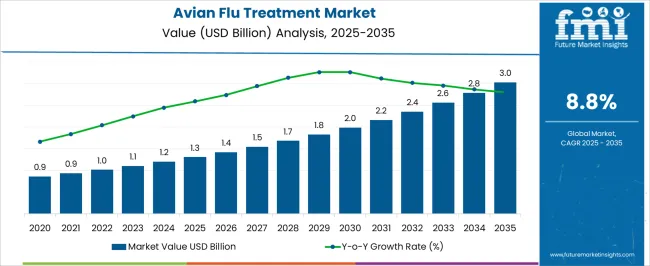

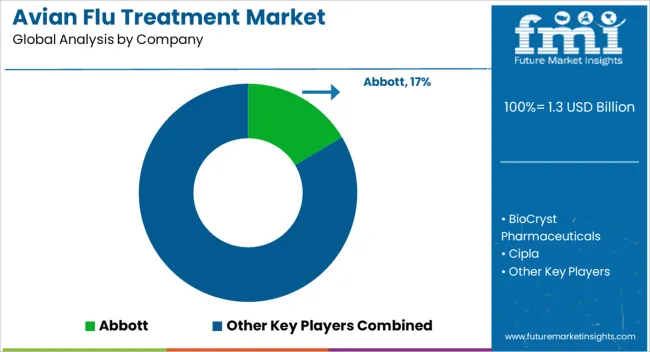

The Avian Flu Treatment Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Avian Flu Treatment Market Estimated Value in (2025 E) | USD 1.3 billion |

| Avian Flu Treatment Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The Avian Flu Treatment market is experiencing steady growth, driven by the rising prevalence of avian influenza outbreaks across poultry and human populations, which has created an urgent need for effective treatment solutions. Increasing awareness among healthcare providers regarding early intervention and disease management is supporting market adoption. Antiviral medications, rapid diagnostic capabilities, and improved treatment protocols are enhancing patient outcomes and reducing mortality rates.

Public health initiatives and government-led vaccination campaigns are also contributing to demand for complementary therapeutic interventions. The growing emphasis on pandemic preparedness and the development of integrated healthcare strategies for viral infections is further shaping market dynamics. Investments in research and development for novel antivirals and combination therapies are enabling more effective disease management.

Hospitals and clinical institutions are prioritizing stockpiling and efficient distribution of antiviral drugs to manage sudden outbreaks As surveillance, rapid response, and treatment protocols continue to evolve, the Avian Flu Treatment market is expected to sustain growth, supported by heightened clinical awareness, regulatory focus, and global health initiatives targeting influenza prevention and treatment.

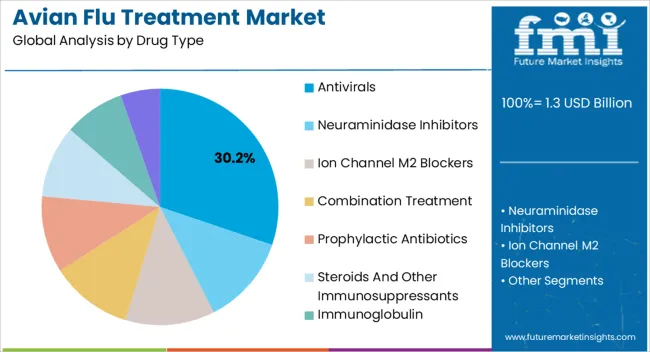

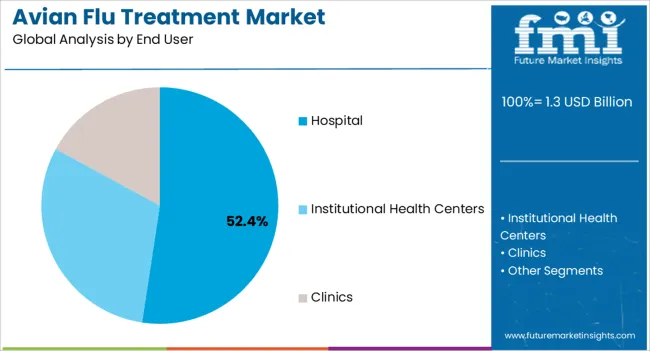

The avian flu treatment market is segmented by drug type, end user, and geographic regions. By drug type, avian flu treatment market is divided into Antivirals, Neuraminidase Inhibitors, Ion Channel M2 Blockers, Combination Treatment, Prophylactic Antibiotics, Steroids And Other Immunosuppressants, Immunoglobulin, and Ribavirin. In terms of end user, avian flu treatment market is classified into Hospital, Institutional Health Centers, and Clinics. Regionally, the avian flu treatment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antivirals drug type segment is projected to hold 30.2% of the market revenue in 2025, making it the leading drug type. Its growth is being driven by the proven efficacy of antiviral medications in reducing viral replication, limiting disease progression, and preventing severe complications. Clinicians increasingly rely on antivirals as a frontline treatment for confirmed avian influenza cases, supported by established treatment protocols and clinical guidelines.

Research advancements in antiviral formulations, including combination therapies and improved pharmacokinetics, have enhanced treatment outcomes and patient compliance. The ability to administer antivirals in both hospital and outpatient settings enables rapid response during outbreaks, which reinforces adoption.

Increased awareness among healthcare professionals and improved accessibility in regions prone to avian flu outbreaks further support the segment’s growth As global efforts to contain avian influenza intensify and new antiviral options are developed, the antivirals segment is expected to maintain its leadership in the market, driven by clinical efficacy, regulatory approvals, and expanding treatment access.

The hospital end-use segment is anticipated to account for 52.4% of the market revenue in 2025, establishing it as the leading end-user category. Growth is driven by hospitals being the primary care settings for diagnosis, treatment, and management of avian influenza cases. Hospitals offer advanced diagnostic tools, intensive care facilities, and rapid access to antiviral drugs, ensuring timely treatment and improved patient outcomes.

The concentration of specialized healthcare professionals and integrated treatment protocols in hospital settings enables effective management of severe cases and reduces mortality rates. Hospitals also play a crucial role in pandemic preparedness, maintaining stockpiles of antiviral medications and implementing infection control measures to prevent disease spread.

Increasing hospital investments in healthcare infrastructure, emergency preparedness, and training programs for viral infection management further reinforce demand As healthcare systems continue to prioritize patient safety, disease containment, and efficient treatment delivery, the hospital segment is expected to remain the largest revenue contributor in the Avian Flu Treatment market, driven by clinical efficacy and institutional adoption of standardized protocols.

Avian influenza (AI), generally called bird flu, is an infectious viral disease of birds. I t is generally found in some species of water birds mainly in wild water fowl such as ducks and geese. Avian influenza virus sometimes infect poultry and other birds resulting in outbreaks.

Avian influenza is usually rare in humans but sometimes it passes to human and other species due to close contact with the infected bird. The common virus which can infect humans are A(H5N1) and A(H7N9). Avian flu viruses are characterized into two high pathogenicity or low pathogenicity.

The risk of transmission of avian flu is in those people who work in poultry, travel to virus infected countries, contact with infected bird and by eating raw or under cooked meat or eggs. The A(H5N1) virus subtype, is highly pathogenic, the first infection in humans of this virus was reported in 1997 in Hong Kong.

After that the virus has spread to Asia, Europe and Africa and have affected many countries on large-scale, causing millions of poultry infections, several hundred human cases, and many human deaths. These avian flu outbreaks in poultry have seriously impacted livelihoods, the economy and international trade in affected countries.

The A(H7N9) virus subtype, is very rare and is of a low pathogenicity and its cases are reported only in China. Avian flu symptoms depends of type of virus subtype infection. Preliminary symptoms of A(H5N1) virus include high fever, cough, diarrhea, headache, sore throat, runny nose, muscle ache. Also, lower respiratory tract problems emerge early in patients.

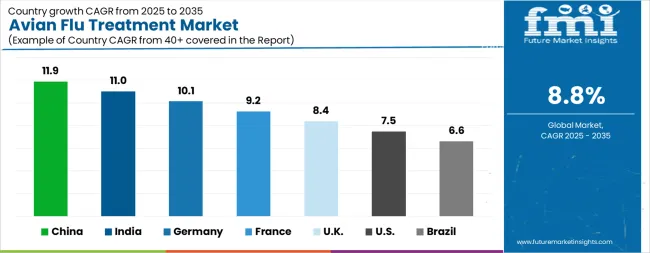

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The Avian Flu Treatment Market is expected to register a CAGR of 8.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.9%, followed by India at 11.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.6%, yet still underscores a broadly positive trajectory for the global Avian Flu Treatment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.1%. The USA Avian Flu Treatment Market is estimated to be valued at USD 447.8 million in 2025 and is anticipated to reach a valuation of USD 921.3 million by 2035. Sales are projected to rise at a CAGR of 7.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 61.8 million and USD 35.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Drug Type | Antivirals, Neuraminidase Inhibitors, Ion Channel M2 Blockers, Combination Treatment, Prophylactic Antibiotics, Steroids And Other Immunosuppressants, Immunoglobulin, and Ribavirin |

| End User | Hospital, Institutional Health Centers, and Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abbott, BioCryst Pharmaceuticals, Cipla, Forrest Pharmaceuticals, Gilead Sciences [Gilead Sciences], GlaxoSmithKline [GlaxoSmithKline], Macleods Pharmaceuticals, Pfizer [Pfizer], Roche [Roche], Sanofi [Sanofi], and Sinovac Biotech |

The global avian flu treatment market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the avian flu treatment market is projected to reach USD 3.0 billion by 2035.

The avian flu treatment market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in avian flu treatment market are antivirals, neuraminidase inhibitors, ion channel m2 blockers, combination treatment, prophylactic antibiotics, steroids and other immunosuppressants, immunoglobulin and ribavirin.

In terms of end user, hospital segment to command 52.4% share in the avian flu treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Avian Metapneumovirus Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Avian Influenza Antigen Testing Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flux-Coated Preforms Market Size and Share Forecast Outlook 2025 to 2035

Flux-Coated Preforms for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Fluorosilicone Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Film Market Forecast and Outlook 2025 to 2035

Fluidized Conveying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fluorinated Bottle Market Size and Share Forecast Outlook 2025 to 2035

Flue Gas Coolers Market Size and Share Forecast Outlook 2025 to 2035

Fluoroscopy Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Fluorescent Pigment Market Size and Share Forecast Outlook 2025 to 2035

Fluidized Bed Dryer Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymer Market Size and Share Forecast Outlook 2025 to 2035

Fluorometer Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence-Activated Cell Sorting Market Size and Share Forecast Outlook 2025 to 2035

Fluid Aspiration System Market Size and Share Forecast Outlook 2025 to 2035

Fluorinert Electronic Liquid for Automotive Market Size and Share Forecast Outlook 2025 to 2035

Fluid Dispensing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA