The global automotive lighting market is valued at USD 42.05 billion in 2025 and is projected to expand to USD 79.0 billion by 2035, growing at a CAGR of 6.5% over the forecast period. This robust growth is driven by the surge in vehicle production, increasing adoption of electric vehicles (EVs), and a shift in consumer preference toward advanced, energy-efficient, and aesthetically enhanced lighting technologies.

Modern lighting systems not only enhance vehicle safety and visibility but have also evolved into critical components of the vehicle's design and brand identity. These factors are pushing both OEMs and aftermarket players to innovate and diversify their product portfolios to meet evolving global standards. A significant trend fueling this growth is the widespread adoption of LED, laser, and matrix beam lighting systems, particularly in luxury vehicles, SUVs, and electric vehicles. These advanced systems offer longer lifespan, lower power consumption, and enhanced brightness compared to traditional halogen lights.

Regulatory mandates such as Daytime Running Lights (DRLs), automatic high-beams, and pedestrian-aware adaptive lighting systems are further stimulating OEM adoption. Integration of lighting systems with Advanced Driver Assistance Systems (ADAS) is emerging as a major differentiator, enabling real-time adaptability based on traffic conditions and driver behavior. The aftermarket segment is also witnessing accelerated growth, especially in emerging markets like India, Brazil, and Southeast Asia, where vehicle customization and plug-and-play LED kits are gaining immense popularity. These markets favor lighting upgrades that enhance both performance and aesthetics at an affordable price.

At the same time, innovations in interior lighting, such as customizable ambient RGB themes, voice-activated systems, and mood-based lighting configurations, are reshaping the in-cabin experience across vehicle segments. As the automotive sector becomes increasingly software-defined, manufacturers are investing in modular lighting systems, digital diagnostics, and V2X (vehicle-to-everything) communication-enabled light modules. These advancements are not only improving road safety and user comfort but also reinforcing the role of lighting as a central element in connected and autonomous vehicle platforms. As a result, the automotive lighting industry is poised for a decade of transformation and sustained investment.

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 42.05 billion |

| Market Size (2035) | USD 79.0 billion |

| CAGR (2025 to 2035) | 6.5% |

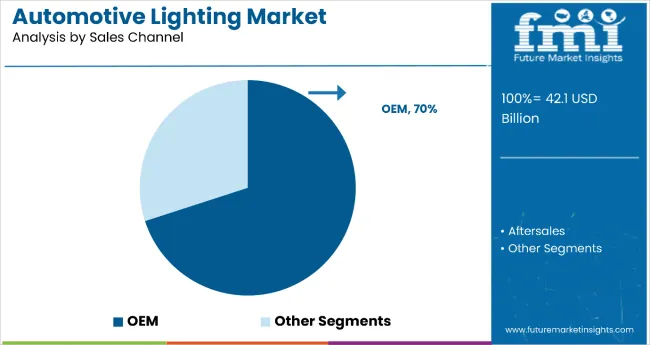

The OEM (Original Equipment Manufacturer) segment holds the dominant position with 70.0% of the market share in the sales channel category within the automotive lighting market. This leadership is driven by the direct integration of lighting systems during vehicle manufacturing processes, where automakers specify and install lighting components as part of original vehicle configurations.

OEM channels benefit from long-term supply contracts, bulk purchasing advantages, and close collaboration between lighting manufacturers and automotive OEMs in developing next-generation lighting technologies.

The segment's dominance is reinforced by the increasing complexity of automotive lighting systems, including adaptive headlights, dynamic turn signals, and integrated ADAS lighting features that require specialized engineering and seamless vehicle integration.

OEMs prioritize reliable suppliers that can meet stringent quality standards, regulatory compliance requirements, and production scheduling demands. As vehicle electrification accelerates and autonomous driving technologies advance, the OEM segment is positioned to maintain its market leadership through continued investment in innovative lighting solutions and strategic partnerships with automotive manufacturers.

v

v

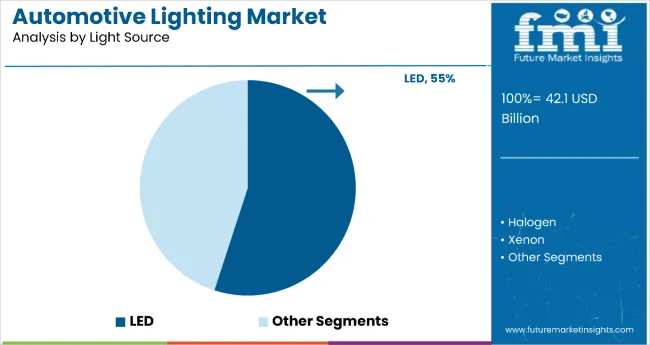

LED technology dominates the automotive lighting market with 55% of the market share, reflecting the widespread adoption of LED-based lighting solutions across headlights, taillights, interior lighting, and decorative applications.

This segment's leadership is attributed to LED's superior energy efficiency, extended lifespan, and design flexibility that enable automakers to create distinctive lighting signatures while reducing power consumption and maintenance requirements. LED lights offer instant illumination, enhanced visibility, and the ability to create complex lighting patterns that improve both safety and aesthetic appeal.

The segment encompasses applications across all vehicle categories, from economy cars to luxury vehicles, where LEDs provide cost-effective lighting solutions with premium appearance and performance characteristics.

The growing emphasis on vehicle electrification and energy optimization makes LED technology particularly attractive for electric and hybrid vehicles where power efficiency directly impacts driving range. As automotive design trends favor sleeker profiles and advanced lighting functionalities, the LED segment is expected to strengthen its market position through continued innovations in chip technology, thermal management, and intelligent lighting control systems.

LED lighting is leading the transformation in automotive lighting solutions by offering energy efficiency, long operation, and manufacturing plans that are less complicated. Automakers from different countries are progressively swapping halogen and xenon units for LED systems that use adaptation to create dynamic bending light, sequential indicators, and signature DRLs (Daytime Running Lights).

In luxury cars and premium mid-size cars, the full-LED configuration is a standard feature, while the mini and the SUV segment are by now using bi-function LED modules for their economic performance. CO2 emissions targets in the EU, Japan, and North America, besides lighting and safety features, have brought about the acceleration of this process.

Companies such as Audi, BMW, and Hyundai are also including matrix LED and pixel lighting technologies that improve night vision and prevent glare, setting the pace for new developments in the field of automotive lighting.

Although the LED systems continue to dominate the market, halogen lights still have their place in entry-level and budget vehicles, especially in developing countries like India, Brazil, and Southeast Asia. The production cost is low and if it's necessary to replace them; they're found easy to replace. This is why they are a good option for economic vehicle models. In 2023, halogen lights made up more than 40% of the total global headlight installations, particularly in compact cars and light commercial vehicles (LCVs).

However, some automotive manufacturers are now trying to go hybrid with some configurations that include a halogen and an LED DRL light. The replacement of halogen lamps through technical services is the fact that they are frequently replaced and that there is a considerable number of the global vehicle that uses the old methods of lighting.

Front headlights are the key and most technological complex use in automotive lighting, the main task of which is to be the vehicle's key visibility and brand identity factor. Over the last decade, this segment has seen development from basic illumination to adaptive driving beams (ADB), laser-assisted lights, and camera-integrated smart systems. Headlights are more commonly accompanied by ADAS sensors and LiDAR modules, especially in luxury cars, EVs, and premium SUVs that feature automatic high-beam adjustment, pedestrian detection, and corner lighting.

In the race for digital light projection that can display symbols on the road, manufacturers such as OEMs have the edge. This not only helps to make the roads safer but also improve communication with pedestrians. Both Europe and China have front lighting as a major focus for regulation improving the R&D outcomes in light precision, range, and glare mitigation.

Interior lighting has transitioned from merely the installation of overhead lamps as it is now a crucial part of the connected driving experience especially with the advent of digital cockpits and the ambient lighting culture. Automakers are leading by offering customizable RGB ambient lighting zones across dashboards, doors, and center consoles, which are often linked to drive modes, infotainment cues, and voice assistant activity. The interior lighting themes that change based on the driving mode and the weekend or movie themes are offered mainly by luxury automakers such as Mercedes Benz and Genesis.

In addition to that, even compact and mid-size models are now implementing LED strips and a welcome sequence feature as standard. Roof lights, glove box lights, and courtesy LEDs also play a huge role in this because these are often integrated with occupancy sensors and gesture controls. The advancement in EV cabin technology contributes more to this space, as lighting is turning a central part of the human-machine interface (HMI) design.

Design Complexity and Integration with ADAS Systems

Today, lighting solutions have shifted from being components by themselves to being integrated into the vehicle's driver assistance technology and electronic architecture. Up until now, we are also observing the incorporation of pedestrian alert, cornering lamps, and so on, as adaptive headlights start to gain popularity and ensuring precise synchronization with cameras, sensors, and vehicle control units is carried out, thus, the software complexity adds.

Any improper calibration or lags in the system may lead to dysfunctioning of the light projection or a delay in the turn-on sequence, thus, all of these can threaten safety. For 2023, automotive headlamp systems based on automatic learning young people's interest were several recalled by different countries globally due to glare, which speaks for threadbare standard testing and low-integrated frameworks that exist. This issue has gained a special weight as the same fleet of brands is being required to introduce lighting technologies to a variety of platforms.

High Costs Limiting LED and Laser Adoption in Lower Segments

What is provided by LED and laser-based lighting is extraordinary lighting performance, but these are the real culprits behind high production costs and the installation of these systems often being expensive. Entry-level cars in emerging markets have to rely on halogens or else they are basically the only kind of type that is addressed with them, not that they aren't up to the mark.

The OEMs' dilemma is to weigh the costs of lighting upgrades, especially in competitive markets like Southeast Asia and Latin America, against the automotive industry cost pressures. In 2023, the percentage of LED usage in sub-compact vehicles showed an increase; yet, it was still less than 25% worldwide. This underlines the need for the introduction of cost-effective LED modules and the simplification of integration designs for the purpose of the market expansion.

Advanced LED and Laser Systems Driving Nighttime Safety

The transformation through the matrix LED, pixel lighting, and laser-based headlamps is totally changing the concept of vehicle safety, especially in night driving and poor weather conditions. At the same time, these systems are the ones that beam shape adapt, avoid glare, and direct light, thanks to which drivers get to see the road obstacles and road signs in more clarity. Several car manufacturers in Europe presented new AI-adaptive car headlights in 2023 that react to traffic, pedestrians, and speed of the vehicle in real-meeting time.

Their technologies will now become standard not only in premium and upper-mid but also with the active safety lighting support that international regulations are backing. Modular, software-driven lighting units offered to car manufacturers via Tier-1 suppliers will be the ones that benefit from the latest OEM partnerships and vehicle advancements.

Personalized Ambient and Exterior Lighting as a Brand Differentiator

This feature of lighting is fastly being adopted as a signature design and personalization feature of the vehicle. The dynamic turn indicators, welcome animations, illuminated logos, and door projection lighting are some of the exterior applications while the multi-zone ambient lighting with user-configurable themes is a part of the interior system.

The year of 2023 was a milestone year for the automotive industry as more than 40% of luxury vehicles were equipped with customizable interior lighting packages along with the capability of integration into infotainment systems and driving modes. With the autoregister of cabinets becoming more software-defined, the command line invoked lighting can act as a carrier for the company's brand and podcast listeXperiences.

Aftermarket LED Upgrades Expanding in Emerging Markets

The aftermarket LED segment has been growing at an extraordinarily fast pace in places such as India, Southeast Asia, and Latin America, where car owners are in search of stylish, high-performance lighting alternatives that are not officially provided by OEMs. The easy plug-and-play LED headlight replacements, DRL kits, fog lamps, and rear light clusters are the most sought-after changes.

In 2023, the Indian market of aftermarket LED lighting achieved over 18% y-o-y growth supported through e-commerce and installation networks. The trend continues because of lower prices, simplicity of installation, and the desire for a premium appearance. Lighting manufacturers that have products with universal-fit, regulation-compliant, and wide compatibility are bound to continue seeing positive aftermarket results.

The USA automotive lighting market is characterized by high adoption of advanced lighting systems, driven by evolving safety standards and a growing preference for high-performance, energy-efficient vehicles. Demand for LED, laser, and adaptive lighting technologies is rising across both OEM and aftermarket channels. Regulatory mandates by the National Highway Traffic Safety Administration (NHTSA) have encouraged the shift from halogen to intelligent lighting systems that improve night visibility and driver safety.

Premium vehicles and electric vehicles (EVs) are leading adopters of dynamic headlamps, ambient interior lighting, and automatic high-beam systems. American automakers are partnering with Tier 1 lighting suppliers to integrate advanced driver-assistance systems (ADAS) with lighting modules for improved signaling and obstacle detection.

The emergence of autonomous vehicles and connected cars is also influencing lighting design, emphasizing communication lighting (V2X indicators), projection systems, and customizable digital lighting. Consumers are also demanding aesthetic upgrades and personalization, fueling demand in the aftermarket segment.The trend toward vehicle electrification and smart mobility is aligning with lightweight, low-power consumption LED and OLED technologies, enhancing both vehicle design and energy efficiency.

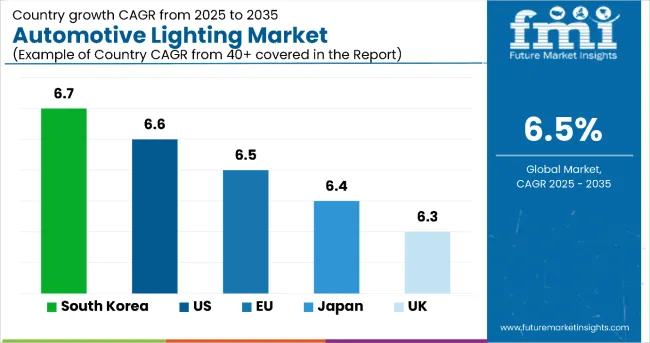

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.6% |

The UK automotive lighting market is evolving steadily, guided by advancements in smart mobility, EV adoption, and changing consumer aesthetics. British consumers increasingly favor advanced exterior and interior lighting, particularly adaptive LED and matrix beam headlamps in mid-range and luxury vehicles. The UK’s focus on road safety and carbon emission reduction also supports the adoption of energy-efficient lighting systems.

Post-Brexit, localized supply chains have encouraged partnerships between UK-based OEMs and European Tier 1 suppliers for cost-effective lighting solutions. The integration of lighting with ADAS, such as pedestrian detection and lane departure warning systems, is gaining traction. Automakers are also exploring OLED and laser lighting for next-gen EVs, enhancing design appeal and aerodynamic efficiency.

The UK government’s Road to Zero strategy, aiming to phase out petrol and diesel vehicles by 2035, indirectly boosts the automotive lighting market by pushing demand for EVs, which typically feature advanced lighting systems.

As part of smart city initiatives, vehicle-to-infrastructure (V2I) lighting communication is being trialed, paving the way for autonomous-ready lighting innovations. Custom ambient lighting in interiors is also becoming a norm in premium and shared vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

The European Union is a major innovation hub in the automotive lighting industry, driven by stringent safety regulations, luxury vehicle production, and electrification. Countries like Germany, France, and Italy are leading manufacturers of adaptive LED, matrix laser, and OLED-based lighting solutions. The implementation of UNECE regulations regarding intelligent lighting systems has accelerated the transition from halogen to next-gen lighting technologies.

Europe’s focus on vehicle safety through the General Safety Regulation (GSR) mandates automatic headlamp levelling, glare-free high beams, and enhanced rear lighting-boosting demand for sensor-integrated lighting modules. Luxury OEMs like BMW, Audi, and Mercedes-Benz are at the forefront, introducing 3D projection lighting, welcome animations, and logo projectors.

The automotive lighting sector is also being shaped by the rapid electrification of vehicles. EV platforms allow more flexibility in lighting design, which is being capitalized upon through continuous LED strips, animated tail lamps, and dynamic indicators.

Collaborations between lighting suppliers and tech companies are bringing V2X and digital lighting signatures to mass market. Additionally, aftermarket demand for custom lighting kits and smart interiors is robust, especially in Germany and the Nordics.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

Japan’s automotive lighting market is steadily advancing, supported by strong domestic automakers, smart city initiatives, and stringent automotive safety norms. Companies like Koito, Stanley Electric, and Ichikoh dominate the local and global lighting supply chains, continuously innovating in the areas of adaptive driving beams, LED headlights, and compact projector systems.

Japan’s automakers are integrating lighting with autonomous features and electric drivetrain technologies, especially in hybrid and EV models. Daytime running lights (DRLs), cornering lamps, and intelligent rear combination lamps are increasingly standard across new vehicle models. Miniaturized sensors and camera-based lighting control are gaining interest, enhancing safety and visibility.

Japan’s dense urban environments also encourage the use of sophisticated lighting systems that aid in navigation, lane keeping, and pedestrian interaction-especially critical for autonomous and compact city cars. Interior lighting is shifting toward human-centric designs with mood lighting, touch-sensitive controls, and AI-responsive illumination. With the government’s push for zero-emission vehicles and connected transport infrastructure, smart lighting systems are being developed for V2X communications, especially for last-mile AVs, taxis, and delivery fleets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

South Korea’s automotive lighting market is surging due to a combination of high EV penetration, leading tech ecosystems, and export-oriented automotive manufacturing. Hyundai and Kia, in partnership with lighting firms like SL Corporation and Lumens, are integrating high-performance lighting solutions into new platforms, especially for electric and luxury segments.

South Korea is emphasizing high-efficiency LED systems, adaptive beam headlights, and next-gen tail lamps across passenger and commercial vehicles. With government support for future mobility, automotive lighting is becoming a key enabler in smart and autonomous driving ecosystems.

Integration of AI and camera systems with lighting-such as predictive headlight control and lane-adaptive beams-is accelerating. Lighting also plays a role in personalization, with Korean vehicles increasingly offering customizable exterior light signatures and animated interior ambient lighting.

Export growth, particularly to North America and Europe, drives demand for lighting solutions that meet international standards, pushing innovation in design, thermal efficiency, and smart connectivity. South Korea’s advanced semiconductor and display industries are contributing to OLED lighting expansion for vehicle interiors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

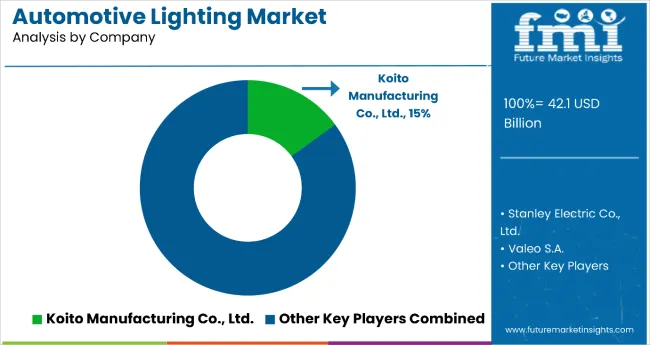

Koito Manufacturing Co., Ltd.

Koito is a pioneer in the manufacture of LED and laser front headlamp systems, one of the leader companies in front lighting technologies, globally. Due to its advanced headlamp systems, Koito is the first choice among OEMs, who are increasingly incorporating these features, together with adaptive functionality, night vision, and weight-saving design.

Valeo S.A.

Valeo addresses the market with the full range of lighting solutions such as fog, rear, and cabin lights. It is recognized as a provider of innovation with ADAS-compatible lights, modular design, and lightweight materials in line with the architecture of the next generation of vehicles.

Hella GmbH & Co. KGaA

Hella, as a manufacturer of a wide range of lighting products, has its priority as LED and matrix headlamps. The brand is well-known for adaptive lighting technology, modularity, and its long-standing collaboration with premium automakers.

Marelli Automotive Lighting

Marelli caters to both performance and style-driven sectors, positioning itself as a supplier of cutting-edge, front and rear lighting modules. Merging the art of design with energy-saving technologies, Marelli occupies a special position in the automotive design sector globally.

Stanley Electric Co., Ltd.

Stanley is a well-established partner of high-quality xenon and LED lights. It is the compact design and optical innovation which are the main factors Vulcan's success in helping to achieve the OEM aiming for lower power consumption and accuracy in illumination.

Other Key Players

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Light Source, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Light Source, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Light Source, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Light Source, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Light Source, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Light Source, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Light Source, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Light Source, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Light Source, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Light Source, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Light Source, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Light Source, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Light Source, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Light Source, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Light Source, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Light Source, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Light Source, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Light Source, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Light Source, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Light Source, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Light Source, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Light Source, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Light Source, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Light Source, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Light Source, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Light Source, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Light Source, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Light Source, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Light Source, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Light Source, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Light Source, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Light Source, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Light Source, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Light Source, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Light Source, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Light Source, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Light Source, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Light Source, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Light Source, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Light Source, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Light Source, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Light Source, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Light Source, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Light Source, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Light Source, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Light Source, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Light Source, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Application, 2023 to 2033

Figure 177: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Light Source, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

The automotive lighting market is valued at USD 42.05 billion in 2025.

By 2035, the automotive lighting market is projected to reach USD 79.0 billion

Growth is driven by LED and adaptive lighting innovations, vehicle production increases, and stringent global safety regulations.

China, followed by Germany, the USA, Japan, and India are among the top contributors to the global automotive lighting market.

The LED lighting segment leads with the highest CAGR of 7.8% during the 2025 to 2035 forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.