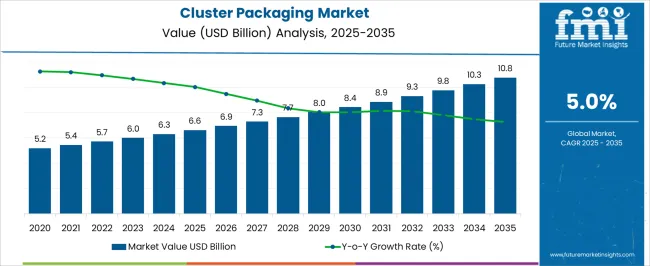

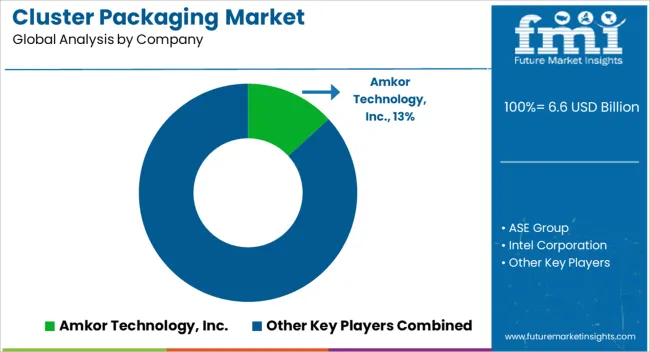

The Cluster Packaging Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 10.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Cluster Packaging Market Estimated Value in (2025 E) | USD 6.6 billion |

| Cluster Packaging Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Cluster Packaging market is witnessing steady growth due to its increasing adoption across food and beverage, consumer goods, and industrial sectors. Rising demand for sustainable and lightweight packaging solutions is driving manufacturers to prioritize eco-friendly materials and cost-efficient formats. Cluster packaging offers superior handling, storage, and transportation benefits, which makes it a preferred choice among producers and retailers.

Increasing consumption of packaged beverages, ready-to-eat meals, and consumer convenience products is accelerating the use of this format. Sustainability concerns are encouraging the use of recyclable and biodegradable materials, particularly paper-based options, while manufacturers are integrating digital printing and automation technologies to improve design and efficiency. The demand for multipack formats is also expanding as retail chains and e-commerce platforms push for bulk sales and consumer value packs.

Additionally, strict environmental regulations and corporate commitments toward reducing plastic waste are further propelling innovation in cluster packaging solutions As industries focus on cost optimization and brand differentiation, the market is positioned for long-term expansion supported by evolving consumer preferences and regulatory frameworks.

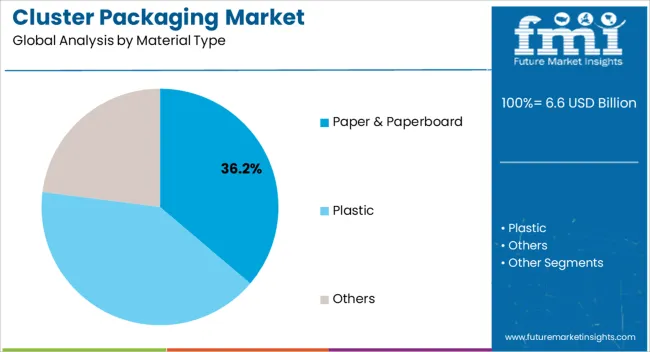

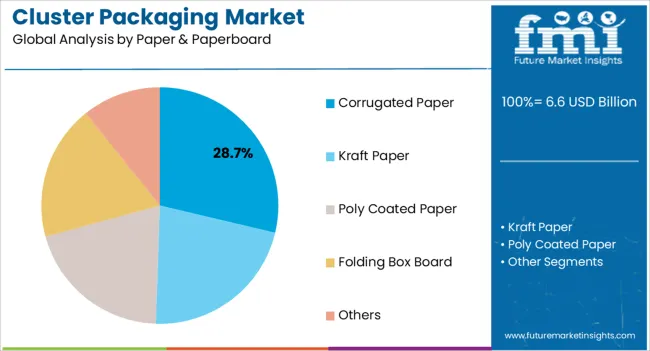

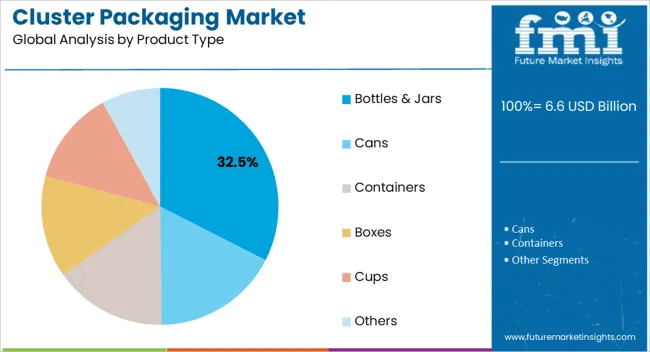

The cluster packaging market is segmented by material type, paper & paperboard, product type, packaging style, number of tiers, end-use, and geographic regions. By material type, cluster packaging market is divided into Paper & Paperboard, Plastic, and Others. In terms of paper & paperboard, cluster packaging market is classified into Corrugated Paper, Kraft Paper, Poly Coated Paper, Folding Box Board, and Others. Based on product type, cluster packaging market is segmented into Bottles & Jars, Cans, Containers, Boxes, Cups, and Others. By packaging style, cluster packaging market is segmented into Neck-Through Style, Over The Top Style, Handle Based Style, Cluster Sleeve Style, Cluster Side Style, and Others. By number of tiers, cluster packaging market is segmented into Single Tier Cluster Packaging and Multiple Tier Cluster Packaging. By end-use, cluster packaging market is segmented into Food, Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Industrial Goods, and Others. Regionally, the cluster packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper and paperboard material type segment is projected to account for 36.2% of the Cluster Packaging market revenue in 2025, positioning it as the leading material category. Growth is being supported by the increasing global shift toward recyclable and biodegradable packaging options that align with sustainability goals. Paper and paperboard materials provide cost-effectiveness, lightweight handling, and versatility, making them highly suitable for multipack formats.

Their ease of printing also supports brand visibility through attractive designs and marketing messages. Consumer awareness regarding the environmental impact of plastic packaging is driving demand for renewable paper-based solutions. Food and beverage companies are increasingly adopting these materials to meet both consumer expectations and regulatory compliance requirements.

The ability of paperboard to maintain structural integrity while offering flexibility in design is further supporting adoption across a wide range of applications As sustainability becomes a key purchase driver, paper and paperboard are expected to continue leading the material type category in the Cluster Packaging market.

The corrugated paper product type segment is expected to capture 28.7% of the Cluster Packaging market share in 2025, emerging as the largest product type. This dominance is driven by the strength, durability, and lightweight properties of corrugated paper, which make it ideal for protecting goods during transportation and storage. Corrugated formats are widely used across food, beverage, and consumer goods industries, offering cost-effective multipack solutions.

The rising e-commerce sector is further fueling demand, as corrugated paper provides excellent stacking and load-bearing capabilities while remaining recyclable and eco-friendly. Manufacturers are leveraging advanced printing technologies to enhance the aesthetic appeal of corrugated packaging, adding value to brand marketing strategies.

The versatility of corrugated formats enables adaptation across bottles, jars, cans, and cartons, making it highly flexible for diverse packaging needs As sustainability initiatives gain momentum and companies seek durable yet environmentally responsible packaging solutions, corrugated paper is set to maintain its strong presence in the market, supported by broad adoption across industries.

The bottles and jars product type segment is projected to hold 32.5% of the Cluster Packaging market revenue in 2025, making it the leading application format. This leadership is being driven by the rising consumption of beverages, sauces, dairy products, and personal care items that are typically packaged in bottles and jars. Cluster packaging for bottles and jars provides superior convenience in transportation, retail display, and consumer handling, making it an essential solution for manufacturers.

The format also offers strong marketing advantages, as cluster packs allow for easy multipack promotions and value offerings. Sustainability considerations are further influencing design innovations, with recyclable paperboard and lightweight materials increasingly used in cluster packs for bottles and jars.

The growing expansion of e-commerce and retail distribution channels is also fueling demand, as multipacks simplify logistics and reduce costs As beverage and personal care consumption continues to rise globally, bottles and jars remain the most significant end-use product type within cluster packaging, ensuring their leadership position in the market.

Packaging plays a crucial role in maintaining the safety of products. The development of end user sectors such as FMGC, electronic, health supplements and personal care products is driving the demand for unique packaging that helps in keeping the product safe.

Moreover, the launch of chemically-induced products along with organic products is driving the demand for cluster packaging. The chances of the product getting damaged are high. This, in turn, has increased the demand for safe and reliable packaging of products.

The growth of cluster packaging market can be attributed to the safety it provides along with the convenience it offers consumers for carrying products. Cluster packaging products such as cans, jars, containers, cups and boxes ensure that the product does not spill or be harmed by external factors.

This had led to the wide adoption of cluster packaging for various products. Furthermore, cluster packaging manufacturers are maximizing sales opportunities owing to the sustainable nature of certain cluster packaging products.

Future Market Insights states that the convenience of carrying products in bulk is favoring the growth of cluster packaging. Most consumers are investing in products that are packaged in larger quantities. This, in turn, reduces the number of times they have to buy the same product and helps in storing goods for a longer duration.

The material used for cluster packaging such as kraft paper, poly coated paper or folding box is another reliant factor of cluster packaging accelerating the growth of the market.

The advantages associated with cluster packaging are positively influencing the growth of the market.

In the upcoming years, the role of packaging products will become essential as consumers are becoming more aware of the impact their choices have on the planet. Moreover, cluster packaging not only promises but also delivers on saving material and packaging products in bulk, making it a desirable and dependable option.

Cost-effective packaging along with flexible packaging is a sustainable trend in the packaging industry. This has led to manufacturers reinventing the current style of packaging and changing the same to cater to the need of end user industries.

From liquid products to ointments and creams, the nature of packaging varies for every end user industry. But, with the cluster packaging industry undergoing drastic changes, the dependency on the same is expected to increase in the future.

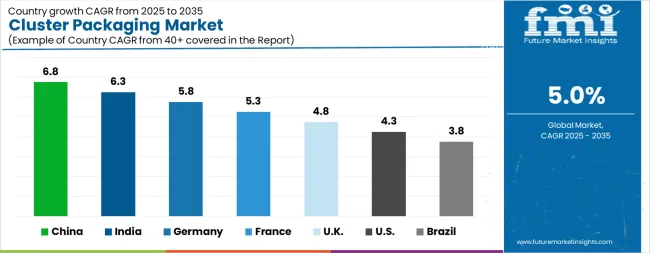

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The Cluster Packaging Market is expected to register a CAGR of 5.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.8%, followed by India at 6.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Cluster Packaging Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.8%. The USA Cluster Packaging Market is estimated to be valued at USD 2.5 billion in 2025 and is anticipated to reach a valuation of USD 3.7 billion by 2035. Sales are projected to rise at a CAGR of 4.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 348.7 million and USD 215.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Material Type | Paper & Paperboard, Plastic, and Others |

| Paper & Paperboard | Corrugated Paper, Kraft Paper, Poly Coated Paper, Folding Box Board, and Others |

| Product Type | Bottles & Jars, Cans, Containers, Boxes, Cups, and Others |

| Packaging Style | Neck-Through Style, Over The Top Style, Handle Based Style, Cluster Sleeve Style, Cluster Side Style, and Others |

| Number Of Tiers | Single Tier Cluster Packaging and Multiple Tier Cluster Packaging |

| End-Use | Food, Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Industrial Goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amkor Technology, Inc., ASE Group, Intel Corporation, Samsung Electronics Co., Ltd., TSMC (Taiwan Semiconductor Manufacturing Company), Texas Instruments Incorporated, STMicroelectronics N.V., Broadcom Inc., Qualcomm Incorporated, NXP Semiconductors N.V., Infineon Technologies AG, Renesas Electronics Corporation, Micron Technology, Inc., and SK Hynix Inc. |

The global cluster packaging market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the cluster packaging market is projected to reach USD 10.8 billion by 2035.

The cluster packaging market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cluster packaging market are paper & paperboard, plastic and others.

In terms of paper & paperboard, corrugated paper segment to command 28.7% share in the cluster packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cluster Packaging for Beer Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Cluster Packaging for Beer Suppliers

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA