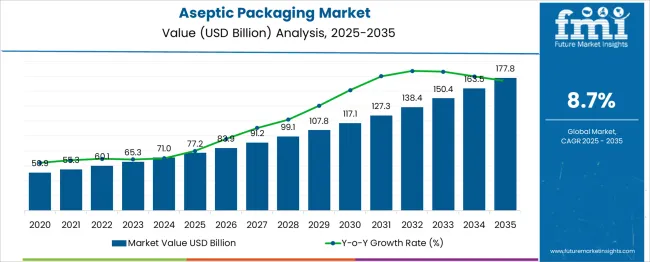

The Aseptic Packaging Market is estimated to be valued at USD 77.2 billion in 2025 and is projected to reach USD 177.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. A rolling CAGR analysis indicates varying growth rates over the forecast period, with acceleration in the earlier years followed by a slight deceleration. Between 2025 and 2030, the market expands from USD 77.2 billion to USD 99.1 billion, contributing USD 21.9 billion in growth, reflecting a rolling CAGR of 8.7%.

This phase shows strong momentum, driven by increasing demand for shelf-stable food and beverages, along with advancements in aseptic packaging technologies that support global distribution. From 2030 to 2035, the market grows from USD 99.1 billion to USD 177.8 billion, adding USD 78.7 billion in value, with a slightly higher rolling CAGR of 9.4%.

This acceleration in the latter half of the forecast period is driven by expanded applications in emerging markets, regulatory support for eco-friendly packaging solutions, and rising consumer demand for healthier, long-shelf-life products. The rolling CAGR analysis shows an initial period of strong but steady growth, followed by a higher growth rate as the market adopts new technologies, expands globally, and benefits from innovations in sustainability and convenience, reinforcing its upward trajectory.

| Metric | Value |

|---|---|

| Aseptic Packaging Market Estimated Value in (2025 E) | USD 77.2 billion |

| Aseptic Packaging Market Forecast Value in (2035 F) | USD 177.8 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The aseptic packaging market is expanding steadily due to increasing demand for shelf-stable food and beverage products, rising environmental concerns, and improvements in sterile packaging technologies. Consumer preference for preservative-free, ready-to-consume liquids has driven adoption across the beverage and dairy sectors.

Regulatory support for sustainable and recyclable materials has encouraged packaging manufacturers to transition toward lightweight, multilayer solutions with lower environmental impact. The market is further driven by advancements in filling equipment and high-barrier materials that extend product shelf life without refrigeration.

As urban populations grow and cold-chain infrastructure remains limited in many regions, aseptic packaging offers a reliable solution for safely distributing perishable goods with minimal spoilage. Furthermore, increasing penetration of single-serve formats, especially in developing countries, continues to reinforce market traction.

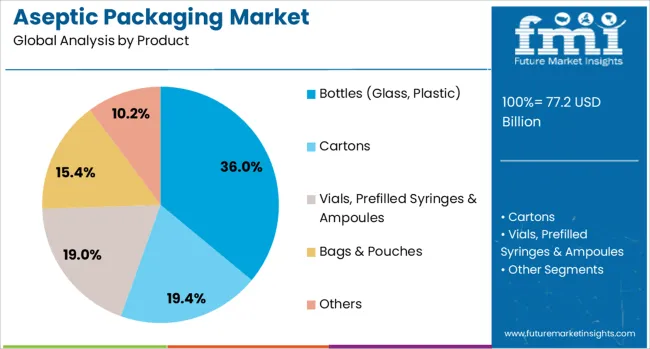

The aseptic packaging market is segmented by product, end-user, and geographic regions. The aseptic packaging market is divided into Bottles (Glass, Plastic), Cartons, Vials, Prefilled Syringes & Ampoules, Bags & Pouches, and Others.

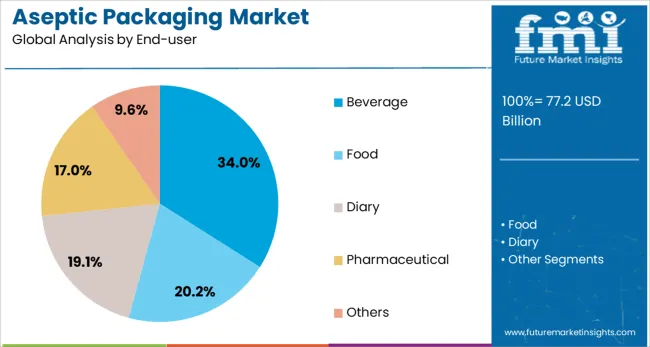

In terms of end-users of the aseptic packaging market, it is classified into Beverage, Food, Dairy, Pharmaceutical, and Others. Regionally, the aseptic packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By product, bottles-both glass and plastic-are projected to lead the market with a 36.00% share in 2025. Their dominance stems from their widespread use in aseptically filled dairy drinks, plant-based beverages, and juices.

Plastic bottles, especially PET and HDPE formats, are favored for their lightweight and shatter-resistant properties, making them ideal for single-use and on-the-go applications. Glass bottles, while heavier, maintain strong consumer appeal in premium product categories due to their inert nature and recyclability.

Innovations in neck finish, multilayer barrier integration, and ergonomic design have enhanced bottle compatibility with aseptic filling lines. As health-conscious consumers demand transparent packaging with minimal additives, aseptic bottles provide an optimal balance of safety, aesthetics, and sustainability.

Beverage is forecast to dominate the aseptic packaging market by end-user, holding a 34.00% share in 2025. This leadership is supported by rising consumption of functional beverages, flavored waters, plant-based milks, and cold brew coffees, all of which require microbiological stability without refrigeration.

Aseptic packaging meets this requirement while preserving flavor and nutritional integrity, making it attractive for both brands and consumers. Moreover, the format is aligned with e-commerce and export needs, as it reduces weight and extends shelf life, enabling greater supply chain efficiency.

Leading beverage manufacturers are increasingly investing in aseptic filling infrastructure to reduce waste, optimize throughput, and expand into new product categories such as organic or preservative-free drinks.

Growth in the aseptic packaging market is being fueled by the increasing consumer demand for longer shelf life and non-refrigerated food and beverage products. Aseptic packaging helps preserve the quality and safety of liquids such as juices, dairy, soups, and sauces without requiring refrigeration or preservatives. Despite challenges such as high capital investment and complex production processes, there are significant opportunities for growth in emerging markets and innovations, particularly in the development of eco-friendly packaging solutions that address environmental concerns and consumer preferences for green products.

The demand for convenience and fresh food products is driving the growth of the aseptic packaging market. Consumers are increasingly opting for packaged, ready-to-consume beverages and food items that do not require refrigeration, which makes aseptic packaging highly beneficial. As people seek healthier, preservative-free alternatives, aseptic packaging enables manufacturers to offer products that maintain their quality and freshness without the use of chemicals. Furthermore, the rise in urbanization and busy lifestyles contributes to the increased demand for quick and convenient meals, further fueling the need for aseptic packaging solutions. This growing consumer interest in long-lasting, healthy, and convenient food options makes aseptic packaging an essential component of modern food and beverage manufacturing, particularly for on-the-go consumption in metropolitan areas.

A major challenge in the aseptic packaging market is the significant cost associated with developing and maintaining the necessary infrastructure. The equipment required for sterilization, filling, and sealing of products is expensive and involves high upfront costs. While these systems help ensure product safety and longevity, they also require continuous maintenance, adding to overall operational costs. The process of maintaining sterile conditions during production demands a high level of expertise and quality control, which further complicates the production process. The raw material sourcing for packaging components, such as plastics and foil, can face disruptions, leading to price fluctuations and supply chain difficulties. These cost-related and operational complexities create obstacles for smaller businesses and increase the barrier to entry for new market participants.

Emerging markets represent a significant growth opportunity for the aseptic packaging industry. With increasing disposable incomes and shifting consumer lifestyles in regions like Asia, Latin America, and Africa, there is growing demand for packaged food and beverage products. As urbanization progresses, more consumers are seeking convenience and quality, making aseptic packaging an ideal solution for manufacturers to offer shelf-stable products. There is also significant potential for innovation in packaging materials, with an increasing emphasis on eco-friendly, recyclable, and biodegradable options. Manufacturers are developing lightweight packaging solutions to reduce environmental impact and improve cost efficiency. These trends create opportunities for businesses to expand into emerging markets while meeting global consumer demands for high-quality, eco-conscious, and affordable food products, supporting growth in the aseptic packaging sector.

The aseptic packaging market is seeing a growing trend toward automation, which is helping manufacturers enhance efficiency, reduce costs, and maintain consistent product quality. Automated systems are increasingly being used in sterilization, filling, and sealing processes, streamlining production and minimizing human error. Moreover, there is a growing focus on advancements in barrier materials that offer improved protection against contaminants and enhance the shelf life of products. Manufacturers are developing packaging materials with superior barrier properties, such as enhanced resistance to light, oxygen, and moisture, which ensures that products remain fresh for longer periods. This trend is contributing to the overall growth of the market, as manufacturers are able to offer more durable and effective packaging solutions that meet consumer needs for safety, convenience, and longer-lasting products.

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

| USA | 7.4% |

| Brazil | 6.5% |

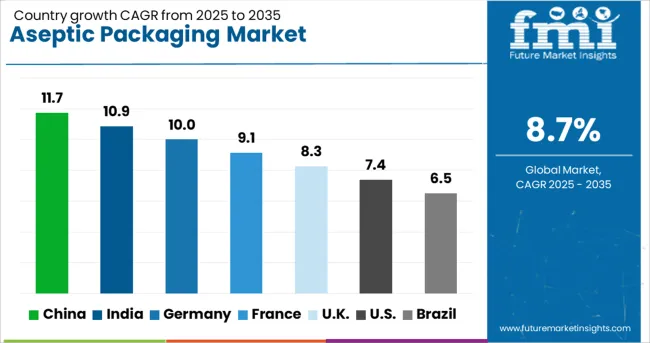

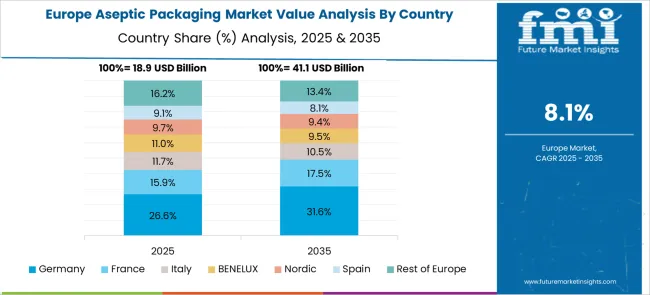

The aseptic packaging market is projected to grow at a CAGR of 8.7% from 2025 to 2035. China leads at 11.7%, followed by India at 10.9%, and France at 9.1%. The United Kingdom records 8.3%, while the United States stands at 7.4%. The strong growth in BRICS nations like China and India is driven by increasing demand in food and beverage sectors, along with growing consumer preferences for long shelf-life products. Developed markets like France, the UK, and the USA show steady growth, with innovations in packaging technology and advancements in automation. The analysis covers over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 11.7% through 2035, leading the market due to its robust food and beverage sector. The country’s large population, increasing urbanization, and rising disposable income contribute to the growing demand for packaged food, particularly long-shelf-life products such as dairy, juices, and ready-to-eat meals. China’s focus on food safety and modernization of packaging technologies is accelerating the adoption of aseptic packaging, allowing for the preservation of nutritional value without refrigeration. The country’s booming e-commerce market is also playing a crucial role in the expanding reach of aseptically packaged products.

India is projected to grow at a CAGR of 10.9% through 2035, primarily driven by the growth in the food and beverage sector. With rapid urbanization and rising disposable incomes, the demand for convenient, long-shelf-life food products is increasing, particularly in dairy, juices, and ready-to-eat meals. The government’s focus on modernizing food packaging technologies, including aseptic packaging, and improving distribution networks, supports this market expansion. Furthermore, India’s rising middle class and changing consumer preferences towards packaged, convenience foods are major drivers for the adoption of aseptic packaging. This growth is also bolstered by advancements in cold chain logistics and retail networks, ensuring a broader reach for products that rely on aseptic packaging.

France is projected to grow at a CAGR of 9.1% through 2035, with demand primarily driven by the food and beverage sector. The French market benefits from increasing consumer interest in long-shelf-life, ready-to-eat meals, dairy, and beverages. As French consumers continue to prioritize convenience and food safety, aseptic packaging is becoming a key solution to meet these demands. The country’s strong focus on energy-efficient production and reducing food waste is also contributing to the growing adoption of aseptic packaging, which preserves the quality and extends the shelf life of products without refrigeration. The growing interest in eco-friendly and recyclable packaging solutions is driving innovations in aseptic packaging technologies.

The United Kingdom is projected to grow at a CAGR of 8.3% through 2035, with a focus on increasing demand for shelf-stable products. The UK market is driven by the increasing popularity of ready-to-eat meals, beverages, and dairy products that require aseptic packaging for extended shelf life and enhanced convenience. Consumer preferences for on-the-go, portable food options continue to support market growth. The rise of online grocery shopping in the UK is boosting the demand for aseptically packaged food products, making them accessible to a broader consumer base. UK manufacturers are investing in innovative, eco-friendly packaging materials to meet both consumer and regulatory demands for sustainable packaging.

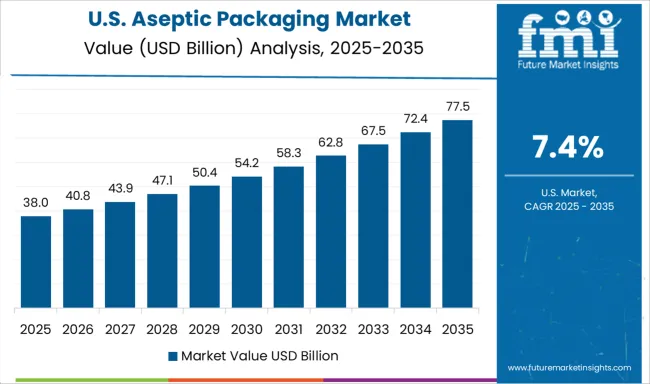

The United States is projected to grow at a CAGR of 7.4% through 2035, driven by the demand for shelf-stable food and beverage products. The USA market for aseptic packaging benefits from an increasing preference for convenience foods like ready-to-eat meals, dairy, and beverages. The growing trend of on-the-go consumption and a busy lifestyle among USA consumers are key factors accelerating the demand for aseptically packaged products. The government’s policies and regulatory frameworks focusing on food safety further stimulate the adoption of aseptic packaging. The advancements in packaging technology, which improve the shelf life and nutritional retention of food products, are gaining popularity.

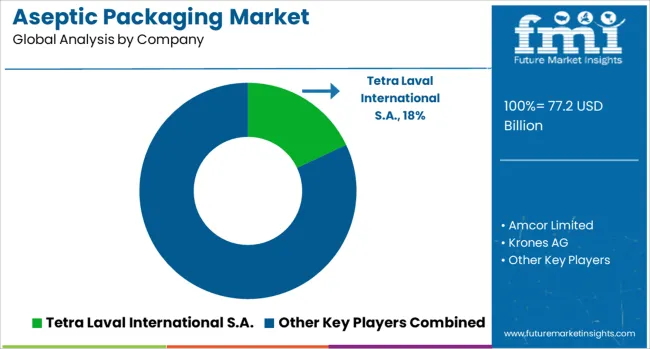

The aseptic packaging market is led by global packaging giants and specialized companies offering advanced, sterilized packaging solutions to ensure the safety and longevity of food and beverage products without refrigeration. Tetra Laval International S.A. dominates the market with its Tetra Pak brand, offering a comprehensive range of aseptic packaging solutions for liquids such as juices, dairy products, and soups, known for their efficiency and environmental sustainability.

Amcor Limited and DowDuPont Inc. (now merged as Dow) are also key players, providing innovative packaging technologies with a focus on extending shelf life and reducing the need for preservatives. Krones AG is a significant player in the aseptic packaging space, offering filling and packaging systems for the food and beverage industry, with an emphasis on high throughput and operational efficiency.

Agropur Cooperative and Scholle IPN provide specialized aseptic packaging solutions for liquid dairy, juices, and ready-to-drink beverages, focusing on improving product integrity while enhancing cost-effectiveness. Ecolean stands out with its lightweight, flexible aseptic packaging solutions that are widely adopted in the dairy and beverage sectors, focusing on sustainability and ease of use.

Lamican International Oy, AB International Oy, and Goglio S.P.A. offer customized aseptic packaging solutions for both food and non-food industries, while Sealed Air Corporation delivers aseptic packaging for a variety of consumer goods, placing strong emphasis on hygiene, safety, and innovation in product design. IPI SRL and Printpack Inc. provide flexible aseptic packaging formats that cater to emerging markets, enhancing both functionality and consumer appeal.

| Item | Value |

|---|---|

| Quantitative Units | USD 77.2 Billion |

| Product | Bottles (Glass, Plastic), Cartons, Vials, Prefilled Syringes & Ampoules, Bags & Pouches, and Others |

| End-user | Beverage, Food, Diary, Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tetra Laval International S.A., Amcor Limited, Krones AG, DowDuPont Inc., Agropur Cooperative, Scholle IPN, Ecolean, Lamican International Oy, AB International Oy, Sealed Air Corporation, Goglio S.P.A, IPI SRL, and Printpack Inc. |

| Additional Attributes | Dollar sales by packaging type (cartons, pouches, bags, bottles) and end-use segments (food & beverage, pharmaceuticals, cosmetics, chemicals). Demand dynamics are driven by increasing consumer demand for long-shelf-life, ready-to-consume beverages and foods, the growing preference for sustainable packaging solutions, and the rise of aseptic packaging in pharmaceuticals. Regional trends indicate North America and Europe leading the market, driven by high demand for dairy, juices, and convenience foods, while Asia-Pacific and Latin America are expanding rapidly due to urbanization, increased disposable incomes, and demand for packaged beverages |

The global aseptic packaging market is estimated to be valued at USD 77.2 billion in 2025.

The market size for the aseptic packaging market is projected to reach USD 177.8 billion by 2035.

The aseptic packaging market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in aseptic packaging market are bottles (glass, plastic), cartons, vials, prefilled syringes & ampoules, bags & pouches and others.

In terms of end-user, beverage segment to command 34.0% share in the aseptic packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aseptic Packaging Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Equipment Market Trends - Growth & Forecast 2025 to 2035

Aseptic Liquid Packaging Boards Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Paper for Packaging Market from 2023 to 2033

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aseptic IBC Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Formulation Processing Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Containment Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA