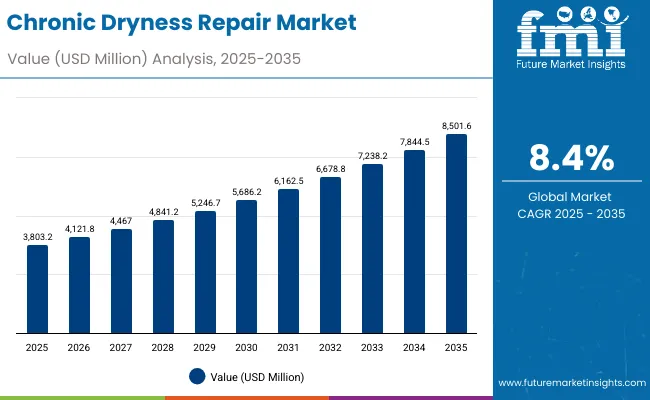

The Chronic Dryness Repair Market is expected to record a valuation of USD 3,803.2 million in 2025 and USD 8,501.6 million in 2035, with an increase of USD 4,698.4 million, which equals a growth of 123.5% over the decade. The overall expansion represents a CAGR of 8.4% and a more than 2X increase in market size.

Chronic Dryness Repair Market Key Takeaways

| Metric | Value |

|---|---|

| Chronic Dryness Repair Market Estimated Value in (2025E) | USD 3,803.2 million |

| Chronic Dryness Repair Market Forecast Value in (2035F) | USD 8,501.6 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

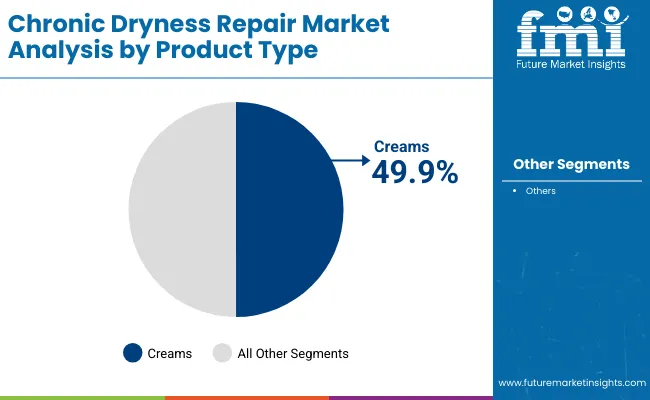

During the first five-year period from 2025 to 2030, the market increases from USD 3,803.2 million to USD 5,686.2 million, adding USD 1,883.0 million, which accounts for 40.0% of the total decade growth. This phase records steady adoption of creams, balms, and ointments across pharmacies and hospitals, driven by rising incidence of diabetic skin dryness and psoriasis-related complications. Creams dominate this period as they cater to over 49.90% of global demand with consistent acceptance among both medical and general consumer groups.

The second half from 2030 to 2035 contributes USD 2,815.4 million, equal to 60.0% of total growth, as the market jumps from USD 5,686.2 million to USD 8,501.6 million. This acceleration is powered by the growing preference for medical-grade and dermatologist-tested solutions, alongside e-commerce expansion in Asia-Pacific markets such as China and India. Long-lasting moisturization and barrier reinforcement solutions gain traction, while distribution through digital-first platforms accounts for an increasing share. Specialized formulations with active ingredients like hyaluronic acid, urea, and petrolatum underpin higher-value offerings, ensuring deeper penetration into both premium and clinical categories.

From 2020 to 2024, the Chronic Dryness Repair Market expanded steadily, reaching nearly USD 3.7 billion equivalent, driven by rising awareness of skin hydration solutions. During this period, the competitive landscape was dominated by major consumer health and dermatology brands controlling more than 80% of revenue, with leaders such as Eucerin and Aquaphor focusing on medical-grade solutions. Competitive differentiation relied on dermatologist testing, active ingredient concentration, and suitability for sensitive skin, while channels like pharmacies and hospitals accounted for bulk of sales. Online platforms had limited traction before 2024, contributing less than 15% of the total value.

Demand for chronic dryness repair products will expand further to USD 3,803.2 million in 2025, and the revenue mix will shift as digital and clean-label offerings grow beyond 20% share. Traditional cream leaders face rising competition from e-commerce driven entrants offering tailored, AI-recommended regimens and subscription-based delivery models. Major incumbents are pivoting to hybrid approaches, blending dermatologist-grade positioning with consumer-focused formats such as balms and lotions. Emerging players specializing in clean-label and fragrance-free categories are gaining visibility, while innovation is shifting toward ingredient transparency and efficacy for aging adults, diabetic patients, and chronic skin sufferers. The competitive advantage is moving beyond product familiarity to medical credibility, digital accessibility, and consumer trust.

Rising prevalence of chronic skin conditions such as eczema, psoriasis, and diabetic skin complications has accelerated demand for intensive repair products. Consumers are increasingly seeking dermatologist-tested and medical-grade formulations that ensure proven efficacy for long-term dryness relief. Creams and ointments remain primary treatment formats due to their strong hydration capacity, while lotions and balms gain acceptance in lifestyle-focused skincare. Active ingredients like hyaluronic acid, glycerin, and petrolatum are leading the formulation base owing to their clinically established ability to restore skin barrier and retain moisture.

Expansion of e-commerce platforms has created easier access to dermatologist-trusted brands, especially in emerging Asian markets. Growth is also supported by increased awareness campaigns around skin health, particularly among aging populations. Pharmacies and drugstores continue to dominate distribution, but digital-first platforms are emerging as key growth engines. Segment expansion is led by creams in product type, medical-grade claims in positioning, and pharmacies in distribution, with strong uptake across aging adults, diabetic patients, and chronic skin sufferers.

The market is segmented by function, active ingredient, product type, claim, channel, end user, and region. Functions include intense hydration, barrier reinforcement, long-lasting moisturization, and crack prevention. Active ingredients cover hyaluronic acid, urea, shea butter, glycerin, and petrolatum, reflecting diverse therapeutic approaches. Product types span creams, balms, ointments, and lotions, representing the most widely adopted application forms. Claims include dermatologist-tested, fragrance-free, medical-grade, and clean-label, demonstrating how clinical trust and transparency are shaping consumer preferences.

Channels include pharmacies/drugstores, e-commerce, mass retail, and clinics/hospitals, offering a broad mix of professional and consumer-driven access points. End users are segmented into aging adults, diabetic patients, psoriasis/eczema sufferers, and general consumers, highlighting the diverse population base for dryness repair needs. Regionally, the scope includes USA, China, India, Japan, Germany, UK, and other global markets with differentiated growth outlooks.

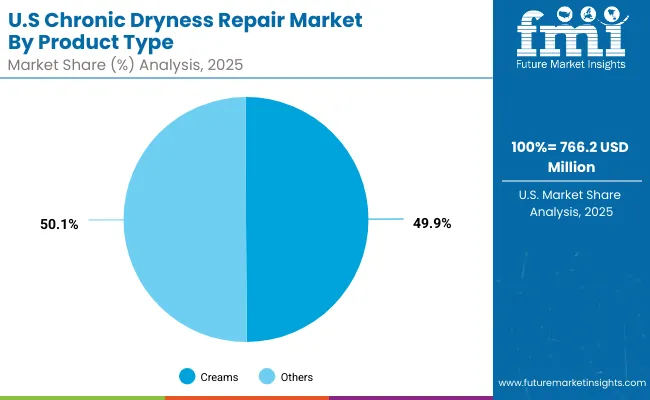

| Product Type | Value Share% 2025 |

|---|---|

| Creams | 49.9% |

| Others | 50.1% |

The creams segment is projected to contribute 49.90% of the Chronic Dryness Repair Market revenue in 2025, maintaining its lead as the dominant product type. Creams remain the preferred choice among consumers due to their ease of application, fast absorption, and strong clinical evidence for long-lasting hydration. Dermatologists frequently recommend cream formulations for conditions such as eczema, psoriasis, and diabetic skin dryness, further strengthening their dominance.

The segment’s growth is also supported by innovations in formulations enriched with hyaluronic acid, urea, and glycerin, which improve moisture retention and enhance skin barrier repair. As clean-label and fragrance-free preferences expand, creams are increasingly being adapted to meet sensitive-skin demands. This adaptability ensures creams retain their position as the backbone of chronic dryness repair solutions globally.

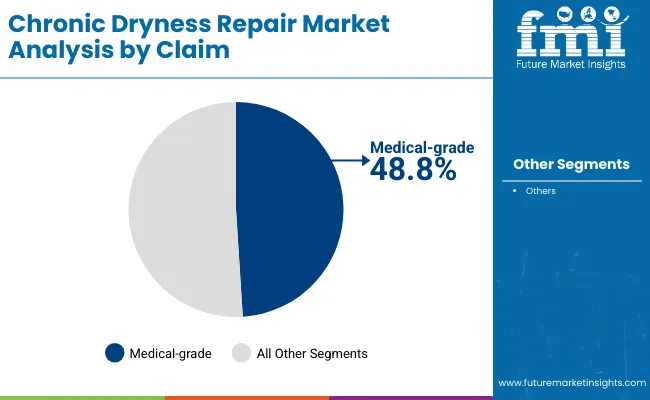

| Claim | Value Share% 2025 |

|---|---|

| Medical-grade | 48.8% |

| Others | 51.2% |

The medical-grade segment is expected to capture 48.80% of the Chronic Dryness Repair Market in 2025, establishing itself as the leading claim category. Consumers and healthcare professionals are increasingly prioritizing products that carry clinical validation, proven safety, and dermatologist-tested assurance. This demand is especially prominent among patients with chronic skin conditions requiring consistent and effective repair.

The segment’s rise is also influenced by heightened trust in formulations that feature higher concentrations of active ingredients like petrolatum and urea, both of which have medically recognized benefits for barrier reinforcement and hydration. As awareness of the link between skin health and systemic conditions such as diabetes grows, the medical-grade category is positioned to expand further. Its ability to combine clinical efficacy with consumer confidence ensures that medical-grade formulations remain central to market growth.

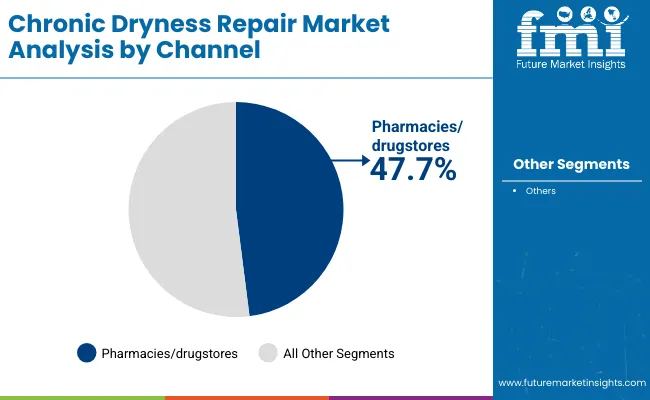

| Channel | Value Share% 2025 |

|---|---|

| Pharmacies/drugstores | 47.7% |

| Others | 52.3% |

The pharmacies/drugstores segment is forecasted to hold 47.70% of the Chronic Dryness Repair Market in 2025, reflecting its position as the leading distribution channel. Pharmacies continue to dominate due to their accessibility, professional guidance from pharmacists, and consumer trust in purchasing medical-grade and dermatologist-recommended products. They serve as primary points of access for patients seeking treatment for chronic dryness linked to conditions such as eczema, psoriasis, and diabetes.

This channel’s strength is reinforced by its ability to carry a wide range of specialized brands like Eucerin, Aquaphor, and La Roche-Posay, which are trusted for their clinical efficacy. While e-commerce is gaining momentum, particularly in Asia-Pacific markets, pharmacies and drugstores maintain an edge in credibility and assurance of authenticity. Their established presence and integration with healthcare networks ensure they remain the cornerstone of product distribution.

Rising Burden of Chronic Skin Conditions Among High-Risk Groups

The Chronic Dryness Repair Market is propelled by the increasing prevalence of skin conditions associated with aging populations, diabetic patients, and autoimmune disorders such as psoriasis and eczema. In markets like the USA and Europe, diabetic-related dryness is driving sustained demand, while in Asia-Pacific, rapidly aging demographics are boosting adoption of hydration and barrier-repair products. This medically linked demand differentiates chronic dryness repair products from general moisturizers, ensuring consistent long-term market expansion.

Shift Toward Medical-Grade and Clinically Validated Formulations

Consumer demand is shifting decisively toward medical-grade and dermatologist-tested solutions, which already account for nearly 48.80% of global revenues in 2025. Unlike generic moisturizers, these formulations emphasize proven efficacy using active ingredients like urea and petrolatum at clinically relevant concentrations. Healthcare professionals increasingly recommend such products, boosting their credibility in both developed and emerging markets. This driver is particularly strong in China and India, where rising disposable incomes are fueling purchases of higher-value, medically positioned products.

High Dependence on Established Pharmacy Channels

With pharmacies/drugstores contributing 47.70% of market revenues in 2025, the sector remains heavily reliant on traditional distribution models. While effective for credibility, this dependence limits accessibility in regions where modern pharmacy infrastructure is underdeveloped. In rural Asia and Africa, fragmented retail networks reduce product penetration, constraining volume growth compared to markets with robust e-commerce ecosystems.

Price Sensitivity in Emerging Economies

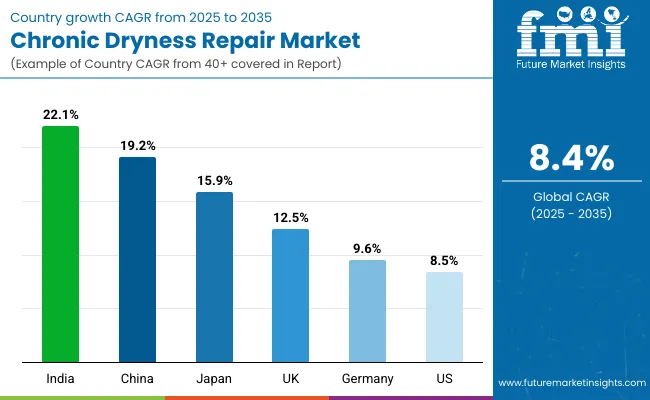

Although demand is growing rapidly in countries like India (22.1% CAGR), high product costs limit mass adoption beyond affluent consumer groups. Medical-grade and branded dermatologist-tested creams and ointments are priced at a premium, creating barriers for low-income populations who often substitute with low-cost alternatives. This price sensitivity hinders faster scale-up in large but cost-conscious markets.

Acceleration of E-commerce and Subscription-Based Skin Health Models

E-commerce platforms are rapidly reshaping distribution, especially in China and India, where online adoption is outpacing traditional channels. Brands are experimenting with subscription-based deliveries of creams and balms tailored to chronic dryness, ensuring continuous supply for patients requiring long-term management. This digital-first shift is reshaping the competitive landscape by lowering entry barriers for smaller clean-label players.

Ingredient Transparency and Personalization Driving Consumer Choice

Consumers increasingly demand ingredient transparency, preferring products with clear labeling of actives like hyaluronic acid, glycerin, and shea butter. At the same time, digital diagnostic tools are enabling personalized recommendations based on skin type, condition severity, and comorbidities like diabetes. This trend is pushing brands to integrate science-backed formulations with digital engagement, strengthening trust while differentiating their offerings in a crowded marketplace.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.2% |

| USA | 8.5% |

| India | 22.1% |

| UK | 12.5% |

| Germany | 9.6% |

| Japan | 15.9% |

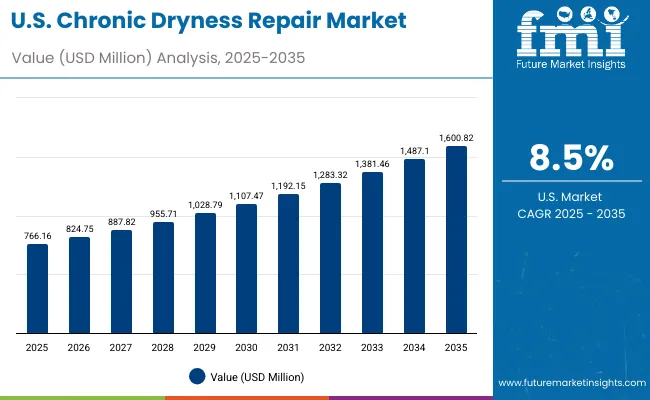

| Year | USA Chronic Dryness Repair Market (USD Million) |

|---|---|

| 2025 | 766.16 |

| 2026 | 824.75 |

| 2027 | 887.82 |

| 2028 | 955.71 |

| 2029 | 1,028.79 |

| 2030 | 1,107.47 |

| 2031 | 1,192.15 |

| 2032 | 1,283.32 |

| 2033 | 1,381.46 |

| 2034 | 1,487.10 |

| 2035 | 1,600.82 |

The Chronic Dryness Repair Market in the United States is projected to grow at a CAGR of 8.5%, led by rising diagnoses of eczema and diabetes-linked xerosis among aging adults. Medical-grade, dermatologist-tested creams dominate first-line management due to strong clinical evidence, while fragrance-free and sensitive-skin lines are expanding penetration across primary care and dermatology clinics. Pharmacies/drugstores remain the primary channel for adherence-driven regimens, with e-commerce scaling refill cycles and subscription bundles for chronic users. High-frequency usage in winter-prone regions and among psoriasis/eczema sufferers is boosting multi-pack formats and higher-value urea/petrolatum combinations.

The Chronic Dryness Repair Market in the United Kingdom is expected to grow at a CAGR of 12.5%, supported by NHS-driven guidance on emollient therapy and heightened consumer preference for fragrance-free and clean-label claims. Pharmacy chains are expanding medical-grade shelf space, while specialty retailers emphasize ingredient transparency around urea, glycerin, and hyaluronic acid. Seasonal flare-ups, indoor heating, and occupational hand dryness are driving uptake of creams and ointments with higher occlusivity. Public-private awareness campaigns on skin barrier health and diabetic foot care are improving regimen compliance and repeat purchases.

India is witnessing rapid growth in the Chronic Dryness Repair Market, which is forecast to expand at a CAGR of 22.1% through 2035. Penetration is accelerating beyond metros via pharmacies and online marketplaces, with tier-2/3 cities adopting affordable medical-grade creams and balms. A large diabetic population and rising dermatology consults are increasing demand for urea- and glycerin-based formulas, while petroleum jelly/ointment formats serve crack prevention in arid zones. Educational content and doctor-led campaigns are improving regimen literacy, shifting users from occasional moisturizers to chronic repair routines.

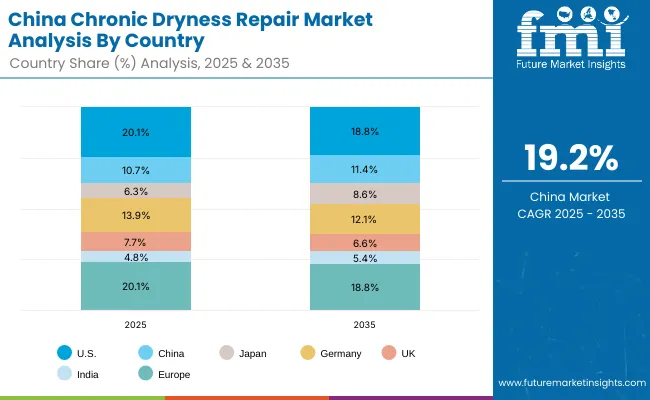

The Chronic Dryness Repair Market in China is expected to grow at a CAGR of 19.2%, the highest among leading economies. Momentum is driven by rapid e-commerce scale-up, hospital-pharmacy partnerships, and strong consumer trust in medical-grade and dermatologist-tested claims. Urban millennials and aging consumers are trading up to hyaluronic acid and urea-led creams with documented efficacy, while local brands compete on clean-label positioning and pricing. Government emphasis on chronic disease management and digital health platforms is further widening access and adherence for long-term dryness repair.

| USA by Product Type | Value Share% 2025 |

|---|---|

| Creams | 49.9% |

| Others | 50.1% |

The Chronic Dryness Repair Market in the United States is valued at USD 766.2 million in 2025, with creams leading at 49.90% share. This dominance stems from high consumer preference for cream-based formats due to their ease of use, wide availability, and dermatologist endorsement for chronic conditions such as eczema and diabetic skin dryness. Creams also align well with the USA healthcare system, where medical-grade and prescription-strength formulations are trusted for clinical efficacy.

The growth of creams is supported by strong pharmacy and drugstore distribution networks, ensuring access across both urban and suburban regions. While balms and ointments serve niche categories such as cracked skin repair, creams remain the mainstay for aging adults and chronic skin sufferers. The market’s evolution is further driven by the rising shift toward fragrance-free and dermatologist-tested claims, reinforcing consumer trust in clinically validated solutions.

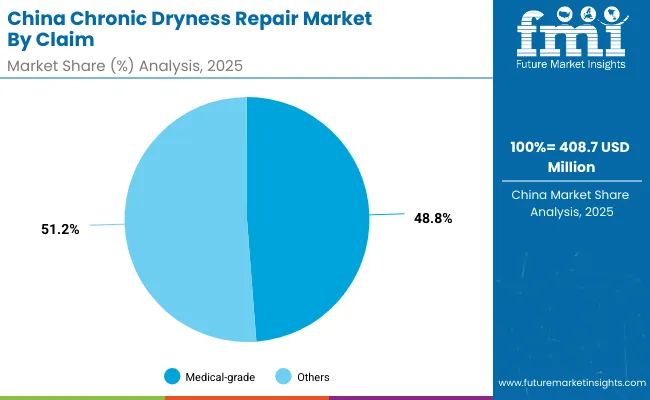

| China by Claim | Value Share% 2025 |

|---|---|

| Medical-grade | 48.8% |

| Others | 51.2% |

The Chronic Dryness Repair Market in China is valued at USD 408.7 million in 2025, with medical-grade claims leading at 48.80%. This strong positioning reflects growing consumer trust in dermatologist-tested and clinically validated products, particularly among middle- and upper-income groups in urban areas. Rising awareness of chronic skin conditions and their association with systemic health issues such as diabetes is also fueling reliance on medically oriented formulations.

E-commerce penetration plays a pivotal role in China, enabling widespread access to both global brands and local innovators. Affordable yet effective domestic solutions are gaining ground alongside premium international players, helping broaden adoption beyond top-tier cities. As healthcare spending and digital platforms continue to expand, medical-grade formulations are expected to remain the backbone of China’s chronic dryness repair market over the next decade.

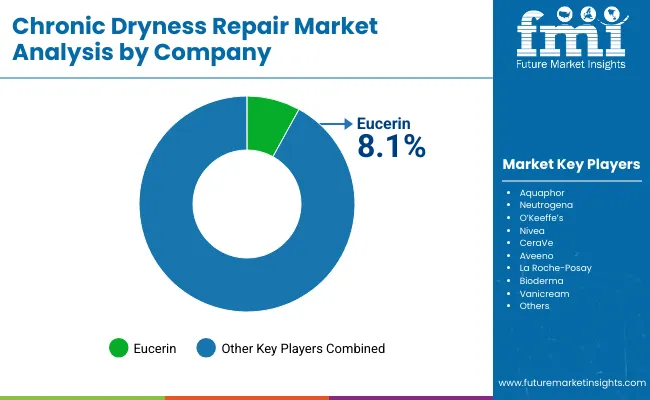

The Chronic Dryness Repair Market is moderately fragmented, with established dermatology-led skincare brands leading competition. Eucerin holds the largest global share at 8.10% in 2025, benefiting from its strong medical-grade positioning and pharmacy-led presence across both developed and emerging markets. Its portfolio, built on clinically validated formulations, continues to serve as a benchmark for chronic dryness care.

Other leading players, including Aquaphor, Neutrogena, O’Keeffe’s, Nivea, CeraVe, Aveeno, La Roche-Posay, Bioderma, and Vanicream, contribute to the remaining share. These companies emphasize differentiation through clean-label innovations, dermatologist endorsements, and targeted solutions for aging adults, diabetic patients, and eczema sufferers. Competitive dynamics are shifting toward ingredient transparency, e-commerce-driven expansion, and digital-first personalization models.

Fragmentation also opens opportunities for smaller, niche brands that specialize in fragrance-free or sensitive-skin solutions. As demand expands in high-growth markets like China and India, incumbents are intensifying efforts to adapt formulations, pricing, and distribution models. Over the next decade, competitive advantage is expected to move from sheer brand recognition to clinical credibility, digital engagement, and omnichannel accessibility.

Key Developments in Chronic Dryness Repair Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Component | Product Type: Creams, Balms, Ointments, Lotions |

| Range | Claims: Dermatologist-tested, Fragrance-free, Medical-grade, Clean-label |

| Technology | Active Ingredients: Hyaluronic acid, Urea, Shea butter, Glycerin, Petrolatum |

| Type | Functions: Intense hydration, Barrier reinforcement, Long-lasting moisturization, Crack prevention |

| End-use Industry | End Users: Aging adults, Diabetic patients, Psoriasis/eczema sufferers, General consumers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eucerin, Aquaphor, Neutrogena, O’Keeffe’s, Nivea, CeraVe, Aveeno, La Roche-Posay, Bioderma, Vanicream |

| Additional Attributes | Dollar sales by product type, claim, channel, active ingredient, and end user; adoption trends in medical-grade and dermatologist-tested formulations; rising demand for fragrance-free and clean-label products; pharmacy/drugstore vs e-commerce channel dynamics; country-level CAGR benchmarking (USA, China, India, Japan, UK, Germany); competitive share (Eucerin 8.10% in 2025); formulation advances using hyaluronic acid, urea, glycerin, petrolatum; regional shifts driven by aging demographics and diabetes prevalence. |

The Chronic Dryness Repair Market is estimated to be valued at USD 3,803.2 million in 2025.

The market size is projected to reach USD 8,501.6 million by 2035.

The market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in the Chronic Dryness Repair Market are creams, balms, ointments, and lotions.

In terms of product type, creams are expected to command 49.90% of the market share in 2025, valued at USD 1,880.8 million. In claims, medical-grade formulations are projected to lead with 48.80% share, equivalent to USD 1,842.4 million. In channel, pharmacies and drugstores are forecasted to account for 47.70% of the market, representing USD 1,804.0 million in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Sarcoidosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Market Size and Share Forecast Outlook 2025 to 2035

Chronic Skin Redness Care Market Size and Share Forecast Outlook 2025 to 2035

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Chronic Pulmonary Hypertension Treatment Market Analysis and Forecast by Drug Type, Route of Administration, Distribution Channel, Region through 2035

Chronic Smell and Flavor Loss Treatment Market – Innovations & Growth 2025 to 2035

Chronic Granulomatous Disease (CGD) Management Market – Size, Share & Trends 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Chronic Pain Market Analysis – Growth, Demand & Forecast 2024 to 2034

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Chronic Respiratory Diseases Treatment Market

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA