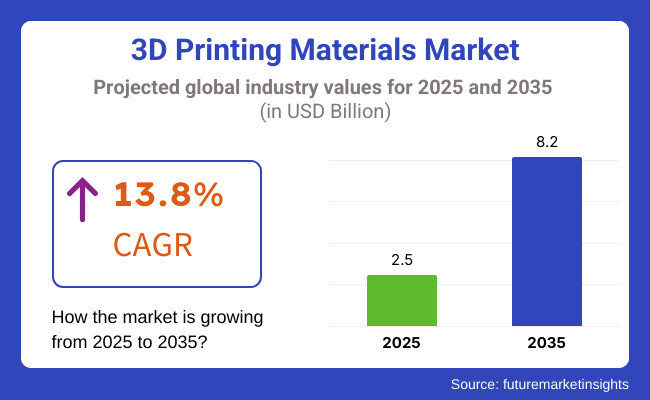

The 3D printing materials market is valued at USD 2.5 billion in2025 and is anticipated to surpass USD 8.2 billion in 2035, growing at a CAGR of 13.2% during the next decade. The market signifies a robust CAGR of 13.8%, supported by the rising adoption of additive manufacturing technologies in arange of sectors.

The increasing demand for high mechanical strength, high durability, and environmental durability ofmaterials is also prompting producers to invest heavily in developing the properties of materials.

3Dprinting services are becoming popular across many business domains - aerospace, automotive, medicine, consumer products, etc., thus increasing the demand for unique printing materials. AM is capableof producing intermetallic, ceramic, polymers, and biocompatible materials, the range of which has gradually expanded.

It plays a vital role in changing the production of objects as manufacturers arelooking for cheaper and more sustainable methods of production by supplying information about materials used during the additive manufacturing process. Furthermore, new rapidly emerging technologies such asmulti-material printing and nanofabrication allow customized novel material properties and expansion of the application domain.

Breakthroughs in additive manufacturing technology and growing demand forlightweight, rugged, and recoverable materials primarily drive industry expansion. We have a growing relianceon 3D-printed alloys and composites to make lighter and more efficient butterfly bolts for both the aircraft and automotive industries to create structural stability and enhance fuel efficiency. Further, this rise in the emphasis on the sustainability factor is resulting in the growth ofbio-based and recyclable filaments to supplement global green initiatives.

The industry is growing, but there are issues such as high material prices anda shortage of materials and processing capacity. The cost of specializedmaterials such as high-performance metal powders and composite resins is another deterrent to widespread adoption. Moreover, the common use of various materials with consistent print quality along withmechanical properties introduces technical challenges that require continued R&D. Complex regulations regarding the safety of materials and application normsonly add to the troubles in the industry, particularly in the case of medical and aerospace applications.

More innovation and an improved sustainability focus are alsonotched up in the industry, along with a wider industrial application. Some examples of the kinds of materials that 3D printing technology allows to be created are high-strength composites, conductive materials for electronics, and biodegradable filaments for 3Dprinting.

Intelligent and Machine Learning have been coupled with 3D printing toimprove the performance of material and process. As companies discover new applications, it's only likely that the industry will experience rapid growth, unlocking mass customization, rapid prototyping, and decentralized manufacturing in the near future.

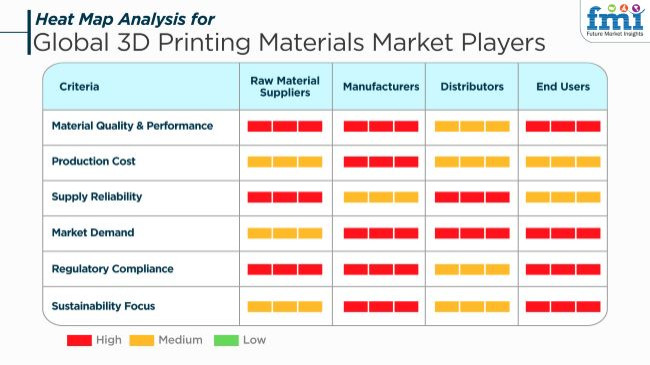

The industry is in a positive growth stage, motivated by numerous factors such as the uptake of advancement technologies in different industries such as automotive, aerospace, and healthcare. Performance, durability, and quality of material are very important for manufacturers, especially in applications with high precision such as aerospace parts and medical implants. End users care about material compatibility among various 3D printing technologies, such as FDM, SLA, SLS, and metal 3D printing, in influencing purchasing behavior.

Sustainability is on the rise, with greater emphasis on biodegradable filaments, recycled polymers, and eco-friendly resins. Adherence to rules and regulations is very crucial in the medical and aerospace sectors where strict safety and quality rules are imposed.

The demand for lower costs will remain a central point, especially for industrial customers who are looking for volume buying and affordable supply chain. The field will stay by innovative developments, along with a larger share of the research being conducted on high-performance composite materials, bio-based polymers, and metal alloys to broaden their application in multiple industries.

Contract & Deals Analysis – 3D Printing Materials Market

| Company | Contract Value (USD Million) |

|---|---|

| Stratasys Ltd. | Approximately USD 90 - USD 100 |

| 3D Systems Corporation | Approximately USD 80 - USD 90 |

| BASF 3D Printing Solutions | Approximately USD 70 - USD 80 |

| Evonik Industries | Approximately USD 60 - USD 70 |

The industry grew gradually between 2020 and 2024 for the following reasons: improvement in additive manufacturing and growth in industrial adoption. Lightweight, durable, and high-performance material was needed. This made companies become more innovative and resulted in firms innovating in the areas of bio-based polymers, metal powder, and composite filaments.

Supply chain disruptions and fluctuating prices of raw materials were challenges in the industry. Investments in localized manufacturing and recycling technologies have stabilized supply and enhanced sustainability in Kenya.

The industry is, therefore, projected to change between 2025 and 2035 through innovations in nanocomposites, biodegradable polymers, and material optimization through artificial intelligence. Recycling and upcycling in 3D printing will continue to fuel the demand for these materials to undergo downstream processing as the industry goes circular and green.

Smart materials with self-healing, conductivity, and shape memory will widen the scope of sectors into medical implants, electronic devices, and building construction. Prices will also become more competitive as scalability in production is enhanced. Thus, more uses will become popular in consumer and industrial markets.

Shifts in the 3D Printing Materials Market from 2020 to 2024 and Future Trends 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments enforced tighter standards on 3D printing material, with assurance of safety, recyclability, and compliance with environmental regulations (e.g., FDA, REACH, RoHS). | Blockchain-based supply chain tracking and AI-based material certification systems ensure compliance, transparency, and real-time safety assurance of them. |

| In the industrial sector, composite materials such as polymers reinforced with fibers and carbon fibers are increasing demand for stronger, heat-resistant, and lightweight components. | AI-optimized, multi-functional materials with self-healing, adaptive mechanical properties, and tunable conductivity revolutionize industrial applications in aerospace, automotive, and healthcare. |

| The adoption of metal powder, such as titanium, aluminum, and stainless steel, has increased in applications such as aerospace, healthcare, and automotive. | The alignment of enhanced alloys and powders with nano-engineered technologies by AI promises ultra-lightweight, high-strength structures for space exploration, electric vehicles, and next-generation medical implants. |

| The healthcare sector saw applications of biocompatible resins and polymers increase for custom-built medical devices, implants, and prostheses for patients. | Synthesis by AI makes possible 4D-printed tissues that are living, regenerative scaffolds, and even entire bio-printed organs that can be designed according to personalized medicine. |

| Companies emphasized eco-friendly filaments, bio-resins, and recycled metal powders to minimize material wastage and environmental footprints. | AI-driven circular economy frameworks combine entirely biodegradable, carbon-negative 3D printing materials that allow sustainable production and closed-loop material recycling. |

| Food-grade printing materials extended to personalized nutrition, confectionery, and alternative protein manufacturing. | AI-personalized food 3D printing materials allow nutrient-optimized, biodegradable, and functional food architectures, revolutionizing personalized nutrition and sustainable food production. |

| Scientists investigated algae-based resins, biodegradable PLA substitutes, and plant-based polymers for more sustainable 3D printing solutions. | AI-driven bio-inspired material design facilitates fully renewable, carbon-capturing them, diminishing the reliance on fossil-derived polymers and rare earth metals. |

The industry is prone to risks by raw material availability, regulatory issues, technological breakthroughs, patents, and supply chain ruptures.

The issue of raw material availability is of utmost importance as 3D printing techniques are dependent on various materials including plastic (PLA, ABS, PETG), metal (titanium, aluminum, stainless steel), ceramic, and composite materials. Changes in the prices of raw materials, tensions in the geopolitical scene, and trade agreements may influence the production and, in turn, the price.

Regulatory challenges depend on the industry concerned. In the case of healthcare, aerospace, and automotive sectors, the materials used should fulfill the required safety, durability, and compliance standards (e.g., FDA for medical devices, ASTM for aerospace).

Technological advancements mean both opportunities and threats. The rise of next-generation materials like biodegradable polymers, nanocomposites, and high-performance alloys could obsolete existing products and result in the need for endless R&D money. Companies that do not introduce new products are in danger of getting irrelevant in the industry.

Intellectual property (IP) problems set up as 3D printing enables distributed manufacturing, local production. Local replacement of patented designs is a threat that IP theft and counterfeiting would have not only on manufacturers but also on end-users.

Plastics can be printed in three dimensions (3D) the most by volume, whilebeing the cheapest with the easiest and most versatile material properties. They are used widely byFDM and SLS technologies.

Some common plastic materials are PLA (Polylactic Acid), ABS (Acrylonitrile ButadieneStyrene), and PETG (Polyethylene Terephthalate Glycol). PLA is one of the most common materials usedfor consumer 3D printing; it is biodegradable, relatively friendly to the environment, and easy to work with. ABS is strong and tough and is used in a wide variety of automotive and industrialapplications. This impact-resistant filament is a perfect candidate for food-safe applications orfunctional parts.

Companies like Stratasys, Ultimaker, and Prusa Research produce some of the finest quality plasticfilaments.

Metal 3D printing is transforming industries, including the aerospace, automotive, and healthcare sectors. Unlike plastic-based printing, metal 3D printing enablesthe production of durable and robust components, which would not be possible due to the low weight and complex geometry.

Common materials include Titanium, StainlessSteel, Aluminum, and Cobalt-Chrome. Titanium is a choice for aerospace and medical applications because it is corrosion-resistant,high-strength, and biocompatible. Aluminum is generally used for lightweight, automotive, and aerospace applications, while cobalt chrome has an established usage in medical and dental applications.

Some of the important players in the industry are General Electric (GE Additive), EOS, andDesktop Metal. GE Additive is a recognized leader in advanced metal manufacturing solutions, while EOS specializes in high-performance metal powders used inindustrial manufacturing. Desktop Metal specializes in low-cost metal 3Dprinting for mass production. The growth potential for metal 3D printing is emphasized by the increasing adoption in the medical implant and aerospaceindustries.

Filament-based 3D printing is the most prevalent form of 3D printing, especially in Fused deposition modeling (FDM) printers. It is widely used for prototyping, functional parts, consumer applications, and the like.

Some of the top filament providers are MakerBot, Poly Maker, and BASF Forward AM. MakerBot is a high-quality filament brand designed for professional and educational use. Poly maker is a developer of advanced 3D printing materials, with their products featuring engineering-grade filaments. BASF Forward AM is a top provider of industrial-grade filaments for high-performance industries.

There are a variety of filaments available, from standard thermoplastics (PLA, ABS, PETG) to advanced composites (carbon fiber, nylon, PEEK) for various industry applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| China | 10.1% |

| Germany | 8.9% |

| Japan | 9.2% |

| India | 10.3% |

| Australia | 8.7% |

The industry in the USA is growing as additive manufacturing gains ground in the aerospace, healthcare, and automotive sectors. The manufacturing industry embraces printing to increase manufacturing efficiency, lower costs, and facilitate speedy prototyping.

The United States government and the private sector alone spent more than USD 10 billion on additive manufacturing and material R&D in 2024. FMI estimates the USA industry to grow at 9.5% CAGR over the forecast period.

Growth Drivers in the USA

| Drivers | Details |

|---|---|

| Aerospace and Defense Applications Growth | Growing demand for 3D-printed parts in low-weight, high-strength applications. |

| Biocompatible and Sustainable Materials Development | Development of biodegradable and bio-based print materials in medical and green industries. |

| Growing Applications in Custom Manufacturing and Quick Prototyping | Cost-efficient, on-demand manufacturing facilitated by three-dimensional printing materials. |

The Chinese industry is transforming with industrial automation, the need for low-cost production, and government support of intelligent manufacturing technology. Since China is one of the world's biggest manufacturers of industrial products, consumer electronics, automotive, and health industries are increasing their demand for printing. In 2024, China invested 12 billion USD in research and mass production of printing materials. FMI forecasts the industry in China to grow at a 10.1% CAGR throughout the study.

Growth Drivers in China

| Primary Drivers | Details |

|---|---|

| Government Assistance to Support Advanced Manufacturing and Intelligent Factories | Additive manufacturing policy results in industry growth. |

| Metals and Composite Printing Materials Growing Opportunity | The timing is right with the rising demand for performance materials in the aerospace and automotive sectors. |

| Consumer Products and Healthcare Increasing Utilization | Improving accuracy in prosthetics, dental implants, and consumer devices through personalization. |

Germany's materials industry is growing with the help of its robust manufacturing industry, increasing use of additive manufacturing in precision engineering, and development of high-strength polymer materials. As a technology leader, Germany is investing in medical device printing materials, automotive component printing materials, and tooling printing materials. Germany's emphasis on energy-saving and recyclable materials fuels 3D printing solutions.

Growth Drivers in Germany

| Drivers | Details |

|---|---|

| Heavy Industry and Automotive End-Take | Companies are utilizing 3D printing for personalized manufacturing and weight-light parts. |

| High-Performing and Environmental Materials Demand for Boost | Increasing spending on carbon fiber, high-temperature-resistance materials, and biodegradable materials. |

| Breakthrough in Multi-Material Printing Technology | Innovation on hybrid materials with multifunctional purpose. |

The Japanese industry is growing with growing high-precision printing technologies, medical and electronics production embracing additive technology, and nanomaterial development. The manufacturing sector leverages them to produce miniaturized parts, robots, and semiconductors. Japan's material science and nanotechnology capabilities have pushed the applications of 3D printing ahead. According to FMI, the Japanese industry is projected to grow at 9.2% CAGR through the forecast period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Integration of 3D Printing with High-Tech Manufacturing | Japan is a pioneer in ultra-high-precision additive manufacturing of semiconductors and electronics. |

| Growth of Biocompatible and Medical-Grade Materials | Impact:More implants and patient-specific prosthetics 3D-printed. |

| Emergence of Conductive and High-Strength Polymers | More use of advanced materials in robotics and AI-based systems. |

The Indian industry is expanding with investments in digital manufacturing, additive manufacturing establishing itself in education and healthcare driving the industry forward through government initiatives. Initiatives like 'Make in India' and an industrialized base generate industry demand for economically viable and multifunctional materials. AI-driven material development and local production of materials drive industry growth.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Initiatives for Intelligent and Digital Manufacturing | Regulations favoring local manufacturing of 3D printing material fuel adoption. |

| Growth in Healthcare and Education Applications | Growth in applications of 3D-printed models to train surgeons, prosthetics, and anatomical study. |

| Growing Demand for Low-Cost, High-Strength Printing Materials | Material optimization using artificial intelligence to achieve maximum efficiency. |

Australia's industry is expanding due to investments in renewable energy solutions, medical studies, and aerospace. Defense, healthcare, and mining sectors are adopting them to improve efficiency, customization, and sustainability. National emphasis on developing innovation in high-performance materials is creating a need for next-generation metal-based and composite 3D printing technology.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Government Support to Additive Manufacturing and Material Science | R&D and local production policies boost the growth of industries. |

| Growth of 3D Printing in Aerospace and Healthcare | Increased applications of custom-made implants and plane components. |

| Increase in Demand for Environmentally Friendly and Recyclable 3D Printing Material. | Companies now utilize sustainable materials to produce with low wastage. |

The most common power-based methods are selective laser sintering (SLS) for plastics and direct metal laser sintering (DMLS) for metals. This technique makes it possible for a very accurate way of manufacturing that minimizes the use of material.

Major suppliers are 3D Systems, HP, and Renishaw. 3D Systems pioneered additive manufacturing and provided advanced polymer and metal powders. HP was known for its Multijet Fusion (MJF) technology, which uses powder-based printing to generate high-speed production. Renishaw, the leader in metal 3D printing, supplies industrial-grade powders to customers around the globe.

Since material science and printing technology are constantly evolving and growing, the industry is also expected to expand significantly. Therefore, additive manufacturing is future-proofed due to the increasing demand for greener, faster, and industry-optimized materials.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stratasys Ltd. | 20-25% |

| 3D Systems Corporation | 15-20% |

| BASF SE | 10-15% |

| Arkema S.A. | 8-12% |

| Evonik Industries AG | 5-10% |

| Materialise NV | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stratasys Ltd. | High-performance polymer materials for industrial 3D printing applications. |

| 3D Systems Corporation | Advanced metal and plastic printing materials for healthcare and aerospace. |

| BASF SE | Engineering-grade thermoplastics and sustainable materials for additive manufacturing. |

| Arkema S.A. | Specialty resins and high-performance composite materials for 3D printing. |

| Evonik Industries AG | Biodegradable and high-performance polymers for industrial applications. |

| Materialise NV | Customized materials and software solutions for medical and consumer applications. |

Key Company Insights

Stratasys Ltd. (20-25%)

Stratasys leads the industry with its groundbreaking polymer solutions for industrial and medical industries. The company continues to be at the leading edge of creating high-performance and environmentally friendly materials.

3D Systems Corporation (15-20%)

3D Systems is an expert in developing high-quality metal and plastic printing materials used in aerospace, automotive, and medical applications.

BASF SE (10-15%)

BASF is the expert in thermoplastic materials for additive manufacturing, focusing on sustainability and value-driven production.

Arkema S.A. (8-12%)

Arkema creates specialty resins and composite materials, serving high-performance 3D printing applications demanded by industries.

Evonik Industries AG (5-10%)

Evonik is a leader in biodegradable and high-performance polymers, enhancing the range of materials available for industrial 3D printing.

Materialise NV (4-8%)

Materialise provides customized material solutions and software integration to optimize additive manufacturing processes.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in them by improving material properties, expanding sustainable options, and integrating AI-driven material development. The increasing adoption of high-performance, cost-effective, and eco-friendly materials continues to shape the competitive landscape of the industry.

By material type, the industry is segmented into plastics (Acrylonitrile Butadiene Styrene (ABS), Nylon, Polylactic Acid (PLA), High Impact Polystyrene (HIPS), Polyvinyl Alcohol (PVA), Polyethylene Terephthalate (PET), others), metals (steel, aluminum, nickel & alloys, cobalt & alloys, others), ceramics, and others.

By form, the industry is segmented into filament, powder, and liquid.

By application, the industry is segmented into electronics & consumers, automotive, medical, industrial, education, aerospace, and others.

By region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 36: Europe Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Asia Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: Asia Pacific Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: MEA Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 56: MEA Market Volume (Tons) Forecast by Technology, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 58: MEA Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Form, 2023 to 2033

Figure 27: Global Market Attractiveness by Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Form, 2023 to 2033

Figure 57: North America Market Attractiveness by Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 101: Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 105: Europe Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Form, 2023 to 2033

Figure 117: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 161: MEA Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 165: MEA Market Volume (Tons) Analysis by Technology, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 169: MEA Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: MEA Market Attractiveness by Form, 2023 to 2033

Figure 177: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 178: MEA Market Attractiveness by Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Application, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

The industry is expected to reach USD 2.5 billion in 2025.

The industry is projected to reach USD 8.2 billion by 2035.

India is expected to grow at a CAGR of 10.3% during the forecast period.

Key companies include Covestro AG, Arkema S.A., Sandvik A.B., Evonik Industries A.G., EOS GmbH Electro Optical Systems, Ultimaker B.V., Hoganas AB, The EXONE Company, General Electric, 3D Systems Corporation, Materialise NV, STRATASYS LTD, and MARKFORGED Inc.

Metal and composite 3D printing materials are being widely used.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.