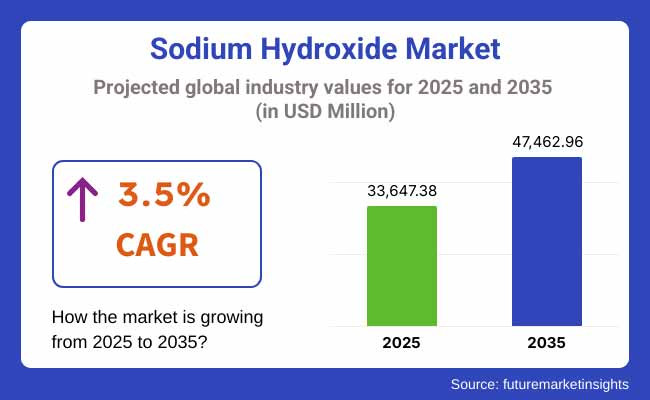

The global sodium hydroxide market is expected to be valued at USD 33,647.3 million in 2025 and is forecast to reach USD 47,466.2 million by 2035, with a CAGR of 3.5% over the assessment period. Growth is being supported by rising industrial consumption across pulp and paper, alumina refining, textiles, water treatment, and chemical manufacturing sectors.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 33,647.3 million |

| Projected Market Size in 2035 | USD 47,466.2 million |

| CAGR (2025 to 2035) | 3.5% |

In the Asia-Pacific region, sodium hydroxide is being heavily consumed in China and India due to strong industrial activity and infrastructure development. In the pulp and paper industry, it is being applied for lignin removal and bleaching operations. Textile manufacturers are using caustic soda in dyeing and mercerization processes. Growing urbanization, rising population, and the export-driven production of processed goods are sustaining regional demand.

Countries such as Indonesia and Vietnam are witnessing increased sodium hydroxide usage, particularly in alumina production and chemical intermediates. These countries are expanding domestic refining and manufacturing capacities, reinforcing their role as emerging demand centers within Southeast Asia.

In North America, sodium hydroxide consumption is being driven by infrastructure modernization, alumina processing, and increased investment in municipal wastewater treatment. In the United States, caustic soda is being utilized for the extraction of alumina used in lightweight metal applications across the automotive and aerospace industries. High-purity grades are being procured for biofuels and renewable chemical production, aligning with clean energy targets.

Western Europe is registering stable growth, supported by applications in bio-based polymers, PVC production, and renewable surfactants. Sodium hydroxide is also being used in food and pharmaceutical processing due to strict quality and safety regulations. European producers are transitioning to membrane electrolysis to meet EU energy efficiency and decarbonization targets.

A global shift toward membrane cell technology is being observed across producers in Europe, North America, and Asia. This production method reduces electricity consumption, eliminates the use of mercury and asbestos, and enables the manufacture of high-purity caustic soda. Upgrades from diaphragm and mercury-based facilities to membrane systems are being implemented to improve compliance, lower emissions, and expand application potential in high-value downstream segments.

The pulp and paper industry is set to drive approximately 30% of global sodium hydroxide demand by 2025, with CAGR 4.2% major applications in pulping, bleaching, and wastewater treatment. As the shift toward sustainable and recyclable packaging accelerates-particularly for e-commerce and food-grade materials-paper manufacturers are expanding production facilities.

Southeast Asia and Latin America are emerging as key investment destinations due to low operating costs and abundant raw material availability. Sodium hydroxide is vital in kraft and sulfite pulping processes, and its role in closed-loop chemical recovery systems makes it indispensable for operational efficiency and environmental compliance in modern paper mills.

Sodium hydroxide in flake form is projected to account for approximately 18% of the global market share in 2025, with a forecast CAGR of around 4.5% through 2035. Flake-type caustic soda is preferred in applications requiring precise dosing, safer handling, and reduced moisture sensitivity, particularly in small- to mid-scale operations.

Key end-use industries include textiles, soap and detergent manufacturing, water treatment, and dye processing. Emerging markets in Africa and Southeast Asia are witnessing increased adoption due to its easier transport and storage benefits. Suppliers are targeting the flake segment with improved packaging and moisture-resistant solutions to meet rising industrial standards.

Volatility in Raw Material Prices and Energy Costs

Sodium hydroxide market to cope with raw material prices like brine, energy due to electrolysis produces flake salt, and other major challenge. Changes in electrolysis and product price inspire hope for trans-border trading: it may be possible to import some of the needed high-salt brine from abroad if necessary. The price of electricity and flake salt has direct influence on the manufactory's expenses and profits; on top of this, dealing with environmental problems also adds to its investment costs.

Environmental and Safety Regulations

Firms and facilities that handle, transport or dispose of sodium hydroxide are besieged with strict environmental and safety regulations. Compliance with hazardous material regulations and wastewater discharge limits raise the level needed for advanced containment and treatment, but also expend costs growing companies' have to shoulder.

Expansion in End-Use Industries

Demand for Sodium Hydroxide is expanding rapidly in such diverse areas as paper and pulp, water supply treatment chemicals aren't cleaning up well sportswear fabric; these are all potential growth points. Electronic information products, emerging industries that are yet to come onto the scene (e.g. high-tech products) also provide niche fields for Sodium Hydroxide marketing.

Advancements in Green Manufacturing Technologies

Development in power saving production technology and sustainable manufacturing process will mean opportunities to cut production costs and environmentally friendly. With companies turning toward renewable energy integration, or innovative electrolysis methods alike, who can do it faster and better than others will not only set the rules but also keep catching up with evolving requirements of law along way too.

The USA market for sodium hydroxide is growing steadily as it has proven multi-applications in such widely-different fields as pulp and paper, textiles, water treatment, and chemicals. Established consumer industries and heavy investment in water-treatment plant construction give support to demand. However, the problems faced by the market are disruptions of supply channels and upsets in raw material prices.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

In the United Kingdom, demand for sodium hydroxide is driven by the increasing need for effective water treatment solutions and applications in chemical manufacturing. Thus, enforcement of environmental regulations concerning water quality improvement and industrial cleaning have given rise to Sodium hydroxide usage in the UK.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

The sodium hydroxide market in the European Union is underpinned by strong industrial and manufacturing activities that encompass German, Italian and French enterprises. Greater concern about environmental practices, rather than just more considerations for profit making from being ecologically friendly will act to boost market prospects.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.6% |

South Korea’s sodium hydroxide market is developing in the electronics, semiconductor and chemical engineering fields. Since South Korea is a big force in world electronics and semiconductors, demand for high-purity sodium hydroxide for cleaning and etch applications remains large. Regulatory compliance and environmental factors are also influencing market directions.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

The sodium hydroxide market is highly consolidated, with leading players pursuing expansion and backward integration. Manufacturers are investing in membrane electrolysis technology to reduce energy consumption and improve environmental compliance.

Strategic partnerships with downstream users, particularly in the chemical and water treatment sectors, are enhancing supply security and pricing stability. Additionally, growing regulatory scrutiny on emissions is compelling producers to modernize chlor-alkali facilities across Europe and North America. Demand diversification across mature and emerging economies is expected to sustain long-term growth.

The overall market size for sodium hydroxide market was USD 33,647.3 million in 2025.

The sodium hydroxide market is expected to reach USD 47,466.2 million in 2035.

Rising demand across alumina, textiles, pulp and paper, water treatment, and petrochemicals, coupled with growing soaps, detergents, and pharmaceutical industries, will drive sodium hydroxide market growth during the forecast period.

The top 5 countries which drives the development of sodium hydroxide market are USA, European Union, Japan, South Korea and UK.

Flakes demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Sodium Hydroxide Market

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA