The Automotive Coolant Market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period. In the initial phase from 2020 to 2025, the market grows from USD 7.0 billion to USD 8.1 billion, driven by rising vehicle production globally and heightened regulatory requirements targeting emissions and engine efficiency. The increasing complexity of internal combustion engines, coupled with the growing adoption of hybrid and electric vehicles, necessitates advanced coolant formulations to manage thermal conditions effectively and ensure optimal performance.

This period also sees growing demand for environmentally friendly and extended-life coolants that reduce maintenance costs and environmental impact. Between 2026 and 2030, the market advances from USD 8.4 billion to USD 9.7 billion, supported by continuous technological innovations in coolant chemistry that enhance heat transfer capabilities, corrosion resistance, and compatibility with diverse engine types. Expanding automotive sales in emerging economies further propels demand during this phase. The final phase from 2031 to 2035 witnesses accelerated growth from USD 10.1 billion to USD 12.0 billion, driven by stricter environmental regulations promoting the use of eco-friendly, non-toxic, and recyclable coolants. Increased focus on thermal management for electric vehicle batteries and powertrains also bolsters market expansion. Overall, the automotive coolant market is positioned for sustained and robust growth through 2035, fueled by evolving automotive technologies, regulatory pressures, and expanding global vehicle fleets.

| Metric | Value |

|---|---|

| Automotive Coolant Market Estimated Value in (2025 E) | USD 8.4 billion |

| Automotive Coolant Market Forecast Value in (2035 F) | USD 12.0 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The automotive coolant market is undergoing transformative growth as manufacturers adapt to increasingly complex engine architectures and environmental mandates. Ethylene glycol, propylene glycol, and hybrid formulations are being refined to offer improved thermal stability, anti-corrosive performance, and compatibility with modern engine materials. The growing preference for coolants that extend drain intervals and reduce maintenance frequency has encouraged the adoption of advanced additive technologies and formulations tailored to high-performance and fuel-efficient engines.

Passenger car production, especially in emerging economies, continues to grow steadily, creating sustained demand for reliable and long-life coolant solutions. Additionally, the introduction of electric and hybrid vehicles has expanded the scope of thermal management systems beyond traditional combustion engines, opening new avenues for innovation in coolant technologies.

As global vehicle fleets grow and urbanization increases pressure on transport infrastructure, the demand for efficient and durable cooling solutions is expected to remain strong. Future growth is expected to be shaped by OEM partnerships, tighter OEM standards, and the integration of sensor-based monitoring systems in next-generation cooling systems.

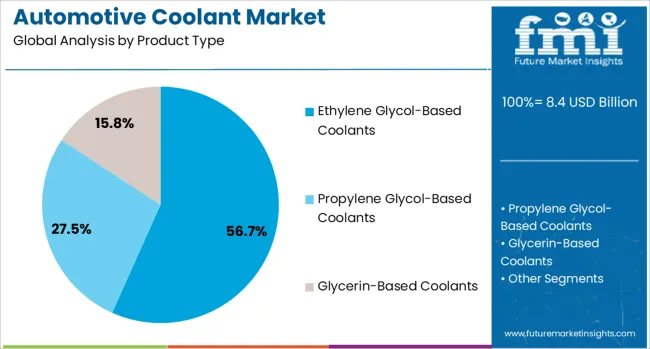

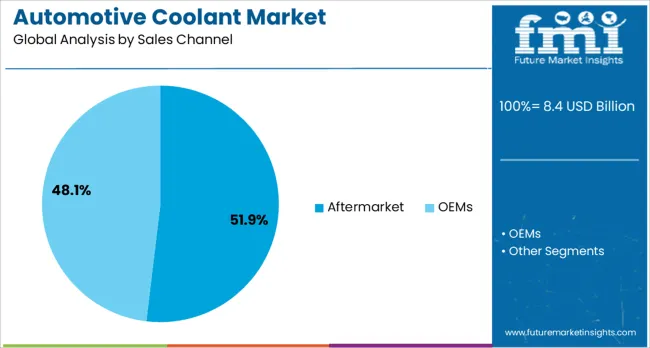

The automotive coolant market is segmented by product type, vehicle type, technology, sales channel, and geographic regions. By product type, the automotive coolant market is divided into Ethylene Glycol-Based Coolants, Propylene Glycol-Based Coolants, and Glycerin-Based Coolants. In terms of vehicle type, the automotive coolant market is classified into Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Two-Wheelers. Based on technology, the automotive coolant market is segmented into Organic Acid Technology (OAT), Hybrid Organic Acid Technology (HOAT), and Inorganic Acid Technology (IAT). The sales channel of the automotive coolant market is segmented into Aftermarket and OEMs. Regionally, the automotive coolant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ethylene glycol-based coolants are expected to account for 56.7% of the total automotive coolant market revenue in 2025, making them the leading product type. Their dominance can be attributed to superior heat transfer capabilities, cost-effectiveness, and extensive compatibility with a wide range of engine materials. These coolants have been favored across regions due to their ability to deliver consistent performance across a broad temperature range and in diverse climatic conditions.

The formulation flexibility of ethylene glycol-based products allows easy blending with corrosion inhibitors and additives, supporting extended service intervals and reduced maintenance costs. Automotive OEMs have continued to prefer ethylene glycol formulations due to the established global infrastructure for distribution, recycling, and performance validation.

Their effectiveness in internal combustion engines, coupled with evolving formulations that meet stricter environmental and technical standards, has strengthened their position in both OEM and aftermarket channels. As vehicle production continues to expand globally, the demand for this coolant type is expected to remain robust in the coming years.

Passenger cars are projected to contribute 51.2% of the overall revenue share in the automotive coolant market in 2025, maintaining their position as the dominant vehicle category. The widespread adoption of personal mobility, particularly in densely populated and fast-growing economies, has significantly influenced coolant demand across this segment. Increasing vehicle ownership rates, combined with growing awareness of preventive maintenance, have supported regular coolant replacement cycles in passenger vehicles.

Automakers have also integrated compact and turbocharged engines in newer models, which require more efficient and durable coolant solutions to ensure optimal thermal performance. Furthermore, urban driving conditions with frequent stop-and-go traffic create additional heat stress on engines, reinforcing the need for high-quality coolants.

As manufacturers seek to enhance fuel economy and reduce emissions, the role of efficient thermal management has become more critical. These factors, along with the growing trend of extended warranty periods and OEM-specified maintenance standards, have contributed to the sustained growth of coolants within the passenger car segment.

Organic Acid Technology is expected to account for 39.8% of the total automotive coolant market revenue in 2025, emerging as the preferred technology. The growth of this segment is supported by its long-life performance characteristics and minimal environmental impact compared to traditional silicate-based formulations. OAT-based coolants use organic carboxylate inhibitors that provide extended protection against corrosion and scaling, making them suitable for modern engine systems that demand longer service intervals.

This technology has been increasingly adopted by global OEMs due to its ability to remain effective over distances exceeding 150000 kilometers, reducing the need for frequent coolant changes. OAT coolants are also compatible with aluminum and plastic components used in modern engine assemblies, which contributes to reduced wear and improved heat dissipation.

The transition toward lightweight, high-efficiency powertrains has further strengthened the adoption of OAT-based solutions. Additionally, the reduced use of phosphate, nitrate, and amine additives aligns well with emerging environmental regulations, ensuring long-term viability in diverse regional markets.

The automotive coolant market is expanding through rising vehicle production, a shift toward long-life formulations, climate-adapted product strategies, and strong aftermarket growth supported by service network expansion.

Global automotive coolant consumption is being propelled by rising vehicle manufacturing volumes across passenger and commercial segments. Increased production in emerging economies such as China, India, and Southeast Asia is contributing significantly to aftermarket and OEM coolant requirements. Expanding fleets in these regions, combined with consumer preference for vehicles offering longer maintenance intervals, are boosting demand for high-performance coolants. OEMs are standardizing advanced formulations to meet engine protection and extended drain interval needs. Growth in hybrid and electric vehicles, which require specialized thermal management fluids, is also influencing market dynamics. This trend is expected to shape new product launches as manufacturers address diverse climatic conditions and regulatory standards for performance and safety.

The market is witnessing a clear transition toward long-life organic acid technology (OAT) and hybrid organic acid technology (HOAT) coolants. These advanced formulations offer extended service intervals, improved corrosion resistance, and reduced environmental impact compared to conventional inorganic additive technology (IAT) products. OEM endorsements and factory-fill adoption have accelerated OAT usage in both passenger and commercial vehicles. Reduced replacement frequency appeals to cost-conscious fleet operators and private owners, creating a notable aftermarket shift. Expansion in high-performance vehicles, where thermal stability is critical, has also reinforced demand for premium coolant chemistries. This shift aligns with industry trends emphasizing lifecycle efficiency and maintenance cost reduction.

Regional temperature variations significantly influence coolant product selection, driving manufacturers to adapt formulations for optimal performance under different climatic conditions. In colder regions such as North America and Europe, antifreeze protection and freeze-point depression remain priorities, while in warmer markets like the Middle East and Southeast Asia, heat dissipation and anti-boiling properties are critical. Regulatory frameworks in multiple countries mandate coolant compositions that limit certain additives for environmental and safety compliance. These requirements encourage R&D investment in low-toxicity and biodegradable formulations without compromising performance. Compliance with regional standards has become a strategic differentiator for coolant producers seeking OEM partnerships and aftermarket dominance.

The automotive coolant aftermarket is benefiting from extended vehicle ownership cycles and growing consumer awareness regarding preventive maintenance. Authorized service centers, quick-lube facilities, and independent workshops are actively promoting premium coolant upgrades during routine servicing. Strategic partnerships between coolant manufacturers and service networks are enhancing brand visibility and driving market penetration. Packaging innovations such as pre-mixed and ready-to-use coolants are simplifying end-user adoption. In fast-growing economies, improved service infrastructure is enabling greater reach in rural and semi-urban areas, capturing untapped replacement demand. The combination of OEM supply channels and aftermarket networks positions manufacturers to secure sustained revenue streams.

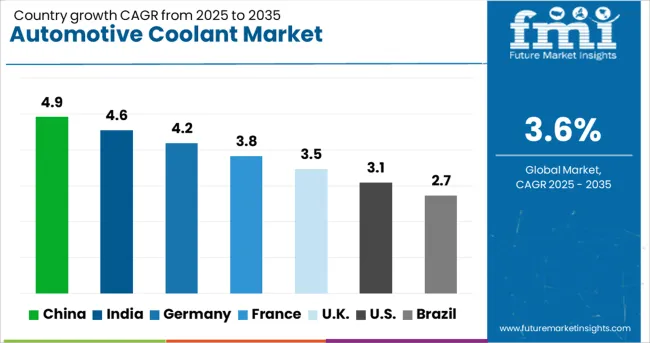

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.6% |

| Germany | 4.2% |

| France | 3.8% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.7% |

The automotive coolant market is projected to grow globally at a CAGR of 3.6% from 2025 to 2035, supported by rising vehicle parc, expansion in aftermarket servicing, and increasing adoption of advanced coolant formulations for both ICE and electric vehicles. China leads with a CAGR of 4.9%, driven by rapid fleet expansion, high production volumes, and growing penetration of long-life organic acid technology coolants. India follows at 4.6%, fueled by robust automotive manufacturing growth and a rising focus on preventive maintenance. France records 3.8%, supported by demand in both passenger and light commercial vehicle segments. The United Kingdom grows at 3.5% due to expanding electric vehicle adoption and related coolant innovations, while the United States stands at 3.1%, influenced by a mature aftermarket and stable vehicle replacement rates. These nations set critical performance benchmarks, helping suppliers refine product portfolios, regional distribution strategies, and OEM partnerships to capture long-term growth in the automotive thermal management space.

China is projected to post a CAGR of 4.9% for 2025–2035, higher than the nearly 4.3% recorded during 2020–2024. This uplift is supported by continued growth in domestic vehicle production, increasing adoption of long-life coolants, and a robust aftermarket service industry. Expanding EV production has also created demand for advanced thermal management solutions. The commercial vehicle segment continues to drive high-volume coolant consumption, while OEM requirements are pushing for improved chemical formulations. The aftermarket is benefiting from rising consumer awareness about preventive maintenance schedules, ensuring more frequent coolant replacement cycles.

India is expected to achieve a CAGR of 4.6% for 2025–2035, up from about 4.1% seen between 2020–2024. The upward shift is due to rising automotive production capacity, fleet growth, and greater adoption of organic acid technology coolants in both passenger and commercial vehicles. Tier-II and Tier-III cities are emerging as strong aftermarket hubs due to rising vehicle ownership. OEM partnerships with lubricant and coolant suppliers have strengthened, ensuring consistent quality and brand trust in both factory-fill and service channels. Increasing vehicle export volumes are also pushing domestic manufacturers to meet global coolant performance standards.

France is projected to grow at a CAGR of 3.8% for 2025–2035, compared to approximately 3.4% during 2020–2024. This growth improvement is attributed to greater integration of advanced coolant systems in hybrid and electric vehicles, as well as a steady aftermarket demand from the aging ICE vehicle fleet. OEM-led product standardization is boosting adoption of high-performance coolants that meet both European and global specifications. The aftermarket remains resilient due to strict maintenance regulations and high consumer awareness. Growing demand in light commercial vehicles for urban logistics also contributes to long-term coolant consumption stability.

The United Kingdom is forecasted to achieve a CAGR of 3.5% for 2025–2035, up from roughly 3.0% registered between 2020–2024. This increase is driven by rising adoption of specialized coolants for electric and hybrid vehicles, alongside a gradual recovery in automotive sales. The aftermarket is witnessing stable growth due to higher consumer awareness and more frequent servicing intervals. OEMs are collaborating with suppliers to introduce formulations that enhance corrosion resistance and reduce environmental impact without compromising performance. Fleet operators are increasingly opting for long-life coolants to minimize downtime and operational costs.

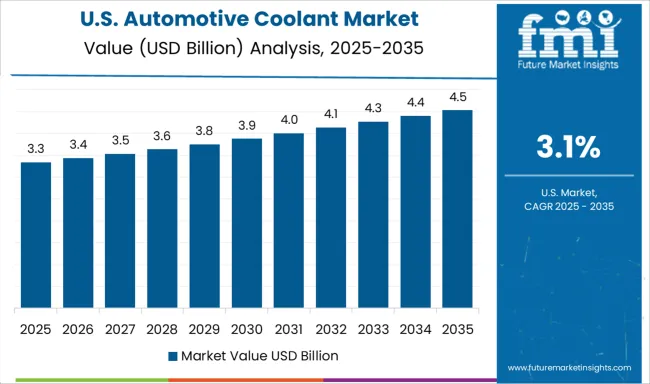

The United States is expected to post a CAGR of 3.1% for 2025–2035, slightly higher than the 2.7% recorded during 2020–2024. Growth is being fueled by an aging vehicle parc, steady replacement rates, and the rising need for advanced coolants in both ICE and EV platforms. The commercial vehicle segment accounts for a substantial portion of demand, driven by long-haul operations that require optimal thermal performance. Increasing consumer education on preventive maintenance is leading to more timely coolant changes. Domestic manufacturing capacity and distribution channels remain strong, ensuring product availability across service centers and retail outlets.

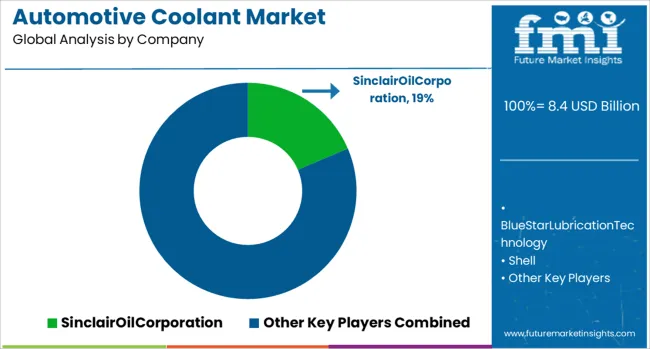

The automotive coolant market is increasingly competitive, with Sinclair Oil Corporation emerging as a leading player, leveraging its extensive portfolio of high-performance coolants and aftermarket fluids for passenger vehicles, commercial trucks, and industrial engines. Sinclair’s leadership is supported by its long-standing industry presence, strong brand recognition, and focus on product reliability, thermal stability, and corrosion protection across diverse climatic and operational conditions. Key players such as BASF SE, The Dow Chemical Company, Chevron Corporation, and ExxonMobil continue to hold significant shares by offering OEM-compliant formulations, extended-life coolants, and multi-vehicle compatibility, ensuring consistent performance and meeting evolving regulatory standards.

Emerging players including Prestone Products Corporation, Valvoline Inc., and FUCHS Group are expanding their presence by introducing hybrid organic acid technology (HOAT) and fully organic acid technology (OAT) formulations, focusing on eco-friendly and biodegradable options. Market dynamics are driven by rising vehicle production, increasing engine efficiency requirements, and consumer demand for low-maintenance, long-life coolants. Strategies across the competitive landscape include enhancing additive packages, optimizing freezing and boiling point ranges, targeting hybrid and electric vehicle thermal management, and improving corrosion resistance. Innovations in nano-enhanced coolants, sustainable fluid formulations, and long-service technologies are expected to shape competitive positioning and drive continued growth in the global automotive coolant market.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.4 Billion |

| Product Type | Ethylene Glycol-Based Coolants, Propylene Glycol-Based Coolants, and Glycerin-Based Coolants |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Two-Wheelers |

| Technology | Organic Acid Technology (OAT), Hybrid Organic Acid Technology (HOAT), and Inorganic Acid Technology (IAT) |

| Sales Channel | Aftermarket and OEMs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SinclairOilCorporation, BlueStarLubricationTechnology, Shell, LukoilPetrons, AshlandCorporation, Chevron, and ExxonMobil |

| Additional Attributes | Dollar sales, share by region and product type, competitive landscape, regulatory requirements, raw material trends, distribution channels, pricing dynamics, and growth opportunities in emerging segments. |

The global automotive coolant market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the automotive coolant market is projected to reach USD 12.0 billion by 2035.

The automotive coolant market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in automotive coolant market are ethylene glycol-based coolants, propylene glycol-based coolants and glycerin-based coolants.

In terms of vehicle type, passenger cars segment to command 51.2% share in the automotive coolant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Coolant Additives Market Size and Share Forecast Outlook 2025 to 2035

Automotive Coolant Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive Coolant Reservoir Tank Market

Automotive Electric Coolant Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA