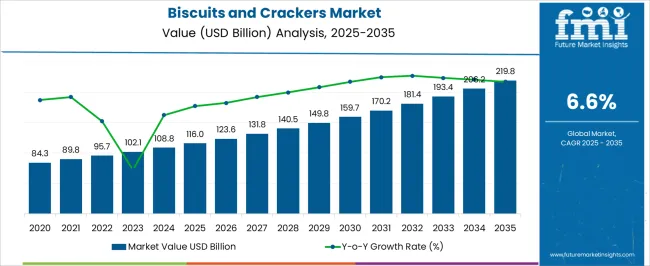

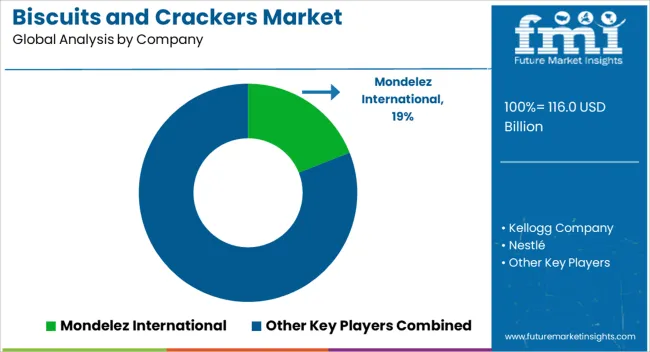

The biscuits and crackers market is estimated to be valued at USD 116.0 billion in 2025 and is projected to reach USD 219.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

Annual increments show gradual acceleration, with values reaching USD 89.8 billion in 2022, USD 95.7 billion in 2023, USD 102.1 billion in 2024, and USD 108.8 billion immediately before attaining USD 116.0 billion in 2025. This phase marks a peak-to-trough pattern, where growth peaks are influenced by festive seasons, promotional campaigns, and high consumer demand, while temporary troughs occur during off-peak periods due to inventory adjustments and seasonal consumption cycles.

From 2026 to 2030, the market advances from USD 116.0 billion to USD 159.7 billion. Values increase to USD 123.6 billion in 2026, USD 131.8 billion in 2027, USD 140.5 billion in 2028, USD 149.8 billion in 2029, reaching USD 159.7 billion in 2030. This period exhibits a clear oscillating trend, as growth accelerates during new product launches and promotional campaigns but stabilizes during slower consumption phases. Between 2031 and 2035, the market expands from USD 170.2 billion to USD 219.8 billion. Incremental values rise to USD 181.4 billion in 2031, USD 193.4 billion in 2032, USD 206.2 billion in 2033, reaching the final value of USD 219.8 billion in 2035.

| Metric | Value |

|---|---|

| Biscuits and Crackers Market Estimated Value in (2025 E) | USD 116.0 billion |

| Biscuits and Crackers Market Forecast Value in (2035 F) | USD 219.8 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The biscuits and crackers market is supported by several parent markets that shape its demand and distribution across different consumer categories. The bakery products market plays the most dominant role, with biscuits and crackers accounting for nearly 20-25% of this segment. As convenient snack items, they are a staple within bakery offerings, driven by their versatility in flavor, texture, and formats. The snack foods market contributes around 15-18%, as biscuits and crackers are often positioned alongside chips, nuts, and other packaged snacks, catering to both on-the-go consumption and household stocking. The confectionery and packaged foods market accounts for about 10-12%, with biscuits and crackers sharing retail space with chocolates, candies, and other packaged indulgence items that appeal to impulse buyers.

The retail and e-commerce market plays an equally significant role, representing nearly 12-15% of the share. Supermarkets, hypermarkets, convenience stores, and online platforms are key channels through which biscuits and crackers reach consumers, highlighting the importance of wide distribution networks. Finally, the health and wellness food market contributes about 6-8%. With the rise of high-fiber, low-sugar, and fortified product variants, biscuits and crackers have increasingly been adapted to meet evolving consumer preferences in health-focused categories.

The market is experiencing steady expansion, supported by rising consumer demand for convenient snack options that combine taste, nutrition, and portability. Growth has been influenced by evolving lifestyles, increasing urbanization, and a greater focus on on-the-go consumption. The sector has benefited from innovation in flavor profiles, ingredient diversification, and packaging technologies that enhance shelf life and product freshness.

Rising disposable incomes and the growth of organized retail channels have further boosted accessibility and product availability in both developed and emerging markets. Health-conscious consumer trends have also contributed to the introduction of fortified and whole grain options, while indulgence-focused variants continue to drive strong sales.

The market outlook remains positive, with manufacturers leveraging digital marketing, premiumization strategies, and eco-friendly packaging initiatives to expand market penetration Increasing global demand, coupled with ongoing product development and brand differentiation efforts, is expected to sustain the sector’s growth trajectory over the forecast period.

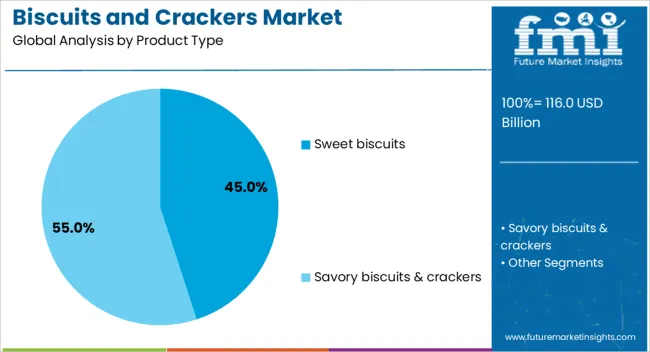

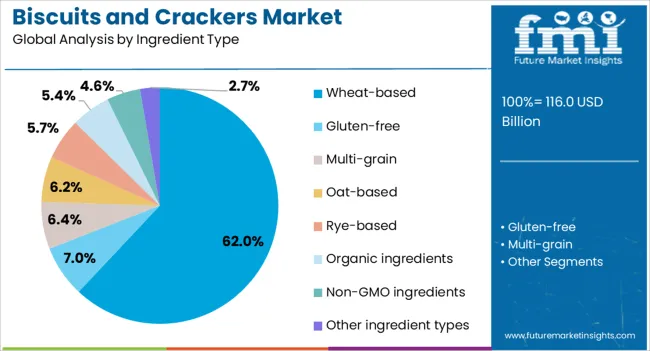

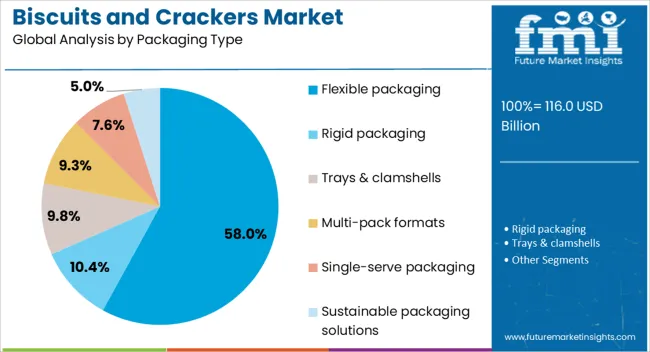

The biscuits and crackers market is segmented by product type, ingredient type, packaging type, price segment, distribution channel, end use, and geographic regions. By product type, biscuits and crackers market is divided into sweet biscuits, savory biscuits & crackers, digestive biscuits, health & wellness biscuits, sandwich biscuits, breakfast biscuits, artisanal & specialty biscuits, and other product types. In terms of ingredient type, biscuits and crackers market is classified into wheat-based, gluten-free, multi-grain, oat-based, rye-based, organic ingredients, non-GMO ingredients, and other ingredient types. Based on packaging type, biscuits and crackers market is segmented into flexible packaging, rigid packaging, trays & clamshells, multi-pack formats, single-serve packaging, and sustainable packaging solutions. By price segment, biscuits and crackers market is segmented into mid-range, economy, premium, and super-premium & artisanal. By distribution channel, biscuits and crackers market is segmented into supermarkets & hypermarkets, convenience stores, specialty stores, online retail, foodservice, vending machines, direct-to-consumer, and other distribution channels. By end use, biscuits and crackers market is segmented into retail / household consumption, foodservice, industrial / food processing, and other end uses. Regionally, the biscuits and crackers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sweet biscuits segment is anticipated to hold 45% of the biscuits and crackers market revenue share in 2025, making it the leading product type. This dominance has been supported by the consistent consumer preference for indulgent snack options that deliver both flavor and variety. Sweet biscuits have maintained widespread appeal due to their versatility in formats, including filled, coated, and plain variants, catering to different taste preferences. The segment’s growth has been further reinforced by strong brand loyalty, seasonal demand peaks, and the introduction of innovative flavor combinations. Convenience in packaging and portion control has increased their consumption in both household and on-the-go settings. The ability to adapt to premium and economy price points has also ensured broad consumer reach With ongoing investments in recipe innovation and the use of quality ingredients, sweet biscuits are positioned to retain their leadership in the product type category.

The wheat-based segment is projected to account for 62% of the market revenue share in 2025, establishing it as the leading ingredient type. Growth in this segment has been supported by the widespread availability of wheat as a primary raw material, its favorable taste profile, and its ability to deliver desired texture and structure to baked products. Wheat-based biscuits and crackers have gained consumer trust due to their familiarity, affordability, and versatility in product formulation. The nutritional benefits of whole wheat and fortified wheat variants have further enhanced appeal, especially among health-conscious consumers. This segment has also benefited from established supply chains and the adaptability of wheat in both traditional and innovative product lines. Its compatibility with diverse flavoring agents and fillings has allowed for continuous product development These factors collectively contribute to the sustained dominance of wheat-based formulations within the ingredient type category.

The flexible packaging segment is expected to capture 58% of the market revenue share in 2025, making it the most widely used packaging type. This preference has been driven by the ability of flexible packaging to offer superior product protection, maintain freshness, and extend shelf life. Lightweight and cost-effective materials have reduced transportation costs, supporting efficient distribution across multiple retail formats. Flexible packaging also provides design versatility, allowing brands to create visually appealing and informative packaging that enhances shelf visibility. Its convenience for portion-controlled packs and resealable formats has improved consumer usability, further boosting its adoption. Additionally, advances in sustainable materials and recyclable packaging solutions have addressed growing environmental concerns, strengthening consumer acceptance The adaptability of flexible packaging to various product sizes and formats ensures its continued relevance as the dominant choice in the packaging type category.

The biscuits and crackers market is expanding as consumers embrace convenient snacking options that offer both variety and portability. Growth is supported by innovations in flavors, health-focused recipes, and premium product lines. Challenges remain in managing raw material price fluctuations, compliance costs, and competitive pressures, particularly for smaller producers. Expanding opportunities in e-commerce, premiumization, and functional product development are reshaping the category. With changing retail patterns and strong consumer appetite for indulgent yet practical foods, biscuits and crackers remain a staple in global packaged food consumption.

Biscuits and crackers are widely consumed across age groups due to their portability, long shelf life, and versatility as both snacks and meal accompaniments. The rising demand for on-the-go food options in urban regions has strengthened consumption patterns, with flavored, filled, and healthy variants gaining popularity. Manufacturers are innovating with recipes incorporating whole grains, seeds, and gluten-free alternatives to appeal to health-conscious buyers. The appeal of biscuits and crackers extends across both premium and mass-market categories, making them accessible to diverse demographics. Marketing campaigns focusing on indulgence, health benefits, and taste variety are further fueling growth. As consumer snacking preferences evolve, biscuits and crackers continue to position themselves as one of the most adaptable packaged food categories worldwide.

Ingredients such as wheat, sugar, and vegetable oils are subject to frequent fluctuations in global commodity markets, which directly impact production costs. Energy-intensive baking processes add further expense, creating pressure on margins for manufacturers. Smaller producers often struggle to absorb these costs, leading to uneven competition with larger multinational companies that benefit from economies of scale. Transportation bottlenecks and changing trade policies can also disrupt the supply of raw materials, affecting product availability in certain regions. Regulatory requirements regarding labeling, additives, and nutritional content impose additional compliance costs on producers. These challenges create constraints for both large and small manufacturers, making cost management a critical factor in maintaining competitiveness while ensuring consistent product quality across diverse markets.

Companies are introducing products with exotic flavors, functional ingredients, and innovative textures to appeal to changing consumer palates. Premiumization trends are gaining traction, with artisanal and gourmet biscuits commanding greater interest in developed markets. Health-focused variants such as high-fiber, sugar-free, and protein-enriched biscuits are targeting niche audiences, while family packs and mini-portion formats appeal to mass-market buyers. Packaging innovation, including resealable packs and portion-controlled options, is also enhancing convenience and freshness. Brands are leveraging e-commerce platforms and direct-to-consumer channels to launch limited-edition products and engage with niche segments. The ability to combine indulgence with perceived health benefits offers manufacturers new avenues for differentiation. This ongoing product diversification ensures biscuits and crackers remain relevant across both traditional retail outlets and emerging digital distribution channels.

Supermarkets and hypermarkets remain dominant sales platforms, but convenience stores and online retailers are capturing growing shares. The surge of e-commerce has enabled brands to expand their reach beyond traditional markets, offering subscription models and direct shipping that enhance consumer convenience. Online platforms also provide opportunities for niche and artisanal brands to showcase their products without the need for extensive physical distribution networks. In emerging markets, the rise of local retail chains and expanding urbanization are boosting product availability. Strategic partnerships between manufacturers and retailers are ensuring wider shelf presence and promotional visibility. These shifts in retail dynamics highlight how distribution strategies are becoming as important as product innovation, ensuring biscuits and crackers continue to adapt to rapidly changing consumer shopping behaviors worldwide.

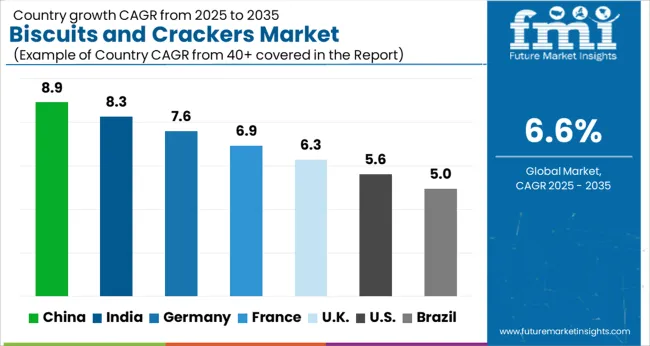

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The biscuits and crackers market is forecasted to expand at a global CAGR of 6.6% between 2025 and 2035. China leads with a growth rate of 8.9%, followed by India at 8.3% and France at 6.9%, while the United Kingdom records 6.3% and the United States trails at 5.6%. China and India secure the highest growth premiums of +2.3% and +1.7% above the global average, driven by evolving snacking habits, e-commerce penetration, and rising disposable incomes. France demonstrates steady momentum with premiumization trends, while the UK and USA maintain moderate but consistent expansion supported by product diversification and strong retail networks. The analysis spans over 40+ countries, with the leading markets shown below.

China is set to lead the biscuits and crackers market, expanding at a CAGR of 8.9% from 2025 to 2035. Growth is influenced by increasing snacking habits across urban and semi-urban populations, supported by rising incomes and changing food preferences. Packaged snack foods are witnessing strong adoption, with biscuits and crackers being positioned as convenient, affordable, and versatile options. The expansion of retail channels, from supermarkets to online platforms, has also improved product accessibility across the country. Flavor diversification, healthier variants, and premium offerings are increasingly attracting consumers who seek both indulgence and functionality. Local producers and multinational brands are competing actively, focusing on packaging innovation and product differentiation.

India is expected to grow at a CAGR of 8.3% between 2025 and 2035, positioning itself as one of the fastest-growing markets for biscuits and crackers. Affordability, wide distribution, and the perception of biscuits as both snacks and meal substitutes play a vital role in their popularity. Growth is fueled by increasing urbanization, higher disposable incomes, and a rising preference for packaged and hygienic food options. The growing school-age population and expanding consumption in rural areas further enhance the industry’s prospects. Domestic brands dominate the market, but global players are expanding aggressively, offering new flavors, formats, and premium ranges.

France is forecasted to grow at a CAGR of 6.9% between 2025 and 2035, supported by its established bakery and confectionery traditions. French consumers place high importance on taste, quality, and authenticity, which influences demand for premium and artisanal biscuit offerings. Health-conscious consumers are showing greater interest in low-sugar, high-fiber, and gluten-free options, creating space for niche innovation. The market is supported by a mix of domestic heritage brands and global players that continue to expand their product portfolios. Strong supermarket penetration ensures accessibility, while online retail is gradually strengthening its role in distribution. Seasonal variations and festive sales also contribute to consumption patterns. France’s focus on premium snacking culture positions biscuits and crackers as both everyday essentials and indulgence products, keeping demand consistently high.

The United Kingdom is projected to grow at a CAGR of 6.3% between 2025 and 2035, with biscuits and crackers firmly positioned as everyday snacking items. Tradition, convenience, and variety continue to drive demand across demographics. There is a growing shift toward indulgent premium biscuits and healthier crackers, catering to both taste and wellness-conscious consumers. Seasonal launches, limited-edition flavors, and packaging innovation keep the category dynamic and appealing. The retail landscape, dominated by supermarkets and convenience stores, ensures wide availability, while online grocery delivery strengthens accessibility. Domestic heritage brands maintain strong loyalty, while international companies are targeting the premium and health-oriented niches.

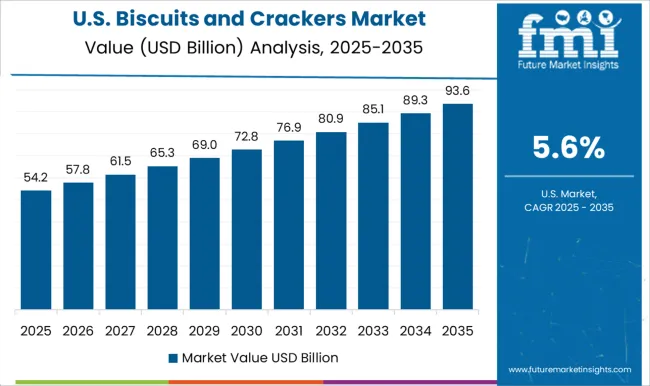

The USA biscuits and crackers market is expected to grow at a CAGR of 5.6% from 2025 to 2035. Growth is influenced by consumer demand for convenient snacking options and the expanding role of healthier packaged snacks. Crackers are increasingly preferred as functional snacks, often positioned with cheese, dips, and spreads, appealing to a wide consumer base. Biscuits, though traditionally less dominant in the USA compared to Europe, are seeing steady growth due to innovation in flavors and packaging. Premiumization, clean-label offerings, and reduced sugar variants are becoming major growth areas. The dominance of large snack food companies ensures consistent product launches, while private labels in retail chains are strengthening competition.

In the biscuits and crackers market, competition is dominated by multinational leaders and regionally entrenched players that compete through innovation, distribution reach, and brand positioning. Mondelez International leads with Oreo, Ritz, and belVita, offering indulgent cookies, savory crackers, and breakfast biscuits that combine taste with convenience. Kellogg Company emphasizes snack crackers and breakfast-oriented biscuits under its global snacking portfolio, highlighting portion control and wholesome positioning. Nestlé integrates fortified biscuits and wafers into its global snacking strategy, balancing indulgence with added nutrition to strengthen its appeal in both developed and emerging markets.

PepsiCo participates through Quaker and other snack biscuit formats, targeting functional snacking occasions with a blend of flavor and nutrition. Britannia Industries commands strong dominance in India with glucose biscuits, cream-filled varieties, and premium cookies, leveraging one of the widest distribution networks in the country. Campbell Soup, through Arnott’s, focuses on heritage brands with established consumer loyalty in Australia and selected export markets. ITC expands market share in India under its Sunfeast brand, emphasizing innovation across digestive, cream, and premium cookies while penetrating rural and semi-urban channels. Strategies across the market highlight product diversification, localized flavor adaptation, and balancing health with indulgence. Mondelez and Nestlé extend global brands while tailoring flavors to local preferences. Kellogg and PepsiCo emphasize functional snacking and convenience packaging. Britannia and ITC compete through affordability, frequent product launches, and expansive retail penetration.

Arnott’s maintains premium positioning while extending its cracker range into export markets. Product brochures showcase depth of offerings: Mondelez highlights Oreo, Ritz, belVita, and Chips Ahoy!; Kellogg presents Nutri-Grain bars and snack crackers; Nestlé details fortified biscuits and wafers; PepsiCo promotes Quaker snack biscuits; Britannia and ITC emphasize diverse formats from glucose to premium cookies; Arnott’s underlines iconic cream biscuits and savory crackers. These portfolios capture how leading brands position themselves at the intersection of indulgence, nutrition, and convenience.

| Item | Value |

|---|---|

| Quantitative Units | USD 116.0 billion |

| Product Type | Sweet biscuits, Savory biscuits & crackers, Digestive biscuits, Health & wellness biscuits, Sandwich biscuits, Breakfast biscuits, Artisanal & specialty biscuits, and Other product types |

| Ingredient Type | Wheat-based, Gluten-free, Multi-grain, Oat-based, Rye-based, Organic ingredients, Non-GMO ingredients, and Other ingredient types |

| Packaging Type | Flexible packaging, Rigid packaging, Trays & clamshells, Multi-pack formats, Single-serve packaging, and Sustainable packaging solutions |

| Price Segment | Mid-range, Economy, Premium, and Super-premium & artisanal |

| Distribution Channel | Supermarkets & hypermarkets, Convenience stores, Specialty stores, Online retail, Foodservice, Vending machines, Direct-to-consumer, and Other distribution channels |

| End Use | Retail / Household consumption, Foodservice, Industrial / Food processing, and Other end uses |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mondelez International, Kellogg Company, Nestlé, PepsiCo (Quaker / snack biscuits), Britannia Industries, Campbell Soup / Arnott’s, and ITC |

| Additional Attributes | Dollar sales by product type (sweet biscuits, savory biscuits, crackers), packaging format (single-serve, multi-pack, family pack), and distribution channel (retail, modern trade, e-commerce). Demand dynamics are influenced by convenience, snacking trends, and rising consumer preference for premium and health-oriented products. Regional growth is significant in North America, Europe, and Asia-Pacific, driven by expanding retail networks, brand penetration, and innovative product launches targeting urban and semi-urban populations. |

The global biscuits and crackers market is estimated to be valued at USD 116.0 billion in 2025.

The market size for the biscuits and crackers market is projected to reach USD 219.8 billion by 2035.

The biscuits and crackers market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in biscuits and crackers market are sweet biscuits, cookies, cream-filled biscuits, and others.

In terms of ingredient type, wheat-based segment to command 62.0% share in the biscuits and crackers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA