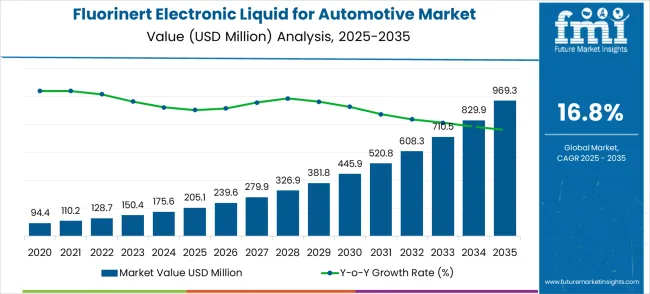

The fluorinert electronic liquid for automotive market begins its decade journey from a USD 205.1 million foundation in 2025, setting the stage for extraordinary expansion ahead. The first half of the decade witnesses explosive momentum building, with market value climbing from USD 239.6 million in 2026 to USD 520.8 million by 2030. This initial phase reflects accelerating electric vehicle adoption and increasing thermal management complexity in automotive electronics.

The latter half will witness unprecedented growth dynamics, propelling the market from USD 608.3 million in 2031 to reach USD 969.3 million by 2035. Dollar additions during 2030-2035 outpace the earlier period significantly, with annual increments averaging USD 89.7 million compared to USD 63.1 million in the first phase. This progression represents a remarkable 372.7% total value increase over the forecast decade.

Market maturation factors include electric vehicle mainstream adoption, advanced battery thermal management requirements, and high-performance computing integration in autonomous vehicles. The 16.8% compound annual growth rate positions participants to capitalize on USD 764.2 million in additional market value creation. This trajectory signals exceptional opportunities for specialty chemical manufacturers, automotive technology integrators, and thermal management solution providers across the global automotive transformation landscape.

Market expansion unfolds through two distinct growth periods, characterized by dramatically different competitive dynamics for each phase. The 2025-2030 foundation period delivers USD 315.7 million in value additions, representing 154.0% growth from the baseline. Market dynamics during this phase center on the scaling of electric vehicles, advancements in battery technology, and the sophistication of thermal management systems.

The 2030-2035 acceleration period generates USD 448.5 million in incremental value, reflecting 86.1% growth from the 2030 position. This phase exhibits mature market characteristics, characterized by enhanced competition, integrated cooling system strategies, and the integration of next-generation automotive electronics. Dollar contributions shift from foundational EV adoption to advanced autonomous vehicle requirements and high-performance computing thermal management.

The competitive landscape evolves from specialty chemical supply to integrated thermal management solutions. The first period focuses on technology validation and the development of OEM partnerships. The second period witnesses intensified competition for premium application segments and comprehensive solution development across battery cooling, power electronics, and autonomous vehicle computing systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 205.1M |

| Market Forecast (2035) | USD 969.3M |

| Growth Rate | 16.8% CAGR sustained expansion |

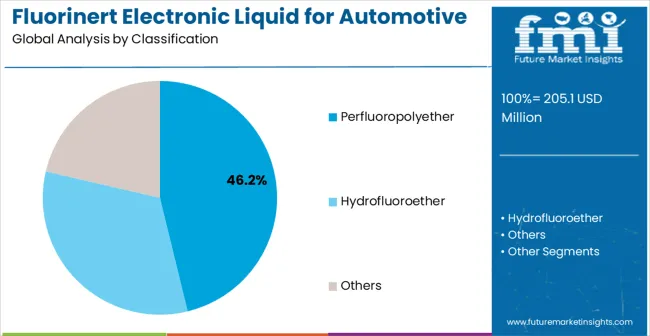

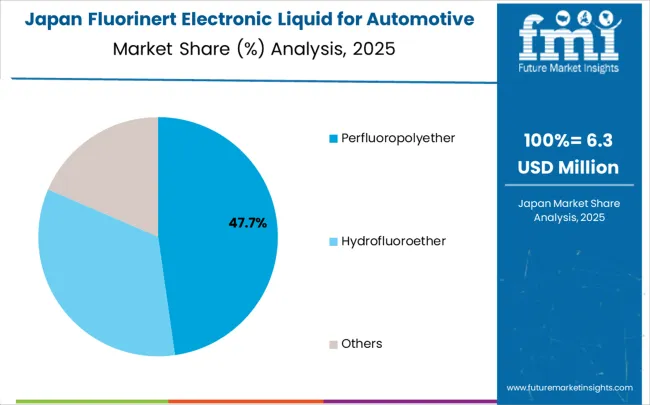

| Segment Leader | Perfluoropolyether type |

| Application Focus | Battery cooling |

Market expansion rests on four transformative shifts driving automotive thermal management demand acceleration:

The growth faces headwinds from high material costs and specialized handling requirements for fluorinert chemicals. Traditional cooling solutions maintain cost advantages for less demanding thermal management applications. Regulatory complexity around fluorinated compounds creates adoption barriers and requires specialized expertise for proper implementation and environmental compliance.

Primary Classification: Chemical Type Distribution

Secondary Breakdown: Application Categories

Geographic Segmentation: Regional Market Distribution

Perfluoropolyether (PFPE) compounds establish clear market leadership through superior thermal stability and exceptional electrical insulation properties essential for automotive electronic applications. Chemical inertness enables long-term reliability in demanding automotive environments while maintaining consistent performance across wide temperature ranges. Low vapor pressure characteristics prevent system contamination and ensure stable operation throughout vehicle lifecycles.

Advanced molecular engineering enables customized viscosity and thermal properties optimized for specific automotive applications including battery cooling and power electronics thermal management. Superior oxidation resistance provides extended service life compared to conventional cooling fluids while eliminating maintenance requirements. Compatibility with automotive materials including seals, gaskets, and electronic components ensures system integrity and prevents chemical degradation.

PFPE fluids offer comprehensive performance advantages including non-flammability, chemical inertness, and electrical insulation compared to alternative cooling solutions requiring additional safety measures. Temperature stability enables operation across automotive temperature ranges without performance degradation or chemical breakdown. Customizable formulations accommodate diverse thermal management requirements across different vehicle architectures and electronic systems.

High raw material costs create adoption barriers for cost-sensitive automotive applications requiring significant performance justification. Specialized handling requirements necessitate trained personnel and proper disposal procedures increasing operational complexity. Environmental considerations around PFAS chemicals require comprehensive lifecycle management and regulatory compliance monitoring.

The acceleration of electric vehicle adoption drives demand for advanced battery thermal management systems, which require specialized fluorine-free cooling solutions. Autonomous vehicle development creates high-performance computing thermal management requirements exceeding conventional cooling capabilities. The expansion of electrification across automotive systems necessitates comprehensive power electronics cooling for inverters, converters, and charging infrastructure. Safety regulation enhancement mandates non-flammable cooling solutions providing electrical insulation and chemical stability.

High chemical costs create adoption barriers for budget-constrained automotive applications requiring significant performance justification and cost-benefit analysis. Environmental regulations around fluorinated compounds require specialized handling, disposal procedures, and long-term environmental impact assessment. Technical complexity necessitates specialized expertise for proper implementation, maintenance, and regulatory compliance. Supply chain concentration creates availability concerns and potential cost volatility, affecting automotive production planning.

Next-generation fluorinert formulations reduce environmental impact while maintaining superior performance characteristics for automotive applications. Integrated cooling system design enables comprehensive thermal management across multiple vehicle systems through unified fluorinert circulation. The development of recycling technology creates opportunities for a circular economy, reducing environmental impact and material costs. Digital monitoring integration enables predictive maintenance and performance optimization for fluorinert cooling systems.

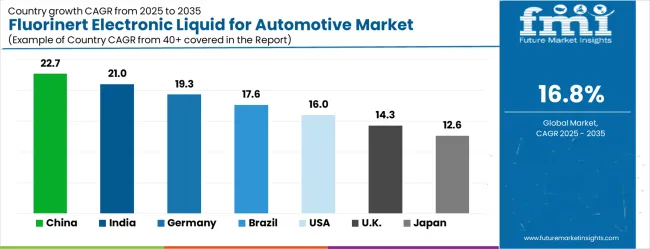

| Country | CAGR (2025–2035) |

|---|---|

| China | 22.7% |

| India | 21.0% |

| Germany | 19.3% |

| Brazil | 17.6% |

| United States | 16.0% |

| United Kingdom | 14.3% |

| Japan | 12.6% |

Global market dynamics reveal distinct performance tiers reflecting regional electric vehicle adoption rates and automotive technology development priorities. Ultra-High Growth Markets including China (22.7% CAGR) and India (21.0% CAGR) demonstrate aggressive electric vehicle expansion with comprehensive thermal management technology adoption. Technology Innovation Leaders such as Germany (19.3% CAGR) represent European automotive engineering excellence with advanced fluorinert application development. Strong Performers including Brazil (17.6% CAGR) and the United States (16.0% CAGR) show robust growth aligned with electric vehicle scaling and automotive electrification initiatives. Developed Markets including the United Kingdom (14.3% CAGR) and Japan (12.6% CAGR) display strong growth reflecting established automotive innovation with premium thermal management focus.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

China is projected to lead the fluorinert electronic liquid market with a growth rate of 22.7% CAGR from 2025 to 2035. The country’s rapid expansion of electric vehicle (EV) production is driving significant demand for advanced thermal management technologies, including Fluorinert. China is one of the world’s largest EV producers, with government-backed policies promoting clean energy adoption and electric mobility. With major manufacturing hubs such as Shanghai, Beijing, and Shenzhen, the country’s automotive industry is integrating innovative solutions to ensure optimal battery performance, particularly for EVs. The growing importance of electric vehicle infrastructure, including fast-charging stations, further drives demand for reliable thermal management. Fluorinert’s superior heat transfer properties make it an ideal solution for maintaining temperature control in high-performance electric vehicle batteries, ensuring safety and longevity. The adoption of Fluorinert aligns with China’s long-term environmental and energy efficiency goals, solidifying its role in the future of electric transportation.

India is set for significant growth in the fluorinert electronic liquid market, with a projected CAGR of 21.0% from 2025 to 2035. As India accelerates its push towards electric vehicle adoption, the demand for high-performance thermal management solutions like Fluorinert is expected to grow exponentially. The Indian government’s FAME scheme, aimed at promoting electric vehicle manufacturing and adoption, is expected to drive the market’s growth. The rising manufacturing sector and its positioning as a key automotive hub in Asia contribute to the increasing demand for advanced battery cooling solutions. With a focus on developing both domestic electric vehicle production and infrastructure, India is on track to become a significant player in the global electric vehicle market. Fluorinert’s ability to enhance battery efficiency and safety aligns perfectly with India’s energy sustainability goals, particularly in the automotive sector. As the electric vehicle landscape in India expands, Fluorinert’s role in maintaining optimal battery temperature will be critical to the country’s EV adoption strategy.

Germany is expected to experience a CAGR of 19.3% in the fluorinert electronic liquid market from 2025 to 2035, driven by its strong automotive sector and commitment to environmental sustainability. As a leader in automotive engineering, Germany’s automakers such as Volkswagen, BMW, and Mercedes-Benz are increasingly investing in electric vehicle production, thus increasing demand for advanced thermal management solutions. Germany’s automotive industry is adopting cutting-edge technologies like Fluorinert to optimize battery performance and extend the lifespan of electric vehicle batteries. Stringent EU regulations on carbon emissions and energy efficiency also push manufacturers to adopt green technologies, further boosting the demand for effective thermal management systems. Fluorinert, with its superior heat transfer properties, ensures safe operation of high-power batteries, a key concern for Germany’s automotive manufacturers. The country’s emphasis on electric vehicle infrastructure development, including widespread charging stations, supports the broader adoption of Fluorinert in EV cooling applications.

Brazil is expected to grow at a CAGR of 17.6% in the fluorinert electronic liquid market from 2025 to 2035, driven by the country’s efforts to expand its electric vehicle production capabilities. Brazil is increasingly embracing clean energy solutions as part of its broader environmental strategy, and the automotive industry plays a key role in this shift. With a growing focus on electric vehicle production, especially in key manufacturing centers like São Paulo, Brazil’s automotive sector will require reliable and efficient thermal management systems like Fluorinert to enhance battery performance. The Brazilian government’s support for green mobility, combined with the expansion of EV infrastructure, is expected to further increase demand for Fluorinert. Fluorinert is critical for maintaining optimal battery temperature in high-performance electric vehicles, ensuring safety and reliability. Brazil’s automotive sector, bolstered by investments from both domestic and international players, is set to benefit from the adoption of advanced cooling technologies, which will be essential for meeting global emission standards and ensuring long-term EV market growth.

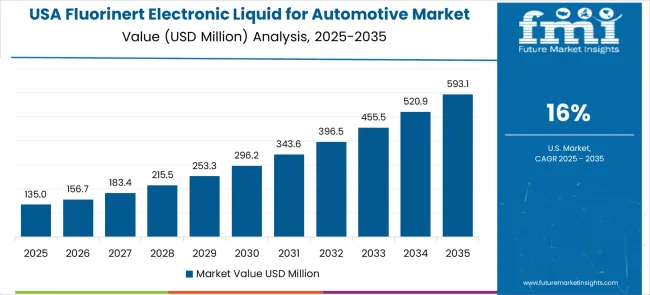

The United States is expected to grow at a CAGR of 16.0% in the Fluorinert electronic liquid market from 2025 to 2035, with the rapidly expanding electric vehicle sector being the primary driver. As the USA automotive industry leads the charge in electric vehicle production, driven by companies like Tesla, General Motors, and Ford, the demand for Fluorinert is expected to rise significantly. Fluorinert is vital for enhancing the efficiency of high-power battery systems used in electric vehicles, preventing overheating and ensuring longer battery life. The USA government’s commitment to reducing carbon emissions and promoting sustainable transportation also supports the adoption of Fluorinert for thermal management in electric vehicles. The expansion of EV charging infrastructure and an increase in electric vehicle production capacity will provide further opportunities for Fluorinert’s integration into advanced automotive cooling systems. As the USA continues to scale its EV industry, Fluorinert’s role in battery cooling will be essential to maintaining the reliability and performance of these cutting-edge vehicles.

The United Kingdom is projected to experience a CAGR of 14.3% in the Fluorinert electronic liquid market from 2025 to 2035. As the UK automotive industry accelerates its transition to electric vehicles, the demand for efficient thermal management solutions like Fluorinert will continue to rise. UK-based automakers such as Jaguar Land Rover and Nissan are prioritizing electric vehicle production, requiring advanced cooling systems to ensure the performance and safety of their EV batteries. Government initiatives focused on achieving carbon neutrality and reducing emissions further support the adoption of Fluorinert in the automotive sector. With the growing installation of EV charging stations and the expansion of infrastructure, Fluorinert will play a crucial role in maintaining optimal battery temperatures, ensuring safety and efficiency. UK manufacturers are increasingly investing in research and development to enhance their electric vehicle offerings, driving demand for innovative thermal management technologies.

Japan is expected to grow at a CAGR of 12.6% in the Fluorinert electronic liquid market from 2025 to 2035, primarily driven by the country’s leadership in automotive technology and innovation. Japanese automotive giants such as Toyota and Honda are at the forefront of hybrid and electric vehicle development, which increases the demand for advanced thermal management solutions. Fluorinert, with its superior heat transfer properties, is integral to maintaining battery efficiency and safety in high-performance EVs. Japan’s emphasis on energy efficiency and sustainability further supports the growing adoption of Fluorinert in automotive applications. The Japanese government’s focus on reducing carbon emissions and its investments in EV infrastructure are expected to create more opportunities for Fluorinert solutions. As Japan continues to innovate in electric vehicle technology, the demand for Fluorinert as a key thermal management solution will remain strong, helping to ensure the performance and safety of the country’s growing electric vehicle fleet.

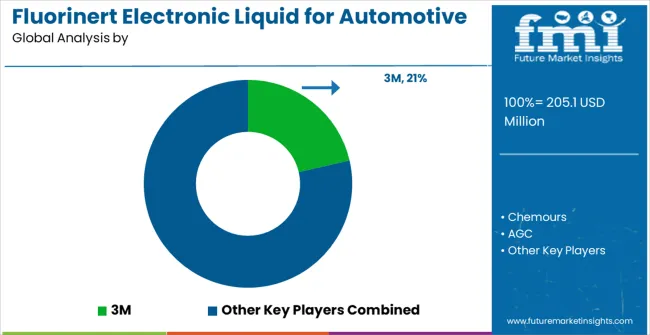

Market structure reflects moderate concentration with established global chemical manufacturers maintaining significant positions while specialized technology providers serve specific automotive applications. Competition emphasizes technological innovation, comprehensive solution integration, and automotive OEM partnership development. Industry dynamics favor companies combining advanced chemical manufacturing capabilities with automotive thermal management expertise and global supply chain presence.

Tier 1 - Global Chemical Leaders: Companies like 3M and Chemours dominate through comprehensive fluorinert portfolios, global manufacturing networks, and extensive automotive OEM relationships. Competitive advantages include proven product reliability, technical support capabilities, and integrated solution development spanning multiple automotive applications.

Tier 2 - Specialized Chemical Providers: Organizations including Solvay and DAIKIN focus on specific application segments through specialized expertise and targeted automotive market development. Competitive advantages include application-specific knowledge, flexible customization capabilities, and regional market specialization enabling responsive technical support and product development.

Tier 3 - Regional and Application Specialists: Companies including Chinese manufacturers serve local markets through cost-competitive solutions and specialized automotive applications. Competitive advantages include regional market knowledge, flexible production capacity, and partnership relationships with domestic automotive manufacturers and tier-one suppliers.

| Item | Value |

|---|---|

| Quantitative Units | USD 969.3 Million |

| Chemical Type | Perfluoropolyether, Hydrofluoroether, Others |

| Application | Battery Cooling, Battery Heating, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | 3M, Chemours, AGC, Solvay, DAIKIN, Fluorez Technology Co., Ltd., Zhejiang Noah Fluorochemical Co., Ltd., JUHUA Group Corporation, Sinochem Lantian Co., Ltd. |

| Additional Attributes | Dollar sales by chemical type categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape analysis, adoption patterns across automotive sectors, integration with electric vehicle systems, thermal management innovations, environmental compliance standards |

The global fluorinert electronic liquid for automotive market is estimated to be valued at USD 205.1 million in 2025.

The market size for the fluorinert electronic liquid for automotive market is projected to reach USD 969.3 million by 2035.

The fluorinert electronic liquid for automotive market is expected to grow at a 16.8% CAGR between 2025 and 2035.

The key product types in fluorinert electronic liquid for automotive market are perfluoropolyether, hydrofluoroether and others.

In terms of application, battery cooling segment to command 52.8% share in the fluorinert electronic liquid for automotive market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronic Skin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA