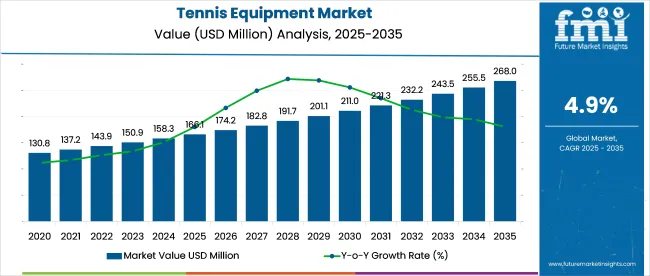

The tennis equipment market is estimated to reach USD 265.8 million by 2035, up from USD 166.1 million in 2025, growing at a CAGR of 4.9%. Demand has been shaped less by professional tournaments and more by recreational and semi-organized community players.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 166.1 million |

| Forecast Value (2035) | USD 265.8 million |

| CAGR (2025 to 2035) | 4.9% |

Nielsen data suggests that 3 in 5 new buyers purchase their first racket from non-sports-specific stores. On the supply side, warehouse proximity has become key; manufacturers have relocated inventory hubs closer to secondary cities. Contract manufacturing across Thailand and Vietnam recovered post-2022, though European resellers still operate with 12-15% longer lead times than pre-pandemic norms.

In January 2025, Babolat released the Pure Drive Gen11, designed to elevate spin and baseline dominance for aggressive players. As detailed in launch reports from January 16, 2025, the Gen11 features a reengineered frame that boosts stability and enlarges the sweet spot, enabling greater shot control during high-speed rallies.

Spin potential has been enhanced through subtle design shifts, catering to players seeking explosive topspin from deep positions. The racket also features a sleek, updated look while preserving the Pure Drive’s signature design. This model targets competitive players focused on power, spin, and consistency during prolonged baseline exchanges

The tennis equipment market represents around 22-25% of the global racquet sports equipment segment, which also includes badminton, squash, and padel. Within the broader sports equipment market, its share stands near 1.2-1.5%, influenced by the presence of larger categories such as football and basketball.

When placed under the athletic and sportswear industry, which includes footwear and apparel across various disciplines, tennis equipment contributes about 0.8-1.0%. In the fitness and recreation goods sector, its position is smaller, accounting for less than 0.5% due to the dominance of general exercise products. At the level of the global sporting goods market, its share is under 0.3%, showing its specialized status among a wide array of consumer and professional sports segments.

Per capita spending on tennis equipment exhibits strong regional disparities, influenced by economic conditions, cultural engagement, and accessibility to organized sports infrastructure. North America and Europe lead global consumption due to high participation in professional and recreational tennis, supported by robust retail channels and club memberships. These regions represent mature markets where individual spending levels remain consistently high, particularly for racquets, apparel, and accessories.

The tennis equipment market exhibits a well-defined trade ecosystem where Asia dominates production and developed regions drive consumption. Manufacturing economies capitalize on cost-efficiency and scale, while demand-heavy markets rely on imports to meet premium quality standards. This trade pattern is reinforced by strong brand positioning, which ensures that advanced equipment from Asia reaches markets with higher purchasing power.

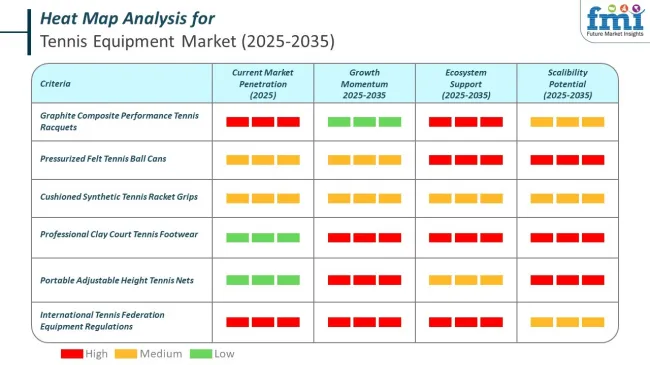

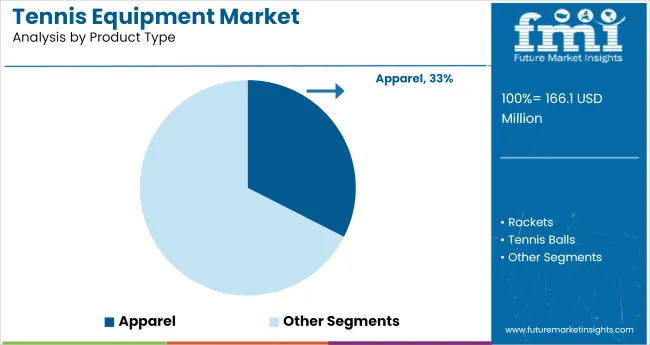

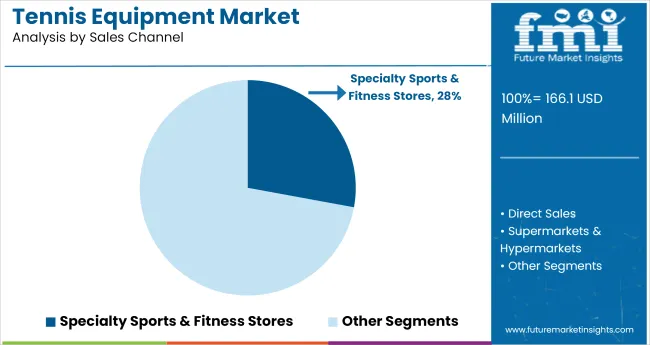

The industry is segmented by product type into apparel, rackets, tennis balls, strings, and others. By sales channel, it includes specialty sports & fitness stores, online retailers, supermarkets, direct sales, and other distribution channels.

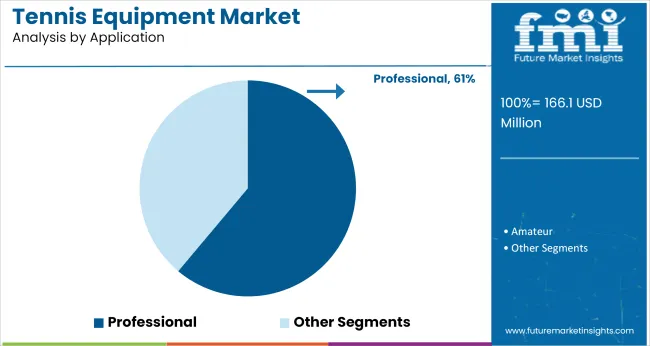

By application, the industry is divided into professional and amateur segments. Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa, and Oceania.

The apparel segment is projected to capture a significant share, with an estimated 32.5% industry share in 2025. As players prioritize comfort and performance, the demand for specialized tennis clothing, including moisture-wicking fabrics and durable footwear, is increasing.

Leading brands like Nike, Adidas, and Under Armour focus on performance-oriented designs catering to both professional athletes and casual players. Brands such as Lacoste are offering eco-conscious apparel lines to appeal to consumers who prioritize responsible purchasing choices.

Specialty sports and fitness stores are expected to account for a 27.9% share in 2025. These stores, such as Dick’s Sporting Goods and Sports Authority, provide a wide variety of tennis equipment, from racquets to shoes, catering to both professionals and amateurs.

Consumers prefer in-person shopping for personalized advice, the ability to physically test products, and the assurance of product quality. Specialty stores like Tennis Warehouse offer niche products, attracting serious players. These retail outlets also support the growth of the tennis community through in-store events and equipment demonstrations.

The amateur segment is projected to capture 61.1% share in 2025. As tennis continues to grow in popularity, especially for recreational purposes, the demand for affordable, entry-level equipment is on the rise.

Companies like Wilson and Babolat are responding with a wide range of products designed for casual players, including easy-to-use racquets and durable footwear. The rise of community tennis clubs and recreational centers is further contributing to the growth of this segment, offering access to tennis for all age groups and skill levels.

The tennis equipment sector is being influenced by a combination of technological advancements, increasing participation in the sport, and evolving consumer preferences. Rising interest in tennis, particularly among younger generations, is driving the demand for innovative and performance-enhancing equipment. However, high product costs, competition from alternative sports, and supply chain challenges are creating persistent obstacles for manufacturers.

Technological Advancements Drive Equipment Innovation

Demand for tennis equipment is driven by continuous innovations in racquet design, string materials, and footwear. Advanced racquet technologies, such as lighter frames and enhanced durability, offer players improved performance. These innovations attract both recreational and professional players, with leading brands investing heavily in R&D to stay competitive in the industry.

Challenges from High Product Costs and Competition

The high cost of premium tennis equipment, including advanced racquets and performance shoes, remains a barrier for casual players and emerging markets. The industry faces stiff competition from other recreational sports and alternative activities. As tennis grows globally, particularly in emerging regions, manufacturers are addressing affordability issues while balancing product quality. Competition from new entrants also poses challenges to established brands.

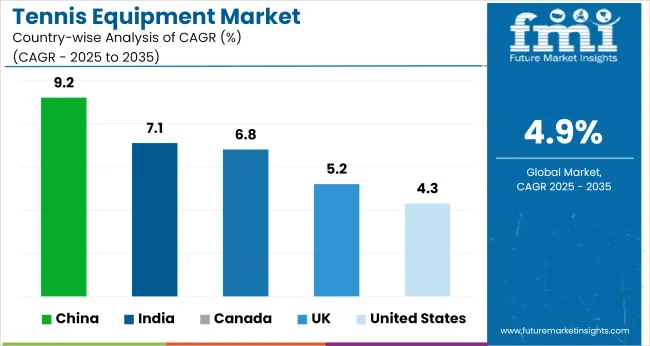

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Unites States | 4.3% |

| Canada | 6.8% |

| UK | 5.2% |

| China | 9.2% |

| India | 7.1% |

With global growth in tennis equipment projected at 4.9% CAGR from 2025 to 2035, country-level performance shows sharp divergence tied to infrastructure, consumer base, and institutional investment. China leads with 9.2%, outpacing the global average by 4.3 points.

This growth is fueled by rising grassroots participation, local tournament expansion, and domestic manufacturing upgrades across Jiangsu and Guangdong. India follows at 7.1%, driven by sports academies investing in mid-range gear and growing D2C distribution via online retailers.

Canada posts a 6.8% CAGR, supported by rising female participation and indoor court infrastructure investments in suburban regions. These three countries,China, India, and Canada,outperform the global average and reflect upward momentum in BRICS and select G7 regions.

The United Kingdom, at 5.2%, is slightly above trend, but faces a flattening curve in rural clubs due to aging infrastructure. The United States, with 4.3%, lags the global baseline, reflecting slower replacement cycles and stagnant public court investments in non-metropolitan areas across several OECD zones.

The tennis equipment market in the United States is expected to grow at a CAGR of 4.3% from 2025 to 2035. The demand for this equipment continues to rise as recreational participation increases, largely driven by the popularity of major tennis events like the USA Open.

Brands such as Prince, Yonex, and Tecnifibre are capitalizing on this demand by offering a wide range of products suited to both professional and amateur players. Youth tennis programs are also expanding, contributing to a broader market for entry-level and mid-range equipment. With the growing focus on fitness and wellness, tennis continues to attract players of all ages.

The tennis equipment market in Canada is set for robust growth, with a CAGR of 6.8% from 2025 to 2035. The sport’s increasing popularity, particularly in urban centers, is driving demand for high-quality equipment. Brands like Volkl, Babolat, and Head cater to both recreational and professional players.

The long winters in Canada have led to the growth of indoor tennis, which has become a year-round sport. With Tennis Canada supporting grassroots initiatives, more people are participating in tennis, which is expected to maintained demand for this equipment in the coming years.

The tennis equipment market in the UK is projected to grow at a CAGR of 5.2% from 2025 to 2035. The UK’s strong tennis culture, fostered by the global popularity of Wimbledon, continues to drive demand for tennis products.

Established brands like Tecnifibre, Wilson, and Lotto dominate the industry, offering advanced racquets, shoes, and apparel for players of all levels. The industry is also seeing a rise in female participation and youth engagement, further supporting the growing demand for tennis equipment. As players increasingly seek high-performance gear, technological innovations in racquets continue to play a key role in industry expansion.

Sales of tennis equipment in China are grow at a CAGR of 9.2% from 2025 to 2035. This growth is driven by increasing tennis participation, particularly in urban areas, and the rising popularity of tennis as both a recreational and competitive sport.

Brands like Head, Yonex, and Prince are expanding their industry share, offering a combination of premium and beginner-friendly products. Government-backed initiatives promoting physical activity and the construction of tennis facilities are further fueling this demand. With focus on sports infrastructure, the country is poised to become a major player in the industry.

Demand for tennis equipment is experiencing strong growth, with a projected CAGR of 7.1% from 2025 to 2035. The sport’s increasing visibility due to the success of Indian players is driving more people to take up tennis, especially among youth and urban professionals.

Major brands like Slazenger, Wilson, and Yonex are capitalizing on this growth by offering a wide range of affordable yet high-quality equipment. Tennis academies and fitness centers are expanding, further increasing the accessibility of the sport. The rise in media exposure and domestic tournaments is further encouraging people to invest in tennis equipment.

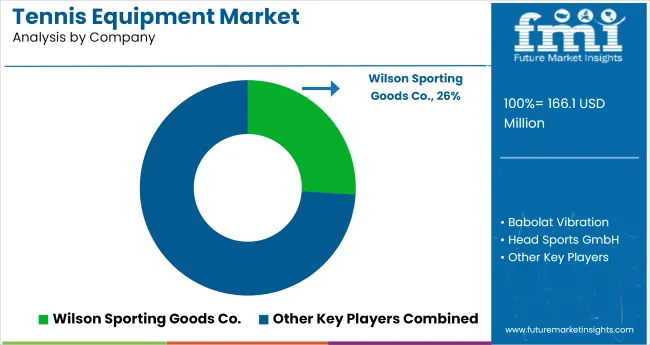

Leading Company - Wilson Sporting Goods Co.

Industry Share - 26%

In the tennis equipment market, established brands are expanding through athlete-driven branding, product line diversification, and supply chain responsiveness. Wilson, Head, and Babolat continue to dominate racket sales, supported by ATP and WTA endorsements and iterative performance innovations.

These companies rely on Southeast Asian manufacturing hubs to remain agile in batch sizing and distribution. Meanwhile, Nike, Adidas, and Asics focus on apparel and footwear, maintaining relevance through direct-to-consumer engagement and visibility in global tournaments. Yonex and Tecnifibre are reinforcing their positions with tournament sponsorships and specialized string technologies, particularly in European and Asian markets.

Emerging players like Solinco, Diadem, and Furi Sport are gaining visibility through grassroots campaigns, fast product cycles, and urban-focused outreach. These firms appeal to digitally native buyers seeking limited-edition designs and alternative brand narratives. Dunlop and Prince are rebuilding their legacy status by targeting niche tournaments and retail bundling.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 166.1 million |

| Projected Industry Size (2035) | USD 265.8 million |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Rackets, Tennis Balls, Strings, Apparel, Others |

| Sales Channels Analyzed (Segment 2) | Direct Sales, Supermarkets & Hypermarkets, Specialty Sports & Fitness Stores, Electronics & Sports Stores, Online Retailers, Other Sales Channels |

| Applications Analyzed (Segment 3) | Professional, Amateur |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Saudi Arabia, UAE, South Africa |

| Key Players | Wilson Sporting Goods Co., Babolat Vibration, Head Sports GmbH, Prince Global Sports LLC, Yonex Co., Ltd., Adidas AG, Nike, Inc., Dunlop Sport, Asics Corporation, Tecnifibre, Other Players (As requested) |

| Additional Attributes | Dollar sales, share by product type and application, growth in online and specialty retail channels, consumer shift toward performance gear, regional participation trends in amateur tennis |

This segment includes rackets, tennis balls, strings, apparel, and others.

The industry is segmented into direct sales, supermarkets & hypermarkets, specialty sports & fitness stores, electronics & sports stores, online retailers, and other sales channels.

This segment covers professional and amateur usage.

Regional analysis includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The industry is projected to reach USD 166.1 million in 2025.

The industry is expected to grow at a CAGR of 4.9% from 2025 to 2035.

Apparel is expected to capture 32.5% of the industry share in 2025.

China is projected to register the highest CAGR of 9.2% from 2025 to 2035.

The industry is projected to reach USD 265.8 million by 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA