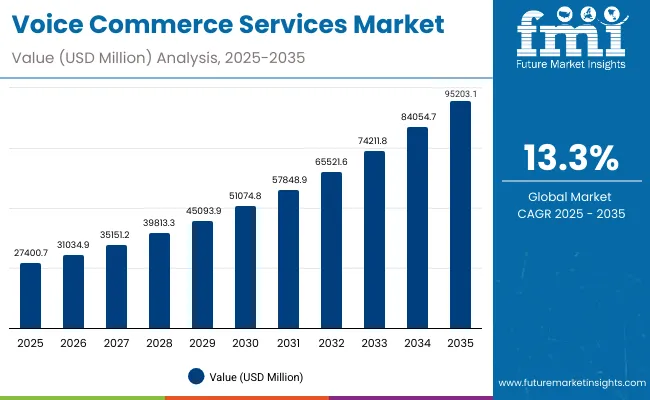

The voice commerce services market is expected to record a valuation of USD 27,400.7 million in 2025 and USD 95,203.1 million in 2035, with an increase of USD 67,802.4 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.3% and a 2X increase in market size.

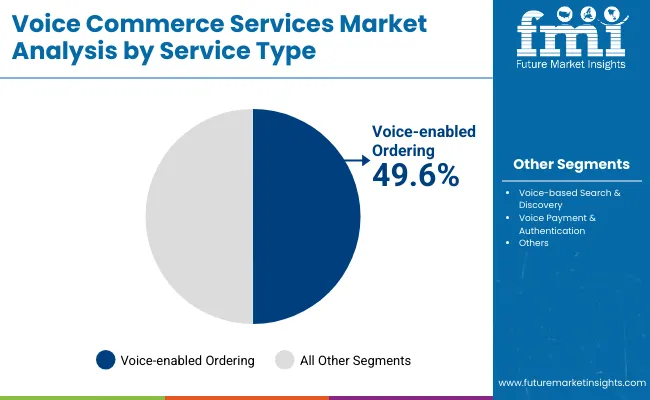

During the first five-year period from 2025 to 2030, the market increases from USD 27,400.7 million to USD 51,074.8 million, adding USD 23,674.1 million, which accounts for 35% of the total decade growth. This phase records steady adoption in retail & e-commerce and banking/finance services, driven by the need for convenience and secure transactions. Voice-enabled ordering dominates this period as it caters to nearly 49.6% of applications requiring faster commerce execution.

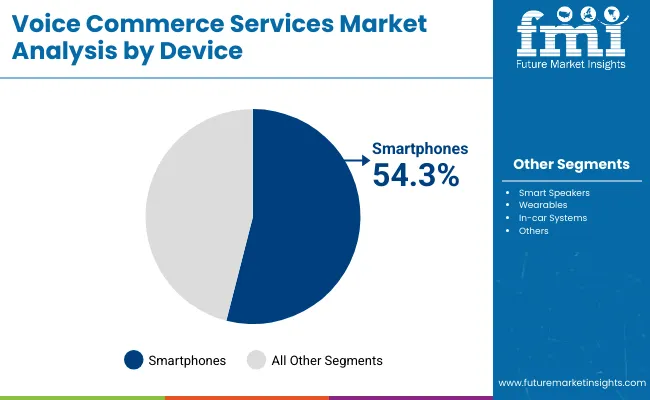

The second half from 2030 to 2035 contributes USD 44,128.3 million, equal to 65% of total growth, as the market jumps from USD 51,074.8 million to USD 95,203.1 million. This acceleration is powered by widespread deployment of AI-based voice assistants, personalized shopping interfaces, and multi-lingual voice platforms in smart ecosystems. Smartphones and smart speakers together capture a larger share above 54.3% by the end of the decade. Cloud-led voice commerce and software-driven integrations add recurring revenue, increasing the service-based share beyond 50% in total value.

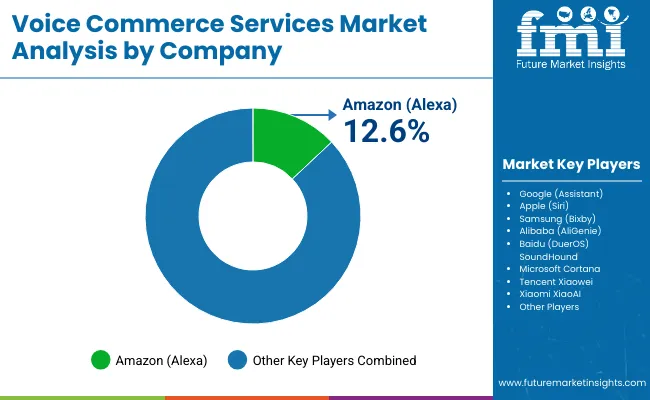

From 2020 to 2024, the Voice Commerce Services Market experienced rapid adoption, moving toward AI-powered assistants integrated into smartphones and smart speakers. During this period, the competitive landscape was dominated by technology giants (Amazon, Google, Apple, Alibaba, Baidu) controlling nearly 70% of global penetration, focusing on voice-enabled ordering, search, and authentication. Differentiation relied on ecosystem reach, language support, and AI personalization, while standalone third-party platforms had limited traction, contributing less than 15% of the overall market value.

Demand for voice commerce services will expand to USD 27,400.7 million in 2025 and further to USD 95,203.1 million by 2035, reflecting a 193% decade growth. The revenue mix will evolve as retail & e-commerce remains the dominant vertical but new sectors like banking/finance and travel bookings grow faster. Traditional leaders such as Amazon (Alexa) and Google Assistant face rising competition from regional AI-driven platforms (Baidu DuerOS, Alibaba AliGenie, Xiaomi XiaoAI, TencentXiaowei) offering multi-lingual capabilities, localized commerce, and cloud-based integrations.

By 2035, smartphones and smart speakers will together capture over 54% of device-led usage, but the competitive advantage will shift from hardware and voice activation alone to ecosystem strength, interoperability, and recurring subscription revenues. Emerging players focusing on AI-driven personalization, digital twin commerce models, and AR/VR-integrated shopping experiences are expected to gain share. The market is moving away from voice recognition accuracy alone toward scalability, contextual intelligence, and end-to-end commerce ecosystems.

Voice Commerce Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 27,400.7 million |

| Market Forecast Value in (2035F) | USD 95,203.1 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 27,400.7 million to USD 51,074.8 million, adding USD 23,674.1 million, which accounts for 35% of the total decade growth. This phase records steady adoption in retail & e-commerce and banking/finance services, driven by the need for convenience and secure transactions. Voice-enabled ordering dominates this period as it caters to nearly 49.6% of applications requiring faster commerce execution.

The second half from 2030 to 2035 contributes USD 44,128.3 million, equal to 65% of total growth, as the market jumps from USD 51,074.8 million to USD 95,203.1 million. This acceleration is powered by widespread deployment of AI-based voice assistants, personalized shopping interfaces, and multi-lingual voice platforms in smart ecosystems. Smartphones and smart speakers together capture a larger share above 54.3% by the end of the decade. Cloud-led voice commerce and software-driven integrations add recurring revenue, increasing the service-based share beyond 50% in total value.

From 2020 to 2024, the Voice Commerce Services Market experienced rapid adoption, moving toward AI-powered assistants integrated into smartphones and smart speakers. During this period, the competitive landscape was dominated by technology giants (Amazon, Google, Apple, Alibaba, Baidu) controlling nearly 70% of global penetration, focusing on voice-enabled ordering, search, and authentication. Differentiation relied on ecosystem reach, language support, and AI personalization, while standalone third-party platforms had limited traction, contributing less than 15% of the overall market value.

Demand for voice commerce services will expand to USD 27,400.7 million in 2025 and further to USD 95,203.1 million by 2035, reflecting a 193% decade growth. The revenue mix will evolve as retail & e-commerce remains the dominant vertical but new sectors like banking/finance and travel bookings grow faster. Traditional leaders such as Amazon (Alexa) and Google Assistant face rising competition from regional AI-driven platforms (Baidu DuerOS, Alibaba AliGenie, Xiaomi XiaoAI, TencentXiaowei) offering multi-lingual capabilities, localized commerce, and cloud-based integrations.

By 2035, smartphones and smart speakers will together capture over 54% of device-led usage, but the competitive advantage will shift from hardware and voice activation alone to ecosystem strength, interoperability, and recurring subscription revenues. Emerging players focusing on AI-driven personalization, digital twin commerce models, and AR/VR-integrated shopping experiences are expected to gain share. The market is moving away from voice recognition accuracy alone toward scalability, contextual intelligence, and end-to-end commerce ecosystems.

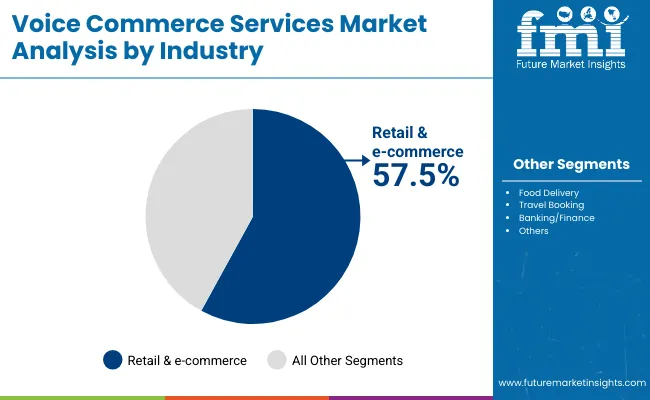

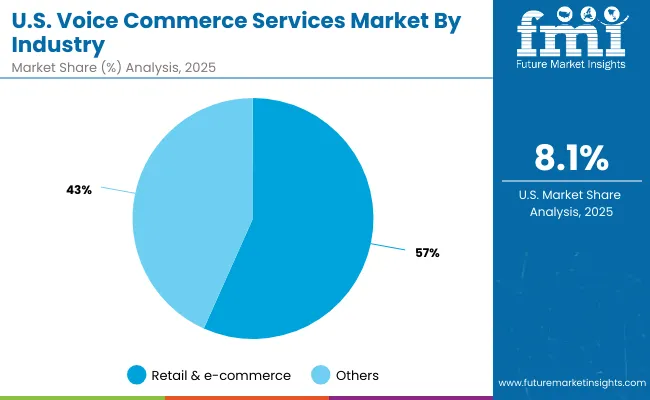

The growth of the Voice Commerce Services Market is strongly driven by seamless integration of voice assistants into retail and e-commerce platforms. Major players like Amazon, Alibaba, and Walmart are embedding voice-enabled ordering into their shopping ecosystems, enabling frictionless purchases and personalized promotions. This eliminates barriers such as app navigation and checkout delays, enhancing customer stickiness. Retail & e-commerce already captures 57.5% share, and the convenience-driven shift toward hands-free shopping ensures sustained adoption across smartphones, smart speakers, and in-car systems.

Beyond basic ordering, voice commerce is expanding through advanced AI-based authentication and personalization features. Companies are using biometrics-driven voice recognition to enable secure payments and financial transactions, especially in banking and fintech sectors. At the same time, personalized shopping experiences powered by natural language processing and contextual intelligence allow platforms to recommend products, services, and deals tailored to user behavior. This dual promise of security plus personalization is accelerating adoption, with countries like India and China showing high CAGR growth of 21.0% and 18.7% respectively.

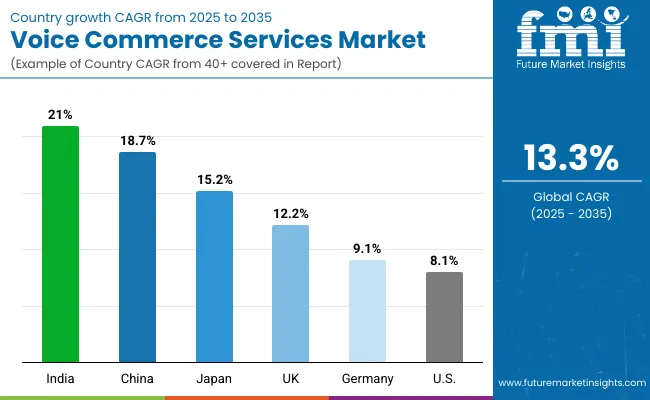

The Voice Commerce Services Market is segmented by service type, device, industry, and region. Service types include voice-enabled ordering, voice-based search & discovery, and voice payment & authentication, reflecting the core functionalities driving consumer adoption. Device segmentation spans smartphones, smart speakers, wearables, and in-car systems, enabling usage across personal, household, and mobility contexts. By industry, the market is categorized into retail & e-commerce, food delivery, travel booking, and banking/finance, each representing diverse applications of voice commerce solutions. Regionally, the scope covers major economies including the USA, China, India, UK, Germany, and Japan, with growth rates ranging from 8.1% in the USA to 21.0% in India, highlighting varied adoption curves across markets.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Voice-enabled ordering | 49.6% |

| Others | 50.4% |

The voice-enabled ordering segment is projected to contribute 49.6% of the Voice Commerce Services Market revenue in 2025, maintaining its lead as the dominant service type category. This is driven by ongoing demand for frictionless retail transactions, fast product reorders, and hands-free shopping experiences. Consumers are increasingly relying on smart devices to streamline purchases, especially in retail & e-commerce and food delivery verticals.

The segment’s growth is also supported by the integration of AI-based personalization and predictive commerce capabilities that simplify buying journeys. As digital ecosystems expand, players like Amazon Alexa, Google Assistant, and Alibaba AliGenie are strengthening voice ordering functions with loyalty programs and subscription tie-ins. The voice-enabled ordering segment is expected to retain its position as the backbone of voice commerce adoption through 2035.

| Industry | Value Share% 2025 |

|---|---|

| Retail & e-commerce | 57.5% |

| Others | 42.5% |

The retail & e-commerce segment is forecasted to hold 57.5% of the market share in 2025, led by its application in seamless voice-enabled shopping and ordering processes. This dominance is driven by consumer demand for frictionless checkout experiences, personalized promotions, and convenience-led digital commerce adoption.

The segment’s growth is further supported by integration of voice assistants with mobile apps, smart speakers, and in-car systems, which expand omnichannel engagement. Retailers are leveraging AI-powered voice platforms to enable hands-free reorders, subscription renewals, and product discovery, directly enhancing conversion rates.

As voice assistants become central to customer engagement and transaction execution, the retail & e-commerce segment is expected to continue driving overall adoption, anchoring its position as the leading revenue contributor within the Voice Commerce Services Market through 2035.

| Device | Value Share% 2025 |

|---|---|

| Smartphones | 54.3% |

| Others | 45.7% |

The smartphones segment is projected to account for 54.3% of the Voice Commerce Services Market revenue in 2025, establishing it as the leading device category. Smartphones dominate due to their ubiquity, user familiarity, and integration with AI-driven voice assistants such as Alexa, Google Assistant, Siri, and Bixby.

Their suitability for on-the-go purchases, banking transactions, and personalized shopping experiences makes them the most convenient medium for consumers. Continuous advancements in mobile processors, natural language processing (NLP), and app integration have further improved accuracy, responsiveness, and security in voice transactions.

Given their balance of accessibility, functionality, and ecosystem reach, smartphones are expected to maintain their leading role in the Voice Commerce Services Market through 2035, with strong adoption in high-growth regions such as China and India.

Seamless Integration into E-Commerce Ecosystems

Voice commerce adoption is accelerating as global e-commerce leaders like Amazon, Alibaba, and Walmart integrate voice assistants directly into shopping platforms. This integration allows consumers to reorder products, manage subscriptions, and discover personalized deals using natural speech. By eliminating complex navigation and checkout steps, voice-enabled ordering reduces friction, improving conversion rates and enhancing customer loyalty. Retail & e-commerce already represents 57.5% market share in 2025, and as smartphone and smart speaker penetration deepens, voice integration will become a cornerstone of omnichannel commerce strategies worldwide.

Rising Adoption in Banking and Finance

Beyond retail, voice commerce is witnessing growth in secure voice-based payment and authentication systems, particularly in banking and fintech. Biometric-enabled voice recognition provides a secure, frictionless alternative to PINs and passwords, addressing consumer concerns about fraud while simplifying transactions. Financial institutions in Asia-Pacific, especially India (21.0% CAGR) and China (18.7% CAGR), are at the forefront of this adoption. These systems also allow users to check balances, transfer funds, and initiate bill payments through conversational AI. The need for speed, convenience, and security is propelling this expansion across financial services.

Data Privacy and Security Concerns

Despite rapid adoption, privacy concerns remain a critical barrier for voice commerce. Voice-enabled devices continuously capture user data, raising fears of unauthorized access, surveillance, and data misuse. Incidents of accidental voice recordings and vulnerabilities in AI algorithms have heightened consumer skepticism, especially in Europe, where GDPR compliance is stringent. Banking and healthcare applications, in particular, face trust deficits as consumers worry about sensitive data being exposed. These challenges slow down adoption rates, requiring providers to invest heavily in end-to-end encryption, transparent policies, and secure authentication protocols to build confidence.

Multi-Lingual and Localized Voice Platforms

A defining trend in the Voice Commerce Services Market is the rise of multi-lingual and localized AI assistants, especially in high-growth regions like India, China, and Southeast Asia. Players like Baidu’s DuerOS and Alibaba’s AliGenie are embedding local dialects and cultural nuances to expand penetration in non-English-speaking markets. This trend aligns with the surge in smartphone-driven commerce, making voice shopping accessible to rural and semi-urban populations. By 2035, this localization will transform voice commerce into an inclusive global channel, moving beyond English-centric systems to contextual, culturally adaptive voice ecosystems.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.7% |

| USA | 8.1% |

| India | 21.0% |

| UK | 12.2% |

| Germany | 9.1% |

| Japan | 15.2% |

The Voice Commerce Services Market is witnessing significant geographic variations in growth, with certain countries taking the lead due to unique digital ecosystems and consumer behavior patterns. India, with a CAGR of 21.0%, stands as the fastest-growing market globally, propelled by its massive smartphone penetration, digital-first consumer base, and the adoption of regional language-enabled AI assistants. The government’s digital initiatives, coupled with platforms like Reliance Jio and Flipkart integrating voice technologies, further accelerate adoption. China, projected to grow at 18.7% CAGR, is another powerhouse, driven by local tech giants such as Alibaba (AliGenie), Baidu (DuerOS), and Xiaomi (XiaoAI) who are embedding voice commerce into mainstream e-commerce, mobile payments, and entertainment services.

Japan, expanding at 15.2% CAGR, is leveraging advancements in consumer electronics and AI personalization, where domestic players are actively developing innovative voice solutions. The UK, with 12.2% CAGR, shows strong growth from smart speaker adoption and expansion into financial services and travel bookings, reflecting high consumer trust in AI-driven services. Germany, at 9.1%, is cautious but consistent, prioritizing secure, GDPR-compliant solutions, particularly in automotive applications like in-car commerce. Meanwhile, the USA market, growing at 8.1% CAGR, reflects maturity and saturation, with Amazon Alexa and Google Assistant dominating, while future growth depends on advanced applications in smart homes and vehicles.

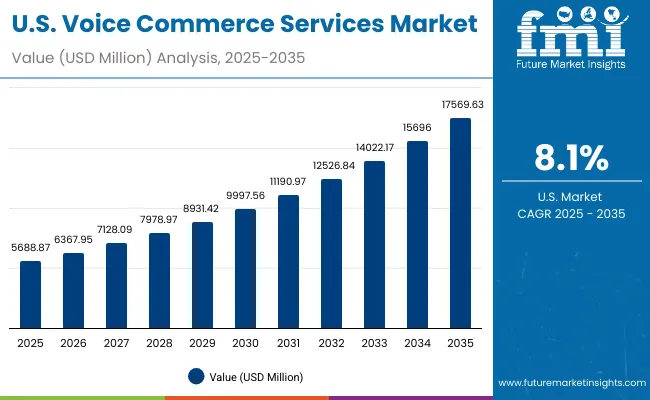

| Year | USA Voice Commerce Services Market (USD Million) |

|---|---|

| 2025 | 5688.87 |

| 2026 | 6367.95 |

| 2027 | 7128.09 |

| 2028 | 7978.97 |

| 2029 | 8931.42 |

| 2030 | 9997.56 |

| 2031 | 11190.97 |

| 2032 | 12526.84 |

| 2033 | 14022.17 |

| 2034 | 15696.00 |

| 2035 | 17569.63 |

The Voice Commerce Services Market in the United States is projected to grow at a CAGR of 8.1% from 2025 to 2035, reaching USD 17,569.6 million by the end of the period. Growth is led by strong adoption of Amazon Alexa and Google Assistant ecosystems, supported by smart home penetration, in-car integrations, and rising consumer comfort with voice-enabled shopping. The retail & e-commerce sector contributes 56.7% of the 2025 market share, highlighting the dominance of hands-free ordering and personalized shopping experiences. Financial services and travel bookings are expanding as voice payments and authentication gain traction. Privacy and data security concerns remain a limiting factor, but advancements in encryption and biometrics are improving user trust.

The Voice Commerce Services Market in the United Kingdom is expected to grow at a CAGR of 12.2% from 2025 to 2035, driven by increasing adoption of voice assistants in retail, banking, and travel bookings. UK consumers are showing strong engagement with smart speakers and smartphone-based assistants, with retailers leveraging voice platforms to enable hands-free shopping, personalized promotions, and faster checkout. Financial institutions are also embracing voice authentication and payment technologies, expanding secure digital banking options. The UK government’s support for AI innovation, coupled with consumer openness toward smart ecosystems, positions the market for steady expansion.

India is witnessing the fastest growth in the Voice Commerce Services Market, projected to expand at a CAGR of 21.0% through 2035. Rapid smartphone adoption, affordable internet access, and the integration of regional language-enabled voice assistants are driving penetration deep into tier-2 and tier-3 cities. E-commerce platforms and fintech companies are at the forefront, embedding voice technologies into apps to simplify shopping, payments, and financial transactions for first-time digital users. Educational institutions and training programs are increasingly incorporating voice AI modules and conversational commerce skills, preparing a workforce aligned with future digital retail needs. The government’s Digital India initiatives, combined with local innovation and private sector investments, continue to fuel nationwide expansion.

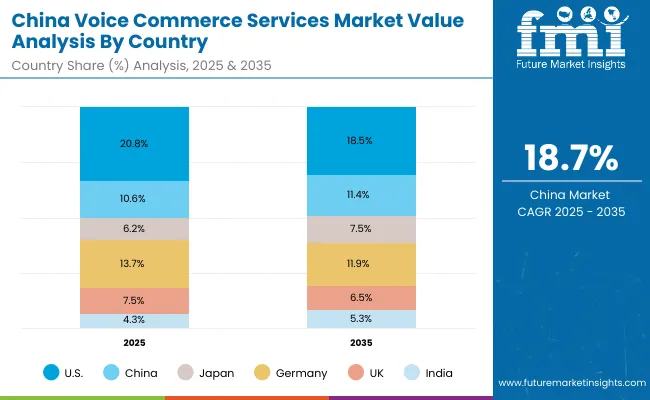

The Voice Commerce Services Market in China is expected to grow at a CAGR of 18.7% from 2025 to 2035, the second-fastest among leading economies. Growth is fueled by strong ecosystem rollouts from Alibaba (AliGenie), Baidu (DuerOS), and Xiaomi (XiaoAI), who are embedding voice commerce into e-commerce, digital payments, and smart home ecosystems. The rapid expansion of AI-driven personalization, localized language support, and mobile-first platforms has made voice commerce accessible across both urban and rural markets. The government’s push for smart cities and digital innovation is further supporting adoption across multiple industries, from retail and finance to entertainment and education.

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.5% |

| India | 4.3% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.5% |

| China | 11.4% |

| Japan | 7.5% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

The Voice Commerce Services Market in China is expected to grow at a CAGR of 18.7% from 2025 to 2035, the second-fastest among leading economies. Growth is fueled by strong ecosystem rollouts from Alibaba (AliGenie), Baidu (DuerOS), and Xiaomi (XiaoAI), who are embedding voice commerce into e-commerce, digital payments, and smart home ecosystems. The rapid expansion of AI-driven personalization, localized language support, and mobile-first platforms has made voice commerce accessible across both urban and rural markets. The government’s push for smart cities and digital innovation is further supporting adoption across multiple industries, from retail and finance to entertainment and education.

| USA by Industry | Value Share% 2025 |

|---|---|

| Retail & e-commerce | 56.7% |

| Others | 43.3% |

The Voice Commerce Services Market in the United States is projected at USD 5,688.9 million in 2025, with retail & e-commerce contributing 56.7% and other industries such as travel, finance, and food delivery accounting for 43.3%. This dominance reflects the maturity of the USA digital retail ecosystem, where Amazon Alexa and Google Assistant are firmly embedded into consumer shopping behaviors. Growth is supported by the expansion of voice-enabled payments, in-car commerce integrations, and smart home adoption, which extend the use of voice assistants beyond shopping into everyday transactions.

Advancements in AI-based personalization, contextual commerce, and biometrics-driven authentication are improving consumer trust and creating recurring service-based revenue opportunities. While privacy and data security remain key restraints, strong investments in encryption and regulatory compliance are addressing these concerns. The USA market is shifting toward a model where ecosystem integration, secure payments, and omnichannel adoption drive long-term growth.

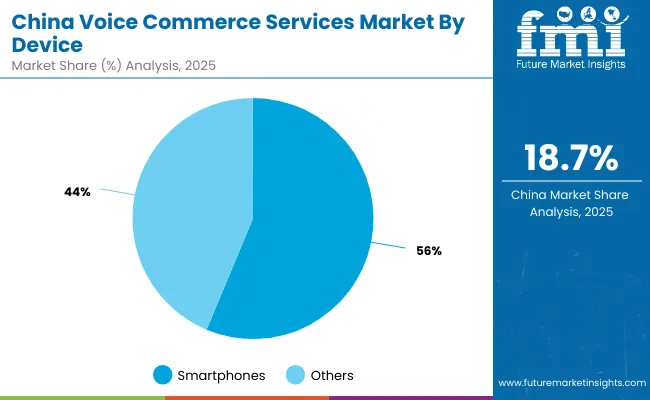

| China by Device | Value Share% 2025 |

|---|---|

| Smartphones | 56.3% |

| Others | 43.7% |

The Voice Commerce Services Market in China is projected at USD 6,018 million in 2025 from smartphones alone, with devices collectively capturing a significant share of adoption. Smartphones dominate with 56.3%, reflecting China’s mobile-first digital ecosystem, where super-apps and AI assistants are deeply integrated into daily commerce. Local platforms such as Alibaba’s AliGenie, Baidu’s DuerOS, and Xiaomi’s XiaoAI are shaping consumer behavior by embedding multi-lingual, payment-enabled, and personalized voice experiences into retail and financial ecosystems.

The opportunity lies in expanding voice commerce into lower-tier cities, where rising smartphone penetration and affordable data are opening new consumer bases. Cross-sector applications in food delivery, mobile banking, and entertainment streaming are accelerating, supported by favorable government policies for AI innovation and digital infrastructure. By leveraging AI-driven personalization, regional dialect support, and cloud integration, China is poised to remain a global leader in scaling voice commerce services.

The voice commerce services market is rapidly growing, driven by advances in voice recognition and the increasing use of smart devices. Key players include Amazon (Alexa), Google (Assistant), Apple (Siri), Samsung (Bixby), Alibaba (AliGenie), Baidu (DuerOS), SoundHound AI, Microsoft (Cortana), and Xiaomi (XiaoAI), each offering unique voice-enabled shopping experiences.

Amazon Alexa leads the market, enabling seamless shopping and order tracking via its extensive ecosystem of smart devices. Google Assistant follows closely, leveraging Google’s search and shopping capabilities for voice-based commerce across diverse platforms. Apple’s Siri integrates voice commerce with Apple’s services and hardware, providing a premium, secure shopping experience.

Samsung’s Bixby focuses on voice shopping within its suite of connected devices, while Alibaba’s AliGenie and Baidu’s DuerOS dominate in China, capitalizing on their strong e-commerce ecosystems. SoundHound AI offers advanced conversational AI, enhancing natural voice interactions for shopping. Microsoft’s Cortana remains relevant in enterprise environments, integrating voice commerce with Microsoft’s productivity tools. Xiaomi’s XiaoAI is expanding its reach through its ecosystem of smart devices, primarily in China and emerging markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 27,400.7 Million |

| Service Type | Voice-enabled ordering, Voice-based search & discovery, Voice payment & authentication |

| Device | Smartphones, Smart speakers, Wearables, In-car systems |

| Retail & e-commerce | Retail & e-commerce, Food delivery, Travel booking, Banking/finance |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon.com, Inc. (Alexa); Google LLC (Assistant); Apple Inc. (Siri); Samsung Electronics Co., Ltd. (Bixby); Alibaba Group Holding Limited (AliGenie); Baidu, Inc. (DuerOS); SoundHound AI, Inc.; Microsoft Corporation (Cortana); Xiaomi Corporation (XiaoAI) |

| Additional Attributes | Dollar sales by service type (voice-enabled ordering, search & discovery, authentication) and device categories, adoption trends in retail & e-commerce and financial services, rising demand for smartphone-led voice commerce, sector-specific growth in food delivery, travel booking, and banking, revenue segmentation between hardware devices, software ecosystems, and AI-driven services, integration with multi-lingual support, cloud platforms, and digital payment systems, regional adoption influenced by smartphone penetration and government-led digitization, and innovations in AI-based personalization, biometric voice authentication, and contextual commerce experiences. |

The global Voice Commerce Services Market is estimated to be valued at USD 27,400.7 million in 2025.

The market size for the Voice Commerce Services Market is projected to reach USD 95,203.1 million by 2035.

The Voice Commerce Services Market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key service types in the Voice Commerce Services Market are voice-enabled ordering, voice-based search & discovery, and voice payment & authentication.

In terms of industry adoption, Retail & e-commerce is expected to command the largest share at 57.5% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Voice Clinic Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Voice Analyser Market Size and Share Forecast Outlook 2025 to 2035

Voice Over Internet Protocol (VoIP) Over WLAN (VoWLAN) Market Size and Share Forecast Outlook 2025 to 2035

Voice over Internet Protocol (VoIP) Market Size and Share Forecast Outlook 2025 to 2035

Voice to Text on Mobile Devices Market Size and Share Forecast Outlook 2025 to 2035

Voice Assistance Application Market Size and Share Forecast Outlook 2025 to 2035

Voice Assistants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Voice Over LTE Market Analysis – Trends & Industry Forecast 2025 to 2035

Voice Over WLAN Market Report – Growth & Forecast 2025 to 2035

Voice Picking Solution Market Analysis by Component, Industry Vertical, Technology, Deployment Mode and Region from 2025 to 2035

Analyzing Voice Over LTE (VOLTE) and Voice Over Wi-Fi Market Share & Insights

VoLTE and Voice Over Wi-Fi Market Outlook 2025 to 2035

Commerce Cloud Market

Ecommerce Software and Platform Market Size and Share Forecast Outlook 2025 to 2035

Europe Ecommerce Paper Bags Market Analysis – Trends & Forecast 2024-2034

E-Commerce Packaging Market Forecast Outlook 2025 to 2035

E-commerce Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Q-Commerce Last-Mile Thermal Packs & Reverse Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Invoice Processing Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA