growth rate of 6.4% over the forecast period.

The varicose vein treatment market has advanced steadily, supported by rising prevalence of chronic venous insufficiency and a strong preference for minimally invasive interventions. Healthcare systems across North America and Europe have expanded insurance coverage for clinically indicated procedures, reinforcing demand for endovenous ablation and sclerotherapy.

Technological improvements in laser fibers, radiofrequency catheters, and ultrasound-guided delivery systems have enhanced procedural success rates and shortened recovery times. Physicians and patients have increasingly opted for outpatient treatments that combine efficacy with favorable cosmetic outcomes.

Varicose vein treatment represents approximately 6.1% of the Vascular Devices Market, reflecting its specialized but growing share within peripheral vascular interventions as minimally invasive procedures gain traction. Within the Surgical and Interventional Devices Market, the segment contributes around 3.3%, highlighting adoption relative to broader interventional categories such as coronary and neurovascular devices.

In the Aesthetic Devices Market, varicose vein treatment accounts for nearly 4.8%, underscoring its dual role in therapeutic and cosmetic vascular procedures aimed at improving both health outcomes and patient quality of life.

Endovenous Laser Systems dominates the product segment with a revenue share of 46.7% has been attributed to endovenous laser systems, underscoring their prominence in contemporary varicose vein management. Utilization has been driven by evidence demonstrating high closure rates, reduced procedural discomfort, and shorter recovery times compared to traditional vein stripping. Physicians have favored laser-based devices for their precision, predictable energy delivery, and compatibility with ultrasound guidance, which improves procedural safety.

Hospitals and vein clinics have prioritized investments in endovenous laser systems to expand minimally invasive treatment capacity and differentiate service offerings. Manufacturers have advanced fiber designs and wavelength technologies to optimize thermal profiles and reduce adverse events.

Hospitals holds a revenue share of 40.5% has been attributed to hospitals, reflecting their role as primary providers of vein care and advanced interventions. Utilization has been driven by centralized infrastructure supporting duplex ultrasound, endovenous ablation, and perioperative monitoring. Hospitals have integrated multidisciplinary vein care programs to manage complex cases requiring coordinated medical and surgical expertise. Reimbursement structures in many countries have reinforced hospital-based treatment as standard of care for chronic venous insufficiency.

Comprehensive Analysis of Challenges Impacting the Varicose Vein Treatment Market

One of the most pressing challenges in the varicose vein treatment market is the cost of advanced procedures and devices, which can limit accessibility for patients in lower-income brackets and emerging markets. Despite growing demand, insurance coverage is often limited to severe or symptomatic cases, particularly in countries where vein treatment is classified as cosmetic rather than a medical necessity.

This limits reimbursement availability and may discourage early intervention. Additionally, a lack of public awareness about venous diseases and available treatment options results in underdiagnosis, especially in rural and underserved areas. Inconsistent availability of trained vein specialists and uneven geographic distribution of advanced clinics further constrain market expansion. Patients may also hesitate to seek care due to fear of recurrence, procedural pain, or lack of understanding of newer treatment modalities.

Emerging Opportunities and Innovations Driving Growth in the Varicose Vein Treatment Market

On the opportunity side, the market is benefiting from a growing trend of minimally invasive technologies that minimize downtime, enhance cosmetic outcomes, and facilitate outpatient care models. Other advanced techniques, such as foam sclerotherapy, endovenous laser therapy (EVLT), radiofrequency ablation (RFA), and glue-based techniques, are quickly becoming popular owing to their high efficacy and patient satisfaction levels.

The rapid proliferation of dedicated vein clinics, which are mostly run by multispecialty health groups, is expanding access to invisible disease diagnostics, as well as same-day treatment. Development of digital health tools such as video and messaging consultation services, and post-procedure monitoring applications, facilitate patient engagement and encourage compliance with treatments.

Growing investments from private equity and venture capital in vein care startups, combined with supportive initiatives to improve healthcare infrastructure, are paving the way for new product development, training platforms, and increased market access.

The growing societal focus on aesthetics and self-care is fueling demand for treatments that eliminate visible veins with minimal scarring or recovery time. Patients are increasingly seeking care not only for pain relief or discomfort but also for cosmetic enhancement. Both men and women are opting for minimally invasive procedures that deliver visible improvements without surgical downtime.

Clinics are offering bundled services, including skincare and vein therapy, to cater to holistic aesthetic demands. Media influence and increasing visibility of aesthetic treatments on social platforms are also playing a role in normalizing and promoting vein care, especially among younger demographics.

A notable trend reshaping the varicose vein treatment market is the adoption of hybrid protocols that combine multiple minimally invasive approaches tailored to individual patient anatomy and disease progression. Physicians are increasingly employing a combination of therapies, such as EVLA for truncal veins, followed by sclerotherapy for tributaries, to improve closure rates and reduce recurrence. This layered, personalized care model is proving especially valuable for patients with complex or recurrent cases and is gaining support in clinical guidelines.

Market Outlook

In the North America region, the USA encompasses a significant market for varicose vein treatment attributed to the high prevalence of venous insufficiency, rising obesity prevalence, and growing interest in minimally invasive procedures in the region. The growth is attributed to the availability of advanced treatment modalities such as endovenous laser therapy, radiofrequency ablation, sclerotherapy, and vein adhesives, which are widely accessible in the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.9% |

Market Outlook

Germany's varicose vein treatment market is well-developed and technologically sophisticated, with a strong focus on early and non-surgical treatments. The nation is at the forefront of the use of endovenous ablation technologies and foam sclerotherapy, with a well-organized public healthcare system. Preventive care and outpatient treatment are well-practiced, with doctors and vascular specialists highly skilled in phlebology.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.6% |

Market Outlook

India's market for varicose vein treatment is growing rapidly, driven by increasing awareness, the rising prevalence of venous disease, and improved access to laser and catheter-based treatments in private facilities. Although traditional surgery is still prevalent in small centers, tier-1 and tier-2 cities are seeing rising demand for minimally invasive and aesthetically pleasing treatments.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

Market Outlook

China’s varicose vein treatment market is experiencing robust growth, driven by increasing urbanization, sedentary lifestyles, and government initiatives to modernize healthcare infrastructure. Rising income levels and awareness of cosmetic procedures are fueling demand for advanced treatments such as EVLT, foam sclerotherapy, and cyanoacrylate closure. The expansion of private hospitals and cosmetic surgery centers is creating new opportunities for device manufacturers and service providers.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.4% |

Market Outlook

The United Kingdom’s market for varicose vein treatment is supported by both public and private healthcare sectors, with a focus on evidence-based, minimally invasive therapies. While the NHS generally limits treatment to severe or symptomatic cases, private healthcare providers are increasingly offering cosmetic and functional vein procedures. Demand is increasing for outpatient treatments that provide faster recovery and enhanced aesthetics.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The competitive landscape has been shaped by manufacturers investing in next-generation laser and radiofrequency systems with enhanced ergonomics and real-time feedback features. Leading players have pursued clinical studies to demonstrate long-term efficacy and reinforce guideline inclusion.

Partnerships with outpatient clinics and hospitals have expanded procedural adoption and improved practitioner training. Strategic acquisitions of complementary technologies, such as adhesive closure systems and disposable catheters, have diversified portfolios. These efforts are expected to maintain competitive intensity and accelerate innovation in minimally invasive varicose vein treatment.

Key Development:

Endovenous Laser Systems, Endovenous Laser Fibers and Others

Hospitals, Ambulatory Surgical Centers and Specialized Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Varicose Vein Treatment Market was USD 857.8 million in 2025.

The Varicose Vein Treatment Market is expected to reach USD 1,594.2 million in 2035.

Rising prevalence of varicose veins, increased awareness and aesthetic demand and Adoption of minimally invasive treatments like endovenous laser therapy, radiofrequency ablation, and sclerotherapy for faster recovery and improved outcomes are factors that boost the market growth.

The top key players that drives the development of Varicose Vein Treatment Market are, Medtronic plc, AngioDynamics Inc., biolitec AG,VVT Medical Ltd., and Lumenis Ltd.

Endovenous laser systems in product type of varicose vein treatment market is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vein Illuminator Market Size and Share Forecast Outlook 2025 to 2035

Vein Finder Market Analysis - Trends & Future Outlook 2025 to 2035

Retinal Vein Occlusion Treatment Market - Outlook 2025 to 2035

Cerebral Vein Thrombosis Treatment Market Analysis by Treatment, Drug Class, End Use and Region: Forecast for 2025 to 2035

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA