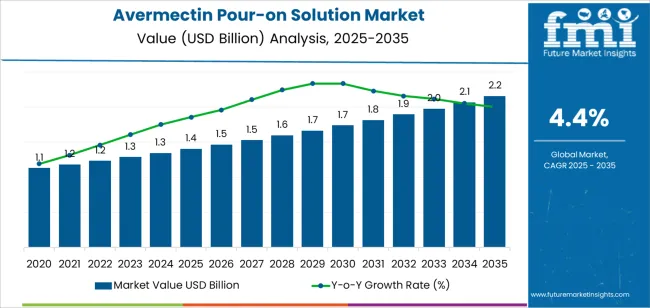

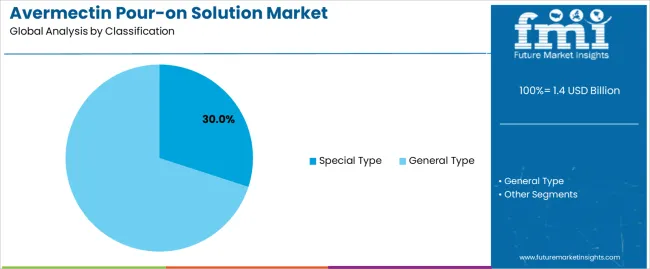

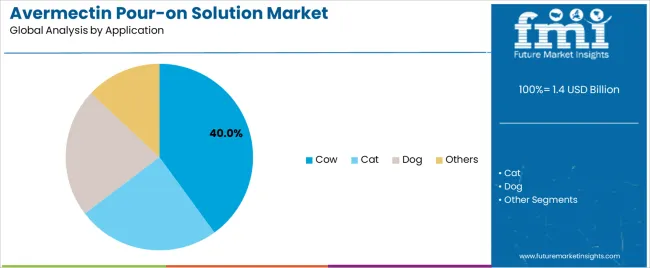

The Avermectin Pour-on Solution market is valued at USD 1.4 billion in 2025 and is projected to reach USD 2.2 billion by 2035, representing a CAGR of 4.4% and an absolute opportunity of about USD 0.8 billion over the decade. Growth is being driven by broad adoption in cattle production, where the cow application represents roughly 40% of 2025 demand, and by formulation improvements that increase rainfastness, absorption, and residual efficacy in varied field conditions. Special type formulations account for about 30% of the market in 2025 as manufacturers prioritise extended-action and targeted parasite coverage to reduce treatment frequency and labour costs.

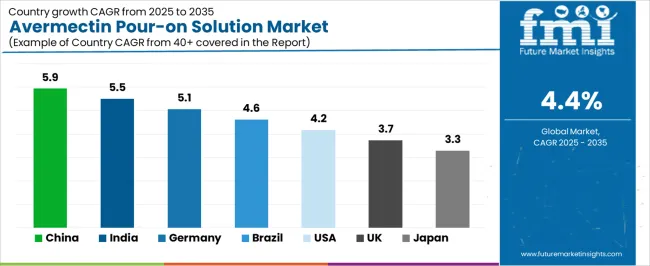

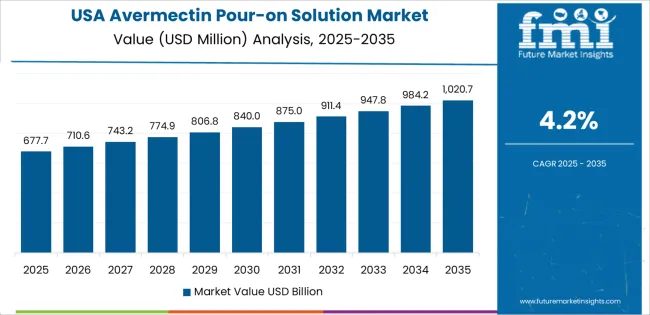

Asia Pacific, North America, and Europe are identified as the primary growth zones, with Asia Pacific leading consumption due to large herd populations and improving veterinary distribution networks. Rolling analysis indicates a steady rise from USD 1.4 billion in 2025 to USD 1.74 billion by 2030 and onward to USD 2.16–2.2 billion by 2035 as integrated parasite management and controlled-release chemistry mature; a modest deceleration is expected in the 2030–2035 window owing to tighter residue rules and adoption of complementary IPM strategies. Country growth rates illustrate regional differentiation: China (5.9% CAGR), India (5.5%), Germany (5.1%), Brazil (4.6%), USA (4.2%), UK (3.7%) and Japan (3.3%). Competitive positioning is shaped by formulation stability, residue compliance, and distribution reach, with leading firms including AdvaCare Pharma, Chongqing Fangtong, Veyong Pharma, Laboratorios Microsules, Interchemie, Shandong Hope, Norbrook, Boehringer Ingelheim Animal Health, and Chanelle Pharma investing in product extension, precision dosing systems, and resistance-management partnerships to sustain long-term market share.

Asia Pacific leads global consumption, supported by large livestock populations and increasing awareness of animal productivity improvement. North America and Europe maintain strong regulatory and commercial frameworks emphasizing product quality and withdrawal period compliance. By 2035, formulation advancement, cold-chain optimization, and integrated parasite management programs are expected to shape long-term market resilience and sustain steady global demand for avermectin pour-on solutions.

Between 2025 and 2030, the Avermectin Pour-on Solution Market is projected to grow from USD 1.4 billion to USD 1.74 billion, reflecting a growth volatility index (GVI) of 1.07, indicating a moderate and steady acceleration phase. Growth in this period will be primarily driven by increasing livestock populations, higher demand for external parasite control solutions, and expanding adoption of pour-on formulations due to their ease of use and dosing precision. The agricultural sector’s focus on productivity enhancement, coupled with rising awareness of animal health management, will further reinforce adoption. Manufacturers are emphasizing improved formulation stability, extended residual efficacy, and reduced environmental toxicity to meet evolving regulatory standards.

From 2030 to 2035, the market is expected to advance from USD 1.74 billion to USD 2.16 billion, yielding a GVI of 0.93, which signifies a mild deceleration as the market transitions toward maturity. The deceleration will reflect greater regulatory scrutiny surrounding chemical residues, a gradual shift toward integrated pest management (IPM) systems, and increased penetration of alternative biocontrol products. Nonetheless, continued livestock intensification in developing regions and innovations in controlled-release formulations will sustain growth. Partnerships between veterinary pharmaceutical companies and agritech firms will drive the development of next-generation avermectin products designed for enhanced safety and long-term efficacy.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.4 million |

| Market Forecast Value (2035) | USD 2.2 million |

| Forecast CAGR (2025–2035) | 4.4% |

The avermectin pour-on solution market is expanding as livestock producers seek efficient, broad-spectrum antiparasitic treatments that reduce handling stress and labor requirements. Avermectin-based formulations, applied topically along the animal’s backline, provide systemic protection against both internal and external parasites such as gastrointestinal worms, lice, and mites. Their ease of administration, rapid absorption, and long-lasting efficacy make them particularly suitable for large-scale cattle, sheep, and goat operations. Increasing emphasis on animal health management to improve productivity and meet export-quality standards continues to drive consistent product demand in developed and emerging agricultural regions.

Market growth is further supported by the rising global consumption of meat and dairy products, prompting farmers to maintain parasite-free herds for optimal weight gain and milk yield. Manufacturers focus on refining formulation stability, carrier compatibility, and dosage precision to ensure uniform absorption and minimal residue. Regulatory compliance with residue limits and environmental safety guidelines shapes product development and distribution strategies. However, growing concerns about parasite resistance and the need for integrated pest management programs encourage ongoing research into combination and rotation therapies. Expanding veterinary awareness and improved rural supply networks sustain long-term adoption of avermectin pour-on solutions across global livestock health markets.

The avermectin pour-on solution market is segmented by classification, application, and region. By classification, the market is divided into special type and general type formulations. Based on application, it is categorized into cow, cat, dog, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define formulation specialization, livestock application range, and regional veterinary care trends influencing antiparasitic treatment adoption across animal health markets.

The special type segment accounts for approximately 30.0% of the global avermectin pour-on solution market in 2025, making it the leading classification category. This segment’s leadership stems from the increasing use of enhanced formulations designed for targeted parasite control and extended residual activity in livestock management. Special type solutions are optimized for broad-spectrum efficacy against internal and external parasites while reducing treatment frequency and labor requirements in field conditions.

These formulations often include improved solvent carriers and stabilizers that ensure consistent absorption through the skin and prolonged systemic action. Their adoption is particularly strong in the cattle sector, where herd-scale treatment efficiency and animal welfare are operational priorities. The segment benefits from advances in formulation chemistry that enhance rainfastness, bioavailability, and photostability.

Veterinary pharmaceutical manufacturers continue to expand product portfolios with region-specific variations compliant with agricultural and food safety standards. Demand for special type pour-on solutions remains concentrated in North America, Latin America, and Oceania regions with large-scale cattle operations emphasizing productivity, reduced infection cycles, and safe antiparasitic control. This category’s technical reliability and performance stability sustain its leadership within the global avermectin solution market.

The cow segment represents about 40.0% of the total avermectin pour-on solution market in 2025, making it the largest application category. Its dominance reflects the extensive use of avermectin formulations in bovine parasite management, where external parasites such as lice, mites, and ticks significantly affect health and milk productivity. Pour-on solutions offer efficient administration, uniform dosage control, and reduced handling stress, making them the preferred antiparasitic treatment method for both dairy and beef cattle.

The segment’s growth is reinforced by increasing herd sizes and preventive health management practices in commercial livestock operations. Avermectin solutions are valued for their broad-spectrum activity, long-lasting protection, and compatibility with routine farm management protocols. In addition, improved formulations provide stable efficacy under variable environmental conditions, minimizing re-infestation risks.

Regional demand is strongest in Latin America, North America, and East Asia, where cattle farming is integral to agricultural output. Ongoing product innovations, including combination treatments and extended-release pour-on variants, continue to strengthen usage in this category. The cow segment remains the central focus of the market, representing the primary driver of overall demand for avermectin-based external parasite control solutions worldwide.

The avermectin pour-on solution market is expanding as livestock producers increasingly adopt topical antiparasitic treatments for efficient control of internal and external parasites. These solutions offer advantages in application speed, dosing accuracy, and reduced stress for animals compared with injectable methods. Market growth is supported by increasing herd sizes, improved access to veterinary care, and the need to maintain productivity in intensive livestock systems. However, the sector faces restraints from rising drug resistance, regulatory scrutiny, and competition from other parasite-control formulations. Continuous research and innovation in formulation stability and efficacy are shaping product evolution across regions.

Growth in this market is driven by higher livestock populations and the efficiency requirements of large-scale farming operations. Pour-on products enable easy administration across large herds and help reduce handling time and labour costs. The growing emphasis on animal health and disease prevention is encouraging adoption in both developed and developing regions. Governments promoting better livestock health standards and expanding veterinary distribution networks also contribute to higher product penetration. Consistent performance under varied climatic conditions further strengthens the market position of pour-on treatments compared to traditional dosage forms.

The main constraints affecting market expansion include the development of parasite resistance to macrocyclic lactones, fluctuating raw material costs, and strict residue regulations in meat and dairy products. Environmental concerns regarding chemical runoff and the impact on non-target species are also limiting widespread use. Additionally, smaller producers in cost-sensitive regions may rely on lower-priced generic alternatives or alternative delivery methods. The requirement for trained personnel to ensure correct dosing and adherence to withdrawal periods adds to operational challenges. These factors collectively moderate the overall growth pace of the market.

Current trends include the introduction of improved formulations that enhance absorption and weather resistance, ensuring consistent effectiveness under varying field conditions. Manufacturers are focusing on extended-action products that reduce dosing frequency and improve animal welfare outcomes. Packaging innovations, such as precision dispensers and reduced-waste containers, are being adopted to streamline farm operations. Digital herd-management integration and regional parasite-monitoring programmes are influencing usage patterns, encouraging data-driven parasite-control strategies. With rising global demand for protein and improved livestock health standards, the market is expected to progress steadily toward efficiency-based product differentiation.

| Country | CAGR (%) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

| USA | 4.2% |

| UK | 3.7% |

| Japan | 3.3% |

The avermectin pour-on solution market is expanding steadily across global regions, with China leading at a 5.9% CAGR through 2035, supported by large-scale livestock farming, veterinary pharmaceutical manufacturing, and advancements in antiparasitic formulations. India follows at 5.5%, driven by rising cattle population, growing veterinary healthcare investments, and increasing awareness of animal productivity enhancement. Germany records 5.1%, benefiting from regulatory support, precision formulation standards, and strong demand for safe and effective livestock treatments.

Brazil grows at 4.6%, reflecting expansion in the beef and dairy sectors and improved distribution networks for animal healthcare products. The USA, at 4.2%, maintains a stable market emphasizing product innovation and compliance, while the UK (3.7%) and Japan (3.3%) focus on high-quality formulations, sustainable manufacturing, and the adoption of residue-free veterinary solutions.

China is showing steady expansion in the avermectin pour-on solution market, projected to grow at a CAGR of 5.9% through 2035. Rapid growth in livestock farming and stronger animal health regulations are fueling demand for antiparasitic formulations. Domestic veterinary pharmaceutical companies are emphasizing residue control, dosing precision, and temperature stability. Expanding distribution channels across rural and peri-urban regions support consistent product access. Continuous investments in veterinary R&D and disease control initiatives are helping improve formulation safety and treatment efficiency across dairy, beef, and small ruminant sectors.

India is witnessing consistent development in the avermectin pour-on solution market, increasing at a CAGR of 5.5% through 2035. Expanding dairy production, government disease prevention programs, and rising farmer awareness are driving adoption. Domestic manufacturers are introducing affordable, climate-adapted formulations that ensure broad parasite coverage. Collaborations between veterinary associations and agricultural cooperatives are promoting training in parasite control management. Growing emphasis on animal productivity and health efficiency supports higher market penetration across northern and southern states.

Across Germany, the avermectin pour-on solution market is advancing at a CAGR of 5.1%, supported by innovation, quality control, and environmental regulation. Manufacturers are enhancing pour-on formulations with precision dosing, low toxicity, and quick absorption properties. Strict residue management requirements and antimicrobial stewardship policies guide product design. Research institutions collaborate with veterinary companies to develop sustainable antiparasitic technologies. Growing export of high-quality formulations across Europe reinforces Germany’s influence in the veterinary pharmaceutical sector.

Brazil is recording steady growth in the avermectin pour-on solution market, forecast to expand at a CAGR of 4.6% through 2035. Expanding cattle production and rising livestock export activities are boosting antiparasitic treatment demand. Local manufacturers are prioritizing cost-effective, weather-resistant formulations suitable for tropical conditions. Veterinary service expansion in rural regions is improving awareness and treatment coverage. The combination of public health programs and animal productivity goals continues to support consistent market growth.

In the United States, the avermectin pour-on solution market is growing at a CAGR of 4.2% through 2035. Demand from large-scale livestock operations and increased focus on treatment precision are driving sales. Producers are formulating next-generation products with low toxicity, reduced residue, and improved absorption rates. Automation in dosing systems is improving labor efficiency and minimizing waste. Ongoing R&D in resistance management supports product efficacy across major cattle and sheep-producing states.

Across the United Kingdom, the avermectin pour-on solution market is advancing at a CAGR of 3.7% through 2035. The growing focus on sustainable agriculture and animal welfare compliance is shaping market direction. Manufacturers are developing biodegradable and low-residue formulations to meet strict regulatory requirements. Research into resistance mitigation and eco-friendly delivery systems continues to advance. Small and medium-scale livestock farms remain key consumers, ensuring steady baseline demand for safe, effective antiparasitic solutions.

Japan is demonstrating consistent progress in the avermectin pour-on solution market, projected to rise at a CAGR of 3.3% through 2035. Domestic producers focus on precise dosing, rapid absorption, and improved resistance control in veterinary applications. Advanced quality assurance frameworks ensure product reliability and uniformity. Growth in livestock operations in regional prefectures sustains stable product utilization. Ongoing research into combination therapies supports diversification and efficacy improvement for cattle, goats, and equine markets.

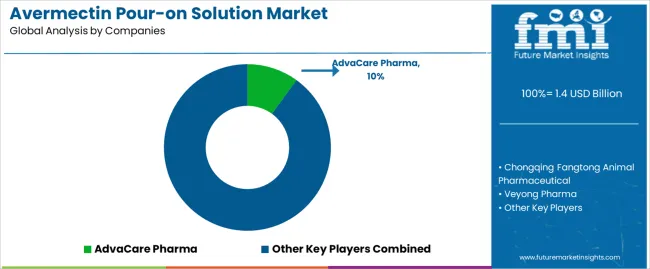

The global avermectin pour-on solution market shows moderate concentration, supported by established veterinary pharmaceutical manufacturers and regional producers specializing in antiparasitic formulations. AdvaCare Pharma leads the market with an estimated 10% share, offering a wide portfolio of pour-on antiparasitic solutions used across livestock management systems. Chongqing Fangtong Animal Pharmaceutical and Veyong Pharma maintain strong positions through large-scale production capacity and consistent formulation quality serving agricultural sectors across Asia.

Laboratorios Microsules Uruguay and Interchemie contribute to regional competitiveness through GMP-certified manufacturing and distribution across Latin America, Africa, and the Middle East. Shandong Hope Biotech and Norbrook enhance their presence with diversified product lines combining macrocyclic lactone formulations for external and systemic parasite control in cattle and sheep.

Boehringer Ingelheim Animal Health and Chanelle Pharma strengthen the high-value segment through research-driven formulation stability and proven efficacy across variable climatic conditions. Shandong Yahua Biological Technology, Creator, and Harbin Qianhe Animal Drug Manufacturing expand China’s production base with cost-effective solutions targeted at emerging markets. Sichuan Weierkang Animal Pharmacy Group, Henan Liangdian Group, and Luoyang Langwei Animal Pharmaceutical contribute to supply chain continuity through regional distribution and formulation specialization.

Competition in this market is defined by active ingredient concentration, formulation stability, and spectrum of parasite coverage. Strategic differentiation depends on regulatory approvals, residue safety, and extended protection duration, while long-term growth is driven by biosecurity awareness, improved livestock health management, and expansion of veterinary pharmaceutical exports to developing agricultural economies.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Classification) | Special Type, General Type |

| Application | Cow, Cat, Dog, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | AdvaCare Pharma, Chongqing Fangtong Animal Pharmaceutical, Veyong Pharma, Laboratorios Microsules Uruguay, Interchemie, Shandong Hope Biotech, Norbrook, Boehringer Ingelheim Animal Health, Shandong Yahua Biological Technology, Chanelle Pharma, Creator, Harbin Qianhe Animal Drug Manufacturing, Sichuan Weierkang Animal Pharmacy Group, Henan Liangdian Group, Luoyang Langwei Animal Pharmaceutical |

| Additional Attributes | Market breakdown by classification and application segments; regional livestock health and veterinary treatment trends; competitive landscape focusing on formulation stability, efficacy, and compliance with residue standards. |

The global avermectin pour-on solution market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the avermectin pour-on solution market is projected to reach USD 2.2 billion by 2035.

The avermectin pour-on solution market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in avermectin pour-on solution market are special type and general type.

In terms of application, cow segment to command 40.0% share in the avermectin pour-on solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

5PL Solutions Market

High-Resolution Anoscopy Market Size and Share Forecast Outlook 2025 to 2035

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

G-3 PLC Solution Market – Smart Grids & Connectivity

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

WealthTech Solutions Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Solutions Market Size and Share Forecast Outlook 2025 to 2035

Geospatial Solution Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

E-Learning Solution Market by Solution, Deployment, & Region Forecast till 2035

eDiscovery solution Market

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA