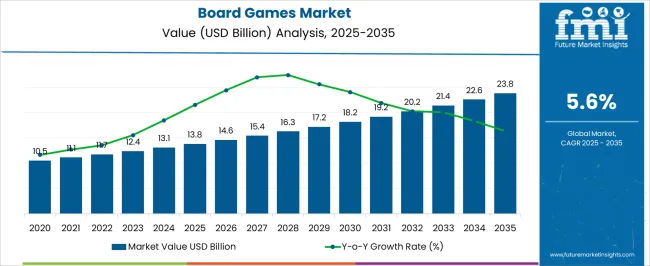

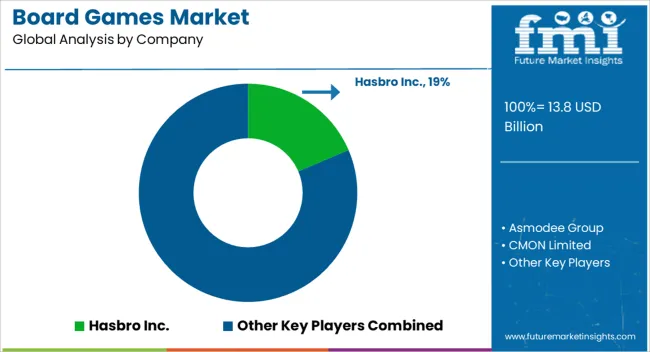

The Board Games Market is estimated to be valued at USD 13.8 billion in 2025 and is projected to reach USD 23.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The absolute dollar opportunity during this decade stands at USD 10 billion, indicating significant expansion potential for industry stakeholders. Year-wise data shows a steady increase from USD 13.8 billion in 2025 to USD 18.2 billion by 2030, marking an addition of USD 4.4 billion over five years.

This phase reflects a consistent market expansion driven by growing consumer interest, diversified game offerings, and rising demand for interactive entertainment. Between 2031 and 2035, the market value further rises from USD 19.2 billion to USD 23.8 billion, adding another USD 4.6 billion within five years. This period highlights accelerating market adoption and increased penetration in emerging regions.

The consistent growth rate with incremental gains each year points to stable market dynamics and ongoing consumer engagement. The absolute dollar growth of USD 10 billion from 2025 to 2035 underscores attractive opportunities for investors and manufacturers.

Expansion is likely propelled by innovation in game designs, digital integration, and expanding retail channels. Overall, the Board Games Market displays a promising growth trajectory with steady revenue increases supporting long-term strategic planning and investment decisions.

| Metric | Value |

|---|---|

| Board Games Market Estimated Value in (2025 E) | USD 13.8 billion |

| Board Games Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The board games market is undergoing a steady resurgence fueled by increased screen fatigue, rising interest in offline social interaction, and educational benefits linked to game-based learning. Demand is being supported by innovations in game design, storytelling, and localized content, which have expanded board games' appeal across age groups and cultures.

The COVID-19 era contributed to a revival of in-home entertainment, a trend that continues post-pandemic with growing interest in family-oriented, intellectually engaging recreational formats. The emergence of hybrid games integrating app-based enhancements has also broadened consumer engagement.

Additionally, rising disposable income and gifting trends are encouraging premium board game purchases. The market is expected to benefit from further expansion into educational institutions and digital retail channels, particularly as publishers focus on age-specific cognitive development and thematic diversity to capture niche audiences.

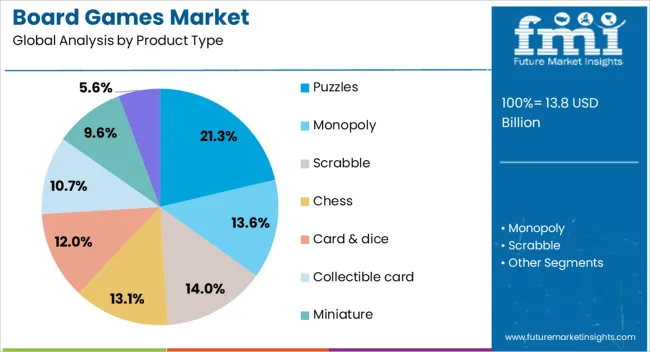

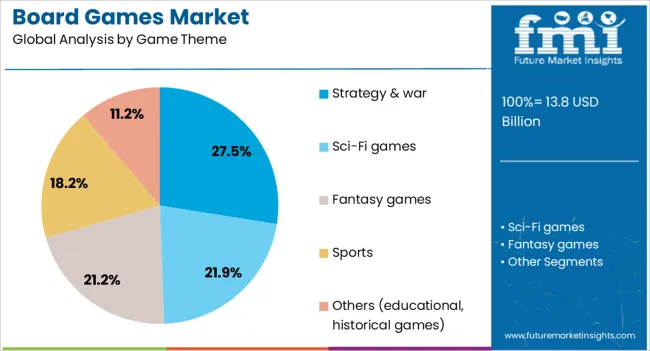

The board games market is segmented by product type, game theme, age group, distribution channel, and geographic regions. By product type, the board games market is divided into Puzzles, Monopoly, Scrabble, Chess, Card & dice, Collectible card, Miniature, and Others (Rummikub, Candy Land, Battleship). In terms of game theme, the board games market is classified into Strategy & war, Sci-Fi games, Fantasy games, Sports, and Others (educational, historical games).

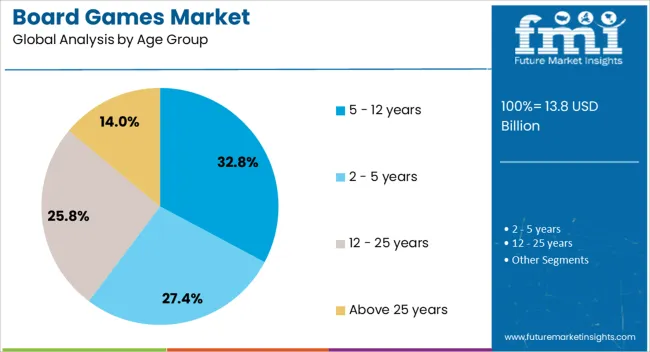

The board games market is segmented into 5 - 12 years, 2 - 5 years, 12 - 25 years, and above 25 years. The distribution channel of the board games market is segmented into Offline and Online. Regionally, the board games industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Puzzles are projected to account for 21.3% of the board games market revenue in 2025, making them the most prominent product type segment. This lead has been influenced by the growing emphasis on logic-building, spatial awareness, and independent problem-solving among both children and adults.

Puzzles are seen as effective tools for cognitive stimulation and stress relief, contributing to their sustained popularity. Their minimal setup requirements and broad availability across price points have also reinforced their utility as accessible and replayable entertainment options.

Moreover, the resurgence of nostalgic and retro puzzle formats, along with innovations in 3D and interactive puzzle mechanics, has diversified their market presence across retail and e-commerce platforms.

The strategy & war segment is expected to dominate the market thematically, with a projected 27.5% revenue share in 2025. This segment’s performance is being driven by the increasing consumer preference for immersive, multi-layered gameplay that encourages long-term engagement and competitive interaction.

Enhanced storytelling, modular expansion sets, and complex rule structures have appealed to hobbyists and core gaming communities. As consumers seek intellectually demanding content and strategic thinking experiences, this genre continues to evolve with historical, fantasy, and tactical sub-themes.

Additionally, growing participation in gaming forums, tournaments, and collectible components is supporting sustained consumer interest and repeat purchases within the strategy and war theme segment.

Children aged 5 to 12 are projected to represent 32.8% of the market revenue in 2025, positioning this age group as the leading consumer demographic. This dominance is being reinforced by the growing integration of educational outcomes into game mechanics, including literacy, numeracy, and critical thinking skills.

Parents and educators are increasingly turning to board games as tools for interactive learning and developmental support. Age-appropriate designs, simplified instructions, and visual appeal have further improved engagement levels among this demographic.

Licensing partnerships with popular children’s franchises have expanded product adoption, while school curricula and pediatric recommendations continue to support board games as part of structured learning and play environments.

The board games market has witnessed significant growth fueled by rising consumer interest in offline social entertainment and strategic leisure activities. Increasing time spent at home, amplified by global lifestyle shifts, has boosted demand for diverse and innovative board games. Classic and modern board games appeal to various age groups, fostering family bonding and social interaction. Additionally, the expansion of specialty stores and e-commerce platforms has improved accessibility and variety, catering to niche preferences. Product innovations incorporating augmented reality, storytelling elements, and collaborative gameplay have enhanced user engagement.

Board games have regained popularity as a preferred form of social and family entertainment, offering interactive experiences that promote communication and teamwork. Consumers increasingly seek offline activities that encourage face-to-face interaction, especially amid rising digital fatigue. Board games facilitate bonding among friends and family members across different age groups, making them attractive for home entertainment. Game nights, social gatherings, and educational settings have embraced board games to foster creativity and cognitive skills. This renewed focus on shared experiences has led to increased sales and the introduction of games designed for diverse group sizes and skill levels, supporting continuous market expansion.

Manufacturers have introduced innovative features to traditional board games, blending storytelling, strategy, and technology to create immersive experiences. The incorporation of augmented reality components and app integration allows hybrid gameplay that combines physical and digital elements. Diverse themes, such as fantasy, historical, and educational, cater to varied consumer interests. Cooperative and competitive game formats address different player preferences, broadening market appeal. Limited editions and collector’s versions generate excitement among enthusiasts and foster brand loyalty. This product diversification encourages repeat purchases and attracts new players, contributing to the dynamic evolution of the board games market.

The availability of board games through multiple retail channels, including online marketplaces, specialty hobby stores, and large retail chains, has broadened consumer access worldwide. E-commerce platforms offer extensive catalogs, customer reviews, and competitive pricing, facilitating informed purchase decisions. Specialty stores provide personalized recommendations and community engagement through events and game nights. Increased presence in mass-market retailers introduces casual players to the category. Distribution expansion into emerging markets capitalizes on growing middle-class populations and disposable incomes. This widespread availability supports steady market growth by reaching diverse demographics and geographic regions.

The rise of digital gaming platforms, mobile apps, and online multiplayer games presents significant competition to the traditional board games market. Digital entertainment offers convenience, instant access, and immersive graphics that attract a large user base, especially among younger consumers. Changing leisure preferences and screen-centric lifestyles may reduce time allocated to physical board games. To counter this, manufacturers emphasize the unique social and tactile experiences of board games, promoting their value in fostering interpersonal connections. Hybrid game formats and digital enhancements are also leveraged to bridge the gap. Balancing innovation with the preservation of core gameplay elements remains essential for market sustainability.

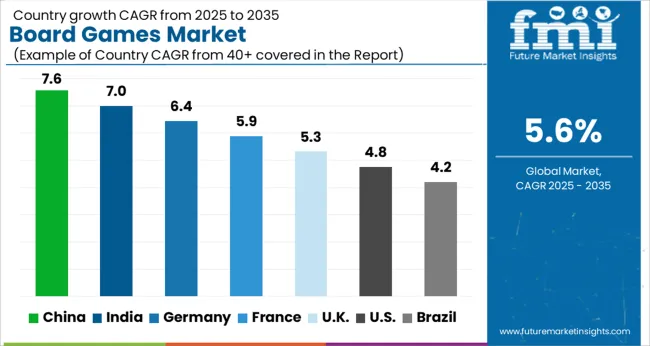

The market is expected to grow at a CAGR of 5.6% between 2025 and 2035, driven by rising consumer interest in interactive entertainment, growing family leisure activities, and increasing product variety. China leads with a 7.6% CAGR, supported by expanding manufacturing capabilities and rising domestic demand. India follows at 7.0%, fueled by growing urban middle-class engagement and e-commerce penetration.

Germany, growing at 6.4%, benefits from a strong tradition of board game design and high-quality production. The UK, at 5.3%, experiences steady demand from family and educational segments. The USA, with a 4.8% CAGR, reflects growth influenced by innovation in game themes and increased popularity of social gaming. This report includes insights on 40+ countries; the top markets are shown here for reference.

The board games industry in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, fueled by rising interest in family entertainment and social gaming culture. The market benefits from expanding retail distribution and e-commerce platforms promoting a variety of traditional and modern board games. Leading Chinese companies like Shenzhen Yuhong Culture and Entertainment Co are innovating by integrating digital elements with physical gameplay, appealing to younger consumers. Educational board games focused on cognitive development have gained traction in schools and homes. The increasing popularity of strategy and cooperative games is expected to further strengthen demand, making China a significant contributor to the Asia Pacific gaming landscape.

India’s board games market is anticipated to expand at a CAGR of 7.0% during 2025 to 2035, supported by growing interest in offline family entertainment and social gatherings. Traditional games are being revitalized alongside Western-style strategy and party games gaining popularity among urban youth. Increasing availability through retail chains and online stores facilitates market growth. Local game developers are collaborating with international publishers to launch culturally relevant titles. Educational institutions are incorporating board games as learning tools, stimulating demand. Rising disposable income in tier 2 and tier 3 cities also contributes to expanding sales volumes.

Sales of board games in Germany are expected to grow at a CAGR of 6.4% through 2035, supported by the country’s rich tradition of tabletop gaming and strong consumer interest. Germany is home to internationally renowned game designers and hosts major industry events such as Spiel Essen, which boost market visibility. Family-oriented games and complex strategy titles remain popular. Retail and specialty gaming stores continue to be key distribution channels, while online sales have shown steady increase. The focus on high-quality components and innovative game mechanics drives consumer loyalty and market expansion.

The United Kingdom’s board games market is forecasted to expand at a CAGR of 5.3% between 2025 and 2035, with growth driven by increased demand for social and party games. Retailers and online platforms are broadening their selections to include a mix of classic and new titles. Consumer preference for games that encourage social interaction and casual play has supported market diversification. Local publishers and game designers actively promote the market through community events and crowdfunding platforms. The increasing engagement of younger consumers and families is expected to sustain steady sales growth.

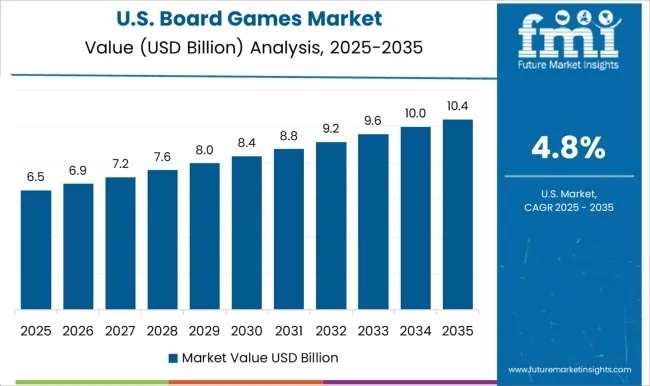

The United States board games market is projected to grow at a CAGR of 4.8% over 2025 to 2035, influenced by a resurgence of interest in analog entertainment. Family game nights and game cafes contribute to growing popularity, while diverse offerings appeal to casual and hardcore gamers alike. Retail expansion in specialty stores and online marketplaces supports accessibility. Major publishers such as Hasbro and Mattel continue to invest in new releases and licensing deals. The rise of cooperative and narrative-driven games has particularly boosted market activity, encouraging wider consumer engagement.

The market features a mix of well-established global companies and innovative niche players offering diverse tabletop gaming experiences. Hasbro Inc. stands as a dominant leader with iconic titles and a vast distribution network that spans worldwide retail channels. Asmodee Group, owning multiple brands, expands its portfolio through acquisitions and product launches, focusing on both family and strategy games.

CMON Limited and Czech Games Edition cater to enthusiasts with complex, thematic games that emphasize high-quality components and immersive storytelling. Days of Wonder and Fantasy Flight Games are recognized for premium games that combine strategic depth with engaging narratives, appealing to hobbyists. Goliath Games LLC and HABA specialize in family-friendly and children’s games, emphasizing simplicity and educational value.

Companies like IELLO, Indie Boards and Cards, and Kosmos Verlags-GmbH focus on niche segments, offering innovative mechanics and unique themes. Mattel Inc., PlayMonster LLC, and Ravensburger AG maintain diverse product lines balancing classic and modern board games with strong brand recognition.

Spin Master Corp., Schmidt Spiele GmbH, USAopoly Inc., University Games Corp., and Z-Man Games LLC complement the market with licensed titles, expansions, and collectible games. Competitive strategies revolve around frequent product launches, collaborations with designers, and expanding digital adaptations. Entry barriers include brand loyalty, extensive distribution networks, and intellectual property rights. Established providers leverage these advantages to maintain market leadership in a sector driven by creativity and community engagement.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.8 Billion |

| Product Type | Puzzles, Monopoly, Scrabble, Chess, Card & dice, Collectible card, Miniature, and Others (Rummikub, Candy Land, Battleship) |

| Game Theme | Strategy & war, Sci-Fi games, Fantasy games, Sports, and Others (educational, historical games) |

| Age Group | 5 - 12 years, 2 - 5 years, 12 - 25 years, and Above 25 years |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hasbro Inc., Asmodee Group, CMON Limited, Czech Games Edition, Days of Wonder, Fantasy Flight Games, Goliath Games LLC, HABA - Habermaass GmbH, IELLO, Indie Boards and Cards, Kosmos Verlags-GmbH & Co. KG, Mattel Inc., North Star Games, PlayMonster LLC, Ravensburger AG, Spin Master Corp., Schmidt Spiele GmbH, USAopoly Inc., University Games Corp., and Z-Man Games LLC |

| Additional Attributes | Dollar sales by game type and distribution channel, demand dynamics across family entertainment, educational use, and competitive gaming, regional trends in consumer preferences across North America, Europe, and Asia-Pacific, innovation in augmented reality integration, customizable game components, and sustainable materials, environmental impact of manufacturing processes, packaging waste, and product lifecycle, and emerging use cases in digital-physical hybrid games, therapeutic applications, and interactive learning platforms. |

The global board games market is estimated to be valued at USD 13.8 billion in 2025.

The market size for the board games market is projected to reach USD 23.8 billion by 2035.

The board games market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in board games market are puzzles, monopoly, scrabble, chess, card & dice, collectible card, miniature and others (rummikub, candy land, battleship).

In terms of game theme, strategy & war segment to command 27.5% share in the board games market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Games and Puzzles Market is segmented by Type, Licensing, Distribution Channel and Region through 2025 to 2035.

Onboard Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

On-Board Connectivity Market Size and Share Forecast Outlook 2025 to 2035

On-board Magnetic Sensors Market Trends and Forecast 2025 to 2035

Market Share Insights of Boxboard Packaging Providers

On-Board Fuse Box Market

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Cardboard Trays Market Size, Share & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Market Share Breakdown of Cardboard Crates Manufacturers

Dashboard Camera Market Growth - Trends & Forecast 2024 to 2034

Cardboard Filler Market Trends – Size, Demand & Forecast 2024-2034

Cardboard Tubs Market

Greyboard Market

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiberboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA