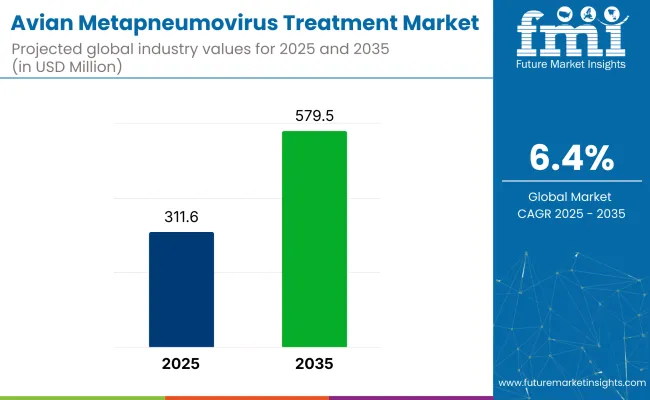

The avian metapneumovirus treatment market value is expected to be approximately USD 311.6 million, which is anticipated to nearly double, reaching around USD 579.5 million by 2035. This market is projected to grow at a healthy CAGR of 6.4% from 2025 to 2035. This steady increase reflects the growing importance of effective treatment options for avian metapneumovirus, a viral infection that severely impacts the poultry industry by causing respiratory illnesses and affecting productivity in birds.

As of 2025, the avian metapneumovirus (aMPV) treatment market represents a specialized segment within the broader animal health and veterinary markets. In the global veterinary pharmaceuticals market, it holds a minor share of around 0.5-1%, as it targets a specific viral disease in poultry. Within the global animal health market, its share is approximately 0.3-0.7%, given the wide range of species and conditions covered.

In the poultry healthcare market, aMPV treatments have a more notable presence, contributing roughly 3-5%, due to the disease’s economic impact on egg production and broiler health. In the livestock disease treatment market, its share is about 1-2%, and within the animal vaccines market, it makes up around 2-4%, driven by preventive vaccination efforts in commercial poultry farming.

“Avian metapneumovirus causes severe respiratory challenges leading to increased mortality rates and drops in egg production in affected flocks,” said Ivan Alvarado, D.V.M., innovation discovery livestock technical services for Merck Animal Health. In May 2024, the USA Department of Agriculture (USDA) announced an emergency allocation of USD 824 million from the Commodity Credit Corporation to support the Animal and Plant Health Inspection Service (APHIS) in combating Highly Pathogenic Avian Influenza (HPAI) and H5N1 outbreaks in dairy cattle.

Researchers at South Dakota State University have identified a new strain of aMPV (subgroup B) and are actively working on developing a safe and effective vaccine. Their efforts include isolating the virus and developing specific diagnostic tests to aid in early detection and control measures.

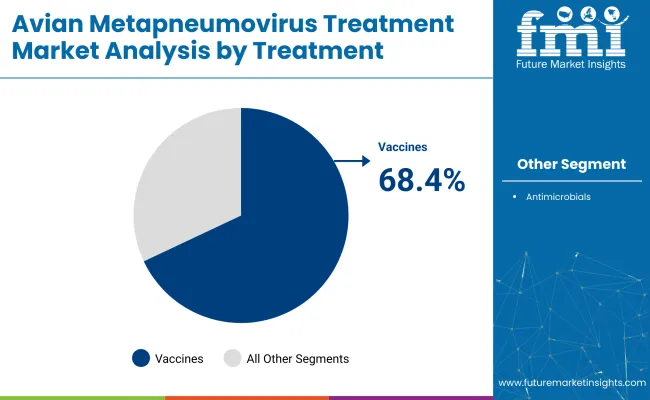

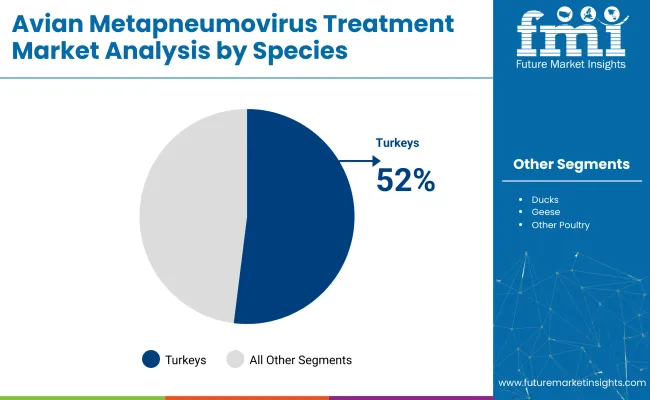

Vaccines lead the market due to their effectiveness in prevention and long-term disease control. Turkeys are the most affected species, driving higher treatment demand, particularly for the aMPV-B subtype, which is more virulent and widespread.

Vaccines are projected to dominate the industry in 2025, accounting for 68.4% of the market share. Vaccines dominate the industry primarily due to their effectiveness in preventing outbreaks and controlling the spread of the virus within poultry populations.

Turkeys are projected to account for 52.0% of the avian metapneumovirus treatment industry share in 2025. Avian Metapneumovirus is particularly aggressive in turkeys, often leading to severe respiratory symptoms, reduced weight gain, and poor feed conversion, which directly impacts commercial productivity.

The aMPV-B is projected to account for 53.0% of the market share in 2025. The aMPV-B (Avian Metapneumovirus subtype B) segment dominates the market due to its widespread prevalence and higher pathogenicity compared to other subtypes.

Commercial poultry farms are projected to account for 62.6% of the industry share in 2025. Commercial poultry farms dominate the market segment due to the high concentration of birds in confined spaces, which significantly increases the risk of rapid disease transmission.

The industry is driven by the increasing prevalence of respiratory infections in poultry and the resulting economic losses, prompting higher demand for vaccines and treatments. Regulatory support and advancements in veterinary medicine further accelerate market growth through improved biosecurity and innovative therapies.

Rising Disease Prevalence and Economic Impact on the Poultry Industry

One of the key dynamics driving the Avian Metapneumovirus (aMPV) Treatment market is the rising prevalence of respiratory infections caused by the virus in poultry, particularly in high-density commercial farms. Outbreaks of aMPV can lead to significant economic losses due to decreased productivity, increased mortality, and higher veterinary intervention costs.

The virus spreads rapidly, especially in turkeys and chickens, prompting poultry producers to adopt proactive health management strategies. This has resulted in a growing demand for effective vaccines, diagnostics, and antiviral treatments that can mitigate the risks associated with such outbreaks.

Government Regulations and Advancements in Veterinary Medicine

Another major dynamic shaping the market is the growing regulatory emphasis on animal health and food safety, coupled with advances in veterinary medicine. Governments and animal health organizations are encouraging strict biosecurity measures and routine vaccination to control the spread of aMPV, especially in countries with intensive poultry farming.

These regulatory frameworks are fostering greater adoption of standardized treatment and prevention protocols. At the same time, innovation in veterinary pharmaceutical research is leading to the development of more effective and targeted vaccines, including subtype-specific formulations like aMPV-B.

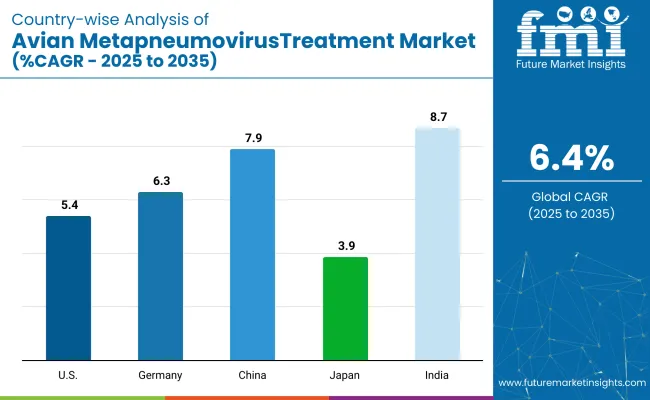

| Countries | CAGR (%) |

|---|---|

| USA | 5.4% |

| Germany | 6.3% |

| China | 7.9% |

| Japan | 3.9% |

| India | 8.7% |

The market is expected to be driven by rising poultry production, growing concerns over flock health, and the increasing adoption of vaccination programs. Strong growth is anticipated in countries with intensive poultry farming, like the USA, Brazil, and China, while Europe continues to lead in disease monitoring and vaccine innovation.

The USA market is estimated to grow at a 5.4% CAGR during the forecast period. The growth of the market in the USA is largely driven by the country’s massive commercial poultry industry, which ranks among the largest globally.

The German Avian Metapneumovirus Treatment industry is estimated to grow at a 6.3% CAGR during the study period.

China Avian Metapneumovirus Treatment industry is estimated to grow at 7.9% CAGR during the study period. The market growth is fueled by its rapidly expanding poultry sector, which is under increasing pressure to improve disease management practices amid recurring outbreaks.

Japan market is estimated to grow at 3.9% CAGR during the study period. The market growth, though moderate, is supported by the country's strong focus on food safety, animal welfare, and biosecurity.

The avian metapneumovirus treatment industry in India is estimated to grow at 8.7% CAGR during the forecast period. India is projected to witness the fastest growth in the market, primarily due to its rapidly growing poultry industry and increasing disease burden in densely populated farming regions.

Key players like Merck & Co., Inc., Boehringer Ingelheim Animal Health, and HIPRA dominate the Avian Metapneumovirus Treatment market due to their extensive portfolios and advanced vaccine technologies. Merck & Co., Inc. leverages strong R&D capabilities to develop innovative vaccines and antiviral solutions for poultry diseases.

Boehringer Ingelheim Animal Health focuses on comprehensive animal health programs, including tailored vaccines to combat Avian Metapneumovirus. HIPRA specializes in developing subtype-specific vaccines and diagnostic tools, enhancing disease management.

Other major companies such as Ceva Animal Health, Virbac, AdvaCare Pharma®, Ashish Life Science, and Phibro Animal Health Corporation contribute by offering a range of effective treatment options, focusing on biosecurity and flock health, thereby strengthening the overall market landscape.

Recent Avian Metapneumovirus Treatment Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 311.6 million |

| Projected Market Size (2035) | USD 579.5 million |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Treatment Analyzed (Segment 1) | Vaccines, Live-Attenuated Vaccines, Inactivated Vaccines, And Antimicrobials. |

| Species Covered (Segment 2) | Chickens( Broilers And Layers ), Turkeys, Ducks And Geese, And Other Poultry Species. |

| Indication Covered (Segment 3) | aMPV -A, aMPV -B, aMPV -C, and aMPV -D. |

| Sales Channel Analyzed (Segment 4) | Commercial Poultry Farms, Veterinary Clinics, Poultry Integrators, Retail Pharmacy Chains, And Online Sales Channels. |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Market | Merck & Co., Inc., Boehringer Ingelheim Animal Health, HIPRA, Ceva Animal Health, Virbac, AdvaCare Pharma®, Ashish Life Science, and Phibro Animal Health Corporation. |

| Additional Attributes | Dollar sales by sample type (saliva vs urine); Market demand for hormone monitoring in fertility, sleep, and menopause; Trends in subscription models vs one-time purchases; Growth in online sales and e-commerce for health tech products |

The market is segmented into vaccines, live-attenuated vaccines, inactivated vaccines, and antimicrobials.

The market covers chickens (including broilers and layers), turkeys, ducks and geese, and other poultry species.

The market is categorized into aMPV-A, aMPV-B, aMPV-C, and aMPV-D.

The market is divided into commercial poultry farms, veterinary clinics, poultry integrators, retail pharmacy chains, and online sales channels.

The market spans North America, Western Europe, East Asia, and South Asia.

The market is expected to reach USD 579.5 million by 2035.

The market size is projected to be USD 311.6 million in 2025.

The market is expected to grow at a CAGR of 6.4% from 2025 to 2035.

India is expected to be the fastest growing with a CAGR of 8.7%.

Vaccines, accounting for over 68.4% of the market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA