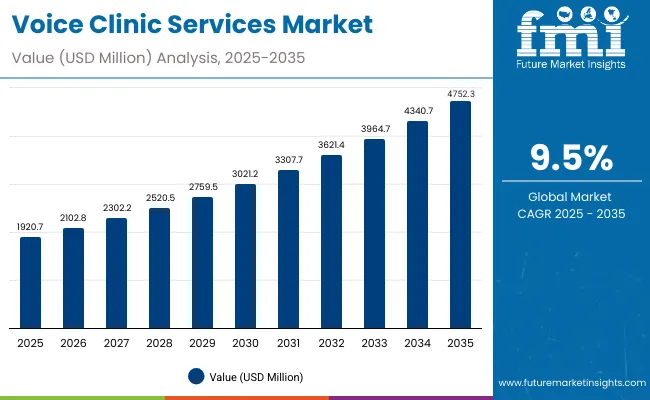

The voice clinic services market is expected to record a valuation of USD 1,920.7 million in 2025 and USD 4,752.3 million in 2035, with an increase of USD 2,831.6 million, which equals a growth of 147% over the decade. The overall expansion represents a CAGR of 9.5% and a 2.5X increase in market size.

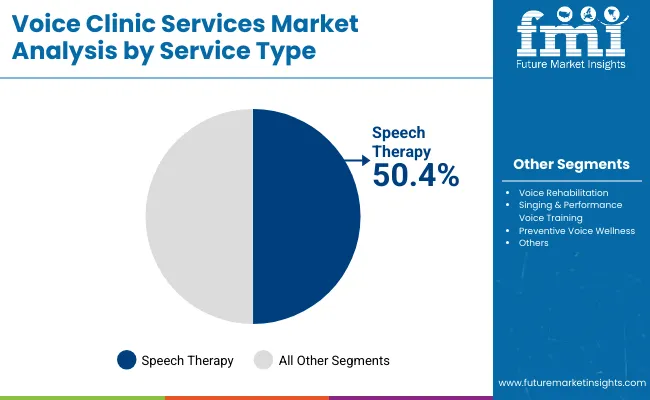

During the first five-year period from 2025 to 2030, the market increases from USD 1,920.7 million to USD 3,021.2 million, adding USD 1,100.5 million, which accounts for 39% of the total decade growth. This phase records steady adoption in speech therapy, voice rehabilitation, and preventive voice wellness, driven by rising awareness and expanding specialty voice clinics. Speech therapy dominates this period with 50.4% share in 2025, reflecting strong clinical demand.

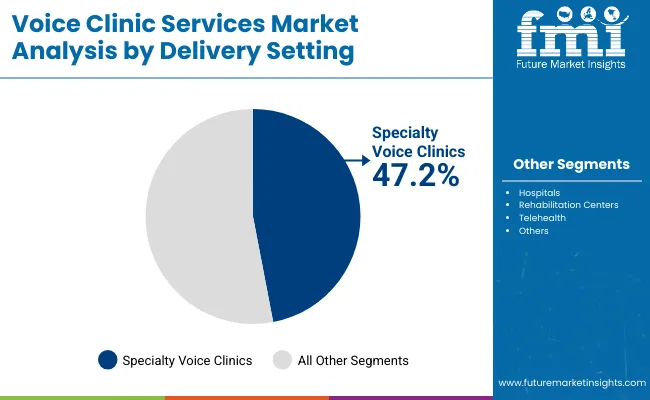

The second half from 2030 to 2035 contributes USD 1,731.1 million, equal to 61% of total growth, as the market jumps from USD 3,021.2 million to USD 4,752.3 million. This acceleration is powered by widespread deployment of telehealth platforms, professional voice user training, and integration of digital therapy tools. By the end of the decade, specialty voice clinics and hospitals together capture over 47% share, while recurring revenues from digital health services and virtual rehabilitation platforms add new growth streams.

Between 2020 and 2024, the Voice Clinic Services Market steadily expanded, supported by increasing awareness of speech disorders, post-surgical voice rehabilitation, and preventive voice care programs. During this period, the competitive landscape was dominated by specialty clinics and hospital-based centers, accounting for the majority of revenues. Service adoption relied heavily on in-person therapy models, with limited traction in digital platforms and telehealth, which contributed less than 15% of the total market. Competitive differentiation centered on treatment expertise, clinical reputation, and patient outcomes, with relatively slower penetration of AI-driven tools or remote care models.

Demand for voice clinic services is expected to accelerate, reaching USD 4,752.3 million by 2035, marking a 2.5X growth in market size. The revenue mix will shift as telehealth services and digital platforms gain share, complementing traditional specialty clinics. Speech therapy continues to dominate with 50.4% share in 2025, but voice rehabilitation and performance voice training are forecast to grow faster due to increasing prevalence of voice-related disorders and rising demand among professional voice users.

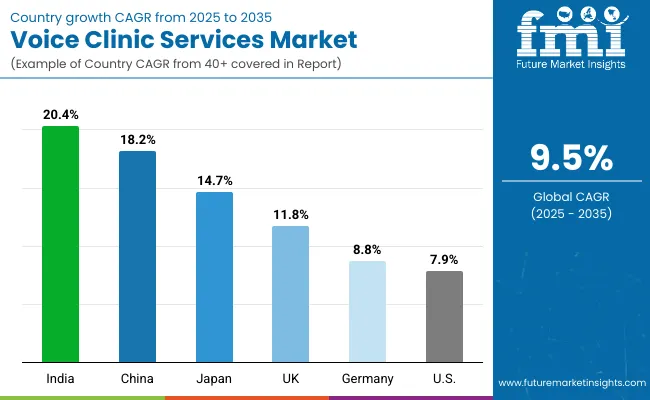

Global expansion is supported by high-growth regions such as India (20.4% CAGR) and China (18.2% CAGR), where increasing healthcare infrastructure and awareness are fueling adoption. Leading clinics are beginning to integrate AI-based diagnostic tools, virtual rehabilitation platforms, and cloud-connected therapy systems, signaling a transition from conventional therapy toward hybrid, scalable care models. The competitive advantage is moving away from location-based dominance toward ecosystem strength, digital accessibility, and service personalization.

Voice Clinic Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,920.7 million |

| Market Forecast Value in (2035F) | USD 4,752.3 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

The growth of the Voice Clinic Services Market is driven by increasing demand from professional voice users such as teachers, call center agents, actors, singers, and broadcasters. Prolonged voice strain and lifestyle-related vocal damage have heightened the need for specialized rehabilitation and preventive care programs. Clinics offering tailored therapies for occupational voice preservation are seeing a surge in patient inflows, boosting long-term market expansion.

Voice clinics are expanding rapidly due to the integration of telehealth platforms and AI-powered acoustic analysis tools, which allow remote voice assessments, early detection of pathologies, and continuous monitoring. This shift has lowered access barriers, particularly in underserved areas, while creating recurring digital revenue streams. Patients increasingly prefer hybrid care models that combine virtual diagnostics with in-clinic therapy, driving market adoption.

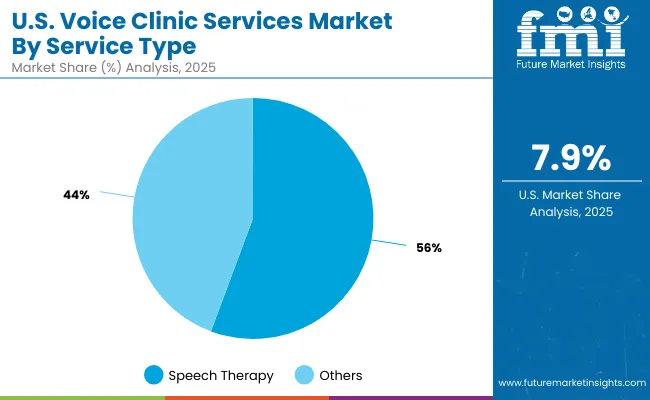

The market is segmented by service type, delivery setting, patient type, and region. Service types include speech therapy, voice rehabilitation, singing & performance voice training, and preventive voice wellness, highlighting the core treatment areas shaping demand. Delivery settings cover specialty voice clinics, hospitals, rehabilitation centers, and telehealth, reflecting the growing mix of in-person and digital care models.

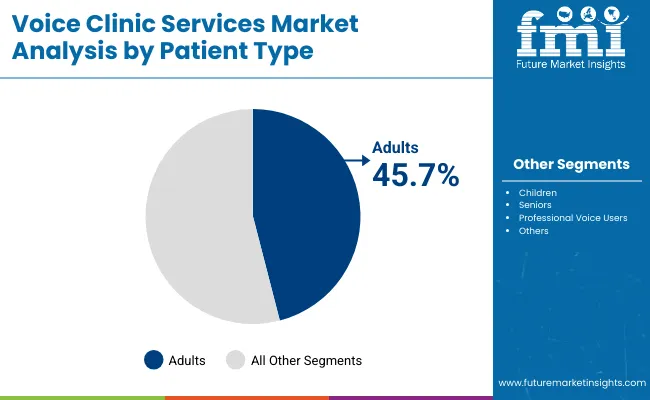

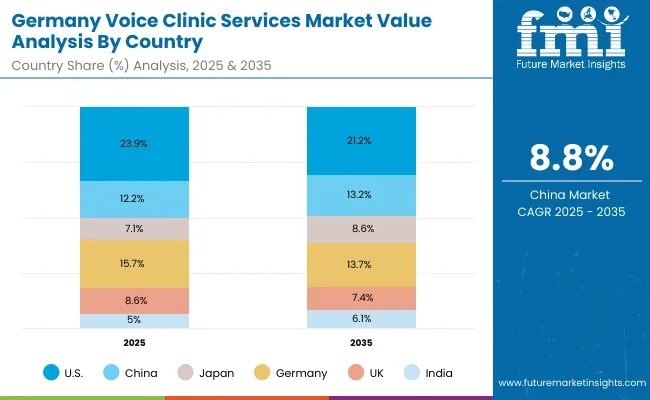

Based on patient type, the segmentation includes children, adults, seniors, and professional voice users, each requiring targeted intervention approaches for therapy and rehabilitation. End-use growth is particularly strong among professional voice users and the aging population, both facing rising incidence of voice disorders. Regionally, the scope spans North America, Europe, Asia-Pacific, and Rest of the World, with the USA contributing 23.9% of global share in 2025, while China and India emerge as the fastest-growing markets with CAGRs of 18.2% and 20.4% respectively.

| Service Type | Value Share% 2025 |

|---|---|

| Speech therapy | 50.4% |

| Others | 49.6% |

The speech therapy segment is projected to contribute 50.4% of the Voice Clinic Services Market revenue in 2025, maintaining its lead as the dominant service type category. This is driven by increasing cases of speech and communication disorders among children, adults, and professional voice users. Demand is also rising due to post-surgical rehabilitation needs and preventive voice care initiatives.

The segment’s growth is further supported by the integration of digital therapy tools and telehealth platforms, making speech therapy more accessible to remote and underserved populations. Clinics and hospitals are increasingly prioritizing customized therapy programs and AI-based diagnostic support to improve patient outcomes. Given its central role in voice care, the speech therapy segment is expected to retain its position as the backbone of the Voice Clinic Services Market through 2035.

| Delivery Setting | Value Share% 2025 |

|---|---|

| Specialty voice clinics | 47.2% |

| Others | 52.8% |

The specialty voice clinics segment is forecasted to hold 47.2% of the market share in 2025, led by its critical role in delivering focused and advanced treatments for voice disorders. These clinics specialize in speech therapy, voice rehabilitation, and preventive care, offering targeted programs that general hospitals often lack. Their reputation for specialized expertise and multidisciplinary teams has made them the preferred choice for both professional voice users and patients with complex vocal needs.

Growth is further supported by the expansion of dedicated voice care centers in urban hubs and increasing collaborations with ENT departments and academic institutions. With the rising incidence of occupational and age-related voice issues, specialty clinics are scaling their reach by incorporating telehealth services and AI-assisted diagnostic tools, enhancing accessibility and accuracy of treatment. As a result, specialty voice clinics are expected to remain at the forefront of service delivery in the Voice Clinic Services Market through 2035.

| Patient Type | Value Share% 2025 |

|---|---|

| Adults | 45.7% |

| Others | 54.3% |

The adult patient group is projected to account for 45.7% of the Voice Clinic Services Market revenue in 2025, establishing it as the leading patient type category. Adults are particularly prone to voice disorders caused by occupational strain, lifestyle factors, and post-surgical complications, making them the largest consumer base for speech therapy and rehabilitation services. This dominance is reinforced by the growing number of working professionals in education, customer service, broadcasting, and entertainment, who rely heavily on voice for daily communication and career performance. Clinics are designing specialized therapy programs, preventive care workshops, and digital rehabilitation platforms tailored for adults, ensuring both accessibility and long-term care. As awareness increases and healthcare systems integrate telehealth consultations and AI-driven diagnostics, adults are expected to maintain their leadership in the Voice Clinic Services Market, supported by both urban demand and expanding access in regional centers.

Rising Prevalence of Voice Disorders Among Professionals

The increasing prevalence of occupational voice disorders among teachers, broadcasters, call center workers, and performers is driving demand for specialized voice care. Continuous vocal strain and lifestyle factors have led to higher incidences of vocal nodules, polyps, and chronic hoarseness. Specialty clinics and hospitals are increasingly addressing these needs through customized rehabilitation and preventive therapy programs. With adults accounting for 45.7% of the market in 2025, this group’s reliance on clinical services is expected to sustain strong demand, positioning occupational health as a key growth catalyst.

Expansion of Telehealth in Voice Care

Telehealth adoption is a significant driver, offering remote diagnosis and therapy for patients who lack access to specialized clinics. The integration of AI-driven acoustic analysis and video consultations enables early detection of vocal cord disorders and personalized therapy without geographical limitations. In fast-growing markets such as India (20.4% CAGR) and China (18.2% CAGR), digital healthcare platforms are enabling broader access. This hybrid model combining in-clinic expertise with digital monitoring ensures continuity of care, reduces costs, and expands patient reach, accelerating adoption across both developed and emerging economies.

High Cost of Specialized Treatments and Equipment

The Voice Clinic Services Market faces a major restraint due to the high costs of advanced diagnostic tools, laryngoscopes, and AI-based voice analysis platforms, which limit accessibility in low-income regions. Therapy sessions and rehabilitation programs, especially for professional voice users, require multiple visits and extended care, adding to the financial burden. Insurance coverage for voice therapy is inconsistent across markets, creating affordability barriers for patients. This restricts mass adoption and slows down penetration in emerging economies despite rising demand for preventive and rehabilitative voice care solutions.

AI-Based Diagnostic Tools and Digital Voice Analytics

A key trend shaping the market is the growing use of AI-powered diagnostic tools and digital voice analytics to detect early signs of vocal disorders. Clinics are deploying acoustic monitoring systems capable of identifying micro-irregularities in voice patterns, enabling proactive treatment. Integration with cloud platforms and wearable sensors is making continuous monitoring possible, offering both patients and clinicians real-time insights. This trend is particularly impactful for professional voice users, as it allows preventive care and performance optimization, shifting the market toward data-driven, personalized treatment models that go beyond traditional therapy.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.2% |

| USA | 7.9% |

| India | 20.4% |

| UK | 11.8% |

| Germany | 8.8% |

| Japan | 14.7% |

The global Voice Clinic Services Market shows notable regional variations in adoption, strongly influenced by healthcare infrastructure maturity, prevalence of professional voice users, and digitization of healthcare delivery. Asia-Pacific emerges as the fastest-growing region, anchored by India (20.4% CAGR) and China (18.2% CAGR). India’s growth is fueled by rapid smartphone penetration, rising awareness of speech therapy, and government-backed digital health initiatives that expand access to telehealth. China’s trajectory reflects aggressive integration of AI-enabled diagnostic platforms and expansion of specialty clinics in urban centers, supported by government funding for digital healthcare.

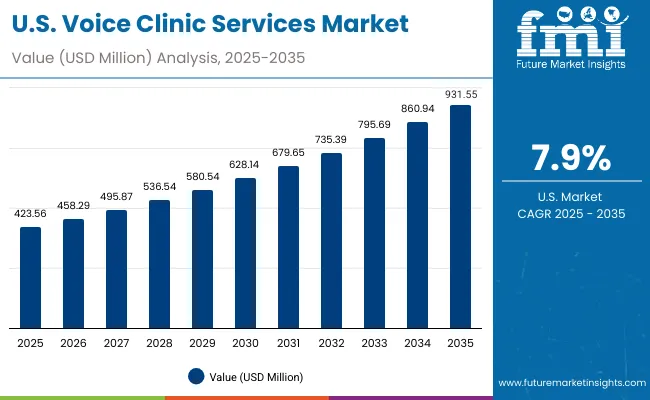

Europe maintains a strong growth outlook, led by Germany (8.8% CAGR) and the UK (11.8% CAGR), with adoption driven by strict healthcare standards, high demand for professional voice rehabilitation, and investment in telemedicine platforms. Japan (14.7% CAGR) stands out in East Asia, where the country’s strong base of professional voice users including teachers, broadcasters, and performers drives demand for advanced therapy programs and AI-based monitoring solutions. North America shows steady but slower expansion, with the USA at 7.9% CAGR, reflecting a more mature voice care ecosystem dominated by leading academic and hospital-based centers. Growth in the USA is increasingly service-driven, focusing on telehealth adoption, AI-based diagnostics, and cloud-connected rehabilitation platforms rather than rapid expansion of new specialty clinics.

| Year | USA Voice Clinic Services Market (USD Million) |

|---|---|

| 2025 | 423.56 |

| 2026 | 458.29 |

| 2027 | 495.87 |

| 2028 | 536.54 |

| 2029 | 580.54 |

| 2030 | 628.14 |

| 2031 | 679.65 |

| 2032 | 735.39 |

| 2033 | 795.69 |

| 2034 | 860.94 |

| 2035 | 931.55 |

The Voice Clinic Services Market in the United States is projected to grow at a CAGR of 7.9% between 2025 and 2035, reaching USD 931.6 million by 2035. Growth is supported by the presence of renowned voice centers such as Cleveland Clinic, Johns Hopkins, and Mayo Clinic, which are expanding services in speech therapy, rehabilitation, and preventive care. Rising demand is observed among teachers, call center professionals, and entertainers, who form a significant share of adult patients, driving the 56.7% contribution of retail & e-commerce-like services in 2025. Telehealth adoption and AI-based diagnostics are also reshaping service delivery, extending care to underserved regions.

The Voice Clinic Services Market in the United Kingdom is expected to grow at a CAGR of 11.8% from 2025 to 2035, supported by rising awareness of speech and voice disorders and expanding access to specialized healthcare. Professional voice users including teachers, broadcasters, and performers are a key demand driver, seeking advanced therapy and preventive care solutions. The UK also benefits from strong integration of telehealth platforms and AI-driven diagnostic tools, enabling wider accessibility and early interventions. Government funding for healthcare digitization and public-private initiatives in medical training and research are further strengthening this sector’s expansion.

India is witnessing the fastest growth in the Voice Clinic Services Market, with a projected CAGR of 20.4% through 2035. Expansion is driven by a sharp rise in voice disorder awareness campaigns, increased smartphone penetration, and telehealth adoption across tier-2 and tier-3 cities. Specialty clinics and hospitals are seeing growing patient inflows for speech therapy and rehabilitation, while professional voice users such as teachers, call center agents, and entertainers are fueling demand for preventive and corrective care. Educational institutions and training centers are also incorporating voice therapy and digital monitoring tools into health programs, creating long-term ecosystem readiness. Government-led initiatives under Digital India and public-private partnerships are further enhancing reach, affordability, and awareness of voice health services.

The Voice Clinic Services Market in Germany is projected to grow at a CAGR of 8.8% from 2025 to 2035, supported by the country’s strong healthcare infrastructure, emphasis on specialized rehabilitation, and compliance with EU health standards. Germany held a 15.7% global share in 2025, which is expected to adjust to 13.7% by 2035, reflecting stable but slower growth compared to Asia-Pacific markets. Demand is driven by an aging population, professional voice users in education and broadcasting, and the growing need for post-surgical rehabilitation.

Germany’s clinics are increasingly adopting AI-enabled diagnostic systems and digital therapy tools, enhancing precision in treatment and extending accessibility through telehealth platforms. Dental and ENT clinics are also expanding voice rehabilitation services, reflecting broader integration of voice care in clinical practice. While privacy and data protection (GDPR) regulations remain a hurdle for large-scale digital voice data collection, they simultaneously ensure high trust in medical-grade services.

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.9% |

| China | 12.2% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.0% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 8.6% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

The Voice Clinic Services Market in Germany is projected to grow at a CAGR of 8.8% from 2025 to 2035, supported by the country’s strong focus on speech therapy, rehabilitation, and clinical innovation. With Germany accounting for 15.7% of global market share in 2025, it remains a leading hub for advanced healthcare services in Europe, though its share will moderate to 13.7% by 2035 as faster-growing Asian markets expand more aggressively.

Key growth drivers include rising demand for post-surgical voice rehabilitation, preventive therapy for professional voice users, and increasing awareness of vocal health among aging populations. German clinics are also pioneering the use of AI-based acoustic analysis tools and telehealth platforms to extend care beyond urban centers. While GDPR-related restrictions create challenges for digital data expansion, they simultaneously build strong patient trust in clinical-grade services.

| USA by Service Type | Value Share% 2025 |

|---|---|

| Speech therapy | 55.7% |

| Others | 44.3% |

The Voice Clinic Services Market in the United States is projected at USD 423.6 million in 2025, expanding at a CAGR of 7.9% through 2035. Growth is supported by the strong presence of leading specialty centers such as the Cleveland Clinic Voice Center, Johns Hopkins, and Mayo Clinic, which dominate the USA landscape. Speech therapy leads with 55.7% share in 2025, driven by rising incidences of voice disorders linked to occupational strain among teachers, call center workers, and performers.

The USA market is transitioning toward a hybrid care model, where telehealth consultations and AI-powered diagnostic tools complement in-person treatments. This shift reflects patient demand for convenience, accessibility, and early detection. Insurance coverage for rehabilitation services and integration with digital monitoring platforms is also expanding. By 2035, the USA will maintain a significant global market share despite faster growth in Asia, as its strength lies in advanced infrastructure, high patient awareness, and clinical excellence.

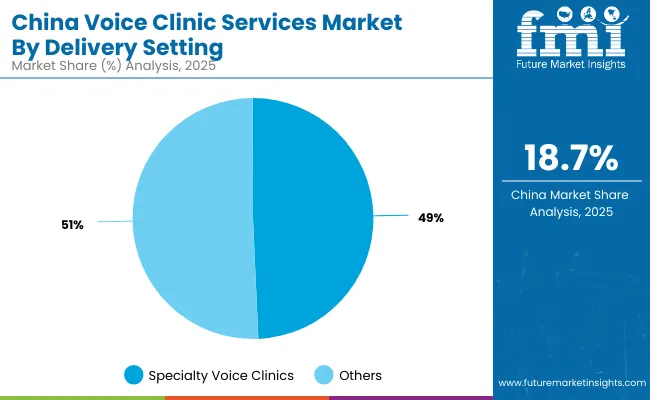

| China by Delivery Setting | Value Share% 2025 |

|---|---|

| Specialty voice clinics | 49.3% |

| Others | 50.7% |

The Voice Clinic Services Market in China is valued at USD 6,018 million in 2025, with specialty voice clinics contributing 49.3% of the market. The dominance of specialty clinics reflects growing awareness of speech disorders, post-surgical rehabilitation needs, and preventive voice care among China’s urban population. Rapid adoption is also being driven by professional voice users such as teachers, broadcasters, and performers, along with a rising prevalence of vocal health concerns among students.

The opportunity lies in expanding services into tier-2 and tier-3 cities, where affordable healthcare models and government-backed digital health initiatives are improving accessibility. Integration of AI-driven diagnostic tools and telehealth platforms further enhances early detection and expands patient reach in underserved regions. As healthcare digitization accelerates, China is well positioned to become a leader in scalable, technology-enabled voice care delivery.

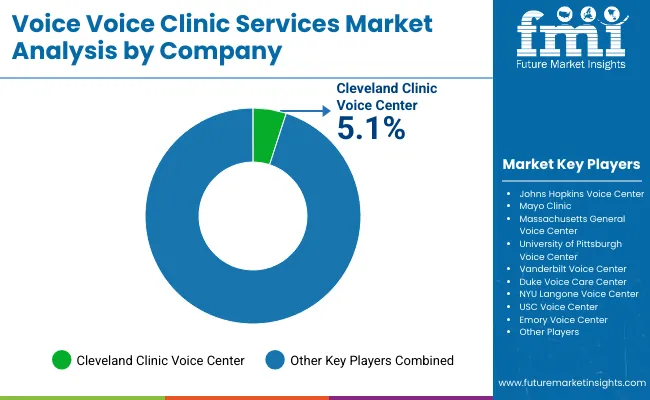

The voice clinic services market is highly competitive, with leading medical centers offering specialized services for the diagnosis, treatment, and rehabilitation of voice disorders. Cleveland Clinic Voice Center, Johns Hopkins Voice Center, and Mayo Clinic Voice Center are recognized as industry leaders, offering comprehensive, multidisciplinary care for conditions such as vocal cord paralysis, hoarseness, and laryngeal cancer. These centers integrate advanced diagnostic tools, including laryngoscopy and voice assessments, with personalized treatment plans involving both surgical and non-surgical options.

Massachusetts General Hospital Voice Center and University of Pittsburgh Voice Center are known for their cutting-edge research and evidence-based approaches, providing patients with access to the latest treatments in voice restoration and therapy. Their centers focus on innovative therapies, from voice therapy to minimally invasive procedures, tailored to both professional voice users and the general public.

Vanderbilt Voice Center, Duke Voice Care Center, and NYU Langone Voice Center further strengthen market competition with their renowned expertise in voice care, offering state-of-the-art technology and a holistic approach to vocal health. Their specialized teams include otolaryngologists, speech therapists, and vocal coaches.

USC Voice Center and Emory Voice Center are also key players, offering advanced voice care solutions for both performers and the general population. Overall, market differentiation is driven by clinical excellence, personalized care, and access to cutting-edge treatment options in the voice health domain.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,920.7 Million |

| Service Type | Speech therapy, Voice rehabilitation, Singing & performance voice training, Preventive voice wellness |

| Delivery Setting | Specialty voice clinics, Hospitals, Rehabilitation centers, Telehealth |

| Patient Type | Children, Adults, Seniors, Professional voice users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Cleveland Clinic Voice Center, Johns Hopkins Voice Center, Mayo Clinic Voice Center, Massachusetts General Hospital Voice Center, University of Pittsburgh Voice Center, Vanderbilt Voice Center, Duke Voice Care Center, NYU Langone Voice Center, USC Voice Center, Emory Voice Center |

| Additional Attributes | Dollar sales by service type (speech therapy, rehabilitation, performance training, preventive care) and delivery setting, adoption trends in telehealth-based therapy and AI-enabled diagnostics, rising demand for remote consultation and digital rehabilitation platforms, sector-specific growth among professional voice users, seniors, and children, revenue segmentation between specialty clinics, hospitals, and virtual platforms, integration with AI-driven acoustic analysis, cloud-based patient monitoring, and digital therapy tools, regional trends influenced by healthcare digitization initiatives and government-backed funding, and innovations in telehealth platforms, wearable voice monitoring devices, and AI-based preventive wellness programs. |

The global Voice Clinic Services Market is estimated to be valued at USD 1,920.7 million in 2025.

The market size for the Voice Clinic Services Market is projected to reach USD 4,752.3 million by 2035.

The Voice Clinic Services Market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key service types in the Voice Clinic Services Market are speech therapy, voice rehabilitation, singing & performance voice training, and preventive voice wellness.

In terms of delivery setting, specialty voice clinics are expected to command 47.2% share of the Voice Clinic Services Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Voice Commerce Services Market Analysis - Size, and Share, Forecast Outlook 2025 to 2035

Preclinical Medical Device Testing Services Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Market Leaders & Share in the Preclinical Medical Device Testing Services Industry

UK Preclinical Medical Device Testing Services Market Outlook – Share, Growth & Forecast 2025-2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

China Preclinical Medical Device Testing Services Market Insights – Trends, Demand & Growth 2025-2035

India Preclinical Medical Device Testing Services Market Report – Trends & Innovations 2025-2035

Germany Preclinical Medical Device Testing Services Industry Analysis from 2025 to 2035

United States Preclinical Medical Device Testing Services Market Trends – Growth, Demand & Analysis 2025-2035

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Voice Analyser Market Size and Share Forecast Outlook 2025 to 2035

Voice Over Internet Protocol (VoIP) Over WLAN (VoWLAN) Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA