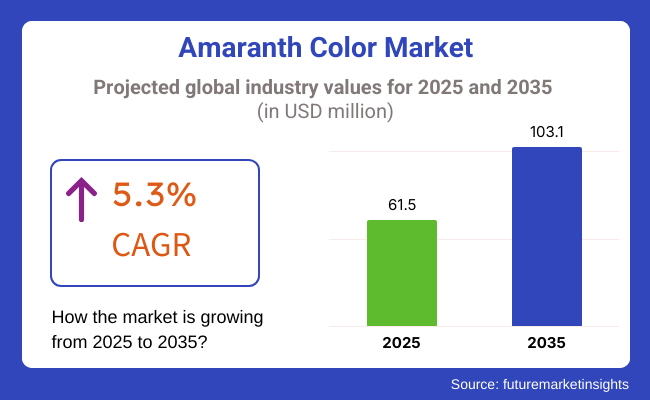

The Amaranth Color Market has a strong potential to be able to increase the demand in the global market strongly with the expected growth to USD 61.5 million in 2025. The market will most likely develop a CAGR of 5.3% during the time of analysis, starting from 2025 and lasting until 2035. It is estimated that by 2035 the market value will reach a total of USD 103.1 million.

As the most prominent food color additive, amaranth color, which can also be considered a synthetic food dye, is a common sight in the food and beverage industry. It is easy to find it in various formulations because of the lively red color it gives and its good tolerance in the presence of different substances.

Its demand is partly driven by the increasing amounts of processed and packaged foods, confectioneries, and beverages, which are the main sectors supported by the amaranth color market. Moreover, the incorporation of amaranth color in pharmaceuticals and cosmetics is bringing further advantages to the market.

According to the increasing consumption of eye-catching and multi-colored food, the market grows rapidly. To enhance their attractiveness, manufacturers are developing different food formulations by adding amaranth color. The growth of the food processing industry and the subsequent rise in the demand for this food colorant have influenced the situation where additional factors play a role in developing economies.

Synthetic food colors are being regulated in a different manner in different areas which affects the market. While some countries continue to authorize the use of amaranth color in food applications, the strong regulations in some areas make it difficult for companies to enter those markets. The concurrent research and development strivings to enhance synthetic food color safety and fabricate advanced formulations have a positive impact by bringing new opportunities for businesses.

Even with the acceptance of its use being launched, the market is still quite challenging. The concerns about the health impacts of synthetic food colors along with the regulations blocking the application of amaranth color in the food sector in places like the USA have made the latter one a better alternative. The consumers' demand for products that are free from artificial additives and are made from natural ingredients has turned into a threat for the food color sector, and the same applies to amaranth.

Nevertheless, the manufacturers are searching for new uses, for instance, in the pharmaceutical and personal care products sectors, where its coloring properties still have meaning. The market is also profiting from the higher demand for low-cost and long-term food colorants, especially in the inexpensive area. The enhancement of technology in colorant formulations is anticipated to back up the market growth in the next few years.

Amaranth color market is experiencing continuous growth with its flexibility, widely employed in food, cosmetics, drugs, textiles, and animal nutrition. In the food and beverages market, amaranth color finds extensive use in candies, soft drinks, and processed food, although the regulatory limits of the market in specific markets drive adoption.

Pharmaceuticals use amaranth as a tablet and capsule coating, focusing on stability and health regulation compliance. Cosmetics use amaranth in lipsticks, blushes, and skin care because of its appearance and pigmentation characteristics. Its application as a dye in the textile industry is increasing, but cost is a major consideration.

Animal feed uses are restricted but offer potential for growth. As demand for natural and regulatory-friendly colorants grows, manufacturers are looking to alternatives such as plant-based and bioengineered types to meet changing consumer needs.

Between 2020 and 2024, there was a growing demand for amaranth color on a constant basis as consumer demand for vegetable and natural colors in food and beverages rose. Water-soluble man-made azo amaranth with a deep red to purple characteristic color was the popular choice when food manufacturers needed an alternative for artificial colors based on growing concerns about health and safety.

The rising demand for natural ingredients and clean-label foods also helped drive the market. Amaranth color had found widespread applications in processed foods, drinks, confectionery, and cosmetics because of its stability and affordability. But regulatory limitations and food safety concerns in some regions checked its maximum market potential. Firms focussed on improving product formulation and on finding alternatives to satisfy regulatory demands while maintaining product quality.

Forward to 2025 to 2035, the amaranth color market is expected to shift towards naturally derived and more sustainable alternatives as a result of consumer pressure and regulatory pressures. Biotechnology and natural extraction process innovations will be able to enhance the intensity and stability of plant-based amaranth colorants. Increased focus on organic and non-GMO ingredients will drive product innovation, compelling producers to reformulate products with green amaranth-based colorants. Higher spending on research and development will further enhance the efficiency of production, lower the cost, and cause color uniformity. Incentives on natural additives from the government and more transparent labeling will increase the confidence of the consumers. Growth in emerging economies and the growth trend of plant-based diets will provide new avenues for growth to the amaranth color market.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing growth due to growing demand for natural and plant colorants. | Faster growth because of sustainable sourcing and natural substitutes. |

| Growing concern with artificial colorants and health implications. | Higher demand for organic, non-GMO, and clean-label alternatives. |

| Synthetic amaranth colorants commonly applied in processed foods and cosmetics. | Migration towards plant-based and bio-based amaranth substitutes. |

| High demand from developed markets; low adoption in some countries from regulatory restrictions. | Increasing global adoption with regulatory convergence and product innovation. |

| Limits on synthetic amaranth color in specific markets because of health issues. | Higher acceptance of natural equivalents and more strict labeling. |

| Expansion from retail and direct-to-consumer channels. | Increased growth in omnichannel distribution channels, such as online and specialty stores. |

| Enhanced formulation for enhanced color stability and shelf life. | Biotechnology-based color manufacturing and advanced natural extraction methods. |

| Battle for market space between synthetic dye producers and natural color manufacturers. | Consolidation and collaborations driving product diversification. |

| Emphasis on color vibrancy and cost-effectiveness at a consistent level. | Emphasis on sustainability, health benefits, and natural sourcing. |

| Regulatory restrictions and health-related concerns in specific markets. | Ensuring product consistency, meeting natural certification standards, and balancing cost. |

The color amaranth market is increasing due to the rise in the demand for natural food colorants. On the other hand, the risks of the companies in terms of synthetic dyes and food additive regulatory approvals which are very strict are high. The companies have to comply with international food safety regulations and also, conduct very extensive tests to avoid the legal problems and keep the market trust they have earned.

Production stability is affected by the supply chain issues like the fluctuations in the supply of raw materials and the dependence on specific growing areas. Global warming, soil deterioration, and crop production difficulties also, are further deviations in the market. The companies have to source sustainably, create strong supply chains, and scout new raw material alternatives in order to address these concerns.

The difficulties in production cost and the small scale of amaranth color penetration in the market are crucial. The amaranth pigment extraction and refinement process requires unique methods, which in turn increase operating costs. The businesses should prioritize the increase of production efficiency, introduce cheaper technology, and open up the way for strategic partnerships to reap the benefits of the cost savings and fast growth.

Growing consumer awareness and perception issues further complicate the market growth. The worries about synthetic alternatives, wrong assumptions, and question marks on labeling rules can all make it hard for the people to adopt. Good marketing, transparency in the supply of the ingredients, and campaigns for education are vital tools for gaining the trust of consumers and expanding market scope.

Consumers prefer to buy synthetic dyes and other natural coloring agents like beetroot and turmeric which reduces the market share for hand loom. For the purpose of this, the companies should focus on the quality of the product they provide, the technology used, and the use of their product.

Amaranth Color Market, by Form of Amaranth Color Powder and Liquid: The Amaranth Color can be segmented into powder and liquid form; powder form is broadly utilized in industries whereas, due to solubility, stability, and application, fluid form is also well-known in the commercial sector.

By 2025, powdered amaranth color would hold more than 60 percent of the total share, the report added. It is widely used in confectionery, bakery, pharmaceuticals, and cosmetics due to its long shelf life, high stability, and convenient storage.

The powdered version is particularly common in dry beverage mixes, processed foods, and dietary supplements, and its resistance to heat and light helps maintain the quality of color. Leading manufacturers, such as Sensient Technologies Corporation and Dynamic Products Ltd., produce high-purity powdered amaranth colors for food and cosmetic industries worldwide.

Liquid amaranth color is estimated to account for around 40% of market share by 2025.

It’s commonly used in drinks, dairy products, and liquid pharmaceuticals, where its rapid dissolution and simple integration provide benefits. This form is especially popular among syrup, flavored beverages, and processed food producers. Businesses, including Koel Colors and Neelikon Food Dyes & Chemicals Ltd., are expanding their liquid dye portfolios worldwide to meet demand in food and beverage applications.

Rising regulatory attention on the use of synthetic dyes is forecast to spur a gradual market shift in favor of natural color additives in food and beverage applications as the demand for powder or liquid amaranth color progresses into the future.

The application-based types include Beverages, Bakery, Snacks, & Cereals, which in turn cater to different end-use industries.In fact, the beverage industry will represent a key end-user industry for amaranth color buying for around 45% market share by 2025. In particular, it is commonly used to provide aesthetic appeal and product differentiation in carbonated soft drinks, flavored water, and fruit juices, as well as in alcoholic beverages.

Its high solubility and brilliant red color render it a common synthetic colorant for RTD (ready-to-drink) cocktails and powdered drink mixes. Major beverage companies - such as The Coca-Cola Company and PepsiCo use synthetic food colors, such as amaranth, in some foreign markets.

High-quality amaranth color is offered by companies such as Neelikon Food Dyes & Chemicals Ltd., Koel Colours, and others for use in beverages.

In 2025, the bakery, snacks, and cereals segment is expected to account for approximately 35% of the total market share due to the growing preference for eye-catching and colored bakery items.

The heat stability of amaranth color makes it suitable for applications such as cakes, cookies, wafers, breakfast cereals, and extruded snacks, as it remains stable during baking and processing. It is also seeing an increase in demand due to the rising popularity of decorative icings, frosting, and flavored coating. Firms like Sensient Technologies Corporation and Dynamic Products Ltd. offer tailor-made color formulations for confectionery and snack manufacturers globally.

While some food processors are turning to plant-based alternatives in light of the trend toward natural colors, amaranth color almost certainly remains a more affordable and stable option for large-volume drinks and baked goods.

The amaranth color market is constantly being strengthened by the increasing demands regarding the synthetic and natural food colors found in the food and beverage industries, pharmaceuticals, and even cosmetics. Amaranth is a water-soluble azo dye (E123), and it is very much used in confectionery, beverages, dairy products, and pharmaceuticals, where this component benefits from its high stability and high-intensity red hue. However, certain regions like the USA and some parts of Europe have regulatory restrictions regarding amaranth, leading to the absorption of this dye, hence developing trends toward naturally derived alternatives such as beetroot and anthocyanin colors.

Most of the major players, such as Sensient Technologies, Koninklijke DSM, and Chr. Hansen, ADM, and BASF SE have much-diversified portfolios on synthetic and natural. These start-ups and niche players are making innovations of red pigments, mostly from plants or algae, to pursue the clean label as well as natural ingredients trend.

The advancement in extraction and formulation technologies speeds up the pace from which the market is built. The developments ensure improved color stability, resistance to heat, and compatibility with pH. Besides, companies will devote more time and funds to developing safer synthetic alternatives to meet increasingly strict regulations and consumer preference changes happening right now. Regional regulatory compliance, cost-effectiveness, and collaboration with food and beverage manufacturers contribute to the strategic factors that drive competition in the industry. As demand for natural and synthetic food colors keeps on changing, companies invest in R&D, optimize their supply chain, and diversify their products to foster a stronger market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sensient Technologies Corporation | 20-24% |

| Koninklijke DSM N.V. | 16-20% |

| CHR Hansen Holding A/S | 12-16% |

| Archer Daniels Midland Company (ADM) | 10-14% |

| BASF SE | 8-12% |

| Other Players (18-30% Combined) | (See below) |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Sensient Technologies Corporation | Leading supplier of synthetic food colors, ensuring regulatory compliance and stability in various food applications. |

| Koninklijke DSM N.V. | Focuses on sustainable and high-performance color solutions, expanding its food ingredient portfolio. |

| CHR Hansen Holding A/S | Invests in research for alternative coloring solutions, balancing synthetic and natural dye applications. |

| Archer Daniels Midland Company (ADM) | Develops high-quality color formulations and strengthens its supply chain for global distribution. |

| BASF SE | Specializes in chemical innovations, including synthetic dyes that meet regulatory standards in key markets. |

Key Company Insights

Sensient Technologies (20-24%)

Sensient is a prominent synthetic food coloring manufacturer with strict regulatory compliance assurance and stable formulations for confectionery, beverages, and pharmaceutical applications.

Koninklijke DSM N.V. (16-20%)

Innovative food ingredients that include synthetic and alternative coloring solutions form part of DSM's relentless sustainability drive.

CHR Hansen Holding A/S (12-16%)

Best known for its natural food colors, CHR Hansen also puts money into synthetic dyes and adapts them to customers' market requirements.

Archer Daniels Midland (ADM) (10-14%)

As a company with a background in processing food, the company focuses on developing stable, low-cost synthetic dyes for different markets.

BASF SE (8-12%)

BASF, being one of the leading chemical companies around the world, continues to innovate high-performance synthetic dyes, ensuring that they meet food and pharmaceutical requirements.

Other Key Players

It's classified as beverage, bakery, snacks, and cereals, candy/confectionery, dairy, fruit preparations/fillings, meat, poultry, fish, and eggs, potatoes, pasta, and rice, sauces, soups, and dressings, seasonings, and pet food.

It's classified as liquid, powder, and gel.

It's divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global industry is estimated at a value of USD 61.5 million in 2025.

Sales increased at 4.9 % CAGR between 2020 and 2024.

Some of the leaders in this industry include Sensient Technologies, Koninklijke DSM N.V., CHR Hansen Holding A/S, Archer Daniels Midland Company (ADM), BASF SE, Corbion N.V., Kalsec Inc., Dohler Group, Roha Dyechem Pvt. Ltd., Naturex (Givaudan), and Others.

The Amaranth Color Market is driven by rising demand for natural colorants, clean-label products, plant-based ingredients.

The industry is projected to grow at a forecast CAGR of 5.3 % from 2025 to 2035.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 35: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East & Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 46: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: Middle East & Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 48: Middle East & Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Form, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 20: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Form, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 56: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Form, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 92: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 93: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 110: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 111: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 120: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East & Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 128: Middle East & Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 129: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East & Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 135: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Middle East & Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 139: Middle East & Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 143: Middle East & Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in the Amaranth Industry

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Colorectal Cancer Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Coloring Foodstuffs Market Insights – Natural Pigments & Growth 2025 to 2035

Colorimeter Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Colored Gemstones Industry

Colored BIPV Market Report – Trends, Demand & Growth through 2034

Colorimetric Indicator Labels Market Trends – Growth & Forecast 2024-2034

Color Meter Market

Color Concentrates Market

Oil Colors Market Trends – Growth & Demand Forecast 2025 to 2035

Food Color Market Analysis - Size, Share, and Forecast 2025 to 2035

Male Color Cosmetics Market - Trends, Growth & Forecast 2025 to 2035

Multi Colored LED Beads Market Size and Share Forecast Outlook 2025 to 2035

India Colored Gemstones Market Size and Share Forecast Outlook 2025 to 2035

Water Color Market Size and Share Forecast Outlook 2025 to 2035

Multi-Color Printer Market Analysis – Trends & Forecast 2024-2034

Rigid Colored PU Foam Market

Cheese Color Market Size and Share Forecast Outlook 2025 to 2035

Carmine Color Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA