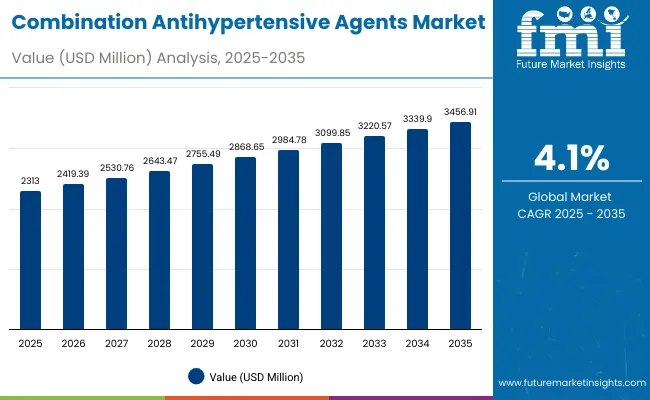

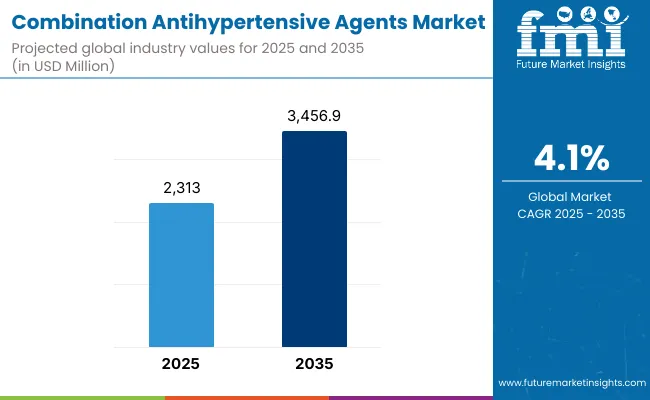

The global combination antihypertensive agents market is projected to grow from USD 2,313.0 million in 2025 to approximately USD 3,456.9 million by 2035, recording an absolute increase of USD 1,143.9 million over the forecast period. This translates into a total growth of 49.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035.

Combination Antihypertensive Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,313.0 million |

| Forecast Value in (2035F) | USD 3,456.9 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The overall market size is expected to grow by nearly 1.5X during the same period, supported by increasing prevalence of hypertension worldwide, rising demand for combination therapies, and growing focus on cardiovascular disease management and prevention.

Between 2025 and 2030, the combination antihypertensive agents market is projected to expand from USD 2,313.0 million to USD 2,827.7 million, resulting in a value increase of USD 514.7 million, which represents 45.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising awareness about cardiovascular health, increasing demand for personalized therapeutic approaches, and growing penetration of combination therapies in emerging markets. Pharmaceutical companies are expanding their combination antihypertensive portfolios to address the growing demand for effective blood pressure management solutions for complex cardiovascular conditions.

From 2030 to 2035, the market is forecast to grow from USD 2,827.7 million to USD 3,456.9 million, adding another USD 629.2 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized pharmacy channels, integration of digital health platforms with combination therapy management, and development of personalized treatment protocols. The growing adoption of evidence-based medicine and healthcare provider recommendations will drive demand for clinically proven combination antihypertensive agents with enhanced efficacy and safety profiles.

Between 2020 and 2025, the combination antihypertensive agents market experienced steady expansion, driven by increasing recognition of hypertension as a global health concern and growing acceptance of combination therapy approaches. The market developed as healthcare providers recognized the need for comprehensive treatment solutions to address complex cardiovascular conditions. Clinical research and regulatory approvals began emphasizing the importance of combination therapies in achieving better patient outcomes for challenging hypertension management.

Market expansion is being supported by the increasing prevalence of hypertension worldwide and the corresponding demand for more effective therapeutic approaches. Modern healthcare providers are increasingly focused on combination therapies that can address multiple cardiovascular risk factors simultaneously, improve treatment adherence, and reduce the burden of polypharmacy. The proven efficacy of specific drug combinations in treating resistant hypertension, diabetic hypertension, and hypertension with comorbidities makes them essential components of comprehensive cardiovascular treatment plans.

The growing emphasis on personalized medicine and precision cardiovascular care is driving demand for tailored combination therapies that address individual patient needs and genetic profiles. Healthcare provider preference for simplified medication regimens that combine multiple active ingredients in single formulations is creating opportunities for innovative drug development. The rising influence of clinical guidelines and evidence-based treatment protocols is also contributing to increased adoption of proven combination antihypertensive agents across different patient populations and therapeutic areas.

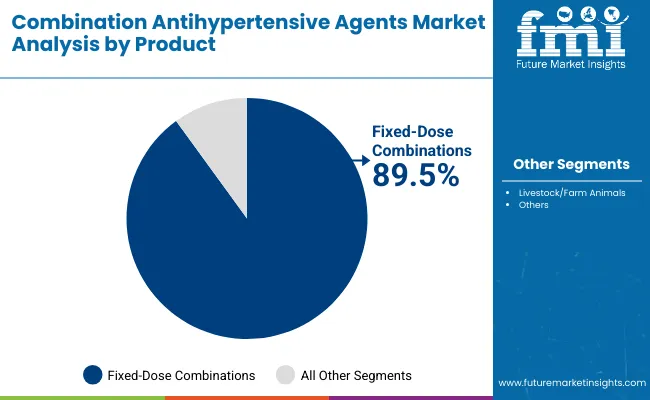

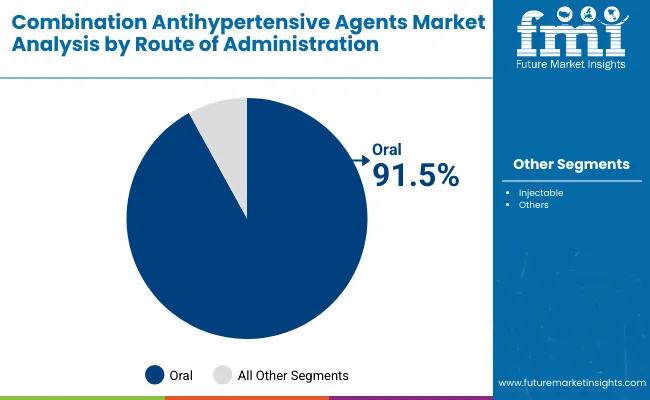

The market is segmented by product, route of administration, sales channel, and region. By product, the market is divided into fixed-dose combinations and livestock/farm animals. Based on route of administration, the market is categorized into oral and injectable. In terms of sales channel, the market is segmented into hospital pharmacies, retail pharmacies, drug stores, and online pharmacies. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The fixed-dose combinations segment is projected to account for 89.5% of the combination antihypertensive agents market in 2025, reaffirming its position as the category's dominant product type. Healthcare providers increasingly recognize the synergistic benefits of combining multiple antihypertensive medications in fixed-dose formulations for treating complex cardiovascular conditions, particularly resistant hypertension and hypertension with multiple comorbidities. This product type addresses both systolic and diastolic blood pressure management, providing comprehensive therapeutic coverage.

This product class forms the foundation of most treatment protocols for hypertension management, as it represents the most clinically validated and widely accepted combination approach in cardiovascular medicine. Regulatory approvals and extensive clinical research continue to strengthen confidence in these formulations. With increasing recognition of the complexity of hypertension requiring multi-targeted approaches, fixed-dose combinations align with both acute treatment and long-term management goals. Their broad therapeutic utility across multiple patient populations ensures sustained market dominance, making them the central growth driver of combination antihypertensive demand.

Oral administration is projected to represent 91.5% of combination antihypertensive agents demand in 2025, underscoring its role as the primary route driving combination therapy adoption. Healthcare providers recognize that oral formulations offer superior patient convenience, compliance, and cost-effectiveness compared to injectable alternatives. The oral route provides optimal bioavailability for most antihypertensive combinations while maintaining ease of administration for chronic disease management.

The segment is supported by patient preference for non-invasive medication administration and the established safety profile of oral antihypertensive combinations. Additionally, healthcare systems are increasingly adopting treatment guidelines that recommend oral combinations as first-line therapy for optimal outcomes. As clinical understanding of hypertension management advances, oral combination therapies will continue to play a crucial role in comprehensive treatment strategies, reinforcing their essential position within the antihypertensive market.

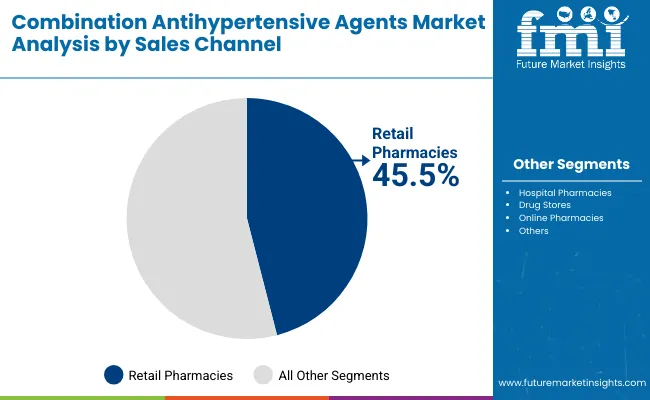

The retail pharmacies channel is forecasted to contribute 45.5% of the combination antihypertensive agents market in 2025, reflecting the primary role of community pharmacies in cardiovascular medication dispensing and patient care. Patients with chronic hypertension rely on accessible, convenient pharmacy services for ongoing medication management, making retail pharmacies the cornerstone of combination antihypertensive distribution. This channel provides essential services including medication counseling, adherence monitoring, and coordination with healthcare providers.

The segment benefits from established relationships between patients and pharmacists, who provide continuity of care and medication management support. Retail pharmacies also offer advantages in terms of insurance coverage processing, generic substitution options, and patient convenience through extended hours and multiple locations. With growing emphasis on community-based cardiovascular care and patient-centered pharmacy services, retail pharmacies serve as critical access points for combination antihypertensive agents, making them fundamental drivers of market accessibility and growth.

The combination antihypertensive agents market is advancing steadily due to increasing recognition of resistant hypertension and growing demand for comprehensive therapeutic approaches. However, the market faces challenges including complex regulatory pathways, potential for increased side effects, and concerns about drug interactions. Innovation in combination formulations and personalized treatment protocols continue to influence product development and market expansion patterns.

Expansion of Hospital Pharmacies and Specialty Care Channels

The growing adoption of specialized cardiovascular care facilities is enabling more sophisticated combination therapy management and monitoring. Hospital pharmacies offer comprehensive medication management services, including therapeutic drug monitoring and adverse event management, that are particularly important for complex combination regimens. Specialty care channels provide access to cardiovascular specialists who can optimize combination therapy selection and dosing.

Integration of Digital Health Platforms and Medication Management Systems

Modern pharmaceutical companies are incorporating digital health technologies such as medication adherence monitoring, electronic prescribing systems, and patient portal integration to enhance combination therapy management. These technologies improve medication compliance, enable real-time monitoring of therapeutic outcomes, and provide better coordination between healthcare providers. Advanced digital platforms also enable personalized dosing recommendations and early identification of potential drug interactions or adverse events.

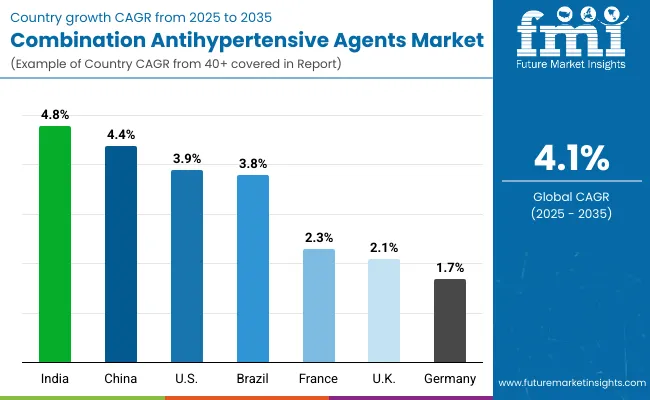

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.8% |

| China | 4.4% |

| USA | 3.9% |

| Brazil | 3.8% |

| France | 2.3% |

| UK | 2.1% |

| Germany | 1.7% |

The combination antihypertensive agents market is experiencing varied growth globally, with India leading at a 4.8% CAGR through 2035, driven by expanding healthcare infrastructure, increasing cardiovascular disease awareness, and growing access to antihypertensive medications. China follows at 4.4%, supported by healthcare system reforms, increasing recognition of hypertension management importance, and expanding pharmaceutical coverage. The USA shows growth at 3.9%, representing a mature market with established treatment patterns and regulatory frameworks. Brazil demonstrates growth at 3.8%, emphasizing improved access to cardiovascular care and combination therapy adoption. Europe records 2.3% growth, focusing on evidence-based treatment protocols and comprehensive cardiovascular care systems.

The report covers an in-depth analysis of 40+ countries;seven top-performing countries are highlighted below.

Revenue from combination antihypertensive agents in China is projected to exhibit steady growth with a CAGR of 4.4% through 2035, driven by ongoing healthcare system reforms and increasing recognition of cardiovascular health as a priority health issue. The country's expanding healthcare infrastructure and growing availability of specialized cardiovascular services are creating significant opportunities for combination therapy adoption. Major international and domestic pharmaceutical companies are establishing comprehensive distribution networks to serve the growing population of patients requiring complex hypertension treatment across urban and developing regions.

Revenue from combination antihypertensive agents in India is expanding at a CAGR of 4.8%, supported by increasing healthcare accessibility, growing cardiovascular health awareness, and expanding pharmaceutical market presence. The country's large patient population and increasing recognition of hypertension as a major health concern are driving demand for effective combination therapy solutions. International pharmaceutical companies and domestic manufacturers are establishing distribution channels to serve the growing demand for quality antihypertensive medications.

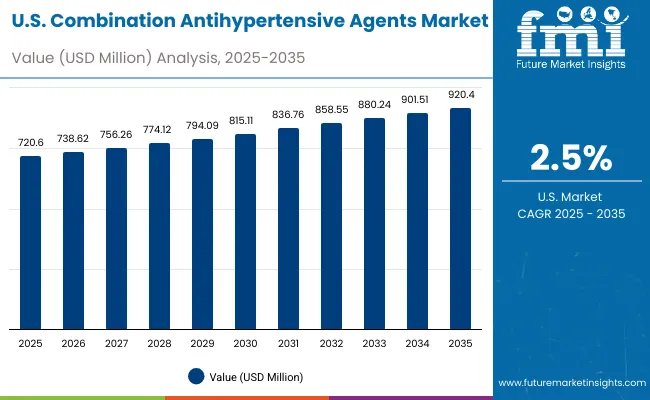

Demand for combination antihypertensive agents in the USA is projected to grow at a CAGR of 3.9%, supported by well-established cardiovascular care systems and evidence-based treatment guidelines. American healthcare providers consistently utilize combination therapies for treatment-resistant hypertension and complex cardiovascular presentations. The market is characterized by mature treatment protocols, comprehensive insurance coverage, and established relationships between healthcare providers and pharmaceutical companies.

Revenue from combination antihypertensive agents in Brazil is projected to grow at a CAGR of 3.8% through 2035, driven by healthcare system development, increasing access to cardiovascular care, and growing recognition of hypertension management importance. Brazilian healthcare providers are increasingly adopting combination therapy approaches for complex hypertensive conditions, supported by expanding pharmaceutical market presence and improved treatment accessibility.

Revenue from combination antihypertensive agents in the UK is projected to grow at a CAGR of 2.1% through 2035, supported by the National Health Service framework and comprehensive evidence-based treatment guidelines that facilitate appropriate use of combination therapies for complex hypertensive conditions. British healthcare providers consistently utilize established protocols for combination therapy management, emphasizing patient outcomes and treatment optimization within integrated care systems.

Revenue from combination antihypertensive agents in Germany is projected to grow at a CAGR of 1.7% through 2035, supported by the country's well-established cardiovascular care infrastructure, comprehensive healthcare coverage, and systematic approach to hypertension treatment. German healthcare providers emphasize evidence-based combination therapy utilization within structured healthcare frameworks that prioritize clinical effectiveness and patient safety.

Revenue from combination antihypertensive agents in France is projected to grow at a CAGR of 2.3% through 2035, supported by the country's comprehensive healthcare system, established cardiovascular care infrastructure, and systematic approach to hypertension treatment. French healthcare providers emphasize evidence-based combination therapy utilization within integrated care frameworks that prioritize patient outcomes and treatment continuity.

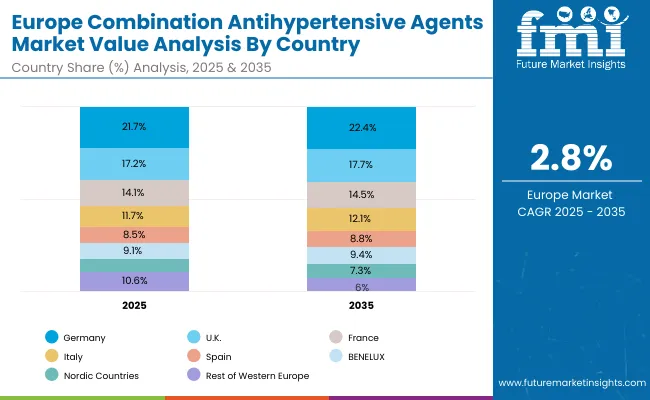

The combination antihypertensive agents market in Europe is projected to expand steadily through 2035, supported by increasing adoption of polypharmacy in cardiovascular medicine, rising prevalence of complex hypertension and cardiovascular disorders, and ongoing clinical innovation in multi-target therapies. Germany will continue to lead the regional market, accounting for 21.7% in 2025 and rising to 22.4% by 2035, supported by a strong clinical research base, reimbursement pathways, and robust cardiovascular care infrastructure. The United Kingdom follows with 17.2% in 2025, increasing to 17.7% by 2035, driven by NHS adoption of advanced treatment guidelines, digital cardiovascular health integration, and broadening specialist networks.

France holds 14.1% in 2025, edging up to 14.5% by 2035 as cardiovascular hospitals expand multi-drug therapy protocols and demand grows for tailored treatment regimens. Italy contributes 11.7% in 2025, remaining broadly stable at 12.1% by 2035, supported by strong regional cardiovascular health programs and growing clinical trial participation. Spain represents 8.5% in 2025, inching upward to 8.8% by 2035, underpinned by strengthening access to cardiovascular services and patient support programs.

BENELUX markets together account for 9.1% in 2025, moving to 9.4% by 2035, supported by innovation-friendly regulatory frameworks and academic-industry collaboration. The Nordic countries represent 7.1% in 2025, increasing to 7.3% by 2035, with demand fueled by progressive healthcare systems and early adoption of evidence-based cardiovascular care. The Rest of Western Europe moderates from 10.6% in 2025 to 7.8% by 2035, as larger core markets capture a greater share of investment, clinical trials, and adoption of combination therapy protocols.

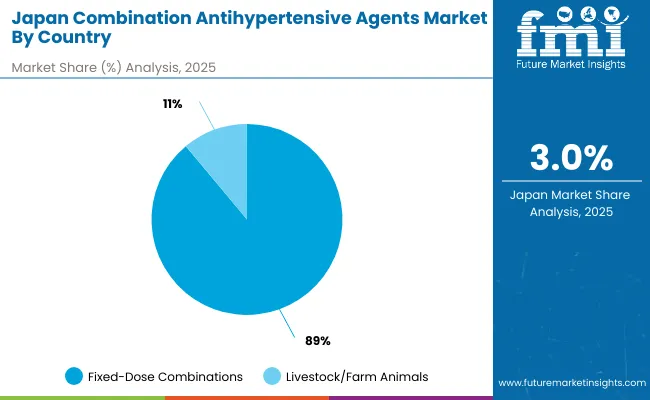

The combination antihypertensive agents market in Japan is set to remain concentrated across key product categories in 2025, reflecting clinical preferences in cardiovascular practice and evolving prescribing patterns. Fixed-Dose Combinations dominate with an 88.5% share in 2025, supported by their central role in managing resistant hypertension, cardiovascular comorbidities, and complex blood pressure management requirements.

Livestock/Farm Animals applications represent 11.5% in 2025, gaining traction from veterinary medicine applications and agricultural health management needs. This segment reflects the growing recognition of cardiovascular health management across diverse applications beyond human healthcare.

The dominance of Fixed-Dose Combinations underscores the clinical preference for simplified medication regimens that enhance patient compliance while delivering effective blood pressure control through multiple mechanisms of action, making them the cornerstone of modern hypertension management strategies.

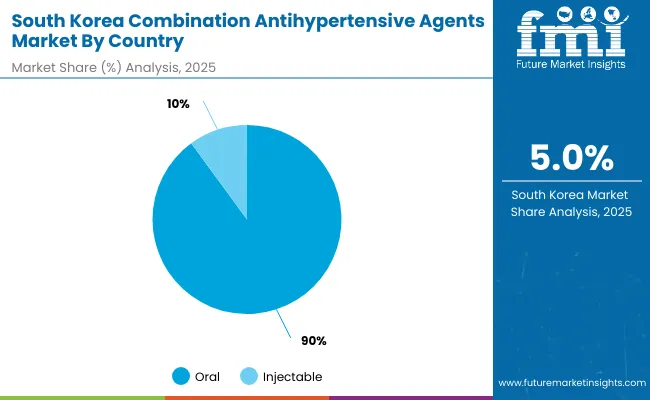

The combination antihypertensive agents market in South Korea in 2025 is shaped by strong preference for oral administration routes, reflecting both clinical practices and patient preferences. Oral administration accounts for the largest share at 89.5%, supported by superior patient convenience, established safety profiles, and comprehensive healthcare provider familiarity with oral combination formulations.

Injectable administration follows with 10.5%, driven by specialized clinical situations requiring rapid blood pressure control, hospital-based emergency management, and specific patient populations who cannot tolerate oral medications. This route provides immediate therapeutic effects and precise dosing control in critical care environments.

The overwhelming preference for oral administration highlights the importance of patient-friendly treatment approaches in chronic disease management, where long-term adherence and convenience are essential factors in achieving optimal cardiovascular outcomes and sustained blood pressure control.

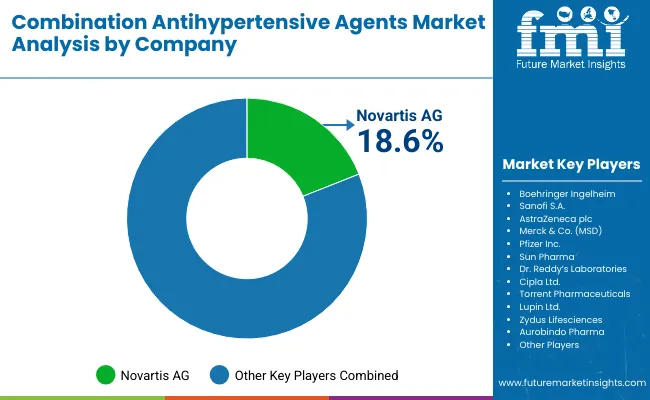

The combination antihypertensive agents market is characterized by competition among established pharmaceutical companies, specialty cardiovascular focused firms, and generic drug manufacturers. Companies are investing in clinical research, regulatory compliance, strategic partnerships, and healthcare provider education to deliver effective, safe, and accessible combination therapy solutions. Drug development, clinical validation, and market access strategies are central to strengthening product portfolios and market presence.

Novartis AG leads the market with 18.6% global value share, offering clinically-proven combination antihypertensive agents with a focus on efficacy and patient outcomes. Boehringer Ingelheim provides comprehensive cardiovascular combination products with emphasis on innovation and clinical excellence. Sanofi S.A. focuses on established combination therapies with strong clinical evidence and healthcare provider acceptance. AstraZeneca plc delivers innovative formulation technologies and specialized cardiovascular solutions for combination therapies.

Merck & Co. operates with comprehensive pharmaceutical portfolios including combination products across multiple therapeutic areas. Pfizer Inc. provides established combination products with strong market presence and clinical validation. Sun Pharma, Dr. Reddy's Laboratories, Cipla Ltd., Torrent Pharmaceuticals, Lupin Ltd., Zydus Lifesciences, and Aurobindo Pharma provide generic alternatives and specialized formulations to enhance market accessibility and patient access to essential combination treatments across diverse global markets.

Key Players in the Combination Antihypertensive Agents Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,313.0 Million |

| Product | Fixed-Dose Combinations, Livestock/Farm Animals |

| Route of Administration | Oral, Injectable |

| Sales Channel | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Pharmacies |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Novartis AG, Boehringer Ingelheim , Sanofi S.A., AstraZeneca plc, Merck & Co., Pfizer Inc., Sun Pharma, Dr. Reddy's Laboratories, Cipla Ltd., Torrent Pharmaceuticals, Lupin Ltd., Zydus Lifesciences |

| Additional Attributes | Dollar sales by combination type and therapeutic indication, regional demand trends, competitive landscape, healthcare provider preferences for specific combinations, integration with specialty pharmacy channels, innovations in extended-release formulations, patient adherence monitoring, and clinical outcome optimization |

The global combination antihypertensive agents market is valued at USD 2,313.0 million in 2025.

The size for the combination antihypertensive agents market is projected to reach USD 3,456.9 million by 2035.

The combination antihypertensive agents market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key formulation segments in the combination antihypertensive agents market are fixed-dose combinations and loose combinations.

In terms of formulation, fixed-dose combinations segment is set to command 89.5% share in the combination antihypertensive agents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Combination Kinase Inhibitor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Combination Spanner Set Market Size and Share Forecast Outlook 2025 to 2035

Fuse Combination Unit Market Growth - Trends, Analysis & Forecast by Type, Current Rating, Application, End-use Industry and Region through 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA