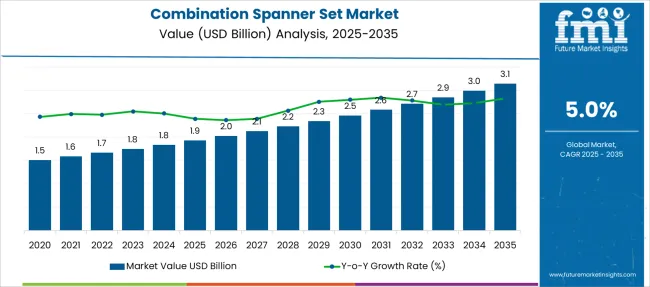

The Combination Spanner Set Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Combination Spanner Set Market Estimated Value in (2025E) | USD 1.9 billion |

| Combination Spanner Set Market Forecast Value in (2035F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

Rising industrial activities and the need for efficient toolkits to support machinery maintenance have contributed to market expansion. Consumer preferences have shifted towards versatile spanner sets that offer both ratcheting and fixed functionalities, improving work efficiency.

Advances in manufacturing processes have enhanced product durability and precision, driving preference for high-quality tools. Furthermore, growth in small and medium enterprises and DIY home improvement trends has widened the customer base.

The market is expected to grow as product innovations focus on ergonomic designs and corrosion-resistant materials. Segmental growth is anticipated to be led by ratchet combination spanners, medium-sized sets, and chrome vanadium as the preferred material due to its strength and durability.

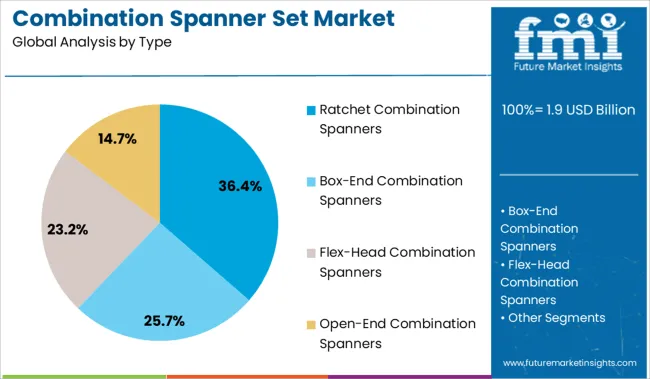

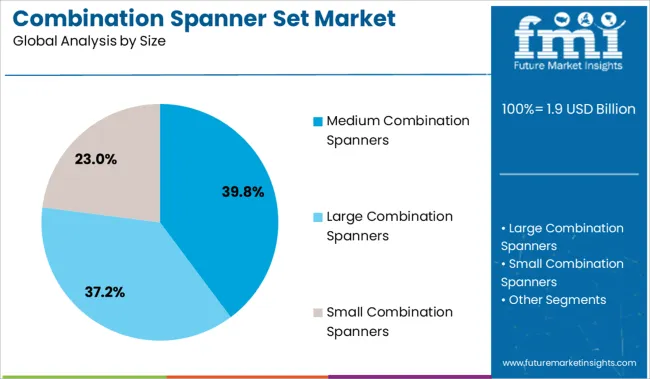

The market is segmented by Type, Size, Material, End Use, and Distribution Channel, and region. By Type, the market is divided into Ratchet Combination Spanners, Box-End Combination Spanners, Flex-Head Combination Spanners, and Open-End Combination Spanners. In terms of Size, the market is classified into Medium Combination Spanners, Large Combination Spanners, and Small Combination Spanners.

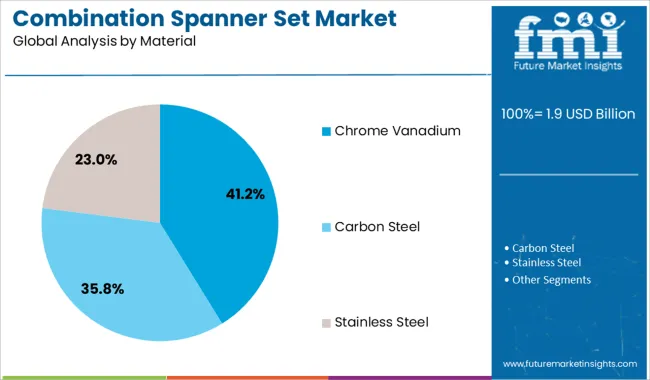

Based on Material, the market is segmented into Chrome Vanadium, Carbon Steel, and Stainless Steel. By End Use, the market is divided into the Automotive Industry, the Construction Industry, Home Use/DIY, and the Manufacturing Industry. By Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ratchet combination spanners segment is expected to hold 36.4% of the market revenue in 2025 due to their ability to provide continuous motion without removing the tool from the fastener. This feature enhances work speed and efficiency, making these spanners favored in professional and industrial settings. The segment benefits from innovations that improve ratchet mechanism durability and smoothness.

Users prioritize tools that reduce fatigue and allow operation in tight spaces.

As industries focus on productivity and tool reliability, ratchet combination spanners continue to be widely adopted.

Medium combination spanners are projected to contribute 39.8% of the market revenue in 2025. These sizes cater to the most commonly used fasteners in automotive and machinery maintenance, offering versatility across various applications. The balance between maneuverability and torque application has made medium-sized spanners popular among both professionals and hobbyists.

Product designs often emphasize ergonomic handles and weight optimization for user comfort.

The prevalence of medium-sized fasteners in manufacturing and repair tasks ensures consistent demand for this segment.

Chrome vanadium is projected to hold 41.2% of the market revenue in 2025, favored for its excellent strength and resistance to wear and corrosion. This material provides durability under high torque conditions and extends the lifespan of spanner sets. Manufacturing processes using chrome vanadium ensure precision and reliability, which are critical for safety and performance.

The material’s cost-effectiveness and widespread availability contribute to its popularity.

As users demand longer-lasting tools that maintain performance under harsh conditions, chrome vanadium remains the preferred choice for combination spanners.

Rising DIY home repairs, industrial maintenance activity, and auto service needs are boosting combination spanner set demand. Opportunities lie in modular designs, ergonomic tools, rental partnerships, and expansion via e-commerce and tool libraries.

Combination spanner sets are increasingly popular as individuals, workshops, and service centers need reliable tools for routine maintenance, machinery servicing, and vehicle repair. Growing interest in home improvement, small engine maintenance, and domestic fabrication projects is fueling adoption. Industrial clients from manufacturing plants to logistics fleets depend on durable spanner sets for bolt tightening, leak checks, and equipment servicing. Offers that include both imperial and metric sizes, along with chrome vanadium steel and corrosion-resistant finishes, appeal across user segments. Growing interest in gear maintenance for motorcycles, bicycles, and machinery also supports awareness. Affordable starter kits and brand recognition through tool vending machines, repair shops, and hardware retailers continue to boost demand in both hobbyist and professional markets.

Opportunities exist in designing modular combination spanner sets with interchangeable heads, compact storage cases, and interchangeable size adapters. Ergonomic features like slim handles, torque markers, and lightweight alloys can attract users concerned with comfort and efficiency. E-commerce platforms and tool rental services provide access in markets lacking physical tool retail stores. Cooperative marketing with mechanic garages, hardware stores, and vocational training centers can expand reach and trust. Offering prepaid rental or subscription plans enables contractors and occasional users to access premium sets without purchasing outright. Expansion into emerging regions and rural populations with bundling options such as starter kits or vehicle-specific collections—can tap untapped customer segments. Strong after-sales warranties and accessory add-ons contribute to loyalty and repeat sales.

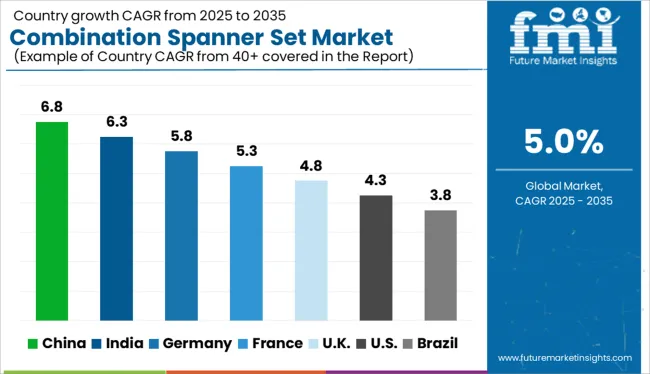

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global combination spanner set market is forecasted to grow at a CAGR of 5.0% from 2025 to 2035, driven by rising industrial maintenance needs, DIY tool adoption, and growth in automotive and construction sectors. Among BRICS nations, China leads with a 6.8% CAGR, backed by expansive manufacturing capacity, global exports, and robust aftermarket tool demand. India follows at 6.3%, supported by small-scale industrialization, infrastructure development, and the Make in India initiative. Within the OECD group, Germany shows healthy growth at 5.8%, owing to demand for precision tools in automotive engineering and industrial servicing. The United Kingdom (4.8%) and the United States (4.3%) reflect mature market dynamics, with steady demand through hardware retail and professional-grade tool upgrades. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The combination spanner set market in China is projected to expand at a CAGR of 6.8%, fueled by strong industrial growth, booming manufacturing clusters, and widespread workshop automation. Domestic toolmakers are scaling up exports while also catering to rising demand from automotive service centers and construction firms. Smart factories and heavy machinery maintenance facilities are driving adoption of metric spanner sets with advanced torque durability. E-commerce penetration is deepening market reach among SMEs, where price-performance balance is key. Online platforms are also enabling custom kit bundling based on job-type preferences.

In India, market for combination spanner sets is projected to grow at a CAGR of 6.3%, supported by infrastructure development, automotive servicing growth, and SME-led industrialization. Tier 2 cities are witnessing surging demand for standardized toolkits, especially in machine repair shops and civil engineering firms. Indian technicians often prefer chrome-vanadium alloy sets for durability and affordability. Government schemes aimed at boosting local manufacturing are also encouraging tool upskilling and bulk purchasing for training centers and technical institutes. Import substitution policies are stimulating local tool production capacity.

Combination spanner set market in Germany is estimated to grow at a CAGR of 5.8%, led by demand in automotive engineering, aerospace tooling, and mechanical assembly. High-precision tool preferences dominate, with torque consistency, finish quality, and DIN compliance being critical purchase drivers. Professional users in industrial zones favor anti-slip open-end designs and laser-etched size markings for visibility. German buyers typically opt for complete tool cabinets that include modular spanner sets as core components. Sustainability regulations are also pushing interest in recyclable steel tools with extended service life.

The combination spanner set market in the United Kingdom is expected to grow at a CAGR of 4.8%, as maintenance services expand across infrastructure, transportation, and renewable energy. Technicians across rail, EV, and construction sectors are seeking ergonomic, corrosion-resistant spanners for field jobs. Online retailers and tool specialists are increasingly offering bundled sets tailored to trade-specific needs. Post-Brexit shifts in sourcing have led to greater interest in European-made and certified tools. UK apprenticeships in trades and maintenance are also driving entry-level demand for branded, standardized toolkits.

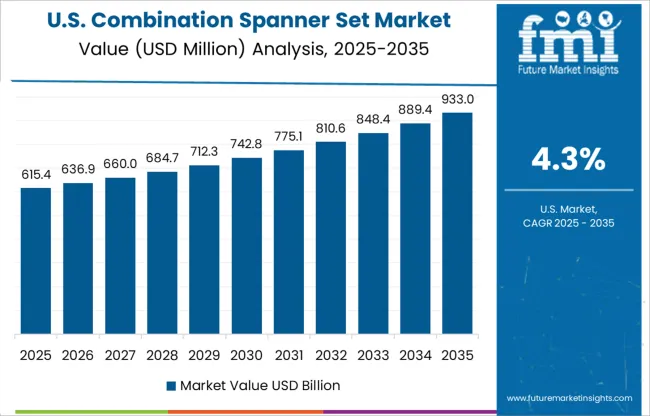

The United States market is projected to grow at a CAGR of 4.3%, with steady demand coming from residential contractors, automotive garages, and energy sector technicians. Metric and SAE dual sets are increasingly preferred to support cross-platform tool compatibility. Consumers value drop-forged, chrome-plated spanners for home use and DIY kits. Professional-grade purchases are often channeled through wholesale distributors, where quality assurance and lifetime replacement guarantees influence buying decisions. Tool subscription boxes and mobile jobsite kits are also gaining traction across service fleets and independent technicians.

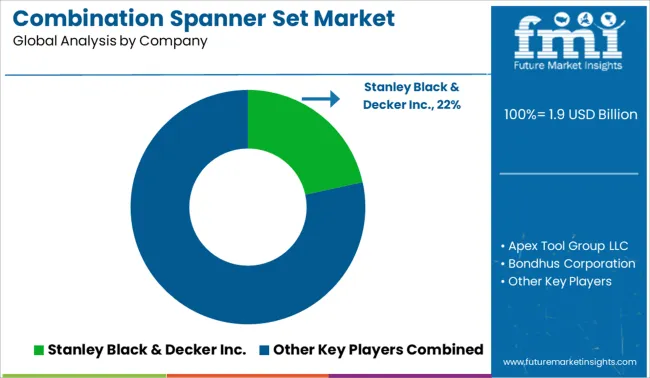

The combination spanner set market is moderately fragmented, featuring a mix of global tool manufacturers and specialty hand tool brands competing on quality, durability, and brand loyalty. Tier 1 companies like Stanley Black & Decker Inc., Snap-on Inc., and Apex Tool Group lead with extensive product portfolios, strong distribution networks, and an established presence in both professional and DIY segments. Stanley Black & Decker holds the top share at 21.6%, backed by its global reach and trusted sub-brands such as DeWalt and Proto. Tier 2 players, including Facom SAS, Mac Tools, and Wera Werkzeuge, focus on precision engineering and ergonomic design, appealing to automotive and industrial users. Tier 3 brands like Bondhus, Sunex Tools, and Wiha serve value-conscious markets with reliable, cost-effective offerings. Market growth is supported by rising demand for hand tools in construction, manufacturing, and maintenance applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Ratchet Combination Spanners, Box-End Combination Spanners, Flex-Head Combination Spanners, and Open-End Combination Spanners |

| Size | Medium Combination Spanners, Large Combination Spanners, and Small Combination Spanners |

| Material | Chrome Vanadium, Carbon Steel, and Stainless Steel |

| End Use | Automotive Industry, Construction Industry, Home Use/DIY, and Manufacturing Industry |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stanley Black & Decker Inc., Apex Tool Group LLC, Bondhus Corporation, Cromwell Group Holdings Ltd., Facom SAS, Hillman Group Inc., Klein Tools Inc., Mac Tools, Matco Tools Corporation, Proto Industrial Tools, Snap-on Inc., Sunex Tools Inc., Wera Werkzeuge GmbH, Wiha Tools Ltd., and Wright Tool Company |

| Additional Attributes | Dollar sales by material type (chrome vanadium, carbon steel, stainless steel), size range (metric, imperial, mixed), and end-user segment (automotive repair, industrial maintenance, household use, professional workshops); regional demand patterns influenced by DIY trends, industrial tooling standards, and automotive servicing rates; product innovation in corrosion resistance, ergonomic grip, and torque performance; distribution channel dynamics across online platforms, hardware chains, and B2B suppliers; environmental impact of raw material sourcing and packaging; and emerging use cases in precision mechanical assembly and modular toolkits. |

The global combination spanner set market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the combination spanner set market is projected to reach USD 3.1 billion by 2035.

The combination spanner set market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in combination spanner set market are ratchet combination spanners, box-end combination spanners, flex-head combination spanners and open-end combination spanners.

In terms of size, medium combination spanners segment to command 39.8% share in the combination spanner set market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Combination Kinase Inhibitor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Combination Antihypertensive Agents Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Setting Spray Market Growth – Demand, Trends & Forecast 2025 to 2035

AI-Powered Smart Set-Top Boxes – Future of Home Entertainment

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Asset-Based Lending Market Size and Share Forecast Outlook 2025 to 2035

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Asset Financing Platform Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Asset Tags Sector

Asset Management System Market

Asset And Liability Management Solutions Market

Offset Ink Market Size and Share Forecast Outlook 2025 to 2035

Sunset Yellow FCF Market Size and Share Forecast Outlook 2025 to 2035

Closet Organizers Market Trends – Growth & Demand Forecast 2025 to 2035

Genset Market Size, Share, Outlook & Forecast 2025 to 2035

Market Share Insights of Gusseted Bag Providers

Gusseted Bag Market by Material Type from 2024 to 2034

IT Asset Disposition Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA