The ASEAN Food Service Equipment market is set to grow from an estimated USD 14,878.4 million in 2025 to USD 16,646.6 million by 2035, with a compound annual growth rate (CAGR) of 5.1% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 14,878.4 million |

| Projected ASEAN Value (2035F) | USD 16,646.6 million |

| Value-based CAGR (2025 to 2035) | 5.1% |

ASEAN's Food Service Equipment Market is making great advances as the region's foodservice sector transforms to meet the rising demands of the consumers for good quality, convenience, and innovation. The market forms a comprehensive range of appliances, that are designed for various places, such as commercial kitchens, restaurants, hotels, cafes, and other food service outlets, and is used in industries including hotels, fine dining, casual dining, fast food, and institutional cafeterias.

The key sections in the market consist of food preparation equipment, drink preparation equipment, cooking equipment, heating and holding equipment, food safety and sanitation equipment, and food packaging and wrapping equipment.

One of the major causes of the ASEAN food service equipment market's surge is the rapidly growing number of foodservice outlets alongside the fast-paced urbanization, which, in turn, leads to the demand for both kitchen technology and consumer convenience.

Also, the foodservice chains' shift in consumers' preference toward the quick-service, health-conscious, and high-quality food options is a significant factor that is affecting the decision of the restaurants, hotels, and cafes to invest in modern facilities to improve their work processes and achieve better results.

The booming food delivery phenomenon even makes more demand for the equipment that can produce the food on a larger scale and in an effective way, from the preparing and cooking to the packaging.

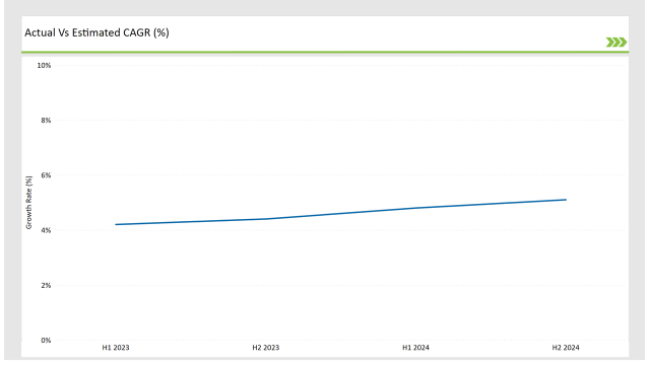

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the ASEAN Food Service Equipment market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December

For the ASEAN Food Service Equipment market, the sector is predicted to grow at a CAGR of 4.2% during the first half of 2023, with an increase to 4.4% in the second half of the same year.

In 2024, the growth rate is expected to decrease slightly to 4.8% in H1 but is expected to rise to 5.1% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2023.

| Date | Development/M&A Activity & Details |

|---|---|

| August 2023 | DSM Nutritional Products launched a new line of Food Service Equipment -based flavor enhancers in Malaysia, targeting the growing demand for clean-label ingredients. |

| November 2023 | Lesaffre expanded its Food Service Equipment production capabilities in Thailand, aiming to meet the increasing demand from the animal feed industry. |

| September 2023 | Cargill introduced a Food Service Equipment -derived immune-boosting ingredient for dietary supplements in Singapore, capitalizing on the wellness trend. |

| July 2022 | Angel Yeast began offering customized Food Service Equipment formulations in Malaysia to cater to the specific needs of the local food industry |

| January 2025 | AB Mauri launched a new Food Service Equipment product in Vietnam for use in savory food applications, including sauces and ready meals. |

The rise of technology is a prominent trend in the ASEAN Food Service Equipment Market

Technological advancements are one of the main characteristics of the ASEAN Food Service Equipment Market and the trend for smart kitchen devices being more commonly found in the commercial kitchens, food service outlets, and restaurants throughout the region.

In fact, smart kitchen appliances are the Internet of Things (IoT) devices that enable connectivity and control the refrigerator, ovens, fryers, and dishwashers to the smartphone or the centralized system. The sophisticated tools not just aid in the automation of food service processes but also support the present-day sensing system functionalities that track the real-time output of equipment, energy consumption, and preventive maintenance schedules.

With the transition of the Food Service industry in ASEAN towards digitalization, the restaurant and hotel managers have started to invest more in the use of smart equipment for improving the quality of food, saving energy, and enhancing customer satisfaction.

For instance, ovens and fryers that have the sensors to modulate temperature settings, timers, and cooking modes automatically provide considerable savings on labor costs while simultaneously maintaining the quality of food. Furthermore, these smart appliances also contribute to the reduction of inserting information without the intention which is vital for the food safety assurance.

Energy efficiency has become a significant trend within the ASEAN Food Service Equipment Market

The ASEAN Food Service Equipment Market has witnessed a significant trend toward energy efficiency, which is primarily attributed to the demand for environmentally sustainable operations and the desire to decrease utility bills. The Food Service equipment that is energy-efficient these days is no longer merely an option.

It is, in fact, an absolute necessity for Food Service operators who are striving for a double objective: to lessen their carbon footprint as well as to cut down their electric and water bills.

Smart food operators are increasingly incorporating energy-saving technologies into their operations as a response to the exorbitant energy rates and the heightened awareness of environmental issues. This approach not only helps them with the economic aspect but they are also able to contribute to the environment.

In the case of energy-efficient equipment, the benefits are even more pronounced in large operations such as hotels, fine dining restaurants, and quick-service restaurants (QSRs) where energy consumption can be very high.

For example, energy-efficient fryers and grills can contribute to electricity savings while still ensuring superior cooking performance. Likewise, refrigerators and freezers that employ a newer form of cooling technology will decrease the amount of energy that is used and also extend the life of foods and improve the quality of foods.

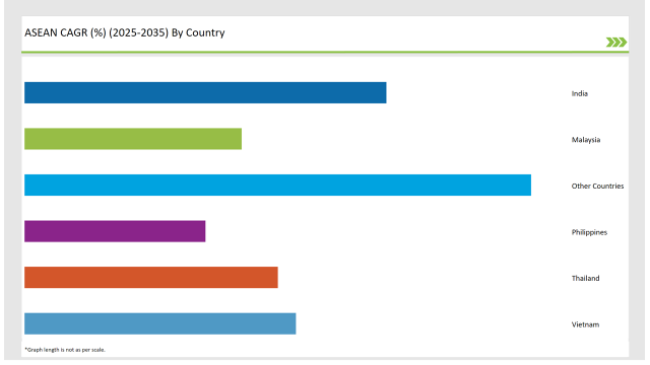

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Food Service industry in India is experiencing an incredible speed of growth, which is directly reflected in the surge of Food Service equipment demand. India’s Food Service sector, characterized by a rapidly increasing population, higher disposable income, and an ever-changing urban landscape, is at the center of the development of the kitchen equipment high-pressure technologies.

The urban areas residing in fast-food chains, casual dining, and quick-service restaurants (QSRs) hook up the installation of food preparation and cooking equipment.

Moreover, on account of the bustling state of India, its hospitality industry is also flourishing, particularly in well-known towns like Delhi, Mumbai, and Bangalore. Hotels, fine-dining restaurants, and canteens are in search of the latest kitchen equipment to keep up with their rapidly increasing requests for a broader selection of high-quality food items.

The introduction of cutting-edge fryer ovens and gas grills among the kitchenware inventions, which are energy-efficient growingly, are perceived as solute problems to reach of the operationality, food safety, and energy cost maintenance ranging of the kitchen.

The entry of a larger number of modern food service outlets, such as hotels, fine dining, and QSRs, is the main driver of the food service equipment sector in the Malaysian market. Owing to the shift in consumer preference to fast, easy, and high-quality meals, there is a rising need for trendy, efficient, and high-quality food that helps the kitchen to work faster.

The trend of hiring advanced cooking, preparation, and sanitation equipment at restaurants in Malaysia illustrates that restaurateurs focus on meeting the needs of their businesses. Malaysia's tourism industry is another important driving factor for the food service sector.

The hospitality sector, which has hosted many international guests, is purchasing these high-end kitchen appliances to provide top-notch dining for their guests. Another factor is the rise of food delivery and cloud kitchens in towns, which leads to the increase of food service equipment, especially in containers, wrappers, and storage facilities.

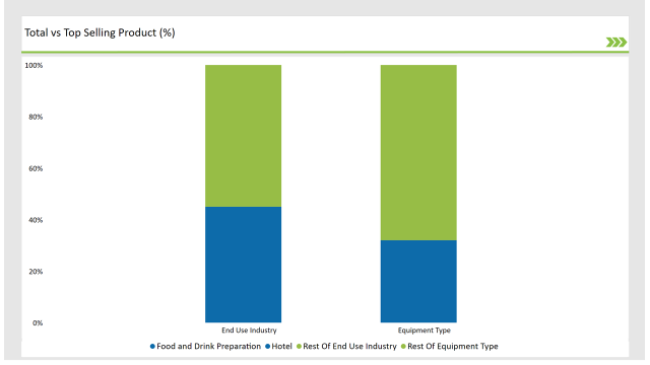

In the Food & Beverages Preparation Equipment segment, the most sought-after and widely used across the ASEAN food service sector are the slicers and peelers. They are indispensable equipment found in restaurants, hotels, and food processing facilities for the preparation of vegetables, meats, and other food items.

Slicers and peelers are tools that are the most common type of equipment used to cut and strip vegetables and fruits, respectively. Food manufacturing involves the use of slicers and peelers at an industrial level in order to greatly reduce the physical labor that needs to be done; thus, being more efficient with time.

The, mainly, but not only slicers and peels have the advantages of precision cutting and creating a consistent yield of the product, thus, being the key to having a uniform presentation and good quality food. The growing trend toward eating away from home, fast-food consumption, and the popularity of prepared meals is the driving force behind the increase in the use of these machines in both large and small food outlets.

The hotel sector, along with the food service equipment manufacturer sector, is expanding. These are the two sectors that confirm this. The reason is that gastronomy hotels rely more on the customer experience and kitchen operations rather than ever.These marketing focuses can be implemented in various ways.

Customers who place a strong emphasis on food technology invest in the latest tools for cooking and serving dishes that impress the diners while at the same time making them more efficient. This is necessary to keep ahead of the pack in a market where cooking exceptionally well and delivering exceptional service can be the deciding factors.

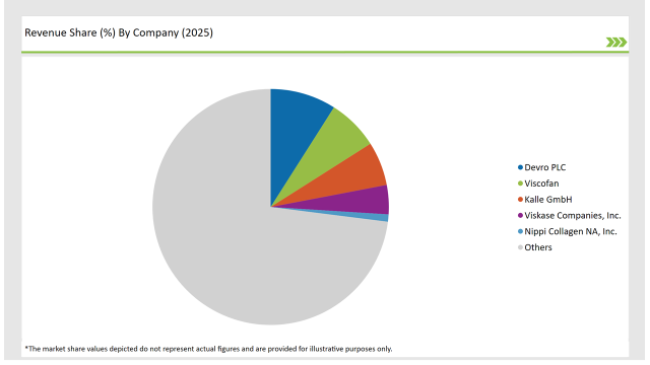

2025 Market Share of ASEAN Food Service Equipment Manufacturers

Note: The above chart is indicative

The ASEAN Food Service Equipment Market is a full-blown competition among many global and local players for market share. The field is dominated by big international brands like Rational AG, Middleby Corporation, Combi Master, and Electrolux Professional which present the latest technical developments offering a wide selection of kitchen solutions such as energy-efficient appliances, smart kitchen systems, and high-quality cooking equipment.

These companies have a strong foothold in ASEN nations and are always trying to catch up with the food service operators' requirements by introducing innovative products.

As for Product Type, the industry has been categorized into Hotels, Fast Food Restaurants Commercial Kitchens (Catering), Institutional Canteens and Cafeteria, Bakery, and Travel Retail Services (Airways, Ships, Railways, and Households.

As per Equipment, the industry has been categorized into Food and Drink Preparation Equipment, Cooking Equipment, Heating and Holding Equipment, Dishwasher and Sanitation Equipment, Refrigerators and Chillers Baking Equipment, Food Packaging and Wrapping Equipment.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Food Service Equipment market is projected to grow at a CAGR of 5.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 16,646.6 million.

India are key Country with high consumption rates in the ASEAN Food Service Equipment market.

Leading manufacturers include Devro PLC, Viscofan, Kalle GmbH, Viskase Companies, Inc., Nippi Collagen NA, Inc. are the key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Food Service Equipment Companies

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Food Service Industry - Size, Share, and Forecast 2025 to 2035

Food Service Coffee Market Analysis by Type and End User Through 2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Food Stabilizers Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Superfood Powder Market Report - Growth, Demand & Forecast 2025 to 2035

Food Holding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA