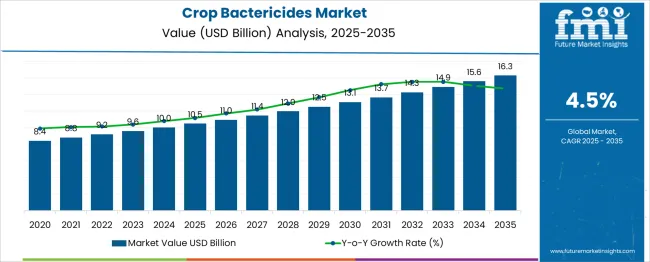

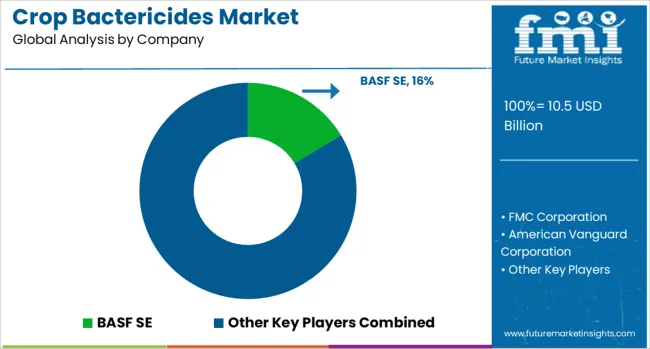

The Crop Bactericides Market is estimated to be valued at USD 10.5 billion in 2025 and is projected to reach USD 16.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Crop Bactericides Market Estimated Value in (2025 E) | USD 10.5 billion |

| Crop Bactericides Market Forecast Value in (2035 F) | USD 16.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The crop bactericides market is expanding steadily due to growing concerns over crop loss caused by bacterial infections and the increasing need to protect high-value crops from disease outbreaks. Rising global food demand, coupled with a shrinking availability of arable land, has prompted farmers and agribusinesses to adopt effective crop protection measures, thereby driving the uptake of bactericides.

The market is also witnessing growing regulatory support for integrated pest and disease management practices that encourage the responsible use of bactericides. Technological advancements in formulation and delivery systems have enhanced product efficacy, while environmental concerns continue to steer innovation toward biodegradable and residue-free solutions.

As climate variability continues to alter pathogen behavior and increase susceptibility across various crops, the role of bactericides is expected to become more central to ensuring food security. The market outlook remains positive, supported by increased awareness, precision agriculture, and the demand for sustainable farming practices.

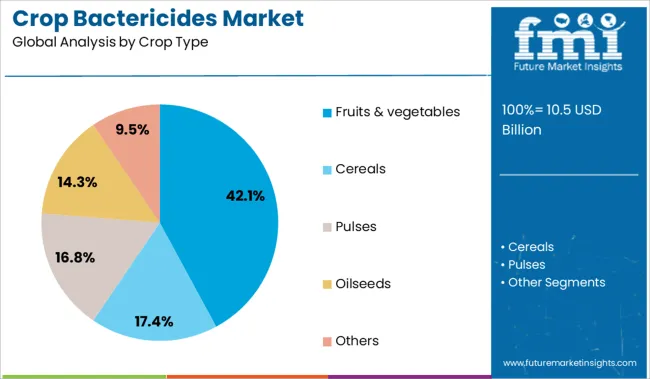

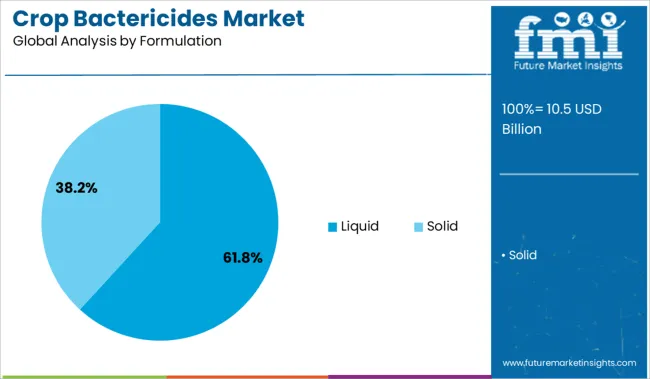

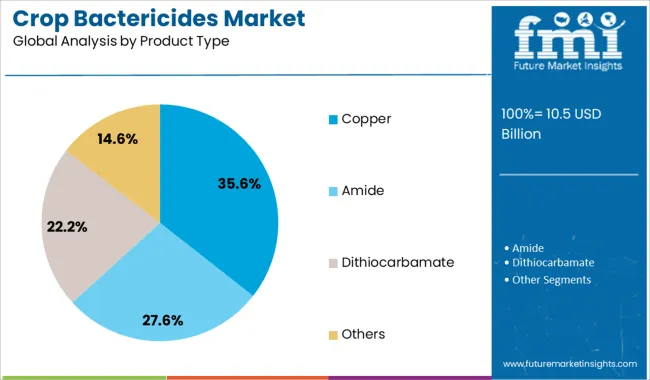

The crop bactericides market is segmented by crop type, formulation, product type, and application and geographic regions. By crop type, the crop bactericides market is divided into Fruits & vegetables, Cereals, Pulses, Oilseeds, and Others. In terms of formulation, the crop bactericides market is classified into Liquid and Solid. Based on the product type, the crop bactericides market is segmented into Copper, Amide, Dithiocarbamate, and Others. By application of the crop bactericides, the market is segmented into Foliar, Soil, and Others. Regionally, the crop bactericides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fruits and vegetables segment leads the crop type category with a 42.1% market share, highlighting the high susceptibility of these crops to bacterial diseases and the critical need for protection throughout their growth cycles. Due to their perishable nature and higher economic value, fruits and vegetables are more vulnerable to yield loss from bacterial infections, especially under fluctuating weather conditions and high humidity.

Growers increasingly depend on bactericides to prevent diseases such as bacterial spot, blight, and canker, which can severely impact both crop quality and marketability. The segment's growth is further fueled by increasing export demand for unblemished, high-grade produce and stricter international quality standards.

The trend toward organic and residue-conscious farming is also prompting innovation in bactericide formulations suitable for fruits and vegetables. Ongoing investments in horticultural R&D and rising awareness among farmers about disease prevention are expected to maintain the segment’s leadership in the coming years.

The liquid segment commands a significant 61.8% market share in the formulation category, driven by its ease of application, better coverage, and higher bioavailability compared to solid alternatives. Farmers widely prefer liquid formulations for their compatibility with modern spraying equipment and their ability to deliver active ingredients uniformly across large areas.

This format allows for quicker absorption and more immediate action against bacterial pathogens, which is crucial in preventing rapid disease spread. The flexibility of liquid bactericides in both foliar and soil application methods adds to their appeal, especially in high-value crop cultivation.

As precision agriculture continues to advance, liquid formulations are being tailored for compatibility with sensor-based application systems, ensuring reduced waste and optimized usage. The trend toward sustainable practices and the need for residue-free farming is also encouraging the development of eco-friendly liquid bactericides, which is expected to strengthen this segment's dominance further.

The copper product type segment holds a 35.6% share in the crop bactericides market, reflecting its long-standing usage and proven effectiveness in controlling a broad spectrum of bacterial pathogens. Copper-based bactericides are favored for their multi-site mode of action, which reduces the risk of resistance development and provides consistent protection across various crops and environmental conditions.

The segment continues to be widely adopted in both conventional and organic farming systems, particularly in regions with high bacterial disease pressure. Recent advancements in copper nano-formulations and chelated compounds have enhanced uptake efficiency and minimized phytotoxicity, thereby extending the utility of copper in modern agricultural practices.

Regulatory efforts to reduce heavy metal accumulation in soil are prompting manufacturers to optimize copper dosage levels without compromising efficacy. As farmers prioritize reliable and cost-effective bactericide options, the copper segment is expected to retain its relevance in integrated disease management programs.

The crop bactericides are increasingly utilized to manage bacterial infections in high-value crops and prevent economic losses in agriculture. In 2024, outbreaks of bacterial spot in tomatoes triggered widespread adoption of copper-based bactericides. In 2025, early blight in potatoes and citrus canker in orchards led to significant usage of systemic bactericides to prevent yield loss. Simultaneously, opportunities are emerging in novel biological bactericides for integrated pest management. Suppliers offering both traditional and next-generation bactericide solutions are well-positioned to meet farmer demand while navigating resistance management strategies.

Escalating prevalence of bacterial infections has been recognized as a primary driver for bactericide adoption. In 2024, tomato growers increased application of bactericides following severe outbreaks of bacterial spot and speck that threatened marketable yields. In 2025, citrus canker and bacterial wilt incidences prompted tree-fruit and vegetable producers to implement bactericide rotations and protectant sprays during susceptible crop stages. These developments indicate that crop disease threats, rather than standard preventive treatments, are compelling growers to invest in targeted bactericide interventions. Manufacturers supplying effective, validated control chemistries with resistance management guidance are thus being positioned to lead in crop protection programs.

In 2024, trials of microbial-based bactericide products, for example, Bacillus-based formulations, were introduced to combat bacterial leaf blight in rice under field conditions. In 2025, pilot programs expanded to include bacteriophage- and peptide-based biocontrols targeting fire blight in orchards. These developments demonstrate that biological bactericides can shift control strategies from sole reliance on chemical protectants to integrated, eco-compatible solutions. Suppliers offering biological bactericides with proven field efficacy and low resistance risk are thus being positioned to capture value in integrated disease management systems.

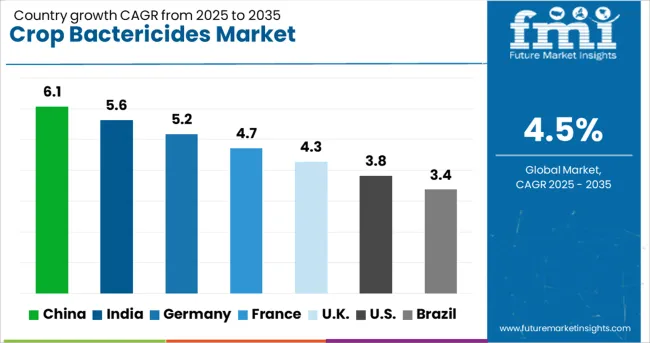

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global crop bactericides market is projected to grow at a CAGR of 4.5% between 2025 and 2035. China leads with 6.1%, followed by India at 5.6% and Germany at 5.2%. France records 4.7%, while the United Kingdom posts 4.3%. Growth is driven by the increasing need for disease-resistant crops, rising adoption of integrated pest management practices, and demand for bio-based solutions. China and India dominate due to high agricultural output and pest pressure, while Germany focuses on sustainable and residue-free bactericides. France and the UK emphasize eco-friendly formulations and advanced crop protection systems.

China is expected to grow at 6.1%, supported by extensive rice, vegetable, and fruit cultivation susceptible to bacterial infections. Copper-based bactericides remain dominant, while bio-based alternatives are gaining popularity due to residue regulations. Government-backed programs for plant disease control and increasing investment in precision agriculture technologies further accelerate adoption in large-scale farming operations.

India is forecast to grow at 5.6%, driven by rising bacterial blight and wilt incidences in key crops such as rice, cotton, and pulses. Local manufacturers focus on developing cost-effective, weather-stable formulations. Adoption of bio-bactericides is growing in horticulture and export-driven agriculture segments. Government programs promoting integrated pest management strengthen the role of bactericides in sustainable farming.

Germany is expected to grow at 5.2%, supported by a strong regulatory framework encouraging low-residue and sustainable crop protection practices. Advanced bactericide formulations combining systemic and contact modes dominate demand in fruits, vegetables, and greenhouse crops. Manufacturers prioritize eco-certified solutions compatible with organic farming. Growing consumer demand for chemical-free produce enhances innovation in bio-bactericides.

France is forecast to grow at 4.7%, driven by expanding fruit orchards and viticulture requiring bacterial disease prevention. Demand for copper alternatives rises under EU restrictions on heavy metal usage. French manufacturers invest in microbial-based bactericides compatible with precision spraying systems. Adoption of crop monitoring technologies enables targeted application to reduce environmental impact.

The UK is expected to grow at 4.3%, driven by demand for advanced crop protection in cereals, vegetables, and soft fruits. Local players focus on residue-free and environment-friendly bactericides to comply with post-Brexit regulatory frameworks. Smart farming adoption accelerates demand for digitally managed bactericide application programs, ensuring efficiency and traceability in food production.

The crop bactericides market is moderately consolidated, led by BASF SE with a significant market share. The company holds a dominant position through its comprehensive bactericide portfolio, advanced formulation technologies, and strong distribution networks across global agricultural markets. Dominant player status is held exclusively by BASF SE. Key players include FMC Corporation, American Vanguard Corporation, Sumitomo Chemical Co., Ltd, PI Industries, Bayer CropScience AG, Syngenta AG, Nippon Soda Co., Ltd, Dow AgroSciences LLC, and Nufarm Limited, each providing bactericidal solutions targeting critical crops such as fruits, vegetables, and cereals with emphasis on disease resistance and yield optimization. Emerging players remain limited in this market due to strict regulatory approvals, high R&D costs, and the dominance of established agrochemical manufacturers. Market demand is driven by the rising prevalence of bacterial crop infections, the need for residue-compliant crop protection products, and the growing adoption of integrated pest management strategies in commercial agriculture.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.5 Billion |

| Crop Type | Fruits & vegetables, Cereals, Pulses, Oilseeds, and Others |

| Formulation | Liquid and Solid |

| Product Type | Copper, Amide, Dithiocarbamate, and Others |

| Application | Foliar, Soil, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, FMC Corporation, American Vanguard Corporation, Sumitomo Chemical Co., Ltd, PI Industries, Bayer CropScience AG, Syngenta AG, Nippon Soda Co., Ltd, Dow AgroSciences LLC, and NufarmLimited |

| Additional Attributes | Dollar sales by product type (organic vs synthetic), regional demand trends, competitive landscape, farmer preference for residue-free and environmentally compliant formulations, integration with precision agriculture platforms and sensor-based spraying systems, innovations in microbial bactericides, biocontrol agents, and nano-formulations for enhanced efficacy and crop safety. |

The global crop bactericides market is estimated to be valued at USD 10.5 billion in 2025.

The market size for the crop bactericides market is projected to reach USD 16.3 billion by 2035.

The crop bactericides market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in crop bactericides market are fruits & vegetables, cereals, pulses, oilseeds and others.

In terms of formulation, liquid segment to command 61.8% share in the crop bactericides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crop Micronutrient Market Insights - Precision Farming & Yield Optimization 2025 to 2035

Crop Nutrient Management Market

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Micropipette Puller Market Size and Share Forecast Outlook 2025 to 2035

Macroporous Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Microplate Washer Market Size and Share Forecast Outlook 2025 to 2035

Microprocessor Market Size and Share Forecast Outlook 2025 to 2035

Microprinting Market Size and Share Forecast Outlook 2025 to 2035

Micropiles Market Size and Share Forecast Outlook 2025 to 2035

Microporous Insulation Material Market Size and Share Forecast Outlook 2025 to 2035

Micropump Market Insights - Trends, Demand & Forecast 2025 to 2035

Microplate Instrumentation and Supplies Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Systems Market Growth - Trends & Forecast 2025 to 2035

Microparticulated Whey Protein Market Analysis by Application, Form & Region Through 2035

Microphone Market Trends - Growth & Forecast 2025 to 2035

Microplate Luminometer Market Analysis – Trends & Industry Insights 2024-2034

Microparticle Injectables Market

Microplate Readers Market

Car Microphone Market Size and Share Forecast Outlook 2025 to 2035

Smart Crop Mobility Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA