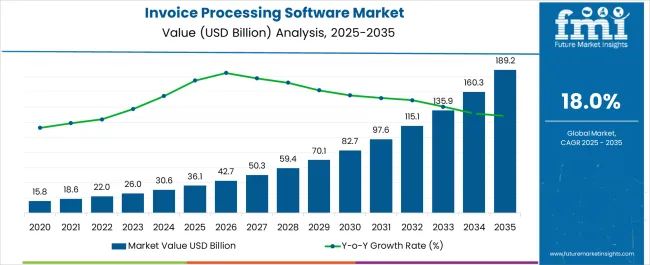

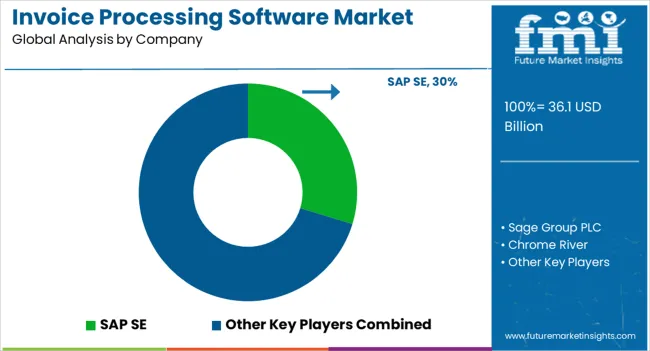

The Invoice Processing Software Market is estimated to be valued at USD 36.1 billion in 2025 and is projected to reach USD 189.2 billion by 2035, registering a compound annual growth rate (CAGR) of 18.0% over the forecast period.

| Metric | Value |

|---|---|

| Invoice Processing Software Market Estimated Value in (2025 E) | USD 36.1 billion |

| Invoice Processing Software Market Forecast Value in (2035 F) | USD 189.2 billion |

| Forecast CAGR (2025 to 2035) | 18.0% |

The invoice processing software market is experiencing accelerated growth as enterprises prioritize digital transformation, operational efficiency, and compliance-driven automation. Rising volumes of financial transactions and the need to minimize human error have increased reliance on automated invoicing systems.

Cloud-based deployment models, integration with enterprise resource planning systems, and advancements in artificial intelligence are enabling enhanced accuracy, faster processing times, and cost savings. The surge in remote work has also expanded the adoption of digital financial workflows, reducing dependency on manual invoice handling.

Regulatory compliance requirements, particularly around tax governance and audit trails, are further driving adoption. Looking ahead, the market outlook remains favorable as enterprises increasingly seek scalable and intelligent invoice management solutions to improve cash flow visibility, enhance financial reporting, and support seamless cross-border transactions.

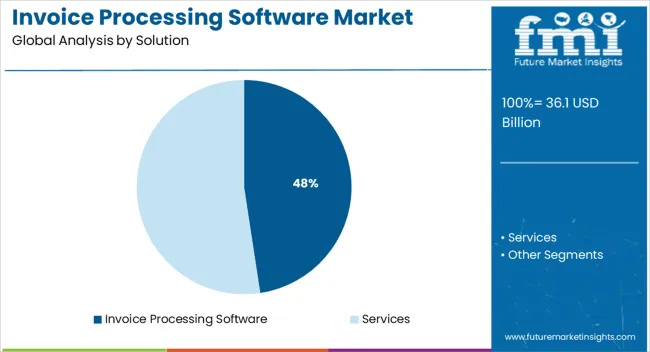

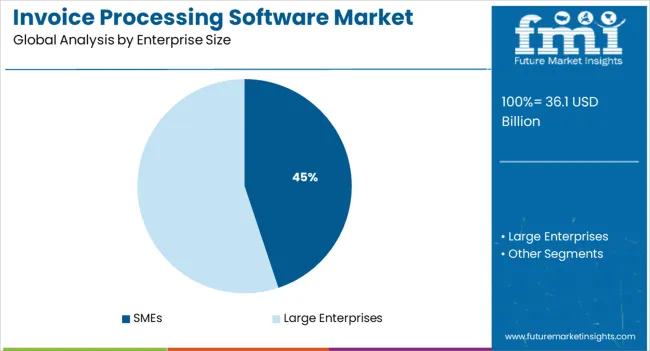

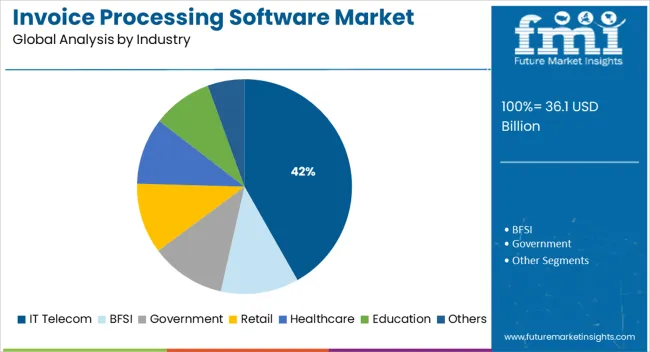

The market is segmented by Solution, Enterprise Size, and Industry and region. By Solution, the market is divided into Invoice Processing Software and Services. In terms of Enterprise Size, the market is classified into SMEs and Large Enterprises. Based on Industry, the market is segmented into IT Telecom, BFSI, Government, Retail, Healthcare, Education, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The invoice processing software solution segment is projected to hold 47.60% of total revenue by 2025, making it the leading segment in the solution category. This dominance is attributed to its ability to streamline accounts payable functions, automate repetitive processes, and reduce administrative costs.

Enterprises adopting invoice processing software benefit from reduced error rates, faster approval cycles, and stronger compliance with financial regulations. Additionally, the growing integration of AI-driven data capture and machine learning-based validation tools has further strengthened its adoption.

The scalability and flexibility of these solutions have also appealed to businesses of varying sizes, positioning this segment at the forefront of overall market growth.

The SMEs segment is expected to contribute 44.90% of the total revenue by 2025, making it the most prominent segment in enterprise size. This leadership position is being driven by the increasing focus of small and medium-sized businesses on cost optimization, operational efficiency, and digital adoption.

SMEs face heightened pressure to modernize financial processes while operating under budget constraints, making automated invoice software an attractive solution. The availability of affordable cloud-based models has lowered entry barriers and enabled smaller firms to access advanced financial tools without significant infrastructure investments.

Enhanced accuracy, improved cash management, and compliance benefits have further accelerated adoption, making SMEs a key growth driver within the market.

The IT and telecom segment is projected to hold 41.80% of the total revenue by 2025, making it the leading industry vertical. This dominance is explained by the high transaction volumes, complex vendor ecosystems, and recurring service contracts that require streamlined invoice management.

Automated solutions have enabled IT and telecom enterprises to reduce processing delays, strengthen audit readiness, and improve financial visibility across large-scale operations. The sector’s rapid pace of digital transformation has encouraged faster adoption of integrated invoicing platforms that align with global accounting standards.

In addition, the increasing reliance on subscription-based models and cloud services has further fueled the demand for efficient invoice processing, positioning the IT and telecom industry as the most influential adopter of these solutions.

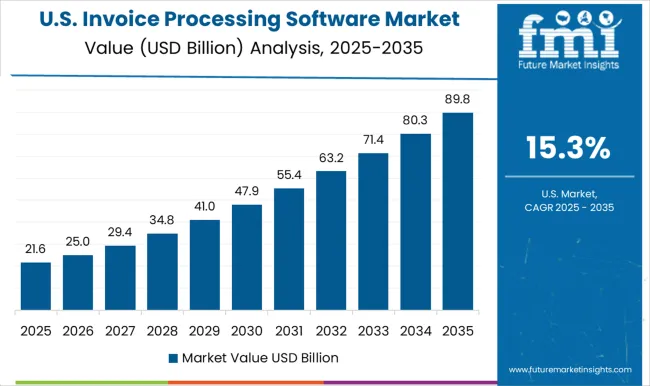

According to latest research, invoice processing software market is estimated to grow with a expected CAGR of 15%. Increasing need for secure payments to reduce frauds and adoption of cloud-based service is increasing the demand for invoice processing software.

The cloud based solution is helping enterprises to stay above of growing start-ups by gaining profitable revenue streams with minimum investment. The cloud based solution also help enterprises to quickly extend and customize their applications while creating opportunities for enterprises to transform and grow digitally.

Adoption of cloud-based invoice processing solution is a new trend in the market. Cloud-based solutions help companies to reduce their infrastructure and resources (IT personnel) costs, while at the same time allowing them access to all features as offered by on-premise software.

Various vendors such as SAP SE, Zoho Corporation and others that have been providing cloud-based quality and invoice processing solutions in the global market for over a decade have witnessed significant growth in terms of demand for cloud-based solution in the past few years.

Cloud-based invoice processing software enables users to receive real-time business updates and take required actions. Urgent issues regarding payments are being addressed in real time due to adoption of cloud based solution. Digital wallets and invoicing through mobile apps have also become a part of cloud based invoicing process.

Adoption of blockchain technology in invoicing process is increasing as blockchain technology has a potential to revolutionize how transactions are validated, invoices issued and payments made. Using blockchain in invoicing process helps user to make seamless payments from customer to businesses digital wallet. Transaction are easy to monitor and track and the entire history of exchange can be downloaded from blockchain.

Blockchain technology eliminates the manual steps involved in invoice processing and the transaction are becoming paperless as the adoption of blockchain is increasing. As the transaction information is stored in blockchain all relevant parties can view and verify the processes and it can be used with artificial intelligence for identifying payment profiles and risk of end debtors.

Invoice processing solution vendors can focus on expanding their businesses across countries in South Asia Pacific region where there is increasing demand of innovative invoice processing solution to automate the invoicing process and avoid human errors in the process. Invoice processing solution market is growing rapidly due to growing business complexities and changing regulatory requirements.

Therefore companies need to focus on the growing need to analyze regulatory requirements, polices, and obligations. Also, government initiatives that are mandating the use of invoice processing software is facilitating the growth of invoice processing software in the region.

Adoption of invoice processing solution is growing in the region due to rising adaptation of the solution in small and medium size businesses. Moreover, invoice processing solutions offered in the region are integrated with analytical tools like Machine Learning (ML), artificial intelligence, blockchain technology that enable organizations get actionable insights and thereby focus on reducing organizational risks.

Some of the key players in the region are following product launch strategy in order to offer innovative invoice processing solution.

Some of the leading Invoice Processing Software providers include

These vendors have adopted various key strategies, to enhance the customer base globally and locally. Companies are also spending millions of dollars into product to fulfill the unmet needs of their customers. Furthermore, many companies are focusing on inorganic strategies by acquiring small and mid-sized organizations present in this market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global invoice processing software market is estimated to be valued at USD 36.1 billion in 2025.

The market size for the invoice processing software market is projected to reach USD 189.2 billion by 2035.

The invoice processing software market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in invoice processing software market are invoice processing software, _on-premise, _cloud-based, services, _integration implementation, _consulting services and _support maintenance.

In terms of enterprise size, smes segment to command 44.9% share in the invoice processing software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Supplies Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Systems Market

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rice Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Equipment Market - Size, Share, and Forecast Outlook 2025 to 2035

Food Processing Seals Market Growth & Demand, 2025 to 2035

Fish Processing Market Analysis by Source, Application, Processing Type, Equipment, and Region through 2035

Media Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA