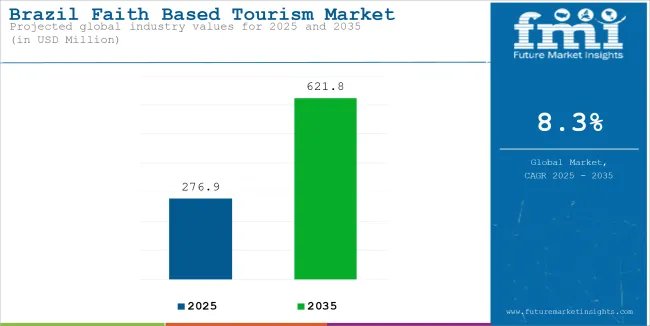

The Brazil Faith Based Tourism Market is expected to increase from USD 279.7 million in 2025 to USD 621.8 million by 2035, at 8.3% CAGR from 2025 to 2035. Lying in vicinity to the US, Brazil attracts numerous tourists from the world’s largest economy. The country’s advanced infrastructure offers ease of traveling to the religious travellers.

| Attribute | Key Insights |

|---|---|

| Estimated Brazil Faith Based Tourism Market Size (2024) | USD 255.7 Million |

| Projected Market Size (2035) | USD 621.8 Million |

| Value-based CAGR (2025 to 2035) | 8.3% |

| Top Players Share in 2024 | 25% to 30% |

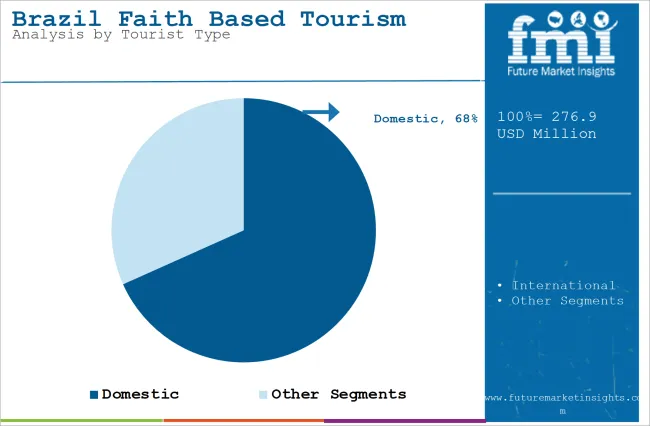

Domestic tourism is expected to hold the lion’s share during the forecast period. This is mainly due to the significantly large numbers of Catholics, with more than 65% of the Brazilian population adhering to this faith. Significant presences of the Catholic churches in Brazil have been instrumental in attracting that group. This also relates to the challenge that international tourists may face as they are Portuguese predominant in Brazil, which may reduce communication skills with native residents whose first language is not Portuguese.

| Segment | Tourist Type (Domestic) |

|---|---|

| Value Share (2024) | 68.3% |

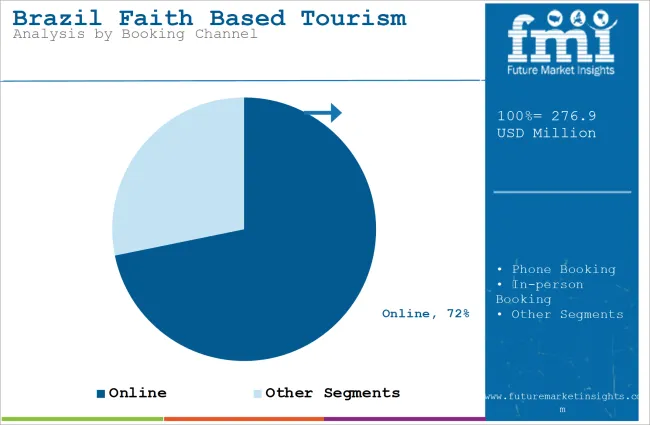

The market through the online booking channel is likely to witness a massive increase in the market share during the forecast period. This can be mainly attributed to the growth of internet usage, which has made the process of ticket booking much easier. Technological advancement has helped consumers master the art of price comparison and reservations. Most importantly, this has increased trust from customers concerning secure online transactions. In the second place, this online mode affords business operators an interface to reach the greater customer populace.

| Segment | Booking Channel (Online) |

|---|---|

| Value Share (2024) | 71.8% |

During the period 2020 to 2024, the sales grew at a CAGR of 8.1%, and it is projected to continue to grow at a CAGR of 8.3% during the forecast period of 2025-35. Structured marketing campaigns by the Brazilian tourism industry stakeholders has led to the significant revenue growth of Brazil faith-based tourism sector. Some of the efforts driving Brazil’s faith-based tourism industry are as follows:

Religious Site Development and Infrastructure

Brazil has invested significantly in religious tourism infrastructure. The Christ the Redeemer statue in Rio de Janeiro received a $4 million restoration project in 2023, enhancing access for visitors and installing new security measures. The Sanctuary of Our Lady of Aparecida, Brazil's largest Marian shrine, expanded its facilities to meet the needs of the ever-increasing visitors; it receives more than 12 million pilgrims annually.

Government Support and Marketing

The Brazilian Tourism Board, Embratur, has launched targeted campaigns promoting religious destinations. Their "Sacred Brazil" initiative, launched in 2023, specifically markets religious sites to international visitors. This program has led to a 30% increase in religious tourist arrivals from neighboring South American countries.

Enhanced Transportation Connectivity

Some religious sites have become more accessible due to developments in transportation infrastructure. Dedicated bus routes connecting the major religious destinations in São Paulo state have increased domestic religious tourism by 25% since 2022. The new regional flights to cities with significant religious sites also boost accessibility for international pilgrims.

Diversification of Religious Experiences

Brazil has extended its traditional Catholic tourism into multi-faith experiences. The Temple of Solomon in São Paulo is the largest religious building in Latin America, and visitors include all denominations of Christianity. Its visitor count increased by 40% since 2022. African-derived religious centers are growing in numbers, and tourism related to them has also grown in cities like Salvador and Recife.

Event-Based Religious Tourism

Key religious events have become a significant driver for faith-based tourism in Brazil. The Círio de Nazaré festival in Belém now attracts over two million participants annually, thus generating substantial revenue for the local economy. The Festival of Saint Francis of Assisi in Canindé has also grown, with increased international attention and visitors.

Strategic Marketing Campaigns Boosting Revenue for Faith-based Tourism Industry in Brazil

The Brazilian Tourism Board released its "Sacred Paths of Brazil" digital campaign in 2023, allowing interactive virtual tours of the major religious sites in Brazil. Over the first six months of its run, which is promoted through all social media channels, it racked up more than 2 million virtual visits to religious destinations in Brazil. The campaign consists of 360-degree tours of the Sanctuary of Aparecida and provides detailed guides for religious festivals.

Brazil has developed partnerships with international tour operators who are into religious tourism. In 2023, collaboration with European Catholic tour operators brought a 35% increase in pilgrim visits from Portugal, Spain, and Italy. The tourism board also partnered with major Latin American travel agencies to create packages that cater to religious tourism, and this increased the number of regional religious tourists.

The "Faith in Brazil" content series is on Brazilian streaming platforms from early 2024, with a view to exhibiting the diversity of religious heritage in Brazil. This very interesting documentary series, in several languages, introduces and explores famous, but also lesser-known, spiritual destinations. It has specially connected more visitors to Afro-Brazilian religious traditions.

Grassroots marketing by the tourism authorities of Brazil has succeeded through local religious communities. The "Guardians of Faith" program in cities like Salvador and Recife has trained the local religious leaders and community members to be cultural ambassadors that will provide tourists with an authentic experience without disrespecting the social life of the area.

The country has enhanced its promotion of religious events through targeted marketing campaigns. The "Festival of Faith" campaign, promoting major religious celebrations across Brazil, has successfully increased international visitor attendance at events like the Círio de Nazaré by 40% compared to previous years.

Infrastructure and Accessibility Issues

The deteriorating infrastructure at many religious sites in Brazil due to insufficient funding for maintenance has been impacting the expansion of faith-based tourism sector in Brazil. The Bom Jesus do Congonhas sanctuary in Minas Gerais has structural problems, which were identified in 2023 and require immediate repair, temporarily restricting access to visitors. Poor public transport links to pilgrimage sites outside major cities have also resulted in fewer visitors, especially for smaller pilgrimage destinations in the interior regions.

Security Concerns

Rising urban crime rates have negatively impacted religious tourism in major Brazilian cities. Evening visitors to Rio de Janeiro's religious sites have declined by 20% as a result of safety concerns, especially in the vicinity of popular religious attractions such as the Metropolitan Cathedral. Tour operators have been forced to adjust religious event times and routes for visitor safety, which has negatively impacted the traditional pilgrimage experience.

Economic Pressures

With rising inflation, religious tourism service charges have risen high in Brazil. Since 2022, accommodation costs for places around important religious locations increased by almost 30%. Consequently, religious tourism for pilgrims at home has been negatively affected by such a scenario. The escalating operating costs for maintaining religious places also resulted in entry fees becoming highly expensive for the visitor in a few destinations.

Environmental Challenges

Climate-related issues have disrupted religious events and site access in Brazil. Heavy rainfall in 2023 caused damage to historical religious buildings in Ouro Preto, while extreme heat waves have affected outdoor religious celebrations in Northeastern Brazil, requiring schedule modifications and additional safety measures.

Workforce Limitations

Qualified religious tourism guides and staff are lacking in the Brazilian faith-based tourism industry. Several religious sites have expressed a challenge in sourcing personnel with knowledge of religion combined with proper training in tourism management. Due to the shortage, the tour operates on reduced availability and extended waiting times at major religious destinations, especially during peak seasons.

The key stakeholders in the market are working toward establishing a responsible, transparent, and accessible travel ecosystem. They are focusing on improving access for underserved travelers, democratizing the travel economy, and pioneering sustainable solutions for the future. Additionally, they will strive to create technological platforms that allow for the effective configuration and utilization of the products and services required to succeed in the travel ecosystem.

The market is expected to reach USD 621.8 million by 2035.

From 2020 to 2024, the market expanded at 8.1% CAGR.

Day trips and local gateways are mostly preferred by domestic tourists in Brazil.

Online booking will account for the significant market revenue by 2035.

The market rose at a CAGR of 8.3% from 2025 to 2035.

Several interfaith initiatives are being taken by the Brazilian government to promote faith-based tourism industry.

Table 1: Market Value (US$ Million) Forecast by Tourism Type, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Tour Type , 2018 to 2033

Table 4: Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 6: Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Figure 1:Brazil Faith Based Tourism Market Value (US$ Million) by Tourism Type, 2023 to 2033

Figure 2:Brazil Faith Based Tourism Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 3:Brazil Faith Based Tourism Market Value (US$ Million) by Tour Type , 2023 to 2033

Figure 4:Brazil Faith Based Tourism Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 5:Brazil Faith Based Tourism Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 6:Brazil Faith Based Tourism Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 7:Brazil Faith Based Tourism Market Value (US$ Million) Analysis by Tourism Type, 2018 to 2033

Figure 8:Brazil Faith Based Tourism Market Value Share (%) and BPS Analysis by Tourism Type, 2023 to 2033

Figure 9:Brazil Faith Based Tourism Market Y-o-Y Growth (%) Projections by Tourism Type, 2023 to 2033

Figure 10:Brazil Faith Based Tourism Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 11:Brazil Faith Based Tourism Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 12:Brazil Faith Based Tourism Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 13:Brazil Faith Based Tourism Market Value (US$ Million) Analysis by Tour Type , 2018 to 2033

Figure 14:Brazil Faith Based Tourism Market Value Share (%) and BPS Analysis by Tour Type , 2023 to 2033

Figure 15:Brazil Faith Based Tourism Market Y-o-Y Growth (%) Projections by Tour Type , 2023 to 2033

Figure 16:Brazil Faith Based Tourism Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 17:Brazil Faith Based Tourism Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 18:Brazil Faith Based Tourism Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 19:Brazil Faith Based Tourism Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 20:Brazil Faith Based Tourism Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 21:Brazil Faith Based Tourism Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 22:Brazil Faith Based Tourism Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 23:Brazil Faith Based Tourism Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 24:Brazil Faith Based Tourism Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 25:Brazil Faith Based Tourism Market Attractiveness by Tourism Type, 2023 to 2033

Figure 26:Brazil Faith Based Tourism Market Attractiveness by Tourist Type, 2023 to 2033

Figure 27:Brazil Faith Based Tourism Market Attractiveness by Tour Type , 2023 to 2033

Figure 28:Brazil Faith Based Tourism Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 29:Brazil Faith Based Tourism Market Attractiveness by Age Group, 2023 to 2033

Figure 30:Brazil Faith Based Tourism Market Attractiveness by Booking Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brazil Aesthetic Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brazil Hyaluronic Acid Products Market Outlook – Share, Growth & Forecast 2025-2035

Brazilian Hemorrhagic Fever (BzHF) Treatment Market

Brazil Safari Tourism Market Growth – Size, Demand & Forecast 2025-2035

Brazil Culinary Tourism Market Insights – Growth & Forecast 2025 to 2035

CMO/CDMO Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

Consumer Packaging Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

Faith-Based Tourism Market Growth – Forecast 2024-2034

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

UAE Faith-Based Tourism Market Trends – Growth & Forecast 2025 to 2035

Italy Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Faith-Based Tourism Market Trends - Growth & Forecast 2025 to 2035

Egypt Faith-Based Tourism Market Trends - Growth & Forecast 2025 to 2035

Japan Faith-Based Tourism Market Growth – Forecast 2024 to 2034

Jordan Faith-Based Tourism Market Analysis – Trends & Forecast 2025 to 2035

Indonesia Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Faith-Based Tourism Market Growth – Forecast 2024 to 2034

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA