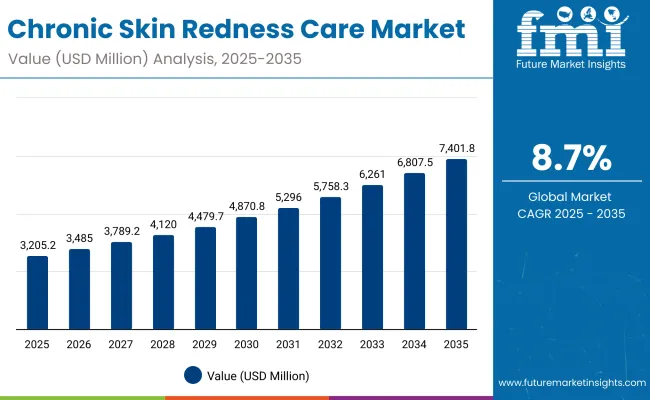

The global chronic skin redness care market has been valued at USD 3,205.20 Million in 2025, and it is projected that the industry will attain a level of USD 7,401.80 Million by 2035.This translates into an absolute increase of USD 4,196.60 Million, reflecting a market expansion of more than 2.3X over the decade.Throughout the forecast window, an annualized growth rate of 8.70% has been projected, pointing toward a durable and structurally sound demand trajectory.

Chronic Skin Redness Care Market Key Takeaways

| Metric | Value |

|---|---|

| Chronic Skin Redness Care Market Estimated Value in (2025E) | USD 3,205.20 Million |

| Chronic Skin Redness Care Market Forecast Value in (2035F) | USD 7,401.80 Million |

| Forecast CAGR (2025 to 2035) | 8.70% |

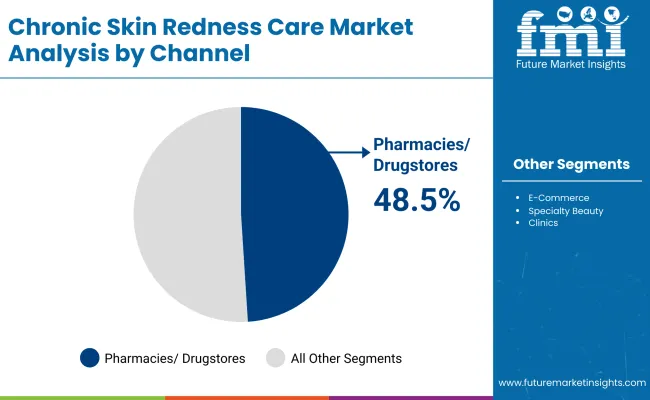

From 2025 to 2030, market revenues are anticipated to progress from USD 3,205.20 Million to USD 4,870.80 Million, which equals a gain of USD 1,665.60 Million and accounts for nearly 40% of the overall ten-year expansion.During this phase, adoption will be reinforced by heightened consumer reliance on dermatologist-tested and fragrance-free formulations, as well as broader distribution through pharmacy-driven retail ecosystems.Pharmacies/drugstores have been estimated to account for 48.50% of 2025 sales, highlighting their role as the category’s strongest trust anchor.

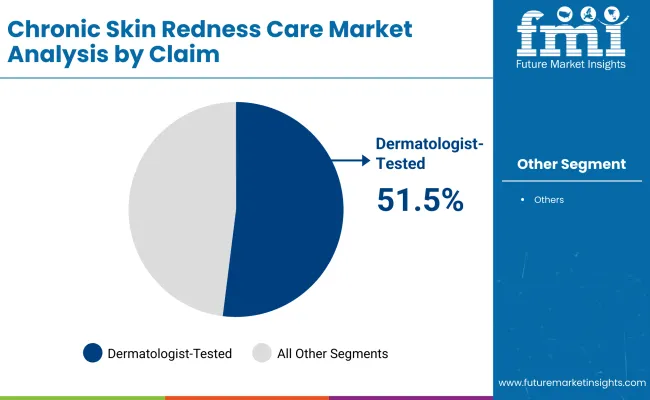

The subsequent phase from 2030 to 2035 is expected to deliver incremental growth of USD 2,531.00 Million, pushing market revenues from USD 4,870.80 Million to USD 7,401.80 Million.This second half of the decade will likely witness acceleration from Asia-Pacific, especially China and India, where CAGRs of 17.60% and 20.40%, respectively, have been indicated.Dermatologist-tested claims will remain dominant, with a 51.50% global share in 2025 (USD 1,648.50 Million), consolidating their leadership as regulatory rigor and consumer sensitivity concerns continue to intensify.

From 2020 to 2024, steady growth was recorded as consumer awareness around redness-prone skin intensified and dermatologist-approved formulations gained traction. By 2025, the market reached USD 3,205.20 Million, and it is forecast that by 2035 revenues will achieve USD 7,401.80 Million. The momentum will be anchored by Asia-Pacific, particularly China and India, where double-digit growth has been projected. Competitive positioning is expected to favor brands with robust clinical validation, pharmacist-driven education, and oMillionichannel reach. The decade ahead will likely be defined by evidence-backed claims and barrier-repair innovation, ensuring stronger consumer trust and sustained adoption.

Growth in the chronic skin redness care market is being driven by a combination of rising consumer awareness, clinical validation, and expanding access to advanced dermatological solutions. Increasing diagnosis of conditions such as rosacea and post-inflammatory redness has been paired with growing demand for dermatologist-tested and hypoallergenic formulations.

Confidence in scientifically backed claims is expected to remain a decisive purchase driver, with consumers favoring products that demonstrate measurable outcomes in redness reduction and barrier repair. Expansion of distribution through pharmacies and e-commerce platforms has been accelerating accessibility, while digital health consultations and teledermatology are anticipated to reinforce adoption across both developed and emerging regions.

Strong double-digit growth in Asia-Pacific markets such as China and India is projected to act as a catalyst, supported by rising incomes and shifting skincare priorities. With innovation focused on barrier-strengthening actives and irritation-free formulations, the market is forecast to achieve sustained momentum through 2035.

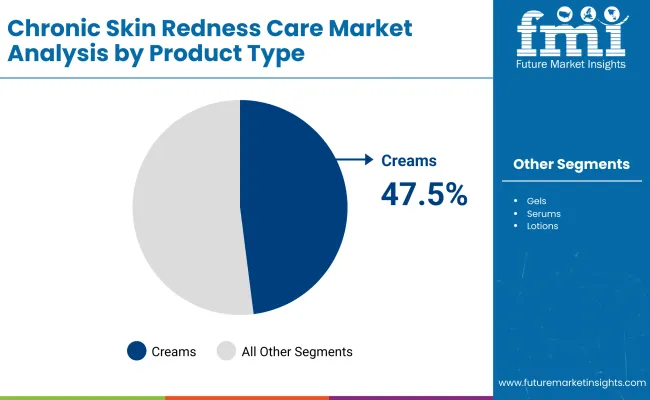

The market is segmented by claim, channel, and product type, highlighting the primary factors shaping consumer adoption and purchasing behavior. Claims include dermatologist-tested and other specialized assurances that address sensitive-skin needs. Channel classification covers pharmacies/drugstores and other outlets such as e-commerce and specialty retail, emphasizing accessibility and trust.

Based on product type, segmentation includes creams and other formats like gels, serums, and lotions, reflecting evolving consumer preferences. This structure provides clarity on how consumer trust, distribution reach, and formulation preferences are influencing the growth trajectory of the chronic skin redness care market.

| Claim | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 51.5% |

| Others | 48.5% |

Dermatologist-tested products accounted for 51.5% of the global value in 2025, equal to USD 1,648.5 million, while other claims represented 48.5% at USD 1,554.04 million. The claim-based segmentation highlights dermatologist-tested products as the most influential in shaping consumer preferences. This dominance reflects rising consumer trust in clinically validated formulations that reduce irritation risks and provide proven skin benefits.

The growing prevalence of sensitive-skin conditions and the increasing role of dermatologist recommendations are expected to reinforce this segment’s leadership throughout the forecast horizon. Other claims are projected to gain relevance as innovation continues around barrier-repair and hypoallergenic benefits. Enhanced claim substantiation and evolving regulatory scrutiny are anticipated to elevate the entire segment, with dermatologist-tested offerings remaining the benchmark for reliability and effectiveness.

| Channel | Market Value Share, 2025 |

|---|---|

| Pharmacies/drugstores | 48.5% |

| Others | 51.5% |

Pharmacies/drugstores captured 48.5% of market value in 2025, equal to USD 1,551.5 million, while other channels accounted for 51.5% at USD 1,651.16 million. Distribution channel segmentation emphasizes the critical role of pharmacies and drugstores as trusted retail points. Their importance is attributed to professional guidance, pharmacist influence, and consumer confidence in medically oriented settings.

The remaining share is driven by e-commerce and specialty retail, which are expected to expand rapidly due to digital adoption and the convenience of online consultations. Over the next decade, the balance between pharmacy-led trust and digital-first accessibility is expected to define channel evolution. Pharmacies will remain vital in regions with strong professional engagement, while e-commerce is forecast to capture a growing proportion of younger, digitally native consumers.

| Product Type | Market Value Share, 2025 |

|---|---|

| Creams | 47.5% |

| Others | 52.5% |

Other product types, including gels, serums, and lotions, held 52.5% of the market in 2025, equal to USD 1,683.54 million, while creams accounted for 47.5% at USD 1,519.2 million. Product type segmentation reflects diverse consumer preferences for formulations addressing redness-prone skin. The larger share of alternatives underscores the shift toward multifunctional and lightweight formats.

Creams, however, retain strong traction for their barrier-protective and emollient-rich properties. Innovation in sensorially elegant textures, fast absorption, and irritation-free actives is anticipated to fuel the expansion of emerging formats.

The next decade is forecast to witness stronger demand for lightweight alternatives, particularly among younger consumers seeking convenience and versatility. While creams will maintain importance as foundational care solutions, alternative product types are expected to set the pace for future growth, shaping the evolving preferences of the redness care consumer base.

The chronic skin redness care market is being reshaped by clinical rigor, shifting patient-centric expectations, and regulatory tightening, while uneven affordability and infrastructure constraints continue to challenge uniform adoption across global regions, shaping both near-term access and long-term strategic positioning.

Integration of Dermatology with Digital Health Platforms

Market expansion has been reinforced by the integration of digital health technologies into dermatology workflows. Teledermatology consultations, AI-enabled skin imaging, and mobile applications for redness tracking are enabling earlier interventions and more personalized treatment pathways. These digital bridges are expected to enhance consumer trust, while also broadening access in underserved regions where specialist dermatologists remain scarce.

Importantly, integration with electronic health records is anticipated to create longitudinal data sets that validate product efficacy, accelerating regulatory approval and positioning validated regimens for sustained adoption. This digital-health convergence is shaping a future where product recommendations are embedded in remote care journeys, making the segment more resilient against geographic barriers.

Regulatory Fragmentation Across Jurisdictions

Global expansion has been constrained by fragmented regulatory environments governing cosmetic-therapeutic boundaries. Markets differ in how redness care is classified-ranging from cosmetic to quasi-drug status-leading to variations in permissible claims, testing requirements, and distribution rights.

This inconsistency increases compliance costs, delays product launches, and complicates cross-border marketing strategies. Smaller companies are disproportionately affected, as they often lack the resources to navigate diverse regulatory frameworks. As governments intensify scrutiny around “clinically tested” or “dermatologist approved” labels, inconsistencies are likely to persist, slowing harmonization. Unless regional alignment improves, innovation speed and global scaling may be dampened, forcing companies to adopt localized, fragmented go-to-market strategies.

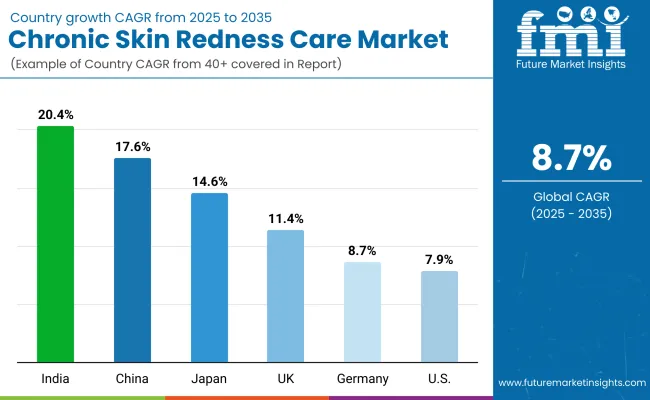

| Country | CAGR |

|---|---|

| China | 17.6% |

| USA | 7.9% |

| India | 20.4% |

| UK | 11.4% |

| Germany | 8.7% |

| Japan | 14.6% |

The chronic skin redness care market demonstrates varied country-level growth trajectories, reflecting differences in healthcare access, dermatology density, consumer awareness, and regulatory frameworks. Asia-Pacific is emerging as the fastest-growing region, anchored by India at a projected CAGR of 20.4% and China at 17.6%. India’s trajectory is being shaped by greater consumer education on skin sensitivity, expanding dermatology clinics, and affordability-driven adoption of pharmacist-recommended products.

In China, double-digit growth is being reinforced by the rapid rise of dermocosmetics, Million channel retail strength, and integration of teledermatology into mainstream care. Japan is forecast to expand at 14.6%, where aging populations and high skincare awareness are expected to sustain demand for advanced formulations with clinical substantiation.

Europe shows steady momentum, with Germany at 8.7%, the UK at 11.4%, and the region overall at 8.2%. Growth here is being supported by heightened regulatory requirements for product claims, dermatologist endorsements, and consumer preference for evidence-based solutions. North America remains a mature yet expanding market, with the USA projected at 7.9% CAGR, reflecting entrenched consumer trust in dermatologist-tested brands and ongoing premiumization of skincare portfolios. These dynamics illustrate that while Asia is driving scale through rapid adoption, Europe and North America continue to provide stability through regulatory rigor and established clinical frameworks.

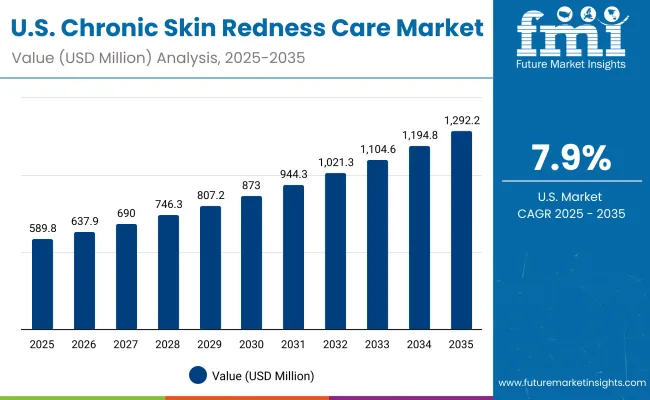

| Year | USA Chronic Skin Redness Care Market (USD Million) |

|---|---|

| 2025 | 589.85 |

| 2026 | 637.97 |

| 2027 | 690.03 |

| 2028 | 746.32 |

| 2029 | 807.22 |

| 2030 | 873.07 |

| 2031 | 944.31 |

| 2032 | 1,021.35 |

| 2033 | 1,104.68 |

| 2034 | 1,194.81 |

| 2035 | 1,292.29 |

The chronic skin redness care market in the United States is projected to expand at a CAGR of 8.16% from 2025 to 2035. This reflects steady growth supported by heightened awareness of skin sensitivity, reinforced clinical validation, and the trusted role of pharmacies and drugstores as primary distribution channels. Dermatologist endorsements are expected to strengthen consumer confidence, while e-commerce expansion will enhance accessibility for younger, digitally native consumers.

Innovation in barrier-repair actives, fragrance-free solutions, and hypoallergenic formulations is anticipated to sustain long-term category resilience. Regulatory scrutiny around clinical claims will elevate competitive standards, favoring brands with robust scientific validation. The decade ahead is forecast to see sustained momentum, with the USA market reaching a value of USD 1,292.29 million by 2035.

Dermatologist-tested formulations will remain the leading claim driving consumer adoption. Pharmacies and drugstores are projected to anchor credibility and consumer trust. Digital platforms will accelerate uptake among younger demographics seeking accessible redness care solutions.

A CAGR of 11.4% has been projected for the UK chronic skin redness care market through 2035. Expansion is expected to be supported by strong pharmacist engagement, high dermatology access, and widening insurance coverage for specialist consultations. Premium dermocosmetics are anticipated to benefit from rigorous claim scrutiny, with dermatologist-tested propositions likely to command shelf leadership.

OMillioni-channel alignment-linking pharmacy credibility with digital advice journeys-is forecast to compress trial friction and raise regimen adherence. Ingredient transparency and low-irritancy profiles are expected to be emphasized as regulatory guidance tightens around sensitivity and fragrance disclosures.

A CAGR of 20.4% has been forecast for India, indicating the fastest trajectory among key markets. Scale is expected to come from urban pharmacy expansion, rapid dermatologist density growth, and affordability-focused pack-price architectures. Digital dermatology and vernacular education are anticipated to widen access beyond metros, guiding consumers toward clinically validated, low-irritancy regimens.

Local manufacturing and agile formulation for humid climates are expected to accelerate adoption while preserving price competitiveness. Partnerships between pharma distributors and beauty retailers are projected to increase reach into Tier-2/3 cities.

A CAGR of 17.6% has been anticipated for China through 2035. Growth is expected to be propelled by dermocosmetics mainstreaming, KOL-driven clinical education, and advanced O2O models that fuse e-commerce with pharmacist consultation. Category development is projected to benefit from stricter platform policing of efficacy claims, pushing brands toward quantifiable redness-reduction outcomes.

Channel balance between pharmacies/drugstores and online marketplaces is expected to remain tight, with subscriptions and replenishment programs improving lifetime value. Cross-border compliance and local filing acceleration are anticipated to speed innovation cycles.

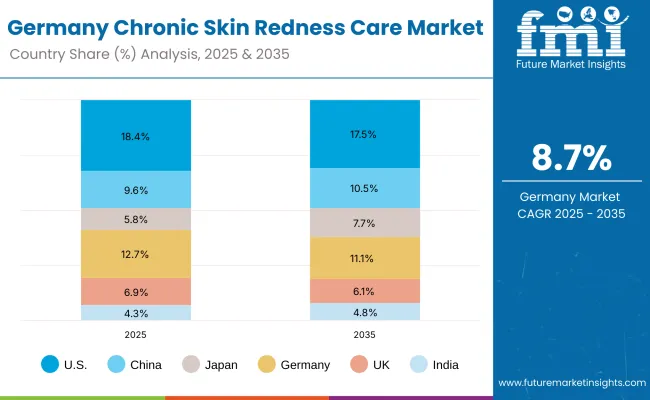

| Country | 2025 |

|---|---|

| USA | 18.4% |

| China | 9.6% |

| Japan | 5.8% |

| Germany | 12.7% |

| UK | 6.9% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 17.5% |

| China | 10.5% |

| Japan | 7.7% |

| Germany | 11.1% |

| UK | 6.1% |

| India | 4.8% |

A CAGR of 8.7% has been projected for Germany, reflecting steady, compliance-led expansion. Pharmacy dominance is expected to persist as dermatologist referrals and pharmacist counseling guide product choices for sensitive-skin cohorts. Regulatory rigor around hypoallergenic and fragrance disclosures is anticipated to reinforce demand for dermatologist-tested, barrier-supportive formulations.

Incremental growth is expected from aging demographics and higher willingness to pay for clinically proven redness attenuation. Digitally enabled adherence programs and insurer partnerships are projected to support continuity of care.

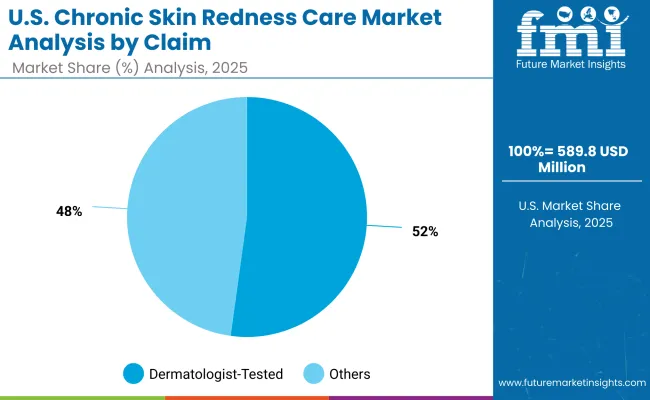

| USA by Claim | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 52.2% |

| Others | 47.8% |

The chronic skin redness care market in the USA is projected at USD 589.85 million in 2025. Dermatologist-tested formulations contribute 52.2% of this value, equal to USD 308.0 million, while other claims account for 47.8%, or USD 281.82 million. This slight dominance of dermatologist-tested products underscores the importance of professional validation and clinical credibility in consumer purchase decisions. Growing reliance on dermatologist guidance, both through in-person consultations and teledermatology platforms, is expected to amplify the influence of evidence-backed claims.

Other claims, while slightly smaller, are anticipated to expand as innovation accelerates in fragrance-free, hypoallergenic, and barrier-repair categories. With consumer sensitivity concerns rising, brands leveraging transparent ingredient disclosure and proof of tolerability are expected to compete effectively.

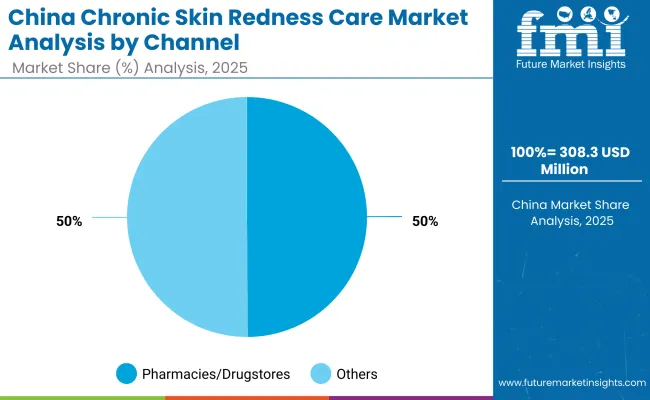

| China by Channel | Market Value Share, 2025 |

|---|---|

| Pharmacies/drugstores | 49.9% |

| Others | 50.1% |

The chronic skin redness care market in China is projected at USD 308.39 million in 2025. Pharmacies and drugstores contribute 49.9% of this value, equal to USD 153.8 million, while other channels, including e-commerce and specialty retail, hold a slightly higher share of 50.1%, equal to USD 154.57 million.

This near-equal distribution highlights China’s unique dual-channel strength, where offline credibility and online convenience operate in parallel. Pharmacies are expected to remain central in consumer trust-building through professional pharmacist counseling, particularly for first-time users of dermocosmetics.

At the same time, online platforms are anticipated to strengthen their lead through live-commerce, subscription models, and AI-driven skin diagnostics that increase consumer engagement. The close channel balance suggests future market competition will hinge on oMillioni-channel integration, where seamless movement between online discovery and offline validation will define leadership.

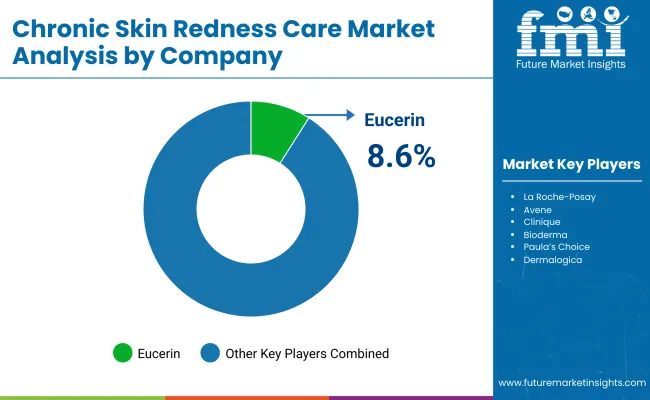

| Company | Global Value Share 2025 |

|---|---|

| Eucerin | 8.6% |

| Others | 91.4% |

The chronic skin redness care market is moderately fragmented, with multinational dermocosmetic leaders, established skincare specialists, and regionally focused brands competing for share. Eucerin has emerged as the leading player globally, holding 8.6% of value share in 2025, while the remainder of the market is distributed among multiple international and local brands, collectively representing 91.4%. Strategic differentiation has been increasingly anchored in dermatologist-tested claims, barrier-repair innovation, and transparent ingredient disclosure.

Eucerin’s leadership has been reinforced by its dermatologist-backed positioning and consistent clinical validation, which continue to appeal to redness-prone and sensitive-skin consumers worldwide. Other global brands such as La Roche-Posay, Avene, Clinique, and Bioderma have been advancing through pharmacy-driven trust and oMillioni-channel distribution strategies, while emerging players like Paula’s Choice and CeraVe are gaining relevance through digital-first campaigns and affordable dermatologist-tested offerings.

Competitive dynamics are expected to shift further as regulatory scrutiny intensifies, pushing brands to invest in clinical trials, measurable redness reduction outcomes, and digital dermatologist engagement. Long-term advantage will be defined less by broad product portfolios and more by evidence-backed differentiation, adherence to claim substantiation standards, and consumer-centric ecosystem strategies that blend offline credibility with online accessibility.

Key Developments in Chronic Skin Redness Care Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million (nominal) |

| Market Value | USD 3,205.20 Million (2025); USD 7,401.80 Million (2035) |

| Growth Rate | 8.70% CAGR (2025 to 2035) |

| Time Horizon | 2025 to 2035 (annual forecasts) |

| Component/Claims | Dermatologist-tested, Others |

| Product Type | Creams, Others (e.g., gels, serums, lotions) |

| Channel | Pharmacies/drugstores, Others (e.g., e-commerce, specialty beauty, clinics) |

| Leading Segments (2025) | Dermatologist-tested 51.50% (USD 1,648.50 Million ); Pharmacies/drugstores 48.50% (USD 1,551.50 Million ); Creams 47.50% (USD 1,519.20 Million ) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered (spotlight) | United States, China, India, Japan, Germany, United Kingdom |

| Country Growth Indicators (CAGR 2025 to 2035) | India 20.40%; China 17.60%; Japan 14.60%; UK 11.40%; Germany 8.70%; USA 7.90% |

| Key Companies Profiled | Eucerin, La Roche-Posay, Avene, Clinique, Bioderma, Paula’s Choice, CeraVe, Vanicream, Dermalogica, Murad |

| Competitive Concentration | Eucerin 8.60% global value share (2025); Others 91.40% |

| USA Snapshot (2025) | USD 589.85 Million ; Claims split-Dermatologist-tested 52.20% (USD 308.00 Million ), Others 47.80% (USD 281.82 Million ) |

| China Channel Snapshot (2025) | Pharmacies/drugstores 49.90% (USD 153.80 Million ); Others 50.10% (USD 154.57 Million ) |

| Additional Attributes | Dollar sales by claim/channel/product type; regulatory tightening on claim substantiation; teledermatology-enabled guidance; barrier-repair and low-irritancy innovation; o Million i-channel integration (pharmacy + e-commerce); subscription/replenishment programs; pharmacist advocacy; ingredient transparency and microbiome-friendly positioning |

The global Chronic Skin Redness Care Market is estimated to be valued at USD 3,205.20 million in 2025.

The market size for the Chronic Skin Redness Care Market is projected to reach USD 7,401.80 million by 2035.

The Chronic Skin Redness Care Market is expected to grow at a CAGR of 8.70% between 2025 and 2035.

The key product types in the Chronic Skin Redness Care Market are creams and other formats such as gels, serums, and lotions.

In terms of claims, the dermatologist-tested segment is projected to command 51.50% share in the Chronic Skin Redness Care Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Sarcoidosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Market Size and Share Forecast Outlook 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Chronic Pulmonary Hypertension Treatment Market Analysis and Forecast by Drug Type, Route of Administration, Distribution Channel, Region through 2035

Chronic Smell and Flavor Loss Treatment Market – Innovations & Growth 2025 to 2035

Chronic Granulomatous Disease (CGD) Management Market – Size, Share & Trends 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Chronic Pain Market Analysis – Growth, Demand & Forecast 2024 to 2034

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Chronic Respiratory Diseases Treatment Market

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA