The ASEAN Calf Milk Replacer market is set to grow from an estimated USD 57.8 million in 2025 to USD 202.8 million by 2035, with a compound annual growth rate (CAGR) of 13.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 57.8 million |

| Projected ASEAN Value (2035F) | USD 202.8 million |

| Value-based CAGR (2025 to 2035) | 13.4% |

The ASEAN Calf Milk Replacer Market's expansion is largely attributed to the growing consumption of dairy products and the increasing dairy farm count in the region. With the dairy sector's growth accelerated, there arises an equivalent demand for efficient calf rearing and a consequential increase in the application of calf milk replacers (CMRs).

The CMRs are being developed particularly for that purpose and provide calves with the necessary ingredients for their normal growth and development, which are the key determinants for the overall productivity of dairy farms.

The 10-member ASEAN community is a special platform for the calf milk replacer business due to the different agricultural practices, economic nights, and consumer preferences. India, Malaysia, and Thailand are the prime countries profiting from this trend through the introduction of new dairy farming technologies and greater knowledge of the advantages of using CMRs.

The move towards industrial dairy cattle production, in addition to the growing mechanization of the agricultural sector, has further stimulated the demand for high-quality calf milk replacers.

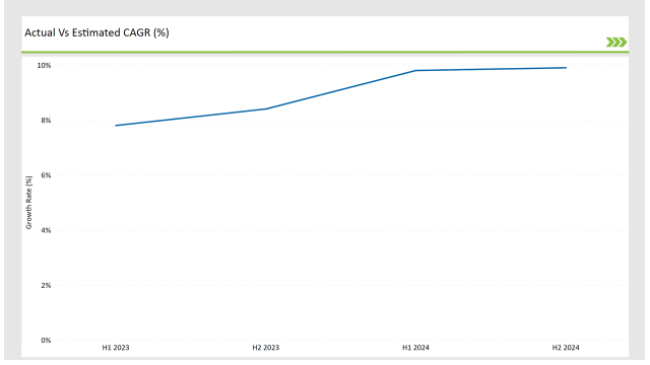

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the ASEAN Calf Milk Replacer market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Calf Milk Replacer market, the sector is predicted to grow at a CAGR of 9.8% during the first half of 2023, with an increase to 10.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 11.8% in H1 but is expected to rise to 13.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2023 | Alltech launched a new line of calf milk replacers in Indonesia, focusing on enhanced digestibility and growth performance to meet the increasing demand for high-quality nutrition in the region's dairy sector. |

| March 2023 | Nutreco announced the expansion of its calf milk replacer product range in Malaysia, introducing formulations enriched with probiotics and prebiotics to support gut health and overall calf development. |

| July 2023 | Cargill introduced a new calf milk replacer in Thailand featuring a unique blend of proteins and fats designed to improve nutrient absorption and promote faster growth rates in calves. |

| September 2023 | De Heus expanded its distribution network for calf milk replacers in Vietnam, enhancing access to its premium products for local dairy farmers and supporting the growth of the dairy industry in the region. |

| November 2023 | Lallemand Animal Nutrition launched a new research initiative in the Philippines aimed at developing innovative calf milk replacer formulations that cater to the specific nutritional needs of local dairy breeds. |

Shift towards Natural Ingredients

The focus on natural inputs in calf milk replacers is picking up speed amidst the health consciousness movement among consumers and farmers. The promotion of this shift is mainly attributed to the spreading of knowledge about the advantages of natural items over their synthetic alternatives.

More and more farmers choose CMRs that come without artificial modifiers and preservatives and instead prefer recipes that have natural sweeteners and organic components. This trend is not just offering health benefits to the calves alone but also confronts the consumer's demand for dairy products that are organic and sustainably made.

In turn, manufacturers are adapting to this trend by reformulating their products, thus achieving the inclusion of high-quality, natural ingredients and enhancing the nutritional value of CMRs. For instance, they are using plant-based proteins, probiotics, and vitamins that come from natural sources.

Increasing Adoption of Technology in Dairy Farming

The integration of technology in dairy farming practices is revolutionizing the calf milk replacer market. Farmers are increasingly adopting advanced technologies such as automated feeding systems, precision nutrition, and data analytics to optimize calf-rearing processes.

These technologies enable farmers to monitor the health and growth of calves more effectively, ensuring that they receive the right nutrition at the right time. For instance, allowing for precise measurement and delivery of calf milk replacers, reducing waste, and ensuring that each calf receives the appropriate amount of nutrition.

Additionally, data analytics tools help farmers track the growth patterns and health indicators of their calves, enabling them to make informed decisions about feeding strategies and product selection.

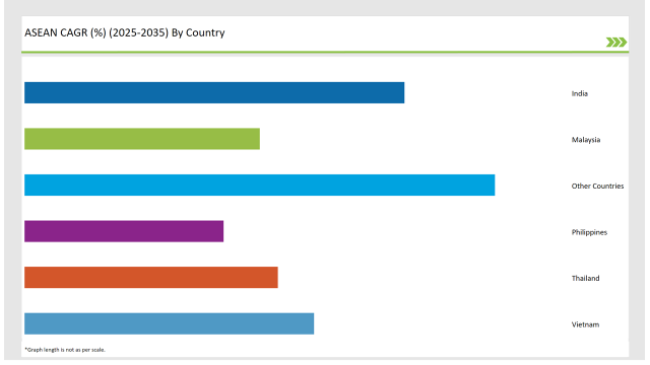

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India is experiencing a major transformation in the calf milk replacer segment that is the result of the increasing demand for dairy products and the growing number of commercial dairy farms. The Indian dairy industry is among the best in the world and as the population keeps on expanding, the consumption of milk and other dairy foods is expected to skyrocket.

Thus, this growth has resulted in a corresponding increase in emphasis on calf-rearing practices where farmers look for effective nutrition solutions to boost the health of calves. India's dairy sector is one of the largest and the booming Indian dairy farmer's association has made the Indian government pay attention to this fact and act accordingly.

The calf milk replacer market in Thailand is thriving fast as a result of consumers becoming concerned with safer food and food quality. The government in Thailand through its strict rules and regulations for food safety, has indirectly caused a rise in demand for trustworthy calf milk replacers. Farmers are now more concentrated on the measures of quality control to show that they are following these regulations and this helps them to be more dependent on CMRs.

The issue of food health among consumers is also a cause of the growth of the calf milk replacer market in Thailand. The demand for safe and properly produced dairy producers increases by using better nutrition for calves thus pups the producers. This tendency helps the cornice to disk are better calf milk to cocaine in their products on the skin.

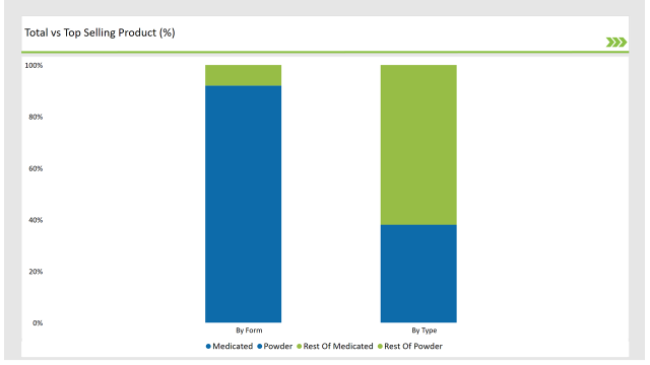

Medicated CMRs, which account for almost 38% of the market, are increasingly popularity among the farmers who face health challenges in their herds. These products can bring therapeutic advantages product promote gut health, and this product is disease-specific prevention.

The rise in diseases among calves and the need for proper management are the main reasons why the market for medicated CMRs has expanded. The realization of the role of media CMRs in total herd health management by farmers is the factor leading to a steady growth in this aspect.

Dominantly characterized by powdered CMRs, the calf milk replacer market is made up of almost 92% powdered CMRs. Farmers like powdered CMRs most, especially because they are easy to carry, can stay for a long time without being affected after opening, and can be kept in a small space. They are intriguing products, as all the farmer needs to do is mix their milk with water.

2025 Market Share of ASEAN Calf Milk Replacer Manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Alltech | 10% |

| Cargill | 8% |

| Nutreco | 7% |

| De Heus | 6% |

| Lallemand Animal Nutrition | 5% |

| Others | 64% |

Note: The above chart is indicative

The prominent participants in the calf milk replacer market are Alltech, Cargill, Nutreco, De Heus, Lallemand Animal Nutrition, etc. These companies take advantage of their animal nutrition knowledge to create premium CMRs for the particular demand of the calves. They are also diversifying their products to include both medicated and non-medicated options as well as natural ingredients and probiotic formulations.

As per Type, the industry has been categorized into Medicated CMR and Non-Medicated CMR

By Form: Powder CMR and Liquid CMR

As per Distribution Channel, the industry has been categorized into Direct Sales/B2B, Retail/B2C

As per End Use, the industry has been categorized as Commercial Dairy Farms, Individual Farmers, and Research & Academic Institutions

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Calf Milk Replacer market is projected to grow at a CAGR of 13.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 202.8 million.

India are key Country with high consumption rates in the ASEAN Calf Milk Replacer market.

Leading manufacturers include Alltech, Cargill, De Heus, and Nutreco are key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Calf Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Analyzing Calf Milk Replacers Market Share & Growth Factors

UK Calf Milk Replacer Market Growth – Trends, Demand & Innovations 2025–2035

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

Europe Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Australia Calf Milk Replacer Market Outlook – Share, Growth & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Pet Milk Replacers Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Goat Milk Replacer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Kitten Milk Replacer & Formula Market

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA