The ASEAN Animal Feed Additives market is set to grow from an estimated USD 1,288.3 million in 2025 to USD 3,787.0 million by 2035, with a compound annual growth rate (CAGR) of 11.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,288.3 million |

| Projected ASEAN Value (2035F) | USD 3,787.0 million |

| Value-based CAGR (2025 to 2035) | 11.4% |

The ASEAN region's animal nutrition supplement market is witnessing a massive advancement mainly due to the increasing requirement for high-quality animal products and the need to support poor livestock productivity.

There is a parallel demand for meat, dairy, and other animal products as the population of the area increases. This has led to a greater concern over animal nutrition and health improvement which is the main reason for the rapid increase in the feed additives use.

Animal feed additives are valuable tools in optimizing feed usage, improving growth rates, and promoting overall health in livestock. These additives are a broad spectrum of products, including vitamins, minerals, amino acids, enzymes, probiotics, and technological additives like preservatives and emulsifiers.

Besides these, the increasing understanding of animal welfare issues and the upsurge of environmentally friendly agricultural practices are also motivating the use of additives that support animal health and lessen the ecological impact.

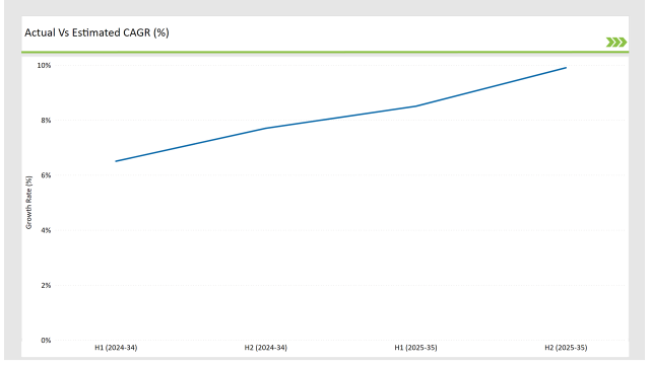

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Animal Feed Additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Animal Feed Additives market, the sector is predicted to grow at a CAGR of 5.5% during the first half of 2024, increasing to 7.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.7% in H1 but is expected to rise to 9.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Cargill: Launched a new line of natural feed additives aimed at improving animal health and productivity. |

| 2024 | BASF: Introduced a novel enzyme-based feed additive designed to enhance nutrient absorption in livestock. |

| 2025 | Nutreco : Expanded its product portfolio to include organic feed additives that meet the growing demand for sustainable solutions. |

| 2025 | Alltech : Released a new range of probiotics for livestock, focusing on gut health and overall performance. |

Increasing Demand for Natural and Organic Additives

The surge in the popularity of natural and organic animal feed additives is mainly credited to the increasing consumer awareness of health and sustainability. As people start to consider more about the origin of their food, there is a proportional demand for animal products that utilize natural diets.

This tendency is causing farmers to opt for feed additives obtained from natural sources overlooking the use of chemical components, such as plant extracts, essential oils, and probiotics. Consumers and producers as well.

Moreover, feed additives not only boost the nutrient content of animal feed but they also help in the well-being and health of animals. On the other hand, natural antioxidants can assist animals in decreasing oxidative stress, while plant-based additives can encourage gut health and improve digestion.

Technological Advancements in Feed Additives

The animal feed additives sector is changing thanks to digital developments, which of course means that more efficient and specific things can be found for animal nutrition. The introduction of new techniques that involve the use of feed formulation, processing, and delivery methods are allowing the additive manufacturers to produce products that are more bioavailable in nutrients and the feed is more efficient.

One such technique is encapsulation technology, which indeed is the factor that enables the controlled release of nutrients and additives throughout the digestive tract, thereby maximizing the advantages the animals get from the feed. Other than that, new developments in fermentation technology are the main reason probiotics and enzymes, which help enhance animals' gut health and nutrient absorption, are being invented.

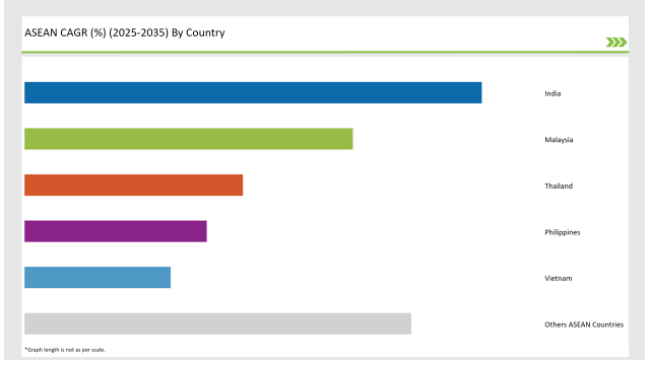

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

An increasing number of people and higher incomes are resulting in more animals, dairy, and other animal products. The phenomenon of the animal markets hitting meat producers to Dietary Planners, Meat243, 546.1 weight 4,017 females 2048.638 more females than males in the population. Consequently, more and more livestock was produced.

The Indian government has been extremely supportive of the agriculture sector, adopting various initiatives to promote the stocking of animals and improve the quality of feeds. Initiatives include fortifying the supply of high-quality nutrition additives for optimizing animal nutrition, the main target of the plan. Furthermore, the growth of dairy and poultry farmers is also increasing the demand for the specific feed additives that are required to solve the animal species' nutritional problems.

The animal feed additives market in Malaysia is observed to be expanding at a fast rate due to the growing interest in livestock rearing and the accompanying rise in demand for superior-quality animal products. The location of Malaysia at the center of the Southeast Asian region has made it a critical site for trade and feed production, and it is drawing investment from businesses both domestically and internationally.

In Malaysia, the government is taking active steps in the promotion of the livestock industry, which includes the execution of different programs to improve the standards of feed quality and availability. Thus, the feeding additives industry finds the basement for its development in this environment, where producers are asking for new alternatives to improve the performance of livestock.

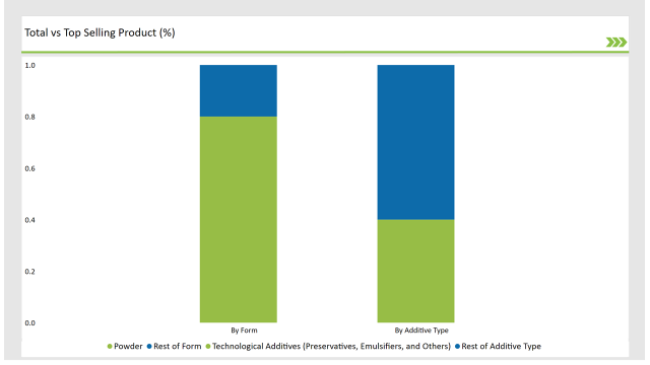

The animal feed additives market will primarily consist of technological additives, which encompass preservatives, emulsifiers, and other functional ingredients, that are expected to prevail and gain a nearly 40% market share by 2025. The additives are key in maintaining the animal feed quality and preventing it from deteriorating; thus, ensuring safety and nutrition levels to the livestock.

Technological additives are a must-have tool for feed products to be preserved and the shelf life to be increased. Inhibitors like preservatives are utilized to inhibit the development of microorganisms that cause harm while emulsifiers aid in the improvement of the feed formulations' texture and consistency. The ever-increasing attention of livestock producers on the quality and safety of feed is related to the rise in demand for technological additives.

The discreteness of powdered feed additives makes them highly suited for industrial establishments, where proper dosage and homogeneous distribution are the two key factors for feed quality and nutritional value upkeep. Besides, powdered additives look to be more durable in the long run than liquid ones, leading to their convenience in transportation and storage.

Rising because of the tendency of producers to adjust their feed formulations to the specific requirements of various animal species and production methods. This nutritional treatment of the animals not only boosts their performance but also diminishes waste and environmental harm.

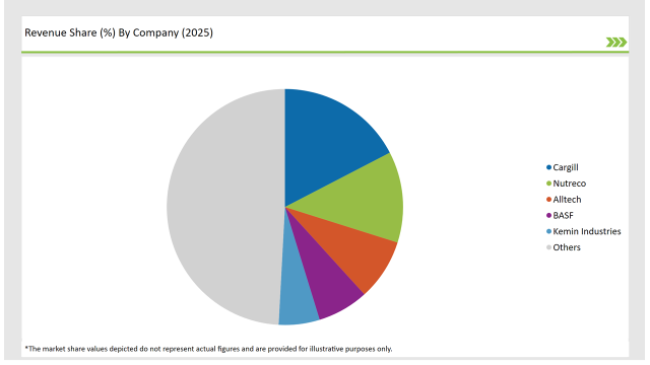

2025 Market Share of ASEAN Animal Feed Additives Manufacturers

Note: The above chart is indicative

The animal feed additives industry is a fiercely contending one, with a multitude of companies trying their best to grab a piece of the market. The main actors in this business field are Cargill, BASF, Nutreco, Alltech, and ADM, etc. These giants are making use of their large-scale research and development for ingenuity and product launch that is by the changing demands of farmers.

Additive Type Technological Additives (Preservatives, Emulsifiers, and Others), Sensory Additives (Sweeteners, Lutein, and Others), and Nutritional Additives

By Form Powder, Granules, and Liquid

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Animal Feed Additives market is projected to grow at a CAGR of 11.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 3,787.0 million.

India are key Country with high consumption rates in the ASEAN Animal Feed Additives market.

Leading manufacturers include Cargill, Nutreco, Alltech, and BASF key players in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA