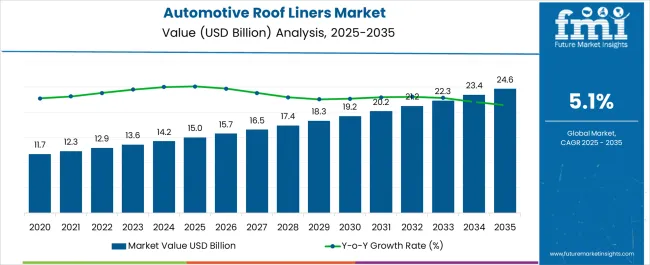

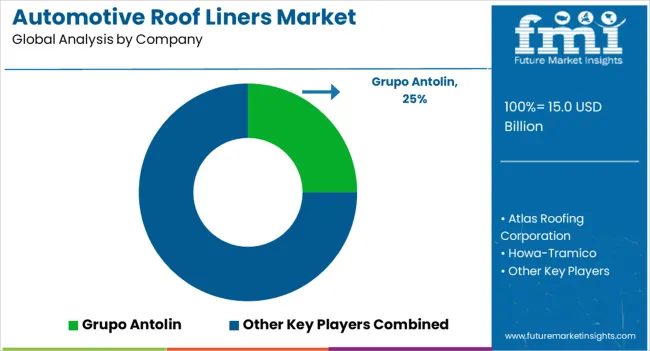

The Automotive Roof Liners Market is estimated to be valued at USD 15.0 billion in 2025 and is projected to reach USD 24.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Roof Liners Market Estimated Value in (2025 E) | USD 15.0 billion |

| Automotive Roof Liners Market Forecast Value in (2035 F) | USD 24.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The Automotive Roof Liners Market is experiencing steady expansion driven by rising consumer demand for enhanced vehicle aesthetics, comfort, and noise insulation. In 2025, the market outlook reflects strong momentum supported by technological improvements in lightweight materials, increased emphasis on interior customization, and growing regulatory focus on vehicle efficiency. Automakers are prioritizing roof liners as a critical component in vehicle interior design because they contribute to acoustic insulation, safety, and passenger comfort.

Growth is being further stimulated by the rising production of passenger vehicles globally and the ongoing trend toward premium interiors even in mid-range vehicles. Increasing investments in material innovation, such as advanced thermoplastics and sustainable composites, are paving the way for long-term adoption across various vehicle classes.

Future opportunities are expected to emerge from electric vehicle integration, where lightweight and durable roof liners enhance efficiency without compromising structural performance With automotive manufacturers increasingly focusing on differentiation through interiors, the market for roof liners is set to remain on a robust growth trajectory in both developed and emerging economies.

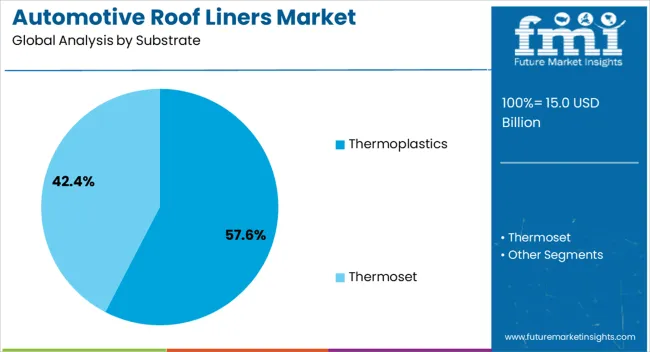

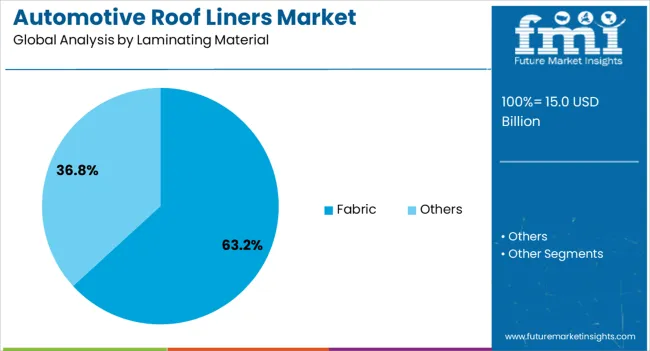

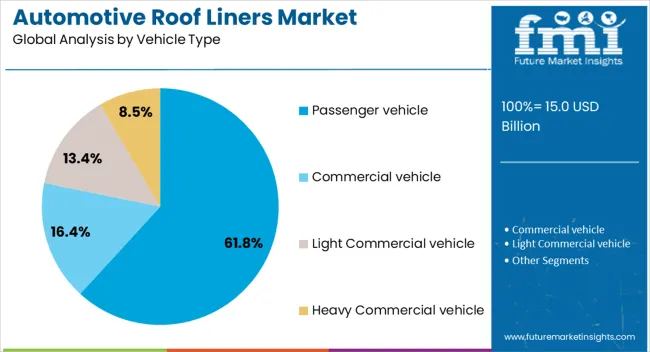

The automotive roof liners market is segmented by substrate, laminating material, vehicle type, and geographic regions. By substrate, automotive roof liners market is divided into Thermoplastics and Thermoset. In terms of laminating material, automotive roof liners market is classified into Fabric and Others. Based on vehicle type, automotive roof liners market is segmented into Passenger vehicle, Commercial vehicle, Light Commercial vehicle, and Heavy Commercial vehicle. Regionally, the automotive roof liners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermoplastics substrate segment is projected to hold 57.60% of the revenue share in the Automotive Roof Liners Market in 2025, positioning it as the leading material choice. This dominance is being attributed to the favorable balance thermoplastics offer between lightweight characteristics and structural durability, which are crucial for modern automotive applications. Their recyclability and ease of processing make them attractive for large-scale production, aligning with the industry’s growing shift toward sustainability and circular economy practices.

The ability to mold thermoplastics into complex shapes while maintaining strength has supported widespread adoption across various vehicle models. Their contribution to noise reduction, impact resistance, and heat insulation further strengthens their appeal. Automakers are increasingly integrating thermoplastic-based roof liners to comply with stringent weight reduction targets that directly influence fuel efficiency and emission standards.

The segment has also gained momentum due to cost advantages and versatility in surface finishing, which enable manufacturers to enhance interior aesthetics without compromising functionality These combined factors have established thermoplastics as the most significant substrate in the market.

The fabric laminating material segment is anticipated to account for 63.20% of the Automotive Roof Liners Market revenue in 2025, making it the largest segment by material type. This leadership position has been reinforced by the aesthetic and functional advantages fabric provides in vehicle interiors. Fabric laminates are widely preferred due to their superior acoustic properties, contributing to cabin noise reduction and improved passenger comfort.

The versatility of fabric materials allows manufacturers to experiment with colors, textures, and finishes, supporting the growing demand for personalized interiors. Fabric also provides a premium look and feel, which has become an essential differentiating factor for automakers seeking to attract customers in both mass and luxury markets. Enhanced adhesion characteristics and compatibility with lightweight substrates like thermoplastics have further boosted their use.

Additionally, fabric laminates offer durability and resistance to wear, ensuring long service life With rising consumer expectations for interior sophistication and the increasing role of design in vehicle purchasing decisions, fabric laminates are expected to maintain their dominance in the foreseeable future.

The passenger vehicle category is expected to contribute 61.80% of the Automotive Roof Liners Market revenue in 2025, securing its position as the leading vehicle type segment. This dominance is being driven by the sheer volume of passenger vehicle production globally, coupled with rising consumer preferences for comfort, safety, and design enhancements in everyday automobiles. Roof liners in passenger vehicles serve multiple functions, from providing structural integrity and concealing electrical components to enhancing thermal insulation and acoustics.

The integration of advanced materials and software-defined design flexibility has enabled automakers to differentiate interiors across vehicle classes. Growing urbanization, rising disposable incomes, and expanding demand for compact and mid-size cars in emerging markets have further accelerated this segment’s growth.

Automakers are also focusing on premiumizing passenger vehicle interiors, even in lower price segments, which has heightened demand for advanced roof liner solutions As electric and hybrid passenger vehicles gain traction, lightweight and high-performance roof liners are becoming increasingly critical, further reinforcing the leadership of this segment within the overall market.

The interior of a vehicle is always the key factor that generates appeal in the buyer, as it boosts the comfort and ergonomics of the vehicle. Automotive roof liners also provide aesthetic look to the interior of the vehicle. Automotive head liners also protects the passengers from head injuries during the time of accidents. Since, majority of premium & luxury car owners prefers the vehicles with top class interiors, in which roof liners are playing the most crucial role in enhancing the interior of the vehicle. Therefore, automotive roof liners are the one of the most preferred category by the buyers.

Additionally, in order to enhance the aesthetic look of the interior of the vehicle, the automotive roof liners manufacturers are also focusing on development of different types of roof liners. The combination of lights with the roof lines have been done and introduction of the lighted roof liners have been witnessed. Therefore the global market for automotive roof liners is anticipated to grow with healthy CAGR during the forecast period.

Preference of automotive roof liners as a value added offering to customers by automotive OEMs has been played a pivotal role in the growth of automotive roof liners market. Rising per capita income of the people in the developing economies is enhancing their disposables incomes leading to increasing demand for luxury & premium vehicles.

This in turn is anticipated to create healthy demand for automotive roof liners in the global market. Additionally the sound absorption capabilities of the automotive roof liners is making its popular in the passenger cars. Therefore with the growing sales of passenger car the automotive roof liners market will also get uplifted. Moreover the vibrations sound produced by the rains also get absorbed by the automotive roof liners. Creating is dependency and a mandatory feature in the vehicles.

In the global market of automotive roof liners, the analysis is to be done on the basis of production trends, regulations and demand across all the geographies. The growing demand for automobiles from the Asia Pacific region, mainly from growing automotive industry of China, India and others is making the region to dominate the global automotive roof liners market. Moreover, increasing population and disposable income of people in the Asia Pacific region is enhancing the demand for luxury & premium vehicles. This is also going to propel the demand for automotive roof liners in the forecast period.

The region is also expected to grow with prominent CAGR in future. Moreover, the market in North America & Europe is expected to grow with the moderate pace during the forecast period. The presence of prominent automobile manufacturers in the region are responsible for mounting demand for automotive roof liners from the region. Furthermore, the market for automotive in the Middle East & Africa is import oriented. Hence, the region is projected to hold marginal share in the global automotive roof liners market in the future.

In the global market of automotive roof lines, names of some of the manufacturers those are involved in the manufacturing and sales of automotive roof liners are mentioned below:

The research report presents a comprehensive assessment of the Automotive Roof Liners market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated Automotive Roof Liners market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to Automotive Roof Liners market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various factors on Automotive Roof Liners market segments and geographies.

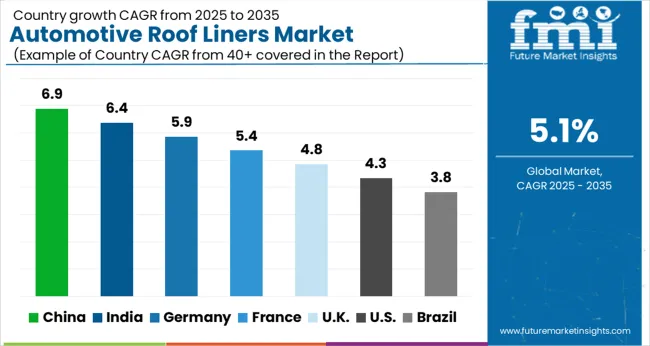

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The Automotive Roof Liners Market is expected to register a CAGR of 5.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.9%, followed by India at 6.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Automotive Roof Liners Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.9%. The USA Automotive Roof Liners Market is estimated to be valued at USD 5.7 billion in 2025 and is anticipated to reach a valuation of USD 8.7 billion by 2035. Sales are projected to rise at a CAGR of 4.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 783.8 million and USD 451.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.0 Billion |

| Substrate | Thermoplastics and Thermoset |

| Laminating Material | Fabric and Others |

| Vehicle Type | Passenger vehicle, Commercial vehicle, Light Commercial vehicle, and Heavy Commercial vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grupo Antolin, Atlas Roofing Corporation, Howa-Tramico, IAC Group, Lear Corporation, Motus Integrated Technologies, Harodite Industries, Industrialesud S.p.a., Toray Plastics, Inc., Freudenberg Performance Materials, Sage Automotive Interiors, SMS Auto Fabrics, Toyota Boshoku Corporation, and UGN Inc. |

The global automotive roof liners market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the automotive roof liners market is projected to reach USD 24.6 billion by 2035.

The automotive roof liners market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in automotive roof liners market are thermoplastics and thermoset.

In terms of laminating material, fabric segment to command 63.2% share in the automotive roof liners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA