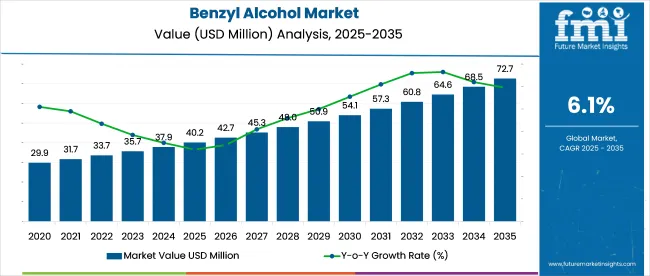

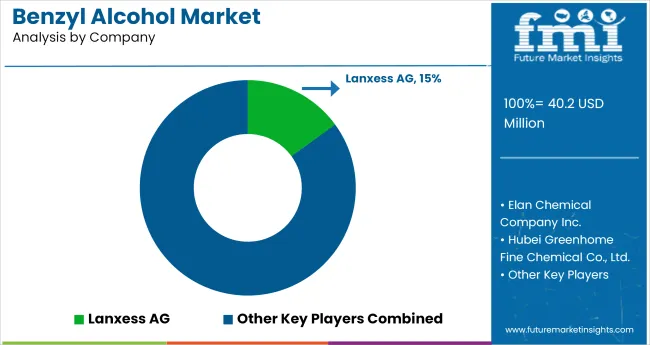

The benzyl alcohol market is projected to grow from USD 40.2 million in 2025 to USD 72.7 million by 2035, expanding at a CAGR of 6.1% throughout the forecast period. This growth is being supported by the compound’s extensive use across paints and coatings, pharmaceuticals, and personal care formulations, where its solvent, preservative, and stabilizing properties are critical.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 40.2 million |

| Projected Industry Value (2035F) | USD 72.7 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

In 2024, global consumption crossed 90,000 tons, with Asia-Pacific accounting for over 40% due to rising drug formulation and specialty chemical production. In India and China, benzyl alcohol is increasingly used in injectable biologics and dermatological creams, where its bacteriostatic properties meet stringent pharmacopoeial standards.

In North America and Europe, pharmaceutical-grade material above 99.5% purity is driving procurement strategies across regulated markets. In the coatings sector, benzyl alcohol is gaining ground as a low-volatility solvent in water-based epoxy systems, especially in construction resins and protective finishes.

Demand from haircare and skincare segments is also increasing as formulators replace parabens with milder preservatives. Supply chain shifts are favoring integrated producers with toluene and benzyl chloride backward linkages. This structural advantage is improving margins while ensuring consistency in a market sensitive to purity and compliance.

As of 2025, the benzyl alcohol market is being recognized as a steadily expanding segment within its broader parent industries. Approximately 5-7% of the global solvents market is represented by benzyl alcohol, driven by its widespread use in coatings, inks, and cleaning formulations.

In the pharmaceutical excipients sector, a share of nearly 6-8% is maintained as benzyl alcohol continues to be used as a preservative and solvent in injectables. Around 4-5% of the personal care ingredients market is occupied by this compound due to its role in fragrance and preservative systems. Its contribution to the paints and coatings additives market is estimated at 3-4% while in the specialty chemicals arena the market share reaches about 7-9%.

The market is gaining traction across key segments including pharmaceuticals grade, synthetic solvents, and pharmaceutical end uses. Demand is rising due to its solvent versatility, clinical safety profile, and increasing use in regulated drug formulations.

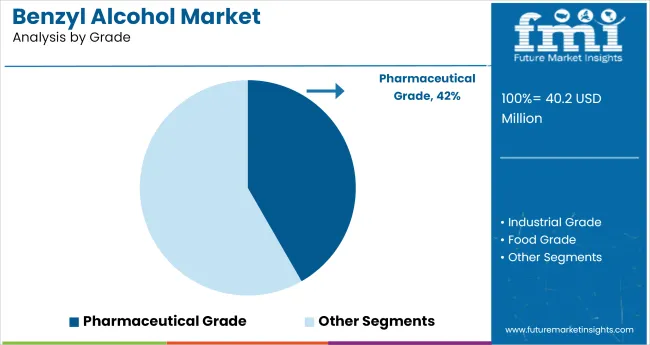

Pharmaceuticals grade benzyl alcohol is expected to dominate the market with a 41.7% share by 2025. Its high purity, non-irritating properties, and proven safety in regulated formulations make it the preferred variant for medical use. It serves as a solvent, bacteriostatic agent, and preservative in injectables and dermatological drugs. The segment benefits from expanding demand in both developed and emerging healthcare markets.

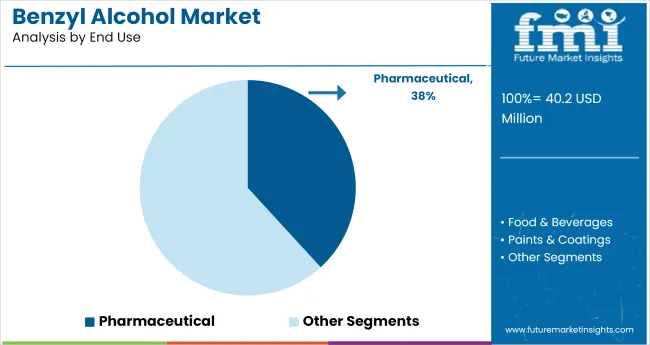

The pharmaceuticals end use segment is projected to capture 38.2% of the market by 2025. This growth is fueled by widespread use in injectables, antiseptic creams, and eye solutions. Benzyl alcohol ensures product stability, enhances solubility, and acts as a preservative across a broad range of therapies. It plays a critical role in multi-dose vials and skin formulations.

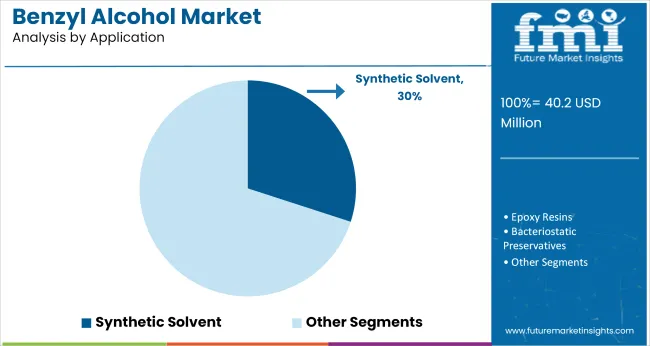

Synthetic solvent usage is forecasted to represent 30% of the market by 2025. The compound serves as an effective solvent in inks, paints, coatings, and epoxy resins. Industrial applications dominate due to consistent use in surface finishes and adhesives.

The market continues to expand as demand increases across paints & coatings, personal care, and pharmaceutical excipients. In 2024, global consumption surpassed 70,000 metric tons, with Asia Pacific leading due to aggressive infrastructure and cosmetics sector growth.

Shift Toward Low-VOC and High-Purity Grades Across Industries

Stringent VOC regulations in Europe and North America are driving demand for high-purity benzyl alcohol with minimal emissions. In 2024, more than 41% of new formulations in paints and cosmetics were based on benzyl alcohol grades compliant with EU REACH and USA EPA guidelines. Pharmaceutical manufacturers are prioritizing injection-grade material with >99.9% purity.

Production Shifts and Feedstock Realignment Impacting Supply

Producers are shifting toward toluene oxidation and benzyl chloride hydrolysis to improve sustainability and reduce benzene-derived feedstocks. In China, several plants transitioned to integrated benzyl derivative platforms to support vertical supply chains. Feedstock volatility and freight rates are influencing procurement strategies in the USA and EU.

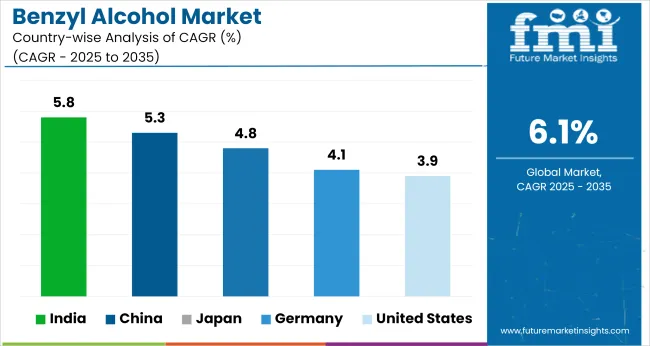

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.8% |

| China | 5.3% |

| Japan | 4.8% |

| Germany | 4.1% |

| United States | 3.9% |

The global market is projected to grow at a 6.1% CAGR through 2035, but regional contributions vary significantly across BRICS and OECD nations. India leads with a 5.8% CAGR, just below the global average, yet remains the fastest-growing producer in Asia due to expanded capacity in Gujarat and increased downstream demand for preservatives in OTC drugs and topical formulations.

China follows at 5.3%, supported by industrial-scale applications in paints and inks, particularly in the Pearl River Delta. Stricter emissions norms are moderating growth. Japan grows at 4.8%, driven by niche use in ophthalmic and personal care segments, though limited domestic synthesis keeps import dependence high.

Germany (4.1%) and the United States (3.9%) underperform the global trend, reflecting slower innovation cycles and lower solvent demand in traditional sectors. ASEAN countries, while still small-scale players, are beginning to emerge as export destinations for BRICS-sourced benzyl alcohol, especially for food-grade applications.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

India’s market for benzyl alcohol is projected to achieve a CAGR of 5.8% from 2025 to 2035, making it the fastest-growing among key global economies. Rapid development in the pharmaceutical sector, especially in Gujarat and Telangana, is driving extensive usage in generic drug formulations.

The compound’s cost efficiency and safety profile make it an ideal excipient in multiple dosage forms. The demand is also climbing in cosmetic manufacturing, where brands are moving away from parabens. Industrial consumption is rising for resins, paints, and agrochemicals.

China’s market is projected to register a CAGR of 5.3% between 2025 and 2035. This growth is supported by strong expansion in the chemical and pharmaceutical manufacturing bases in provinces like Jiangsu and Zhejiang. The compound is widely used as a solvent and intermediate in dye and ink production, which continues to surge with global exports. Increasing domestic consumption of personal care products is also encouraging higher demand for safe preservatives like benzyl alcohol.

Japan is expected to grow steadily at a CAGR of 4.8% through 2035. Strong demand in ophthalmic, injectable, and dermatological formulations drives continued pharmaceutical uptake. Consumer preference for mild preservatives in skincare, especially among aging populations, supports broader adoption across domestic cosmetic lines. Japanese manufacturers value the compound for its purity, safety, and ease of integration into high-compliance formulations.

Sales of benzyl alcohol in Germany are on course to rise at a CAGR of 4.1% from 2025 to 2035. A robust industrial base, particularly in Baden-Württemberg and North Rhine-Westphalia, continues to fuel demand across pharmaceuticals, paints, and adhesives.

As REACH regulations tighten, manufacturers increasingly rely on safer solvent alternatives, strengthening the case for benzyl alcohol. Demand within pharmaceuticals remains steady due to continued use in injectable and oral drug preparations. The growth in sealants and high-performance coating systems adds a layer of industrial momentum.

Demand for benzyl alcohol in the USA is set to grow at a CAGR of 3.9% from 2025 to 2035. Rising pharmaceutical consumption, especially for injectable medications and topical antiseptics, continues to support stable market performance. Regulatory alignment with FDA standards allows the compound to maintain its relevance in over-the-counter and prescription formulations.

In the cosmetics segment, increased usage in preservative systems reflects a wider shift toward paraben-free solutions. Demand also holds steady in industrial applications such as printing inks and coatings.

The industry is fragmented, with global and regional players competing across pharmaceutical, personal care, and industrial domains. Lanxess AG leads in high-purity benzyl alcohol production, particularly for excipient and solvent-grade formulations in Europe. Merck KGaA and Avantor, Inc. supply ultra-high-purity grades tailored for biotech and laboratory applications, benefiting from strong life sciences portfolios.

Wuhan Youji and Hubei Greenhome dominate China’s low-cost manufacturing, offering large-scale supply for resins and coatings. Elan Chemical and Pharmco-AAPER support the USA fragrance and food-grade segments, emphasizing regulatory compliance.

Synerzine Inc. focuses on aroma chemicals for flavors, while Finar Chemicals serves niche pharmaceutical clients in India. Ineos and Emerald Performance target bulk chemical processing applications, leveraging scale and established distribution.

Recent Benzyl Alcohol Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 40.2 million |

| Projected Market Size (2035) | USD 72.7 million |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Grades Analyzed (Segment 1) | Industrial Grade, Food Grade, Pharmaceuticals Grade, Others |

| End Uses Analyzed (Segment 2) | Food & Beverages, Paints & Coatings, Pharmaceuticals, Others |

| Applications Analyzed (Segment 3) | Cleaning Agent, Synthetic Solvent, Epoxy Resins, Bacteriostatic Preservatives, Dielectric Solvent, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Lanxess AG, Elan Chemical Company Inc., Hubei Greenhome Fine Chemical Co., Ltd., Pharmco-AAPER, Wuhan Youji Industries Co., Ltd., Synerzine Inc., Merck KGaA, Emerald Performance Materials, Avantor, Inc., Finar Chemicals, Ineos |

| Additional Attributes | Dollar sales by grade and application, increasing usage in epoxy formulations and medical preservatives, rising demand in electronics and coatings, and strong regional growth in Asia and North America. |

The market is segmented into Industrial Grade, Food Grade, Pharmaceuticals Grade, and Others.

The market is classified into Food & Beverages, Paints & Coating, Pharmaceuticals, and Others.

The market is segmented into Cleaning Agent, Synthetic Solvent, Epoxy Resins, Bacteriostatic Preservatives, Dielectric Solvent, and Others.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The market is valued at USD 40.2 million in 2025 and is projected to reach USD 72.7 million by 2035.

The market is expected to expand at a CAGR of 6.1% between 2025 and 2035.

Pharmaceuticals grade holds the top position with a 41.7% share in 2025.

Pharmaceuticals dominate the market with a 38.2% share in 2025.

India leads the market with a CAGR of 5.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Benzylamine Market Size and Share Forecast Outlook 2025 to 2035

Benzyl Trimethyl Ammonium Chloride Market Growth – Trends & Forecast 2025 to 2035

Alcohol Packaging Market Forecast and Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA