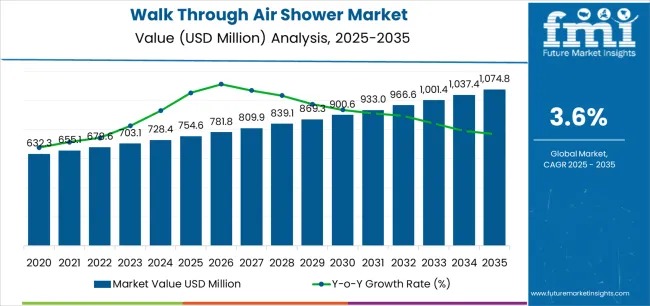

The global walk through air shower market is expected to grow from USD 754.6 million in 2025 to approximately USD 1,074.7 million by 2035, recording an absolute increase of USD 320.1 million over the forecast period. This translates into a total growth of 42.4%, with the market forecast to expand at a CAGR of 3.6% between 2025 and 2035. The market size is expected to grow by nearly 1.4X during the same period, supported by increasing global demand for contamination control equipment, growing adoption of cleanroom entry systems in pharmaceutical manufacturing applications, and rising quality standards driving professional air shower procurement across various electronics production and laboratory research facilities.

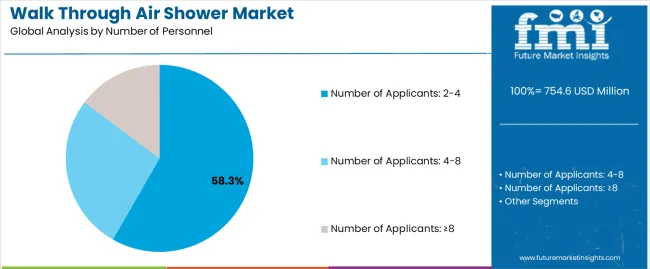

The market trajectory reflects accelerating cleanroom construction activity, particularly in pharmaceutical and electronics manufacturing sectors where product quality and contamination prevention drive stringent entry protocols. Medium-capacity air showers serving two to four personnel continue to dominate installations, offering practical balance between throughput efficiency and space requirements. Higher capacity systems remain concentrated in large-scale manufacturing facilities where personnel traffic volumes justify investment in multi-person entry systems.

Regional growth patterns demonstrate particular strength in Asian markets, where expanding pharmaceutical production and semiconductor fabrication drive consistent air shower installation. European markets maintain steady growth through regulatory compliance requirements and pharmaceutical GMP standards, while North American markets show increasing activity in biotechnology research facilities leveraging stringent contamination control frameworks. Manufacturing facility modernization and ISO cleanroom certification requirements continue to support demand for established equipment suppliers with proven contamination reduction performance.

Technology advancement in nozzle design, airflow optimization, and control system intelligence continues to improve decontamination efficacy while reducing energy consumption. The integration of automated door interlocks and personnel detection sensors enhances operational efficiency for high-traffic installations. Manufacturers are developing modular designs and simplified installation procedures to reduce project deployment timelines and facility integration complexity.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 754.6 million |

| Market Forecast Value (2035) | USD 1,074.7 million |

| Forecast CAGR (2025-2035) | 3.6% |

| MANUFACTURING EXPANSION | CONTAMINATION CONTROL REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Pharmaceutical Production Growth | Cleanroom Entry Standards | GMP Compliance Requirements |

| Continuous expansion of pharmaceutical manufacturing capacity across emerging markets driving demand for contamination control entry systems. | Modern cleanroom operations requiring certified entry equipment delivering proven particle removal and contamination prevention performance. | Regulatory requirements establishing cleanroom entry protocols favoring validated air shower systems with documented performance. |

| Electronics Fabrication Development | Particle Contamination Prevention | ISO Cleanroom Certification |

| Growing emphasis on semiconductor manufacturing and electronics assembly quality creating demand for personnel decontamination systems. | Facility managers investing in air shower equipment offering consistent contamination reduction while maintaining production efficiency. | Quality standards requiring validated entry systems and comprehensive documentation for cleanroom classification maintenance. |

| Biotechnology Research Expansion | Cross-Contamination Control | Facility Validation Standards |

| Superior particle removal characteristics and airflow performance making air showers essential for controlled environment entry applications. | Certified manufacturers with proven contamination reduction records required for pharmaceutical and biotechnology facility applications. | Laboratory accreditation and facility certification standards driving need for documented air shower performance verification. |

| Category | Segments Covered |

|---|---|

| By Number of Personnel | Number of Applicants: 2-4, Number of Applicants: 4-8, Number of Applicants: ≥8 |

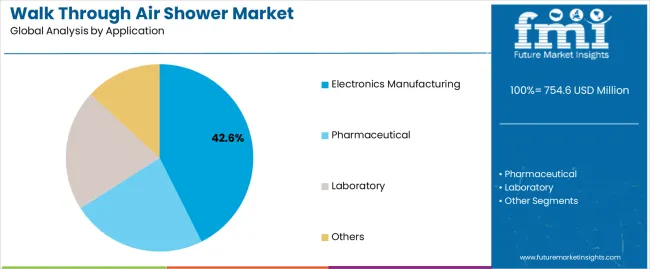

| By Application | Electronics Manufacturing, Pharmaceutical, Laboratory, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Number of Applicants: 2-4 |

|

| Number of Applicants: 4-8 |

|

| Number of Applicants: ≥8 |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Electronics Manufacturing |

|

| Pharmaceutical |

|

| Laboratory |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Pharmaceutical Manufacturing Expansion | High Capital Investment Requirements | Intelligent Control Systems |

| Global pharmaceutical production capacity growth and biosimilar manufacturing development driving cleanroom entry equipment across established and emerging markets. | Significant upfront costs for large-capacity systems affecting adoption in budget-constrained facilities and smaller manufacturing operations. | Integration of personnel detection sensors and automated door interlocks improving operational efficiency and reducing energy consumption during idle periods. |

| Semiconductor Fabrication Growth | Space Requirements | Energy Efficiency Optimization |

| Advanced semiconductor manufacturing and electronics assembly expansion requiring stringent contamination control for product yield protection. | Substantial footprint requirements for medium and large capacity units creating retrofit challenges in existing facilities. | Development of variable frequency drives and optimized nozzle designs reducing electrical consumption while maintaining decontamination performance. |

| Cleanroom Certification Standards | Maintenance Complexity | Modular Design Innovation |

| ISO cleanroom classification requirements and facility validation standards mandating validated entry systems for contamination control. | HEPA filter replacement costs and regular maintenance requirements creating ongoing operational expenses and downtime concerns. | Prefabricated modular construction and simplified installation procedures reducing project timelines and facility integration complexity. |

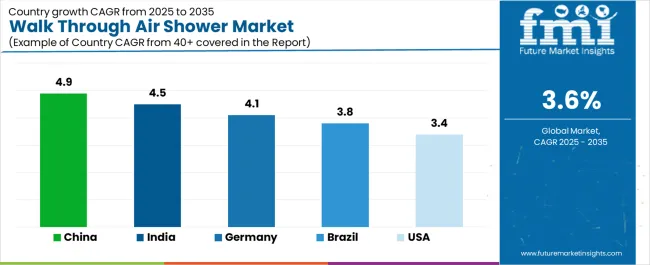

| Country | CAGR (2025-2035) |

|---|---|

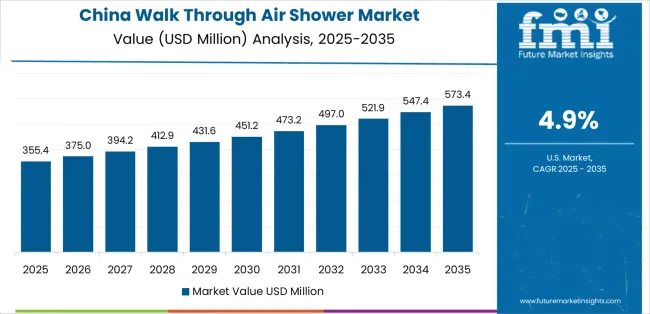

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| United States | 3.4% |

Revenue from walk-through air showers in China is projected to exhibit strong growth, with a market CAGR of 4.9% by 2035. This growth is driven by expanding pharmaceutical production capacity and comprehensive semiconductor fabrication infrastructure, creating substantial opportunities for contamination control equipment suppliers across pharmaceutical manufacturing operations, electronics production facilities, and research laboratory sectors.

The country’s established cleanroom construction tradition and expanding GMP compliance capabilities are generating significant demand for both standard and large-capacity air shower systems. Major pharmaceutical manufacturers and semiconductor fabricators are establishing comprehensive contamination control equipment procurement programs to support large-scale facility operations and meet growing quality standards.

Pharmaceutical manufacturing expansion programs are supporting widespread adoption of air shower systems across production facilities, driving demand for cost-effective contamination control equipment. Semiconductor fabrication capacity development initiatives and electronics assembly growth are creating substantial opportunities for equipment suppliers requiring reliable particle removal performance and competitive manufacturing costs. Regional pharmaceutical production expansion and provincial cleanroom construction development are facilitating adoption of air shower systems throughout major manufacturing regions.

Revenue from walk-through air showers in India is expanding at a CAGR of 4.5% to reach USD 171.8 million by 2035, supported by extensive pharmaceutical manufacturing development and comprehensive biotechnology facility construction, which creates sustained demand for contamination control equipment across diverse production categories and research application segments. The country’s rapidly growing pharmaceutical industry and expanding cleanroom facility capabilities are driving demand for air shower systems that provide consistent particle removal performance while supporting cost-effective installation requirements. Pharmaceutical manufacturers and contract research organizations are investing in contamination control equipment to support growing production volumes and regulatory compliance requirements.

Pharmaceutical production facility expansion and biotechnology manufacturing capability development are creating opportunities for air shower systems across diverse application segments requiring reliable contamination control performance and competitive equipment costs. Generic pharmaceutical production growth and contract manufacturing advancement are driving investments in contamination control equipment supply chains supporting GMP compliance requirements throughout major pharmaceutical manufacturing regions. Quality standardization programs and facility validation development are enhancing demand for certified air shower systems throughout Indian pharmaceutical markets.

Demand for walk-through air showers in Germany is projected to expand at a CAGR of 4.1%, supported by the country's leadership in pharmaceutical manufacturing and advanced biotechnology production. These sectors require sophisticated contamination control equipment for sterile manufacturing and research applications. German pharmaceutical companies are implementing air shower systems that support comprehensive validation protocols, operational reliability, and stringent GMP compliance requirements. The market is characterized by a focus on particle removal efficiency, energy performance, and adherence to European pharmaceutical manufacturing standards.

Pharmaceutical industry investments are prioritizing contamination control equipment that demonstrates superior decontamination performance and documentation capabilities while meeting German environmental protection and workplace safety standards. Biotechnology manufacturing leadership programs and quality excellence initiatives are driving adoption of premium-grade air shower systems that support advanced cleanroom operations and validation requirements. Research and development programs for energy-efficient designs are facilitating adoption of environmentally optimized equipment technologies throughout major pharmaceutical production centers.

Revenue from walk-through air showers in the United States is growing at a CAGR of 3.4%, driven by biotechnology manufacturing development programs and pharmaceutical production expansion, which create sustained opportunities for contamination control equipment suppliers serving both biopharmaceutical manufacturers and contract development organizations. The country’s extensive pharmaceutical manufacturing infrastructure and expanding biosimilar production sector are creating demand for air shower systems that support diverse contamination control requirements while maintaining regulatory compliance standards. Equipment manufacturers and cleanroom contractors are developing supply strategies to support facility construction and equipment validation requirements.

Biotechnology manufacturing programs and pharmaceutical production capacity additions are facilitating adoption of air shower systems capable of supporting diverse cleanroom classification requirements and competitive performance standards. Sterile manufacturing expansion and cell therapy production development are enhancing demand for validated contamination control equipment that supports operational efficiency and regulatory compliance. Academic research facility construction and government laboratory modernization are creating opportunities for air shower capabilities across American pharmaceutical and research facilities.

Demand for walk-through air showers in Brazil is projected to reach a CAGR of 3.8%, driven by pharmaceutical manufacturing development and generic production capabilities supporting healthcare infrastructure growth and comprehensive pharmaceutical manufacturing applications. The country’s expanding pharmaceutical industry and growing cleanroom facility market segments are creating demand for contamination control equipment that supports operational performance and GMP compliance standards. Pharmaceutical manufacturers and facility construction contractors are maintaining comprehensive equipment sourcing capabilities to support diverse project requirements.

Pharmaceutical production programs and generic manufacturing expansion are supporting demand for air shower systems that meet contemporary particle removal and validation documentation standards. Healthcare infrastructure development and biotechnology facility construction programs are creating opportunities for contamination control equipment that provides comprehensive cleanroom entry support. Manufacturing quality enhancement and regulatory compliance programs are facilitating adoption of certified air shower capabilities throughout major pharmaceutical production regions.

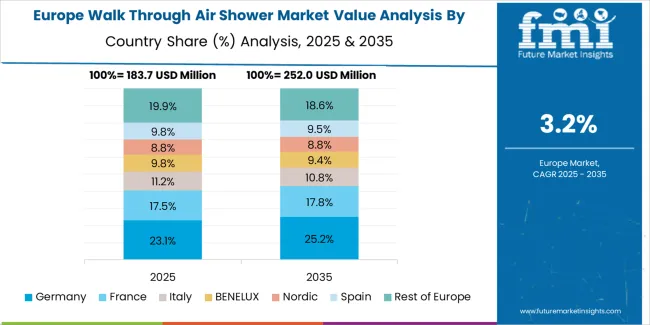

The walk through air shower market in Europe is projected to grow from USD 226.4 million in 2025 to USD 322.4 million by 2035, registering a CAGR of 3.6% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, projected to reach 33.4% by 2035, supported by its extensive pharmaceutical manufacturing infrastructure and electronics production capabilities.

Switzerland follows with a 21.6% share in 2025, expected to reach 22.1% by 2035, driven by comprehensive pharmaceutical industry concentration and biotechnology research facility development. France holds a 16.9% share in 2025, projected to reach 17.3% by 2035 due to pharmaceutical production expansion. Italy commands a 13.2% share, while the United Kingdom accounts for 10.4% in 2025. The Rest of Europe region is anticipated to maintain its collective share at approximately 5.1% through 2035, reflecting established market patterns in Eastern European pharmaceutical manufacturing centers.

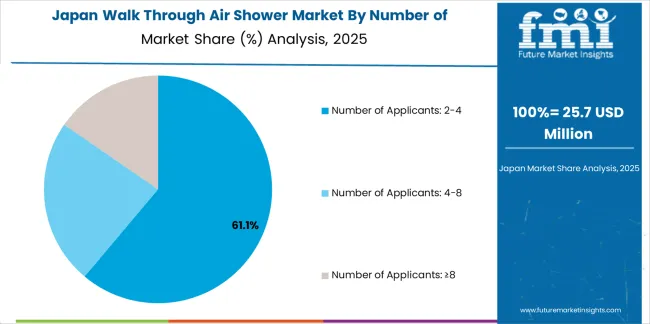

Japanese walk through air shower operations reflect the country's emphasis on manufacturing precision and contamination control excellence. Major pharmaceutical companies including Takeda and Daiichi Sankyo maintain rigorous equipment qualification processes requiring extensive particle removal efficiency testing, airflow uniformity verification, and comprehensive validation documentation. This creates barriers for equipment suppliers but ensures contamination control performance for critical manufacturing environments.

The Japanese market demonstrates preference for compact air shower designs suitable for space-constrained manufacturing facilities and integration with existing cleanroom infrastructure. Companies require specific control system approaches that address integration with facility management systems and automated door sequencing. Performance specifications emphasize energy efficiency and noise reduction, driving demand for optimized blower designs and acoustic treatment.

Regulatory oversight through the Pharmaceuticals and Medical Devices Agency emphasizes comprehensive validation requirements and manufacturing facility standards. The GMP inspection system supports air shower specification through contamination control verification, creating advantages for suppliers with detailed performance documentation and local technical support capabilities.

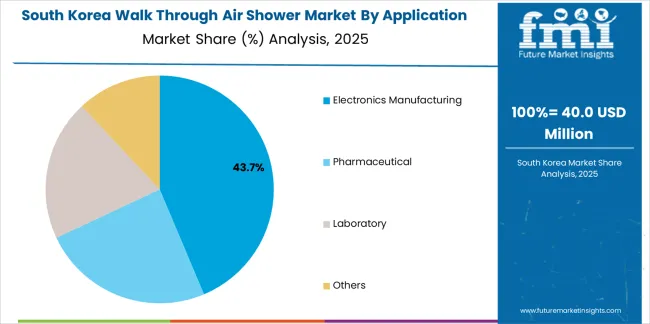

South Korean walk through air shower operations reflect the country's advanced semiconductor manufacturing sector and pharmaceutical production capabilities. Major electronics companies including Samsung Electronics and SK Hynix drive equipment procurement strategies, establishing relationships with certified suppliers to support large-scale fabrication facilities and cleanroom expansion programs.

The Korean market demonstrates strength in high-capacity air shower installations serving mega-fabrication facilities with thousands of personnel requiring efficient shift-change processing. Companies integrate air shower systems with comprehensive facility automation platforms, requiring suppliers to provide building management system compatibility and remote monitoring capabilities. This sophistication creates demand for intelligent control systems and predictive maintenance features.

Regulatory frameworks emphasize environmental protection and energy efficiency standards. Korea Institute of Industrial Technology oversight establishes equipment performance requirements that favor energy-efficient designs with optimized airflow patterns. This benefits suppliers with advanced nozzle technology and variable frequency drive integration for energy consumption reduction.

Profit pools are consolidating around established contamination control equipment manufacturers with proven validation documentation and comprehensive technical support capabilities. Value is migrating from basic air shower equipment to integrated entry systems offering intelligent controls, energy optimization features, and remote monitoring platforms that reduce operational costs and improve facility management. Several archetypes set the pace: global cleanroom equipment specialists defending share through pharmaceutical industry relationships and regulatory expertise; regional manufacturers capturing electronics fabrication segments through customization capabilities and local service networks; modular equipment suppliers offering prefabricated solutions for rapid deployment; and control system innovators providing automation integration and predictive maintenance platforms.

Switching costs remain significant due to facility integration requirements, validation documentation needs, and operational procedure dependencies that stabilize incumbent relationships. Technology differentiation around energy efficiency, throughput optimization, and intelligent control systems creates openings for innovative suppliers to capture new facility construction projects. Equipment standardization in pharmaceutical applications and customization demands in electronics manufacturing create divergent competitive dynamics across market segments.

Consolidation continues as larger facility equipment companies acquire regional air shower manufacturers to expand product portfolios and geographic coverage. Vertical integration accelerates with cleanroom construction firms developing preferred supplier relationships and turnkey project capabilities that bundle air shower equipment with facility construction services. Digital platforms for remote monitoring and predictive maintenance are becoming important differentiators, requiring software investment that pressures smaller manufacturers.

Market dynamics favor suppliers who can demonstrate particle removal efficiency through validation test portfolios, offer comprehensive technical support throughout facility qualification processes, and maintain manufacturing reliability that ensures project delivery schedules. Price competition intensifies in standard pharmaceutical applications where equipment specifications are well-defined, while custom electronics fabrication installations offer opportunities for premium positioning through engineering capabilities. Establish pharmaceutical industry validation documentation with comprehensive test reports and regulatory compliance records; develop energy-efficient designs with intelligent control systems for operational cost reduction; invest in modular construction capabilities and rapid deployment solutions for competitive project timelines.

| Items | Values |

|---|---|

| Quantitative Units | USD 754.6 million |

| Number of Personnel | Number of Applicants: 2-4, Number of Applicants: 4-8, Number of Applicants: ≥8 |

| Application | Electronics Manufacturing, Pharmaceutical, Laboratory, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Switzerland, France, United States, and other 40+ countries |

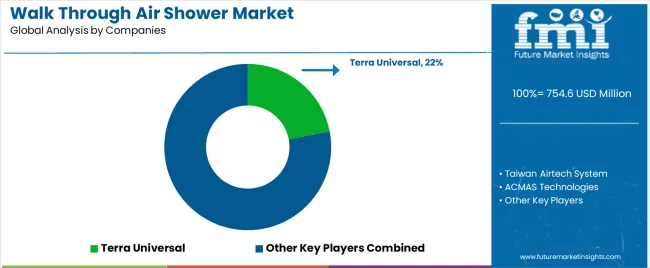

| Key Companies Profiled | Terra Universal, Taiwan Airtech System, ACMAS Technologies, Sunnyda Clean Room, Clean Air Products, INTECH Air & Clean Tech, Air Clean Deviser Taiwan (ACDT), Hytech, Suzhou Indair Indoor Air Tech, SNYLY, Keling, LENGE |

| Additional Attributes | Dollar sales by personnel capacity/application, regional demand (NA, EU, APAC, LATAM, MEA), competitive landscape, pharmaceutical vs electronics adoption, facility integration capabilities, and technology innovations driving contamination control performance, energy efficiency, and operational reliability |

The global walk through air shower market is estimated to be valued at USD 754.6 million in 2025.

The market size for the walk through air shower market is projected to reach USD 1,074.8 million by 2035.

The walk through air shower market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in walk through air shower market are number of applicants: 2-4, number of applicants: 4-8 and number of applicants: ≥8.

In terms of application, electronics manufacturing segment to command 42.6% share in the walk through air shower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Walk-in Cooler & Freezer Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Walk-in Coolers and Freezers Market Size and Share Forecast Outlook 2025 to 2035

Walkie Talkie Market Size and Share Forecast Outlook 2025 to 2035

Walkie Stackers Market Size and Share Forecast Outlook 2025 to 2035

Walking Aid Market Analysis by Product, Technology, End-user, and Region 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

Walk-In Cooler and Freezer Market Growth – Trends & Forecast 2024-2034

Walk Through Metal Detector Market

Knee Walker Market Size and Share Forecast Outlook 2025 to 2035

Assisted Walking Devices Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Walk in Freezer Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Airport Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Escalators And Moving Walkways Market Size and Share Forecast Outlook 2025 to 2035

Through-Type Shelves Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA